Video Games Market Size and Growth 2025 to 2034

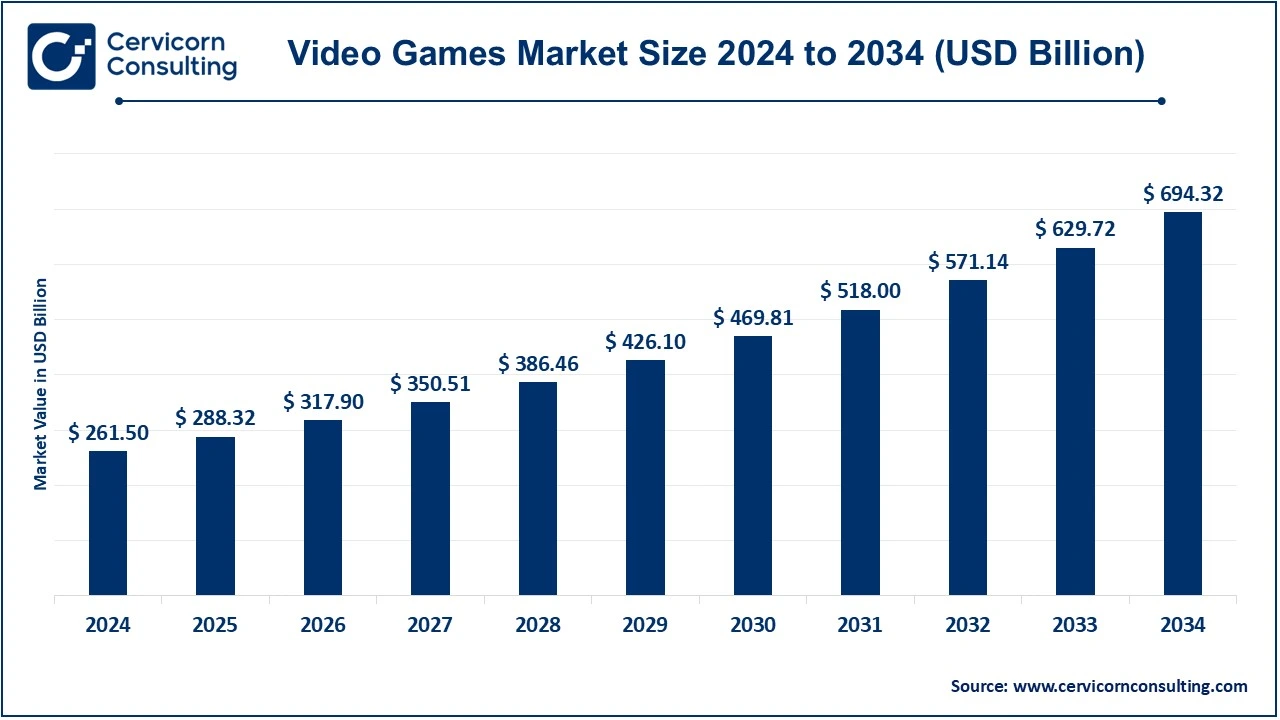

The global video games market size was valued at USD 261.50 billion in 2024 and is expected to be worth around USD 694.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.25% over the forecast period 2025 to 2034.

The video games market is expanding at a very healthy growth rate, primarily due to the adoption of advanced technologies such as virtual reality (VR), augmented reality (AR), and cloud gaming, along with high penetration levels of mobile devices and consoles. In addition to this, the increasing popularity of esports, the emergence of live streaming platforms, increasing demand for multiplayer and online gaming experiences have further supported market demand. Innovation in immersion storytelling, cross-platform play, and subscription-based services allowed the industry to innovate and attract diverse audiences, from casual gamers to competitive players, and contribute to sustained market growth worldwide.

