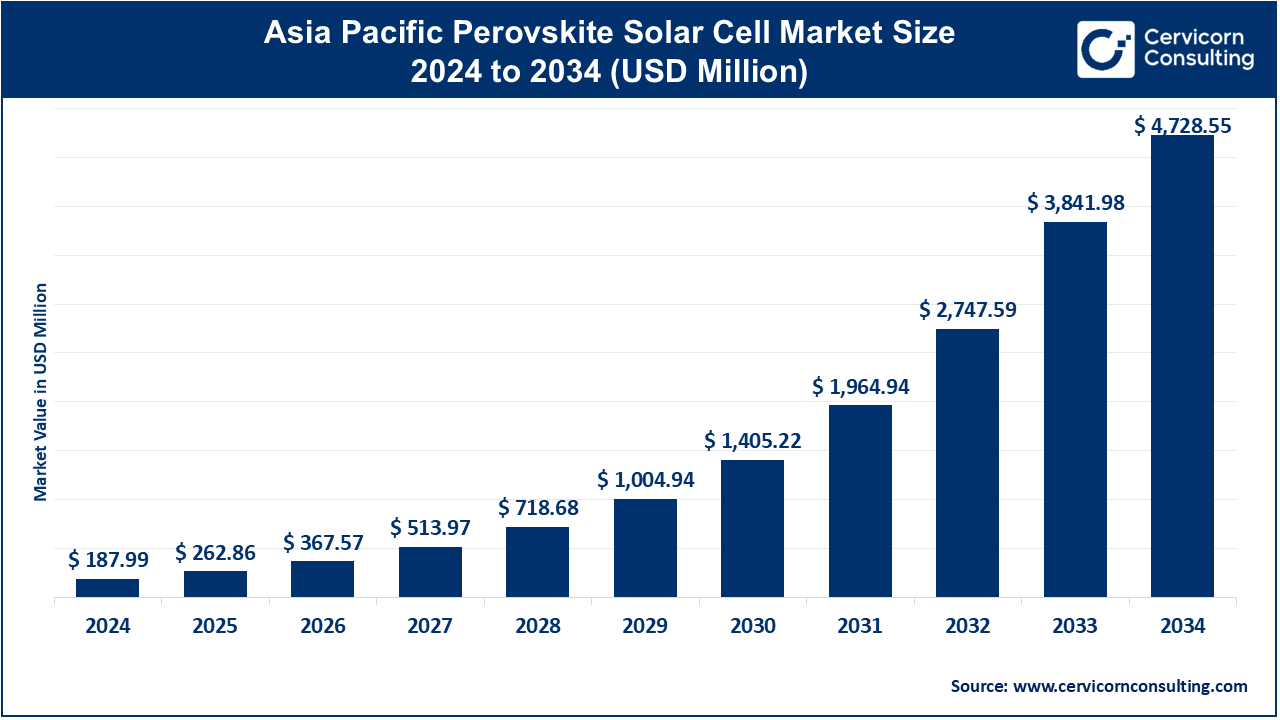

The Asia-Pacific perovskite solar cell market size was valued at USD 187.99 million in 2024 and is expected to be worth around USD 4,728.55 million by 2034, growing at a compound annual growth rate (CAGR) of 10.84% during the forecast period 2025 to 2034.

Several key drivers for the growth of the perovskite solar cells market are identified. This technology is attractive as it promises high efficiency and low production costs compared to silicon-based solar cells, in addition to flexibility. Rising energy demands in countries of the Asia-Pacific region are encouraging more people to adopt renewable sources, such as perovskite solar cells. Government incentives and subsidies have also acted as a huge driving force in the direction of market growth by this shift towards clean energy. Technological advancement in the material and manufacturing process also made it affordable as well as scalable to make perovskite solar cells. It is expected that the market will grow exponentially in the forthcoming years with robust investment from public and private sectors with the urge for sustainable energy.

Increasing Adoption of Flexible Solar Panels

Inclusion within Building-Integrated Photovoltaics (BIPV)

Growing Research and Development Funding

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 262.86 Million |

| Expected Market Size in 2034 | USD 4,728.55 Million |

| CAGR (2025 to 2034) | 38.05% |

| Key Segments | Material Type, Technology, Application, Structure |

| Key Companies | Tata Power Solar Systems Ltd, SHARP CORPORATION, Solaris Technology Industry, Inc., GREEN BRILLIANCE RENEWABLE ENERGY LLP, Trina Solar, Jinko Solar, Panasonic Corporation, Toshiba Corporation, Microquanta Simiconductor Co. Ltd., FrontMaterials Co. Ltd, |

High Energy Demand in the Asia Pacific Region

Government Incentives and Subsidies for Renewable Energy

Declining Material and Production Costs for Perovskite cells

Lead-Based Perovskite: This segment has dominated the market in 2024. Lead-based perovskite solar cells are the most used material in perovskite technology because they have high efficiency and relatively lower production costs. These cells contain lead in their chemical structure that enhances their light absorption capacity. However, the usage of lead is a big environmental and health concern that is related to toxicity. Research is still ongoing to improve their stability and to reduce the risks associated with lead-based components. However, lead-based perovskite solar cells remain to be the most popular in the market, especially in areas where efficiency is the main concern.

