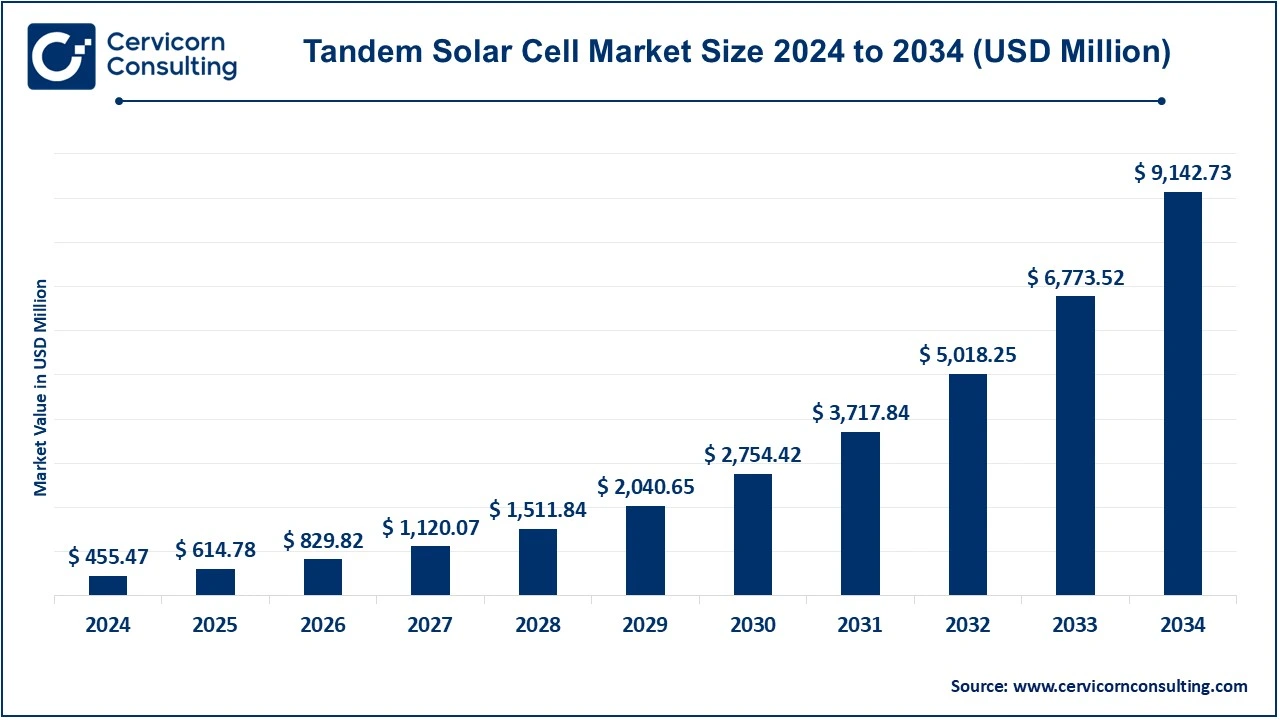

The global tandem solar cell market size was valued at USD 455.47 million in 2024 and is expected to be worth around USD 9,142.73 million by 2034, growing at a compound annual growth rate (CAGR) of 34.98% over the forecast period 2025 to 2034.

The tandem solar cell market is experiencing rapid growth driven by advancements in solar technology and the increasing global demand for highly efficient renewable energy solutions. Combining multiple layers of materials, tandem solar cells achieve higher energy conversion efficiencies than traditional single-junction cells, making them a promising technology for maximizing solar power output. Innovations in perovskite materials and silicon-based cells have further accelerated the commercialization of tandem solar cells, supported by government policies promoting renewable energy adoption and investments in clean energy infrastructure. As the solar industry prioritizes efficiency and cost-effectiveness, tandem solar cells are poised to play a critical role in meeting global energy needs while contributing to sustainability goals.

What is tandem solar cell?

