Turbo Trainer Market Size and Growth 2025 to 2034

The global turbo trainer market size was reached at USD 3.33 billion in 2024 and is expected to be worth around USD 5.31 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.77% from 2025 to 2034. The turbo trainer market has grown significantly due to increasing demand for indoor fitness solutions, particularly after the COVID-19 pandemic. The rise in smart fitness technology, advancements in interactive training apps, and a growing interest in cycling as a fitness trend are key factors driving this growth. More cyclists are shifting towards indoor training due to convenience, personalized workouts, and data-driven performance tracking.

Additionally, eSports cycling and virtual racing have contributed to the expansion of the market. Increased health consciousness, rising disposable income, and the popularity of home-based fitness solutions are fueling market demand. Manufacturers are focusing on innovative features like realistic road feel, wireless connectivity, and AI-powered coaching to attract users. The market is also benefiting from collaborations between cycling brands and fitness platforms, making indoor cycling more immersive and engaging.

What is a Turbo Trainer?

A turbo trainer is a device that allows cyclists to ride their bikes indoors by mounting the rear wheel or attaching the bike frame to a resistance unit. It simulates real-road cycling conditions and is widely used for training, warming up before races, and maintaining fitness during bad weather. Turbo trainers come in different types, including wheel-on trainers, where the rear wheel sits on a roller, and direct-drive trainers, where the rear wheel is removed, and the bike is mounted directly to the resistance unit. Modern turbo trainers include smart trainers that connect to cycling apps like Zwift, TrainerRoad, and Rouvy, offering real-time resistance adjustments based on virtual terrain. They provide data tracking such as power output, cadence, and heart rate, helping cyclists optimize their workouts.

Key insights beneficial to the turbo trainer market

- Increased Adoption: The usage of turbo trainers surged by 40% post-COVID-19 due to lockdown restrictions and remote fitness trends.

- Smart Trainer Growth: Smart turbo trainers accounted for over 60% of the market share, reflecting a shift towards app-connected training.

