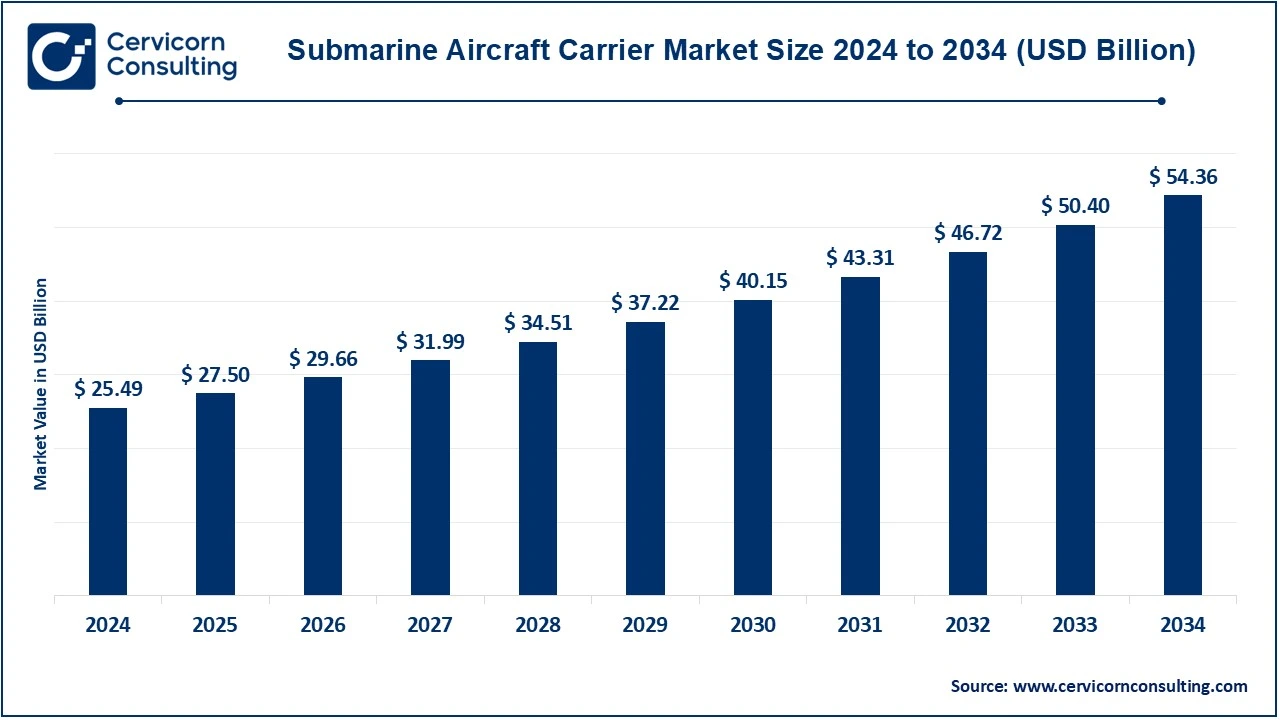

The global submarine aircraft carrier market size was valued at USD 25.49 billion in 2024 and is expected to surpass around USD 54.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.86% over the forecast period 2025 to 2034.

A submarine aircraft carrier is a hypothetical or conceptual combination of a submarine and an aircraft carrier that combines the stealth and diving capabilities of a submarine with the air engagement capabilities of an aircraft carrier. Although there is currently no such vessel in operational military fleets, the idea offers interesting possibilities, particularly for increasing the strategic advantages of naval operations. Although a fully operational submarine aircraft carrier is primarily a concept rather than a reality, it symbolizes a potential path for the future of naval warfare, combining the stealth features and versatility of submarines with the operational agility of aircraft carriers.

