The global bearing market size was valued at USD 149.91 billion in 2024 and is expected to be worth around USD 381.51 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.79% from 2025 to 2034.

Bearings help reduce the contact friction between the moving mechanical surfaces of various types of machine assemblies, thereby contributing significantly to the effective operation of vehicles, aircraft, industrial equipment, etc. Technological development and industrial demand increasingly require miniature bearings to withstand high loads, operate at high speeds, and under adverse conditions. This has led to the development of many innovations to improve the performance, reliability, and performance of bearings.

The rolling bearing sector, which serves as the foundation for many machine engineering, is progressing at an exponential rate as technology and markets evolve. Bearing technologies has moved forward significantly as the culmination of several innovations and trends. The continuous quest for increased efficacy, reliability, and productiveness across a range of domains represents the impetus behind such advancements. It explores the fascinating field of storage technology and the recent developments that are revolutionizing the field.

CEO Statements

Regional Demand and Supply in 2023 (%)

| Region | Production | Demand |

| North America | 12% | 15% |

| Europe | 23% | 21% |

| Asia Pacific | 62% | 59% |

| Central and South America | 2% | 2% |

| Africa & Middle East | 1% | 3% |

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 149.91 Billion |

| Expected Market Size in 2034 | USD 381.51 Billion |

| Projected CAGR 2025 to 2034 | 9.79% |

| Dominant Region | Asia-Pacific |

| Key Segments | Type, Material, Product, Size, Application and Region |

| Key Companies | Schaeffler Group, NSK Ltd., HKT Bearings Ltd., NTN Corporation, JTEKT Corporation, RBC Bearings Inc., Svenska Kullagerfabriken AB, Brammer PLC, The Timken Company, Nachi Fujikoshi Corp., Thordon Bearings Inc., NBI Bearings Europe, Rexnord Corporation, Harbin Bearing Manufacturing Co., Ltd., C&U Group, Minebea Mitsumi Inc., Others |