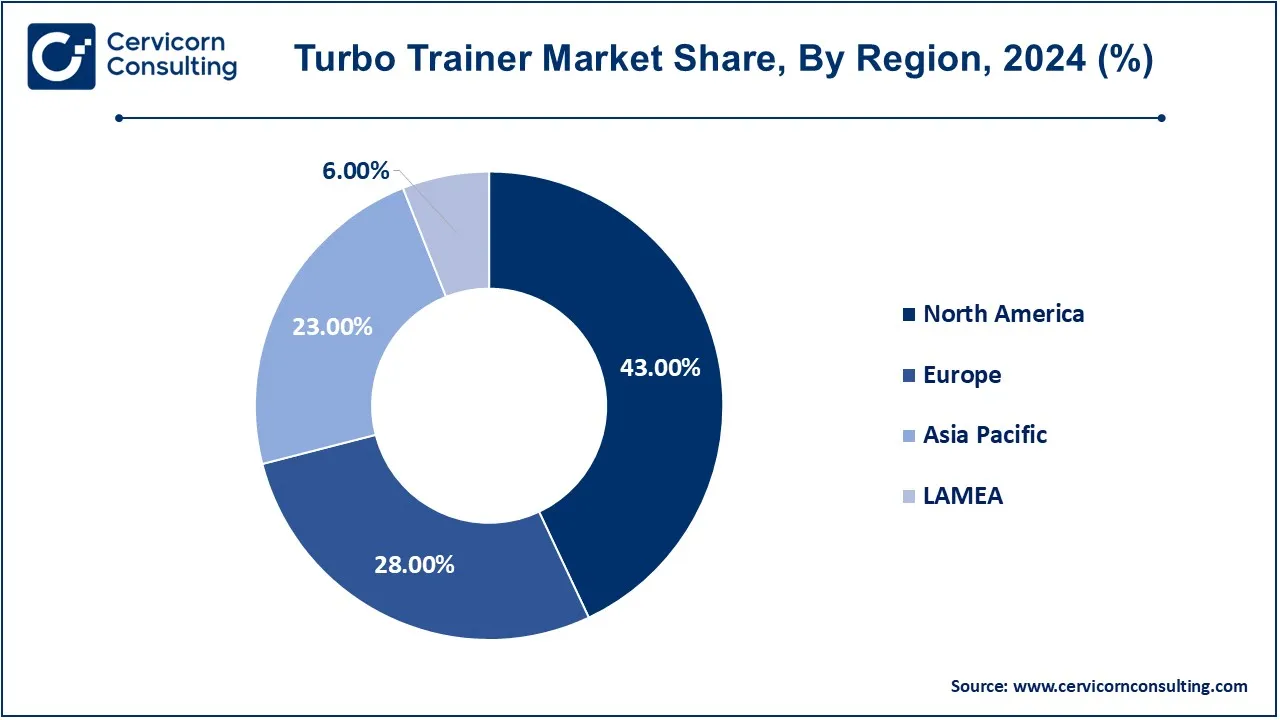

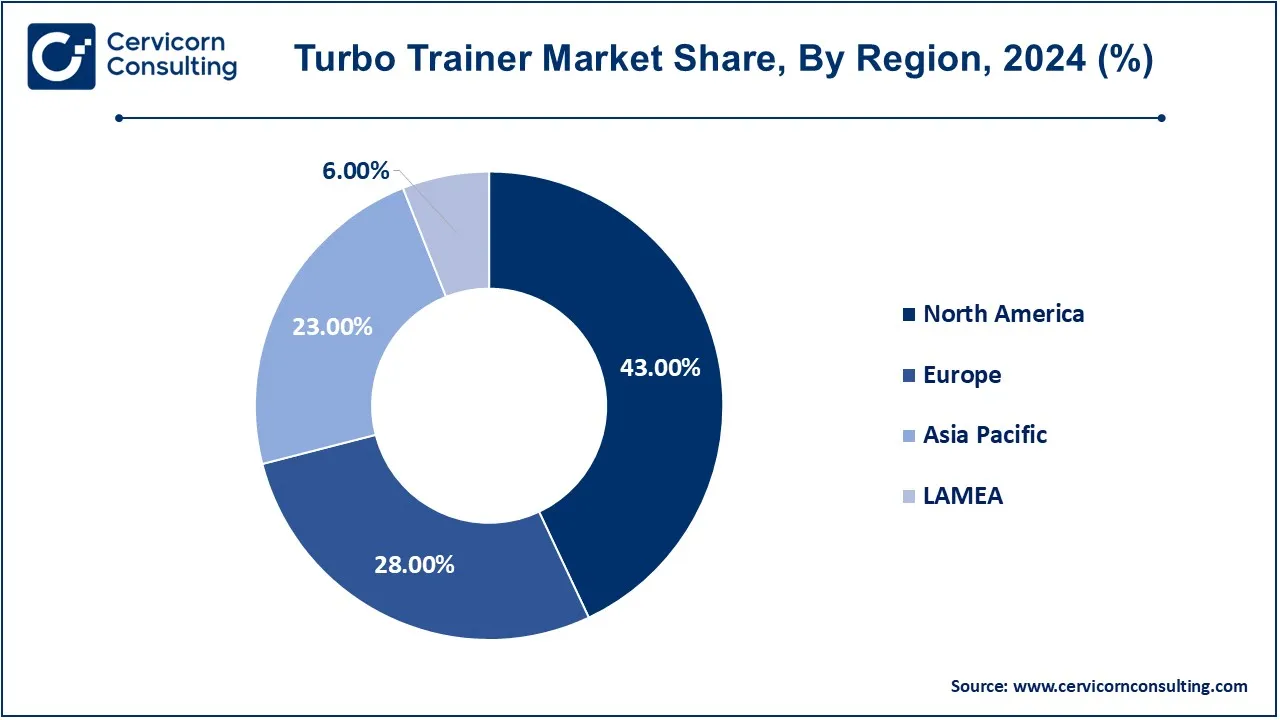

- Regional Expansion: Europe and North America lead the market, with Asia-Pacific showing rapid growth due to increasing health awareness.

