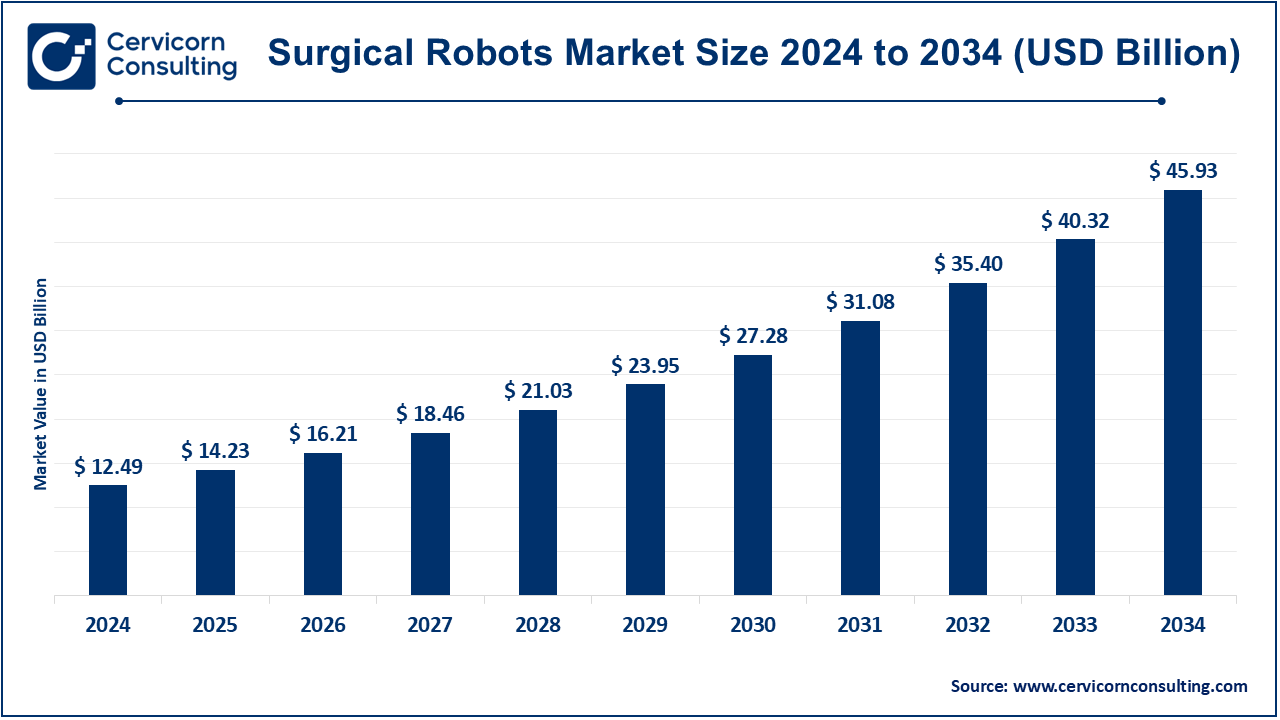

The global surgical robotics market size is evaluated at USD 12.49 billion in 2025 and is forecasted to hit around USD 45.93 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.9% over the forecast period 2025 to 2034. FDA approvals continue to be on the rise, and the applications of robot-assisted surgery are expanding to orthopedic, general, and urological surgeries while requiring precision in complex procedures. Continuous innovations by key players Intuitive Surgical, Medtronic, and CMR Surgical enhance robot-assisted surgical capabilities with the introduction of autonomous robotic systems and AI-driven robot interventions- both of these are fast-changing the industry. The increased geriatric population and escalating prevalence of chronic diseases demand surgical interventions and thereby increase robotic adoption. North America is leading, but the Asia-Pacific region will evolve as the fastest giant market due to rising healthcare investments and advancements in robotic technology.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 12.49 Billion |

| Expected Market Size in 2034 | USD 45.93 Billion |

| Projected CAGR 2025 to 2034 | 13.9% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Product Type, Application, End-User, Regions |

| Key Companies | Intuitive Surgical, Inc. (US), Stryker Corporation (US), Medtronic plc (Ireland), Smith & Nephew plc (UK), Zimmer Biomet Holdings, Inc. (US), Johnson & Johnson (US), CMR Surgical (UK), Renishaw plc (UK), Asensus Surgical (US), Think Surgical, Inc. (US), Auris Health, Inc. (US), Mazor Robotics Ltd. (Israel), TransEnterix Surgical, Inc. (US), Corindus Vascular Robotics, Inc. (US), Titan Medical Inc. (Canada) |

