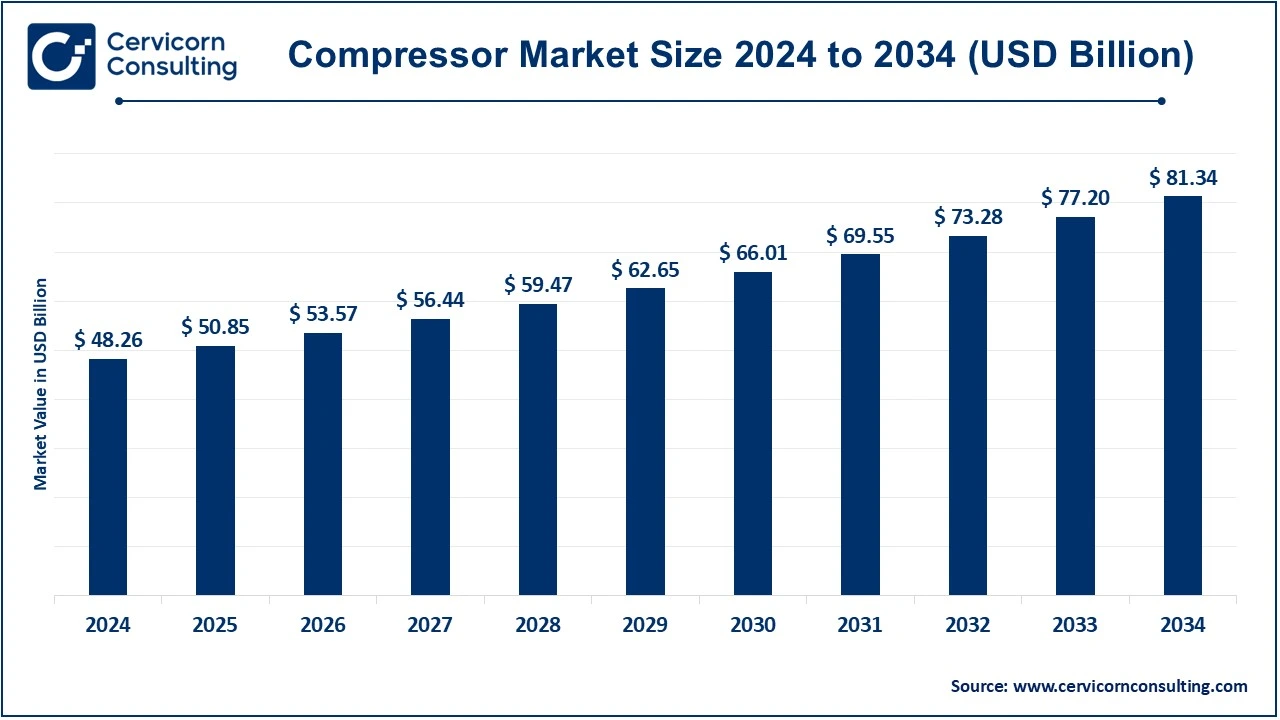

The global compressor market size was valued at USD 48.26 billion in 2024 and is expected to be worth around USD 81.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.35% during the forecast period 2025 to 2034.

The compressor market is growing very fast due to the vast demand for energy-efficient, highly advanced systems from oil and gas, HVAC, manufacturing, and power generation industries. An addition to the number and presence of compressors in construction and energy projects is given by industrialization and infrastructure development. Stricter environmental regulations and initiatives toward environmentally friendly practices have contributed to the growing acceptance of oil-free compressors. Various technological developments, such as IoT-enabled and compressors with variable-speed drive, will serve to improve operational efficiency while cutting energy and maintenance costs. R&D expenditures keep fueling an innovation pipeline that boosts compressor performance and reliability for the varieties of applications in different industries. These factors make compressors an affordable and vital solution to power tools, machinery, and processes across sectors. As continued innovation and efficiency dominate industry thought, the market will carry a steady growth trajectory-anchored by advancements that address regulatory exigencies and consumer demands.

