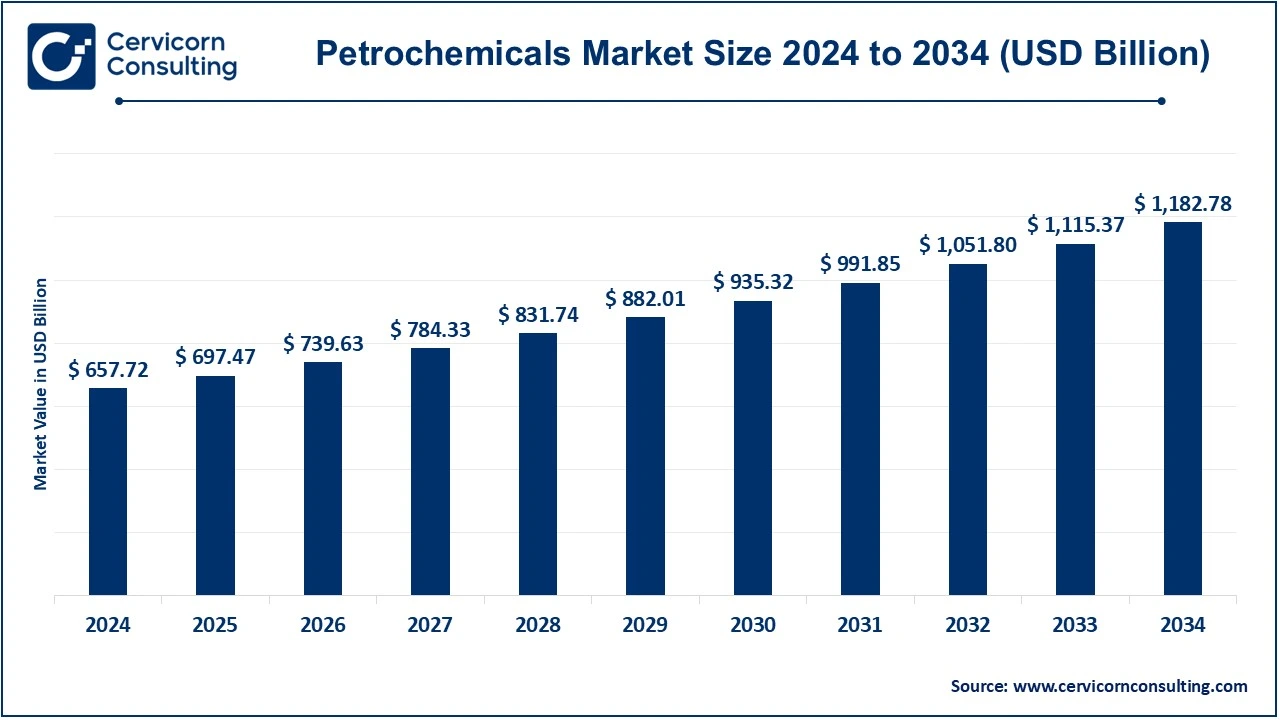

The global petrochemicals market size was valued at USD 657.72 billion in 2024 and is expected to be worth around USD 1,182.78 billion by 2034, rising at a compound annual growth rate (CAGR) of 6.04% over the forecast period 2025 to 2034.

Growth in the demand for plastics, synthetic rubber, and different chemicals for applications in industries like automotive, construction, packaging, and consumer goods contributes to growth in the petrochemicals market. Increasing urbanization, industrialization, and population are resulting in an ever-growing demand for petrochemical products. Improved manufacturing processes, increased renewable resources, and advancements in technologies contribute to expanding the market size for petrochemicals. Growth in demand for renewable and more environment-friendly alternatives is driving the development of novel, green petrochemical solutions pushing the market growth pattern further.

CEO Statements

Dr. Markus Kamieth, CEO of BASF SE

Peter Vanacker, CEO of LyondellBasell Industries Holdings B.V.