Asia Pacific Perovskite Solar Cell Market Revenue Share, By Material Type, 2024 (%)

| Material Type | Revenue Share, 2024 (%) |

| Lead-Based Perovskite | 61% |

| Lead-Free Perovskite | 39% |

Lead-Free Perovskite: The lead-free perovskite solar cells are more and more being used as alternatives to lead-based cells. This is because it would be possible to reduce toxicity and environmental impact. Other metals such as tin or bismuth replace lead in the cells and can still give a good energy conversion efficiency. Although they have inferior performance compared to their lead-based counterparts in general, they are improving in terms of efficiency and stability with improvements in material science. Particularly in the context of light pollution and environmental regulations becoming more stringent, lead-free perovskites provide an especially promising solution for sustainable solar power technologies.

Single-junction: Single-junction solar cells are the type which has a single scintillation layer composed of one material capable of absorbing light. In most cases, because of their less complicated ways of manufacturing, they have been the subject of numerous research. Even though single-junction perovskites have very high efficiency, their performance is limited by the inability to capture a full spectrum of sunlight. They usually manage a maximum efficiency of roughly 20-25 percent. Research is ongoing on improving their stability and efficiency for broader commercial use.

Tandem Solar Cells: Tandem perovskite solar cells combine perovskite with other semiconductor layers, such as silicon, in order to benefit from improved energy conversion efficiencies. Such a combination widens the absorption spectrum, thus enhancing performance in the longer wavelengths visible and infrared ranges. These technologies have been shown to be efficient, as tandem solar cells can score efficiencies beyond single-junction cells, some even exceeding 30 percent efficiency. Through added layers, they can absorb more sunlight, and thus they seem much interesting for concentrated, high-efficiency solar power. That leaves some manufacturing complexities that still prevent wider adoption, plus concerns about compatibility between the materials used.

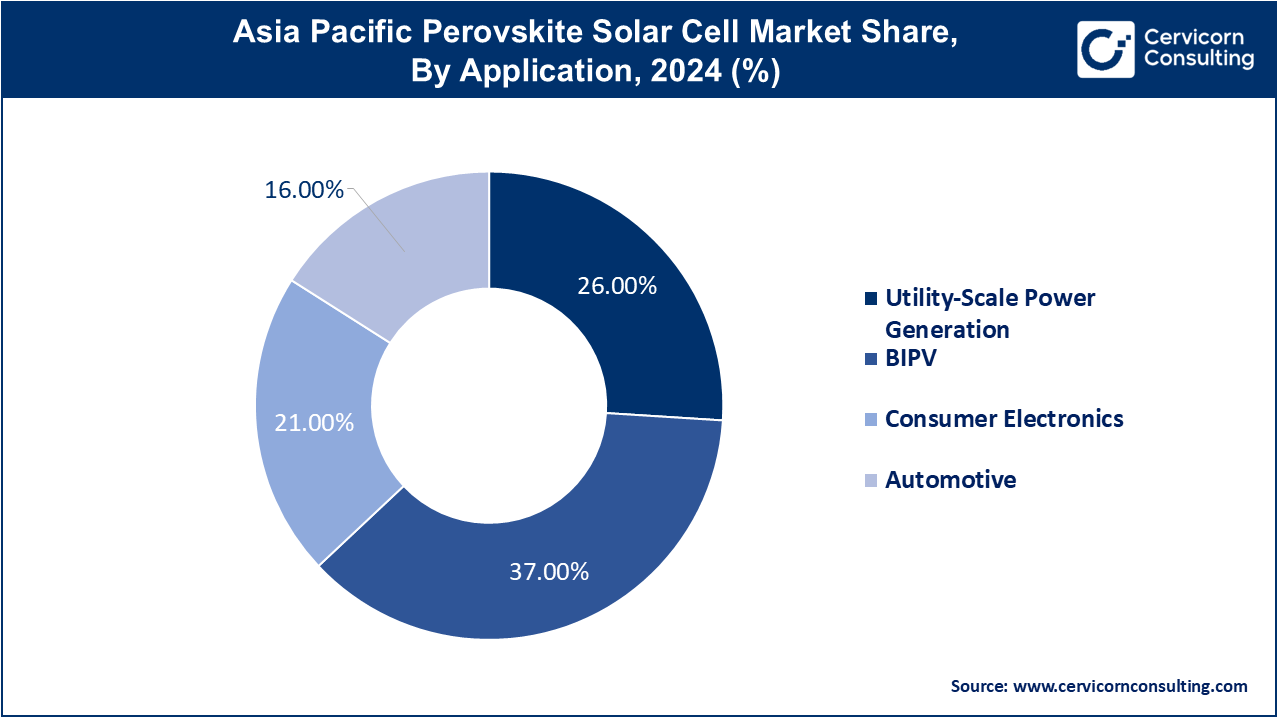

Based on application, the market is segmented into utility-scale power generation, BIPV, consumer electronics, and automotive. The BIPV segment has dominated the market in 2024.