CEO Statements

Ingersoll Rand– Vicente Reynal, CEO

Atlas Copco– Mats Rahmström, CEO

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 48.26 Billion |

| Expected Market Size in 2034 | USD 81.34 Billion |

| CAGR 2025 to 2034 | 5.35% |

| High-impact Region | Asia-Pacific |

| High-growth Region | North America |

| Key Segments | Type, Technology, Pressure Rating, End User, Region |

| Key Companies | Aerzener Maschinenfabrik GmbH, Ariel Corporation, Atlas Copco AB, Baker Hughes Co., Bauer Compressors Inc., Burckhardt Compression Holding AG, Ebara Corporation, Ingersoll Rand Inc, Siemens Energy AG, Sulzer Ltd |

Rapid industrialization in developing countries

Rise in energy demand and power generation needs

Rising demand for HVAC systems in residential and commercial applications

Growth of industrial automation

High initial costs of advanced compressors

Rising energy prices interfere with the operational costs

Improved operational capabilities in smart compressor systems

Rising construction and infrastructural projects in the developing world

Demand for advanced compressors for oil & gas exploration and production

Increasing investment in industrial automation

Ensuring affordability for small and medium enterprises (SMEs)

Overcoming inertia in moving from conventional to digitalized systems

The compressor market is segmented into type, technology, pressure rating, end user and region. Based on type, the market is classified into positive displacement compressors and dynamic compressor. Based on technology, the market is classified into oil-free and oil lubricated. Based on pressure rating, the market is classified into low-pressure compressors (0-20 bar), medium-pressure compressors (20-100 bar), and high-pressure compressors (100+ bar). Based on end user, the market is classified into oil and gas, power, manufacturing, chemicals and petrochemical and others.

Positive Displacement Compressors: Positive displacement compressors draw air or gas and then compress it into a smaller volumetric chamber. Generally, these compressors are applied in the delivery of accurately measured amounts of air; thus, they find application in high-pressure operations. A good example is the screw-type compressor, manufactured by Ingersoll Rand, where they serve in the manufacturing and automotive sector for stable air compression.

Compressor Market Revenue Share, By Type, 2024 (%)

| Type | Revenue Share, 2024 (%) |

| Positive Displacement Compressors | 56.50% |

| Dynamic Compressor | 43.50% |

Dynamic Compressors: Dynamic compressors give kinetic energy to the air or gas, making it flow in a linear manner. Some of the general applications include those where continuous air flow under moderate pressure is required. For example, Siemens provides centrifugal compressors for power plants with high-volume efficiency during constant air delivery.

Oil & Gas: Compressors compress, transport, and process gases in the oil and gas industries. They play crucial roles in either moving natural gas or refining crude oil. An example would be Cameron compressors working on offshore oil rigs with gas compression and transportation in the oil industry.

Power: Compressors are largely utilized in gas turbine engines as well as power generation systems within the power sector. This really becomes vital where energy efficiency and reliability are concerned in electricity generation. For example, in its gas turbines for efficient energy production, GE Power compressors are integrated for application in power plants around the globe.

Manufacturing: A compressor in the manufacturing industry is used to run pneumatic tools, machines, and assembly lines. It provides compressed air to various industrial processes. For instance, Atlas Copco manufactured compressors that share energy-efficient air solutions with the auto and electronics industry to improve productivity.

Chemicals and Petrochemical: In chemicals and petrochemicals, compressors are circulated to compress gases for transport, chemical reactions, and control of pressure. For instance, Gardner Denver offers high-pressure compressors to the chemical industry for effective management of high-pressure gas during the chemical manufacturing processes.

Others: There are other end-users of compressors, including food and beverage, pharmaceutical-based, and HVAC manufacturers. These industries apply compressors in refrigeration, air conditioning, and other key processes. For instance, Frascold manufactures compressors for food refrigeration, cool storage, and transportation combined with temperature control and energy efficiency.

