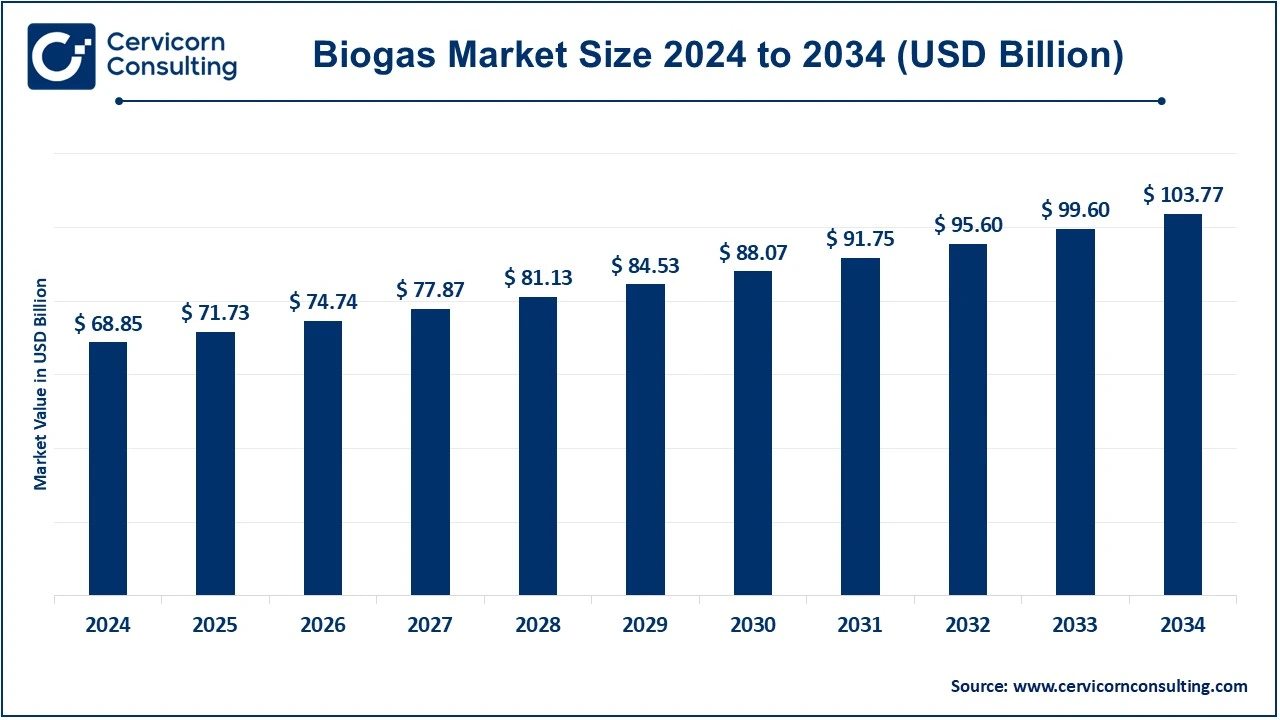

The global biogas market size was valued at USD 68.85 billion in 2024 and is expected to be worth around USD 103.77 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.18% over the forecast period 2024 to 2033.

The biogas market is expected to grow due to increasing product demand from various application segments including heat, power, upgraded biogas, vehicle fuel and cooking gas. In addition, a change in emphasis towards utilizing renewable energy, particularly in the electricity sector, has greatly boosted the need for biogas in energy uses. Also, the growing necessity to lessen reliance on fossil fuels is generating profitable prospects for biogas in automotive fuel uses.

Biogas is a renewable energy source produced by anaerobic digestion of organic matter such as agricultural residues, municipal waste or wastewater. In this process, organic matter is broken down by microorganisms in the absence of oxygen to produce biogas, which mainly consists of methane (CH2) and carbon dioxide (CO2). Biogas offers several benefits such as eco-friendly recycling of industrial and domestic organic waste, protection of groundwater and increasing yield in fields.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 71.73 Billion |

| Expected Market Size in 2034 | USD 103.77 Billion |

| Projected CAGR 2025 to 2034 | 4.18% |

| Leading Region | Europe |

| High-growth Region | Asia-Pacific |

| Key Segments | Source, Application, Region |

| Key Companies | Engie SA, Spectrum Renewable Energy Pvt. Ltd., Air Liquide, EnviTec Biogas AG, Atmos Bioenergy, AAT Biogas Technology, Hitachi Zosen Corporation, Gasum Oy, Ameresco, Biogas Engineering India Pvt Ltd., Schmack Biogas GmbH, Future Biogas Limited, Weltec Biopower GmbH, Green Elephant India Private Limited, Cyy Bio Power Co. Ltd. |