Jim Ratcliffe, CEO of INEOS

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 697.47 Billion |

| Projected Market Size in 2034 | USD 1,182.78 Billion |

| Expected CAGR 2025 to 2034 | 6.04% |

| Leading Region | Asia-Pacific |

| Key Segments | Type, Manufacturing Processes, End-Use, Region |

| Key Companies | BASF SE, LyondellBasell Industries Holdings B.V., INEOS, Shell plc, SABIC, Reliance Industries Limited, Mitsubishi Chemical Corporation, Dow Chemical Company, LG Chem, Chevron Phillips Chemical Company LLC., China National Petroleum Corporation, Maruzen Petrochemical Co., Ltd. |

The petrochemicals market is segmented into type, manufacturing processes, end-use and region. Based on type, the market classified into ethylene, propylene, butadiene, benzene, xylene, toluene, and methanol. Based on manufacturing processes, the market classified into fluid catalytic cracking (FCC), steam cracking, and catalytic reforming. Based on end-use, the market classified into packaging, electronics, construction, automotive, and others.

Ethylene: Ethylene is one of the most important feedstocks of petrochemicals. The main products from ethylene include polyethylene, ethylene oxide, and ethylene glycol. It is the largest mass-produced petrochemical worldwide and is used in various chemicals, plastic, and solvents. Ethylene itself is produced by the process of cracking hydrocarbon mainly derived from natural gas and crude oil. Ethylene is of prime significance to industries such as packaging, automotive, and construction as their products range from plastic films to parts of automobiles.

Propylene: Propylene is one of the most significant petrochemicals produced together with ethylene. It is mainly used in the production of polypropylene, acrylonitrile, and propylene oxide. Propylene is the key feedstock for producing plastics, synthetic rubber, and other industrial chemicals. In addition, propylene is used to make parts of automobiles, clothing, and packaging. The most important sources of propylene are steam cracking and fluid catalytic cracking of crude oil and natural gas. Widespread application in consumer goods, packaging, and the automobile industries shows its significance in the manufacturing processes of today.

Methanol: Methanol is a colorless flammable liquid that has been utilized in its feedstock for producing several chemicals including formaldehyde, and acetic acid among others; it has also been applied as the solvent for biodiesel used in chemical industries as fuels derived from methanol. The primary source for making methanol is from natural gas, coal, or biomass. Methanol is also the most important precursor within the petrochemical market with which to produce base chemicals as well as plastics. Such higher demands for methanol in any business like automotive, construction, and packaging make it an integral element in global petrochemical markets.

Xylene: Xylene is one of the three isomers in ortho, meta, and para-xylene. It is used in the production of other chemicals like terephthalic acid. It is applied as a solvent in the coatings, paints, and cleaning industries. Xylene can be obtained from petroleum and natural gas refining. Xylene is an important commodity in the petrochemical industry because of its wide applications in plastics, automotive parts, and packaging materials, which contribute to the overall manufacturing activities in a myriad of industrial applications.

Packaging: The packaging segment has dominated the market in 2024. This is because petrochemical products such as polyethylene, polypropylene, and PET require a tremendous amount of plastics to be manufactured from primary petrochemical products such as ethylene, propylene, and xylene. Thus, plastics are applied in many fields in packaging materials such as bottles, bags, containers, and films. As a result, this led to more development of the petrochemicals industry due to an increase in demand for lighter, tougher, and more recyclable packaging. With the growing issues of sustainability, the focus is more on biodegradable and recyclable plastics, and hence the petrochemical market is very crucial in packaging.

Electronics: This is an industry wherein electronics components are made using major petrochemical products that include plastics and synthetic products such as semiconductors, circuit boards, casing, and connectors. Therefore, a good number of highly essential polymers used are polycarbonate, ABS, and epoxy resins in electronics assembling. High-performance products in petrochemicals such as electrical insulation, heat resistance, and durability have made petrochemical products so demand for the shrinking, highly integrated electronic devices. Innovation is found in consumer electronics, telecommunication, and computer hardware in the ability of petrochemicals to supply highly specified materials for the electronic marketplace.

Petrochemicals Market Revenue Share, By End-Use, 2024 (%)

| End Use | Revenue Share, 2024 (%) |

| Packaging | 34.90% |

| Electronics | 18.65% |

| Construction | 22.42% |

| Automotive | 14.32% |

| Others | 9.71% |

Building: Petrochemicals are used in the construction sector in making a whole range of materials-including synthetic rubbers, plastics, adhesives, and insulation. These include PVC, which is part of the piping systems, windows, flooring, and roofing materials. The most commonly used insulation and sealant in this regard is polyurethane. The high-performance, cost-effective, and energy-efficient solutions that petrochemicals provide render themselves indispensable in modern construction. On top of this, due to the ever-growing interest in sustainability, markets have introduced more environmentally friendly materials based on petrochemicals for the growing demands of green building projects.

