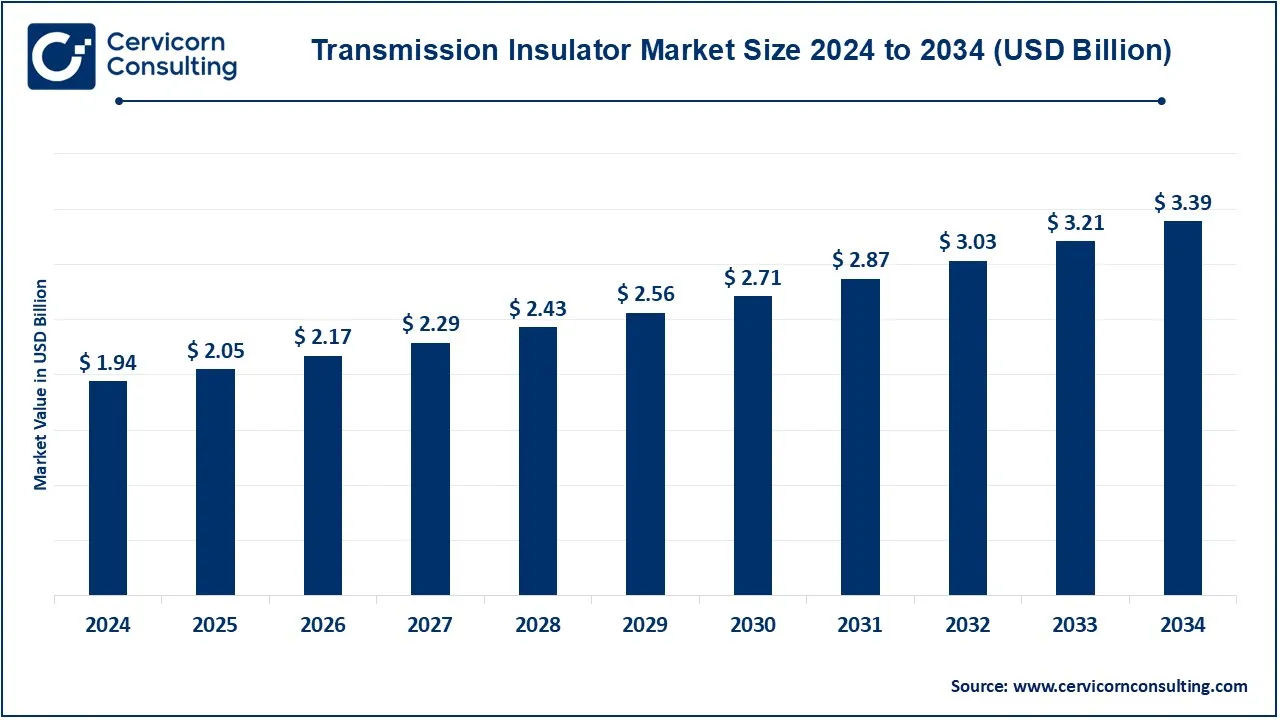

The global transmission insulator market size was valued at USD 1.94 billion in 2024 and is expected to be worth around USD 3.39 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.74% from 2025 to 2034. The transmission insulator market is experiencing steady growth, driven by the increasing global demand for electricity and grid modernization efforts. Governments worldwide are investing in power transmission infrastructure to enhance energy efficiency and reliability. The transition to renewable energy sources like wind and solar also requires improved transmission networks, further boosting the demand for advanced insulators. Additionally, rapid industrialization and urbanization in emerging economies are leading to higher electricity consumption, fueling market expansion. Technological advancements, such as the development of polymer-based insulators, are also contributing to market growth. These insulators offer advantages like superior durability, reduced maintenance costs, and better resistance to environmental factors compared to traditional ceramic insulators.

What is a Transmission Insulator?

A transmission insulator is a crucial component used in electrical power transmission systems to support and separate conductors, preventing unwanted current flow to the ground. These insulators ensure the safe and efficient delivery of electricity across high-voltage transmission lines. Typically made from porcelain, glass, or polymer materials, they provide mechanical support while resisting electrical leakage and environmental factors like heat, moisture, and pollution. There are different types of transmission insulators, including pin-type, suspension-type, and strain insulators, each designed for specific voltage levels and transmission conditions. Suspension insulators are commonly used in high-voltage transmission lines due to their flexibility and ability to bear heavy mechanical loads. With growing demand for electricity and advancements in grid infrastructure, the adoption of reliable and durable insulators is increasing.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 1.94 Billion |

| Expected Market Size in 2034 | USD 3.39 Billion |

| CAGR (2025 to 2034) | 5.74% |

| Key Segments | Material, Type of Insulator, Voltage, Technology, Application, Functionality, End User, Region |

| Key Companies | Siemens, ABB, Alstom, TE Connectivity, Elsewedy Electric, Bharat Heavy Electricals, Hubbell, NGK Insulators, MacLean Power Systems, Marmon Utility LLC, Victor Insulators, Gipro Insulators, PPC Insulators |

