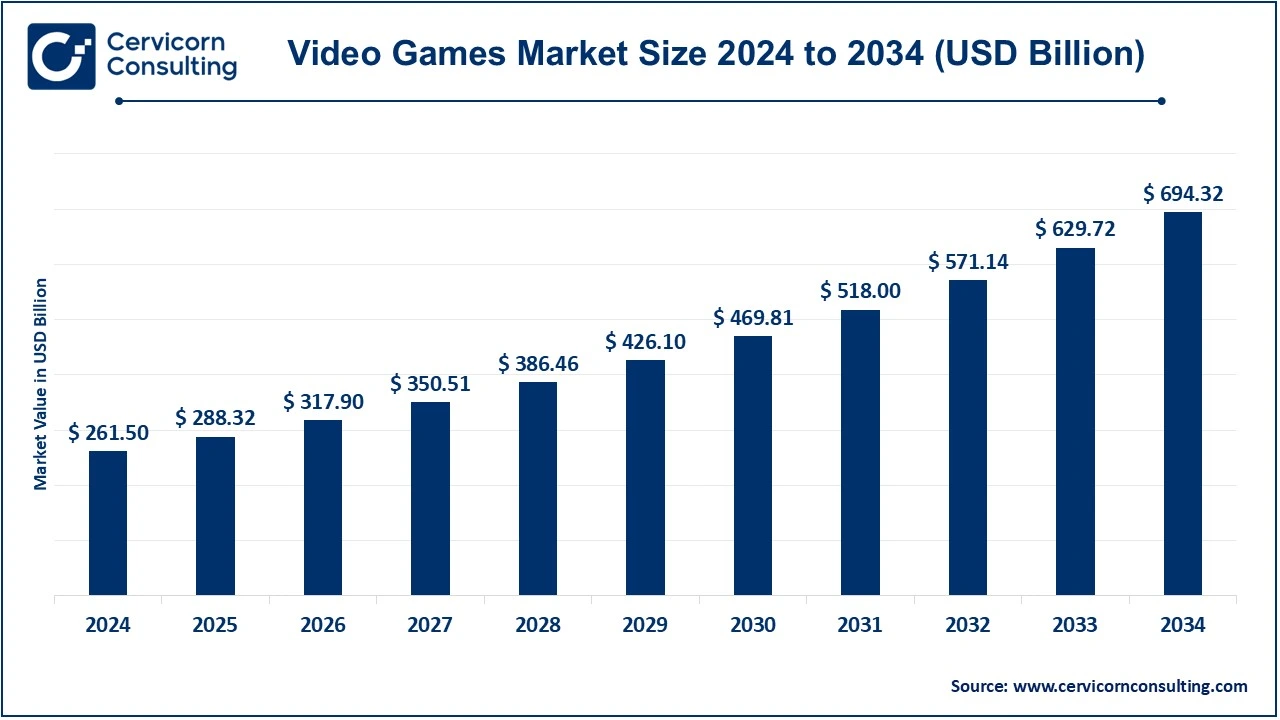

The global video games market size was valued at USD 261.50 billion in 2024 and is expected to be worth around USD 694.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.25% over the forecast period 2025 to 2034.

The video games market is expanding at a very healthy growth rate, primarily due to the adoption of advanced technologies such as virtual reality (VR), augmented reality (AR), and cloud gaming, along with high penetration levels of mobile devices and consoles. In addition to this, the increasing popularity of esports, the emergence of live streaming platforms, increasing demand for multiplayer and online gaming experiences have further supported market demand. Innovation in immersion storytelling, cross-platform play, and subscription-based services allowed the industry to innovate and attract diverse audiences, from casual gamers to competitive players, and contribute to sustained market growth worldwide.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 288.32 Billion |

| Projected Market Size in 2034 | USD 694.32 Billion |

| Expected CAGR 2025 to 2034 | 10.25% |

| Leading Region | Asia-Pacific |

| Key Segments | Device, Type, Hardware, Region |

| Key Companies | Tencent Holding Limited, Nintendo of America Inc., Activision Blizzard, Inc., Electronic Arts Inc., Microsoft Corporation, Sony Corporation, Take-Two Interactive Software, Inc., Amazon.com, Inc., Square Enix Holdings Co., Ltd., Gameloft SE, King Digital Entertainment Ltd. |

