Waste to Energy Market Size and Growth 2025 to 2034

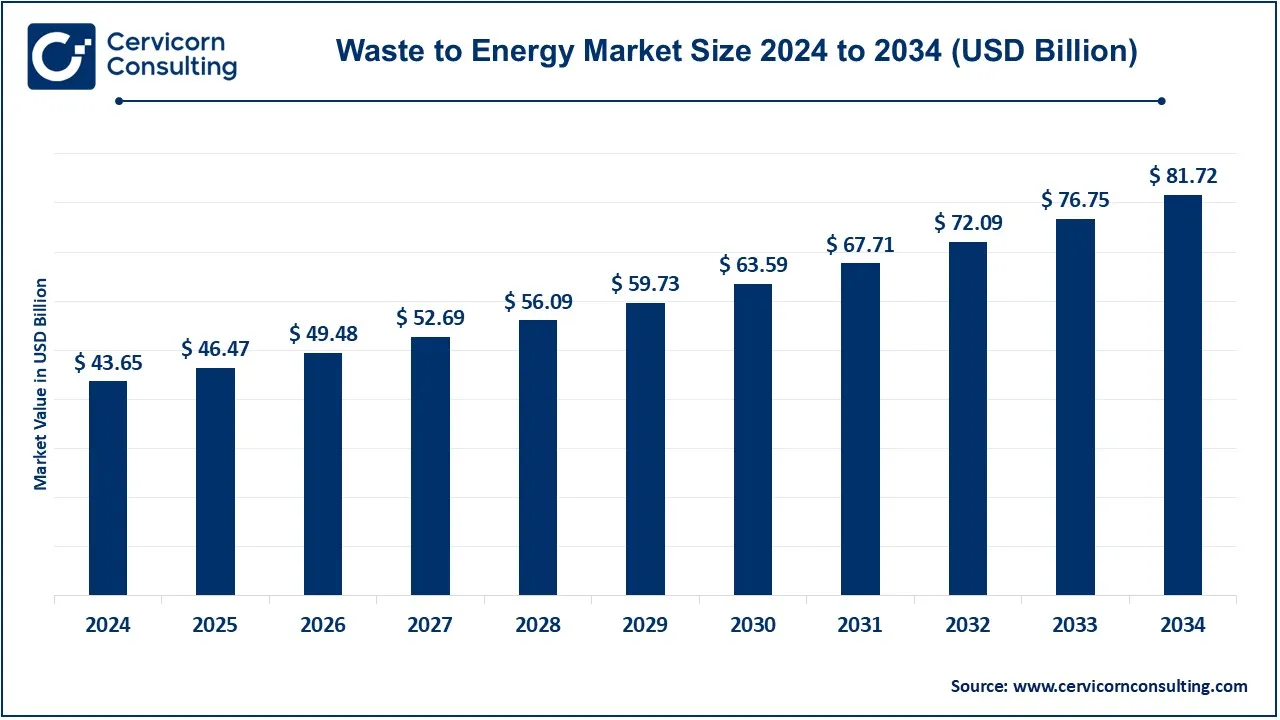

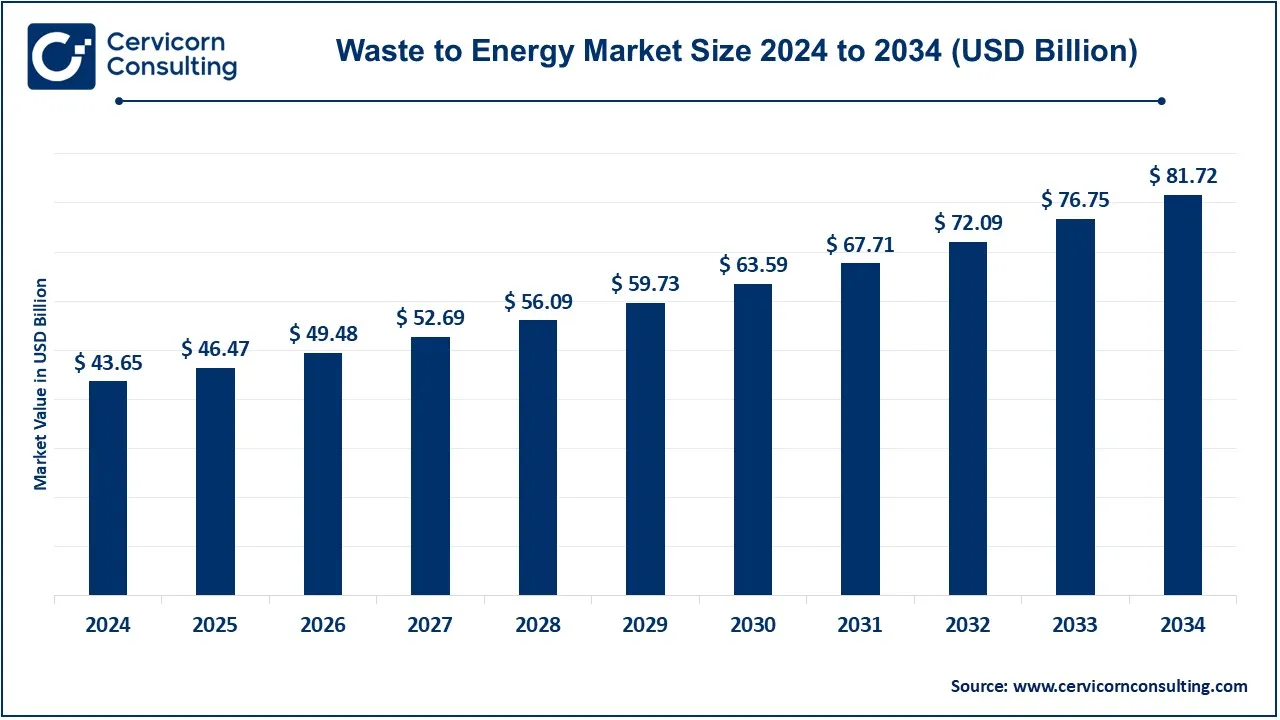

The global waste to energy market size was valued at USD 43.65 billion in 2024 and is expected to be worth around USD 81.72 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.47% from 2025 to 2034.

Waste-to-energy (WtE) is a process that converts non-recyclable waste materials into usable forms of energy, typically electricity or heat, through various technologies like incineration, gasification, and anaerobic digestion. This method reduces the volume of waste sent to landfills while producing renewable energy, making it a valuable solution for waste management and energy generation. WtE plants help mitigate greenhouse gas emissions by diverting waste from landfills, where it would otherwise decompose and release methane, a potent greenhouse gas.

Report Highlights

- The Europe has accounted highest revenue share of 41.60% in 2024.

- The Asia-Pacific region has generated revenue share of 28.70% in 2024.