Increasing Need for Emission Reduction

Increasing Demand from Various Application Areas

Legal Obstacles and Permitting Processes

High Initial Investments Associated with Biogas Production

Cutting-edge Anaerobic Digestion Systems

Market Incentives and Policy Assistance

Infrastructure Challenges

Competition among Renewable Sources

The biogas market is segmented into source, application and region. Based on source, the market is classified into municipal, industrial, and agricultural. Based on application, the market is classified into electricity, heating, vehicle fuel, cooking gas, upgraded gas.

Municipal: The municipal segment has dominated the market in 2024. For municipal sources, solid waste such as food waste, glass, garden waste, non-recyclable paper, wood waste, rags, and sludge from sewage are widely used as raw materials for biogas production. Increasing use of municipal solid waste in biogas production to reduce landfill and greenhouse gas emissions is expected to support the market demand during the forecast period.

Agricultural: Agriculture is one of the major sources of biogas production. Waste materials such as manure, agricultural waste, and food and slaughterhouse waste from dairy, poultry and pig farming and farms are used as feedstocks for biogas production. These feedstocks are stored in clamps or hoppers and ensiled before being fed into the digester to be converted into sustainable energy for various applications including electricity, heat, automotive fuel and feed gas.

Biogas Market Revenue Share, By Source, 2024 (%)

| Source | Revenue Share, 2024 (%) |

| Municipal | 45.20% |

| Industrial | 12.30% |

| Agricultural | 42.50% |

Industrial: The need for wastewater treatment in the industrial sector is expected to increase along with the growing interest in developing practical methods to produce bioproducts and biofuel from industrial food waste. In addition, food and beverage industries are now focusing on proper food waste management to achieve zero waste. Companies such as Nestlé S.A., PepsiCo, Inc. and Unilever plc have started converting food waste into biogas to generate electricity for manufacturing units. These trends and supportive government policies are likely to drive the market growth in the coming years.

Electricity: The electricity segment has dominated the market in 2024. Biogas has gained importance as a sustainable and environmentally friendly source of electricity generation. The use of biogas for electricity generation is in line with global efforts to transition to cleaner and more sustainable energy sources, helps reduce greenhouse gas emissions and promotes environmental sustainability. The use of biogas for electricity generation has increased due to increased focus on the use of renewable energy, particularly in the power sector. In addition, the shift from coal-fired power plants to gas-based power plants taking place in various countries due to rising carbon emissions is expected to boost the demand for biogas for electricity generation during the forecast period.

Heating: Biogas is widely used for heating purposes in the industrial and domestic sectors. Biogas production through the anaerobic decomposition process of organic material is used to generate heat through a gas engine using combined heat and power (CHP) technology. Unlike traditional on-site power generators and boilers, heat is recovered during the combustion process of organic material using heat exchangers built into the cooling and exhaust systems of cogeneration engines. This helps reduce energy consumption as well as pollution.

Vehicle Fuel: Growing awareness of greenhouse gas emissions in the transportation sector as well as various stringent government regulations are driving the demand for biogas as a vehicle fuel. The transportation sector accounts for 30% of global energy consumption and switching to biogas as an alternative vehicle fuel can help reduce greenhouse gas emissions in the transportation sector by 60-80% compared to fossil fuels such as diesel and gasoline. Therefore, countries such as Sweden, Germany, the UK, Switzerland and the US are encouraging the use of biogas-powered trucks, cars and buses through a combination of investment grants, tax exemptions and incentives for feeding biogas into the natural gas grid.

Cooking: Biogas burns cleanly and efficiently, making it a highly effective fuel for cooking. It can be used in a wide range of cooking appliances, including stoves, ovens and boilers, and is easily adapted to achieve different heat levels. Biogas is generally less expensive than other cooking fuels, especially in areas where it can be produced locally. It can also be produced on a small scale, making it accessible to households and small businesses that may not have access to other energy sources. Biogas is an excellent alternative to traditional cooking fuels, providing a clean, efficient and cost-effective way to cook and heat food.

