The global air purifier market size was valued at USD 16.84 billion in 2024 and is expected to be worth around USD 28.54 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.41% over the forecast period 2025 to 2034. The U.S. air purifier market size was estimated at USD 4.57 billion in 2024 and is projected to reach USD 7.75 billion by 2034.

The air purifiers market is growing rapidly due to increasing demand for advanced, energy-efficient systems from residential, commercial, and industrial sectors. Rising concerns over indoor air quality and pollution have led to the widespread adoption of air purifiers in homes, offices, and healthcare facilities. Stricter environmental regulations and growing health consciousness have also driven the acceptance of eco-friendly air purifiers. Technological advancements, such as IoT-enabled and HEPA-filter-equipped devices, enhance operational efficiency while lowering maintenance costs. Continuous R&D investments fuel innovation, improving air purifier performance and durability across diverse applications. These developments position air purifiers as an essential and cost-effective solution for improving air quality, ensuring robust market growth in response to regulatory and consumer demands.

Report Highlights

CEO Statements

COWAY CO., LTD. – Lee Jin-woo, CEO

Dyson Ltd. – Sir James Dyson, CEO

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 16.84 Billion |

| Projected Market Size in 2034 | USD 28.54 Billion |

| Estimated CAGR 2025 to 2034 | 5.41% |

| Dominant Region | North America |

| Rapidly Expanding Region | Asia-Pacific |

| Key Segment | Type, Technology, Coverage Range, Sales Channel, End User, Region |

| Key Companies | Honeywell International, Inc., IQAir, Koninklijke Philips N.V, Unilever PLC, Sharp Electronics Corporation, Samsung Electronics Co., Ltd., LG Electronics, Panasonic Corporation, Whirlpool Corporation, Dyson, Carrier |

