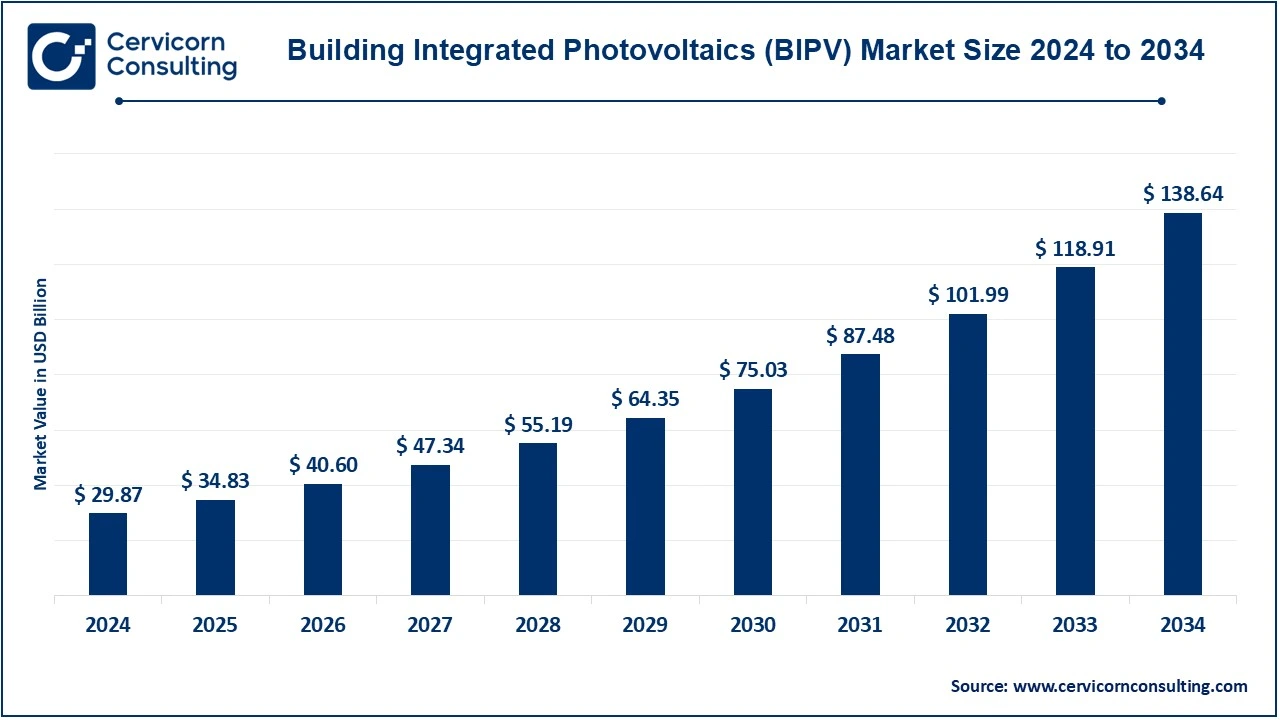

The global building integrated photovoltaics (BIPV) market size was valued at USD 29.87 billion in 2024 and is expected to be worth around USD 138.64 billion by 2034, growing at a compound annual growth rate (CAGR) of 16.59% over the forecast period 2025 to 2034. The BIPV market is growing rapidly due to the convergence of environmental, technological, economic and regulatory factors. As building owners, developers and governments continue to emphasize sustainability and energy efficiency, integrating solar energy directly into buildings will play a critical role in achieving a low-carbon future. With technological advances, reduced costs and a supportive policy environment, BIPV is poised to become a key element of modern, sustainable architecture and urban planning.

Nearly 40% of the world's energy consumption and one-third of its greenhouse gas emissions, in both rich and developing nations, come from buildings. Together, industry and scientists have created effective and sustainable technology. Photovoltaics, thermal photovoltaics, and solar thermal collectors are all viable options since they may be incorporated into the building envelope. Building-integrated solar technologies are achieved when such solar technologies are architecturally integrated into the building envelope.