Upgraded Biogas: Upgraded biogas refers to the process of converting biogas into biomethane, which is achieved by removing hydrogen sulphide, water, carbon dioxide and impurities from the original biogas. This upgraded form of biogas, known as biomethane, shows promise as a cleaner and more refined biofuel, making it suitable for various applications, including fuelling vehicles.

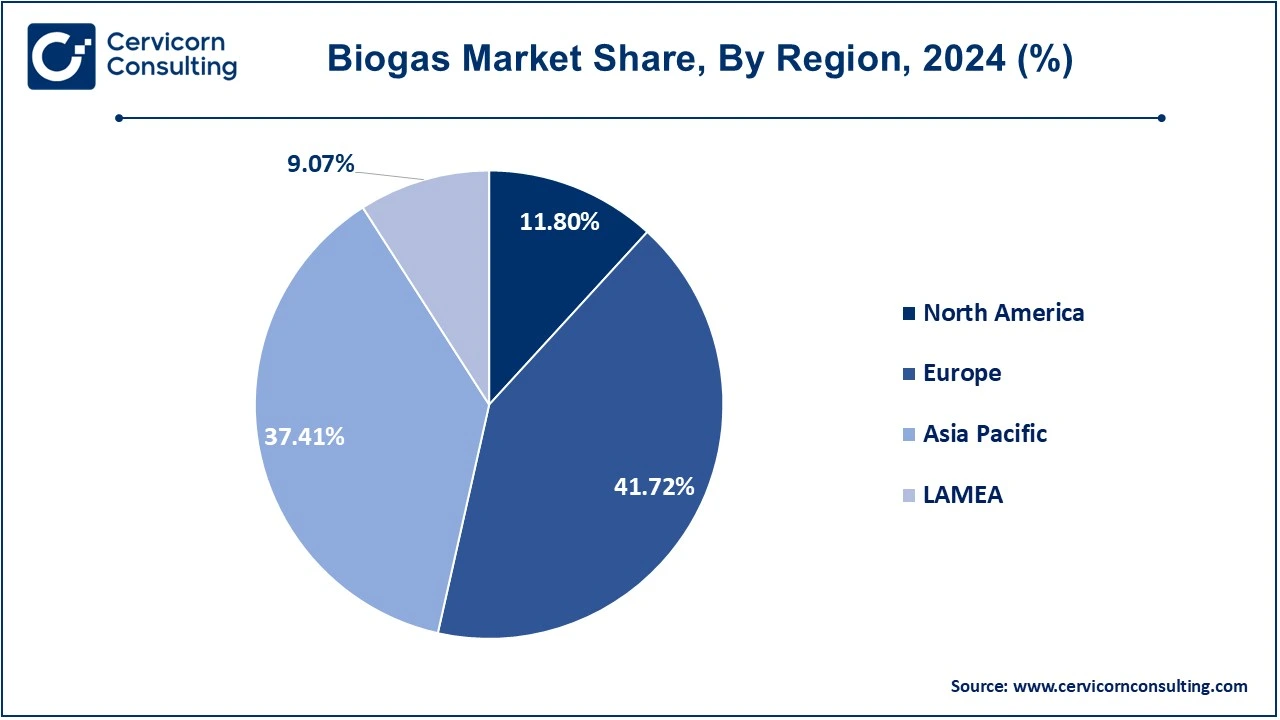

The biogas market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

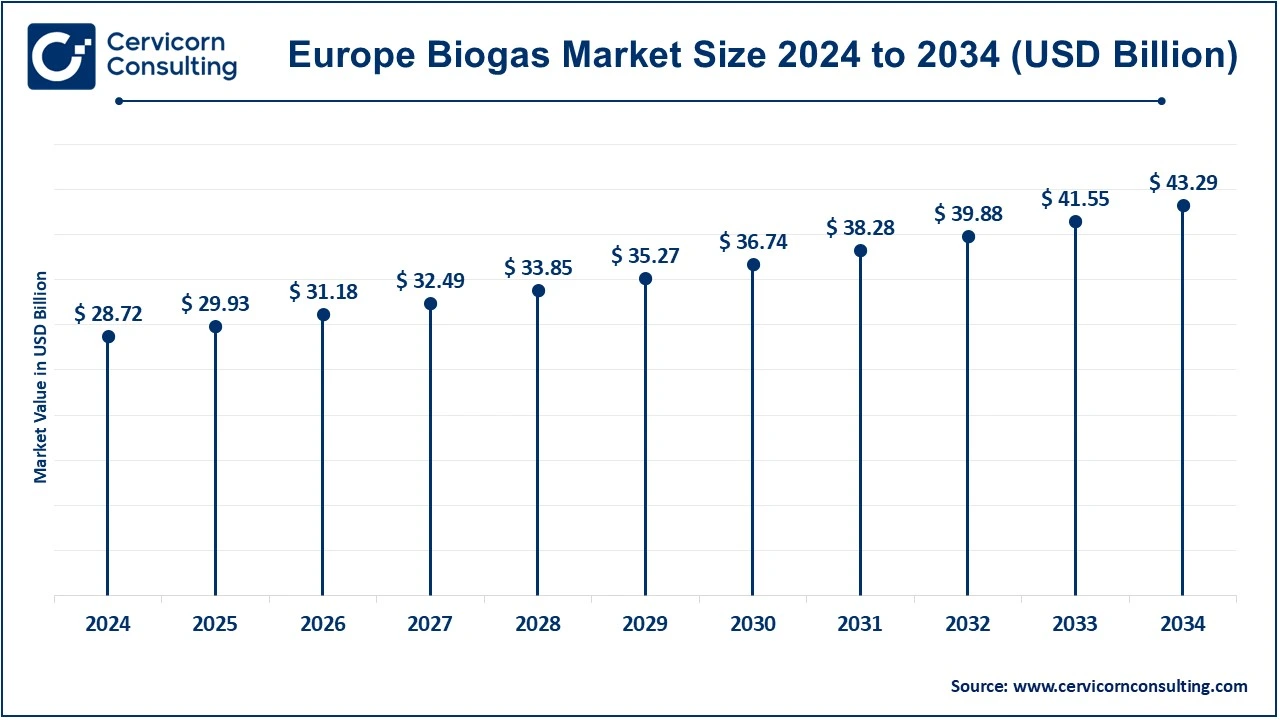

The Europe biogas market size was estimated at USD 28.72 billion in 2024 and is projected to surpass around USD 43.29 billion by 2034. Numerous countries such as Austria, Germany, and Denmark have a robust legal structure for renewable energy sources. Due to technological advancements and increasing spending in the region's refining industry, the biogas market in Europe is growing. Companies across Europe are investing significant amounts in research and development of biogas production from existing sources and are planning to increase the share of feedstock in the next few years, which will support the market growth of biogas in the region. The government and various European organizations are initiating projects to actively promote and support the use of biogas. In addition, the high depletion rate of fossil fuels in the region provides numerous growth prospects for the global market. The European Union has set a goal to use more renewable energy than fossil fuels. The government's focus on reducing carbon emissions also provides growth opportunities for the European market.

The Asia-Pacific biogas market size was accounted for USD 25.76 billion in 2024 and is anticipated to reach around USD 38.82 billion by 2034. The Asia Pacific biogas market is still in the early stages of its development. The main reasons for the region's high growth are the increased demand for biogas and growing public and private investments. The solid waste generated annually worldwide is over 2 billion tons, and about 40% of the solid waste comes from Pacific and Southeast Asian countries. Therefore, the region can produce biogas and solve the problems related to waste management and climate change. In addition, the Asia Pacific market is growing due to the region's high energy consumption and strict environmental laws. Increasing investments by the public and private sectors in China in the production of biogas are driving the development of the market.

The North America biogas market size was estimated at USD 8.12 billion in 2024 and is expected to reach around USD 12.24 billion by 2034. The increasing demand for the product in applications such as cooking gas, electricity, vehicle fuel, heat, and others is expected to have a positive impact on the industry growth during the forecast period. The adoption and innovation of new technologies to promote the production of feedstocks for generating biogas in the U.S. is expected to boost the overall growth of the global market in the region. The major factors supporting the growth include high demand for green fuels, stringent environmental regulations, and increased investments in refinery development. Producers of biogas are pursuing strategies such as mergers and acquisitions to increase their market share and regional production capacity.