The submarine aircraft carriers market is anticipated to be shaped by a combination of technological progress, geopolitical dynamics, and evolving military strategies. As nations seek more covert, versatile, and efficient means to strengthen their naval dominance, this hybrid craft might provide a strategic advantage in displaying might, tackling security concerns, and managing complex global issues such as terrorism, maritime piracy, and international conflicts. Though the concept is mainly theoretical, it holds considerable potential to change naval warfare in the future.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 27.50 Billion |

| Expected Market Size in 2034 | USD 54.36 Billion |

| Projected CAGR 2025 to 2034 | 7.86% |

| Dominant Region | North America |

| Rapidly Expanding Region | Asia-Pacific |

| Key Segments | Type, Aircraft Type, Application, Technology, End User, Region |

| Key Companies | General Dynamics Electric Boat, Huntington Ingalls Industries, Lockheed Martin, Northrop Grumman, BAE Systems, Thales Group, DCN (Direction des Constructions Navales), Naval Group, Rosatomflot, Rubin Design Bureau, JSC United Shipbuilding Corporation, Hyundai Heavy Industries, Daewoo Shipbuilding & Marine Engineering, Kawasaki Heavy Industries, Mitsubishi Heavy Industries, Saab AB, Leonardo S.p.A, Fincantieri, Rolls-Royce, Textron Systems, Boeing, Raytheon Technologies, L3 Technologies, General Atomics, China Shipbuilding Industry Corporation |

Growing Demand for Submarine-Based UAVs

Increase in geopolitical issues between countries

Ethical and Legal Considerations

High costs for development, maintenance and repair

Investments in submarines

Increasing Maritime Power in Global Waters

Geopolitical Tensions

Terrorist Adaptation

The submarine aircraft carrier market is segmented into type, aircraft type, application, technology, end user and region. Based on type, the market is classified into manned, and autonomous. Based on aircraft type, the market is classified into aircraft, fixed wing, rotary wing aircraft, and UAVs. Based on application, the market is classified into naval defense, maritime surveillance & reconnaissance, search and rescue & humanitarian operations. Based on technology, the market is classified into submersible technologies, and aircraft deployment systems. Based on end-user, the market is classified into military & defense agencies, private defense contractors, security & intelligence agencies.

Manned Submarine Aircraft Carriers: They would consist of fully crewed, functioning vessels that could carry submarines and aircraft. It is likely that they would be designed for strategic military purposes including defense, attack, and surveillance. For instance, submarines with nuclear or diesel-electric engines that can transport different UAVs (Unmanned Aerial Vehicles) or VTOL (Vertical Take-Off and Landing) planes.

Autonomous Submarine Aircraft Carriers: Unmanned aircraft systems, like drones, are being used for reconnaissance, surveillance, and striking missions from submerged platforms. This includes autonomous submarines equipped with drones or smaller VTOLs.

Naval Defense: These submarine aircraft carriers would act as a mobile base for nuclear or conventional deterrence, allowing a country to uphold a covert yet powerful military stance in critical maritime areas. Submarine aircraft carriers might be dispatched to hot spots for rapid tactical attacks, providing aircraft to participate in reconnaissance, surveillance, and air strikes.

Maritime Surveillance & Reconnaissance: With drones or specialized aircraft, submarine aircraft carriers could be used to support maritime patrol, early warning systems, and intelligence collection without risking the presence of larger carriers.

Search and Rescue & Humanitarian Operations: The submarine aircraft carriers could be used for non-combat purposes, such as humanitarian missions, search and rescue operations, or disaster relief in areas where airstrips or large vessels cannot operate.

Submersible Technologies: These include submarines powered by nuclear energy and those that are diesel-electric. The submarines powered by nuclear energy would use nuclear reactors to provide almost infinite underwater endurance. The market for these would primarily be restricted to countries with advanced nuclear capabilities. Diesel-electric submarines offer a more cost-effective option for nations without access to nuclear technology while still desiring the stealth and endurance of submersible aircraft carriers.

Aircraft Deployment Systems: These systems include VTOL aircraft and drone or UAV systems. The VTOL aircraft have the capability for vertical take-off and landing, comprising drones, helicopters, or specialized fighter jets, which would be crucial for launching from a submerged platform. The drone or UAV systems signify unmanned aircraft that would improve the practicality of a submarine aircraft carrier. Drones are projected to be a crucial component of this market segment.

Military & Defense Agencies: Nations with sophisticated naval capabilities like the United States, Russia, China, and others may lead in the development or acquisition of such vessels, particularly for strategic military benefit. Allied countries and NATO member states would also commit resources to advanced naval technologies to sustain a competitive advantage in defense, especially in air-sea operations.

Private Defense Contractors: Companies involved in building or designing specialized vessels for naval forces would be part of this market, either in providing prototypes, systems integration, or maintenance services.

