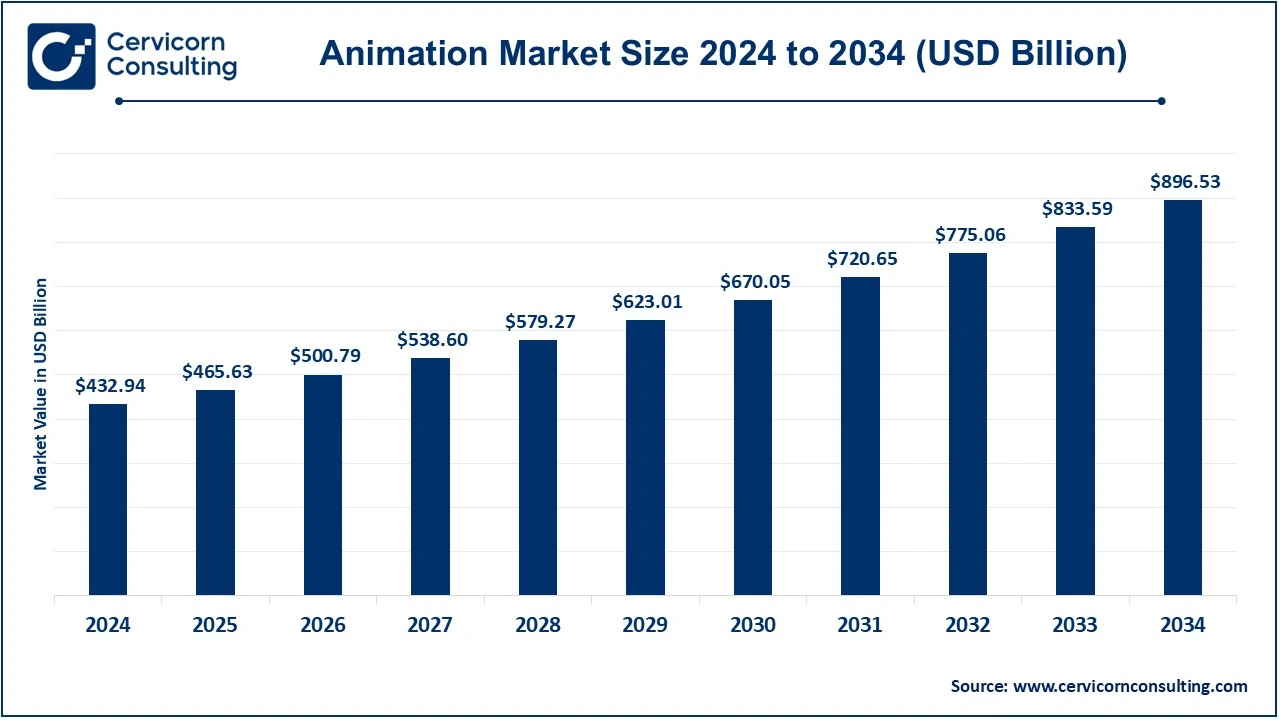

The global animation market size was valued at USD 432.94 billion in 2024 and is expected to be worth around USD 896.53 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.55% over the forecast period 2025 to 2034. The U.S. animation market size was estimated at USD 103.40 billion in 2024.

The market of animation is growing exponentially with high demands for quality content in the entertainment, gaming, and advertising sectors. More innovations in AI, 3D modeling, and motion capture in animation technologies mean a more vivid and realistic experience. With the spread popularity of streaming platforms, animated content opened its doors to a worldwide audience and age groups. This is the market that animated films, series, and video games have emerged to exploit, besides their popularity, which has been due to their promotion through animation in marketing and education factors widening its scope and appeal.

Report Highlights

CEO Statements

Kim Davidson, CEO of SideFX

“SideFX values innovation, integrity, and customer commitment, leveraging deep production expertise to support CG artists in achieving more with less effort. Through initiatives like the free Houdini Apprentice program, the company fosters skill growth and creativity in the industry. Dedicated to evolving with the industry, SideFX offers responsive support, knowledgeable staff, and daily software updates to meet production challenges effectively”.

