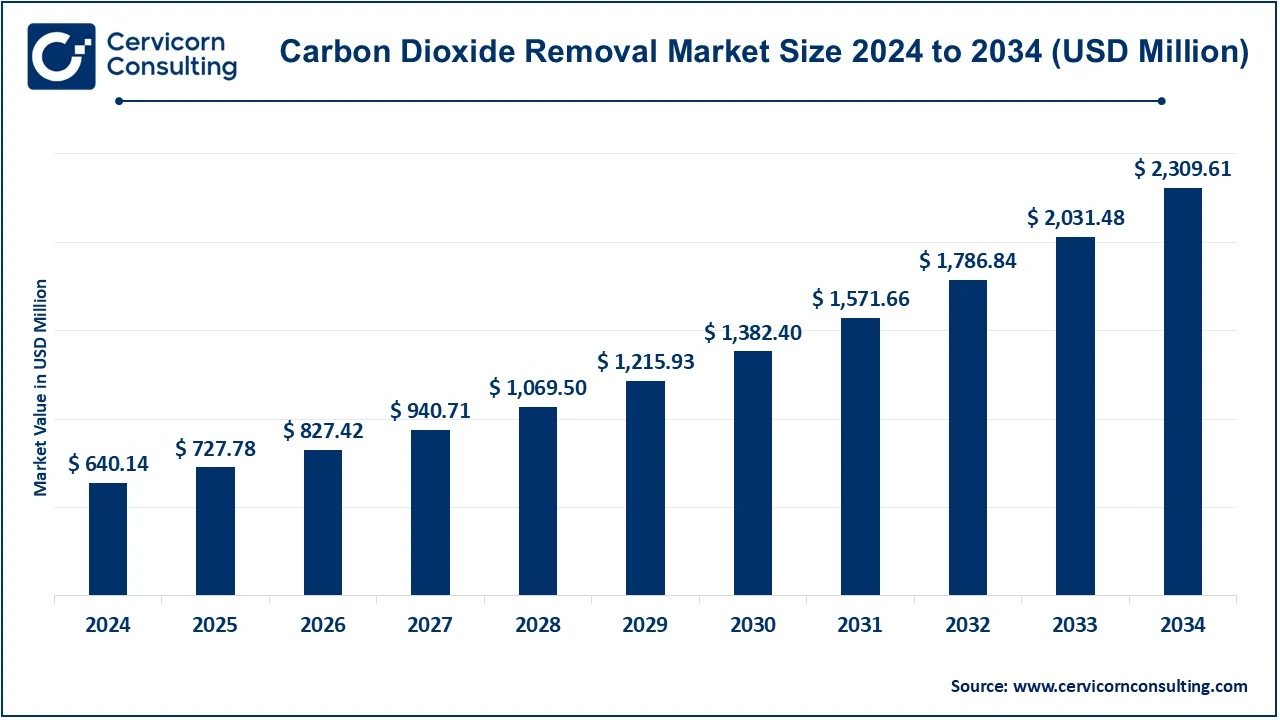

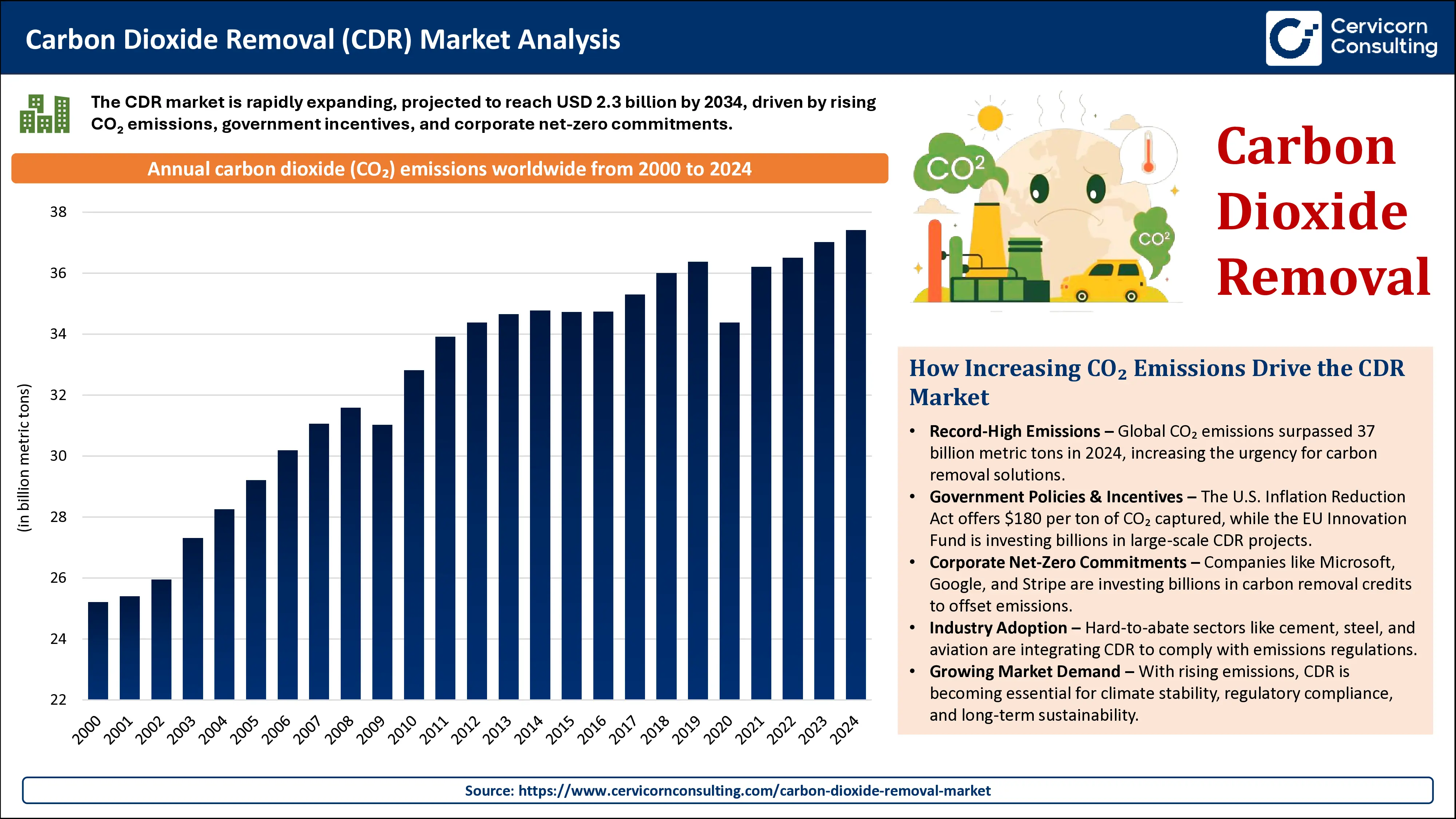

The global carbon dioxide removal market size was valued at USD 640.14 million in 2024 and is expected to be worth around USD 2,309.61 million by 2034, exhibiting a compound annual growth rate (CAGR) of 13.69% during the forecast period 2025 to 2034. The carbon dioxide removal (CDR) market is rapidly expanding due to increasing government policies, corporate sustainability goals, and climate commitments. Countries are introducing tax incentives and funding programs to accelerate technology adoption.

The carbon dioxide removal (CDR) market is booming as the world rallies around various campaigns to combat climate change and also achieve zero net emissions. So here is the broad outline of technologies and solutions, such as direct air capture (DAC), bioenergy with carbon capture and storage (BECCS), an approach that combines ocean-based removals with enhanced weathering, which are aimed at either capturing or removing CO2 from ambient air. Businesses investing in net-zero strategies drive demand for carbon removal solutions, making it an attractive sector for investment. Growing awareness and climate action initiatives by organizations like the UN and World Economic Forum further boost CDR adoption. Market growth is coming from commitments to sustainability, carbon pricing mechanisms, and increased investments in clean technologies from governments and corporates alike. The innovations in new efficiencies and scalability of capture systems, combined with supportive policies, nourish expansion of the market. Yet, high capital costs, energy consumption, and regulations are some of the challenges faced in a CDR deployment. Demand for scalable climate solutions will increase the CDR market as its key player in realizing international carbon neutrality targets.

Report Highlights

What is a Carbon Dioxide Removal (CDR)?

