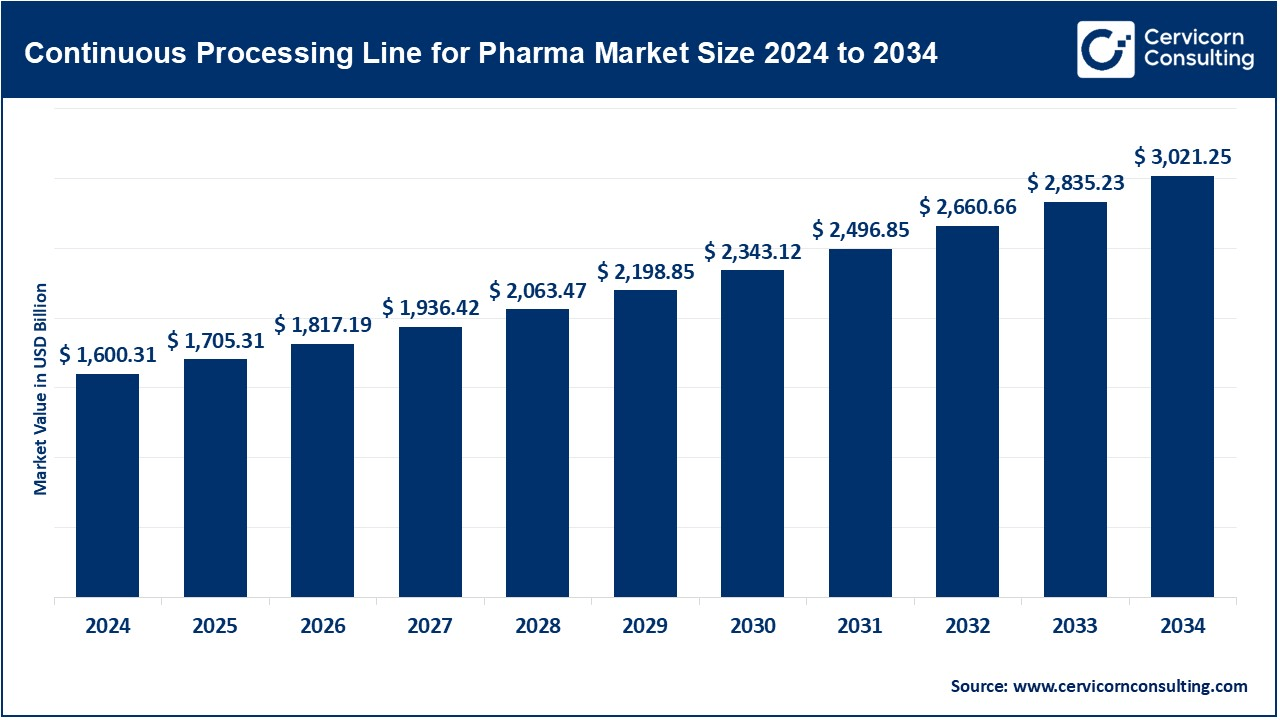

The global continuous processing lines for pharma market size was valued at USD 1,600.31 billion in 2024 and is expected to be worth around USD 3,021.25 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.56% over the forecast period from 2025 to 2034. The accelerated growth of the market for continuous processing lines for the pharmaceutical industry is influenced by a need for pharmaceutical manufacturing processes that are more efficient, cost-effective, and scalable. Continuous manufacturing lines enable improved product quality and shorter manufacturing times with the increasing demand for biologics, gene therapies, and personalized medicine: approval shifts in favor of continuous processing and in the automation realm are encouraging this transition. The pharmaceutical industry's approach for small batch sizes and greater flexibility in production is driving the uptake of continuous processing lines further.