The transmission insulator market is segmented into material, type of insulator, voltage, technology, application, functionality, end user and region. Based on material, the market is classified into ceramic insulators, glass insulators and polymer insulators. Based on type of insulator, the market is classified into pin insulators, suspension insulators, line post insulators, cap and pin insulators, composite insulators. Based on voltage, the market is classified into low voltage insulators, medium voltage insulators, high voltage insulators and extra high voltage. Based on technology, the market is classified into injection molding, compression molding and cast resin. Based on application, the market is classified into overhead transmission line and substation & switchyard. Based on functionality, the market is classified into mechanical insulation and electrical insulation. Based on end user, the market is classified into utilities, industrial, commercial and residential.

Ceramic Insulators: They are widely applied on transmission lines because they have good electrical properties, and are stiff enough to withstand mechanical stresses. They are prepared from material like porcelain, which imparts excellent high strength with environmental stability. They can be used in various climatic conditions since they can bear heavy temperatures and humidity but are brittle, which is a drawback in applications requiring impact resistance. Ceramic insulators are widely used and have been the standard for ages. They can be relied on to provide long-lasting service.

Glass Insulators: Glass insulators are glassy with good mechanical strength. The construction of a glass insulator is through toughened glass, hence ensuring high electrical insulation. Not only does glass allow for sound electrical insulation but it also withstands all conditions of weather thus providing excellent durability. They have a glassy finish to reduce the level of contamination, thus their maintenance requirements are not too high. Glass insulators have excellent transparency, and therefore inspection is relatively easy if a direct view is possible. Their weight and shattering ability, however, can pose awkward problems during installation and maintenance. Nevertheless, glass insulators are in wide use for overhead transmission lines, especially where the weather is extreme.

Polymer Insulators: Polymer insulators are increasingly being accepted for use primarily because of their lightness and flexibility. Made of synthetic materials, polymer insulators show high resistance to pollution and ultraviolet degradation. The designs reduce their size and weight, thus simplifying the installation and reducing the cost. Other environmental conditions for excellent performance include coastal and industrial areas. Despite all these positive attributes, concerns over long-term durability and thermal stability prevail. In general, polymer insulators are a new alternative that allows efficiency in transmission systems to become greater.

Pin Insulators: Pin insulators are one of those types that are commonly utilized in low to medium-voltage applications. However, it supports the overhead transmission lines significantly. For mounting, these are aligned on the pins or brackets because they have the facility of holding the conductor efficiently and do not allow electrical leakage to occur. As they consist of porcelain, along with glass, materials, they are excellent insulators from the viewpoint of their excellent insulation properties. However, they may not be suitable for the high voltage lines due to the restriction in their electrical strength. Nonetheless, pin insulators are versatile for the majority of utility companies.

Suspension Insulators: The suspension insulators are primarily mounted on high transmission lines. The main function of suspension insulators is to bear the weight of the conductor besides providing electrical insulation. To provide an increased voltage rating, they are mounted in series and, therefore, have reliable long-distance transmission. These are of ceramic, glass, or composite materials, which can resist hostile weather conditions with mechanical stress. Their robust design allows them to work well in all types of environmental conditions, making them an essential part of the power supply.

Line Post Insulators: The line post insulators have variability in application and suitability in both application forms on both substation and overhead lines. They can be hung in a vertical and horizontal form with the positioning of supporting conductors with insulation. They are mostly ceramic, polymer, or glass materials and also quite resistant to mediums of up to high voltage levels. Their designs allow for easy maintenance and replacement to achieve efficiency in operations. The application of cap and pin insulators aids the stability and safety of electrical transmission systems.

Cap and Pin Insulators: Cap and pin is a hybrid, which combines elements of both cap and pin insulators with the primary aim of improving better locking and insulation of conductors. Cap and pin insulators are mainly used in overhead transmission systems. They have great strength and reliability. These insulators are manufactured from materials such as porcelain or glass and can withstand various levels of voltage. The design facilitates easy installation and maintenance and, thus, they remain a preferred utility provider. Cap and pin insulators form a crucial part of power transmission without interruption.