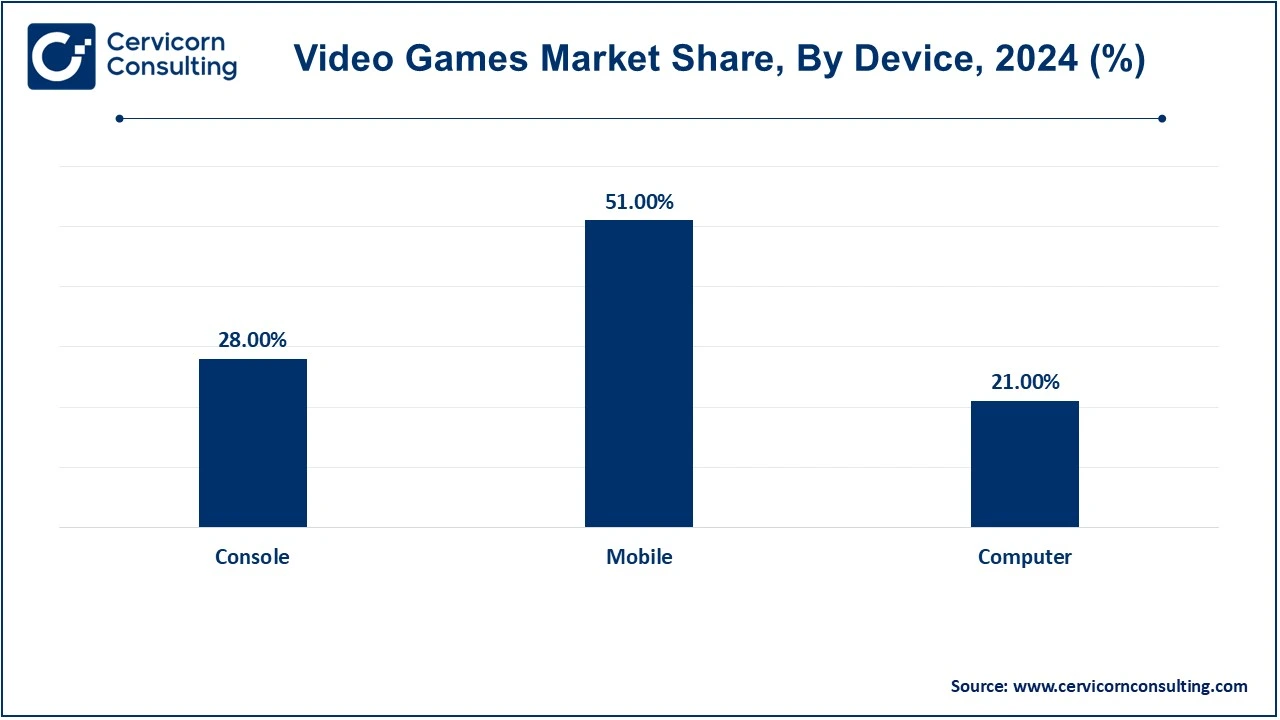

The video games market is segmented into device, type, hardware and region. Based on device, the market is classified into console, mobile, and computer. Based on type, the market is classified into online and offline. Based on hardware, the market is classified into handheld console, static console and video gaming accessories.

Console: The console segment would contain PlayStation, Xbox, and Nintendo Switch systems. In this case, gaming machines are dedicated mainly to playing games and are mostly connected to a television or monitor for display. They provide high-quality graphics and immersive gameplay along with an array of exclusive titles. They are preferred by gamers who prefer a seamless, at-home gaming experience, and the market has grown with advancements in virtual reality, online play, and exclusive game releases.