Security & Intelligence Agencies: Countries focusing on maritime reconnaissance and surveillance may allocate resources to unmanned or autonomous submarine aircraft carriers for non-combat purposes like espionage, reconnaissance, and border monitoring.

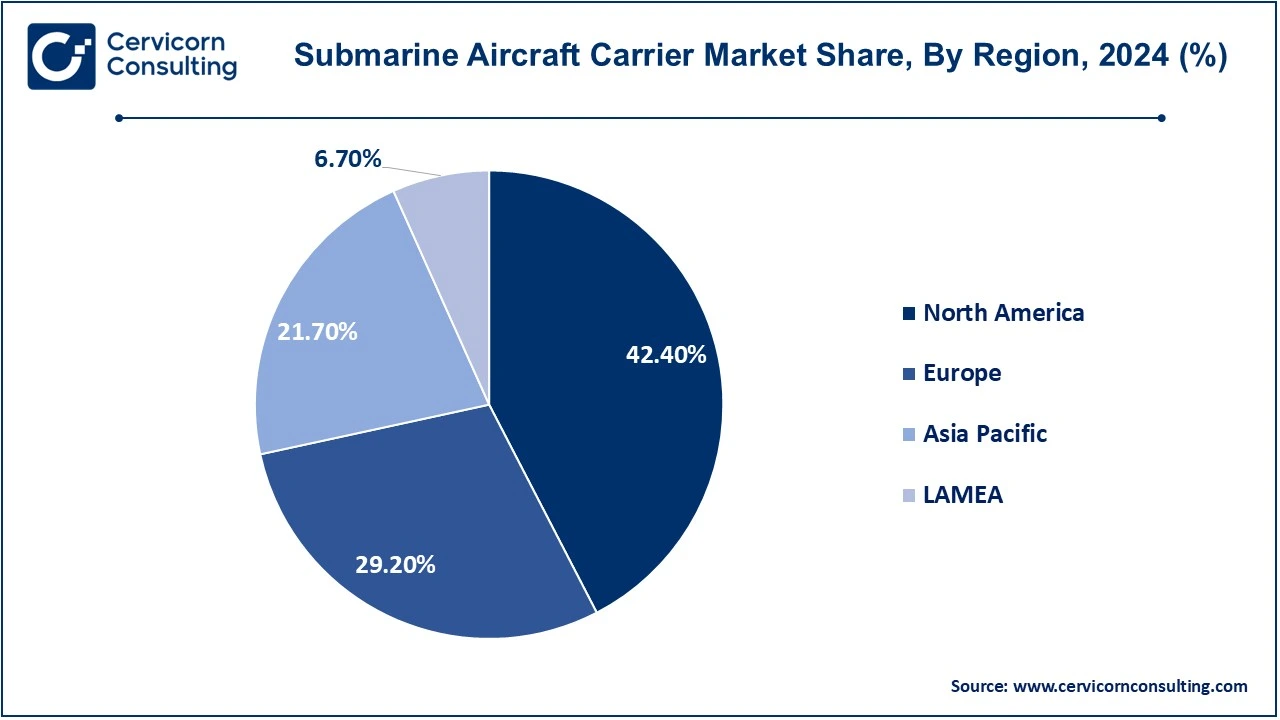

The submarine aircraft carrier market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