Carbon Dioxide Removal (CDR) refers to various methods used to capture and store excess CO2 from the atmosphere to reduce climate change. Natural approaches include afforestation (planting trees), soil carbon sequestration, and ocean-based carbon absorption. Technological methods involve Direct Air Capture (DAC), bioenergy with carbon capture and storage (BECCS), and mineralization. These solutions help lower global temperatures, improve air quality, and support sustainability efforts. CDR is vital for achieving net-zero emissions and limiting global warming to 1.5°C. The Intergovernmental Panel on Climate Change (IPCC) emphasizes that removing billions of tons of CO2 annually is necessary to offset industrial emissions. Governments and corporations are investing heavily in CDR technologies, and policies like carbon credits encourage companies to adopt these solutions.

Key Insights Beneficial to the Carbon Dioxide Removal (CDR) Market

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 727.78 Million |

| Projected Market Size in 2034 | USD 2,309.61 Million |

| Expected CAGR (2025 to 2034) | 13.69% |

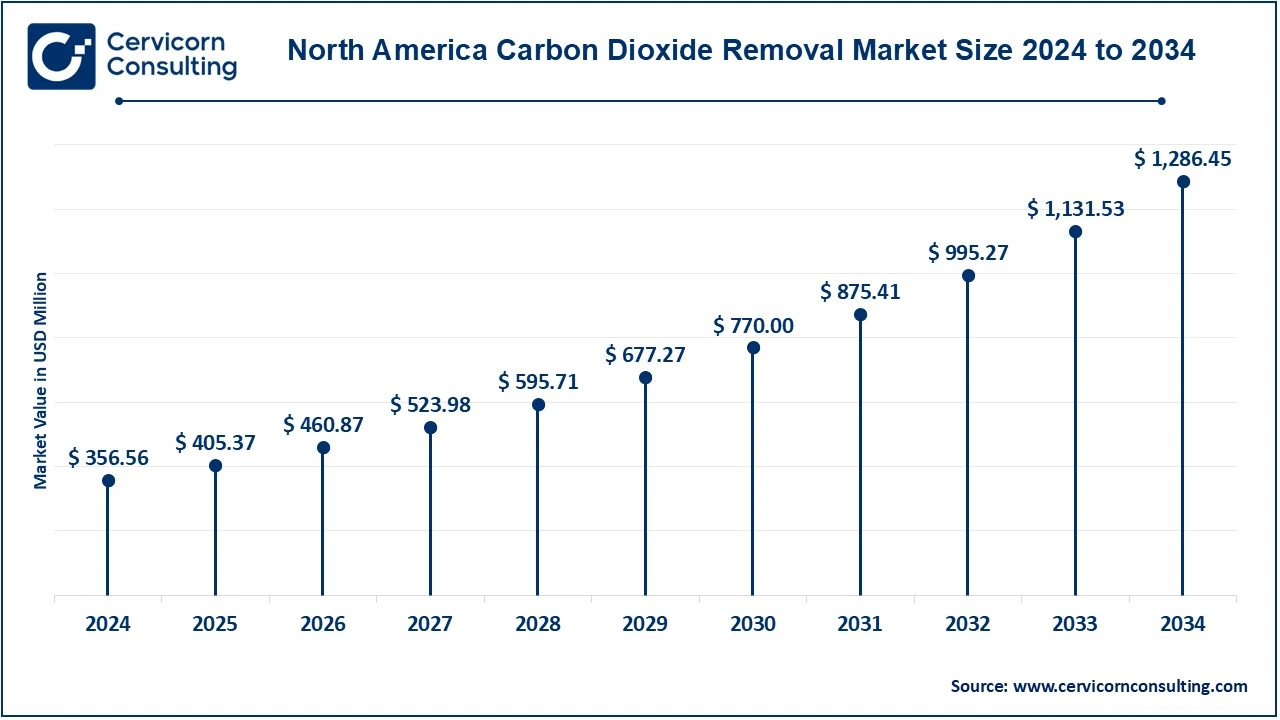

| Dominant Region | North America |

| High-growth Region | Asia Pacific |

| Key Segments | Product, Application, End User, Region |

| Key Companies | Arca, Blue Planet Systems, Bussme Energy AB, Carbfix hf., Carbicrete, Carbofex Ltd., Carbon Engineering Ltd., CarbonCure Technologies Inc., CarbonFree, Cella Mineral Storage Inc., Charm Industrial, Climeworks, Ebb Carbon, Global Thermostat, HEIMDAL, Neustark Ag, Novocarbo GmbH, Oregon Biochar Solutions, Pacific Biochar Benefit, Wakefield BioChar |