Composite Insulators: Composite insulators are made from composite materials mainly for high performance in challenging environments. A composite insulator is designed using a fiberglass center core, covered by a polymer sheath, therefore offering good strength and insulation properties. They do not easily get contaminated with UV degradation. Therefore, these insulators have high efficiency, especially in coastal areas or polluted areas. Installation and maintenance are also done easily on them, thus facilitating overall efficiency in their operation. Though expensive initially, their long-term savings make them increasingly favorable to modern transmission systems.

Low Voltage Insulators: Low voltage insulators are taken in the distribution networks for a voltage below 1 kV. They are used to support and insulate the conductors in housing and commercial use. Such insulators play a very important role in safety so that no leakage of electricity can take place. The materials used in fabricating the low-voltage insulators are ceramic, glass, or polymer. These can conveniently be mounted because of their compact size and lightweight nature, making them a convenient choice for utility providers handling localized power distribution.

Medium Voltage Insulators: These insulators are applied between the voltages of 1 kV to 36 kV. They constitute regional power distribution networks. They are applied for bearing overhead conductors and for offering insulation in substations and many industrial applications. The insulators, on the other hand, are more adaptive to higher electrical stress and environmental conditions than the low-voltage ones. They are manufactured with robust materials and are made from porcelain, polymer, and high voltage for medium voltage. The insulators make the power system performance stronger. It helps to transfer energy effectively without any violation of the safety standards in electrical installation.

High Voltage Insulators: The high voltage insulators rated above 36 kV are important constituents in longer-distance power transmission networks. They protect and safeguard the conductors from environmental influences and electrical stresses. High-voltage insulators are made of ceramic, glass, and composite materials. Such insulators are developed to be operational under extreme conditions. Due to their design, these can work effectively in adverse weather conditions. Such high-voltage insulators help conduct electricity efficiently over long distances.

Extra High Voltage Insulators: Theoretically, extra high voltage insulators can be installed anywhere within the present-day power electricity transmission network for voltage ranges above 230 kV. Power transmission over huge distances on these high-transmission lines supports their construction. Advanced composites and ceramics in its core structure enable the apparatus to withstand extreme electrical stressing conditions as well as worse environmental conditions. Their rigid structure minimizes the electrical breakdown and enhances the quality of the transmission system overall. Because of the increasing need for electricity, high-voltage insulators also are becoming an essential component of sustaining the balance in the network.

Overhead Transmission Line: Overhead transmission lines are a very vital method of transferring power over long distances. The backbone of these lines consists of insulators, which undergo high voltage stress, mechanical strength, and other environmental parameters for all of these applications. They make electrical isolation possible support the conductor strings against sagging, and assure system integrity. Depending on the application at hand and the voltage level specified, environmental conditions will determine to use of ceramic, glass, or polymer insulators. With less maintenance, the improvement in reliability and effectiveness of these power transmissions is enhanced.

Substation & Switchyard: Substation and switchyard insulators are extremely imperative in a way directing electricity flow while keeping in mind its safety. These come for support for several other electrical appliances, such as a transformer and circuit breaker. High voltage levels and recurrent electrical surges make the material used highly significant. In general, porcelain or composite made. They are designed to be durable and reliable. Properly insulated, they save substations and switchyards from ills like electrical faults, which helps towards better stability of the grid.

The transmission insulator market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The North America has dominated market in 2024.

In North America, it is the United States and Canada that lead in market share due to outdated infrastructure and the mandate for upgrading. In the United States, emphasis will be focused on renewable sources of power. That means high-performance insulators are needed, especially in high-voltage applications. For Canada, the crucial thrust would be investment in its transmission networks to enhance its hydroelectric power generation. The market is characterized by standards set up for the improvement of safety and environmental sustainability. All these factors together drive the region toward innovation and adaptation of new advanced materials, such as composite and polymer insulators.

The highest consumers of transmission insulators are those countries where the emphasis is on sustainability and renewable energy in Germany, France, and the UK. High-performance insulators are in very good demand in Germany as it tries to pursue Energiewende, which means an ambitious energy transition. France invests in nuclear energy and on harnessing renewable energy through high-technology insulator materials while the UK invests in offshore wind farms demanding solid, reliable insulator products. Strict policies and partnership engagements in the region also emphasized the effective sustainability of efficient grid systems thereby opening a strong market for transmission insulators.