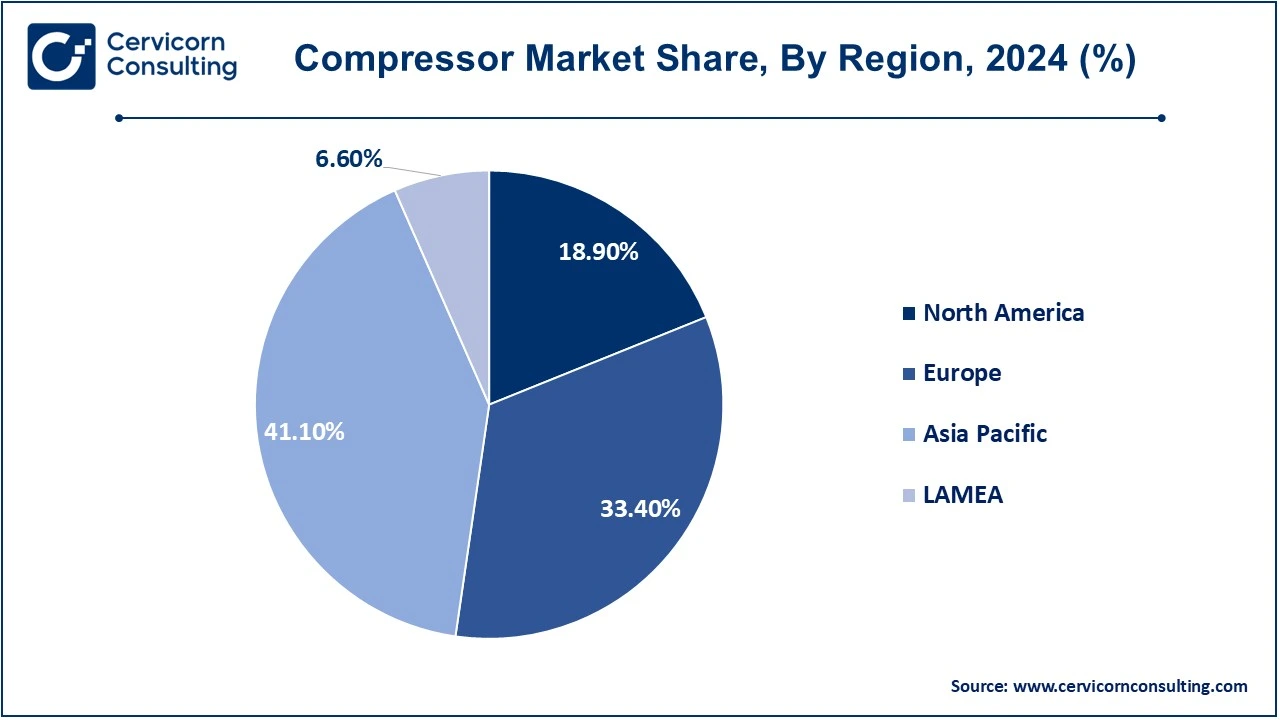

The compressor market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

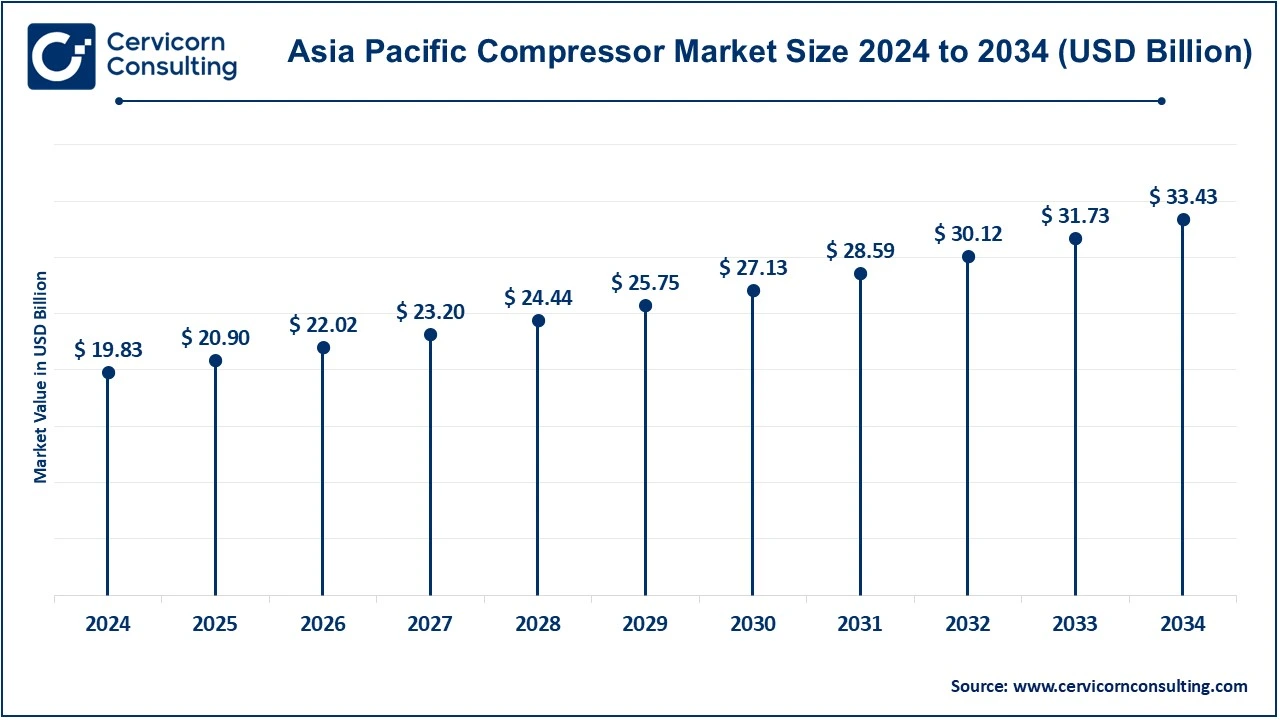

The Asia-Pacific compressor market size was accounted for USD 19.83 billion in 2024 and is expected to hit around USD 33.43 billion by 2034. Asia-Pacific compressor market is rapidly growing due to rapid industrialization, urbanization, and demand for energy. While China, India, and Japan are the major consumers of compressors for manufacturing, construction, and electrical energy, the increasing pressure for many developing countries with ever-growing demand for air and gas serves as a great stimulus for growth. In China, the manufacturing hub, compressors are widely demanded for industries like automotive, electronics, and construction, significantly helping in the region's economic growth.

The North America compressor market size was valued at USD 9.12 billion in 2024 and is expected to reach around USD 15.37 billion by 2034. The growth in North America region is driven by innovations and improvements in turbine efficiency as well as expanding industrialization in oil & gas, manufacturing, and power generation in the United States and Canada. Increased investment in infrastructure and renewable energy is also driving compressor adoption in the North American region. For example, the U.S. dominates the market through its compressor applications in the oil & gas industry to advance energy production and transportation.

The Europe compressor market size was estimated at USD 16.12 billion in 2024 and is projected to surpass around USD 27.17 billion by 2034. The European compressor markets operate under rather strict regulations in respect to environmental regulations and sustainability technologies. Countries such as Germany, the United Kingdom, and France put into force energy-efficient compressors to be compliant with EU legislation and facilitate industrial processes. Chemicals, manufacturing, and power generation also continue to grow here. Germany, a core-by-way-of-fastly-accelerating state, uses modern compressor systems in industries meeting environmental and efficiency conditions.

The LAMEA compressor market size was valued at USD 3.19 billion in 2024 and is anticipated to reach around USD 5.37 billion by 2034. The LAMEA compressor market is growing steadily on the back of infrastructure development, targeting primarily oil & gas, power, and manufacturing. The Middle East in particular is a solid market owing to the huge oil and gas reserves stationed in the region. Countries such as Saudi Arabia, Brazil, and South Africa contribute significantly to the expansion of the market. Because of the need for gas compression and transportation in the oil and gas sector, Saudi Arabia continues to boost its economic growth in the region through meaningful investments in compressor production.