Industrial Automation's Ascent

Rising demand for EVs and robotics

Expensive Manufacturing and Fluctuating Material Costs

Availability of Counterfeits

Increasing Demand for Sustainability and Green Bearings

Increasing Condition Monitoring and Predictive Maintenance

Improper Lubrication

Growing Corrosion Concerns

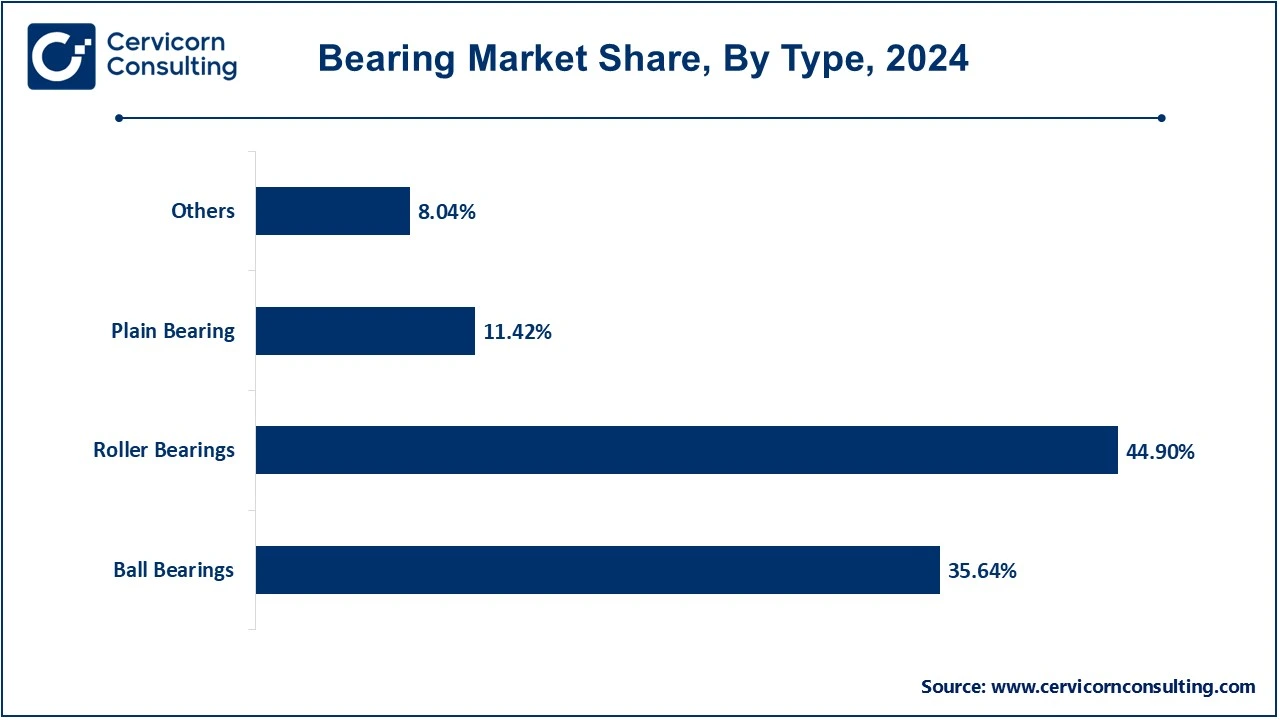

The bearing market is segmented into type, material, product, size, application and region. Based on type, the market is classified into ball bearings, roller bearings, plain bearings, precision bearings, and others. Based on material, the market is classified into steel, plastic, ceramic, and hybrid. Based on product, the market is classified into mounted bearings and unmounted bearings. Based on size, the market is classified into 30 to 40, 41 to 50, 51 to 60, 61 to 70, and 70 & above. Based on application, the market is classified into automotive, aerospace, railway, agriculture, mining & construction, automotive aftermarket, and others.

Ball Bearings: The ball bearing segment is expected to witness tremendous growth during the forecast period due to its exceptional performance over wide temperature ranges. A ball bearing is a rolling element that reduces friction, supports weights and controls the movement and position of moving machine parts. It contains a protective seal that prevents leaks and entry of foreign matter into the housing, thus reducing repair costs. Furthermore, its simple design, low cost and high durability enable it to be used with radial and axial loads, increasing its demand in various applications and end-use areas.

Roller Bearings: The roller bearings is the dominant segment in 2024. Roller bearings are more effective than alternatives in supporting heavy radial and limited axial loads while reducing rotational friction. It is estimated that widespread adoption of roller bearings in several industries including capital goods, automobiles, home appliances and aerospace would increase the demand for the bearing industry.

Plain Bearings: Plain bearings, also known as sleeve bearings, are bearings with no rolling components and are the simplest variety. They allow sliding, oscillating, rotary and reciprocating motions. They are used as bearing strips, plain bearings and wear plates in sliding applications. Plain bearings are superior to roller bearings in terms of resistance to high shock loads and load carrying capacity due to their larger contact area and conformability.

Self-Lubricating Bearings: One of the best new ideas in bearing technology is self-lubricating bearings. Most car bearings take care of their own lubrication, so you don't have to regularly add oil to them. Some key features of these bearings are that they lower friction in tough spots and help keep the right temperature. They are a low-cost bearing option that needs less manual greasing and care. They resist rust and can handle tough environments.

Precision Bearings: Precision bearings offer exceptional accuracy and reliability and are designed to minimize tolerances. Power tool bearings, SKF bearings and NBC bearings come under precision bearings. These bearings offer exceptional dimensional accuracy and ensure smooth operation. They are available in customizable designs tailored to specific requirements and are made of high-quality materials such as steel, ceramic and stainless steel to ensure the longevity and durability of the bearing.

Steel: Steel is the main material used for rolling and ball bearings, both for the rolling elements and the rings. However, some industries require other properties such as higher corrosion resistance, porosity, cost savings, scuff resistance, lightweight materials and high durability. Some steel bearings are carbon steel, chrome steel and stainless steel bearings. The type of bearing made of carbon is commonly found in roller shutters, locks, bicycles, roller skates and shopping carts. Chrome steel has applications in many industries such as vibration motor systems, food processing machinery and linear motion components. Stainless steel bearings can be used in a number of industries including temperature sensitive areas. Examples include food processing, manufacturing, metal plating, instrumentation, high humidity and areas with high chemical exposure.

Plastic: Plain bearings, also called sleeve bearings, are bearings without rolling elements and are the simplest type. They allow sliding, oscillating, rotating and reciprocating motion. They are used as bearing strips, plain bearings and wear plates in sliding applications. Plain bearings are superior to roller bearings in terms of resistance to high shock loads and load carrying capacity due to their larger contact area and conformability.