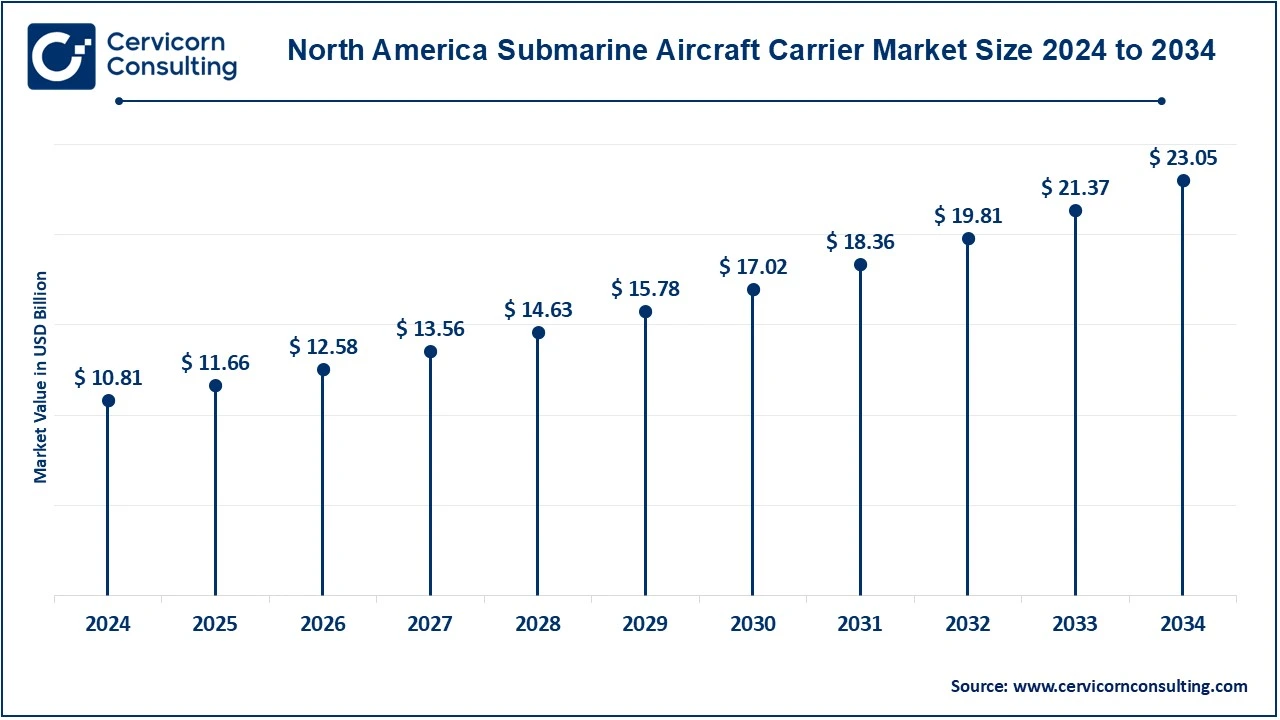

The North America submarine aircraft carrier market size was valued at USD 10.81 billion in 2024 and is expected to reach around USD 23.05 billion by 2034. North America is anticipated to witness robust growth in defense investments and advancements, especially in the U. S. Navy’s effort to grow its fleet to 355 ships by 2030. This growth entails the acquisition of sophisticated warships such as the Gerald R. Ford-class aircraft carriers, emphasizing state-of-the-art technologies for combat preparedness and operational effectiveness. This significant defense expenditure in North America fosters regional growth through procurement, research, and development projects.

The Europe submarine aircraft carrier market size was estimated at USD 7.44 billion in 2024 and is anticipated to hit around USD 15.86 billion by 2034. European nations such as France, Italy and the United Kingdom are investing heavily in advanced naval technology, with a focus on submarines and unmanned aerial systems. The EU and NATO are driving forward the development of next generation defense systems, with leading companies such as Naval Group, Fincantieri and BAE Systems at the forefront of naval defense and shipbuilding. France, Britain and Russia have expertise in nuclear-powered submarines, essential for ships with long-range and stealth capabilities, including potential anti-submarine aircraft carriers. These countries may have positioned themselves as pioneers in advanced naval technology by leveraging their knowledge in nuclear-powered submarines for the development of innovative hybrid systems.

The Asia-Pacific submarine aircraft carrier market size was accounted for USD 5.53 billion in 2024 and is projected to hit around USD 11.80 billion by 2034. With crucial shipping routes such as the South China Sea and the Strait of Malacca facing threats from terrorism and piracy, the Asia-Pacific region is crucial to global maritime trade. Japan, China, and India are enhancing their naval forces, concentrating on aircraft carriers and underwater warfare. China is increasing its number of ships and carriers, while India is bolstering its naval strength and maritime capabilities. These actions signify strategic objectives and modernization initiatives in the area, backed by collaborations and developments in avionics, propulsion technology, and unmanned aerial systems.