Report Highlights

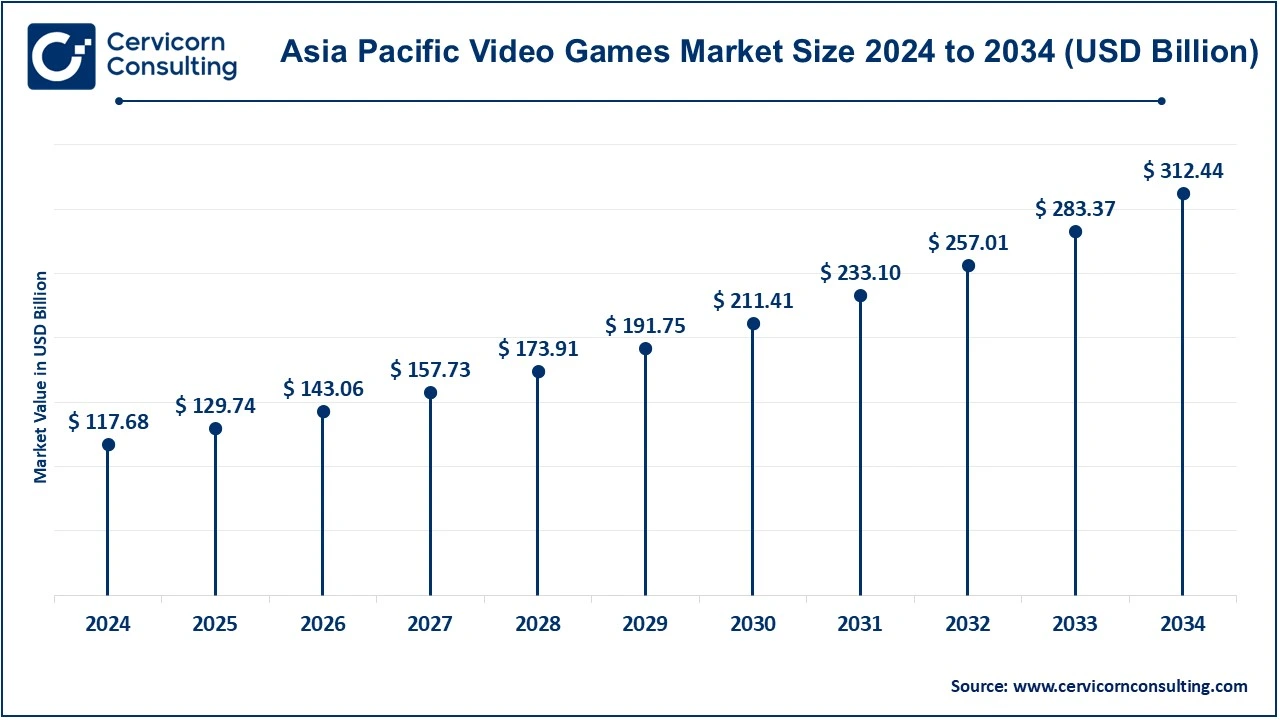

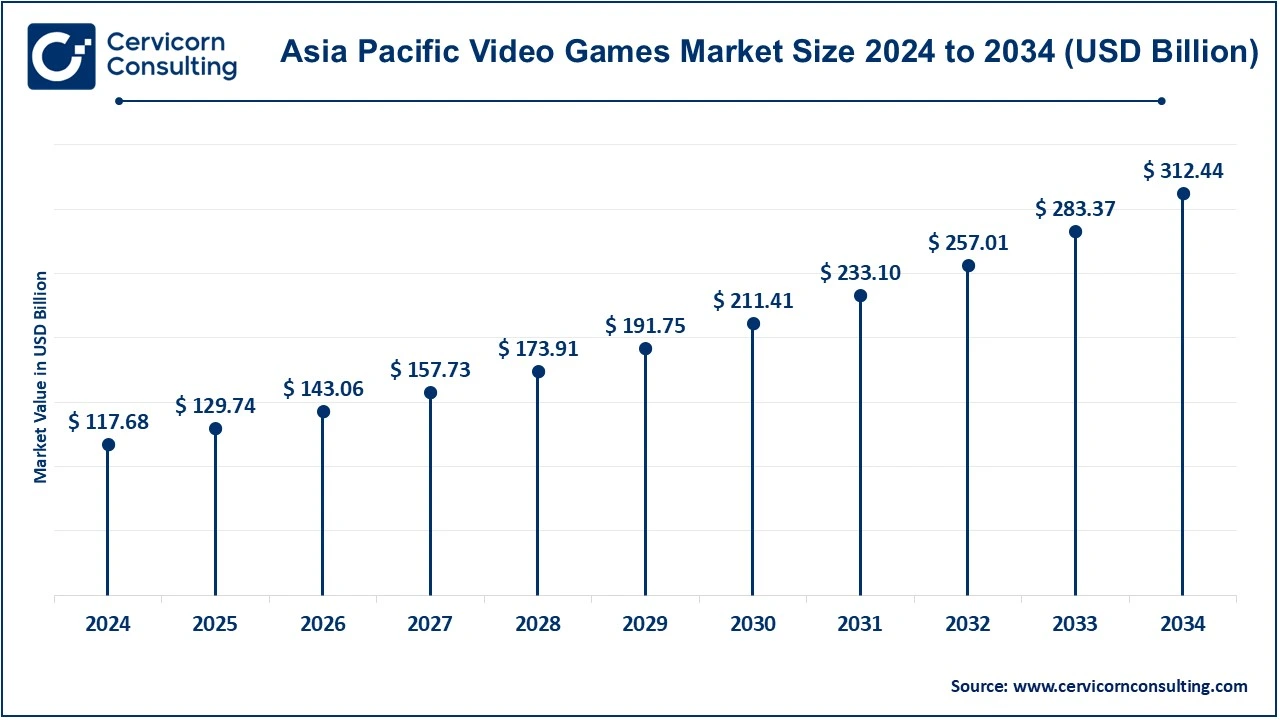

- The Asia-Pacific region witnessing a leading position, accounted for a revenue share of 45% in 2024.

- The North America has generated revenue share of 24% in 2024.