Ceramic: Ceramic bearings are manufactured to produce a highly corrosion resistant and durable bearing using two ceramic rings and a fluororesin retainer. This material is preferred over stainless steel and its differences arise from the non-magnetic requirements of the machinery. The advantages of using a Singapore ceramic ball bearing include high hardness, corrosion resistance, durability, light weight, high temperature resistance, low density and low maintenance as no lubrication is required. The industrial applications for ceramic ball bearings are often in aircraft, dentistry and food processing machinery.

Hybrid: Hybrid bearings are manufactured keeping in mind best practices. The use of high radial and axial strength steel for the rings and bearing grade silicon nitrate to manufacture the rolling elements provides electrical insulation. Thus, hybrid bearing types offer the advantages of high wear resistance, diverse application scenarios in industry, higher speed than most others and non-conductive components for temperature rises or RCF. High-value research and scientific machines such as cryogenic chambers, aerospace engineering and medical devices use hybrid bearing components and materials.

Mounted Bearings: Mounted bearings and housings with rolling element bearings support a rotating shaft that can be bolted to a machine frame or other substructure. There is no need to precisely machine a bearing housing within a surrounding housing. This makes these solutions cost-effective and easy to use while still providing the full performance of the rolling element bearings.

Unmounted Bearings: Unmounted bearings offer a number of advantages when a housing is not required. Unmounted ball bearings consist of a ring of steel balls held in place by a rotating cage. The design of the ball bearing loaded bearing cage allows for normal and axial loading and can tolerate high-speed rotation. These bearings may be protected by polymer seals or metal shields on one or both sides.

Automotive: The automotive segment has lead the market. Increased vehicle production, transition to electric and autonomous vehicles, advancements in bearing technology, and increased demand for efficiency and reliability. With advances in innovation and increasing adoption of smart mobility solutions, the market will significantly impact the future of the automotive industry. Autonomous vehicles that rely on sophisticated steering, braking, and sensing systems require high-precision bearings for optimal performance.

Aerospace: The growth of the aerospace segment is attributed to the increasing interest in travel, the need to renew aging fleets while complying with strict environmental regulations, pressure on fuel prices, and the availability of new technologies to improve global and local transportation systems. In addition, the growth in the aerospace segment is expected to drive demand for aircraft and helicopters in emerging markets. Overall, the aerospace segment will significantly impact the market growth in the coming years.

Railway: The segment growth is attributed to the increasing interest in travel activities, growing need for renewal of ageing fleets due to stringent environmental regulations and pressure on fuel prices coupled with availability of improved options to support global and local transportation systems. Demand from the railway sector is also expected to increase due to accelerated railway construction in developing countries.

Bearing Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Automotive | 48.18% |

| Agriculture | 7.17% |

| Electrical | 2.42% |

| Mining & Construction | 13.50% |

| Railway & Aerospace | 6.82% |

| Automotive Aftermarket | 3.20% |

| Others | 18.71% |

Agriculture: Agriculture is the key development and art of crop and livestock cultivation. There are various types of machines used in crop farming, agriculture or other agricultural activities. These machines operate day and night and their operators demand the highest level of reliability and flexibility along with ease of operation. Therefore, bearings play an important role in the operation of these agricultural applications which include semi-trailers and many other heavy machinery. Bearings in farming machines are made to handle the tough conditions they face while working in the fields. They are made to handle heavy loads, bumps, and shakes that come from moving over rough ground and doing different jobs outside.

Others: Other industries include electricity, mining, construction, and energy. The type of bearings used in an electric motor depends on its design, how it will be used, the environment it works in, and other factors. Electric motors commonly use two main kinds of bearings: ball bearings and roller bearings. The functionality of mining and construction equipment heavily relies on the significance of bearings. Machines used in mining and construction are typically found in harsh settings, such as places with large weights, powerful impacts, a lot of shaking, and dirt. The ideal bearings must be resilient, made from strong components, feature reliable seals, and have the ability to bear substantial weights while withstanding shocks. These features help the machines work for a longer time and improve how well they do their jobs. This set has roller bearings, ring bearings, and ball bearings. It is essential for the bearings in machines within the power generation industry to operate smoothly and consistently without failure.We ought to confirm that the bearings we utilize are sturdy and have longevity. Various types of bearings are present in power-generating machines.Included in this group are ball bearings, roller bearings, pillow block bearings, blade bearings, yaw bearings, and radial bearings.

