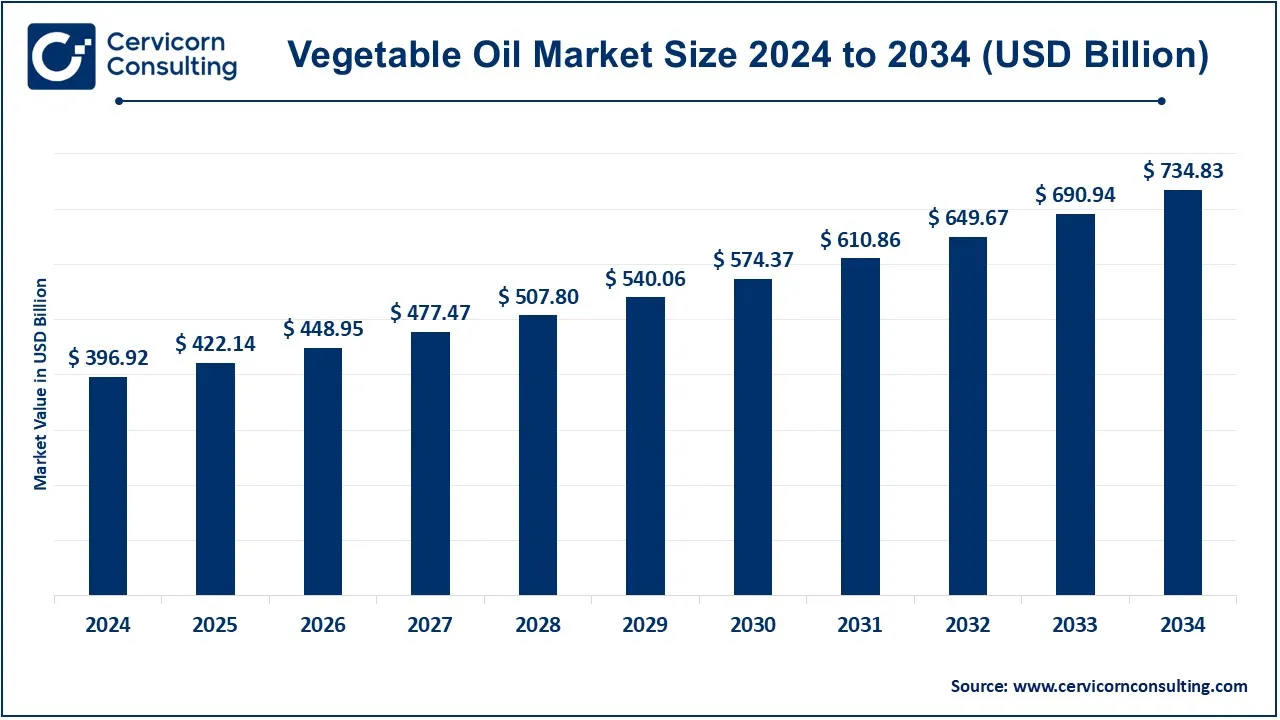

The global vegetable oil market size was valued at USD 396.92 billion in 2024 and is expected to be worth around USD 734.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.35% from 2025 to 2034.

Vegetable oils are oils that are obtained from plant material, usually seeds, nuts, or fruits. Common vegetable oils include soybean, sunflower, olive, palm and canola oil. Vegetable oils do not have a strong flavor at any given temperature and they also have a very high smoke point. For this reason, and because they are inexpensive to produce and easy to store and transport, vegetable oils are most commonly used in cooking and frying. Vegetable oils find use in manufacturing in the production of lotions, soaps, topical creams, pharmaceuticals and biofuels. They contain unsaturated fats and are a healthier alternative to animal fats. When consumed in moderation, vegetable oils can reduce the risk of heart disease.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 396.92 Billion |

| Expected Market Size in 2034 | USD 734.83 Billion |

| CAGR (2025 to 2034) | 6.35% |

| Most Prominent Region | Asia-Pacific |

| Booming Region | North America |

| Key Segments | Type, Application, Distribution Type, Region |

| Key Companies | Archer Daniels Midland Company, Sime Darby Plantation Berhad, Bunge Limited, Olam International Limited, Cargill Incorporated, Golden Agri-Resources, Kuala Lumpur Kepong Berhad, Fuji Oil Holding Inc., Wilmar International Limited, PT Astra Agro Lestari Tbk |