Rise of Airborne Diseases

Rise of Pollutants from Industrial Activities

Rising Consumer Health Consciousness

High Initial Investments

High Ongoing Costs of Replacement Filters

Low Awareness in Rural and Low-Income Areas

Emerging Markets Are the Growing Potential Areas

Developing Solar-Powered Air Purifiers

Demand on the Workspace and Academic Field

Higher Price Sensitivity by Consumers

Counterfeit Products Eroding Market Trust

Crafting Products For Specific Usage

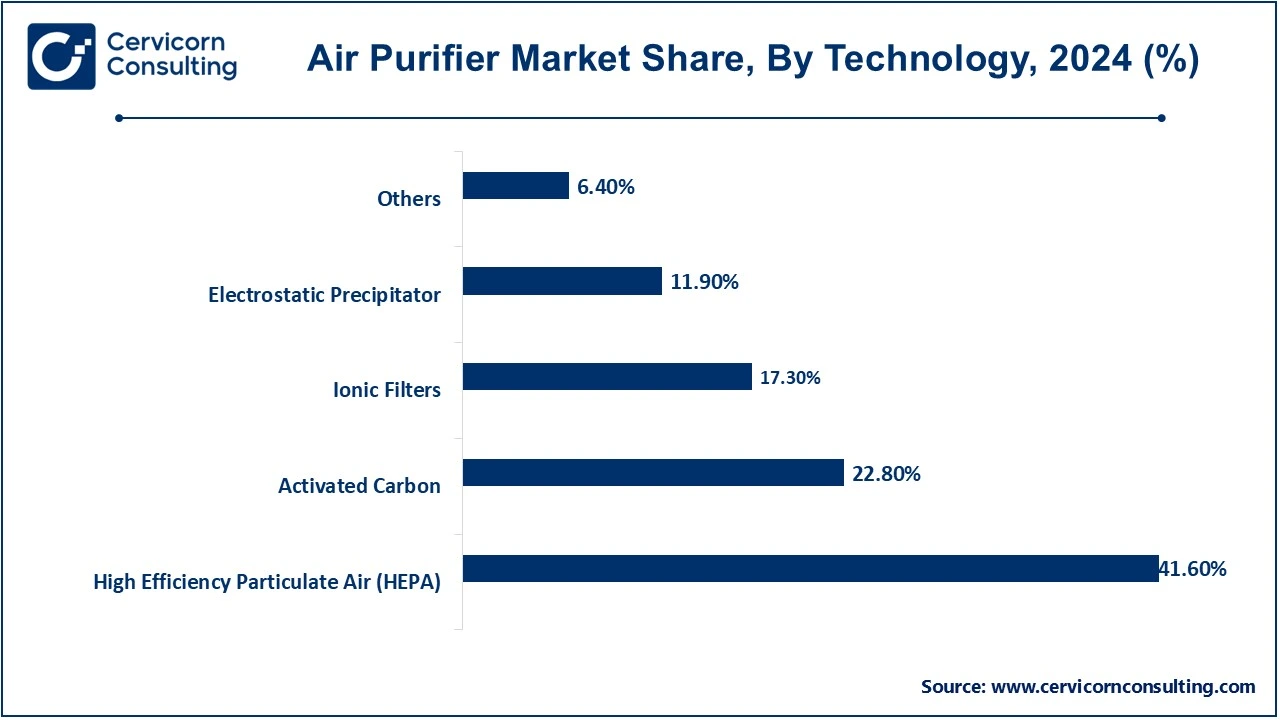

The air purifier market is segmented into type, technology, coverage range, sales channel, end user, region. Based on type, the market is classified into stand-alone and in-duct. Based on technology, the market is classified into high efficiency particulate air (HEPA), activated carbon, ionic filters, electrostatic precipitator, and others. Based on coverage range, the market is classified into below 250 Sq. Ft., 250-400 Sq. Ft., 401-700 Sq. Ft., and above 700 Sq. Ft.. Based on sales channel, the market is classified into online, and offline. Based on end user, the market is classified into residential, commercial, and industrial.

High-Efficiency Particulate Air filter: The HEPA segment has dominated the market in 2024. HEPA technology is one of the most used filtration methods in air purification. It is capable of capturing particles as small as 0.3 microns, including allergens, dust, and bacteria. HEPA filters are perfect for people who are allergic or have problems with their lungs. These filters have been included in some brands' air purifiers by Sharp and Honeywell in order to provide high-efficiency filtering for residences and businesses.

Activated Carbon: Activated carbon creates a mechanism where it can absorb air smells, smoke, and volatile organic compounds. These filters can be used to eliminate smells from cooking, pet dander, or smoke. Many air purifiers, like those by Austin Air, combine activated carbon with HEPA technology because it provides a complete air solution.

Ionic Filters: Ionic filters emit negatively charged ions into the air, which attach themselves to airborne particles and create larger clusters that either drop to the ground or tack on to other surfaces. While ionic purifiers are rather effective in mold and heavy-duty dust and allergen removal, they may produce ozone gas, which bothers the lungs in greater concentrations. Oreck has integrated ionic technology into its air purifiers to deal with fine particulate pollution.

Electrostatic Precipitator: Electrostatic precipitators carry a charge of electricity as a means to capturing the particles out of air. It efficiently filters out dust and pollen and smoke. Unlike HEPA filters, electrostatic precipitators do not need regular changes of filters. For instance, these employ electrostatic technology by which air purifiers generally eliminate contaminants but with a touch of ease.

Stand-alone: Stand-alone air purifiers refer to independent machines designed to eliminate air impurities in a single room or area. Usually, they are compact and easy to operate, equipped with different types of filtration technologies like HEPA or activated carbon. These types of units are customarily suitable for household and other smaller commercial applications, with flexibility and mobility as an added advantage. Examples include the Dyson Pure Cool, which is known for air purification combined with cool air for personal spaces.

In-duct: In-duct air purifiers are placed in a building’s HVAC system for whole building or facility air cleaning. They are best used in bigger spaces and for commercial applications, giving a central air filtration feature. This would require professional installation and maintenance, which enhances ongoing air quality, as seen in industries and multi-story buildings. In this case, in-duct filtration systems are offered by Trane for large commercial environments.

Commercial: The commercial segment has dominated the market in 2024. Commercial air purifiers are installed in offices, hotels, hospitals, and other suites to provide a strictly clean and safe environment for employees, customers, and patients. Often, they will need to cover superior spaces and provide a higher capacity for such. The brands of commercial air purifiers, such as Blueair and IQAir, can be used to ensure that businesses run a healthy environment, improve productivity, and keep airborne pathogens, allergens, and pollutants at bay.

Air Purifier Market Revenue Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Commercial | 57% |

| Residential | 30% |

| Industrial | 13% |

Residential: Air purifiers for homes would just work within the households in cleaning the quality of air by removing various pollutants like dust, allergens, and odors. With growing awareness among consumers about the health risks posed by air pollution, so more and more homeowners are buying air purifiers. Various brands of air purifiers for the residential market, such as Honeywell and Coway, aim for the various needs of their customers, for instance, controlling allergens or removing VOCs.

Industrial: Industrial air purifiers have been specifically designed as part of extensive systems for removing hazardous chemicals, particulates, or other pollutants, and can be installed in factories, warehouses, as well as in any production plants. Air purifiers, therefore, are highly used in industries like manufacturing and pharmaceuticals. Their applications range from high performance industrial air purifiers such as Camfil, which meet regulatory standards for workplace air safety in industries.