Shantanu Narayen, CEO of Adobe

“At Adobe, our mission is to empower creatives with the tools and technologies that help them bring their ideas to life. Whether you're an animator, filmmaker, or graphic designer, we are committed to enabling new forms of expression and innovation that push the boundaries of what’s possible in digital content creation.”

William Gadea, CEO of IdeaRocket

"At IdeaRocket, we believe animation has the power to simplify complex concepts and captivate audiences. It's an incredibly effective medium for storytelling, allowing us to connect with viewers in ways that static content simply can't."

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 432.94 Billion |

| Projected Market Size in 2034 | USD 896.53 Billion |

| Expected CAGR 2025 to 2034 | 7.55% |

| Dominant Region | North America |

| High Growth Region | Asia-Pacific |

| Key Segments | Product, Revenue Stream, Industry, Region |

| Key Companies | SideFX, Adobe, Broadcast2World, Inc, Smith Micro Software, Inc., Animation Sharks, IdeaRocket, Triggerfish Studios, EIAS3D, NewTek, Inc, BRAFTON, Corel Corporation, Autodesk Inc., Videocaddy, Maxon Computer, WinBizSolutionsIndia |

The animation market is segmented into product, revenue stream, industry, and region. Based on product, the market is classified into 2D animation, 3D animation, motion graphics, stop motion, and other. Based on revenue stream, the market is classified into OTT, advertising, sale of tickets, and others. Based on industry, the market is classified into direct, education, media and entertainment, aerospace and defense, manufacturing, automotive, and healthcare.

2D Animation: 2D animation refers to creating movement in a two-dimensional space usually through frame-by-frame drawing or digital techniques. A very traditional technique has widely been used for television, film, advertising, and digital content. It is a versatile, cost-effective technique that most children enjoy and apply in the entertainment industry of web videos, marketing materials, etc. Through advanced tools in digital technology, 2D animation evolved in its presentation, putting together classic artistry with modern technology to bring rich visual storytelling to audiences and different industries.

3D Animation: The 3D animation segment has dominated the market in 2024. It applies computer-generated imagery for three-dimensional animation and its production. Most frequently, this technique is used in the production of films, video games, and virtual reality. Such technology would increase the depth of reality, textures, and lighting further enhancing the cinematic narration and advertisement as well as visual product presentation. It is being applied in various sectors like the automobile and healthcare industry for real 3D models, which helps with designing, simulating, and training. The growth of usage in 3D animation in AR/VR experiences keeps expanding its full potential.

Animation Market Revenue Share, By Product, 2024 (%)

| Product | Revenue Share, 2024 (%) |

| 2D Animation | 35.32% |

| 3D Animation | 44.13% |

| Stop Motion | 12.64% |

| Others | 7.91% |

Motion Graphics: Motion graphics combine graphic design and animation to convey deep information in a fascinatingly simple way. Most use it in marketing, advertisements, and television by adding text, logos, and symbols to their engaging animations. Motion graphics help social media and explainer videos in which visual communication must always be concise. This style appeals to modern audiences because it can simplify the data, demote key messages, and capture attention quickly, and so it is the preference in media and entertainment.

Stop Motion: Stop motion animation is where an object is photographed from one frame to another to be able to create the effect of movement. It is greatly known in films like The Nightmare Before Christmas and so is very much loved, having a tactile, handcrafted aesthetic. It's very time-consuming, but it makes something unique in terms of visuals. It is quite common in children's shows and commercials as well as art projects. While not as often used as 2D or 3D, stop motion is, undeniably a creative and delightful medium.

Direct Industry: In the direct industry, animation is a direct communication tool. In advertisement and marketing, it is used for promotion content, the explanation of the product features, and more engagement with the audiences. From the television commercial to the ads on social media, through which animation helps the brand to be noticed by conveying simple, memorable messages. And in retail, technology, and services, animated content has gained prominence as digital platforms are increasing in number.