CEO Statements

Oxford PV – Frank Averdung, CEO

"We are on the verge of revolutionizing the solar industry with our perovskite tandem solar cells. Our technology offers the potential for higher efficiencies and lower costs, positioning us to lead the future of renewable energy. Our team’s dedication to pushing the boundaries of solar technology is reflected in the significant progress we've made towards scaling production and achieving commercial success."

These CEO statements reflect a shared commitment to leveraging technology and personalized approaches in perovskite solar cell development, aiming to enhance the industry's efficiency, sustainability, and scalability. Companies like Oxford PV and Microquanta Semiconductor emphasize their focus on increasing power conversion efficiency and lowering production costs. By pioneering advancements in tandem solar cell technology and scaling up production, these players are positioning themselves at the forefront of the renewable energy sector. Their efforts are poised to not only drive innovation in solar technology but also address global energy demands with more affordable, high-performance solutions.

Market Segmentation

By Material Type

By Technology

By Application

By Structure

By Country

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Perovskite Solar Cell

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Material Type Overview

2.2.2 By Technology Overview

2.2.3 By Application Overview

2.2.4 By Structure Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Perovskite Solar Cell Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 High Energy Demand in the Asia Pacific Region

4.1.1.2 Government Incentives and Subsidies for Renewable Energy

4.1.1.3 Declining Material and Production Costs for Perovskite cells

4.1.2 Market Restraints

4.1.2.1 Toxicity of Lead

4.1.2.2 Policy Hurdles

4.1.3 Market Challenges

4.1.3.1 Scaling Up Production

4.1.3.2 Supply Chain Limitations

4.1.4 Market Opportunities

4.1.4.1 Expansion of Solar Power Projects

4.1.4.2 Collaboration/Strategic Partnerships

4.1.4.3 Flexible Electronics

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Perovskite Solar Cell Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Perovskite Solar Cell Market, By Material Type

6.1 Global Perovskite Solar Cell Market Snapshot, By Material Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Lead-Based Perovskite

6.1.1.2 Lead-Free Perovskite

Chapter 7. Perovskite Solar Cell Market, By Technology

7.1 Global Perovskite Solar Cell Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Single-Junction

7.1.1.2 Tandem Solar Cells

Chapter 8. Perovskite Solar Cell Market, By Application

8.1 Global Perovskite Solar Cell Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Utility-Scale Power Generation

8.1.1.2 BIPV

8.1.1.3 Consumer Electronics

8.1.1.4 Automotive

Chapter 9. Perovskite Solar Cell Market, By Structure

9.1 Global Perovskite Solar Cell Market Snapshot, By Structure

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Planar Structure

9.1.1.2 Mesoporous Structure

Chapter 10. Perovskite Solar Cell Market, By Region

10.1 Overview

10.2 Asia-Pacific Perovskite Solar Cell Market Revenue Share, By Country 2024 (%)

10.3 Asia-Pacific Perovskite Solar Cell Market, By Country

10.3.1 Market Size and Forecast

10.4 India

10.4.1 India Perovskite Solar Cell Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Perovskite Solar Cell Market, By Country

10.4.4 China

10.4.4.1 China Perovskite Solar Cell Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 China Market Segmental Analysis

10.4.5 Japan

10.4.5.1 Japan Perovskite Solar Cell Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Japan Market Segmental Analysis

10.4.6 Korea

10.4.6.1 Korea Perovskite Solar Cell Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Korea Market Segmental Analysis

10.4.7 Russia

10.4.7.1 Russia Perovskite Solar Cell Market Revenue, 2022-2034 ($Billion)

10.4.7.2 Market Size and Forecast

10.4.7.3 Russia Market Segmental Analysis

10.4.8 Australia

10.4.8.1 Australia Perovskite Solar Cell Market Revenue, 2022-2034 ($Billion)

10.4.8.2 Market Size and Forecast

10.4.8.3 Australia Market Segmental Analysis

10.4.9 Singapore

10.4.9.1 Singapore Perovskite Solar Cell Market Revenue, 2022-2034 ($Billion)

10.4.9.2 Market Size and Forecast

10.4.9.3 Singapore Market Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Tata Power Solar Systems Ltd

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 SHARP CORPORATION

12.3 Solaris Technology Industry, Inc.

12.4 GREEN BRILLIANCE RENEWABLE ENERGY LLP

12.5 Trina Solar

12.6 Jinko Solar

12.7 Panasonic Corporation

12.8 Toshiba Corporation

12.9 Microquanta Simiconductor Co. Ltd.

12.10 FrontMaterials Co. Ltd