Mobile: The market of mobile games is growing explosively. The increased use of both smartphones and tablets means there is room to play all these available titles, either iOS or Android, offering great broad reach from the casual players to the core ones. Mobile games can also be available for free play and in-app purchasing. Playing while moving with your life is one reason gaming in the mobile environment made it grow into becoming the largest most money-making branch in video gaming.

Computer: PC gaming remains one of the most significant segments, supported by high-performance hardware and great customizations. For the players who game on a PC, there are ultrahigh-definition graphics, open worlds, and the communities of mods. The increasing more platforms, such as Steam, expand market access and bring games, including AAA and independent titles. Most of the buyers gear up with the best gaming mouse, keyboard, and monitor to ensure the best experience with the games on the PC.

Online: Online gaming has become the dominant sector of the video game market. Multiplayer online games, in which players play together in real-time, are also part of this sector. This is fueled by esports, online-only titles, and subscription-based services like Xbox Live and PlayStation Plus. Social interaction, competition, and cooperative gameplay are the essential elements of online games that attract millions of players and grow into global gaming communities every year.

Video Game Market Revenue Share, By Type, 2024 (%)

| Type | Revenue Share, 2024 (%) |

| Online | 43% |

| Offline | 57% |

Offline: Offline gaming is a category of single-player or local multiplayer games that don't rely on the internet. The market segment attracts gamers who like playing in isolation or in local mode without having to rely on servers elsewhere. Titles like RPGs, adventure games, and puzzle games dominate offline gaming. Most players prefer such focused, uninterrupted gameplay in titles. With the increase in digital distribution, even offline games are thriving with online multiplayer experiences on the rise.

The video games market can be further segmented into some key geographical regions: North America, Europe, Asia-Pacific, and LAMEA, which consists of Latin America, Middle East, and Africa. Further details of each region are described below.