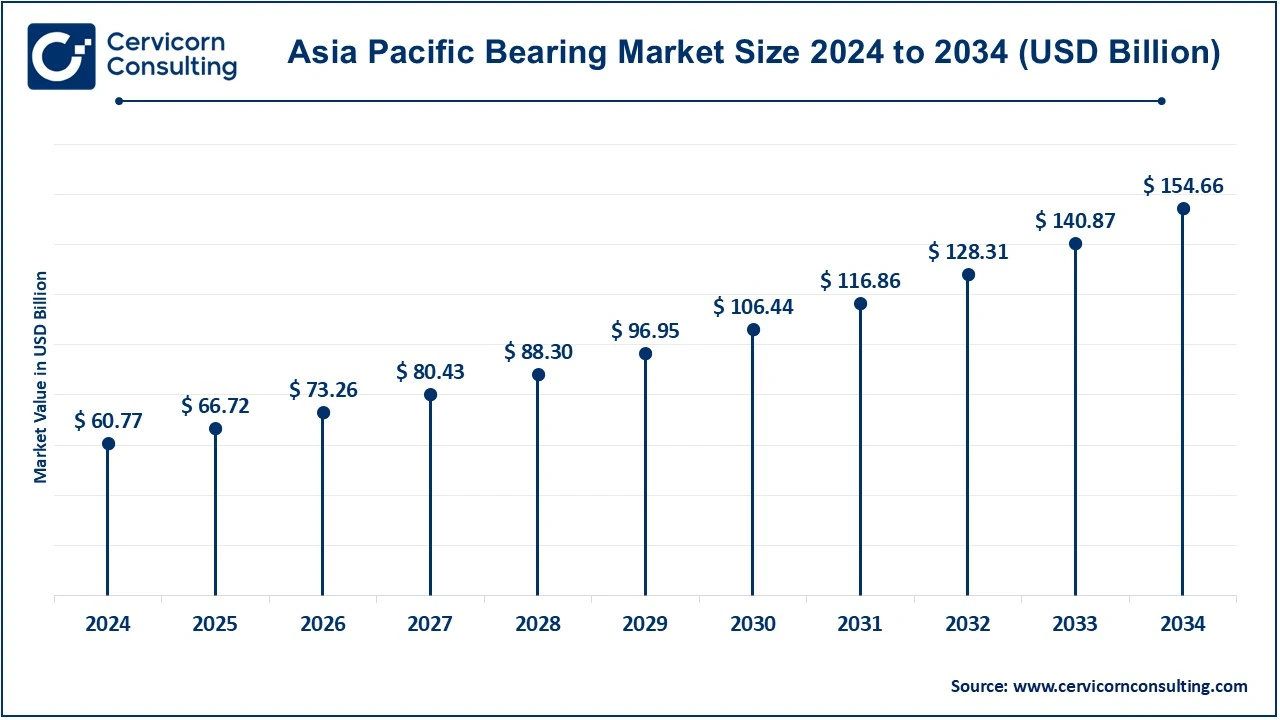

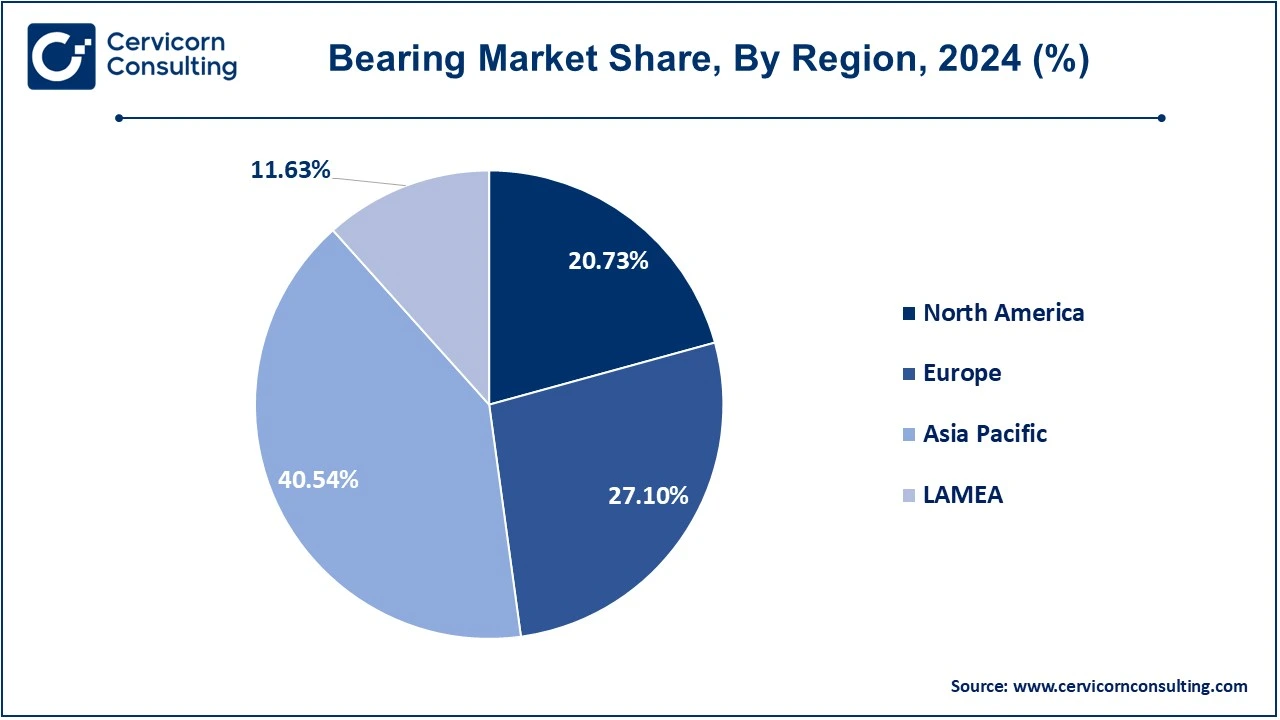

The bearing market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region is expected to remain its dominance over upcoming years.

The Asia-Pacific bearing market size was accounted for USD 60.77 billion in 2024 and is projected to hit around USD 154.66 billion by 2034. Asia Pacific is expected to witness the fastest revenue growth, with China being one of the key markets. Revenues in China are expected to grow significantly in the coming years, owing to rapid expansion of machinery and automobile manufacturing and a thriving aftermarket for industrial equipment and automobile repair. In addition, India's robust construction and mining equipment market is expected to boost the market growth. Moreover, the emerging automobile industry, rapid urbanization, and increasing construction activities have further boosted the market. Lower production costs, availability of skilled labor, and a strong manufacturing base also make Asia Pacific an attractive hub for bearing production. The region is benefiting from growing export opportunities, which contributes to its significant revenue share and continued market leadership.

The North America bearing market size was estimated at USD 31.08 billion in 2024 and is expected to reach around USD 79.09 billion by 2034. The rapidly developing construction industry in North America is the driving force behind the growth of this market. According to Associated General Contractors of America (AGC), the US construction industry generates construction projects worth approximately $1.4 trillion annually. Also, rising industrialization and machinery requirements across manufacturing sectors will further expand the market for bearings. Rapid market growth is expected due to high demand for precision bearings. Moreover, technological advancements such as Industry 4.0, automation, and the Internet of Things (IoT) are driving the adoption of modern machinery and equipment.

The Europe bearing market size was surpassed at USD 40.63 billion in 2024 and is predicted to reach around USD 103.39 billion by 2034. The European bearing market is projected to witness positive growth due to stable economic growth and increased investments. The growth of the bearing market in Europe is driven by the increasing sales and production of electric and hybrid cars and the expansion and development of the automotive and automobile industry. European countries are home to the leading automobile manufacturers and largest private R&D investments, such as Mercedes, BMW, Opel, Audi, Volkswagen, Porsche, Fiat, and Ferrari, to name a few. This is expected to fuel Europe's growing infrastructure development projects, thereby boosting the market growth.

The LAMEA bearing market was valued at USD 17.53 billion in 2024 and is anticipated to reach around USD 44.37 billion by 2034. The increase in foreign investment, manufacturing capacity, large infrastructure projects and demand fuelled by the population boom. The growing construction projects and infrastructure development are driving the market growth. The bearing market in Latin America is exhibiting steady growth, fuelled by the increasing industrialization and expansion of major sectors such as automotive, mining, energy and construction. The rapid industrialization in the Middle East and Africa is opening up new opportunities for the composite bearing market. Moreover, the increasing applications in the mining and manufacturing industries are driving the market expansion, especially in South Africa and Nigeria.