A tandem solar cell is an advanced photovoltaic device that improves efficiency by stacking multiple layers of solar cells made from different materials. Each layer is designed to absorb specific parts of the solar spectrum, reducing energy losses compared to traditional single-junction cells. Common materials used include silicon and perovskite, where silicon captures infrared light, and perovskite absorbs visible and ultraviolet light. This combination allows tandem solar cells to achieve efficiencies above 30%, making them a promising technology for more efficient and cost-effective solar energy solutions.

Key Statistics:

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 614.78 Million |

| Expected Market Size in 2034 | USD 9142.73 Million |

| Estimated CAGR 2025 to 2034 | 34.97% |

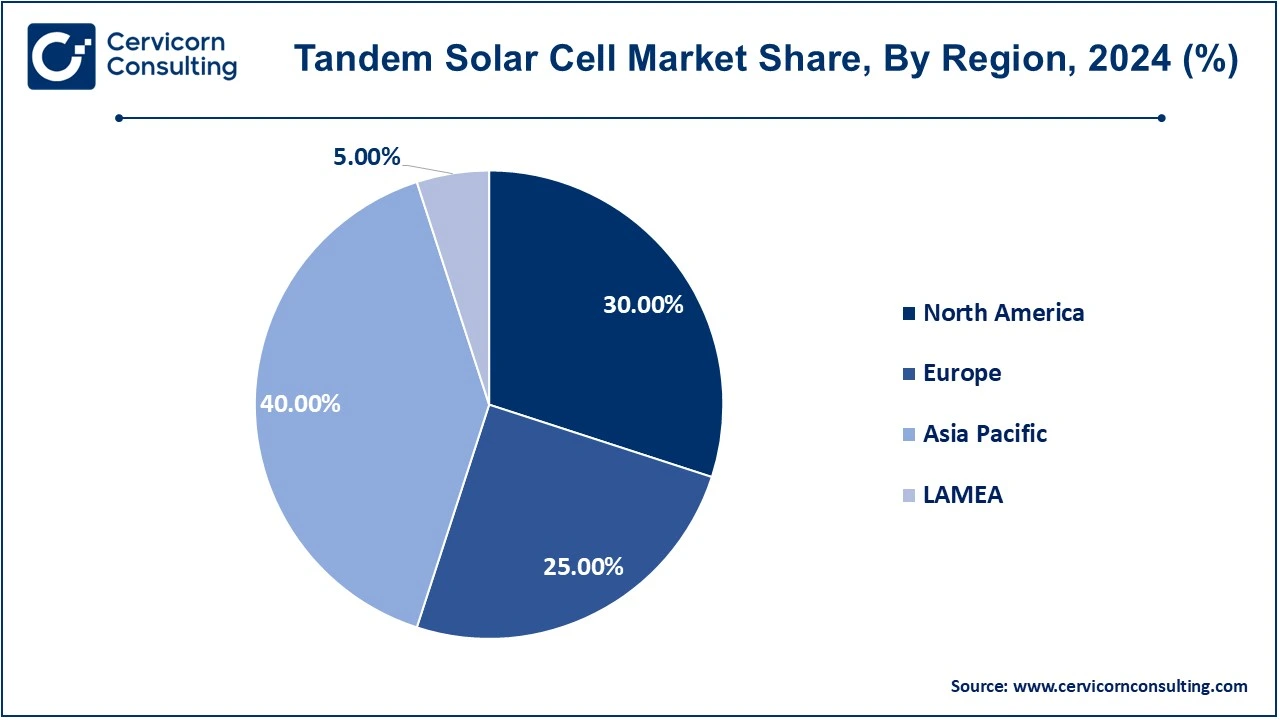

| Leading Region | Asia-Pacific |

| Fastest Growing Region | Asia Pacific |

| Key Segments | Material Type, Technology, Application, Region |

| Key Companies | Oxford PV, LONGi Solar, Trina Solar, Heliatek, First Solar, JinkoSolar, Canadian Solar, SunPower, Solar Frontier, Q CELLS, Peccell Technologies |