The new entrants in the compressor market are employing technology to devise the most efficient and energy-saving compressor systems. These new market players focus on developing advanced compressors with IoT connectivity and variable-speed technology to enhance operational efficiency and reduce energy consumption. Additionally, they are investing in eco-friendly, oil-free compressors to meet rising environmental concerns and industry regulations. For example, Sauer Compressors is integrating digital solutions into their compressors to optimize performance, while Gardner Denver offers energy-efficient, oil-free systems for industries seeking sustainable solutions.

Recent strategic partnerships and agreements in the compressor market reflect a strong commitment to advancing technology, improving efficiency, and meeting the increasing demand for reliable gas compression solutions. These collaborations aim to enhance infrastructure capabilities, support sustainable energy solutions, and address the growing needs of industries across various regions. Some notable examples of key developments in the Compressor Market include:

These developments underscore a global drive to improve compressor through collaborative efforts and substantial investments. By addressing the growing demand for efficient gas compression systems, these initiatives aim to enhance operational efficiency, support infrastructure growth, and cater to key industries, ultimately contributing to sustainable energy solutions and regional economic growth.

Market Segmentation

By Type

By Technology

By Pressure Rating

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Compressor

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Type Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Compressor Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rapid industrialization in developing countries

4.1.1.2 Rise in energy demand and power generation needs

4.1.1.3 Rising demand for HVAC systems in residential and commercial applications

4.1.1.4 Growth of industrial automation

4.1.2 Market Restraints

4.1.2.1 High initial costs of advanced compressors

4.1.2.2 Rising energy prices interfere with the operational costs

4.1.2.3 Improved operational capabilities in smart compressor systems

4.1.3 Market Challenges

4.1.3.1 Ensuring affordability for small and medium enterprises (SMEs)

4.1.3.2 Overcoming inertia in moving from conventional to digitalized systems

4.1.4 Market Opportunities

4.1.4.1 Rising construction and infrastructural projects in the developing world

4.1.4.2 Demand for advanced compressors for oil & gas exploration and production

4.1.4.3 Increasing investment in industrial automation

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Compressor Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Compressor Market, By Technology

6.1 Global Compressor Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Oil-free

6.1.1.2 Oil lubricated

Chapter 7. Compressor Market, By Type

7.1 Global Compressor Market Snapshot, By Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Positive Displacement Compressors

7.1.1.2 Dynamic Compressor

Chapter 8. Compressor Market, By Pressure Rating

8.1 Global Compressor Market Snapshot, By Pressure Rating

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Low-Pressure Compressors (0-20 bar)

8.1.1.2 Medium-Pressure Compressors (20-100 bar)

8.1.1.3 High-Pressure Compressors (100+ bar)

Chapter 9. Compressor Market, By End User

9.1 Global Compressor Market Snapshot, By End User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Oil and gas

9.1.1.2 Power

9.1.1.3 Manufacturing

9.1.1.4 Chemicals and Petrochemical

9.1.1.5 Others

Chapter 10. Compressor Market, By Region

10.1 Overview

10.2 Compressor Market Revenue Share, By Region 2024 (%)

10.3 Global Compressor Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Compressor Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Compressor Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Compressor Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Compressor Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Compressor Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Compressor Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Compressor Market, By Country

10.5.4 UK

10.5.4.1 UK Compressor Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Compressor Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Compressor Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Compressor Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Compressor Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Compressor Market, By Country

10.6.4 China

10.6.4.1 China Compressor Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Compressor Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Compressor Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Compressor Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Compressor Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Compressor Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Compressor Market, By Country

10.7.4 GCC

10.7.4.1 GCC Compressor Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Compressor Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Compressor Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Compressor Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Aerzener Maschinenfabrik GmbH

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Ariel Corporation

12.3 Atlas Copco AB

12.4 Baker Hughes Co.

12.5 Bauer Compressors Inc.

12.6 Burckhardt Compression Holding AG

12.7 Ebara Corporation

12.8 Ingersoll Rand Inc

12.9 Siemens Energy AG

12.10 Sulzer Ltd