The global turbo trainer market size was valued at USD 3.33 billion in 2024 and is expected to be worth around USD 5.31 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.77% from 2025 to 2034.

A turbo trainer is a stable device that mimics real-life riding conditions. Turbo trainers are widely used for training, rehabilitation, and as a quick fix in inclement weather. Built with a frame to keep the bike in place and a resistance unit for varying difficulty levels. It replicates the impact of natural landscapes such as mountains and peaceful roadways. It comes in several styles. This encompasses liquid, magnetic, and directly conductive media. Each variety has a distinct resistance mechanism. Many turbo trainers also work with smartphones and cycling applications. Improve the training experience with virtual riding and performance tracking. Overall, the turbo trainer is essential for recreational and elite cyclists looking to improve their performance year-round.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 3.33 Billion |

| Expected Market Size in 2033 | USD 5.31 Billion |

| CAGR (2025 to 2034) | 4.77% |

| Superior Region | North America |

| Rapidly Expanding Region | Asia-Pacific |

| Key Segments | Product, Resistance Mechanism, Interaction Type, Price Range, Usage, Distribution Channel, Region |

| Key Companies | Technogym, Precor, Elite, Garmin Ltd, Kinetic, Minoura, Schwinn, CycleOps, Sunlite, BKOOL, RAD Cycle Products, Conquer, Blackburn Design |

The turbo trainer market is segmented into product, resistance mechanism, interaction type, price range, usage, distribution channel and region. Based on product, the market is classified into direct drive turbo trainers and wheel-on turbo trainers. Based on resistance mechanism, the market is classified into electronic, fluid and magnetic. Based on interaction type, the market is classified into smart and standard. Based on price range, the market is classified into low, mid and high; Based on usage, the market is classified into personal, commercial, gyms, wellness centers and others. Based on distribution channel, the market is classified into online channels, e-commerce, company websites, offline channels, specialty stores, mega retails stores and others.

Direct drive turbo trainers: Direct drive turbo trainers do not require a rear wheel since they hook up to the axle; they essentially mount on the back of the bike. Such a design is suitable for serious enthusiasts and competitive training purely on the account that it enhances stability as well as reduces possible power measurement errors - this would result in smoother resistance as well as less noisy operation. The reason that direct drive trainers are so popular with enthusiastic cyclists is their ease and compatibility with almost all types of bikes.

Turbo Trainer Market Revenue Share, By Product, 2024 (%)

| Product | Revenue Share, 2024 (%) |

| Direct drive turbo trainers | 60% |

| Wheel-on turbo trainers | 40% |

Wheel-on turbo trainers: Wheel-on turbo trainer designs are more user-friendly and basic for beginners simply because they use the rear wheel as support. These types of trainers also tend to have a broader appeal since they're often cheaper and generally quicker to set up. Being easy to transport, plus easier still to just set up and go makes them suitable for anyone wanting to add indoor cycling into their exercise routine without spending too much or if not at a level where power-measurement accuracy matters too much.

Electronic: The electronic segment has dominated the market in 2024. Smart technology within electronic resistance turbo trainers alters resistance based on the performance of the user or the program being followed. This allows for more realistic conditions to be replicated and provides instant data through performance metrics during a more interactive form of training. They can also interlink with virtual rides and pre-set workouts through various cycling apps to enhance the workout further. These types of turbo trainers are increasingly being used by cyclists to help make indoor training a little more exciting as they do offer such flexibility and there is no manual setup required.

Fluid: Fluid resistance Turbo trainers make use of the fluid-filled sealed chamber in producing the resistance thus allows riders to have a smooth realistic feeling just like outdoors biking. The resistance graduates precisely with an increase in the pace of the cyclists thereby imitating cycling over the outdoors. Though fluid resistance systems are generally noisier than any other kind of resistance system, a more comprehensive workout is expected. As trainers in fluid form are very easy to use, they are also most preferred for cyclists who want to train indoors more effectively with a feeling of riding.