Building-integrated photovoltaic (BIPV) systems are growing in popularity; they can generate electrical energy and, in some cases, warm air for space heating. Photovoltaics can be integrated directly into other components of the building envelope, for example into a wall to create an opaque or shaded wall, or into the outer skin of a building, such as the facade or roof. In both scenarios, photovoltaics replaces traditional building materials. BIPV systems offer enormous potential in the field of domestic cooling/heating. It is well known that high temperatures reduce the efficiency of photovoltaics. BIPV systems have a higher operating temperature than standalone PV modules. They reduce the return losses caused by solar panels within the building envelope. A PVT collector can minimize these undesirable effects. BIPV panels are more economical than BIPV collectors in the current energy market, although BIPV collectors can achieve high energy savings.

Michael Peter, CEO of Siemens Mobility: "We believe that battery hybrid drives and dual-power trains will play an important role in reducing emissions and protecting the environment."

Tracy Robinson became president and CEO of the Canadian National Railway Company (CN Rail): "You can reduce emissions by about 75% if you shift from truck to rail, but doing that requires us to think about our business very differently."

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 34.83 Billion |

| Expected Market Size in 2034 | USD 138.64 Billion |

| Projected CAGR 2025 to 2034 | 16.59% |

| Top-performing Region | Europe |

| Leading Growth Region | Asia-Pacific |

| Key Segments | Technology, Application, End User, Region |

| Key Companies | First Solar, Tesla, SunPower, Sika AG, SolteQ, BASF, Onyx Solar, Dow Solar, Hanergy, Solar Frontier, AGC Inc., Saint-Gobain, Suntech Power, Trina Solar, REC Group |