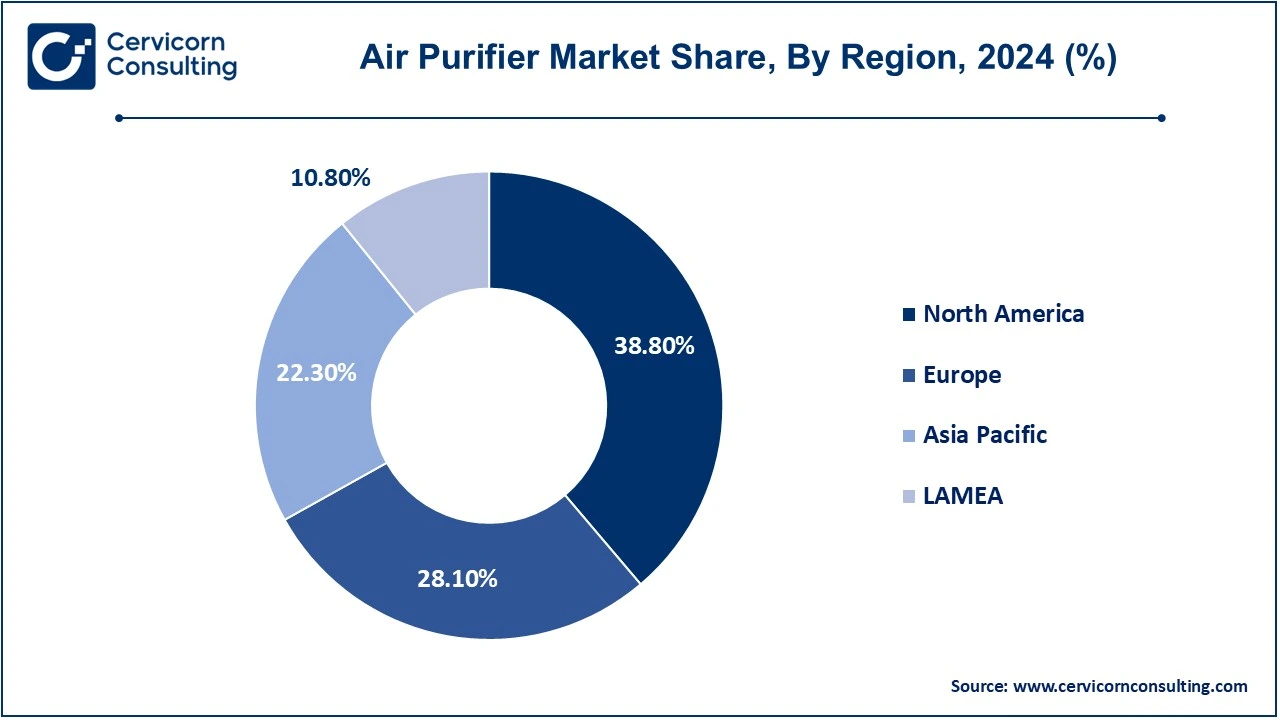

The air purifier market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America air purifier market size was valued at USD 6.53 billion in 2024 and is expected to reach around USD 11.07 billion by 2034. With increased consciousness of not only the harm to health but also the complete need for healthiness, especially due to the most recent government exactions to improve standards on air quality, demand for air purifiers is one of the fastest-growing in North America. North America comprises the US, which has a relatively enhanced market share in the region for air purifiers in homes and offices. Silk partners include Honeywell, IQAir, and Dyson as having one of the most varied combinations of advanced filtration technologies geared toward recovering indoor air quality across cities under poor air quality situations.

The Europe air purifier market size was estimated at USD 4.73 billion in 2024 and is projected to reach around USD 8.02 billion by 2034. Rising consumer awareness in Europe for indoor air pollution and health hazards has come as a boon to increase air purifier demand. Adequate strictness, such as the EU clean air initiatives, spurs the installation of air purifiers in homes, offices, and industry. Top brands in the European market include Phillips, Blueair, and Dyson, which have come forth with different novel solutions towards the improvement of air quality in residential and commercial sectors.

The Asia-Pacific air purifier market size was accounted for USD 3.76 billion in 2024 and is predicted to surpass around USD 6.36 billion by 2034. In the Asia-Pacific region, growing urbanization and industrialization lead to an increasingly growing market demand for air purifiers, given the air pollution activities in China and India. Knowledge about risks posed by airborne contaminants motivates the demand for air purifiers in households, commercial establishments, and industries. Leading manufacturers include Xiaomi, Panasonic, and Sharp, who offer energy-efficient air purifiers primarily targeted for home users and business sectors.