Asia-Pacific, which comprises China and India, is the largest market for transmission insulators. Since transmission insulator applies widely in the country's plans to expand the nation's electrical grid and connect renewable energy projects, high-voltage insulators will be in big demand. India continues to modernize its infrastructure to meet the increasing energy demands that are smart grid technologies. Japan and Australia are adopting innovative insulator solutions to strengthen the resilience of their grids against natural disasters. Advanced materials and technologies in the transmission insulator sector promise a high potential for this region.

LAMEA is led by Brazil and Mexico, focusing on investment in renewable energy and improvement of the transmission infrastructure. The Middle East, in particular the UAE and Saudi Arabia, focuses on an increase in energy systems to bring about an economic acceleration factor that creates a high need for reliable insulators. Africa is leading with South Africa and Kenya toward better electricity supply infrastructure but faces challenges. International investment in renewable energy projects across the region is gradually improving the market for transmission insulators, which makes it a potential growth and development region.

Major players in the transmission insulator industry are General Electric Company, Siemens, ABB, Alstom, and TE Connectivity, all of whom are employing cutting-edge technologies and materials to further upgrade the performance and durability levels of their insulator products. Additionally, these companies spend a lot of their investments on research and development in developing next-generation solutions that exceed high safety and environmental standards. Such companies can expand their geographical market reach through strategic partnerships and collaborations with utilities and energy companies. They also focus on sustainable practices by producing eco-friendly insulators, which would meet the objectives of a global energy transition, therefore strengthening the competitive market position.

CEO Statements

Larry Culp, CEO of General Electric Company

Roland Busch, CEO of Siemens

Clifton Pemble, CEO of ABB

Recent product launches and acquisitions in the transmission insulator industry illustrate a trend toward innovation and strategic collaboration among key industry players. General Electric Company, Siemens, Alstom, ABB and TE Connectivityare some of the developers who are driving innovative functions and features aimed at producing a more sophisticated indoor cycling experience for consumers. Among these are training solutions through AI, better connectivity, and even the ability to create realistic riding simulations to meet this increasing demand for versatile and exciting fitness products. As this technology advances and collaboration continues, evolution in markets is only expected to increase and help improve conditions for all fitness surroundings.

Market Segmentation

By Material

By Type of Insulator

By Voltage

By Technology

By Application

By Functionality

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Transmission Insulator

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Material Overview

2.2.2 By Type of Insulator Overview

2.2.3 By Voltage Overview

2.2.4 By Technology Overview

2.2.5 By Application Overview

2.2.6 By Functionality Overview

2.2.7 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Transmission Insulator Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Infrastructural Development

4.1.1.2 Government Investments

4.1.1.3 Growing Demand for Electrification

4.1.2 Market Restraints

4.1.2.1 High Upfront Costs

4.1.2.2 Location and operating conditions

4.1.2.3 Environmental Regulations

4.1.3 Market Challenges

4.1.3.1 Market Competition

4.1.3.2 Product Quality Assurance

4.1.3.3 Resource Scarcity

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Transmission Insulator Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Transmission Insulator Market, By Material