Government Initiatives and Beneficial Laws

Growing Urbanisation and Space Restrictions

High Initial Costs of BIPV Systems

Adapting to Codes and Standards

Government Incentives and Subsidies for Solar Energy Use

Technological Advances in Solar Cell Efficiency

Performance Challenges

Market Constraints

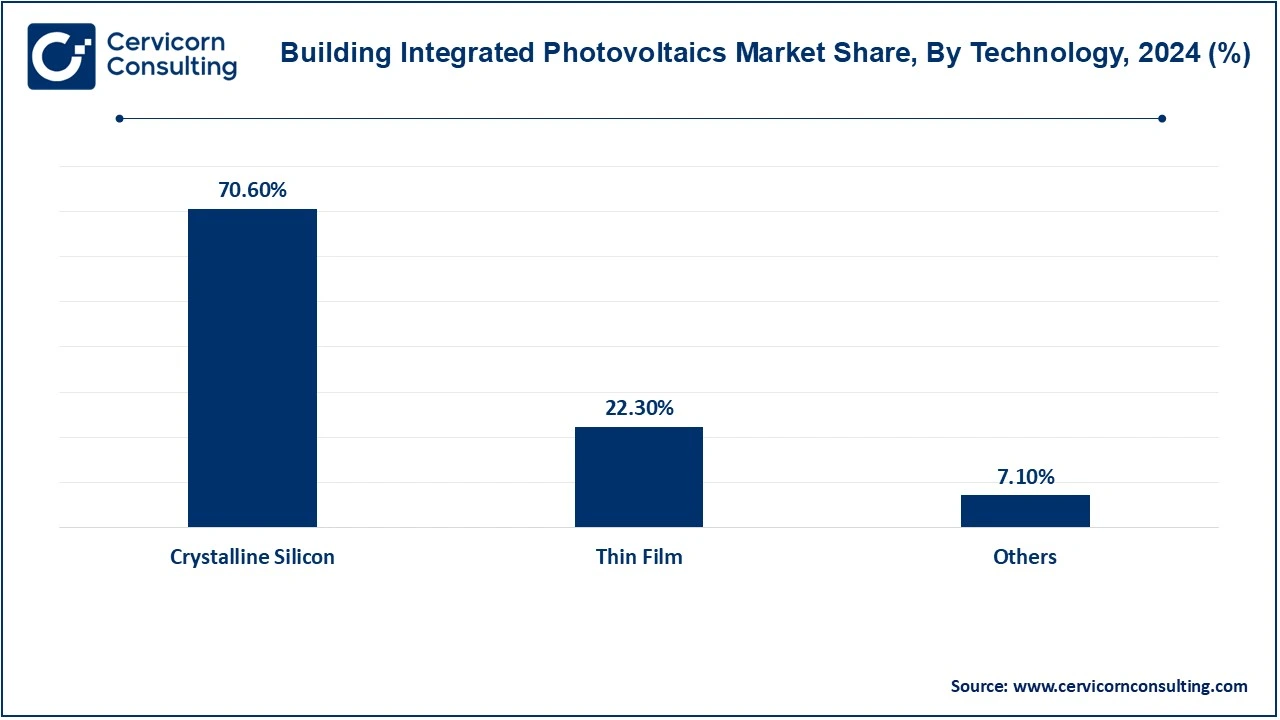

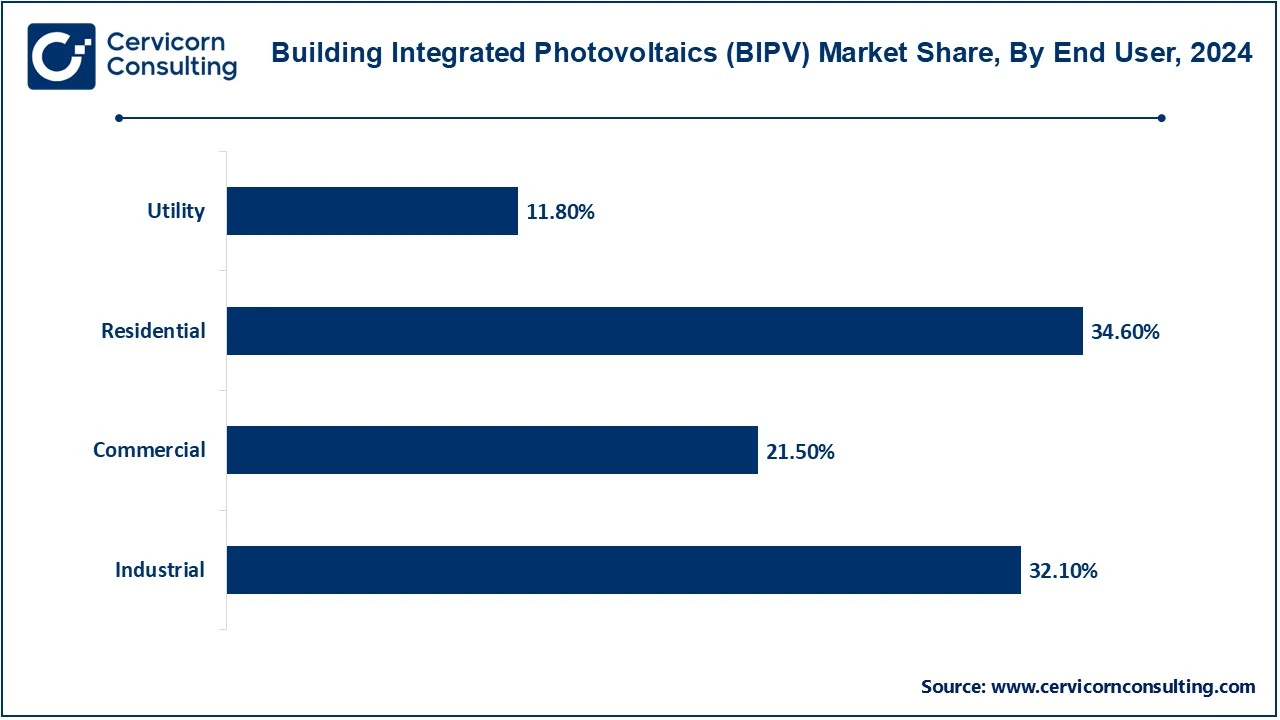

The BIPV market is segmented into technology, application, end user and region. Based on technology, the market is classified into crystalline silicon (c-Si), thin-film, and others. Based on application, the market is classified into roofing, facades/wall, window, and others. Based on end-user, the market is classified into residential, commercial, industrial, and utility.

