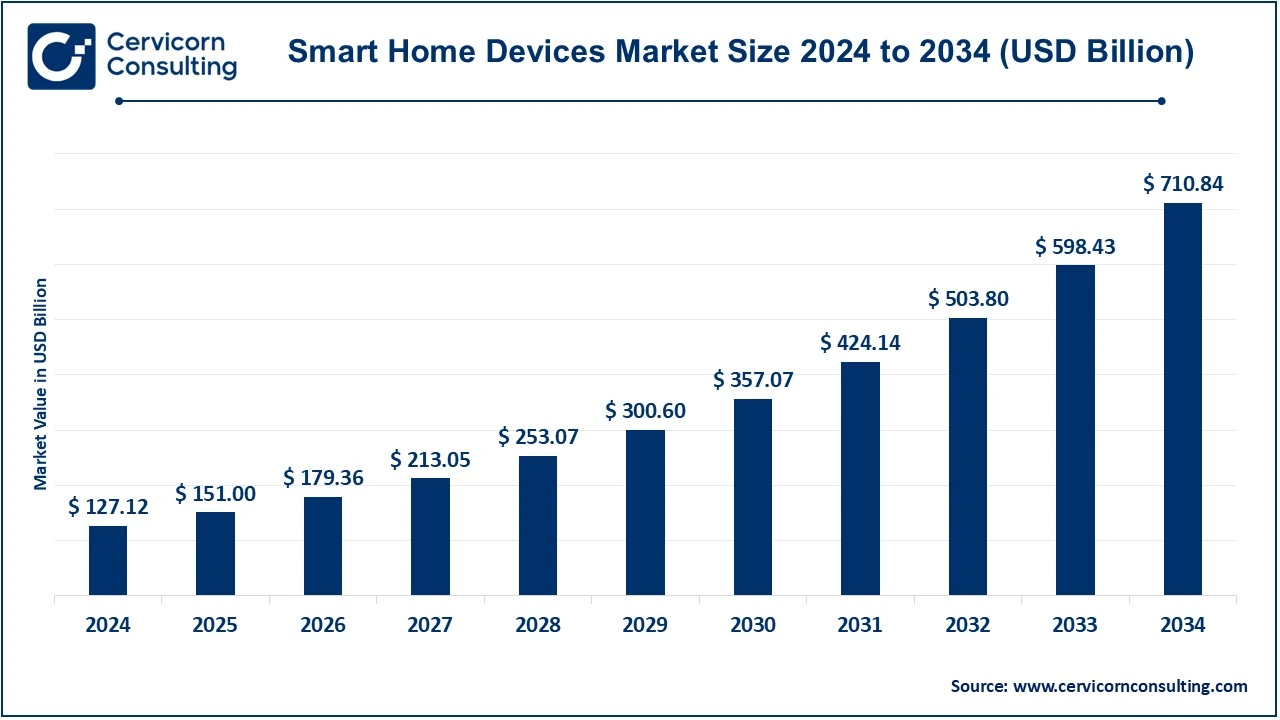

The global smart home devices market size was valued at USD 127.12 billion in 2024 and is expected to be worth around USD 710.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 18.78% over the forecast period 2025 to 2034.

Smart home devices are experiencing very rapid growth due to the higher adoption of Internet of Things technology, the advancement of artificial intelligence, and greater consumer demand for automation, convenience, and energy efficiency. With greater smart home adoption in the market- voice-controlled assistants, connected security systems, energy-efficient appliances, and the like, consumers seek out these solutions to maximize comfort, security, and savings. Another factor fueling growth in this market is rising concern about environmental sustainability and the management of energy. The availability of devices that are both affordable and user-friendly is on the rise.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 151 Billion |

| Projected Market Size in 2034 | USD 710.84 Billion |

| Expected CAGR 2025 to 2034 | 18.78% |

| Leading Region | North America |

| High Growth Region | Asia-Pacific |

| Key Segments | Product, Software & Services, Technology, Price Range, Sales Channel, Region |

| Key Companies | Apple Inc., Amazon Inc., Centrica Connected Home Limited, Emerson Electric Co., General Electric Company, Honeywell International, SAMSUNG, Schneider Electric SE, Sony Corporation, Johnson Controls |

The smart home devices market is segmented into product, software & services, technology, price range, sales channel, region. Based on product, the market is classified into lighting control, security and access control, access control, HVAC control, entertainment, smart speaker, and others. Based on software & services, the market is classified into behavioral and proactive. Based on price range, the market is classified into below US$ 25, US$ 25 - US$ 35, and above US$ 35. Based on sales channel, the market is classified into direct and indirect. Based on technology, the market is classified into Wi-Fi technology, bluetooth technology.