Continuous processing lines for pharma are production systems that enable the uninterrupted manufacturing of pharmaceutical products, especially in the production of complex drugs such as biologics and vaccines. Unlike traditional batch processing, continuous processing allows for a steady flow of raw materials through the production line, reducing manufacturing time and costs. This method improves product consistency, enhances efficiency, and supports real-time monitoring. It’s particularly beneficial for scaling up production and meeting the increasing demand for personalized and high-quality pharmaceutical products while maintaining compliance with stringent regulatory standards.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 1705.31 Billion |

| Expected Market Size in 2034 | USD 3021.25 Billion |

| Projected Market CAGR | 6.56% |

| Dominant Region | North America |

| Fast Growing Region | Asia-Pacific |

| Key Segments | Type of Equipment, Application, End User, Region |

| Key Companies | ACG Engineering, Antares Vision Group, BOSCH Packaging Technology, Bühler Group, Fette Compacting, GEA Group, Glatt Group, IMA Pharma, KORSCH AG, Robert Bosch GmbH, Romaco Group, Sartorius AG, Syntegon Technology GmbH, Truking Technology Limited |

Contract Manufacturing Organizations (CMOs): A third-party service provider of pharmaceutical product manufacturing for another entity is termed a Contract Manufacturing Organization (CMO). However, CMOs have been known to vary in services, such as drug development, formulation, packaging, and continuous production. For CMOs, the implementation of continuous processing lines allows them to handle various pharmaceutical products at different scales of production while making it more efficient in operation. Continuous manufacturing lines assist CMOs in meeting numerous client production demands. This can be accomplished at greater speeds and at lower costs.

Pharmaceutical Companies: Pharmaceutical companies, large-scale and small-to-medium, are embracing continuous processing lines due to the ever-increasing global demand for pharmaceutical products. With continuous processing, pharmaceutical companies get reduced production time, increased throughput, and higher quality of product. Pharmaceutical companies investing in continuous manufacturing systems ensure their production lines become more adaptable, scalable, and cost-effective. This enables them to stay competitive with very high quality and meeting tight regulatory standards.

The continuous processing lines for pharma market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

North America is the biggest market for continuous processing lines, mainly led by the United States and Canada. Big pharma in the U.S. likes that there already is a regulatory infrastructure in place, such as FDA guidelines, for continuous manufacturing. For instance, as of May 2023, Biopharmaceutical manufacturing companies grew considerably with regard to their economic impact, are spread all over the United States, and there is a huge interest in having powerful supply chains to help achieve access to lifesaving treatments for the first time ever. These have taken this growth even faster since 2020 with accelerated demand for innovative treatment options and stake in local production capacity. This growth not only increases the contribution of local economies but also reinforces the overall health care infrastructure as important drugs will remain available for all patients in the country. High emphasis on technology development, and increasing need for efficient methods of production, has caused continuous processing in the pharmaceutical sector to rise rapidly in this region.

The other critical region for the introduction of continuous processing lines is Europe, particularly Germany, the UK, France, and Switzerland. Further support for the regulation by the European Union, especially the EMA, contributed to the uptake of continuous manufacturing. High-quality, high-demanding pharmaceutical products combined with cutting-edge technological capabilities in the region create an innovation hub for pharma manufacturing. For instance, on the new solid pharmaceutical production solutions that are due to be launched in July of 2022, Syntegon will offer a portfolio of technologies such as the Solidlab 2 Plus fluid bed laboratory unit and the TPR 200 Plus tablet press, so that research can be easily translated into production. These innovations are going to increase efficiency and pave the way for more demanding solid dosage forms, furthering Syntegon's commitment toward the support of pharmaceutical manufacturers making medicines efficiently.

The pharmaceutical industry in the Asia-Pacific, with countries like China, Japan, India, and South Korea, is witnessing fast growth. It is largely because of large populations and growing health care needs. For example, in October 2024, SK Pharmteco invested USD 260 million to establish a new facility for small molecule production that will come on stream by the end of 2026. The 135,800-square-foot facility will offer 300 jobs and include eight production trains, which can produce tens of metric tons a year. The investment is part of the strategy to increase small molecules capacity around the world at a time when bottlenecks in supply chains are appearing with the rise in demand and complexity. The investment is in line with SK pharmteco's strategy to enhance turnaround times and service offerings in the biopharmaceutical sector. Continuous processing lines are also being adopted more and more to meet the increased demand for medicines, especially in emerging markets.

LAMEA refers to Latin America, the Middle East, and Africa. This region is gradually moving towards continuous pharma manufacturing. Brazil, Mexico, Saudi Arabia, and South Africa have started adapting modern technologies for drug manufacturing. The main drawback of this region is regulatory complexities and infrastructure. This region is witnessing the emergence of an increasing pharmaceutical market as well as healthcare needs. For example, USAID collaborated with a pharmaceutical firm based in South Africa, for the latter's transfer technology process of this novel rifapentine production, an essential API for the treatment of TB which was transferred back in March 2024. This forms part of the PQM+ program that applies continuous manufacturing in reducing the cost of production and efficiency maximization. It is aiming to increase global access to TB medicines and to support targets set by the global TB community to eradicate the disease as a public health threat by 2030.