Educational Animations: Animation in the field makes complicated concepts more comprehensible and catches students' eyes. Academic animations are utilized both in physical classes and in online learning courses and tutorials for even complicated subjects such as science and mathematics to become easy by visualizing history. There are also interactive animated materials intended for dynamic learning, making it thus possible for children to relate to concepts. Corporates and eLearning require animated educational content as people must use visual aids to swim their way through knowledge retention.

Media and Entertainment: The media and entertainment segment has dominated the market in 2024. Animation is the lifeblood of the media and entertainment industry, covering film, television, video games, and streaming. Animated films, series, and shorts are a huge part of global entertainment that engages audiences with imaginative storytelling and stunning visuals. Motion picture studios use both 2D and 3D animation for feature films and TV shows, and animation also drives video game graphics, virtual reality, and interactive experiences. It could be said that the constant need for innovative animation is very central in this constantly evolving sector.

Aerospace and Defense: It is used in simulative, training, and design visualization in aerospace and defense. In that particular domain, typically aircraft space vehicles or military gadgets, 3D modeling takes place to test performance, train personnel, and create scenario conditions before the final build of the prototype. The presentation and proposal for complicated technologies are also made simpler because animations help explain how something functions and how something might work efficiently. In direct correlation, more realistic and accurate animations go along with better predictions and improved operations for training.

Manufacturing: Manufacturing makes the processes more efficient and enhances the product design with animation and the simulation of virtual scenarios. Even before being used in the actual process, engineers and designers might be able to visualize 3D manufacturing systems and machinery in their designs. Animation is also used in training workers on how to assemble or on how a complex machine works. Manufacturers use such technologies of Industry 4.0 to boost the animation in a way that increases efficiency, reduces error rate, and ultimately improves communication between the different stages of production.

Automotive: 3D animation is required in the car industry, mainly due to design, marketing, and interaction with consumers.3D animation is used to depict car ideas and features associated with it during the design and development stage so that engineers and designers evaluate how attractive, functional, and aerodynamic it will be. It involves animation in developing commercials and advertisements for cars. Animated simulations are also intended to be used in safety testing by showing crash tests or performance in different conditions. Animation adds to the design process and enhances the consumer experience in the automobile industry.

Healthcare: It also illustrates in health care, such complicated medical information to the patient as well as the doctor gets easily simplified through animation. Therefore, making such complicated medical procedures, anatomy, and disease processes understandable through the usage of visual media. It is further used in various kinds of medical training courses that exist for professionals, including programs in surgery or patient care. In the context of pharmaceutical marketing, animated videos provide more interesting details on drug or treatment benefits. Health education through the integration of 3D models with virtual reality applications may become the future change for medical diagnosis as well as the mode by which patients can be made to understand and grasp even complex information.