Crystalline Silicon (C-Si): The crystalline silicon segment has dominated the market in 2024. Crystalline silicon cells can be integrated into building roofs using smart mounting systems that replace the roof panels while maintaining their integrity. This type of integration does not require large investments and offers high efficiency. In addition, anti-reflective coatings are used in the market that aid in the absorption of solar energy and offer superior efficiency. Crystalline silicon currently has the highest energy conversion efficiency; commercial modules typically convert 13 to 21% of the incoming sunlight into electricity.

Thin-Film: Thin film BIPVs are popular when the building has significant weight constraints. In such cases, the building envelope cannot support the weight of crystalline silicon integration, leading to high demand for thin film integration installations. CdTe, amorphous silicon (a-Si), and copper indium gallium diselenide (CIGS) are a few examples of these technologies. These are flexible and lightweight, making them suitable for building facades and other surfaces where traditional panels may not be practical. The thin films perform well even in low light conditions, but typically have lower efficiency compared to crystalline silicon.

Others: The others section covers dye-sensitized solar cells (DSSC), perovskite solar cells, and organic photovoltaics (OPV). Organic photovoltaics' higher energy band gap is anticipated to stimulate demand. Organic PVs' efficiency has significantly increased as a result of quick technical advancements. OPVs are a newer and still developing technology. They are lightweight, flexible, and transparent, making them extremely attractive for innovative BIPV designs such as windows and facades. They are still less efficient than silicon-based solar cells, but ongoing research is improving their performance. The DSSC is a new type of solar cell that requires less energy-intensive materials to produce and, due to its simplicity, can be less expensive to produce. These cells consist of three basic parts: the transparent conducting oxide electrode (TCO) on the front, an internal electrolyte solution, and a counter electrode on the back. Perovskites are still in development but could play an important role in the future of BIPV.

Roofing: The roofing segment has dominated the BIPV market in 2024. Photovoltaic systems integrated into building roofs are known for their efficiency due to the improved light penetration onto the roof surface. Solar cells are integrated into the roofing material, replacing traditional roofing materials such as tiles, shingles or sheets. Ideal for residential, commercial and industrial buildings. Demand for roofs integrated into buildings is expected to increase during the forecast period due to the development of higher quality products.

Facades/Wall: Photovoltaic modules are integrated into the building's external facades or walls, which are often visible and add aesthetic value to the structure. Suitable for both residential and commercial buildings, especially high-rise buildings where vertical integration is important. BIPV facades are enjoying high demand, especially in developed economies with a well-established power distribution system. Demand for the integration of photovoltaics into facades is driven by their increasing installation in the commercial sector. Glass integrations are expected to grow due to the high transparency of integrated systems coupled with the superior integration of glass and BIPV cells.

Building Integrated Photovoltaics Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Roof | 67% |

| Glass | 13.20% |

| Wall | 10.40% |

| Facade | 5.30% |

| Others | 4.10% |

Window: Transparent or semi-transparent photovoltaic materials are used in windows, allowing buildings to generate energy while retaining natural light. Particularly useful for office buildings, skyscrapers and other buildings with large glass surfaces. BIPV windows integrate solar cells into the window glazing and not only retain the functionality of traditional windows, but also provide other benefits such as power generation and thermal insulation. BIPV windows are divided into single-glazed BIPV windows, double-glazed BIPV windows with/without ventilation and vacuum BIPV windows depending on the configuration of the glazing.