The vegetable oil market is segmented into type, application, distribution type and region. Based on type, the market is classified into palm oil, soybean oil, rapeseed oil, sunflower oil, others. Based on application, the market is classified into food, feed and industrial. Based on distribution type, the market is classified into B2B and B2C.

Palm Oil: The palm oil segment has dominated the market in 2024. Palm oil is regarded as the world's most-produced and consumed vegetable oil, due to its multiple uses and high-yield production. The food industry uses it on a grand scale as margarine, cooking oil, and in processed foods and personal care products as well as biodiesel. Sources for palm oil are heavily from Indonesia and Malaysia, accounting very largely for the world market. Environmental issues related to deforestation and sustainability issues have influenced economics for the palm oil market.

Soybean Oil: Soybean oil is heart-healthy, light, versatile, and easy to use in cooking. It finds usage in salad dressings, frying oils, and in processed foods. Major sources of soybean oil production include North American and South American countries such as the U.S. and Brazil. As global hydrocarbon reserves become extremely low, it's increasingly growing into other uses, such as in biodiesel.

Rapeseed Oil: Rapeseed oil, or canola oil in one of its low-erucic-acid variants, is valued for having less saturated fat and a higher proportion of omega-3 fats. It has an important usage in cooking and food manufacturing owing to its neutral flavor and health benefits. In rapeseed oil production, Europe accounts for a large area of cultivation; it is grown for both food and industrial applications, including the production of biodiesel.

Sunflower Oil: Sunflower oil is rated to have a very light taste to it, plus a lot of vitamin E content, making it widely used in cooking, mostly by frying and baking. Countries like Ukraine and Russia extensively produce it and rule the globe's supply. Sunflower oil usage is also progressing toward markets in health-consciousness, because compared to palm or coconut oils it contains lesser amounts of saturated fats.

Food: The food sector-that is, mostly frying, baking, and ingredient-based-vigourously drives the market for the vegetable oils sector. Palm, sunflower, and soybean oils hold the prime position due to their cooking versatility. Innovations in this direction have been in response to the escalating calls for healthy oils or plant-based diets, because of rising requests for unsaturated fatty acid-rich oils. Nevertheless, the population growth and urbanization will provide base fuels for the application growth.

Feed: The incorporation of vegetable oils into animal feed formulation, especially in poultry and swine, is as sources of energy and essential fatty acids. Soy and palm oil are commonly used animal feed ingredients. The increasing demand for quality animal feed has been driven by growing global meat consumption, and vegetable oils are a critical component in this respect. This will gew further, as more and more livestock farmers try to enhance feed efficiency and improve the health of their animals through balanced diets.

Vegetable Oil Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Food | 63.19% |

| Feed | 25.74% |

| Industrial | 11.07% |

Industrial: Besides, the other uses of vegetable oils-for example, the biofuels, lubricants, cosmetics, and pharmaceuticals-are also taking their blocks of instructions from the industrial sector. High demands for renewable energy sources, driven by the growth of biodiesel, led to a rapid resurgence in the use of oils such as palm and soybean. More so, vegetable oils are increasingly taking the place of petroleum-derived products in lubricants and cosmetics with globally sustainable trends. This segment continues to grow with governmental support from the green industry and environmentally friendly products and markets.