- Consumer Spending: The average spending on smart trainers has increased by 25% in the past 3 years, driven by premium models.

Report Highlights

- The North America region has lead the market in 2024 with revenue share of 43%.

- The Europe has accounted for 28% of the total revenue share in 2024.

- By product, the direct drive turbo trainers segment has accounted revenue share of 60% in 2024.

- By resistance mechanism, the electronic segment has recorded revenue share of 46% in 2024.

- By end user, the personal segment has recorded revenue share of 57% in 2024.

Turbo Trainer Market Growth Factors

- Growing Popularity of Indoor Cycling: The growing reputation of indoor cycling can be ascribed to its ease and flexibility. Most people have irritating schedules and prefer to have a training session at home when the climate gets worse. This pattern has prompted manufacturers to devise better quality more practicable rapid trainers that attract both weekend warriors and hard-core riders, which increases their market.

- Technological Advancements: New turbo trainer features, such as smart connection, enhanced resistance systems, and user-friendly interfaces, are drawing new customers. These advancements enable people to connect to fitness applications, review their numbers, and compete in virtual tournaments, making indoor riding more appealing.

- Focus on Multi-Use Fitness Equipment: People today expect versatile training equipment that may be used for a multitude of reasons while remaining economical. Turbo trainers can help with a range of fitness routines, making them suitable for riders who also do strength training or other exercises. This trend encourages customers to add turbo trainers into their fitness routines, which grows the market.

Turbo Trainer Market Trends

- Smart Trainers: Increasing popularity of smart trainers that talk to apps or devices, showing the trend toward more technology-intensive training apparatus. Smart trainers not only bring interactivity and real-time performance monitoring for the users but also virtual racing. This increases user engagement with all sorts of vivid training. The rise in demand, as well as pressure on the sales and competition for products, comes due to the quest for more vivid forms of training from trainers and riders themselves.

- Gamification: The most recent trends suggest that it would be the gamer's elements of challenges, rewards, and competition based on a leaderboard which will form the very core of the game that is turbo training. It makes the users go through their training sessions motivated to work out for greater durations with long workout sessions for better fitness results.

- Advanced Turbo Trainer User Interface: With the technological progress of user interface making, turbo trainers have become much more accessible and easier to use. Intuitive designs and interfaces combined with user-friendly control make the arrangement and operation easier. That is why beginners also find attraction in these products. Improved interfaces enhance the overall training experience, and customers may then focus on exercising instead of wasting too much time fiddling around with technology, thereby improving customer satisfaction and loyalty.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 3.49 Billion |

| Expected Market Size in 2034 |

USD 5.31 Billion |

| CAGR (2025 to 2034) |

4.77% |

| Superior Region |

North America |

| Rapidly Expanding Region |

Asia-Pacific |

| Key Segments |

Product, Resistance Mechanism, Interaction Type, Price Range, Usage, Distribution Channel, Region |

| Key Companies |

Technogym, Precor, Elite, Garmin Ltd, Kinetic, Minoura, Schwinn, CycleOps, Sunlite, BKOOL, RAD Cycle Products, Conquer, Blackburn Design |

Turbo Trainer Market Dynamics

Drivers

- Health and Fitness Consciousness: The greater the emphasis on health and exercising, the more they engage in physical activities, leading to increased demand for turbo trainer type of bicycles. As people become health-conscious, they look for easy and convenient ways to include exercise in their lifestyle. High sales of turbo trainers are recorded due to a greater interest in cycling as a low-intensity form of exercise.