Technological Advancements and Efficiency Gains

Government Incentives and Renewable Energy Policies

High Manufacturing Costs

Material Stability and Durability Concerns

Increasing Demand for High-Efficiency Solar Solutions

Integration with Emerging Solar Markets

Technological Integration and Manufacturing Scalability

Competition from Established Solar Technologies

The tandem solar cell market is segmented into material type, technology, application, and region. Based on material type, the market is classified into perovskite-based tandem cells, silicon-based tandem cells, CIGS-based tandem cells (Copper Indium Gallium Selenide), organic tandem solar cells and Others. Based on technology, the market is classified into two-terminal tandem solar cells, four-terminal tandem solar cells and three-terminal tandem solar cells. Based on application, the market is classified into residential, commercial, utility-scale and specialized applications.

Perovskite-based tandem cells are currently the dominant segment in the tandem solar cell market due to their remarkable efficiency and cost-effectiveness. Perovskite materials have a broad absorption spectrum and high efficiency, with some tandem cells exceeding 30% efficiency. This has drawn significant investment and research, positioning perovskite-based cells as the market leader. Moreover, their relatively low production costs and high scalability make them highly attractive for mass production. Companies like Oxford PV have led this sub-segment, and perovskite-based tandem cells are expected to account for a significant market share in the coming years.

| Material Type | Revenue Share, 2024 (%) |

| Perovskite-based Tandem Cells | 40% |

| Silicon-based Tandem Cells | 30% |

| CIGS-based Tandem Cells (Copper Indium Gallium Selenide) | 15% |

| Organic Tandem Solar Cells | 10% |

| Others | 5% |

Silicon-based tandem cells are seeing rapid growth due to their compatibility with existing silicon solar infrastructure, making them easier to integrate into current solar panel manufacturing processes. While their efficiency is slightly lower than perovskite cells, silicon-based tandem cells offer improved energy conversion rates over traditional single-junction cells, thus driving their growth. The adoption of silicon-based tandem technology by companies such as LONGi Solar and Trina Solar contributes to this rapid expansion.

Two-terminal tandem solar cells dominate the technology segment due to their simpler design and ability to integrate two materials in a series, enhancing the overall energy conversion efficiency. These cells are cost-effective and scalable for commercial production. Their popularity is driven by their ability to deliver high efficiency while maintaining a relatively simple structure compared to other multi-terminal configurations. Companies like Oxford PV and JinkoSolar are heavily investing in this technology.

Four-terminal tandem solar cells are the fastest-growing technology segment due to their flexibility in incorporating independent sub-cells, each optimized for a different part of the solar spectrum. This flexibility enables higher overall efficiency and better performance under varying sunlight conditions. While more complex and costly to produce, the potential for higher power conversion efficiency makes this technology increasingly attractive for utility-scale applications. Companies like First Solar are exploring this advanced technology to push efficiency boundaries.

The utility-scale application of tandem solar cells is currently the largest segment, as the demand for high-efficiency, large-scale energy solutions grows globally. Tandem solar cells offer superior energy output in confined spaces, making them ideal for large solar farms, where maximizing energy generation per square meter is crucial. As solar power becomes more integrated into national grids and as utility companies seek more efficient technologies, tandem solar cells are set to dominate this sector. Companies like Trina Solar and LONGi Solar are focusing on utility-scale projects to maximize their market share.

The residential application segment is experiencing rapid growth due to increasing consumer demand for clean and efficient energy solutions. Tandem solar cells higher efficiency means that homeowners can generate more power from smaller rooftops, making them an attractive option for residential solar installations. Additionally, government incentives and falling installation costs are driving adoption in this segment. Companies like SunPower and Canadian Solar are seeing strong demand from residential customers, driving the growth of this segment.