Turbo Trainer Market Revenue Share, By Resistance Mechanism, 2024 (%)

| Resistance Mechanism | Revenue Share, 2024 (%) |

| Electronic | 46% |

| Fluid | 35% |

| Magnetic | 19% |

Magnetic: Magnetic resistance trainers use magnets to provide variable levels of resistance. This device allows a cyclist to personalize their workout. Because a user can vary the resistance settings manually, different training intensities can be achieved. Fluid or electrical trainers generally are more costly and harder to service than magnetic types. For example, while magnetic resistance trainers are unlikely to attain the quality of much more costly models, these trainers offer reliability and affordability to a broad group of exercise enthusiasts who are looking for an efficient indoor cycling solution.

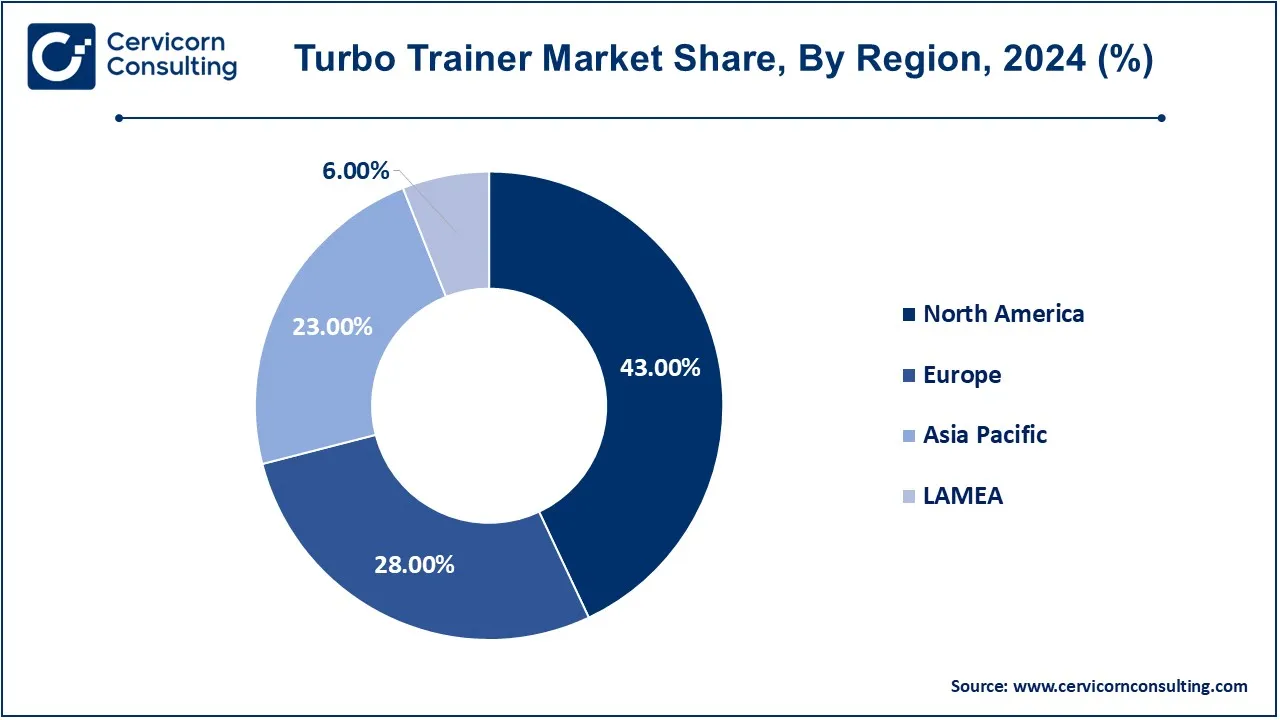

The turbo trainers market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The North America region has dominated the market in 2024.