Automotive: Petrochemicals form a large proportion of usage in the automotive industry. The components of auto, tires, bumpers, dashboards, and interior trim require polymers such as polythene, polypropene, and PVC. Petrochemical-based lightweight, strong, corrosion-resistant automotive parts could very well become a staple in decreasing vehicle weight and enhancing fuel efficiency in a quest for more environmentally friendly vehicles. Moreover, petrochemical-based materials mainly polyurethane and styrene-butadiene rubber also contribute to the performance, safety, and comfort of modern automobiles in support of continuing industry innovations.

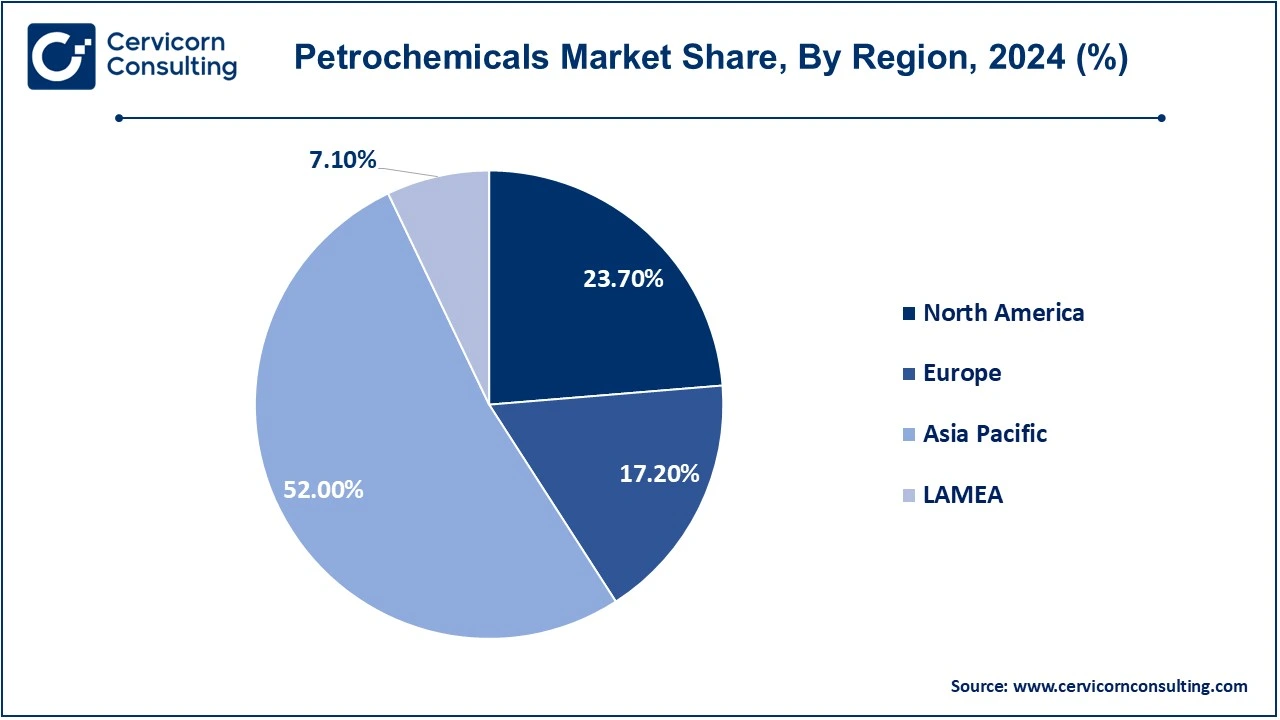

The petrochemicals market is divided into various key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). A detailed description of each region is as follows:

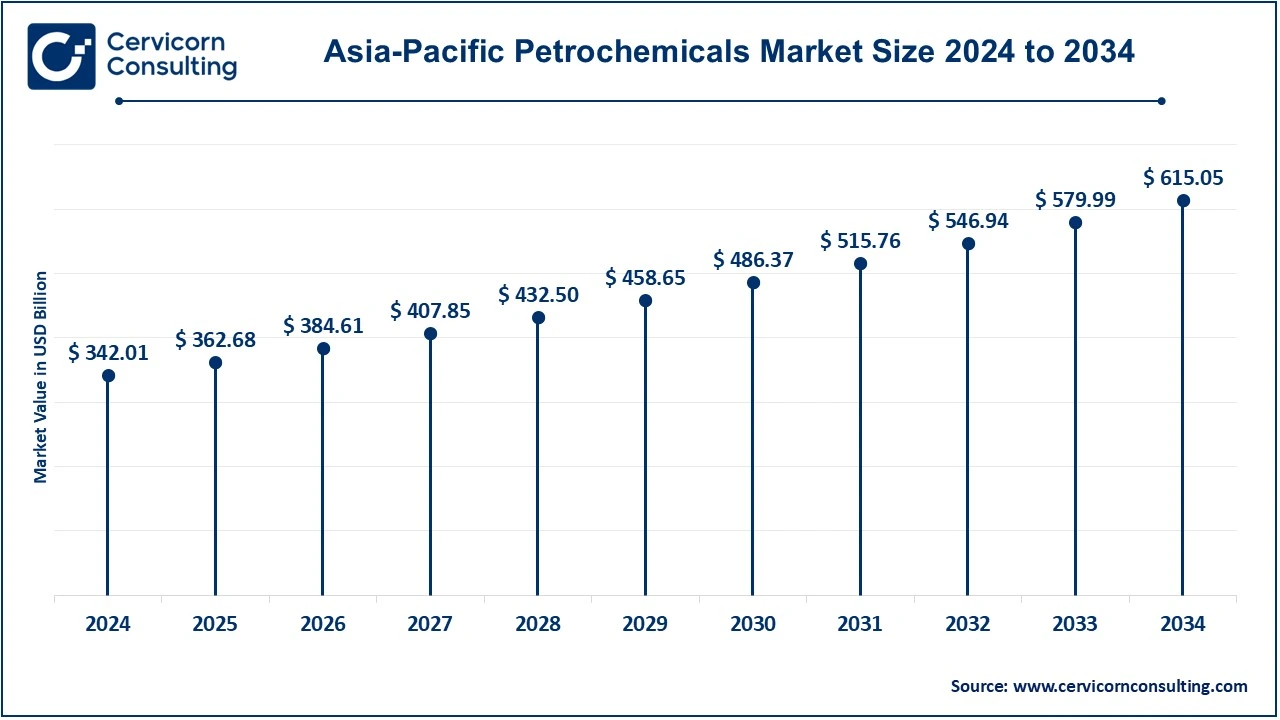

The Asia-Pacific petrochemicals market size was accounted for USD 342.01 billion in 2024 and is predicted to surpass around USD 615.05 billion by 2034. Asia-Pacific is the biggest and the fastest-growing market. The region includes producers such as China, Japan, South Korea, India, and Taiwan. China alone dominates that region and it takes a lion's share of global capacity addition and consumption. It is currently accounting for 60 percent of capacity additions all over the world in 2023, according to recent data. The country will treble domestic paraxylene - the raw material of greatest importance for producing polyester - and two-thirds of the newly added capacity of ethylene. Due to low production costs and abundant availability of raw materials, the region offers considerable scope for the growth of the petrochemical industry, with a robust base of industries like automotive, electronics, and packaging. Urbanization and the increasing middle-class population in this diversified region further fuel the consumption of petrochemicals.

The North America petrochemicals market size was valued at USD 155.88 billion in 2024 and is expected to reach around USD 280.32 billion by 2034. The U.S. is the largest producing and consuming country in North America. The major industrial hubs of the U.S. are located in Texas, Louisiana, and other Gulf Coast areas. ExxonMobil has finalized its takeover of Pioneer Natural Resources, making it one of the biggest movers in the Permian Basin by overdoubling its footprint. This would unite the extensive know-how that Pioneer has pertaining to lands and industries and ExxonMobil's strength of financials along with cutting edge technologies. This alliance targets supporting the net-zero-emission ambition of Pioneer through its advancement from 2050 up to 2035 and is deemed to grow its production to almost 2 million barrels of oil equivalent in a day up to 2027. This will help the company enhance environmental efficiency in its operations in Canada and Mexico by producing natural gas and petrochemical manufacturing. It operates on developed infrastructure, and technological innovation, as well as high demand by the automotive, packaging, and chemical industries.