Others: Others include balconies and sunshades, carports, awnings and skylights. Photovoltaic materials can also be integrated into balcony railings, sunshades or even pergolas, providing energy and providing additional architectural benefits. Solar shading systems are key elements in an architectural standard that is increasingly glazed and transparent while minimizing cooling loads. Various BIPV sunshade systems offer a complement to the shading effects of solar glass or overhead glazing. As versatile elements in skylight constructions, BIPV modules enable the realization of solar architectural solutions with a wide range of design options both indoors and outdoors. They can take on the functions of thermal insulation, sun, glare and weather protection for the building and also enable the targeted use of natural light.

Residential: The residential segment has dominated the market in 2024. The demand for building-integrated photovoltaics in residential sector is expected to increase during the forecast period due to increasing consumer awareness regarding the use of renewable energy sources for electricity generation. The demand for building-integrated photovoltaics for residential buildings is expected to be driven by favourable policies from various authorities and high subsidies and other financial benefits from national governments. The growing use of integrated solutions in German and French homes is anticipated to fuel product demand throughout the course of the projection period.

Commercial: Commercial buildings often have bigger roof surfaces and facades than residential buildings, which allows for the installation of building-integrated solar systems. These buildings also have higher energy consumption during the day, which is associated with the electricity generation from building-integrated photovoltaic systems. The demand for building-integrated photovoltaics in commercial buildings is expected to be driven by the growing number of retrofit projects using these systems. The high emphasis on the aesthetic appeal of solar energy-using systems, especially in commercial buildings, is expected to drive the product demand in this sector.

Industrial: Companies in developed countries in Europe are increasingly integrating BIPV systems as they improve the aesthetics of buildings while harnessing solar energy. The growing number of modified projects that employ building-integrated solar systems is driving demand in the commercial sector. The visual appeal of solar energy systems is valued by commercial organisations, which increases patronage of BIPV in this industry.

The BIPV market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America building-integrated photovoltaics (BIPV) market size was valued at USD 6.69 billion in 2024 and is projected to surpass approximately USD 31.06 billion by 2034. The expansion of the market in North America can be linked to elements such as significant government incentives aimed at enhancing the adoption of renewable energy, an increasing focus on energy-efficient construction practices, and heightened awareness of sustainability among consumers and businesses. The region's sophisticated technological environment is fostering innovation in BIPV solutions and enhancing their assimilation into contemporary architectural designs. Major participants in the market are making considerable investments in research and development to produce visually appealing and highly efficient BIPV products, which is additionally propelling market growth. A rise in residential and commercial construction activities, along with a growing inclination towards green buildings, is driving strong demand for BIPV systems in North America. As states and local governments enforce stricter energy regulations, the market is poised for further growth, establishing North America as a crucial contributor in the global shift towards sustainable energy solutions.