Lighting Control: Smart home lighting controls allow individuals to be away from the house and in front of the smartphone app, or say a few voice commands to control home lights. Control systems make lights go on or off; dim them and also change colors according to prescribed schedules; occupancy; and environmental factors such as heat build-up, smart lighting systems generally are also energy conserving and reduce electricity spending. More value is added through its integration with other devices which include security and HVAC for the automated lighting adjustment, enhanced comfort, security, and energy savings.

Security and Access Control: The products that fall into smart security and access control are cameras, doorbell cameras, and smart locks. It is one of the advanced tools that homeowners use to ensure maximum safety while away from home and receive real-time feeds and motion alerts for timely remote monitoring. Other better convenient features include facial recognition, keyless entry, and remote unlocking. The need for smart security systems is increasing due to the safety concerns homeowners have over the security of their homes, which gives them peace of mind as well as the ability to control their households.

Access Control: Smart access control is better in increasing the security of homes as a user can control and monitor the entry points using a form of keyless technology: smart locks, biometric sensors, and RFID cards. So it is to guarantee access to the house safely, especially far through smartphone or voice commands with the least involvement of keys. Access control also integrates with other safety appliances in transmitting real-time notices whenever there is an unauthorized entrance. The high demand for comfort and security is that which makes these smart appliances extensively embraced in residential homes.

HVAC Control: Smart control systems of HVAC allow homeowners to monitor their heating, ventilation, and air conditioning systems, thus making them feel comfortable and energy-efficient. With the use of smart thermostats and sensors, consumers can set schedules, change temperatures, and even check up on their energy usage with smartphone applications or voice assistants. Such systems learn consumer preferences and adjust with seasonal changes to make sure homes stay at preferred temperature levels. The two key motivators behind smart HVACs include energy savings and enhanced control over an indoor environment in new houses.

Entertainment: Smart entertainment encompasses smart TVs, sound systems, and many other streaming devices that can help in providing a better, connected home entertainment experience. They have voice control and multi-streaming from multiple platforms and other smart home system integrations. It allows users to be in control of the entertainment experience by using mobile applications or even voice assistants for seamless access to content, including video streaming, music, and gaming. With advancing connectivity and user convenience, there is an increasing demand for smart entertainment products with a sense of immersion in home entertainment.

Smart Speaker: With a smart home, users are enabled to control all the various devices in the house by voice commands. The best-sellers are Amazon Echo, Google Home, and Apple HomePod. They provide a central hub for smart home automation in which they can command the lighting, HVAC, security systems, and even entertainment through voice commands. Smart speakers will play music, provide weather updates, answer questions, and offer information, making them very versatile. Their ability to easily fit into daily life is the reason for their mass adoption in households across the world.

Behavioral: Smart homes have behavioral software and services designed for automation personalized by users' habits and preferences. The systems learn how people behave with their devices, thus adjusting settings accordingly. A smart thermostat may for example learn the times when one normally changes the temperature and can do it automatically without even inputting anything. Anticipating the needs of users improves convenience, energy efficiency, and comfort. It is this trend of personal adaptive systems that is fueling growth in the smart home market, wherein consumers seek seamless, tailored experiences.

Smart Home Devices Market Revenue Share, By Software & Services, 2024 (%)

| Software & Services | Revenue Share, 2024 (%) |

| Proactive | 42.40% |

| Behavioral | 57.60% |

Proactive: Proactive software and services in smart homes anticipate and respond before a user explicitly commands a device. For instance, proactive systems can switch on the thermostat before a user comes home or turn off lights when there is no one in the room. Other examples include alerting homeowners about unusual activity picked up by security devices. These systems involve artificial intelligence to predict the needs of the user based on patterns to increase energy efficiency, security, and overall home management. Proactive services make smart homes more intuitive with less necessity for manual intervention.

Direct: These are the places where manufacturers sell their smart home devices to consumers through their owned and operated online stores, physical places, or proprietary platforms. Companies have direct control over the customer experience, price, and products sold. Companies can customize their services, recommendations, and even unique products to be able to sell to consumers. With the growth of e-commerce, direct sales channels play a significant role as they give consumers convenient access to various smart home products, discounts, and direct interaction with the brands in support and product updates.