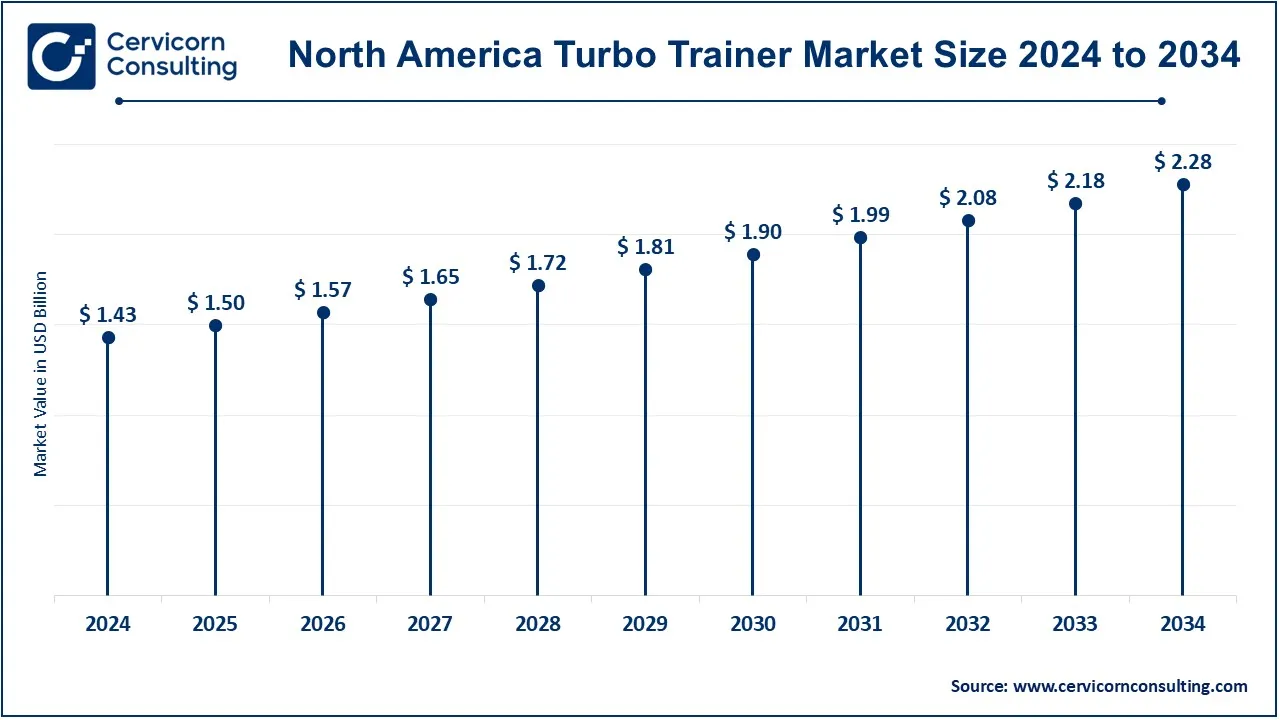

The North America turbo trainer market size was valued at USD 1.43 billion in 2024 and is expected to reach around USD 2.28 billion by 2034. The turbo trainer enjoys a good demand in North America, since cycling is widely popular there, and people are more concerned about their health. The market size is relatively high in the US and Canada. Its demand is maximum in the United States due to the presence of various fitness trends in the region, such as indoor cycling classes and online training programs like Zwift. Furthermore, it is quite burgeoning in Canada, where it will ensure that riders will stay indoors during the most extreme winter months. As a country of high disposable wealth and using advanced training equipment, North America would be a great market for turbo trainer manufacturers.

The Europe turbo trainer market size was estimated at USD 0.93 billion in 2024 and is projected to hit around USD 1.49 billion by 2034. Europe is a big market for turbo trainers because of the emphasis on fitness and the historic tradition of cycling. National involvement in cycling is high within nations dominating the market, such as those seen within the Netherlands, Germany, and the United Kingdom. Another trend that further intensifies demand for turbo trainers is indoor cycling, promoted by both fitness centers and community events. Europe is one of the leading markets for high-end training solutions, with fitness technology and professional cycling growing in popularity throughout the region and sparking innovation in smart trainers.

The Asia-Pacific turbo trainer market size was accounted for USD 0.77 billion in 2024 and is predicted to surpass around USD 1.22 billion by 2034. Turbo trainers are a hastily expanding phenomenon in the Asia Pacific vicinity, due to expanded disposable income and fitness focus. Exercise is becoming increasingly famous among Chinese, Japanese, and Australians. Urbanization and the need for indoor fitness are the principal causes of this fashion. Moreover, the increasing recreation, as well as the competitive sport of cycling, helps get the turbo trainer demand going. Regional producers, for their part, are increasingly entering this market with relatively cheaper products appealing to a broader segment of the consuming public.