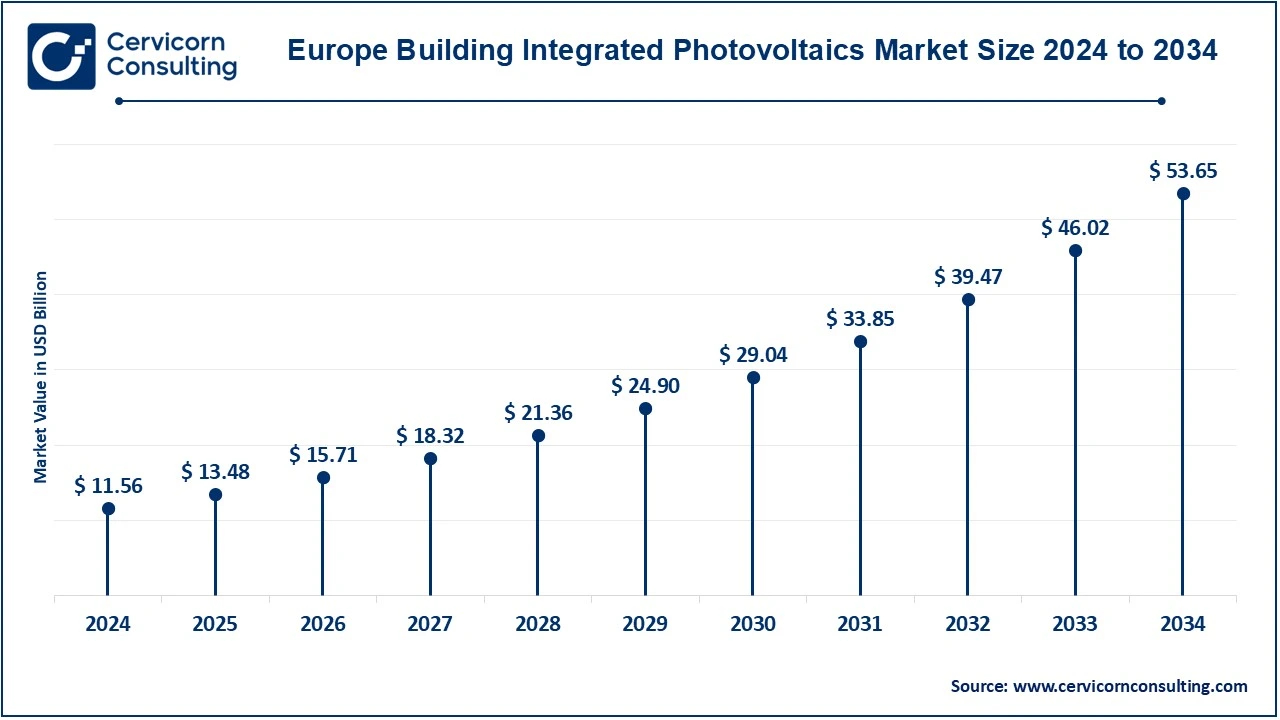

The Europe building-integrated photovoltaics (BIPV) market size was estimated at USD 11.56 billion in 2024 and is forecasted to reach around USD 53.65 billion by 2034. The European market is mainly influenced by a solid regulatory framework that endorses the utilization of renewable energy sources. Moreover, numerous European nations provide incentives like feed-in tariffs and tax credits to promote the adoption of renewable energy. Furthermore, Europe leads the battle against climate change and has pledged to a substantial decrease in greenhouse gases as part of the Paris Agreement (2015). This pledge has resulted in a vigorous encouragement of renewable energy sources, which includes BIPV. Additionally, Europe hosts several significant participants in the BIPV market who are advancing technological innovation in this sector. The existence of these companies, along with their strong research and development (RandD) capabilities, is propelling the BIPV market in the area.

The Asia-Pacific building-integrated photovoltaics (BIPV) market size was accounted for USD 8.75 billion in 2024 and is anticipated to hit around USD 40.62 billion by 2034. The Asia Pacific is the fastest growing market for building-integrated photovoltaics due to huge demand from China and Japan. In China, with its large construction sector and rapid urbanization, BIPV is actively used in infrastructure projects such as highways, airports and railway stations. Government subsidies, such removing permission costs for solar-powered building projects, have boosted uptake. Japan has been one of the biggest users of BIPV, using it widely in workplaces and on roofs in homes. This is a result of the nation's emphasis on renewable energy in the wake of the Fukushima accident. Furthermore, the existence of significant solar module producers in the area, such Trina Solar and JinkoSolar, has been crucial in growing the Asia Pacific industry by supplying cutting-edge products at reasonable prices.

Building Integrated Photovoltaics Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 22.40% |

| Europe | 38.70% |

| Asia-Pacific | 29.30% |

| LAMEA | 6.90% |

The LAMEA BIPV market was valued at USD 2.06 billion in 2024 and is anticipated to grow to around USD 9.57 billion by 2034. The demand for BIPV systems in the LAMEA region is expected to grow due to their application in the industrial and commercial sectors. Moreover, the market has high potential especially in Brazil and Argentina due to increasing installation of solar energy harvesting systems. The demand for BIPV in the MEA region is expected to grow due to the growing market and high usage of renewable energy sources. The market is expected to grow due to the increasing affinity of consumers and large corporates towards adopting BIPVs to reduce their dependence on non-renewable energy sources. The adoption of BIPV in buildings is likely to emerge as a major trend in the region, supported by government intervention. Moreover, the residential segment is expected to account for a limited market share due to the presence of low and middle income consumers in the region.