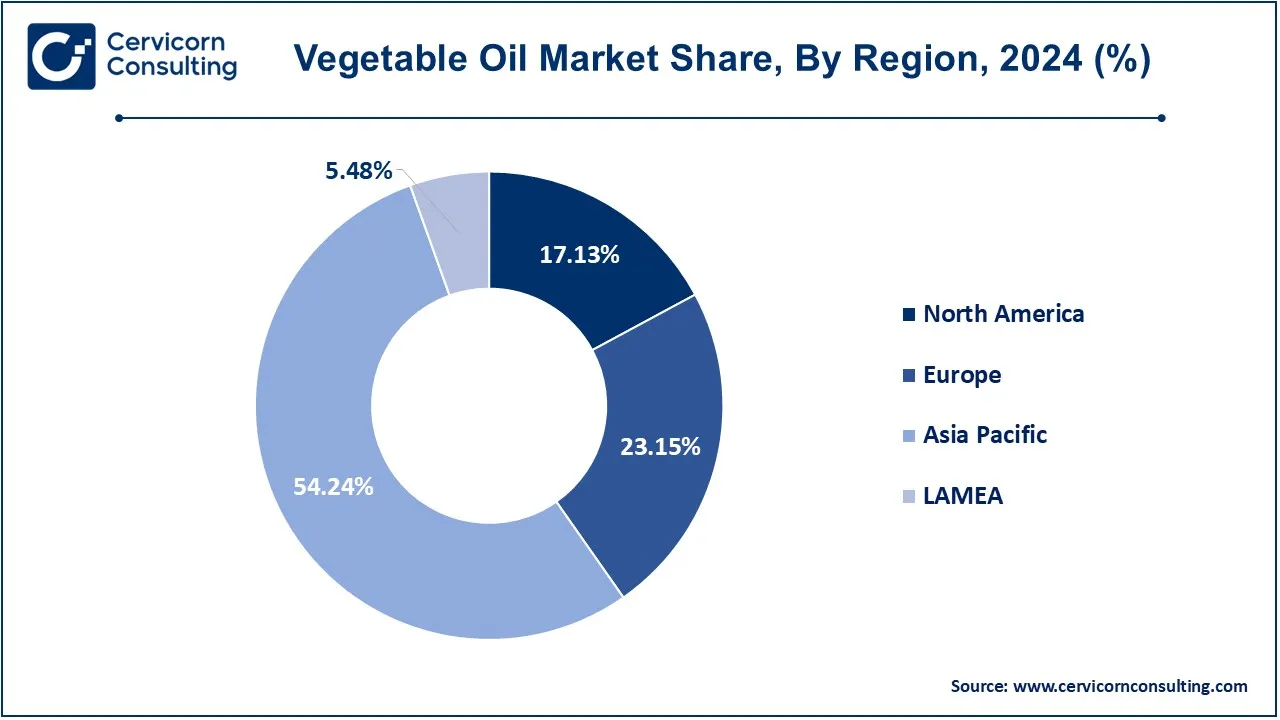

The vegetable oil market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The Asia-Pacific region has dominated the market in 2024.