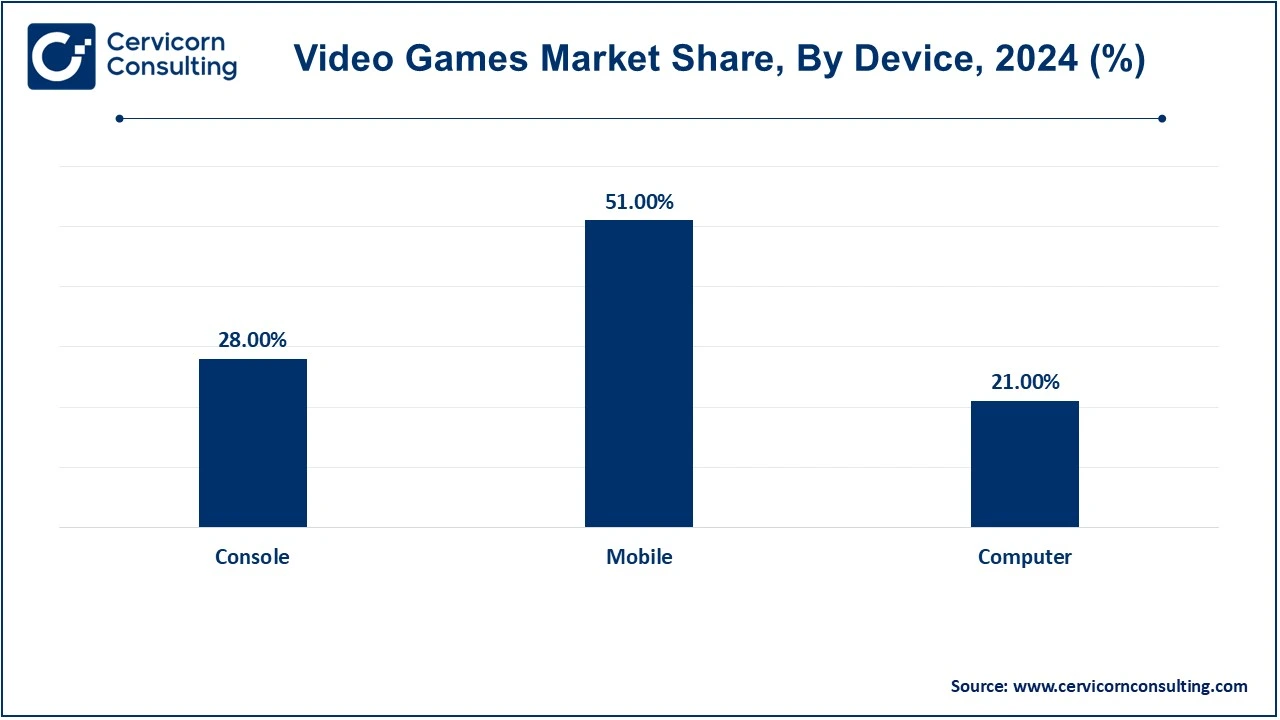

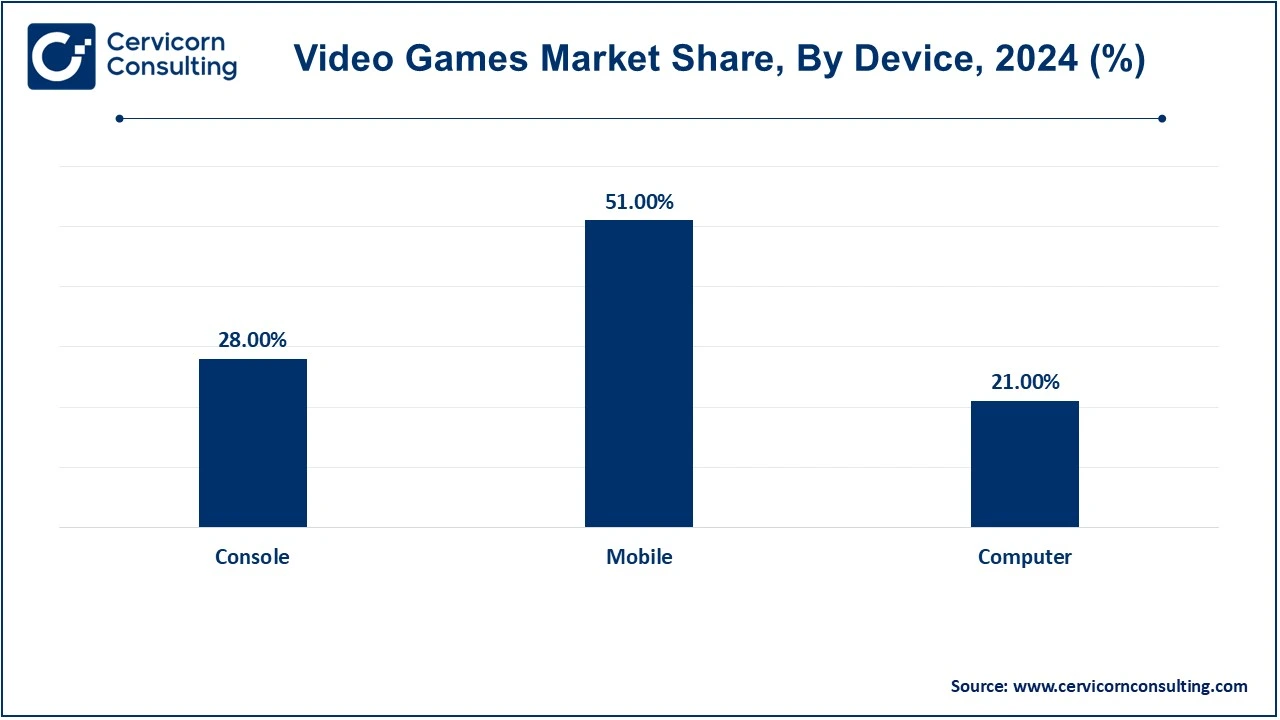

- By device, the mobile segment has captured revenue share of 51% in 2024.

- By device, the console device segment is expected to witness notable growth over the forecast period.

- By type, the offline segment has registered revenue share of around 57% in 2024.

Video Games Market Growth Factors

- Higher Global Internet Penetration: With more areas stable in terms of internet access, online multiplayer gaming and digital distribution platforms are more accessible. This has led to a wide, global player base, higher engagement, cross-border play, and a big increase in demand for online gaming services, which has motivated game developers to focus more on multiplayer experiences and digital-only releases.

- Better graphics and immersive gameplay: Advances in gaming graphics and immersive gameplay technologies, particularly artificial intelligence and virtual reality, have improved a player's experience to a high level. Some innovations have been pushed to new heights and are making games more captivating and the real world. High graphical and immersive environments attract gamers who will have deeper and more engaging experiences.