The LAMEA biogas market was valued at USD 6.24 billion in 2024 and is predicted to hit around USD 9.41 billion by 2034. The demand for biogas in the Latin America region is mainly driven by Brazil, which has the largest share of commodity production among Latin American countries. The considerable growth of the regional market is leading to increased government initiatives towards energy security and energy independence. Moreover, the high dependence on exhaustible fossil fuels has forced the various governments of the region to look for alternatives. The increasing environmental concerns are expected to boost the demand for biogas in the Middle East and Africa. Favourable regulatory policies and increasing government investments will further drive the adoption of biogas across the region.

The global biogas industry is extremely fragmented due to the numerous regional and international players. Numerous players across the world are gradually contributing organic and inorganic developments to strengthen their market position. Most of the companies are focusing on enhancing their production capacities by introducing new plants or expanding existing ones.

Anaergia secured a contract in April 2023 to supply its technologies for PepsiCo's new 'Simba Chips' facility in South Africa. They will use high solids anaerobic digestion to convert food processing waste into renewable energy, generating 800 kW annually. The aim is to reduce Scope 1 emissions, manage waste sustainably and generate carbon-free energy. Hence, the company will help PepsiCo achieve its net zero emission targets and also demonstrate its expertise in the market. In December 2021, BoxLNG Pvt. Ltd., a developer of clean bioenergy projects, signed a technology collaboration and investment agreement with Netherlands-based HoSt Holding B.V (HoSt) to build compressed biogas plants in India. Compressed biogas (CBG), produced by anaerobic decomposition of agricultural waste, press sludge from sugarcane and municipal waste, can be used as fuel for cars. In March 2021, Eni SpA (BIT: ENI) agreed to buy an Italian biogas company from FRI-EL Greenpower, a holding company of the Gostner family, through its circular economy subsidiary “Ecofuel”. However, this acquisition still needs to be approved by the relevant antitrust authorities. In May 2020, Weltec Biopower built a plant in Veria, Greece. The main investor in the project is the largest slaughterhouse for cows and pigs in Greece.

Market Segmentation

By Source

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Biogas

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Source Overview

2.2.2 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Need for Emission Reduction

4.1.1.2 Increasing Demand from Various Application Areas

4.1.2 Market Restraints

4.1.2.1 Legal Obstacles and Permitting Processes

4.1.2.2 High Initial Investments Associated with Biogas Production

4.1.3 Market Challenges

4.1.3.1 Infrastructure Challenges

4.1.3.2 Competition among Renewable Sources

4.1.4 Market Opportunities

4.1.4.1 Cutting-edge Anaerobic Digestion Systems

4.1.4.2 Market Incentives and Policy Assistance

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Biogas Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Biogas Market, By Source