Demand for Minimally Invasive Surgeries Is Increasing

Technological Advancements

High Initial Cost of Surgical Robots

Limited Availability of Skilled Professionals

Expanding in Emerging Markets

AI and Automation Integration

Regulatory Approvals and Compliance

Cybersecurity Risks

Surgical Robotic Systems: Surgical robotic systems are the heart of this market, providing operational control, flexibility, and, ultimately, a better patient outcome. Such systems assist the surgeons in performing difficult surgeries with limiting invasiveness, which leads to a decrease in hospital stay and recovery time. Intuitive Surgical’s Da Vinci system is the leading segment by far. Other key players, such as Medtronic, Stryker, and Johnson & Johnson, are gradually standing their ground. The development of these systems demands high costs on the part of the hospital and training for the surgeons but is equally creating more opportunities in advanced healthcare facilities.

Instruments & Accessories: This segment consists of robotic arms, end-effectors, and surgical tools used in the robotic-assisted procedures. Unlike surgical systems, these components require replacement and generate a steady income. Demand is rising due to the growing number of robotic surgeries performed annually. Instrument manufacturers provide individual customization for different surgeries to enhance precision and reduce the risks of surgery. Nevertheless, the challenges to market expansion are stringent regulatory approvals and high costs. The industry will achieve further growth via new technical enhancements, such as haptic feedback improvements and AI-assisted instruments. It is a competitive segment due to continuous advances in design, materials, and function.

Services: The service segment comprises installation, maintenance, training, and software support of robotic systems. Surgical robots are high-investment products, and hence, after-sales support and training become very essential for hospitals and clinics. These companies do offer a service contract to ensure the performance of the systems for effective operation. It is a steadily growing segment where hospitals are focusing on long-term maintenance rather than replacement of the system. Training programs are widening, becoming custom-made with the type of procedure. AI-driven remote support and solutions for predictive maintenance would be key trends in this area, reducing system downtime. The biggest challenge remains the cost burden on hospitals, especially in developing markets.

General Surgery: General surgery is one of the biggest application areas for surgical robots. Robotic-assisted laparoscopy is used for hernia repair, gall bladder removal, and bariatric surgery. Hospitals prefer robot systems for better precision, lesser complications, and shorter recovery. Intuitive Surgical and Medtronic are the leading companies in this area. The major challenge is making these robotic systems cost-effective for their widespread use. However, with a higher demand for minimally invasive surgeries along with better capabilities of robotics, such as real-time tissue sensing and AI navigation, growth is anticipated.

Orthopedic Surgery: Robotic-assisted orthopedic procedures like knee and hip replacements garner more acceptance due to accuracy and improved patient outcomes. Stryker's Mako and Zimmer Biomet's Rosa® are important players in this segment. These systems help surgeons plan the procedure in a 3D environment for precise implant placement. The market is propelled by an increasing elderly population and growing cases of osteoarthritis. On the contrary, the high cost of robotic systems acts as a barrier to smaller hospitals for adoption. The future includes AI-assisted pre-surgical planning and robotic automation of complex bone surgeries.

Neurosurgery: Robotic-assisted neurosurgery is important for high precision in procedures involving the brain and spine, with reduced risk in fragile surgeries. Medtronic's Mazor X and Zimmer Biomet's Rosa Brain minimally invade in spinal fusion and tumor removal. This segment is growing with the demand for precision in neurosurgical interventions growing. However, advanced training required for the complex nature of neurosurgical procedures will limit adoption. AI-assisted robot navigation and real-time brain mapping for in-situ accuracy are outlines for future trends. An increase in research regarding robotic assistance in deep brain stimulation for treating Parkinson's disease and epilepsy also stimulates market growth.

Gynecological Surgery: Robotic assistance is popular in gynecological surgery for hysterectomies, endometriosis treatment, and fibroid removal. The Da Vinci system is the major product line in this segment that allows the surgeon better dexterity for minimally invasive procedures. The growing incidence of gynecological disorders and increased awareness about robotic surgery benefits stimulate market growth. High procedural costs and limited access to smaller healthcare facilities present challenges. Future innovations are targeted at miniaturized robotic systems for outpatient procedures and AI-assisted decision-making for personalized surgical approaches.