CEO Statements

Marcus Michel, CEO of ACG Engineering

"At ACG Engineering, we believe that continuous processing lines represent the future of pharmaceutical manufacturing. By leveraging cutting-edge technologies and innovative solutions, we are enabling our clients to enhance production efficiency, reduce costs, and maintain the highest standards of quality. The shift to continuous manufacturing not only meets the growing demand for faster drug production but also supports sustainability and operational scalability in an increasingly competitive global market."

Michael Grosse, CEO of BOSCH Packaging Technology

"At Bosch Packaging Technology, we recognize that continuous processing is a transformative step towards a more efficient, scalable, and sustainable pharmaceutical manufacturing process. Our commitment to providing state-of-the-art technology solutions allows pharmaceutical manufacturers to streamline production, reduce time-to-market, and maintain consistent product quality. We are excited to be at the forefront of this evolution, helping our customers adapt to the growing demand for more flexible and efficient manufacturing systems."

Alberto Vacchi, CEO of IMA Pharm

"At IMA Pharma, we are committed to revolutionizing pharmaceutical manufacturing through continuous processing technology. By providing integrated, flexible solutions, we help our customers enhance efficiency, ensure product consistency, and meet the evolving demands of the global pharmaceutical market. Continuous manufacturing not only drives productivity but also contributes to sustainability by minimizing waste and reducing energy consumption—critical factors as the industry moves towards a more sustainable future."

Market Segmentation

By Type of Equipment

By Application

By End User

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Continuous Processing Lines for Pharma

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type of Equipment Overview

2.2.2 By Application Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 High demand for quick-moving pharmaceutical products

4.1.1.2 Increasing regulatory support for continuous manufacturing

4.1.1.3 Advances in drug formulation technologies

4.1.2 Market Restraints

4.1.2.1 High initial investment costs for continuous systems

4.1.2.2 Limited scalability to SMEs

4.1.3 Market Challenges

4.1.3.1 Complexity in implementing continuous systems

4.1.3.2 Long period for capital recovery in continuous systems investments

4.1.4 Market Opportunities

4.1.4.1 Continuous production lines of biologics

4.1.4.2 Partnership with technology companies and research organizations

4.1.4.3 Positive regulatory changes supporting continuous manufacturing

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Continuous Processing Lines for Pharma Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Continuous Processing Lines for Pharma Market, By Type of Equipment

6.1 Global Continuous Processing Lines for Pharma Market Snapshot, By Type of Equipment

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Capsule Filling Line

6.1.1.2 Granulation Line

6.1.1.3 Tablet Coating Line

Chapter 7. Continuous Processing Lines for Pharma Market, By Application

7.1 Global Continuous Processing Lines for Pharma Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Liquid Dose Manufacturing

7.1.1.2 Semi-Solid Manufacturing

7.1.1.3 Solid Dose Manufacturing

Chapter 8. Continuous Processing Lines for Pharma Market, By End-User

8.1 Global Continuous Processing Lines for Pharma Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Contract Manufacturing Organizations (CMOs)

8.1.1.2 Pharmaceutical Companies

Chapter 9. Continuous Processing Lines for Pharma Market, By Region

9.1 Overview

9.2 Continuous Processing Lines for Pharma Market Revenue Share, By Region 2024 (%)

9.3 Global Continuous Processing Lines for Pharma Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Continuous Processing Lines for Pharma Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Continuous Processing Lines for Pharma Market, By Country

9.5.4 UK

9.5.4.1 UK Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Continuous Processing Lines for Pharma Market, By Country

9.6.4 China

9.6.4.1 China Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Continuous Processing Lines for Pharma Market, By Country

9.7.4 GCC

9.7.4.1 GCC Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Continuous Processing Lines for Pharma Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 ACG Engineering

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Antares Vision Group

11.3 BOSCH Packaging Technology

11.4 Bühler Group

11.5 Fette Compacting

11.6 GEA Group

11.7 Glatt Group

11.8 IMA Pharma

11.9 KORSCH AG

11.10 Robert Bosch GmbH

11.11 Romaco Group

11.12 Sartorius AG

11.13 Syntegon Technology GmbH

11.14 Truking Technology Limited