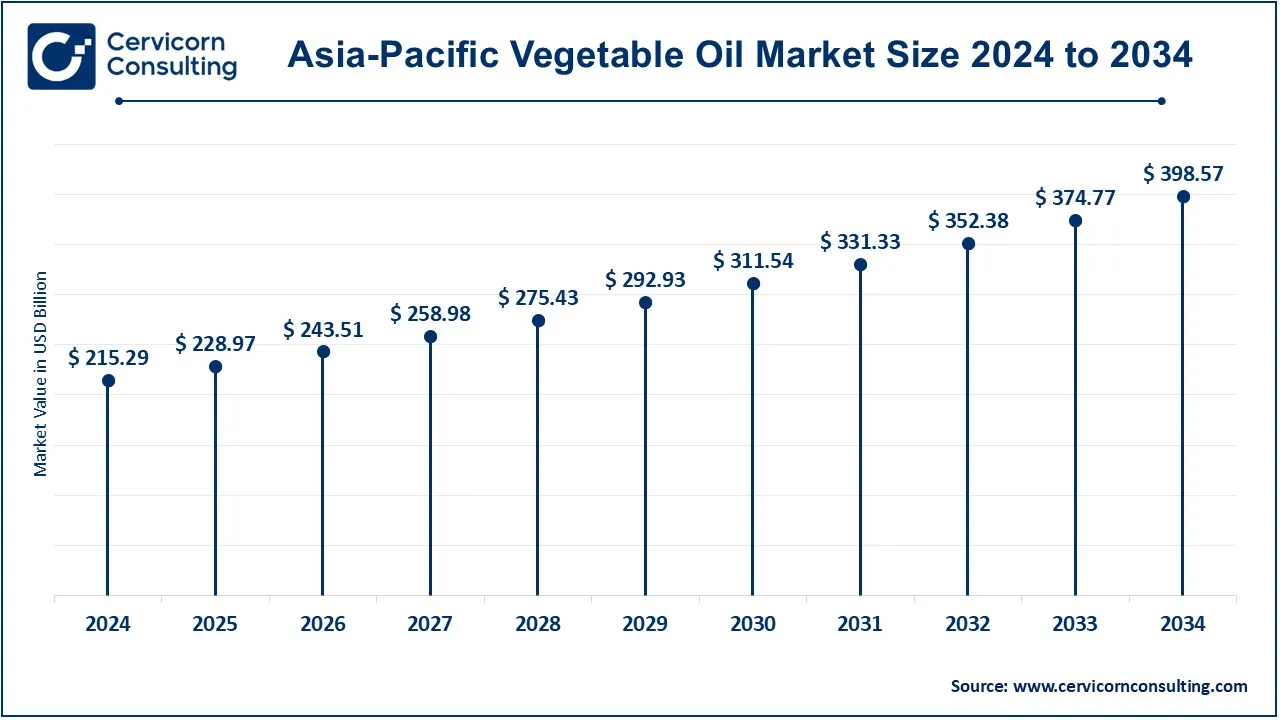

The Asia-Pacific vegetable oil market size was accounted for USD 215.29 billion in 2024 and is predicted to surpass around USD 398.57 billion by 2034. Asia-Pacific still accounts for the largest share of vegetable oil consumption, with China, India, Indonesia, and Malaysia being the key consumers. Palm oil production in Indonesia and Malaysia makes up most of the global supply while China and India are huge consumers of soyabean and palm oils both for food and industrial uses. The population increase, the disposable income increase, and the need for processed foods are the major growth drivers. Improving biodiesel production in this region is another area in which the vegetable oil market will grow.

The North America vegetable oil market size was valued at USD 67.99 billion in 2024 and is expected to reach around USD 125.88 billion by 2034. North America witnesses a genuine demand boom headed by plant-based products and biofuels. The U.S. and Canada are the main maize-reliant producers, with the bulk of production from soybean oil. Health concerns of a burgeoning consumer base-and a preference for non-GMO and organic oils-define market trends. U.S. biofuel policies seem to promote a realization of higher vegetable oil production in favor of biodiesel, usually based on soy oil, giving North America an edge in the global market.

The Europe vegetable oil market size was estimated at USD 91.89 billion in 2024 and is projected to hit around USD 170.11 billion by 2034. Europe is a significant market for vegetable oils, being mainly rapeseed oils and sunflower oils. The region emphasizes sustainability, with countries like Germany, France, and the Netherlands leading in biofuel production and organic oil consumption. Rapeseed oil is primarily used for biodiesel production, driven by the EU’s renewable energy policies. Increasing demand for healthier alternatives and organic food products, as well as the region’s strong regulatory framework for sustainable agriculture, makes Europe a significant market for vegetable oils.