The LAMEA submarine aircraft carrier market size was valued at USD 1.71 billion in 2024 and is anticipated to reach around USD 3.64 billion by 2034. Because of growing worries about border security, terrorism, and maritime safety in vital waterways, the market for submarine aircraft carriers is expanding in the LAMEA area. With the development of nuclear-powered submarines and the possibility of hybrid ships like submarine aircraft carriers, Brazil is well-positioned to join the market. Piracy and maritime terrorism are major problems in areas like the Strait of Malacca, the Gulf of Guinea, and the Somali coast, which increases demand for cutting-edge military technology. Given its increasing interest in forming alliances with foreign armed forces, the LAMEA area is well-positioned to contribute significantly to the development of the rising market.

CEO Statements

Michael Peter, CEO of Siemens Mobility

Tracy Robinson became president and CEO of the Canadian National Railway Company (CN Rail)

Market Segmentation

By Type

By Aircraft Type

By Application

By Technology

By End-User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Submarine Aircraft Carrier

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Aircraft Type Overview

2.2.3 By Technology Overview

2.2.4 By Application Overview

2.2.5 By End Use Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Demand for Submarine-Based UAVs

4.1.1.2 Increase in geopolitical issues between countries

4.1.2 Market Restraints

4.1.2.1 Ethical and Legal Considerations

4.1.2.2 High costs for development, maintenance and repair

4.1.3 Market Challenges

4.1.3.1 Geopolitical Tensions

4.1.3.2 Terrorist Adaptation

4.1.4 Market Opportunities

4.1.4.1 Investments in submarines

4.1.4.2 Increasing Maritime Power in Global Waters

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Submarine Aircraft Carrier Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Submarine Aircraft Carrier Market, By Type

6.1 Global Submarine Aircraft Carrier Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Manned Submarine Aircraft Carriers

6.1.1.2 Autonomous Submarine Aircraft Carriers

Chapter 7. Submarine Aircraft Carrier Market, By Aircraft Type

7.1 Global Submarine Aircraft Carrier Market Snapshot, By Aircraft Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Aircraft

7.1.1.2 Fixed Wing

7.1.1.3 Rotary Wing Aircraft

7.1.1.4 UAVs

Chapter 8. Submarine Aircraft Carrier Market, By Application

8.1 Global Submarine Aircraft Carrier Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Naval Defense

8.1.1.2 Maritime Surveillance & Reconnaissance

8.1.1.3 Search and Rescue & Humanitarian Operations

Chapter 9. Submarine Aircraft Carrier Market, By Technology

9.1 Global Submarine Aircraft Carrier Market Snapshot, By Technology

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Submersible Technologies

9.1.1.2 Aircraft Deployment Systems

Chapter 10. Submarine Aircraft Carrier Market, By End Use

10.1 Global Submarine Aircraft Carrier Market Snapshot, By End Use

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Military & Defense Agencies

10.1.1.2 Private Defense Contractors

10.1.1.3 Security & Intelligence Agencies

Chapter 11. Submarine Aircraft Carrier Market, By Region

11.1 Overview

11.2 Submarine Aircraft Carrier Market Revenue Share, By Region 2024 (%)

11.3 Global Submarine Aircraft Carrier Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Submarine Aircraft Carrier Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Submarine Aircraft Carrier Market, By Country

11.5.4 UK

11.5.4.1 UK Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Submarine Aircraft Carrier Market, By Country

11.6.4 China

11.6.4.1 China Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Submarine Aircraft Carrier Market, By Country

11.7.4 GCC

11.7.4.1 GCC Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Submarine Aircraft Carrier Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 General Dynamics Electric Boat

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Huntington Ingalls Industries

13.3 Lockheed Martin

13.4 Northrop Grumman

13.5 BAE Systems

13.6 Thales Group

13.7 DCN (Direction des Constructions Navales)

13.8 Naval Group

13.9 Rosatomflot

13.10 Rubin Design Bureau

13.11 JSC United Shipbuilding Corporation

13.12 Hyundai Heavy Industries

13.13 Daewoo Shipbuilding & Marine Engineering

13.14 Kawasaki Heavy Industries

13.15 Mitsubishi Heavy Industries

13.16 Saab AB

13.17 Leonardo S.p.A

13.18 Fincantieri

13.19 Rolls-Royce

13.20 Textron Systems

13.21 Boeing

13.22 Raytheon Technologies

13.23 L3 Technologies

13.24 General Atomics

13.25 China Shipbuilding Industry Corporation