- Growing Interest in Cross-Platform Play: Cross-platform play is the most important feature for current video games because it allows easy interaction among players using other gaming systems. This enhances higher socialization and a coherent gaming society. As developers increase the number of compatible games, they gain access to a larger pool of players, hence creating a welcoming environment, tearing down divisions between consoles and PCs, and spreading the market even wider.

Video Games Market Trends

- Introduction of Subscription Models: Video game subscription services, granting access to thousands of games across services like Xbox Game Pass and PlayStation Now, are growing. This model presents playing games as less costly, and more accessible, so it gives continuous value to developers in terms of steady, stable revenue streams while players experience easy access to the breadth of experiences at a cheaper rate.

- The Demand for Cloud Gaming increases: Cloud gaming brings in the factor of cloud delivery, where a client can stream high-quality games without needing expensive hardware. This does allow more casual gamers or the ones who cannot afford to buy and maintain some high-end console or PC for themselves. The future of the industry seems to be moving towards increasing convenience and accessibility brought along by cloud services of the game.

- In-game purchases/microtransactions: This has led to the trend of in-game purchases and microtransactions, shifting the model of the gaming industry into a service-oriented model. Now, most games have become significant sources of revenue through virtual items, skins, and other content sold within the game. Even though this model helps to improve long-term engagement, it also raises controversy regarding its influence on gameplay and how it can bring unfair advantages in competitive settings, especially in free-to-play games.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 288.32 Billion |

| Projected Market Size in 2034 |

USD 694.32 Billion |

| Expected CAGR 2025 to 2034 |

10.25% |

| Leading Region |

Asia-Pacific |

| Key Segments |

Device, Type, Hardware, Region |

| Key Companies |

Tencent Holding Limited, Nintendo of America Inc., Activision Blizzard, Inc., Electronic Arts Inc., Microsoft Corporation, Sony Corporation, Take-Two Interactive Software, Inc., Amazon.com, Inc., Square Enix Holdings Co., Ltd., Gameloft SE, King Digital Entertainment Ltd. |

Video Games Market Dynamics

Drivers

- Rising consumer demand for alternatives of entertainment: Video games are the new source of entertainment and have attracted millions of new players who think this is the first preference for entertainment. Being more interactive than movies and television, video games are complementary sources of entertainment. Continuity with innovation is dictated by a demand for entertainment, and fueling its expansion continues to drive the gaming industry.

- Critical Technological Developments (5G): It improved the online gaming experience, as mobile gamers now experience smoother gameplay, especially for multiplayer games, thanks to the higher speed of data transfer and lower latency. This growth in 5G networks accelerates cloud gaming and opens up possibilities for developers to push the boundaries of mobile and online gaming performance on multiple devices.

- Advancements in Game Development Tools: Easy and user-friendly game development tools increase the ease of developing highly innovative games by developers. These tools reduce the time and costs required in the production of a game, and big and small studios can experiment with novel ideas. The access and availability of these tools fuel the boom in indie games and create a diverse gaming ecosystem, broadening creative horizons.

Restraints

- The rising concern towards data security: The digital releases of each game have increased data privacy and security concerns. To create an account, make in-app purchases, or even interact with fellow players, one has to fill in sensitive information. Such data aggregation gives rise to concerns regarding issues of privacy, and breach thereof may strike a blow at consumer confidence. High development costs must be given priority to laws, and the developers must ensure that player confidence is maintained.

- Development Burden of High Development Costs: Among them, the most significant one is the cost of production of AAA titles. For a growing demand for better graphics, large worlds, and complex gameplay, the prices skyrocketed. Small studios thus became tough for many because they cannot match the scales at huge, well-funded companies can show. Financial risks are considerable; one develops a blockbuster. At worst, this might delay their projects or even cancel them entirely.

- Increasing Regulatory Burden: The more the gaming industry expands, the more it comes under scrutiny by regulators. Worldwide, governments are interested in monitoring loot boxes, microtransactions, and content ratings in-game. Such rigid regulations tend to limit game design choices as well as potentially lead developers to a host of legal issues. Laws concerning gambling and age remain changing and keep on inhibiting game development and sales.

Opportunities

- Increasing Collaborations between Film and Game Studios: A collaboration of film studios and game developers is producing promising opportunities for both. Movies or franchises from games, or games from movies, increase consumer interest much further than each medium could independently. Such collaborations offer new revenue streams and bring cross-media content to appeal to a wider audience, making use of the established fan bases of well-known franchises.