- Time Constraints: People have to get so many things done in a day. Therefore, outdoor cycling may not be possible. The turbo trainer helps save on traveling time, and a great deal of at-home training can be done with it. Turbo trainers have gained popularity since people want to do quick and intense workouts during busy times of the day.

- The growth in online retail: Increased use of e-commerce allows consumers to buy exercise gear, turbo trainers for example, in a completely new way. Among other things, online platforms facilitate price comparison, comparison of the functions of side-by-side products, and reviews by other users. Consumers can look at trainers from their home comforts which increases market reach and easily choose models that even better respond to their needs.

Restraints

- High Price Initial Investment: The reason the premium turbo trainer is not possible for price-conscious consumers even though numerous models feature add-on technological advances is that they are pretty pricey. The price is a high barrier for casual cyclists to cross over, thus limiting growth in the market. It simply implies that customers will accept the cheapest option to their satisfaction, which again limits the sales taken to the front, hence limiting customer bases.

- Space Requirements: Turbo trainers at times demand a large, devoted space to set up and use. To a person dwelling in a house or an apartment who is space-constrained, this will be a significant limitation when deciding to purchase. If they do not have suitable space to store the equipment or room to exercise, they may not be open to the purchase. This would even more restrict its reach to a much larger audience.

- Niche Market: Turbo trainers are much more focused on core cyclists, although limited. Casual fitness fans or those who have never ridden a bike will not find much use in a trainer, so this is another significant challenge for the manufacturers looking to expand the base of their customers through marketing strategies aimed at attracting more general fitness enthusiasts.

Opportunities

- Increasing Demand for Low-Impact Training: Turbo trainers are the low-impact alternative to cycling outdoors, perfect for those who have joint issues or injuries or for those who just want a lighter workout. It is particularly popular among older adults or those on rehabilitation. With the increasing awareness of the advantages of low-impact training, manufacturers of turbo trainers can now penetrate a new market that focuses on keeping joints healthy but still fit cardio-wise.

- Technological Advancements in Trainer Resistance Systems: The latest in resistance technologies-which include both electromagnetic and fluid-based systems-promise cyclists more realistic indoor training. These newer systems provide better smooth transitions of resistance, simulating outdoor terrain much better, and they offer more precise measurements of power. Manufacturers will appeal to these cyclists who desire precision and an immersive and more effective training environment. This would, therefore increase the demand for high-performance turbo trainers.

- Environmental and Space-Saving Designs: With many people immigrating into small spaces, compact fitness solutions are in high demand. This compact fitness solution requirement will be best met by manufacturers who design foldable, quieter, and easier-to-store turbo trainers. Eco-friendly designs made from sustainable materials will also be trending with the eco-conscious customer. Portability combined with sustainability will target an emerging market of efficient, compact, and eco-friendly fitness.

Challenges

- Competition with Other Fitness Products: The turbo trainer faces stiff competition within the various fitness products like the stationary bike and treadmill which has been a very lucrative home gym setup. As such, many consumers will opt for alternative equipment that offers versatility. This kind of rivalry forces manufacturers into specialization and highlighting some unique features to give their product relevance in this packed arena of fitness.

- Technological Compatibility: Turbo trainers need to work well with hundreds of applications and equipment, which is very challenging. Consumers expect compatibility with some of the best-known fitness applications, and technological kinks are a simple route to frustration and dissatisfied consumers. Researchers and developers should be committed to research and development to make sure their products integrate seamlessly with emerging technologies to enhance user experience and loyalty.

- Consumer Education: Customer education on the benefits and use of turbo trainers is essential for market growth. Most consumers have never used a turbo trainer or realized its advantage in indoor cycling. Producers have to spend time in informing marketing techniques, tutorials, and customer support to demystify the product as the consumer will make informed decisions on buying and improve general market uptake.