Urological Surgery: Robotic-assisted urological surgeries like prostatectomies and kidney surgeries are gaining popularity due to their accuracy and efficiency while reducing patient risks. Widely used in this domain, the Da Vinci system ensures surgical accuracy while reducing recovery time. Increased incidence of prostate and kidney cancers has driven the market. However, accessibility in smaller hospitals remains a challenge. The future of the segment is AI-enhanced robotic tools and haptic feedback systems, both of which will fine-tune surgeon control and broaden procedural capability.

Others Surgery: Only surgical robots have gained a foothold in surgery where accuracy means everything: In areas of cardiothoracic, colorectal, and bariatric surgery. Cardiothoracic applications involve robotic-assisted replacements of valves and bypasses of arteries with lesser trauma to the patient. Enhanced visualization and precise dissection are the guiding lights for colorectal interventions. Bariatrics gastric bypass interventions are an area where robotic systems are gaining traction for better patient outcomes. The segment should see increased traction with the growing adoption of these technologies and the burgeoning demand for minimally invasive surgeries. The downside remains the cost of training.

The surgical robots Mmarket is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

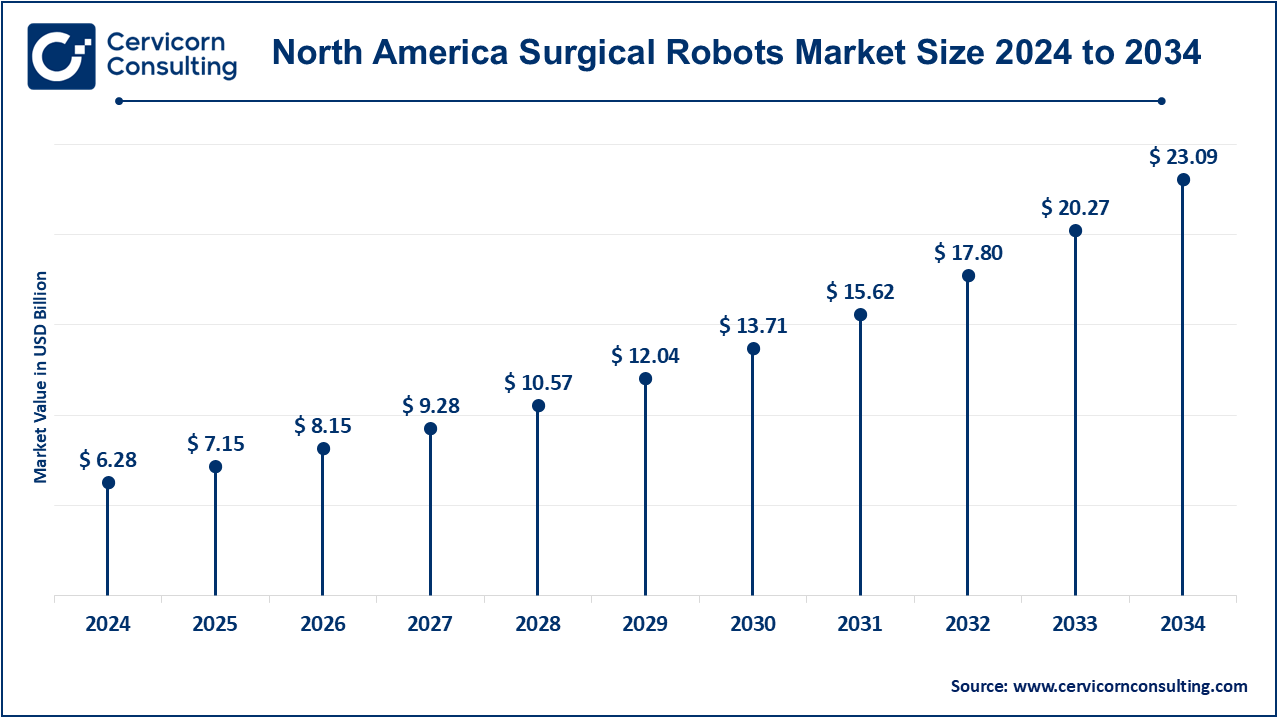

The North America surgical robotics market size was estimated at USD 6.28 billion in 2024 and is projected to hit around USD 23.09 billion by 2034. North America has set the pace in the market, buoyed by state-of-the-art healthcare infrastructure, impressive R&D expenditure, and extremely high acceptance of robotic-assisted surgeries. The U.S. states the scenario with the presence of major players such as Intuitive Surgical and Stryker. Also, favorable reimbursement policies and the high demand for minimally invasive procedures support the market; on the flip side, regulatory hurdles and costs can restrict growth. Future trends would include AI-assisted surgical robots, one of the highest-growth automated systems, and the advancement of robotic training programs.