The LAMEA vegetable oil market was valued at USD 21.75 billion in 2024 and is anticipated to reach around USD 40.27 billion by 2034. The LAMEA region offers an increasing demand for vegetable oils spurred by a burgeoning population and urbanization. Brazil and Argentina are leading soybean oil-producing countries, bearing large export commodities. Latin America diverges somewhat from Africa and Middle East in the consumption trend for cooking oils by employing sunflower and olive oil more often due to the health aspects associated with cooking oils. Africa's demand for inedible and industrial oils surged; the growth of the vegetable oil market is intertwined with the progress of economic development and increasing industrialization in these regions.

The Vegetable oil market is significantly dominated by key players like Archer Daniels Midland Company, Sime Darby Plantation Berhad, Bunge Limited, Olam International Limited, and others. These companies leverage their vast global supply chains, advanced processing technologies, and strong presence in key regions to meet rising demand across various applications, including food, industrial uses, and biodiesel production. Additionally, their investments in sustainable practices, such as responsible sourcing and reducing carbon footprints, allow them to address the growing consumer demand for eco-friendly and healthier oil products.

CEO statements

Juan Luciano, CEO of Archer Daniels Midland (ADM)

Dato’ Mohd Bakke Salleh, CEO of Sime Darby Plantation

Greg Heckman, CEO of Bunge Limited

Recent product launches in the vegetable oil market underscore a notable trend toward innovation and strategic partnerships among key industry players. Companies like Archer Daniels Midland Company, Sime Darby Plantation Berhad, Bunge Limited, and Olam International Limited are investing in advanced processing technologies and sustainable practices to meet the increasing consumer demand for high-quality, eco-friendly oils. This proactive approach not only enhances product offerings but also positions these companies to capitalize on market opportunities, ensuring they remain competitive in a rapidly evolving industry landscape driven by sustainability and health consciousness. Some notable examples of key developments in the Vegetable oil Market include:

Market Segmentation

By Type

By Application

By Distribution Type

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Vegetable Oil

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Application Overview

2.2.3 By Distribution Type Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Vegetable Oil Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising consumption of food

4.1.1.2 Advancements in technology

4.1.1.3 Biofuel demand

4.1.1.4 Health-conscious consumers

4.1.1.5 Growth of urbanization and the growing middle class

4.1.2 Market Restraints

4.1.2.1 Environmental issues

4.1.2.2 Health concerns related to some oils

4.1.2.3 Competition from synthetic oils

4.1.3 Market Challenges

4.1.3.1 Sustainability and deforestation hurdles

4.1.3.2 Consumer awareness of health

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Vegetable Oil Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Vegetable Oil Market, By Type

6.1 Global Vegetable Oil Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Palm Oil

6.1.1.2 Soybean Oil

6.1.1.3 Rapeseed Oil

6.1.1.4 Sunflower Oil

6.1.1.5 Others

Chapter 7. Vegetable Oil Market, By Application

7.1 Global Vegetable Oil Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Food

7.1.1.2 Feed

7.1.1.3 Industrial

Chapter 8. Vegetable Oil Market, By Distribution Type

8.1 Global Vegetable Oil Market Snapshot, By Distribution Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 B2B

8.1.1.2 B2C

Chapter 9. Vegetable Oil Market, By Region

9.1 Overview

9.2 Vegetable Oil Market Revenue Share, By Region 2024 (%)

9.3 Global Vegetable Oil Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Vegetable Oil Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Vegetable Oil Market, By Country

9.5.4 UK

9.5.4.1 UK Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Vegetable Oil Market, By Country

9.6.4 China

9.6.4.1 China Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Vegetable Oil Market, By Country

9.7.4 GCC

9.7.4.1 GCC Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Vegetable Oil Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Archer Daniels Midland Company

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Sime Darby Plantation Berhad

11.3 Bunge Limited

11.4 Olam International Limited

11.5 Cargill Incorporated

11.6 Golden Agri-Resources

11.7 Kuala Lumpur Kepong Berhad

11.8 Fuji Oil Holding Inc.

11.9 Wilmar International Limited

11.10 PT Astra Agro Lestari Tbk