Smart Home Devices Market Revenue Share, By Sales Channel, 2024 (%)

| Sales Channel | Revenue Share, 2024 (%) |

| Direct | 54% |

| Indirect | 46% |

Indirect: Indirect channels of sales include third-party retailers, distributors, and online marketplaces that sell smart home devices on behalf of the manufacturers. Large retailers, online marketplaces, and specialized electronics stores are some of the types of indirect sales. In indirect sales, consumers will have more options for products from several brands, competitive prices, and ease of shopping. Manufacturers also benefit because they can reach markets that they may not have been able to reach directly. With the fast growth of the smart home market, indirect channels are still highly featured in driving the availability and access of products by consumers.

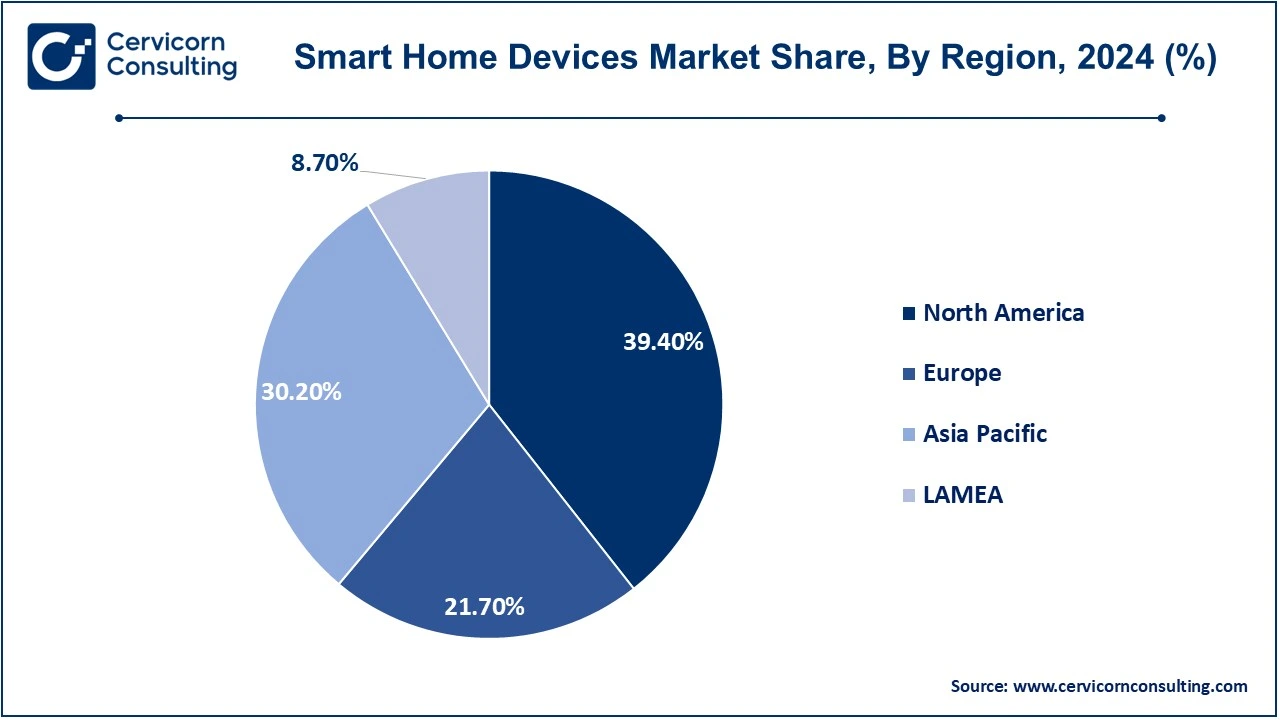

The smart home devices market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