The Europe surgical robotics market size was valued at USD 2.8 billion in 2024 and is estimated to reach around USD 10.3 billion by 2034. With Germany, France, and the UK being strong hold markets, Europe constitutes a major market. The growth of this market is fueled by support from the government for robotic surgery and a focus on innovations in healthcare. However, cost constraints discourage some adoption across regions. There are partnerships between healthcare institutions and robotics companies to improve training and accessibility throughout Europe. In the future, we foresee an increase in AI input and cloud-based robotic platforms for surgery.

The Asia Pacific surgical robotics market size was reached at USD 2.34 billion in 2024 and is forecasted to hit around USD 8.59 billion by 2034. The Asia-Pacific region is the fastest-growing region owing to increasing investments in healthcare in China, Japan, and India. Increased medical tourism, increased awareness, and increased infrastructural development have opened pathways for market expansion. On the contrary, the costs involved and a lack of specialized training have severely limited this development. Planned future developments include the establishment of an in-house robotic system manufacturer, government encouragement for adopting robotic surgery, and AI-controlled robotic systems designed and built to suit the peculiar needs of the healthcare sector in that region.

Surgical robotics Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 50.27% |

| Europe | 22.42% |

| Asia-Pacific | 18.7% |

| LAMEA | 8.61% |

The LAMEA surgical robotics market size was valued at USD 1.08 billion in 2024 and is anticipated to reach around USD 3.95 billion by 2034. These are the fast-growing markets for surgical robots because of increased investment in healthcare modernization. Brazil, Mexico, and Saudi Arabia are key markets due to the increasing hospital network therein. However, high costs and lack of expertise are barriers to the widespread adoption of these technologies. In the future, business development might depend on cost-effective robotic solutions and programs for training surgical skills.

CEO Statements

Intuitive Surgical (CEO: Gary Guthart)

Stryker (CEO: Kevin Lobo)

Medtronic (CEO: Geoff Martha)

Market Segmentation

By Product Type

By Application

By End-User

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Surgical Robots

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Application Overview

2.2.3 By End-User Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Surgical Robots Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Demand for Minimally Invasive Surgeries Is Increasing

4.1.1.2 Technological Advancements

4.1.2 Market Restraints

4.1.2.1 High Initial Cost of Surgical Robots

4.1.2.2 Limited Availability of Skilled Professionals

4.1.3 Market Opportunity

4.1.3.1 Expanding in Emerging Markets

4.1.3.2 AI and Automation Integration

4.1.4 Market Challenges

4.1.4.1 Regulatory Approvals and Compliance

4.1.4.2 Cybersecurity Risks

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Surgical Robots Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Surgical Robots Market, By Product Type

6.1 Global Surgical Robots Market Snapshot, By Product Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Surgical Robotic Systems

6.1.1.2 Instruments & Accessories

6.1.1.3 Services

Chapter 7 Surgical Robots Market, By Application

7.1 Global Surgical Robots Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 General Surgery

7.1.1.2 Orthopedic Surgery

7.1.1.3 Neurosurgery

7.1.1.4 Gynecological Surgery

7.1.1.5 Urological Surgery

7.1.1.6 Others

Chapter 8 Surgical Robots Market, By End-User

8.1 Global Surgical Robots Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

8.1.1.1 Hospitals

8.1.1.2 Ambulatory Surgical Centers (ASCs)

8.1.1.3 Specialty Clinics

Chapter 9 Surgical Robots Market, By Region

9.1 Overview

9.2 Surgical Robots Market Revenue Share, By Region 2023 (%)

9.3 Global Surgical Robots Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Surgical Robots Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Surgical Robots Market, By Country

9.5.4 UK

9.5.4.1 UK Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Surgical Robots Market, By Country

9.6.4 China

9.6.4.1 China Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Surgical Robots Market, By Country

9.7.4 GCC

9.7.4.1 GCC Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Surgical Robots Market Revenue, 2021-2033 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2021-2023

10.1.3 Competitive Analysis By Revenue, 2021-2023

10.2 Recent Developments by the Market Contributors (2023)

Chapter 11 Company Profiles

11.1 Intuitive Surgical, Inc. (US)

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Stryker Corporation (US)

11.3 Medtronic plc (Ireland)

11.4 Smith & Nephew plc (UK)

11.5 Zimmer Biomet Holdings, Inc. (US)

11.6 Johnson & Johnson (US)

11.7 CMR Surgical (UK)

11.8 Renishaw plc (UK)

11.9 Asensus Surgical (US)

11.10 Think Surgical, Inc. (US)