- Integration of AI for Dynamic Gameplay: Artificial intelligence in games gives significant innovations. AI can allow more active, responsive, and highly personalized environments to the participants, with different experiences suited to individual players' actions. This enables game designers to make better and reusable experiences because the AI plays along with choices made by the players, presenting varied outcome possibilities that can encourage numerous plays of the game by the same player.

- Introduction of Virtual Reality and Augmented Reality Technologies: VR and AR will be able to transform the way players interact with the game. Immersion levels previously thought impossible in video games will now become feasible. The affordability of VR headsets and increased interest in mobile gaming AR apps open the door to developers' creation of completely new game genres and ways of playing that no one thought was possible before, and, hence, the scope for innovative game design and experience creation.VR and AR will be able to transform the way players interact with the game. Immersion levels previously thought impossible in video games will now become feasible. The affordability of VR headsets and increased interest in mobile gaming AR apps open the door to developers' creation of completely new game genres and ways of playing that no one thought was possible before, and, hence, the scope for innovative game design and experience creation.

Challenges

- Increase in fierce competition in the market: The video game industry is competitive, dominated by big players like Sony, Microsoft, and Nintendo. It is very hard for small developers to get their visibility in such a saturated market. Innovation, excellent marketing, and the ability to meet changing consumer demands are what separate a developer from the rest in this competitive environment, making it a huge challenge for new or indie game developers.

- Fast Technological Advancements: This pace in technological change does not give time to most developers to take the new advances on their own with full-pace implementation and use. From next-gen consoles and AI tools, up to cloud gaming technology, which continuously needs them to introduce innovative changes, all this builds an enormous amount of stress that might burn out one eventually.

- Increased concerns in Piracy and illegal game distribution: Piracy continues to be one of the greatest challenges game developers and publishers face, mainly because piracy diminishes sales revenue. Fighting piracy is both expensive and time-consuming with little efficiency in many territories. The problem not only affects income but also ensures the viability of the more minor studios over the long run by ensuring protection for intellectual property and, consequently, their sales.

Video Games Market Segmental Analysis

The video games market is segmented into device, type, hardware and region. Based on device, the market is classified into console, mobile, and computer. Based on type, the market is classified into online and offline. Based on hardware, the market is classified into handheld console, static console and video gaming accessories.

Device Analysis

Console: The console segment would contain PlayStation, Xbox, and Nintendo Switch systems. In this case, gaming machines are dedicated mainly to playing games and are mostly connected to a television or monitor for display. They provide high-quality graphics and immersive gameplay along with an array of exclusive titles. They are preferred by gamers who prefer a seamless, at-home gaming experience, and the market has grown with advancements in virtual reality, online play, and exclusive game releases.

Mobile: The market of mobile games is growing explosively. The increased use of both smartphones and tablets means there is room to play all these available titles, either iOS or Android, offering great broad reach from the casual players to the core ones. Mobile games can also be available for free play and in-app purchasing. Playing while moving with your life is one reason gaming in the mobile environment made it grow into becoming the largest most money-making branch in video gaming.

Computer: PC gaming remains one of the most significant segments, supported by high-performance hardware and great customizations. For the players who game on a PC, there are ultrahigh-definition graphics, open worlds, and the communities of mods. The increasing more platforms, such as Steam, expand market access and bring games, including AAA and independent titles. Most of the buyers gear up with the best gaming mouse, keyboard, and monitor to ensure the best experience with the games on the PC.

Type Analysis

Online: Online gaming has become the dominant sector of the video game market. Multiplayer online games, in which players play together in real-time, are also part of this sector. This is fueled by esports, online-only titles, and subscription-based services like Xbox Live and PlayStation Plus. Social interaction, competition, and cooperative gameplay are the essential elements of online games that attract millions of players and grow into global gaming communities every year.

Video Game Market Revenue Share, By Type, 2024 (%)

| Type |

Revenue Share, 2024 (%) |

| Online |

43% |

| Offline |

57% |

Offline: Offline gaming is a category of single-player or local multiplayer games that don't rely on the internet. The market segment attracts gamers who like playing in isolation or in local mode without having to rely on servers elsewhere. Titles like RPGs, adventure games, and puzzle games dominate offline gaming. Most players prefer such focused, uninterrupted gameplay in titles. With the increase in digital distribution, even offline games are thriving with online multiplayer experiences on the rise.