The LAMEA air purifier market size was valued at USD 1.82 billion in 2024 and is anticipated to reach around USD 3.08 billion by 2034. It has been noticed that LAMEA has significantly catapulted to becoming one of the most interesting markets for air washers in the last 2 years – particularly in Brazil, UAE, and South Africa, where pollution typically occurs at very high levels due to urbanization. Increasing awareness about possible health risks doubled with a continuous increasing in disposable income creates demand for air purification systems. With the likes of Airfree and Sharp extended their reach within this segment, introducing localized solutions for residential and commercial needs.

Recent strategic product launches in the air purifier industry reflect a strong commitment to advancing technology, improving efficiency, and meeting the increasing demand for cleaner, healthier indoor air. These innovations are designed to address growing concerns over air pollution, allergens, and airborne diseases, while incorporating features like energy efficiency, smart technology integration, and enhanced filtration systems. Companies are also responding to consumer preferences for user-friendly, eco-friendly solutions.

Market Segmentation

By Type

By Technology

By Coverage Range

By Sales Channel

By End user

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Air Purifier

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Type Overview

2.2.3 By Coverage Range Overview

2.2.4 By Sales Channel Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Air Purifier Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rise of Airborne Diseases

4.1.1.2 Rise of Pollutants from Industrial Activities

4.1.1.3 Rising Consumer Health Consciousness

4.1.2 Market Restraints

4.1.2.1 High Initial Investments

4.1.2.2 High Ongoing Costs of Replacement Filters

4.1.2.3 Low Awareness in Rural and Low-Income Areas

4.1.3 Market Challenges

4.1.3.1 Higher Price Sensitivity by Consumers

4.1.3.2 Counterfeit Products Eroding Market Trust

4.1.3.3 Crafting Products For Specific Usage

4.1.4 Market Opportunities

4.1.4.1 Emerging Markets Are the Growing Potential Areas

4.1.4.2 Developing Solar-Powered Air Purifiers

4.1.4.3 Demand on the Workspace and Academic Field

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Air Purifier Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Air Purifier Market, By Product

6.1 Global Air Purifier Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Roots and Twin-Screw Air Purifiers

6.1.1.2 Centrifugal Air Purifiers

Chapter 7. Air Purifier Market, By Type

7.1 Global Air Purifier Market Snapshot, By Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Stand-alone

7.1.1.2 In-duct

Chapter 8. Air Purifier Market, By Technology

8.1 Global Air Purifier Market Snapshot, By Technology

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 High Efficiency Particulate Air (HEPA)

8.1.1.2 Activated Carbon

8.1.1.3 Ionic Filters

8.1.1.4 Electrostatic Precipitator

8.1.1.5 Others

Chapter 9. Air Purifier Market, By Coverage Range

9.1 Global Air Purifier Market Snapshot, By Coverage Range

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Below 250 Sq. Ft.

9.1.1.2 250-400 Sq. Ft.

9.1.1.3 401-700 Sq. Ft.