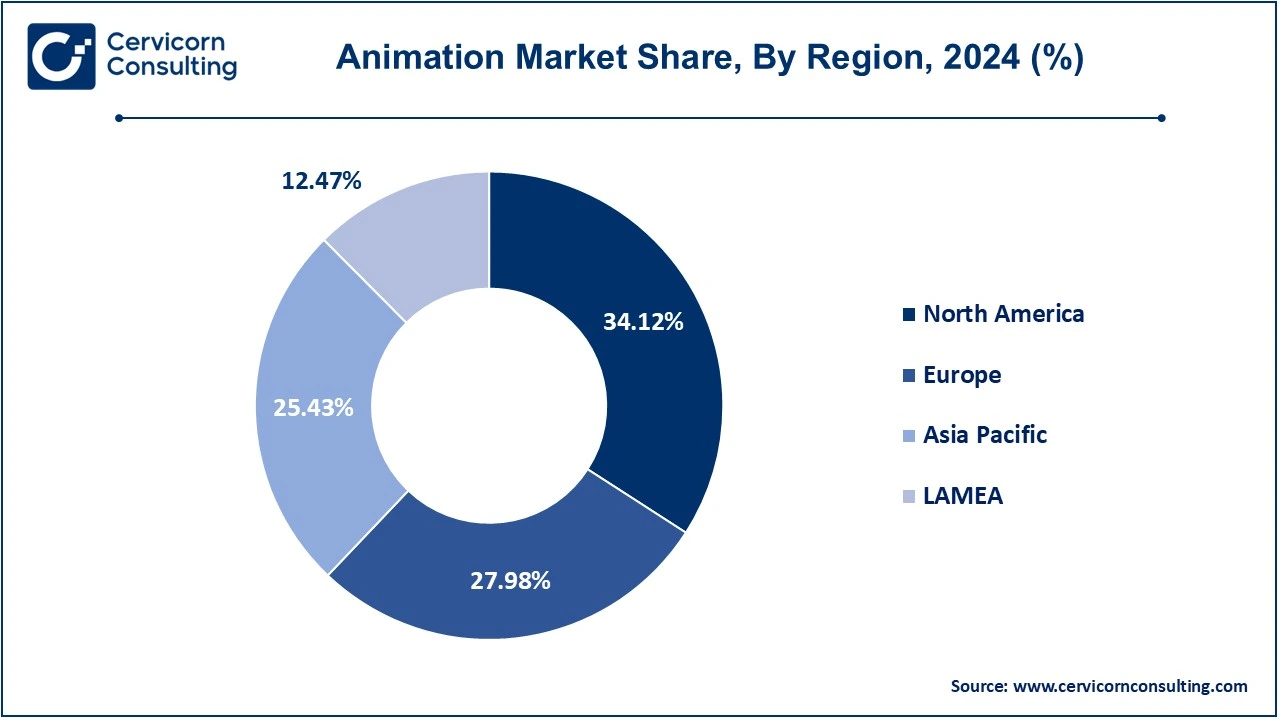

The animation market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

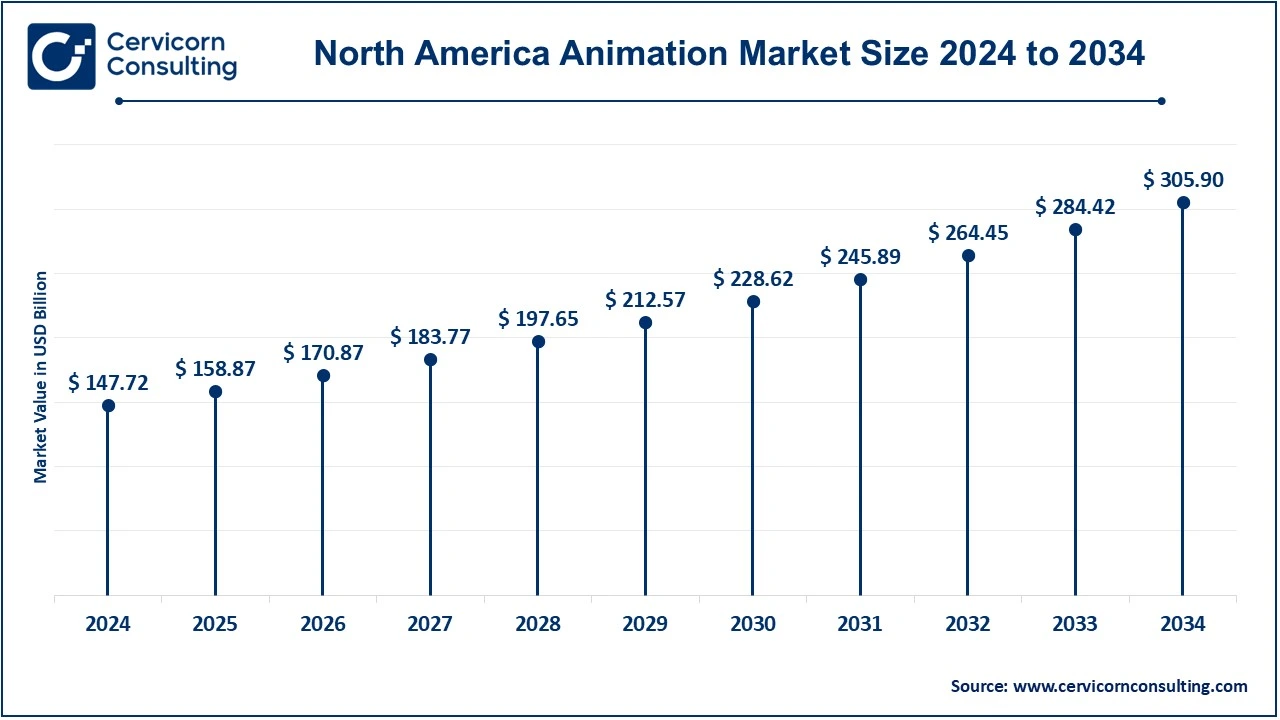

The North America animation market size was valued at USD 147.72 billion in 2024 and is expected to reach around USD 305.90 billion by 2034. North America is the core of the U.S. and Canada, forming a gigantic player in the world market of animation. Home to Pixar, DreamWorks, and Disney amongst others, the U.S. boasts the status of one of the major leaders worldwide in terms of animation production and distribution. Canada is also extremely important to the world in terms of its strengths in animation and visual effects. Quebec's visual effects and animation studios are alarmed by the new provincial tax policy capping the tax credits for international film studios at 65%. This means that the revenue from an industry that generates USD 1.3 billion will be cut down to only USD 393 million by 2025 and risk thousands of jobs. The decision is being called upon to be reversed by industry leaders to secure the competitiveness of Quebec in the global market. Film, television, digital platforms, and gaming top the demand and increase for animated content in North America.

The Europe animation market size was estimated at USD 121.14 billion in 2024 and is projected to hit around USD 250.85 billion by 2034. Europe is a lively animation hub, in France, the United Kingdom, and Germany. France is unique because of the quality history of animated films and proper training institutions like Gobelins. The European market is co-productions, where they pool their resources to work together on certain projects. For example, the EU had prepared a plan to spend more than €4 million for three years in November 2024 to write a