The LAMEA turbo trainer market was valued at USD 0.20 billion in 2024 and is anticipated to reach around USD 0.32 billion by 2034. Factors like growing disposable incomes and the awareness of health propel the growth of turbo trainers in the LAMEA region. Increased exercise-friendly cultures and flourishing cycling culture in the countries of Latin America like Brazil and Argentina assure potential. Since indoor fitness center markets are booming in the Middle East, the use of turbo trainers is also promoted. Africa has a mounting youth and urbanization problem that needs more answers to fitness needs. However, economic differences and lack of access to higher-end products will be a challenge in the expansion of this market.

CEO Statements

Nerio Alessandri, CEO of Technogym

Dustin Grosz, CEO of Precor

Clifton Pemble, CEO of Garmin Ltd

Recent product launches and agreements in the market of turbo trainers indicate a rising pace of innovation and strategic collaboration among key industry players. Some of the developers that are driving innovative functions and features toward producing a more sophisticated indoor cycling experience for consumers are Technogym, Precor, Elite, Garmin Ltd, Kinetic, Minoura, Schwinn, and CycleOps. Among these include training solutions through AI, better connectivity, and even the ability to create realistic riding simulations to meet this rising demand for versatile and exciting fitness products. As technology evolves and collaboration increases, the evolutions in the markets are only expected to intensify and further improve the conditions for all fitness surroundings.

Market Segmentation

By Product

By Resistance Mechanism

By Interaction Type

By Price Range

By Usage

By Distribution Channel

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Turbo Trainer

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Resistance Mechanism Overview

2.2.3 By Interaction Type Overview

2.2.4 By Price Range Overview

2.2.5 By Usage Overview

2.2.6 By Distribution Channel Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Turbo Trainer Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Health and Fitness Consciousness

4.1.1.2 Time Constraints

4.1.1.3 The growth in online retail

4.1.2 Market Restraints

4.1.2.1 High Price Initial Investment

4.1.2.2 Space Requirements

4.1.2.3 Niche Market

4.1.3 Market Challenges

4.1.3.1 Competition with Other Fitness Products

4.1.3.2 Technological Compatibility

4.1.3.3 Consumer Education

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Turbo Trainer Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Turbo Trainer Market, By Product

6.1 Global Turbo Trainer Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Direct drive turbo trainers

6.1.1.2 Wheel-on turbo trainers

Chapter 7. Turbo Trainer Market, By Resistance Mechanism

7.1 Global Turbo Trainer Market Snapshot, By Resistance Mechanism

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Electronic

7.1.1.2 Fluid

7.1.1.3 Magnetic

Chapter 8. Turbo Trainer Market, By Interaction Type

8.1 Global Turbo Trainer Market Snapshot, By Interaction Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Smart

8.1.1.2 Standard

Chapter 9. Turbo Trainer Market, By Price Range

9.1 Global Turbo Trainer Market Snapshot, By Price Range

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Low (less than 200$)