Circular Economy Initiatives

Public-Private Partnerships

High Implementation Cost

Energy Intensity

Adaptation to Regulatory Requirements

Global Collaborations

Limited Infrastructure

Regulatory and Policy Uncertainty

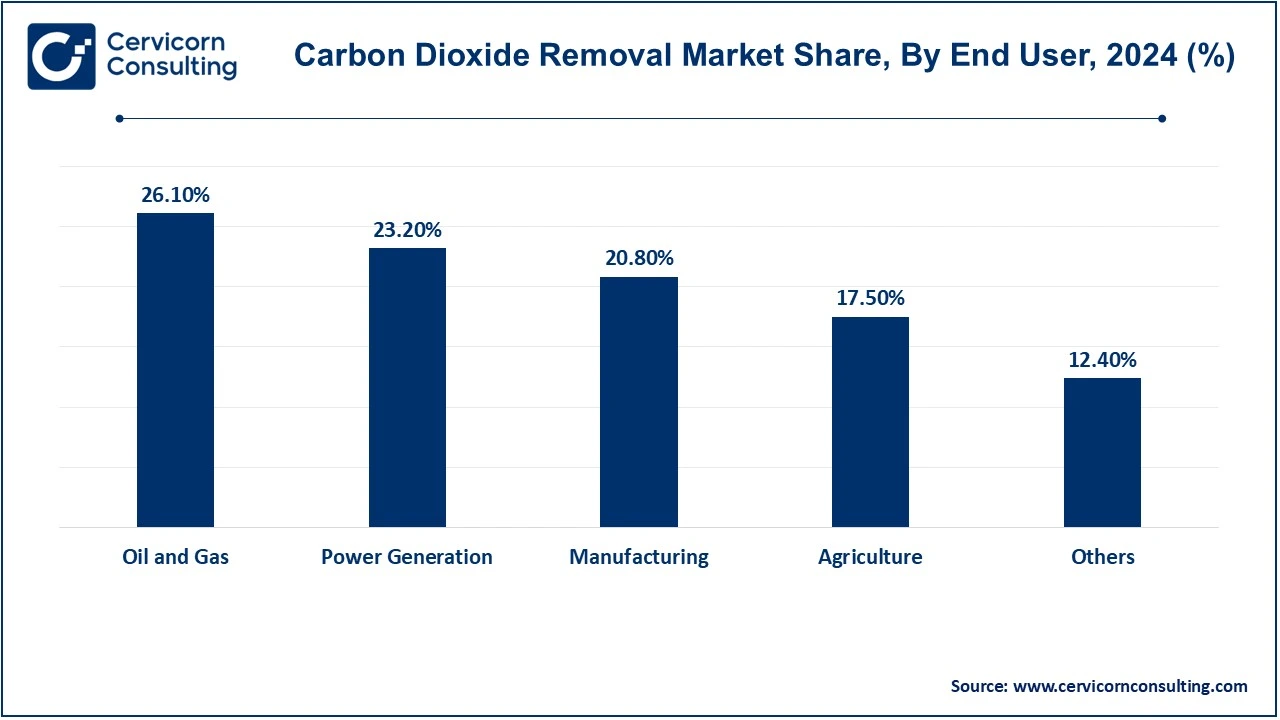

The carbon dioxide removal market is segmented into product, application, end user and region. Based on product, the market is classified into biochar, direct air capture (DAC), microalgae, BECCS, ocean alkalinization, and enhanced/carbon mineralization. Based on application, the market is classified into finance sector, technology sector, and others. Based on end user, the market is classified into oil and gas, power generation, manufacturing, agriculture, and others.

Microalgae: Microalgae-based carbon dioxide removal (CDR) is the capture and bio-based application of produced CO2. Biomass produced via photosynthesis can be converted into biofuels, animal feeds, or bioplastics, whereby these organisms increased their multiplication rates converting them into having better carbon fixation rates than terrestrial plants having a lower range for that particular physiological process. Microalgae cultivation takes place in photobioreactors or open ponds where controlled conditions are used to maximize the uptake of CO2.