detailed report on the country's animation industry - problems this sector faces, analyzing the situation, and planning its development. The research will be a source of information for policymakers and stakeholders to make the EU animation industry more competitive in the international world. This region also hosts beautiful festivals such as Annecy that stimulate creativity and international recognition. Digital distribution then actually reaches further and wider into Europe.

The Asia-Pacific animation market size was accounted for USD 110.10 billion in 2024 and is projected to surpass around USD 227.99 billion by 2034. Asia-Pacific represents the growth region for animation markets. This region is led by Japan, China, and South Korea, where anime in Japan is gaining rapid global appeal as the films and series capture worldwide audiences. The country has invested much in animation studios to produce original content within both domestic markets and globally. South Korea is more than an animation outsourcing hub; its strength is in gaming-related animation. For instance, in December 2022 will see the Computer Animation Festival, hosted by South Korea at SIGGRAPH Asia 2022. It will depict the future of animation as works from 19 countries are to be featured. It will provide unique techniques of animation and ways of telling stories that will serve as a foundation for artists and their makers to present their respective pieces. It is expected to carry diverse content, reflecting the most recent trends and innovations in the animation industry, to foster collaboration and inspiration among participants. It is growing due to the region's increased smartphone penetration and development of digital platforms and due to government support for creative industries.