Turbo Trainer Market Segmental Analysis

The turbo trainer market is segmented into product, resistance mechanism, interaction type, price range, usage, distribution channel and region. Based on product, the market is classified into direct drive turbo trainers and wheel-on turbo trainers. Based on resistance mechanism, the market is classified into electronic, fluid and magnetic. Based on interaction type, the market is classified into smart and standard. Based on price range, the market is classified into low, mid and high; Based on usage, the market is classified into personal, commercial, gyms, wellness centers and others. Based on distribution channel, the market is classified into online channels, e-commerce, company websites, offline channels, specialty stores, mega retails stores and others.

Product Analysis

Direct drive turbo trainers: Direct drive turbo trainers do not require a rear wheel since they hook up to the axle; they essentially mount on the back of the bike. Such a design is suitable for serious enthusiasts and competitive training purely on the account that it enhances stability as well as reduces possible power measurement errors - this would result in smoother resistance as well as less noisy operation. The reason that direct drive trainers are so popular with enthusiastic cyclists is their ease and compatibility with almost all types of bikes.

Turbo Trainer Market Revenue Share, By Product, 2024 (%)

| Product |

Revenue Share, 2024 (%) |

| Direct drive turbo trainers |

60% |

| Wheel-on turbo trainers |

40% |

Wheel-on turbo trainers: Wheel-on turbo trainer designs are more user-friendly and basic for beginners simply because they use the rear wheel as support. These types of trainers also tend to have a broader appeal since they're often cheaper and generally quicker to set up. Being easy to transport, plus easier still to just set up and go makes them suitable for anyone wanting to add indoor cycling into their exercise routine without spending too much or if not at a level where power-measurement accuracy matters too much.

Resistance Mechanism Analysis

Electronic: The electronic segment has dominated the market in 2024. Smart technology within electronic resistance turbo trainers alters resistance based on the performance of the user or the program being followed. This allows for more realistic conditions to be replicated and provides instant data through performance metrics during a more interactive form of training. They can also interlink with virtual rides and pre-set workouts through various cycling apps to enhance the workout further. These types of turbo trainers are increasingly being used by cyclists to help make indoor training a little more exciting as they do offer such flexibility and there is no manual setup required.

Fluid: Fluid resistance Turbo trainers make use of the fluid-filled sealed chamber in producing the resistance thus allows riders to have a smooth realistic feeling just like outdoors biking. The resistance graduates precisely with an increase in the pace of the cyclists thereby imitating cycling over the outdoors. Though fluid resistance systems are generally noisier than any other kind of resistance system, a more comprehensive workout is expected. As trainers in fluid form are very easy to use, they are also most preferred for cyclists who want to train indoors more effectively with a feeling of riding.

Turbo Trainer Market Revenue Share, By Resistance Mechanism, 2024 (%)

| Resistance Mechanism |

Revenue Share, 2024 (%) |

| Electronic |

46% |

| Fluid |

35% |

| Magnetic |

19% |

Magnetic: Magnetic resistance trainers use magnets to provide variable levels of resistance. This device allows a cyclist to personalize their workout. Because a user can vary the resistance settings manually, different training intensities can be achieved. Fluid or electrical trainers generally are more costly and harder to service than magnetic types. For example, while magnetic resistance trainers are unlikely to attain the quality of much more costly models, these trainers offer reliability and affordability to a broad group of exercise enthusiasts who are looking for an efficient indoor cycling solution.

Turbo Trainers Market Regional Analysis

The turbo trainers market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The North America region has dominated the market in 2024.

What factors contribute to North America's leadership in the turbo trainer market?