BECCS: Biomass is an energy production and carbon capture technology that integrates bioenergy with carbon capture to generate net-negative emissions. Such biomass includes agricultural residues or dedicated energy crops, which absorbed atmospheric CO2 during their growth. While they are used for energy production, resulting emissions are taken into geological formations where they would remain stored underground.

Ocean Alkalinization: Ocean alkalinization is a new approach of removing carbon dioxide from the atmosphere through the improvement of alkaline waters to enjoy the benefits of the natural process of increased absorption of CO2 through oceans. The addition of alkaline salts like limestone and other minerals into seawater will improve the ability of the oceans to absorb CO2 from the atmosphere. Thus, the salts will convert most of such absorption into stable bicarbonate ions, which will maybe be stored in oceans for centuries.

Enhanced/Carbon Mineralization: Enhanced/mineralized carbon refers to an increase in speed or rate during standard CO2 outcomes from reactions with minerals to form stable carbonates. This is a form of weathering, as can occur geologically or industrially, in which CO2 is injected into calcium or magnesium-rich rock. Over time, CO2 binds with these minerals, thus permanently storing it inside as solid carbonates. Enhanced mineralization accelerates this reaction, either by adding a specific catalyst or creating ideal conditions, such as high pressure and temperature.

Direct Air Capture (DAC): DAC constitutes one of the most popular methods available and currently under active research and project implementation for the removal of CO2 from the atmosphere. Direct Air Capture technology entails chemical processing for direct CO2 capture from ambient air, usually using large-scale machinery that traps CO2 on solid sorbents or liquid solutions. CO2 is compressed and stored underground (within geological formations) or converted to synthetic fuels, chemicals, or building materials once captured.

Biochar: Biochar is a carbon-dense material that results from the heating of organic biomass (such as agricultural waste) in the absence of oxygen through pyrolysis. Pyrolysis locks carbon in a solid, stable storage form for periods of hundreds to thousands of years, making biochar a method of carbon sequestration. In addition, biochar improves soils through improved moisture, nutrient retention, and general soil health while reducing reliance on synthetic fertilizers, which are carbon delegating.

Finance Sector: The finance sector deals with giving life to investments, risk management, and the development of policies to grow the CDR market. The financial institutes now are more about the recognition of carbon removals into their sustainability agendas. Asset managers, banks, and investment firms are rolling carbon credits and CDR technologies into their portfolios to align them more correctly with environmental, social, and governance (ESG) objectives. With the advent of carbon markets, where purchase carbon credits from CDR projects, there is also a financial incentive toward large-scale deployment.

Technology Sector: In fact, the technology domain happens to lead the innovation in the commercial carbon dioxide removal sector. All way from artificial intelligence or advanced materials to any kind of tech, these companies have been busy developing and optimising the required systems for capturing and storing atmospheric CO2. Emerging technologies such as direct air capture (DAC), carbon mineralization and bioenergy with carbon capture and storage (BECCS) are greatly enhanced by cutting-edge computing, machine learning, and automation to improve efficiency and scalability. Tech companies are innovating in carbon utilization: capturing CO2 and turning it into profitable products such as sustainable fuels, chemicals, and building materials.

Based on end user, the CDR market is segmented into power generation, oil and gas, manufacturing, agriculture, and others. The oil and gas segment has dominated the market in 2024.

The carbon dioxide removal market is segmented into various regions, including North America, Europe, Asia-Pacific, andLAMEA. Here is a brief overview of each region:

The North America carbon dioxide removal market size was estimated at USD 356.56 million in 2024 and is projected to hit around USD 1,286.45 million by 2034. The considered region North America ranks among the very best and largest regions in the CDR market due to a strong commitment from the government and corporate sectors toward climate change mitigation. The U.S. is a significant player with policies such as the Inflation Reduction Act that provides tax credits for carbon capture technologies including direct air capture (DAC) and bioenergy with carbon capture and storage (BECCS).

It has led the world in the CDR market and resulted from the ambitious climate targets and strong regulatory frameworks. It is the European Union's Green Deal and the European Climate Law that legally opened the doors to major investments in CDR technologies. From direct air capture (DAC) to ocean alkalinization and bioenergy with carbon capture and storage (BECCS), multiple initiatives in carbon removal are supported in the area.