The LAMEA animation market was valued at USD 53.99 billion in 2024 and is anticipated to reach around USD 111.80 billion by 2034. LAMEA is the emerging market for animation, led by Brazil, Mexico, and the UAE. The region boasts an active animation sector that produces stories full of rich cultural context, as global demand for Latin American animation is on the rise. In the Middle East, specifically in the UAE, diversification has involved animation, among other initiatives. Africa's animation industry is very nascent but is gaining momentum, as the stories start being-rooted locally in traditions. The rising digital access opens new windows in this region.

The new entrants in the animation market are using technology to design efficient and light supercharging systems that improve production workflows. For instance, SideFX has brought a revolution in animation with Houdini software, which uses procedural generation to automate complex tasks and decrease computational load. This allows the animators to create high-quality visuals with minimal resources, making it possible to accelerate production times and reduce costs significantly. It makes it a powerful tool for studios seeking efficiency in the competitive landscape of today's animation.

Recently, strategic collaborations and investments in the market of animation have provided a strong boost to innovation and globalization. Companies have started partnering to exploit advanced technologies including AI, virtual reality, and cloud-based solutions that enable smooth production workflows while enhancing content quality. Such collaborations aim at improving creative processes, smoothing out the process of distribution, and eventually reaching more audiences through a variety of platforms. Investments also fuel the development of more diverse and engaging animated content because they respond to the higher demands for quality content not only in the traditional markets but also in the new markets with shifting consumer preferences.

Some of the notable examples of key developments in the Animation Market include:

Market Segmentation

By Product Type

By Revenue Stream

By Industry

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Animation

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Revenue Stream Overview

2.2.3 By Industry Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Animation Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Technological Advancements in Animation Software

4.1.1.2 Corporate Use of Animated Explainers

4.1.1.3 Impact of animated franchises on cultures

4.1.2 Market Restraints

4.1.2.1 High Production Cost

4.1.2.2 Limited Monetization Models for Digital Content

4.1.2.3 Regulatory Barriers

4.1.3 Market Challenges

4.1.3.1 Evolving Consumer Preferences

4.1.3.2 Artistic Integrity

4.1.3.3 Content Saturation

4.1.4 Market Opportunities

4.1.4.1 Expansion of Streaming Sites

4.1.4.2 Children-oriented content

4.1.4.3 3D Animation in Architecture and Real Estate

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Animation Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Animation Market, By Product

6.1 Global Animation Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 2D Animation

6.1.1.2 3D Animation

6.1.1.3 Motion graphics

6.1.1.4 Stop Motion

6.1.1.5 Others

Chapter 7. Animation Market, By Revenue Stream

7.1 Global Animation Market Snapshot, By Revenue Stream

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 OTT

7.1.1.2 Advertising

7.1.1.3 Sale of Tickets

7.1.1.4 Others

Chapter 8. Animation Market, By Industry

8.1 Global Animation Market Snapshot, By Industry

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Direct

8.1.1.2 Education

8.1.1.3 Media and Entertainment

8.1.1.4 Aerospace and Defense

8.1.1.5 Manufacturing

8.1.1.6 Automotive

8.1.1.7 Healthcare

Chapter 9. Animation Market, By Region

9.1 Overview

9.2 Animation Market Revenue Share, By Region 2024 (%)

9.3 Global Animation Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Animation Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Animation Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Animation Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Animation Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Animation Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Animation Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Animation Market, By Country

9.5.4 UK

9.5.4.1 UK Animation Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Animation Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Animation Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Animation Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Animation Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Animation Market, By Country

9.6.4 China

9.6.4.1 China Animation Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Animation Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Animation Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Animation Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Animation Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Animation Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Animation Market, By Country

9.7.4 GCC

9.7.4.1 GCC Animation Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Animation Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Animation Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Animation Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 SideFX

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Adobe

11.3 Broadcast2World, Inc

11.4 Smith Micro Software, Inc.

11.5 Animation Sharks

11.6 IdeaRocket

11.7 Triggerfish Studios

11.8 EIAS3D

11.9 NewTek, Inc

11.10 BRAFTON

11.11 Corel Corporation

11.12 Autodesk Inc.

11.13 Videocaddy

11.14 Maxon Computer

11.15 WinBizSolutionsIndia