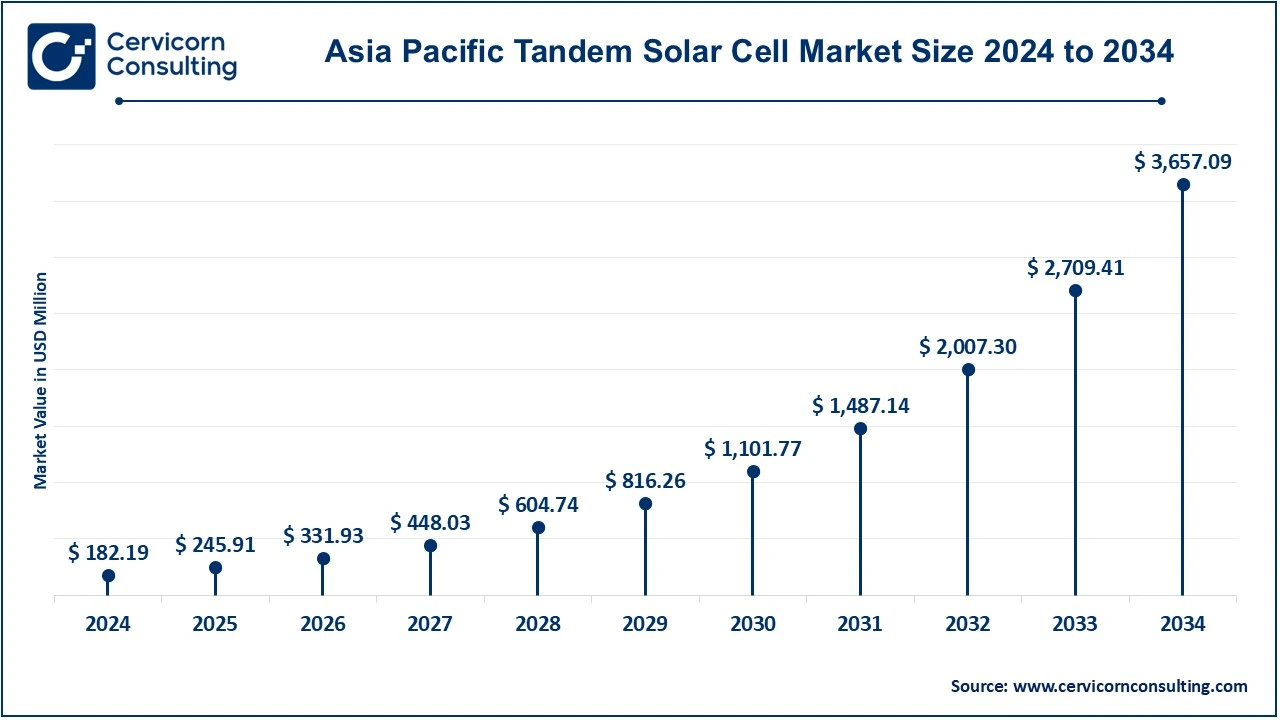

The Asia-Pacific tandem solar cell market size was valued at USD 182.19 million in 2024 and is expected to reach around USD 3,657.09 million by 2034. The Asia-Pacific (APAC) region dominates the market, and it is the fastest-growing region for tandem solar cells. This growth is driven by rapidly increasing energy demands, growing environmental awareness, and the region’s leadership in solar panel manufacturing. Countries like China, India, and Japan are heavily investing in advanced solar technologies, including tandem solar cells, to meet their renewable energy targets. APAC is expanding rapidly, making it the fastest-growing region in the market.

The North America tandem solar cell market size was estimated at USD 136.64 million in 2024 and is projected to hit around USD 2,742.82 million by 2034. North America market growth is driven by strong government support, growing demand for clean energy solutions, and technological advancements in solar power. The U.S., in particular, is one of the largest markets for solar energy, with states like California leading the way in adopting high-efficiency solar technologies. The region continues to grow due to favorable policies and technological advancements. While North America is a major player, it is not the fastest-growing region.

The Europe tandem solar cell market size was accounted for USD 113.87 million in 2024 and is predicted to surpass around USD 2,285.68 million by 2034. The Europe region is characterized by a strong commitment to renewable energy and sustainability, with the European Union setting ambitious goals to reduce carbon emissions. This is driving the demand for more efficient solar technologies like tandem solar cells. Countries such as Germany, the Netherlands, and the UK are investing heavily in R&D and commercializing tandem solar cell technology. While Europe's growth is steady, it is not the fastest-growing compared to APAC.