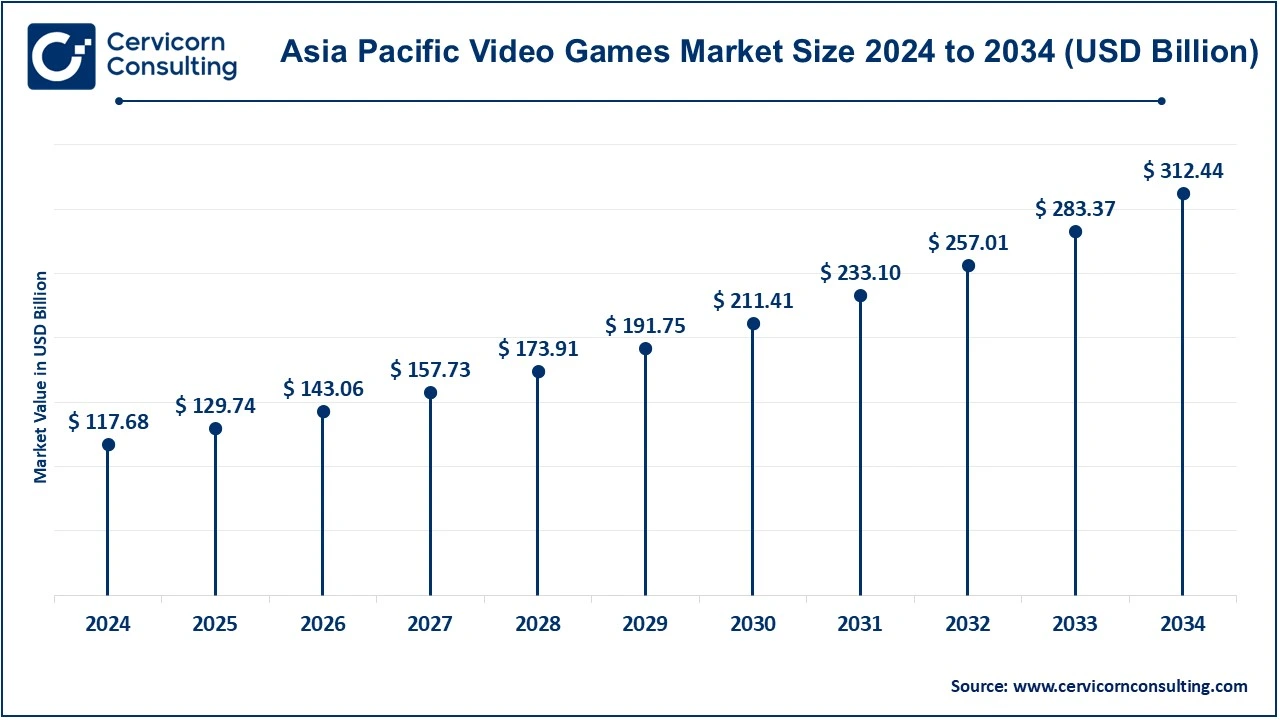

The Asia-Pacific video games market size was accounted for USD 117.68 billion in 2024 and is predicted to hit around USD 312.44 billion by 2034. The China, Japan, South Korea, and India are the largest market for Asia-Pacific. The Chinese market is the world's largest, with major growth areas for mobile gaming, online multiplayer games, and esports. For instance, in February 2024, Dezan Shira & Associates reported that China's gaming industry remained the world's largest, at over USD 41.68 billion in 2023, in which mobile gaming was 74.88% of the revenue. The industry is expected to grow to USD 95.51 billion by 2029. Recent changes in the regulatory system have resulted in 1,075 new game licenses being approved in 2023, which indicates that the government supports the industry even though it faced challenges in the past. The industry is also putting its focus on e-sports, VR technology, and international expansion to strengthen its global presence. Japan is known for its rich heritage of old consoles and RPG games. South Korea has an eSports culture in full swing and dominates online gaming. India is an emerging market with rapidly growing mobile gaming and rising interest in gaming culture.

The North America video games market size was valued at USD 62.76 billion in 2024 and is projected to surge around USD 166.64 billion by 2034. North America includes the United States, Canada, and Mexico. The U.S has remained to be the global largest gaming market and, all infrastructures for gaming, eSports, and streaming have increased. For example, in November 2024, Roblox announced that it would make tremendous improvements in parental controls, thereby boosting security for minors. Children under 13 would not be able to send direct messages to any other player; however, they can send messages publicly. Parents may also monitor their child's account by establishing limits on time spent on screen and by being able to view a list of friends. These are responses to increasing online safety concerns and part of the commitment that Roblox continues to give to user protection. Canada is one country with an impressive game development scene; game studios have been flooding the region. Mexico has been experiencing rapid growth of its gaming market, including growth in mobile and console games. This region's market features discretionary income and tech-savvy consumers.

The Europe video games market size was estimated at USD 261.50 billion in 2024 and is forecasted to grow around USD 694.32 billion by 2034. It consists of countries such as the UK, Germany, France, Spain, and Italy. The UK is so enormous; it has an impressive gaming community, whereas its development is pretty lively. Similarly, Germany is so revered to be great for not only PC but also for console gaming. As the German video game market grew to USD 4.6 billion in revenues according to the 2022 annual report from the German Games Industry Association. Market grows 3% from 2021 year. The leader is a mobile game, with the share at 54%, followed by console and PC games 29% and 17%, respectively. From the report, growth in the player base in this region is represented. For Germany specifically, the number is more than 48 million gamers. Survival and growth in the market since it sustains through economic stress. Game development and eSports events are well recognized about France. The Spanish and Italian market is highly growing very fast, expanding with a higher adoption of mobile gaming. Europe is considered to be a divergent market owing to different tastes and different cultures in playing games within the various countries.

Video Game Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 24% |

| Europe | 21% |

| Asia-Pacific | 45% |

| LAMEA | 10% |

The LAMEA video games market size was valued at USD 26.15 billion in 2024 and is anticipated to reach around USD 69.43 billion by 2034. LAMEA includes Latin America, the Middle East, and Africa. Latin America has Brazil and Mexico experiencing significant growth in mobile and console gaming. The Middle East, especially Saudi Arabia and the UAE, is seeing an increase in demand for gaming due to a young, tech-savvy population and high disposable incomes. In Africa, mobile gaming is rapidly growing, especially in countries like South Africa and Nigeria, where smartphone access is fueling market growth. This region holds huge potential as infrastructure for gaming and access improves.