The Europe petrochemicals market size was reached at USD 113.13 billion in 2024 and is projected to hit around USD 203.44 billion by 2034. Germany, France, the UK, and the Netherlands are the biggest players in the market of Europe. Petrochemical’s production market share is dominated by Germany; however, the second largest is that of France and then the UK. Industrial regions like North Rhine-Westphalia and the Port of Rotterdam have industrial zones in these countries. For example, in April 2024, INEOS completed the acquisition of TotalEnergies petrochemicals assets in Lavera, France. It covers joint venture agreements with INEOS to acquire a 50% equity in Naphtachimie with a 720 ktpa steam cracker Appryl with 300 ktpa polypropylene, and Gexaro with 270 ktpa aromatics, etc. The acquisition is intended to make the company more competitive in the area and allow full integration of these assets with its operations in Southern France. Sectors that encompass automotive, construction and consumer goods enjoy high demand and serve as factors governing the market. Other than this, the region is a center for innovation in sustainable petrochemical technologies.

The LAMEA petrochemicals market was valued at USD 46.70 billion in 2024 and is anticipated to record around USD 83.98 billion by 2034. LAMEA is an emerging market that is diverse with key players in Latin America, the Middle East, and Africa. Among Latin America, Brazil and Argentina are leading producers, and in the Middle East countries like Saudi Arabia, UAE, and Qatar are benefiting through the abundance of oil and natural gas resources. Africa is growing its petrochemical market, which is led by South Africa and Egypt. The demand in this region is driven by the expansion of industrial sectors, growing energy investments, and also augmented infrastructure projects.

Recent strategic plays and partnerships in the petrochemicals business are currently focused on capacity growth, technology advancement, and sustainability. More investment in carbon capture technologies and bio-based feedstocks, for instance, to reduce the footprint of operations. Strategic alliances and joint ventures are formed to get economies of scale, reach new markets, and integrate up or down the supply chain. These efforts need to meet the increasing demand with pressures from regulations and the changes in industry trends towards greener and more efficient production.

Market Segmentation

By Type

By Manufacturing Processes

By End-Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Petrochemicals

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Manufacturing Processes Overview

2.2.3 By End Use Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased demand for packaging

4.1.1.2 Massive Demand for Consumers Products

4.1.1.3 Growth in Manufacturing of Drugs and Cosmetics

4.1.2 Market Restraints

4.1.2.1 Unpredictable prices of the Raw Material

4.1.2.2 Increasing public awareness of environmental impact

4.1.2.3 Health and Safety Issues

4.1.3 Market Challenges

4.1.3.1 Environmental Concern and Sustainability

4.1.3.2 Supply chain disruption

4.1.3.3 Variation of demand in the large markets

4.1.4 Market Opportunities

4.1.4.1 Bio-based and Renewable Petrochemicals Development

4.1.4.2 Investment in Carbon Capture and Storage

4.1.4.3 More Demand for Light-Weight Automotive Components

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Petrochemicals Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Petrochemicals Market, By Type

6.1 Global Petrochemicals Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Ethylene

6.1.1.2 Propylene

6.1.1.3 Butadiene

6.1.1.4 Benzene

6.1.1.5 Xylene

6.1.1.6 Toluene

6.1.1.7 Methanol

Chapter 7. Petrochemicals Market, By Manufacturing Processes

7.1 Global Petrochemicals Market Snapshot, By Manufacturing Processes

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Fluid Catalytic Cracking (FCC)

7.1.1.2 Steam cracking

7.1.1.3 Catalytic reforming

Chapter 8. Petrochemicals Market, By End Use

8.1 Global Petrochemicals Market Snapshot, By End Use

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Automotive

8.1.1.2 Electronics

8.1.1.3 Industrial

8.1.1.4 Packaging

8.1.1.5 Others

Chapter 9. Petrochemicals Market, By Region

9.1 Overview

9.2 Petrochemicals Market Revenue Share, By Region 2024 (%)

9.3 Global Petrochemicals Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Petrochemicals Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Petrochemicals Market, By Country

9.5.4 UK

9.5.4.1 UK Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Petrochemicals Market, By Country

9.6.4 China

9.6.4.1 China Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Petrochemicals Market, By Country

9.7.4 GCC

9.7.4.1 GCC Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Petrochemicals Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 BASF SE

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 LyondellBasell Industries Holdings B.V.

11.3 INEOS

11.4 Shell plc

11.5 SABIC

11.6 Reliance Industries Limited

11.7 Mitsubishi Chemical Corporation

11.8 Dow Chemical Company

11.9 LG Chem

11.10 Chevron Phillips Chemical Company LLC.

11.11 China National Petroleum Corporation

11.12 Maruzen Petrochemical Co., Ltd.