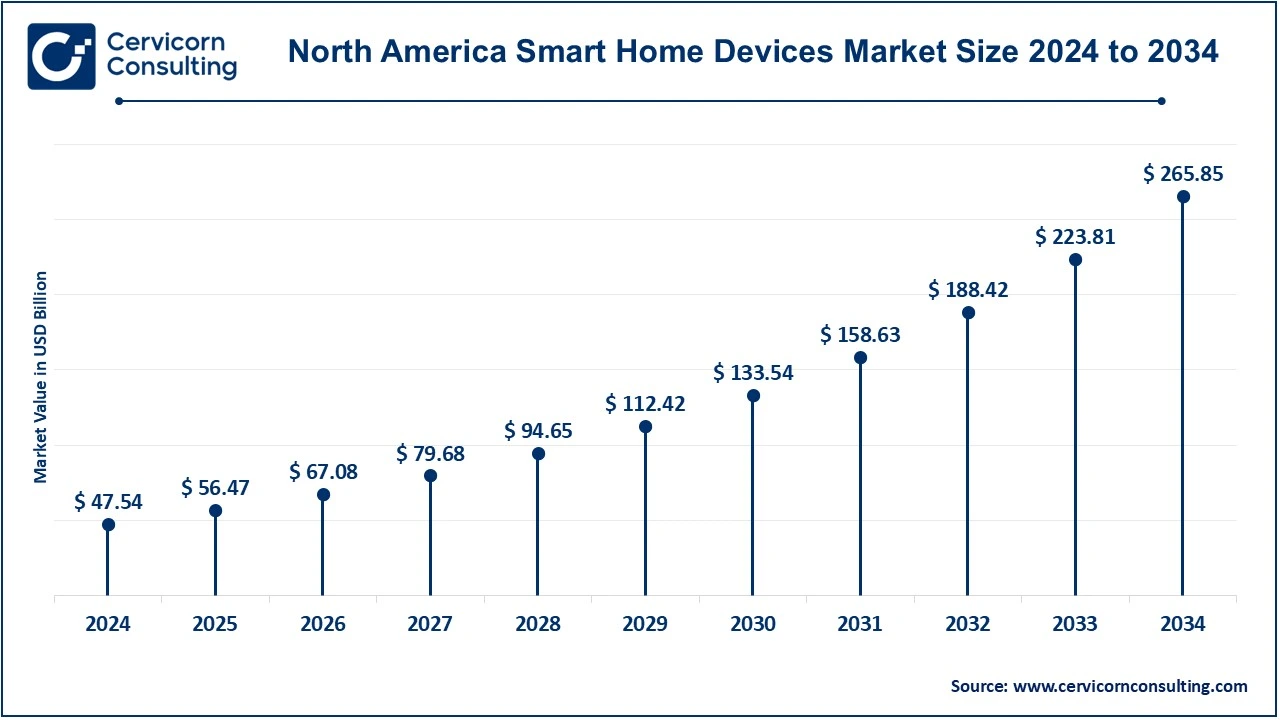

The North America smart home devices market size was valued at USD 47.54 billion in 2024 and is projected to grow around USD 265.85 billion by 2034. North America is one of the world's strongest contenders for smart home devices, as the U.S. and Canada provide the impetus. The U.S. market is also the largest market due to consumers' strong purchasing power, new technology developments, and high usage of IoT (Internet of Things) technologies. As such, North America leads penetration. By the end of 2024, 41 percent of all households in the region had at least one smart home product or system, which translates to 60.8 million smart homes. American consumers are spending more on smart security systems, home automation products, smart thermostats, and voice-controlled assistants such as Amazon Alexa and Google Assistant. The market has also increased in Canada, wherein consumers have started embracing smart devices for energy efficiency and home automation systems.

The Europe smart home devices market size was estimated at USD 27.59 billion in 2024 and is forecasted to surge around USD 154.25 billion by 2034. Key market players have their headquarters in Germany, the UK, France, and the Netherlands. The leading market in Europe is Germany because it has focused on energy-efficient solutions with an increased interest in using smart home technology for sustainability purposes. UK and France also have relatively strong markets, especially for intelligent security systems, lighting, and entertainment devices. For example, already about 39% of households in the UK use connected devices, and that figure will rise considerably to over 50% by 2027. Smart home technologies, especially smart speakers, thermostats, and security systems have become popular and are quickly gaining acceptance across a wider range. The regulatory environment in Europe encourages to reduction of carbon footprint and energy consumption, and therefore smart home devices are more likely to be adopted.

The Asia-Pacific smart home devices market size was accounted for USD 38.39 billion in 2024 and is projected to surpass around USD 214.67 billion by 2034. The Asia-Pacific region is growing very fast, primarily driven by China, Japan, South Korea, and India. China is a hub in both manufacturing and consumption, with extensive adoption of smart home products such as smart appliances, security systems, and voice assistants. The Japanese market is mature, yet very strong for smart home technology that is about energy efficiency and automation. The South Korean market is equally important as consumers are quite responsive to new technology and can see embracing smart TVs, home automation devices, and connected appliances. An emerging market for smart home products also is India due to its ever-growing urban population and increasing disposable income. Tech-savvy mid-class consumers seek ease and security.