Video Games Market Regional Analysis

The video games market can be further segmented into some key geographical regions: North America, Europe, Asia-Pacific, and LAMEA, which consists of Latin America, Middle East, and Africa. Further details of each region are described below.

Why is Asia-Pacific largest market for video games?

The Asia-Pacific video games market size was accounted for USD 117.68 billion in 2024 and is predicted to hit around USD 312.44 billion by 2034. The China, Japan, South Korea, and India are the largest market for Asia-Pacific. The Chinese market is the world's largest, with major growth areas for mobile gaming, online multiplayer games, and esports. For instance, in February 2024, Dezan Shira & Associates reported that China's gaming industry remained the world's largest, at over USD 41.68 billion in 2023, in which mobile gaming was 74.88% of the revenue. The industry is expected to grow to USD 95.51 billion by 2029. Recent changes in the regulatory system have resulted in 1,075 new game licenses being approved in 2023, which indicates that the government supports the industry even though it faced challenges in the past. The industry is also putting its focus on e-sports, VR technology, and international expansion to strengthen its global presence. Japan is known for its rich heritage of old consoles and RPG games. South Korea has an eSports culture in full swing and dominates online gaming. India is an emerging market with rapidly growing mobile gaming and rising interest in gaming culture.

What are the driving growth factors of the North America video games market?

The North America video games market size was valued at USD 62.76 billion in 2024 and is projected to surge around USD 166.64 billion by 2034. North America includes the United States, Canada, and Mexico. The U.S has remained to be the global largest gaming market and, all infrastructures for gaming, eSports, and streaming have increased. For example, in November 2024, Roblox announced that it would make tremendous improvements in parental controls, thereby boosting security for minors. Children under 13 would not be able to send direct messages to any other player; however, they can send messages publicly. Parents may also monitor their child's account by establishing limits on time spent on screen and by being able to view a list of friends. These are responses to increasing online safety concerns and part of the commitment that Roblox continues to give to user protection. Canada is one country with an impressive game development scene; game studios have been flooding the region. Mexico has been experiencing rapid growth of its gaming market, including growth in mobile and console games. This region's market features discretionary income and tech-savvy consumers.

Europe video games market hit considerable growth

The Europe video games market size was estimated at USD 261.50 billion in 2024 and is forecasted to grow around USD 694.32 billion by 2034. It consists of countries such as the UK, Germany, France, Spain, and Italy. The UK is so enormous; it has an impressive gaming community, whereas its development is pretty lively. Similarly, Germany is so revered to be great for not only PC but also for console gaming. As the German video game market grew to USD 4.6 billion in revenues according to the 2022 annual report from the German Games Industry Association. Market grows 3% from 2021 year. The leader is a mobile game, with the share at 54%, followed by console and PC games 29% and 17%, respectively. From the report, growth in the player base in this region is represented. For Germany specifically, the number is more than 48 million gamers. Survival and growth in the market since it sustains through economic stress. Game development and eSports events are well recognized about France. The Spanish and Italian market is highly growing very fast, expanding with a higher adoption of mobile gaming. Europe is considered to be a divergent market owing to different tastes and different cultures in playing games within the various countries.

Video Game Market Revenue Share, By Region, 2024 (%)

| Region |

Revenue Share, 2024 (%) |

| North America |

24% |

| Europe |

21% |

| Asia-Pacific |

45% |

| LAMEA |

10% |

LAMEA Video Games Market Trends

The LAMEA video games market size was valued at USD 26.15 billion in 2024 and is anticipated to reach around USD 69.43 billion by 2034. LAMEA includes Latin America, the Middle East, and Africa. Latin America has Brazil and Mexico experiencing significant growth in mobile and console gaming. The Middle East, especially Saudi Arabia and the UAE, is seeing an increase in demand for gaming due to a young, tech-savvy population and high disposable incomes. In Africa, mobile gaming is rapidly growing, especially in countries like South Africa and Nigeria, where smartphone access is fueling market growth. This region holds huge potential as infrastructure for gaming and access improves.

