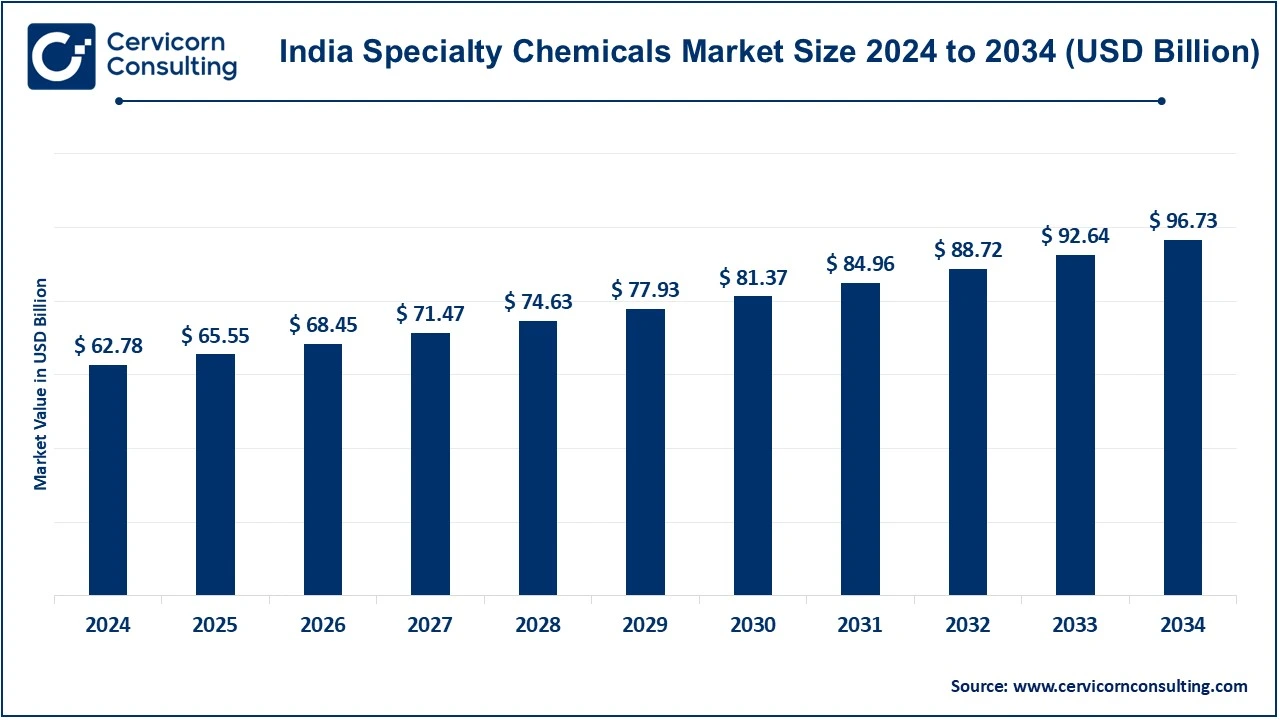

The India specialty chemicals market size was valued at USD 62.78 billion in 2024 and is expected to be worth around USD 96.73 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.41% over the forecast period 2025 to 2034.

This is because specialty chemicals have gained significant growth due to immense demand across the automobile, construction, agriculture, and personal care industries. Growth is further boosted by urbanization, industrialization, and a move toward green and sustainable solutions. In other sectors such as pharmaceuticals, FMCG, and electronics, customized and high-performance solutions by specialty chemicals are pushing up the growth rates. BASF, Aarti Industries, and UPL Limited lead the game, meeting market needs through innovation and eco-friendly practices in specialty chemicals that are becoming irreplaceable across value chains.

Deepak Nitrite– Maulik Mehta, CEO

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 65.55 Billion |

| Expected Market Size in 2034 | USD 96.73 Billion |

| Estimated CAGR 2025 to 2034 | 4.41% |

| Key Segments | Type, End User |

| Key Companies | SRF Limited, Aarti Industries, PI Industries, Atul Limited, Phillips Carbon Black (PCBL), Himadri Speciality Chemicals, Galaxy Surfactants Ltd, Solvay Pharma India, Bodal Chemicals, Huntsman Corporation, Lanxess India, Rallis India, Laxmi Organic Industries, Tata Chemicals, Aditya Birla Chemicals |

Increase in Green Chemistry

Surge in Automotive

Advancements in Construction Industry

High Raw Material Costs

Stringent Environmental Regulations

Demand from US and Europe

Expanding Middle-Class Population

Growth in E-Commerce

Shift to Renewable Energy

Environmental Sustainability

Regulatory Compliance

Quality Inconsistency

Agrochemicals: Agrochemicals comprising fertilizers, pesticides, and herbicides enhance agricultural productivity in India. As the country is trying to support a rapidly growing population, these chemicals help increase crop yield and quality. Key market players such as UPL and PI Industries concentrate on creating novel solutions that protect crops from pests and diseases and ensure better agricultural output. Government support towards the development of sustainable farming and enhanced exports would boost the growth of the agrochemical segment, making it pertinent to India's economy.