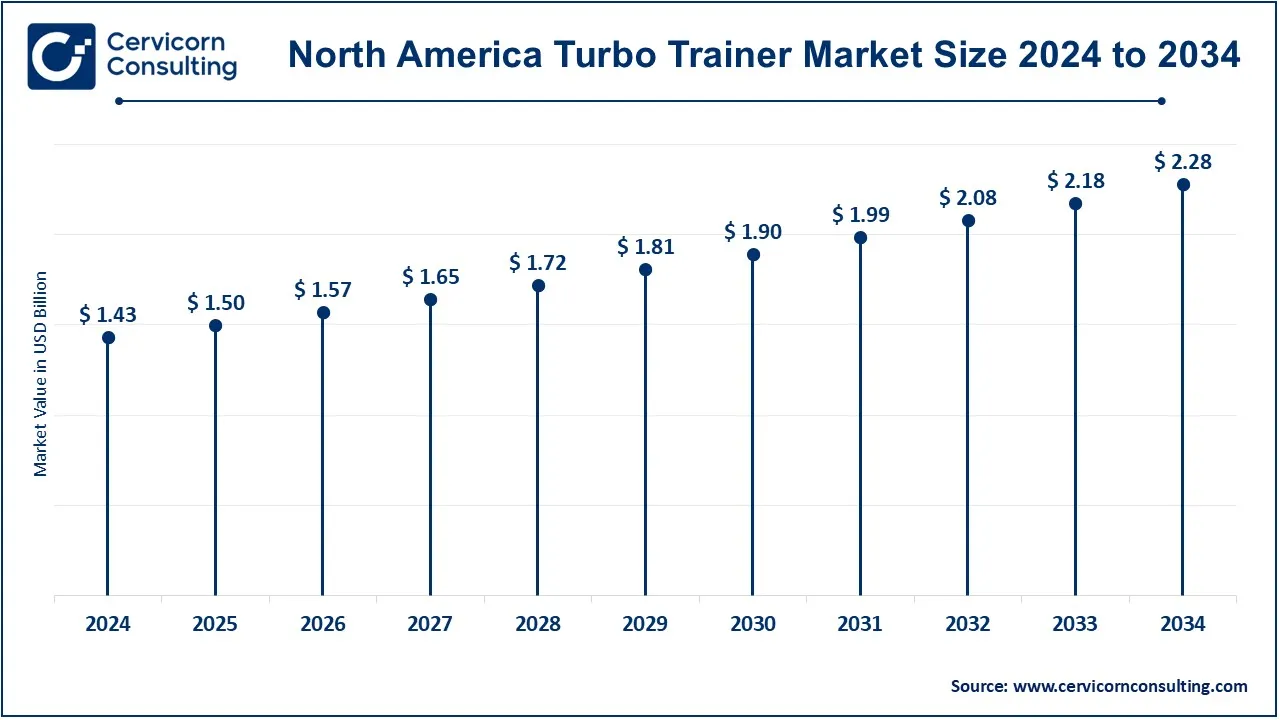

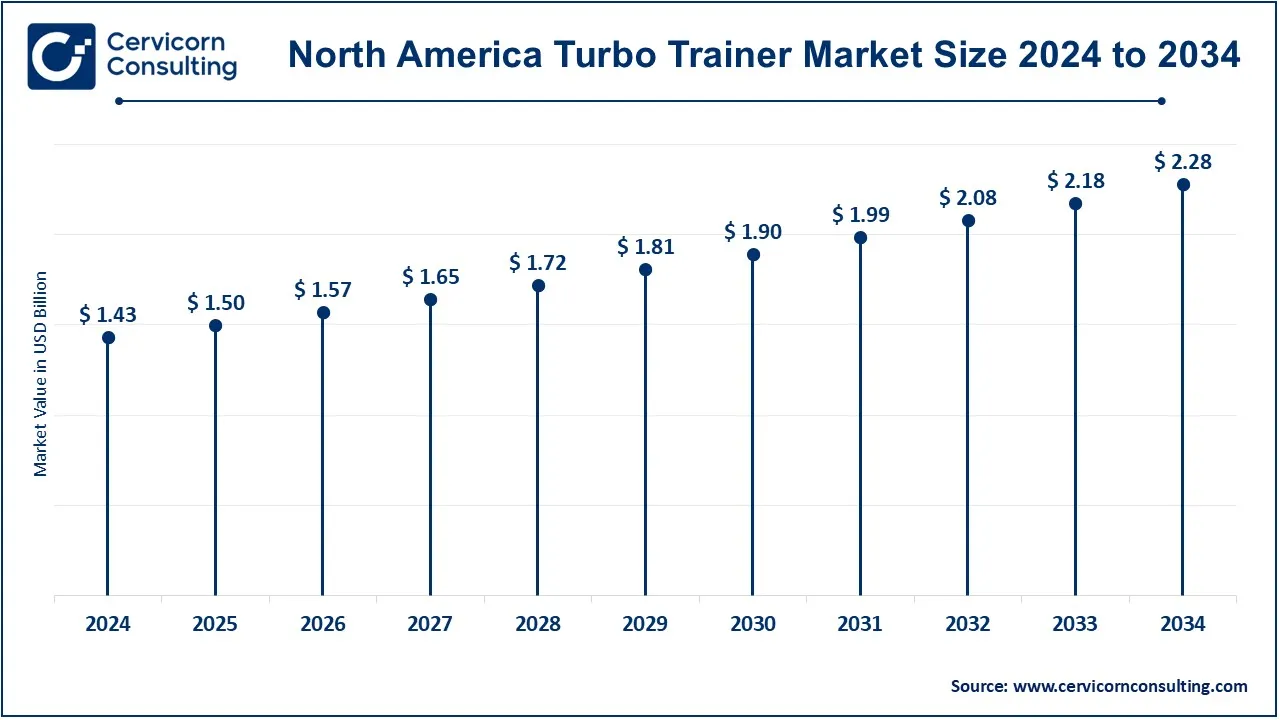

The North America turbo trainer market size was valued at USD 1.43 billion in 2024 and is expected to reach around USD 2.28 billion by 2034. The turbo trainer enjoys a good demand in North America, since cycling is widely popular there, and people are more concerned about their health. The market size is relatively high in the US and Canada. Its demand is maximum in the United States due to the presence of various fitness trends in the region, such as indoor cycling classes and online training programs like Zwift. Furthermore, it is quite burgeoning in Canada, where it will ensure that riders will stay indoors during the most extreme winter months. As a country of high disposable wealth and using advanced training equipment, North America would be a great market for turbo trainer manufacturers.

What are the growth factors of Europe turbo trainer market?

The Europe turbo trainer market size was estimated at USD 0.93 billion in 2024 and is projected to hit around USD 1.49 billion by 2034. Europe is a big market for turbo trainers because of the emphasis on fitness and the historic tradition of cycling. National involvement in cycling is high within nations dominating the market, such as those seen within the Netherlands, Germany, and the United Kingdom. Another trend that further intensifies demand for turbo trainers is indoor cycling, promoted by both fitness centers and community events. Europe is one of the leading markets for high-end training solutions, with fitness technology and professional cycling growing in popularity throughout the region and sparking innovation in smart trainers.

Why is Asia-Pacific region skyrocketing in turbo trainer market?

The Asia-Pacific turbo trainer market size was accounted for USD 0.77 billion in 2024 and is predicted to surpass around USD 1.22 billion by 2034. Turbo trainers are a hastily expanding phenomenon in the Asia Pacific vicinity, due to expanded disposable income and fitness focus. Exercise is becoming increasingly famous among Chinese, Japanese, and Australians. Urbanization and the need for indoor fitness are the principal causes of this fashion. Moreover, the increasing recreation, as well as the competitive sport of cycling, helps get the turbo trainer demand going. Regional producers, for their part, are increasingly entering this market with relatively cheaper products appealing to a broader segment of the consuming public.