Key participants in the worldwide BIPV market are consistently innovating to enhance the energy conversion efficiency of their photovoltaic materials. They have also concentrated on making photovoltaic materials more aesthetically appealing and versatile, such as photovoltaic glass that can be tailored regarding transparency, colour, and size. Since thin-film solar cells are lighter, more affordable, and more adaptable than conventional silicon cells, companies in the market are also producing them. Several major players provide complete BIPV solutions that can be effortlessly integrated into particular sections of a building. They have also created software systems to optimize the production, storage, and utilization of solar energy. These systems can track energy production in real-time, forecast future production based on weather predictions, and oversee energy storage and distribution to enhance efficiency. Solar Frontier and LONGi partnered in October 2023 to boost Japan's BIPV market. Sphelar Power Corporation created the JIS in March 2023 to assess spherical solar cell power output, expected to increase spherical cell use in commercial products.

Market Segmentation

By Technology

By Application

By End-User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Building Integrated Photovoltaics (BIPV)

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Application Overview

2.2.3 By End Use Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Government Initiatives and Beneficial Laws

4.1.1.2 Growing Urbanisation and Space Restrictions

4.1.2 Market Restraints

4.1.2.1 High Initial Costs of BIPV Systems

4.1.2.2 Adapting to Codes and Standards

4.1.3 Market Challenges

4.1.3.1 Performance Challenges

4.1.3.2 Market Constraints

4.1.4 Market Opportunities

4.1.4.1 Government Incentives and Subsidies for Solar Energy Use

4.1.4.2 Technological Advances in Solar Cell Efficiency

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Building Integrated Photovoltaics (BIPV) Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Building Integrated Photovoltaics (BIPV) Market, By Technology

6.1 Global Building Integrated Photovoltaics (BIPV) Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Crystalline Silicon (c-Si)

6.1.1.2 Thin-Film

6.1.1.3 Others

Chapter 7. Building Integrated Photovoltaics (BIPV) Market, By Application

7.1 Global Building Integrated Photovoltaics (BIPV) Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Roofing

7.1.1.2 Facades

7.1.1.3 Wall

7.1.1.4 Window

7.1.1.5 Others

Chapter 8. Building Integrated Photovoltaics (BIPV) Market, By End Use

8.1 Global Building Integrated Photovoltaics (BIPV) Market Snapshot, By End Use

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Residential

8.1.1.2 Commercial

8.1.1.3 Industrial

8.1.1.4 Utility

Chapter 9. Building Integrated Photovoltaics (BIPV) Market, By Region

9.1 Overview

9.2 Building Integrated Photovoltaics (BIPV) Market Revenue Share, By Region 2024 (%)

9.3 Global Building Integrated Photovoltaics (BIPV) Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Building Integrated Photovoltaics (BIPV) Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Building Integrated Photovoltaics (BIPV) Market, By Country

9.5.4 UK

9.5.4.1 UK Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Building Integrated Photovoltaics (BIPV) Market, By Country

9.6.4 China

9.6.4.1 China Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Building Integrated Photovoltaics (BIPV) Market, By Country

9.7.4 GCC

9.7.4.1 GCC Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Building Integrated Photovoltaics (BIPV) Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 First Solar

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Tesla

11.3 SunPower

11.4 Sika AG

11.5 SolteQ

11.6 BASF

11.7 Onyx Solar

11.8 Dow Solar

11.9 Hanergy

11.10 Solar Frontier

11.11 AGC Inc.

11.12 Saint-Gobain

11.13 Suntech Power

11.14 Trina Solar

11.15 REC Group

11.16 Kyocera Corporation

11.17 Veka AG

11.18 Schott AG

11.19 Velux

11.20 BIPVco

11.21 CIGS Solar

11.22 Risen Energy

11.23 JA Solar

11.24 Canadian Solar

11.25 Powerhouse Energy