Construction Chemicals: Infrastructure chemicals, which include adhesives, sealants, and waterproofing compounds, are critical to India's fast-growing infrastructure sector. With mega construction projects like smart cities, highways, and urban expansion, the demand for such chemicals has been on the rise. Pidilite Industries is counted among the leading players promoting unique and high-quality solutions to ensure greater durability and performance of construction materials. Accelerating urbanization is thus positioning construction chemicals as essential in enhancing the safety and efficiency of buildings and infrastructure longevity and driving the market booming.

Flavors and Fragrances: The flavors and fragrances industry caters to the raw material requirements of FMCG products such as perfumes, cosmetics, processed foods, and beverages.The growth in this sector is driven by rising consumer demand for personal care products and flavored goods. The leading companies in this sector are Firmenich, and Synthite Industries, catering to both domestic and international markets by supplying a wide range of ingredients to the food and fragrance sectors. Further demand for natural and innovative flavor profiles drives the market as players in the arena aim at research and development in anticipation of the consumer's palate.

Dyes & Pigments: The following dyes and pigments have turned out to be essential to various industries like textiles, automotive, and plastics. The textile and automotive industries are the fastest-growing industries in India and contribute a lot to this market. Major contributors here are Sudarshan Chemicals and Atul Ltd., which manufacture environmentally friendly as well as vibrant colorants catering to local and international markets. With the growing demand for high-quality, long-lasting colors in fabrics and paints, the demand for innovative dyes and pigments keeps on increasing, contributing to market growth.

Water Treatment Chemicals: Even ground water treatment has become an alternative for dealing with the water shortage and pollution problems that the country of India is confronting today. Therefore, in the coming years, more demand for water purification solution will arise because of growing shortage of water in industries and other urban areas. Thermax Ltd., for example, stands as one of the strong leaders in this space wherein it provides chemicals and technologies for all industrial and municipal water treatments. With the government concentrating on the conservation and utilization of water in a sustainable manner, this market is a long way to steady growth through domestic consumption and export opportunities.

Textile Chemicals: These textile chemicals have a significant impact on quality and efficiency in the processes of textile manufacturing, primarily dye, print, and finish. India is moving at a rapid pace in this domain as a textile super hub. GHCL Limited offers speciality chemicals that improve fabric quality, reduce environmental impact and enhance production process efficiency. Commitment to innovative solutions to the high-performance textile challenge and sustainable manufacturing would allow the growth of the market for textile chemicals-using eco-friendly chemical formulations.

Polymer Additives: These include stabilizers, lubricants, flame retardants, and various other polymer additives used to increase the performance of plastics in applications like packaging, automotive, and construction. Major companies include Clariant Chemicals India, which provides a huge spectrum of sustainable alternatives in polymer additives that add durability, fire resistance, and processability to polymers. As the industries move towards advanced materials and packaging solutions, it is expanding with the increasing focus on reduction of environmental impact from plastic products.

Others: The "Others" segment of the specialty chemicals market comprises products such as surfactants, cleaning agents, and specialty coatings. These chemicals have been used in personal care, electronics, and FMCG industries. Some key contributors in this category have been Galaxy Surfactants and Dow India, thereby providing necessary ingredients that could enhance product performance and sustainability. More and more consumers want premium cleaning products, solutions for personal care, or advanced coatings. This business segment is driven by the innovation of green formulations as well as customized offerings.

Automotive: Specialty chemicals are instrumental in automotive production, especially for bearing lubricants, coatings, and polymer composites. The role of these chemicals is to increase vehicle performance, safety, and longevity. BASF India significantly contributes to the supply of high-performance materials, such as coatings for automotive and engine oils formulated according to the need of a fast-developing automotive technology purposively directed towards greater efficiency and environmental sustainability. With the growing demand for electric vehicles and newer automotive technologies, specialty chemicals will boost innovations that would enhance performance while reducing emissions in transportation.

Agriculture: Specialty chemicals like fertilizers, pesticides, and herbicides play a very important role in Indian agriculture: enhanced crop productivity, crop protection from various pests, and an assurance of guaranteed yield returns. Companies such as Rallis India play a key role in turfing this market by introducing sophisticated agrochemicals directed toward high-efficiency farming. Specialty chemicals prove meaningful in maintaining regular and improved farm productivity to feed the growing population. Sustainable agriculture measures as well as government encouragement towards agrochemical development that ensures food safety and agricultural sustainability also drive the sector.

Textiles: Dominance in the textile market globally brings a consistent demand for specialty chemicals such as colorants, softeners, and finishing agents. Huntsman Corporation provides eco-friendly solutions for dyeing, finishing, and processing textiles, helping reduce the environmental impact of textile production. With India continuing as a prominent textile exporter, innovation in specialty chemicals continues to help with improving quality in fabric, while sustainable practices in chemical usage are becoming increasingly relevant for both domestic and global end-user satisfaction. The increasing attention to eco-conscious production will continue to steer the growth of the sector.