6.1 Global Transmission Insulator Market Snapshot, By Material

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Ceramic Insulators

6.1.1.2 Glass Insulators

6.1.1.3 Polymer Insulators

Chapter 7. Transmission Insulator Market, By Type of Insulator

7.1 Global Transmission Insulator Market Snapshot, By Type of Insulator

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Pin Insulators

7.1.1.2 Suspension Insulators

7.1.1.3 Line Post Insulators

7.1.1.4 Cap and Pin Insulators

7.1.1.5 Composite Insulators

Chapter 8. Transmission Insulator Market, By Voltage

8.1 Global Transmission Insulator Market Snapshot, By Voltage

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Low Voltage Insulators

8.1.1.2 Medium Voltage Insulators

8.1.1.3 High Voltage Insulators

8.1.1.4 Extra High Voltage

Chapter 9. Transmission Insulator Market, By Technology

9.1 Global Transmission Insulator Market Snapshot, By Technology

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Injection Molding

9.1.1.2 Compression Molding

9.1.1.3 Cast Resin

Chapter 10. Transmission Insulator Market, By Application

10.1 Global Transmission Insulator Market Snapshot, By Application

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Overhead Transmission Line

10.1.1.2 Substation & Switchyard

Chapter 11. Transmission Insulator Market, By Functionality

11.1 Global Transmission Insulator Market Snapshot, By Functionality

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Mechanical Insulation

11.1.1.2 Electrical Insulation

Chapter 12. Transmission Insulator Market, By End User

12.1 Global Transmission Insulator Market Snapshot, By End User

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

12.1.1.1 Utilities

12.1.1.2 Industrial

12.1.1.3 Commercial

12.1.1.4 Residential

Chapter 13. Transmission Insulator Market, By Region

13.1 Overview

13.2 Transmission Insulator Market Revenue Share, By Region 2024 (%)

13.3 Global Transmission Insulator Market, By Region

13.3.1 Market Size and Forecast

13.4 North America

13.4.1 North America Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.4.2 Market Size and Forecast

13.4.3 North America Transmission Insulator Market, By Country

13.4.4 U.S.

13.4.4.1 U.S. Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.4.4.2 Market Size and Forecast

13.4.4.3 U.S. Market Segmental Analysis

13.4.5 Canada

13.4.5.1 Canada Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.4.5.2 Market Size and Forecast

13.4.5.3 Canada Market Segmental Analysis

13.4.6 Mexico

13.4.6.1 Mexico Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.4.6.2 Market Size and Forecast

13.4.6.3 Mexico Market Segmental Analysis

13.5 Europe

13.5.1 Europe Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.5.2 Market Size and Forecast

13.5.3 Europe Transmission Insulator Market, By Country

13.5.4 UK

13.5.4.1 UK Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.5.4.2 Market Size and Forecast

13.5.4.3 UKMarket Segmental Analysis

13.5.5 France

13.5.5.1 France Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.5.5.2 Market Size and Forecast

13.5.5.3 FranceMarket Segmental Analysis

13.5.6 Germany

13.5.6.1 Germany Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.5.6.2 Market Size and Forecast

13.5.6.3 GermanyMarket Segmental Analysis

13.5.7 Rest of Europe

13.5.7.1 Rest of Europe Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.5.7.2 Market Size and Forecast

13.5.7.3 Rest of EuropeMarket Segmental Analysis

13.6 Asia Pacific

13.6.1 Asia Pacific Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.6.2 Market Size and Forecast

13.6.3 Asia Pacific Transmission Insulator Market, By Country

13.6.4 China

13.6.4.1 China Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.6.4.2 Market Size and Forecast

13.6.4.3 ChinaMarket Segmental Analysis

13.6.5 Japan

13.6.5.1 Japan Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.6.5.2 Market Size and Forecast

13.6.5.3 JapanMarket Segmental Analysis

13.6.6 India

13.6.6.1 India Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.6.6.2 Market Size and Forecast

13.6.6.3 IndiaMarket Segmental Analysis

13.6.7 Australia

13.6.7.1 Australia Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.6.7.2 Market Size and Forecast

13.6.7.3 AustraliaMarket Segmental Analysis

13.6.8 Rest of Asia Pacific

13.6.8.1 Rest of Asia Pacific Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.6.8.2 Market Size and Forecast

13.6.8.3 Rest of Asia PacificMarket Segmental Analysis

13.7 LAMEA

13.7.1 LAMEA Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.7.2 Market Size and Forecast

13.7.3 LAMEA Transmission Insulator Market, By Country

13.7.4 GCC

13.7.4.1 GCC Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.7.4.2 Market Size and Forecast

13.7.4.3 GCCMarket Segmental Analysis

13.7.5 Africa

13.7.5.1 Africa Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.7.5.2 Market Size and Forecast

13.7.5.3 AfricaMarket Segmental Analysis

13.7.6 Brazil

13.7.6.1 Brazil Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.7.6.2 Market Size and Forecast

13.7.6.3 BrazilMarket Segmental Analysis

13.7.7 Rest of LAMEA

13.7.7.1 Rest of LAMEA Transmission Insulator Market Revenue, 2022-2034 ($Billion)

13.7.7.2 Market Size and Forecast

13.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 14. Competitive Landscape

14.1 Competitor Strategic Analysis

14.1.1 Top Player Positioning/Market Share Analysis

14.1.2 Top Winning Strategies, By Company, 2022-2024

14.1.3 Competitive Analysis By Revenue, 2022-2024

14.2 Recent Developments by the Market Contributors (2024)

Chapter 15. Company Profiles

15.1 Siemens

15.1.1 Company Snapshot

15.1.2 Company and Business Overview

15.1.3 Financial KPIs

15.1.4 Product/Service Portfolio

15.1.5 Strategic Growth

15.1.6 Global Footprints

15.1.7 Recent Development

15.1.8 SWOT Analysis

15.2 ABB

15.3 Alstom

15.4 TE Connectivity

15.5 Elsewedy Electric

15.6 Bharat Heavy Electricals

15.7 Hubbell

15.8 NGK Insulators

15.9 MacLean Power Systems

15.10 Marmon Utility LLC

15.11 Victor Insulators

15.12 Gipro Insulators

15.13 PPC Insulators