The carbon dioxide removal market is poised for rapid growth in the Asia-Pacific region due to commercial activity in the region and rapid increase in CO2 emissions. Carbon removal measures such as lowering CO2 emissions will have to be taken up by countries like China, India and Japan to meet their national climate targets. As the largest emitter of CO2 in the world, China has invested heavily in CDR technologies, focusing on carbon capture, use and storage (CCUS).

The LAMEA region presents a huge and growing potential for CDR market, but there are also specific emerging challenges in this region. This resource-rich region has forests, stretches of land for potential agricultural biochar production and other endogenic resources that could generate solutions in possible carbon-removal activities.

The new entrants in the carbon dioxide removal (CDR) industry are taking strides into innovation, presenting new technologies and approaches in capturing and sequestering atmospheric CO2. They have differing prescriptions that may range from direct air capture (DAC) and bioenergy with carbon capture and storage (BECCS) to nature-based carbon sequestration and reforestation, as shown by start-ups and emerging companies. Most of the recent entrants are working towards fine-tuning performance on existing technologies and cost-effective availability for CDR. For instance, many start-ups are making DAC systems that need less energy or run on renewable sources to make it more cost-efficient. The new entrants are also delving into AI and machine learning methodologies to monitor, improve efficiencies and scale CDR systems. Most of these start-ups are also absorbing partnerships with large corporations, governments, and research institutions to get funds, expertise, and infrastructure to scale their technologies.

Market Segmentation

By Product

By Application

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Carbon Dioxide Removal

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Application Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Carbon Dioxide Removal Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Circular Economy Initiatives

4.1.1.2 Public-Private Partnerships

4.1.2 Market Restraints

4.1.2.1 High Implementation Cost

4.1.2.2 Energy Intensity

4.1.3 Market Challenges

4.1.3.1 Limited Infrastructure

4.1.3.2 Regulatory and Policy Uncertainty

4.1.4 Market Opportunities

4.1.4.1 Adaptation to Regulatory Requirements

4.1.4.2 Global Collaborations

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Carbon Dioxide Removal Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Carbon Dioxide Removal Market, By Product

6.1 Global Carbon Dioxide Removal Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Biochar

6.1.1.2 Direct Air Capture (DAC)

6.1.1.3 Microalgae

6.1.1.4 BECCS

6.1.1.5 Ocean Alkalinization

6.1.1.6 Enhanced/Carbon Mineralization

Chapter 7. Carbon Dioxide Removal Market, By Application

7.1 Global Carbon Dioxide Removal Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Finance Sector

7.1.1.2 Technology Sector

7.1.1.3 Others

Chapter 8. Carbon Dioxide Removal Market, By End User

8.1 Global Carbon Dioxide Removal Market Snapshot, By End User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Agriculture

8.1.1.2 Oil and Gas

8.1.1.3 Power Generation

8.1.1.4 Manufacturing

8.1.1.5 Others

Chapter 9. Carbon Dioxide Removal Market, By Region

9.1 Overview

9.2 Carbon Dioxide Removal Market Revenue Share, By Region 2024 (%)

9.3 Global Carbon Dioxide Removal Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Carbon Dioxide Removal Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Carbon Dioxide Removal Market, By Country

9.5.4 UK

9.5.4.1 UK Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Carbon Dioxide Removal Market, By Country

9.6.4 China

9.6.4.1 China Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Carbon Dioxide Removal Market, By Country

9.7.4 GCC

9.7.4.1 GCC Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Carbon Dioxide Removal Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Arca

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Blue Planet Systems

11.3 Bussme Energy AB

11.4 Carbfix hf.

11.5 Carbicrete

11.6 Carbofex Ltd.

11.7 Carbon Engineering Ltd.

11.8 CarbonCure Technologies Inc.

11.9 CarbonFree

11.10 Cella Mineral Storage Inc.

11.11 Charm Industrial

11.12 Climeworks

11.13 Ebb Carbon

11.14 Global Thermostat

11.15 HEIMDAL

11.16 Neustark Ag

11.17 Novocarbo GmbH

11.18 Oregon Biochar Solutions

11.19 Pacific Biochar Benefit

11.20 Wakefield BioChar