The LAMEA smart home devices market was valued at USD 11.06 billion in 2024 and is anticipated to reach around USD 61.84 billion by 2034. The LAMEA region is diverse and an emerging market, which consists of countries in Latin America, the Middle East, and Africa. In the Latin America region, consumers in urban areas and certain developing cities gradually adopt the technologies for their smart home applications, primarily focusing on smart lighting, security systems, and automation of other home facilities, which offer them lifestyles for enhancement. The adoption rate of smart home devices in the Middle East has been growing pretty rapidly due to the affluent populations present in the UAE, Saudi Arabia, and Qatar. Luxury and convenience are the highest drivers for smart home technology in such regions wherein the highest demand is toward home security systems, smart climate control, and high-end connected devices. Africa is in its early stages of smart home adoption, and the growth would come from South Africa through improved internet penetration and rising urbanization. The economic factors and infrastructure development will significantly impact the growth rate in this region.

The market is majorly dominated by smart home device giants: Apple Inc., Amazon Inc., Centrica Connected Home Limited, Emerson Electric Co., General Electric Company, and Honeywell International to mention a few, hence so much dependence of each player on their respective innovative technological breakthroughs and wider coverage of brand portfolios which can help them have any competition. Apple especially with their complete integration within an ecofriendly Apple system. Amazon is leveraging Alexa-enabled smart devices and its humongous e-commerce platform. Centrica Connected Home specializes in energy management solutions, while Emerson Electric, General Electric, and Honeywell are market leaders in industrial-grade smart home products, advanced automation, and connectivity features. Strong strategic investments in research and development coupled with partnerships will enable these companies to dominate the smart home market as the market evolves.

CEO Statements

Tim Cook, CEO of Apple Inc.

Andy Jassy CEO of Amazon Inc.

Vimal Kapur, CEO of Honeywell International

Some of the significant examples in the Smart Home Devices market include:

Market Segmentation

By Product

By Technology

By Software & Services

By Price Range

By Sales Channel

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Smart Home Devices

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Technology Overview

2.2.3 By Software & Services Overview

2.2.4 By Price Range Overview

2.2.5 By Sales Channel Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Technological Development

4.1.1.2 Integration with Other Devices Improvement

4.1.1.3 Consumer Focus on Home Aesthetics

4.1.2 Market Restraints

4.1.2.1 Complexity in Setup and Integration

4.1.2.2 Privacy Concerns

4.1.2.3 Low Consumer Awareness

4.1.3 Market Challenges

4.1.3.1 Lack of universal standards

4.1.3.2 Skepticism Among Consumers

4.1.4 Market Opportunities

4.1.4.1 Home Automation and Control Systems

4.1.4.2 Energy Management and Smart Thermostats

4.1.4.3 Integrating with Smart Appliances to Promote Aging in Place

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Smart Home Devices Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Smart Home Devices Market, By Product

6.1 Global Smart Home Devices Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Lighting Control

6.1.1.2 Security and Access Control

6.1.1.3 Access Control

6.1.1.4 HVAC Control

6.1.1.5 Entertainment

6.1.1.6 Smart Speaker

6.1.1.7 Others

Chapter 7. Smart Home Devices Market, By Technology

7.1 Global Smart Home Devices Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Wi-Fi Technology

7.1.1.2 Bluetooth Technology

Chapter 8. Smart Home Devices Market, By Software & Services

8.1 Global Smart Home Devices Market Snapshot, By Software & Services

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Behavioral

8.1.1.2 Proactive

Chapter 9. Smart Home Devices Market, By Price Range

9.1 Global Smart Home Devices Market Snapshot, By Price Range

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Below US$ 25

9.1.1.2 US$ 25 - US$ 35

9.1.1.3 Above US$ 35

Chapter 10. Smart Home Devices Market, By Sales Channel

10.1 Global Smart Home Devices Market Snapshot, By Sales Channel

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Direct

10.1.1.2 Indirect

Chapter 11. Smart Home Devices Market, By Region

11.1 Overview

11.2 Smart Home Devices Market Revenue Share, By Region 2024 (%)

11.3 Global Smart Home Devices Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Smart Home Devices Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Smart Home Devices Market, By Country

11.5.4 UK

11.5.4.1 UK Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Smart Home Devices Market, By Country

11.6.4 China

11.6.4.1 China Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Smart Home Devices Market, By Country

11.7.4 GCC

11.7.4.1 GCC Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Smart Home Devices Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Apple Inc.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Amazon Inc.

13.3 Centrica Connected Home Limited

13.4 Emerson Electric Co.

13.5 General Electric Company

13.6 Honeywell International

13.7 SAMSUNG

13.8 Schneider Electric SE

13.9 Sony Corporation

13.10 Johnson Controls