Schaeffler AG, SKF, and The Timken Company are some of the emerging market players in the target market. Key market players are investing a lot of money in research and development to expand their product portfolios, which will boost the further market growth of the bearings industry. The manufacturing companies are focusing on providing bearings for a wide range of industrial applications such as turning, grinding, and milling. Mergers and expansion strategies are expected to further strengthen the market presence of the key market players. Several companies in the market are entering into strategic partnerships and acquisitions with small and medium-sized enterprises to expand their global presence. In order to grow and sustain themselves in a market that is becoming increasingly competitive, the market players are trying to offer affordable products. For example, SKF offers products and solutions such as bearings and units, mechatronic systems, seals, services, as well as lubrication systems. The company operates its operations through two segments namely, automotive and industrial. In the automotive segment, the company manufactures cars, light and heavy trucks, buses, trailers, and two-wheelers with customized seals, bearings, and other related products.

Key players in the bearing industry are pivotal in delivering a variety of innovative construction solutions, such as prefabrication techniques, sustainable materials, and advanced digital technologies.

Market Segmentation

By Type

By Material

By Product

By Size

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Bearing

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Type Overview

2.2.3 By Material Overview

2.2.4 By Size Overview

2.2.5 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Bearing Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Industrial Automation's Ascent

4.1.1.2 Rising demand for EVs and robotics

4.1.2 Market Restraints

4.1.2.1 Expensive Manufacturing and Fluctuating Material Costs

4.1.2.2 Availability of Counterfeits

4.1.3 Market Challenges

4.1.3.1 Improper Lubrication

4.1.3.2 Growing Corrosion Concerns

4.1.4 Market Opportunities

4.1.4.1 Increasing Demand for Sustainability and Green Bearings

4.1.4.2 Increasing Condition Monitoring and Predictive Maintenance

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Bearing Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Bearing Market, By Product

6.1 Global Bearing Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Mounted Bearings

6.1.1.2 Unmounted Bearings

Chapter 7. Bearing Market, By Type

7.1 Global Bearing Market Snapshot, By Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Ball Bearings

7.1.1.2 Roller Bearings

7.1.1.3 Plain Bearings

7.1.1.4 Precision Bearings

7.1.1.5 Others

Chapter 8. Bearing Market, By Material

8.1 Global Bearing Market Snapshot, By Material

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Steel

8.1.1.2 Plastic

8.1.1.3 Ceramic

8.1.1.4 Hybrid

Chapter 9. Bearing Market, By Size

9.1 Global Bearing Market Snapshot, By Size

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 30 to 40

9.1.1.2 41 to 50

9.1.1.3 51 to 60

9.1.1.4 61 to 70

9.1.1.5 70 & above

Chapter 10. Bearing Market, By Application

10.1 Global Bearing Market Snapshot, By Application

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Automotive

10.1.1.2 Aerospace

10.1.1.3 Railway

10.1.1.4 Agriculture

10.1.1.5 Mining & Construction

10.1.1.6 Automotive Aftermarket

10.1.1.7 Others

Chapter 11. Bearing Market, By Region

11.1 Overview

11.2 Bearing Market Revenue Share, By Region 2024 (%)

11.3 Global Bearing Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Bearing Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Bearing Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Bearing Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Bearing Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Bearing Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Bearing Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Bearing Market, By Country

11.5.4 UK

11.5.4.1 UK Bearing Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Bearing Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Bearing Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Bearing Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Bearing Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Bearing Market, By Country

11.6.4 China

11.6.4.1 China Bearing Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Bearing Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Bearing Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Bearing Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Bearing Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Bearing Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Bearing Market, By Country

11.7.4 GCC

11.7.4.1 GCC Bearing Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Bearing Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Bearing Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Bearing Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Schaeffler Group

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 NSK Ltd.

13.3 HKT Bearings Ltd.

13.4 NTN Corporation

13.5 JTEKT Corporation

13.6 RBC Bearings Inc.

13.7 Brammer PLC

13.8 Svenska Kullagerfabriken AB

13.9 The Timken Company

13.10 Nachi Fujikoshi Corp.

13.11 Thordon Bearings Inc.

13.12 NBI Bearings Europe

13.13 Rexnord Corporation

13.14 Harbin Bearing Manufacturing Co., Ltd.

13.15 C&U Group

13.16 Minebea Mitsumi Inc.

13.17 Daido Metal

13.18 Luoyang LYC Bearing

13.19 Igus Corporation

13.20 Wafangdian Bearing Group Co. Ltd.

13.21 IKO Nippon Thompson Co., Ltd.