New entrants in the video game industry are adopting novel strategies in a very competitive industry to have a better grip. Big players include Tencent Holding Limited, Nintendo of America Inc., Activision Blizzard, Inc., Microsoft Corporation and Electronic Arts Inc. in terms of expansion of their markets through mergers, strategic alliances, and technological innovation. These companies are embracing cloud gaming, mobile platforms, and next-generation consoles to meet the evolving demands of consumers. For instance, after it acquired ZeniMax Media and entered the cloud gaming market through Xbox Cloud Gaming, Microsoft Corporation has experienced quite significant growth, with offerings that have brought a new dimension of accessibility and cross-play that has expanded its user base and increased global reach.

CEO Statements

Ma Huateng, CEO of Tencent Holding Limited

Doug Bowser, CEO of Nintendo of America Inc.

Bobby Kotick, CEO of Activision Blizzard, Inc.

The latest strategic partnerships and investments in the animation market reflect a strong push toward innovation and expansion in the global arena. Companies are now collaborating more to use the latest technologies in AI, virtual reality, and use of cloud-based solutions, to optimize production workflows and improve content quality. These partnerships intend to enhance creative processes, streamline distribution, and reach more audiences across multiple platforms. Investments also fuel the development of more diverse and engaging animated content because they respond to the higher demands for quality content not only in the traditional markets but also in the new markets with shifting consumer preferences.

Some key developments of the Video Games Market include the following notable examples:

Market Segmentation

By Device

By Type

By Hardware

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Video Games

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Device Overview

2.2.3 By Hardware Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising consumer demand for alternatives of entertainment

4.1.1.2 Critical Technological Developments (5G)

4.1.1.3 Advancements in Game Development Tools

4.1.2 Market Restraints

4.1.2.1 The rising concern towards data security

4.1.2.2 Development Burden of High Development Costs

4.1.2.3 Increasing Regulatory Burden

4.1.3 Market Challenges

4.1.3.1 Increase in fierce competition in the market

4.1.3.2 Fast Technological Advancements

4.1.3.3 Increased concerns in Piracy and illegal game distribution

4.1.4 Market Opportunities

4.1.4.1 Increasing Collaborations between Film and Game Studios

4.1.4.2 Integration of AI for Dynamic Gameplay

4.1.4.3 Introduction of Virtual Reality and Augmented Reality Technologies

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Video Games Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Video Games Market, By Type

6.1 Global Video Games Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Online

6.1.1.2 Offline

Chapter 7. Video Games Market, By Device

7.1 Global Video Games Market Snapshot, By Device

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Console

7.1.1.2 Mobile

7.1.1.3 Computer

Chapter 8. Video Games Market, By Hardware

8.1 Global Video Games Market Snapshot, By Hardware

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Handheld Console

8.1.1.2 Static Console

8.1.1.3 Video Gaming Accessories

Chapter 9. Video Games Market, By Region

9.1 Overview

9.2 Video Games Market Revenue Share, By Region 2024 (%)

9.3 Global Video Games Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Video Games Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Video Games Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Video Games Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Video Games Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Video Games Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Video Games Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Video Games Market, By Country

9.5.4 UK

9.5.4.1 UK Video Games Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Video Games Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Video Games Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Video Games Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Video Games Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Video Games Market, By Country

9.6.4 China

9.6.4.1 China Video Games Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Video Games Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Video Games Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Video Games Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Video Games Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Video Games Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Video Games Market, By Country

9.7.4 GCC

9.7.4.1 GCC Video Games Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Video Games Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Video Games Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Video Games Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Tencent Holding Limited

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Nintendo of America Inc.

11.3 Activision Blizzard, Inc.

11.4 Electronic Arts Inc.

11.5 Microsoft Corporation

11.6 Sony Corporation

11.7 Take-Two Interactive Software, Inc.

11.8 Amazon.com, Inc.

11.9 Square Enix Holdings Co., Ltd.

11.10 Gameloft SE

11.11 King Digital Entertainment Ltd.