LAMEA turbo trainer market growth

The LAMEA turbo trainer market was valued at USD 0.20 billion in 2024 and is anticipated to reach around USD 0.32 billion by 2034. Factors like growing disposable incomes and the awareness of health propel the growth of turbo trainers in the LAMEA region. Increased exercise-friendly cultures and flourishing cycling culture in the countries of Latin America like Brazil and Argentina assure potential. Since indoor fitness center markets are booming in the Middle East, the use of turbo trainers is also promoted. Africa has a mounting youth and urbanization problem that needs more answers to fitness needs. However, economic differences and lack of access to higher-end products will be a challenge in the expansion of this market.

Turbo Trainer Market Top Companies

CEO Statements

Nerio Alessandri, CEO of Technogym

- "At Technogym, we are committed to promoting wellness through innovation. Our turbo trainers are designed not just as fitness tools but as part of a holistic approach to health. By integrating advanced technology and user-friendly features, we empower our users to achieve their fitness goals, whether at home or in a professional setting. We believe that our innovative solutions will lead the charge in transforming indoor cycling experiences."

Dustin Grosz, CEO of Precor

- "Precor has always focused on delivering high-quality fitness experiences, and our turbo trainers are no exception. We understand the evolving needs of our users and have tailored our products to enhance performance and engagement. Our commitment to quality and user satisfaction ensures that cyclists can train effectively and enjoyably, no matter their fitness level. As we continue to innovate, we aim to inspire more people to embrace indoor cycling.”

Clifton Pemble, CEO of Garmin Ltd

- "At Garmin, we are dedicated to pushing the boundaries of technology to enhance the lives of our users. Our focus remains on innovation, providing seamless integration in fitness and outdoor activities. We believe in empowering people to reach their goals with precision and ease. Together, we can redefine what’s possible in the world of connected devices."

Recent Developments

- In June 2021, Technogym announced an app with a digital coach using AI that enabled health clubs to keep up with the expanding demand for digital fitness solutions in the post-lockdown space. It opened up a library of on-demand video training experiences for members of clubs not connected to the Technogym Mywellness platform. At its heart is Technogym Coach, which provides each user with personalized "Precision Programs" to best achieve its own goals of development, time constraints, and available equipment. For example, fitness objectives included: keeping fit, acquiring good sports performance, or even improving general health.

- In October 2024, Precor entered into a Global distribution agreement with SPIA Cycling Inc., the owner of Stages Cycling. The distribution agreement would increase the availability of commercial indoor cycles along with associated products. Precor would utilize its enormous network in North America to enter diversified markets of fitness clubs and educational institutions and currently plans to expand the reach of the distributor into the international market. Stages SC3 and SC2 road bikes, as well as Stages Studio, for deep data analysis and entertaining cycling experience, are the main products offered.

- In July 2024, the Tacx NEO Bike Plus- it's an indoor smart bike by Garmin Malaysia - the kind of bike that offered a real riding experience, built with features that served simulated gradients and actual enhanced virtual shifting. Truly easy-to-ride quiet, power, and speed metrics were accurate; it was powerful and very responsive even in sprints, and it was completely adjustable to accommodate the most varying types of users. It was ideal for multiple athletes in a single household. Compatible with the smart device, when combined with the Tacx Training app, users enjoyed structured workouts, pro rides, and more immersive films about the most breathtaking cycling routes around the world.

Market Segmentation

By Product

- Direct drive turbo trainers

- Wheel-on turbo trainers

By Resistance Mechanism

- Electronic

- Fluid

- Magnetic

By Interaction Type

By Price Range

- Low (less than 200$)

- Mid (200$-500$)

- High (above 500$)

By Usage

- Personal

- Commercial

- Gyms

- Wellness centers

- Others (Sports associations)

By Distribution Channel

- Online channels

- E-commerce

- Company websites

- Offline channels

- Specialty Stores

- Mega retails stores

- Others (Individual stores, Departmental stores)

By Region

- North America

- APAC

- Europe

- LAMEA

...

...