6.1 Global Biogas Market Snapshot, By Source

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Municipal

6.1.1.2 Industrial

6.1.1.3 Agricultural

Chapter 7. Biogas Market, By Application

7.1 Global Biogas Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Electricity

7.1.1.2 Heating

7.1.1.3 Vehicle Fuel

7.1.1.4 Cooking Gas

7.1.1.5 Upgraded Gas

Chapter 8. Biogas Market, By Region

8.1 Overview

8.2 Biogas Market Revenue Share, By Region 2024 (%)

8.3 Global Biogas Market, By Region

8.3.1 Market Size and Forecast

8.4 North America

8.4.1 North America Biogas Market Revenue, 2022-2034 ($Billion)

8.4.2 Market Size and Forecast

8.4.3 North America Biogas Market, By Country

8.4.4 U.S.

8.4.4.1 U.S. Biogas Market Revenue, 2022-2034 ($Billion)

8.4.4.2 Market Size and Forecast

8.4.4.3 U.S. Market Segmental Analysis

8.4.5 Canada

8.4.5.1 Canada Biogas Market Revenue, 2022-2034 ($Billion)

8.4.5.2 Market Size and Forecast

8.4.5.3 Canada Market Segmental Analysis

8.4.6 Mexico

8.4.6.1 Mexico Biogas Market Revenue, 2022-2034 ($Billion)

8.4.6.2 Market Size and Forecast

8.4.6.3 Mexico Market Segmental Analysis

8.5 Europe

8.5.1 Europe Biogas Market Revenue, 2022-2034 ($Billion)

8.5.2 Market Size and Forecast

8.5.3 Europe Biogas Market, By Country

8.5.4 UK

8.5.4.1 UK Biogas Market Revenue, 2022-2034 ($Billion)

8.5.4.2 Market Size and Forecast

8.5.4.3 UKMarket Segmental Analysis

8.5.5 France

8.5.5.1 France Biogas Market Revenue, 2022-2034 ($Billion)

8.5.5.2 Market Size and Forecast

8.5.5.3 FranceMarket Segmental Analysis

8.5.6 Germany

8.5.6.1 Germany Biogas Market Revenue, 2022-2034 ($Billion)

8.5.6.2 Market Size and Forecast

8.5.6.3 GermanyMarket Segmental Analysis

8.5.7 Rest of Europe

8.5.7.1 Rest of Europe Biogas Market Revenue, 2022-2034 ($Billion)

8.5.7.2 Market Size and Forecast

8.5.7.3 Rest of EuropeMarket Segmental Analysis

8.6 Asia Pacific

8.6.1 Asia Pacific Biogas Market Revenue, 2022-2034 ($Billion)

8.6.2 Market Size and Forecast

8.6.3 Asia Pacific Biogas Market, By Country

8.6.4 China

8.6.4.1 China Biogas Market Revenue, 2022-2034 ($Billion)

8.6.4.2 Market Size and Forecast

8.6.4.3 ChinaMarket Segmental Analysis

8.6.5 Japan

8.6.5.1 Japan Biogas Market Revenue, 2022-2034 ($Billion)

8.6.5.2 Market Size and Forecast

8.6.5.3 JapanMarket Segmental Analysis

8.6.6 India

8.6.6.1 India Biogas Market Revenue, 2022-2034 ($Billion)

8.6.6.2 Market Size and Forecast

8.6.6.3 IndiaMarket Segmental Analysis

8.6.7 Australia

8.6.7.1 Australia Biogas Market Revenue, 2022-2034 ($Billion)

8.6.7.2 Market Size and Forecast

8.6.7.3 AustraliaMarket Segmental Analysis

8.6.8 Rest of Asia Pacific

8.6.8.1 Rest of Asia Pacific Biogas Market Revenue, 2022-2034 ($Billion)

8.6.8.2 Market Size and Forecast

8.6.8.3 Rest of Asia PacificMarket Segmental Analysis

8.7 LAMEA

8.7.1 LAMEA Biogas Market Revenue, 2022-2034 ($Billion)

8.7.2 Market Size and Forecast

8.7.3 LAMEA Biogas Market, By Country

8.7.4 GCC

8.7.4.1 GCC Biogas Market Revenue, 2022-2034 ($Billion)

8.7.4.2 Market Size and Forecast

8.7.4.3 GCCMarket Segmental Analysis

8.7.5 Africa

8.7.5.1 Africa Biogas Market Revenue, 2022-2034 ($Billion)

8.7.5.2 Market Size and Forecast

8.7.5.3 AfricaMarket Segmental Analysis

8.7.6 Brazil

8.7.6.1 Brazil Biogas Market Revenue, 2022-2034 ($Billion)

8.7.6.2 Market Size and Forecast

8.7.6.3 BrazilMarket Segmental Analysis

8.7.7 Rest of LAMEA

8.7.7.1 Rest of LAMEA Biogas Market Revenue, 2022-2034 ($Billion)

8.7.7.2 Market Size and Forecast

8.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 9. Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2022-2024

9.1.3 Competitive Analysis By Revenue, 2022-2024

9.2 Recent Developments by the Market Contributors (2024)

Chapter 10. Company Profiles

10.1 Engie SA

10.1.1 Company Snapshot

10.1.2 Company and Business Overview

10.1.3 Financial KPIs

10.1.4 Product/Service Portfolio

10.1.5 Strategic Growth

10.1.6 Global Footprints

10.1.7 Recent Development

10.1.8 SWOT Analysis

10.2 Spectrum Renewable Energy Pvt. Ltd.

10.3 Air Liquide

10.4 EnviTec Biogas AG

10.5 Atmos BioEnergy

10.6 AAT Biogas Technology

10.7 Hitachi Zosen Corporation

10.8 Gasum Oy

10.9 Ameresco

10.10 Biogas Engineering India Pvt Ltd.

10.11 Schmack Biogas GmbH