9.1.1.4 Above 700 Sq. Ft.

Chapter 10. Air Purifier Market, By Sales Channel

10.1 Global Air Purifier Market Snapshot, By Sales Channel

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Online

10.1.1.2 Offline

Chapter 11. Air Purifier Market, By End user

11.1 Global Air Purifier Market Snapshot, By End user

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Residential

11.1.1.2 Commercial

11.1.1.3 Industrial

Chapter 12. Air Purifier Market, By Region

12.1 Overview

12.2 Air Purifier Market Revenue Share, By Region 2024 (%)

12.3 Global Air Purifier Market, By Region

12.3.1 Market Size and Forecast

12.4 North America

12.4.1 North America Air Purifier Market Revenue, 2022-2034 ($Billion)

12.4.2 Market Size and Forecast

12.4.3 North America Air Purifier Market, By Country

12.4.4 U.S.

12.4.4.1 U.S. Air Purifier Market Revenue, 2022-2034 ($Billion)

12.4.4.2 Market Size and Forecast

12.4.4.3 U.S. Market Segmental Analysis

12.4.5 Canada

12.4.5.1 Canada Air Purifier Market Revenue, 2022-2034 ($Billion)

12.4.5.2 Market Size and Forecast

12.4.5.3 Canada Market Segmental Analysis

12.4.6 Mexico

12.4.6.1 Mexico Air Purifier Market Revenue, 2022-2034 ($Billion)

12.4.6.2 Market Size and Forecast

12.4.6.3 Mexico Market Segmental Analysis

12.5 Europe

12.5.1 Europe Air Purifier Market Revenue, 2022-2034 ($Billion)

12.5.2 Market Size and Forecast

12.5.3 Europe Air Purifier Market, By Country

12.5.4 UK

12.5.4.1 UK Air Purifier Market Revenue, 2022-2034 ($Billion)

12.5.4.2 Market Size and Forecast

12.5.4.3 UKMarket Segmental Analysis

12.5.5 France

12.5.5.1 France Air Purifier Market Revenue, 2022-2034 ($Billion)

12.5.5.2 Market Size and Forecast

12.5.5.3 FranceMarket Segmental Analysis

12.5.6 Germany

12.5.6.1 Germany Air Purifier Market Revenue, 2022-2034 ($Billion)

12.5.6.2 Market Size and Forecast

12.5.6.3 GermanyMarket Segmental Analysis

12.5.7 Rest of Europe

12.5.7.1 Rest of Europe Air Purifier Market Revenue, 2022-2034 ($Billion)

12.5.7.2 Market Size and Forecast

12.5.7.3 Rest of EuropeMarket Segmental Analysis

12.6 Asia Pacific

12.6.1 Asia Pacific Air Purifier Market Revenue, 2022-2034 ($Billion)

12.6.2 Market Size and Forecast

12.6.3 Asia Pacific Air Purifier Market, By Country

12.6.4 China

12.6.4.1 China Air Purifier Market Revenue, 2022-2034 ($Billion)

12.6.4.2 Market Size and Forecast

12.6.4.3 ChinaMarket Segmental Analysis

12.6.5 Japan

12.6.5.1 Japan Air Purifier Market Revenue, 2022-2034 ($Billion)

12.6.5.2 Market Size and Forecast

12.6.5.3 JapanMarket Segmental Analysis

12.6.6 India

12.6.6.1 India Air Purifier Market Revenue, 2022-2034 ($Billion)

12.6.6.2 Market Size and Forecast

12.6.6.3 IndiaMarket Segmental Analysis

12.6.7 Australia

12.6.7.1 Australia Air Purifier Market Revenue, 2022-2034 ($Billion)

12.6.7.2 Market Size and Forecast

12.6.7.3 AustraliaMarket Segmental Analysis

12.6.8 Rest of Asia Pacific

12.6.8.1 Rest of Asia Pacific Air Purifier Market Revenue, 2022-2034 ($Billion)

12.6.8.2 Market Size and Forecast

12.6.8.3 Rest of Asia PacificMarket Segmental Analysis

12.7 LAMEA

12.7.1 LAMEA Air Purifier Market Revenue, 2022-2034 ($Billion)

12.7.2 Market Size and Forecast

12.7.3 LAMEA Air Purifier Market, By Country

12.7.4 GCC

12.7.4.1 GCC Air Purifier Market Revenue, 2022-2034 ($Billion)

12.7.4.2 Market Size and Forecast

12.7.4.3 GCCMarket Segmental Analysis

12.7.5 Africa

12.7.5.1 Africa Air Purifier Market Revenue, 2022-2034 ($Billion)

12.7.5.2 Market Size and Forecast

12.7.5.3 AfricaMarket Segmental Analysis

12.7.6 Brazil

12.7.6.1 Brazil Air Purifier Market Revenue, 2022-2034 ($Billion)

12.7.6.2 Market Size and Forecast

12.7.6.3 BrazilMarket Segmental Analysis

12.7.7 Rest of LAMEA

12.7.7.1 Rest of LAMEA Air Purifier Market Revenue, 2022-2034 ($Billion)

12.7.7.2 Market Size and Forecast

12.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 13. Competitive Landscape

13.1 Competitor Strategic Analysis

13.1.1 Top Player Positioning/Market Share Analysis

13.1.2 Top Winning Strategies, By Company, 2022-2024

13.1.3 Competitive Analysis By Revenue, 2022-2024

13.2 Recent Developments by the Market Contributors (2024)

Chapter 14. Company Profiles

14.1 Honeywell International, Inc.

14.1.1 Company Snapshot

14.1.2 Company and Business Overview

14.1.3 Financial KPIs

14.1.4 Product/Service Portfolio

14.1.5 Strategic Growth

14.1.6 Global Footprints

14.1.7 Recent Development

14.1.8 SWOT Analysis

14.2 IQAir

14.3 Koninklijke Philips N.V

14.4 Unilever PLC

14.5 Sharp Electronics Corporation

14.6 Samsung Electronics Co., Ltd.

14.7 LG Electronics

14.8 Panasonic Corporation

14.9 Whirlpool Corporation

14.10 Dyson

14.11 Carrier