Video Games Market Top Companies

- Tencent Holding Limited

- Nintendo of America Inc.

- Activision Blizzard, Inc.

- Electronic Arts Inc.

- Microsoft Corporation

- Sony Corporation

- Take-Two Interactive Software, Inc.

- Amazon.com, Inc.

- Square Enix Holdings Co., Ltd.

- Gameloft SE

- King Digital Entertainment Ltd.

New entrants in the video game industry are adopting novel strategies in a very competitive industry to have a better grip. Big players include Tencent Holding Limited, Nintendo of America Inc., Activision Blizzard, Inc., Microsoft Corporation and Electronic Arts Inc. in terms of expansion of their markets through mergers, strategic alliances, and technological innovation. These companies are embracing cloud gaming, mobile platforms, and next-generation consoles to meet the evolving demands of consumers. For instance, after it acquired ZeniMax Media and entered the cloud gaming market through Xbox Cloud Gaming, Microsoft Corporation has experienced quite significant growth, with offerings that have brought a new dimension of accessibility and cross-play that has expanded its user base and increased global reach.

CEO Statements

Ma Huateng, CEO of Tencent Holding Limited

- "We believe that mobile gaming is one of the key drivers of Tencent’s long-term growth, and we are committed to expanding our portfolio of mobile games and making them more accessible to global audiences."

Doug Bowser, CEO of Nintendo of America Inc.

- "Looking ahead, Nintendo will continue to focus on providing entertainment that brings joy to people. Our mission is to create new and engaging experiences that appeal to a wide audience and ensure that gaming remains fun and accessible for everyone."

Bobby Kotick, CEO of Activision Blizzard, Inc.

- “Gaming is an incredibly dynamic industry, and we are constantly adapting to meet the needs of our players and partners.”

Recent Developments

The latest strategic partnerships and investments in the animation market reflect a strong push toward innovation and expansion in the global arena. Companies are now collaborating more to use the latest technologies in AI, virtual reality, and use of cloud-based solutions, to optimize production workflows and improve content quality. These partnerships intend to enhance creative processes, streamline distribution, and reach more audiences across multiple platforms. Investments also fuel the development of more diverse and engaging animated content because they respond to the higher demands for quality content not only in the traditional markets but also in the new markets with shifting consumer preferences.

Some key developments of the Video Games Market include the following notable examples:

- In June 2024, Tencent Holdings Ltd stocks had hit an all-time high having gained 28% in 2024 as the phenomenal performance of the game Dungeon & Fighter Mobile did indeed add USD 91 billion in market capitalization. Meanwhile, that indeed happened to be the highest stock lift seen by China so far this year. Good response from analysts who hiked their earnings estimate by over 14% and shows how much they believe in the business of advertisement and gaming done by Tencent. Given the improvement in the legal environment for the gaming sector, hope remains high for games yet to be launched as Tencent emerges as the second-largest firm in Asia.

- In August 2024, Nintendo of America and PlayVS extend their partnership to intensify competitive gaming in high schools and middle schools across North America.The multi-year partnership would see students from 6th to 12th grade compete in leading games such as Super Smash Bros. Ultimate, Splatoon 3, and Mario Kart 8 Deluxe. The program targeted the expansive reach since PlayVS allowed free Nintendo hardware and software for participating schools.Since 2021, more than USD 2.1 million in equipment was donated to the program to support over 73,000 matches and 253 championships-further establishing a thriving esports culture among students.

- In January 2022, Microsoft said that it would buy Activision Blizzard for USD 68.7 billion, or USD 95 per share, to expand its gaming business across PC, console, cloud, and mobile platforms. The acquisition had made Microsoft the world's third-largest gaming company in terms of revenue, which had added franchises such as "World of Warcraft" and "Call of Duty" to its stable. TAt purchase, the environment was friendlier to gaming, the plan was to wrap up the fiscal year 2023, and enhancing the portfolio of Game Pass at Microsoft.

Market Segmentation

By Device

By Type

- Online

- Offline

- Sports

- Shooter

- Racing

- Adventure

- Others

By Hardware

- Handheld Console

- Static Console

- Video Gaming Accessories

By Region

- North America

- APAC

- Europe

- LAMEA

...

...