9.1.1.2 Mid (200$-500$)

9.1.1.3 High (above 500$)

Chapter 10. Turbo Trainer Market, By Usage

10.1 Global Turbo Trainer Market Snapshot, By Usage

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Personal

10.1.1.2 Commercial

10.1.1.3 Gyms

10.1.1.4 Wellness Centers

10.1.1.5 Others (Sports associations)

Chapter 11. Turbo Trainer Market, By Distribution Channel

11.1 Global Turbo Trainer Market Snapshot, By Distribution Channel

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Online channels

11.1.1.2 E-commerce

11.1.1.3 Company websites

11.1.1.4 Offline channels

11.1.1.5 Specialty Stores

11.1.1.6 Mega retails stores

11.1.1.7 Others (Individual stores, Departmental stores)

Chapter 12. Turbo Trainer Market, By Region

12.1 Overview

12.2 Turbo Trainer Market Revenue Share, By Region 2024 (%)

12.3 Global Turbo Trainer Market, By Region

12.3.1 Market Size and Forecast

12.4 North America

12.4.1 North America Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.4.2 Market Size and Forecast

12.4.3 North America Turbo Trainer Market, By Country

12.4.4 U.S.

12.4.4.1 U.S. Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.4.4.2 Market Size and Forecast

12.4.4.3 U.S. Market Segmental Analysis

12.4.5 Canada

12.4.5.1 Canada Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.4.5.2 Market Size and Forecast

12.4.5.3 Canada Market Segmental Analysis

12.4.6 Mexico

12.4.6.1 Mexico Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.4.6.2 Market Size and Forecast

12.4.6.3 Mexico Market Segmental Analysis

12.5 Europe

12.5.1 Europe Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.5.2 Market Size and Forecast

12.5.3 Europe Turbo Trainer Market, By Country

12.5.4 UK

12.5.4.1 UK Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.5.4.2 Market Size and Forecast

12.5.4.3 UKMarket Segmental Analysis

12.5.5 France

12.5.5.1 France Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.5.5.2 Market Size and Forecast

12.5.5.3 FranceMarket Segmental Analysis

12.5.6 Germany

12.5.6.1 Germany Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.5.6.2 Market Size and Forecast

12.5.6.3 GermanyMarket Segmental Analysis

12.5.7 Rest of Europe

12.5.7.1 Rest of Europe Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.5.7.2 Market Size and Forecast

12.5.7.3 Rest of EuropeMarket Segmental Analysis

12.6 Asia Pacific

12.6.1 Asia Pacific Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.6.2 Market Size and Forecast

12.6.3 Asia Pacific Turbo Trainer Market, By Country

12.6.4 China

12.6.4.1 China Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.6.4.2 Market Size and Forecast

12.6.4.3 ChinaMarket Segmental Analysis

12.6.5 Japan

12.6.5.1 Japan Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.6.5.2 Market Size and Forecast

12.6.5.3 JapanMarket Segmental Analysis

12.6.6 India

12.6.6.1 India Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.6.6.2 Market Size and Forecast

12.6.6.3 IndiaMarket Segmental Analysis

12.6.7 Australia

12.6.7.1 Australia Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.6.7.2 Market Size and Forecast

12.6.7.3 AustraliaMarket Segmental Analysis

12.6.8 Rest of Asia Pacific

12.6.8.1 Rest of Asia Pacific Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.6.8.2 Market Size and Forecast

12.6.8.3 Rest of Asia PacificMarket Segmental Analysis

12.7 LAMEA

12.7.1 LAMEA Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.7.2 Market Size and Forecast

12.7.3 LAMEA Turbo Trainer Market, By Country

12.7.4 GCC

12.7.4.1 GCC Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.7.4.2 Market Size and Forecast

12.7.4.3 GCCMarket Segmental Analysis

12.7.5 Africa

12.7.5.1 Africa Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.7.5.2 Market Size and Forecast

12.7.5.3 AfricaMarket Segmental Analysis

12.7.6 Brazil

12.7.6.1 Brazil Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.7.6.2 Market Size and Forecast

12.7.6.3 BrazilMarket Segmental Analysis

12.7.7 Rest of LAMEA

12.7.7.1 Rest of LAMEA Turbo Trainer Market Revenue, 2022-2034 ($Billion)

12.7.7.2 Market Size and Forecast

12.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 13. Competitive Landscape

13.1 Competitor Strategic Analysis

13.1.1 Top Player Positioning/Market Share Analysis

13.1.2 Top Winning Strategies, By Company, 2022-2024

13.1.3 Competitive Analysis By Revenue, 2022-2024

13.2 Recent Developments by the Market Contributors (2024)

Chapter 14. Company Profiles

14.1 Technogym

14.1.1 Company Snapshot

14.1.2 Company and Business Overview

14.1.3 Financial KPIs

14.1.4 Product/Service Portfolio

14.1.5 Strategic Growth

14.1.6 Global Footprints

14.1.7 Recent Development

14.1.8 SWOT Analysis

14.2 Precor

14.3 Elite

14.4 Garmin Ltd

14.5 Kinetic

14.6 Minoura

14.7 Schwinn

14.8 CycleOps

14.9 Sunlite

14.10 BKOOL

14.11 RAD Cycle Products

14.12 Conquer

14.13 Blackburn Design