Consumer Goods: Specialty chemicals play a major role in making personal care and FMCG-related cleaning products. Companies like Hindustan Unilever embark upon using specialty ingredients for their huge line of personal care and cleaning products. They provide products like shampoos, soaps, and detergents with safety and effectiveness. As the consumer market expands in India, favorable conditions for specialty chemicals for consumer goods arise due to rising disposable income, urbanization, and shifting taste toward innovative, sustainable products.

Electronics: In the electronics industry, specialty chemicals are at the very heart of semiconductor manufacturing, printed circuit boards (PCBs), and the development of other electronic components. Solvay India provides high-performance materials, including specialty resins and coatings, which are used in electronic devices and components to ensure reliability and durability. As the electronics market continues to develop with the establishment of 5G, smart devices, and IoT, the demand for advanced specialty chemicals will rise, paving the foundation for next-generation electronic products designed for enhanced performance and sustainable operation.

Others: This category includes pharmaceuticals, packaging, and renewable energy that fall into the "Others" category of the specialty chemicals market. Aditya Birla Chemicals provides a diverse portfolio of solutions addressing this sector, which include excipients for drug formulations and sustainable packaging solutions and materials for renewable energy applications such as solar panels and wind turbines. As these markets for healthcare and clean energy will grow, the demand for specialty chemicals will rise on the back of advances in pharmaceutical development, packaging sustainability, and renewable energy technologies, which will drive further growth for the broader market.

Recent strategic investments and expansions in the specialty chemicals industry reflect a strong commitment to enhancing sustainability, innovation, and operational efficiency. Companies are focusing on increasing their production capabilities through advanced technologies, improving supply chain resilience, and meeting the growing demand for eco-friendly solutions. For instance, firms like BASF and Aditya Birla Chemicals are expanding their research and development efforts to create more sustainable chemical products. These efforts are not only addressing environmental concerns but also helping companies stay competitive in an evolving regulatory landscape.

Market Segmentation

By Type

By End User

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Specialty Chemicals

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By End Use Overview

2.3 Competitive Overview

Chapter 3. India Impact Analysis

3.1 Russia-Ukraine Conflict: India Market Implications

3.2 Regulatory and Policy Changes Impacting India Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increase in Green Chemistry

4.1.1.2 Surge in Automotive

4.1.1.3 Advancements in Construction Industry

4.1.2 Market Restraints

4.1.2.1 High Raw Material Costs

4.1.2.2 Stringent Environmental Regulations

4.1.2.3 Demand from US and Europe

4.1.3 Market Challenges

4.1.3.1 Environmental Sustainability

4.1.3.2 Regulatory Compliance

4.1.3.3 Quality Inconsistency

4.1.4 Market Opportunities

4.1.4.1 Expanding Middle-Class Population

4.1.4.2 Growth in E-Commerce

4.1.4.3 Shift to Renewable Energy

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 India Specialty Chemicals Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Specialty Chemicals Market, By Type

6.1 India Specialty Chemicals Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Agrochemicals

6.1.1.2 Construction Chemicals

6.1.1.3 Electronic Chemicals

6.1.1.4 Adhesives

6.1.1.5 Flavors & Fragrances

6.1.1.6 Dyes & Pigments

6.1.1.7 Water Treatment Chemicals

6.1.1.8 Textile Chemicals

6.1.1.9 Specialty Pulp & Paper Chemicals

6.1.1.10 Polymer Additives

6.1.1.11 Others

Chapter 7. Specialty Chemicals Market, By End Use

7.1 India Specialty Chemicals Market Snapshot, By End Use

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Automotive

7.1.1.2 Agriculture

7.1.1.3 Textiles

7.1.1.4 Consumer Goods

7.1.1.5 Electronics

7.1.1.6 Others

Chapter 8. Specialty Chemicals Market, By India

8.1 Overview

8.2 Specialty Chemicals Market Revenue Share, By States 2024 (%)

8.3 India Specialty Chemicals Market, By States

8.4 Market Size and Forecast

8.5 India Specialty Chemicals Market Segmentation

Chapter 9. Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2022-2024

9.1.3 Competitive Analysis By Revenue, 2022-2024

9.2 Recent Developments by the Market Contributors (2024)

Chapter 10. Company Profiles

10.1 SRF Limited

10.1.1 Company Snapshot

10.1.2 Company and Business Overview

10.1.3 Financial KPIs

10.1.4 Product/Service Portfolio

10.1.5 Strategic Growth

10.1.6 India Footprints

10.1.7 Recent Development

10.1.8 SWOT Analysis

10.2 Aarti Industries

10.3 PI Industries

10.4 Atul Limited

10.5 Phillips Carbon Black (PCBL)

10.6 Himadri Speciality Chemicals

10.7 Galaxy Surfactants Ltd

10.8 Solvay Pharma India

10.9 Bodal Chemicals

10.10 Huntsman Corporation

10.11 Lanxess India

10.12 Rallis India

10.13 Laxmi Organic Industries

10.14 Tata Chemicals

10.15 Aditya Birla Chemicals