The LAMEA tandem solar cell market size was valued at USD 22.77 million in 2024 and is expected to be worth around USD 457.14 million by 2034. The LAMEA region holds a smaller market share. However, it is emerging as a growing market due to increasing energy demand and the need for sustainable solutions in regions like the Middle East, South America, and Africa. The Middle East is focusing on renewable energy as part of its Vision 2030, and countries like Saudi Arabia and the UAE are investing in solar technologies, including tandem cells. Latin America is also seeing increased interest in solar energy due to high levels of solar irradiance. LAMEA is poised for rapid growth in the coming years.

Tandem solar cell companies are leading the charge in advancing solar technology by integrating multiple layers of materials, such as perovskite and silicon, to enhance efficiency beyond traditional single-junction cells. Companies like Oxford PV, LONGi Solar, and Trina Solar are investing heavily in research and development to push the boundaries of solar cell efficiency, with some achieving efficiencies over 30%.

Players like Heliatek and First Solar are focusing on integrating organic photovoltaics and thin-film technologies with perovskite layers to improve scalability and reduce manufacturing costs. JinkoSolar and Canadian Solar are also exploring tandem cell integration with their existing product lines, aiming to capture a larger market share in the high-efficiency segment. Many of these companies are securing substantial investments ranging from USD 5 million to USD 30 million to commercialise tandem technology, scale production, and improve stability. The industry is poised for significant growth as tandem solar cells offer higher energy output per square meter, making them an attractive solution for both commercial and residential applications.

Market Segmentation

By Material Type

By Technology

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Tandem Solar Cell

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Material Type Overview

2.2.2 By Technology Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Technological Advancements and Efficiency Gains

4.1.1.2 Government Incentives and Renewable Energy Policies

4.1.2 Market Restraints

4.1.2.1 High Manufacturing Costs

4.1.2.2 Material Stability and Durability Concerns

4.1.3 Market Challenges

4.1.3.1 Technological Integration and Manufacturing Scalability

4.1.3.2 Competition from Established Solar Technologies

4.1.4 Market Opportunities

4.1.4.1 Increasing Demand for High-Efficiency Solar Solutions

4.1.4.2 Integration with Emerging Solar Markets

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Tandem Solar Cell Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Tandem Solar Cell Market, By Material Type

6.1 Global Tandem Solar Cell Market Snapshot, By Material Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Perovskite-based Tandem Cells

6.1.1.2 Silicon-based Tandem Cells

6.1.1.3 CIGS-based Tandem Cells (Copper Indium Gallium Selenide)

6.1.1.4 Organic Tandem Solar Cells

6.1.1.5 Others (e.g., quantum dots, III-V semiconductors like GaAs)

Chapter 7. Tandem Solar Cell Market, By Technology

7.1 Global Tandem Solar Cell Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Two-terminal Tandem Solar Cells

7.1.1.2 Four-terminal Tandem Solar Cells

7.1.1.3 Three-terminal Tandem Solar Cells

Chapter 8. Tandem Solar Cell Market, By Application

8.1 Global Tandem Solar Cell Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Residential

8.1.1.2 Commercial

8.1.1.3 Utility-scale

8.1.1.4 Specialized Applications

Chapter 9. Tandem Solar Cell Market, By Region

9.1 Overview

9.2 Tandem Solar Cell Market Revenue Share, By Region 2024 (%)

9.3 Global Tandem Solar Cell Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Tandem Solar Cell Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Tandem Solar Cell Market, By Country

9.5.4 UK

9.5.4.1 UK Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Tandem Solar Cell Market, By Country

9.6.4 China

9.6.4.1 China Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Tandem Solar Cell Market, By Country

9.7.4 GCC

9.7.4.1 GCC Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Tandem Solar Cell Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Oxford PV

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 LONGi Solar

11.3 Trina Solar

11.4 Heliatek

11.5 First Solar

11.6 JinkoSolar

11.7 Canadian Solar

11.8 SunPower

11.9 Solar Frontier

11.10 Q CELLS

11.11 Peccell Technologies