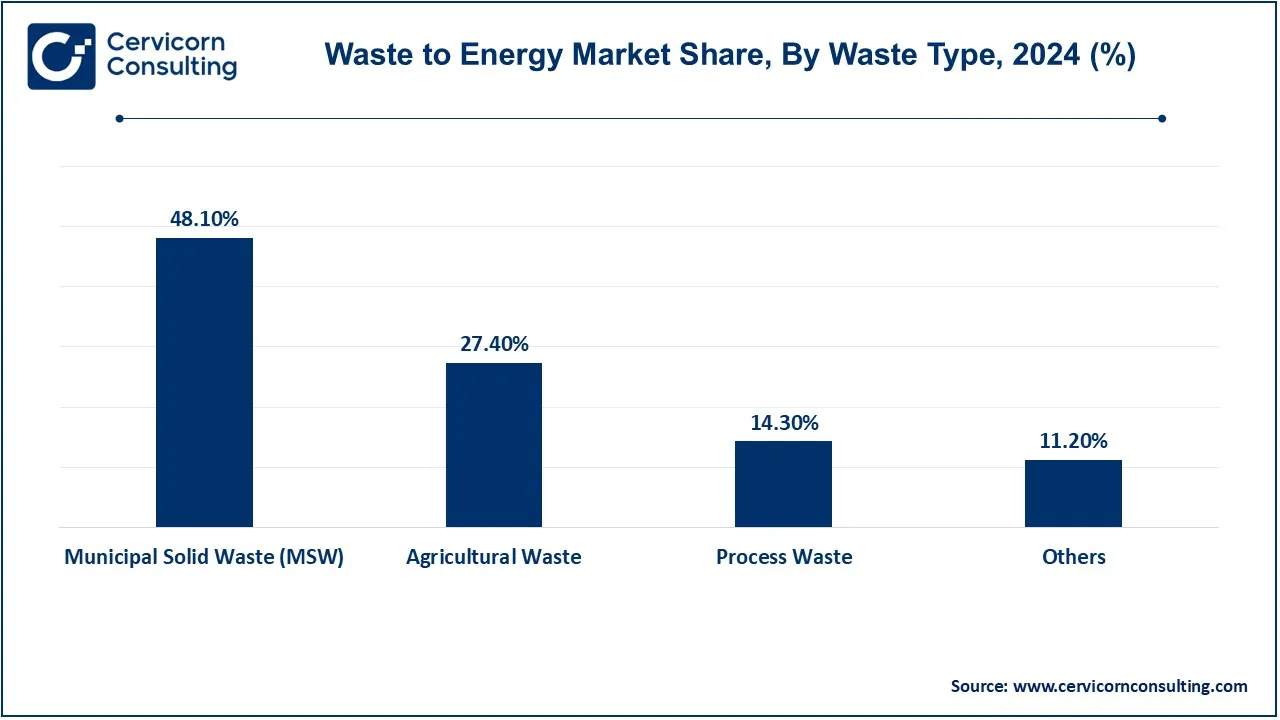

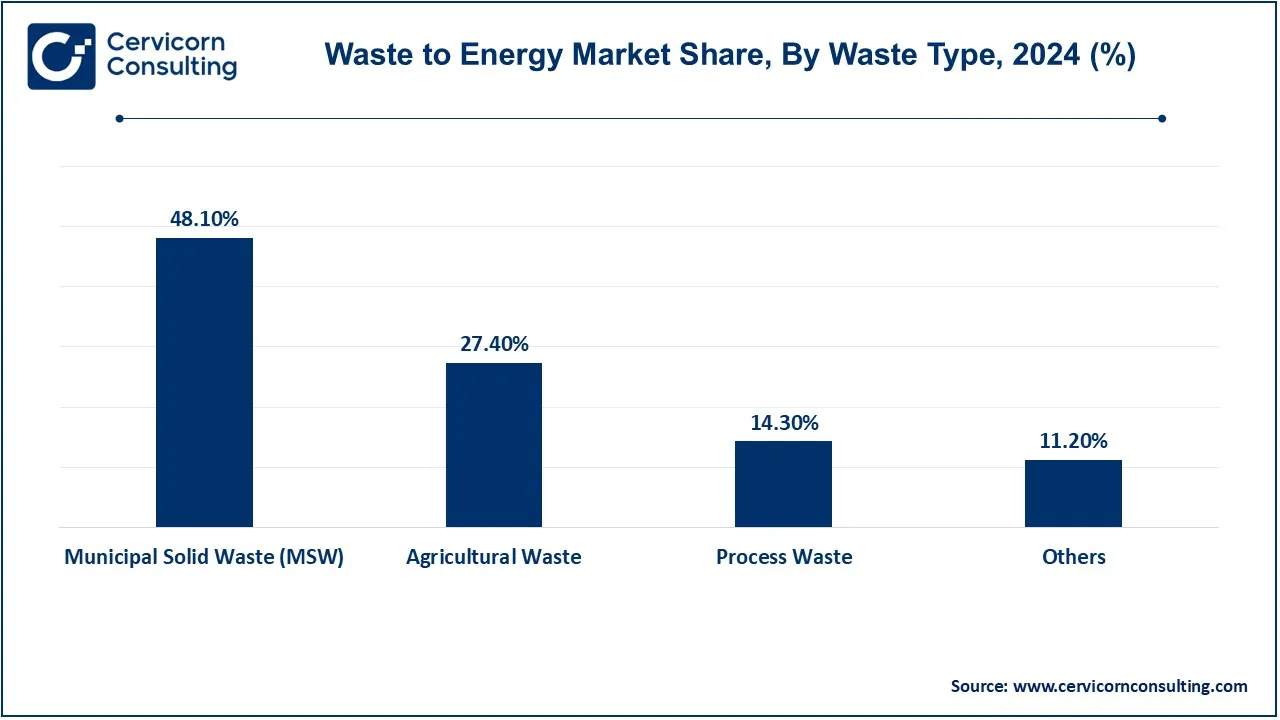

- By waste type, the municipal solid waste (MSW) segment has generated revenue share of 48.10% in 2024.

- By technology, the thermal segment has accounted 81.30% in 2024.

- By application, the electricity segment has recorded 56% of the total revenue share in 2024.

Waste to Energy Market Growth Factors

- Exponential Growth in Waste: Urbanization often comes with an abrupt increase in waste generation, for cities are predominantly associated with the production of refuse. Even though most of the waste produced is municipal solid waste which has limited recyclability, waste-to-energy technologies address this problem by providing an alternative source of clean energy in the management of excess waste. This situation is aggravated even more in developing regions and countries where urbanization is actively taking place leading to the greater need for WtE technologies. As a result, those in power at the government or municipal levels are looking for ways to manage waste and generate energy at the same time and this is what WtE brings in.

- Global Energy Supply Crisis: The demographic trend and the industrial outlook of the globe has been increasing the energy needs of people. Other than the dependence on biomass energy, the WTE makes it easier for the countries to tackle the issue of fossil fuel dependency. When it comes to energy output, WTE plants are steady and reliable; this is better than other renewable sources of energy like the solar and the wind ones and that is why WTE is easily integrated into an energy grid. With the current global energy trends whereby countries are diversifying their sources of within energy and securing energy supplies, WTE systems help mitigate the growing energy supply gap efficiently.

- Increased Investment Perspective for Circular Economy: Concerning the kin of economy with no or limited waste production WTE market is strengthened. Addressing waste by producing energy through WTE methods draws an inbuilt economy where resource use is not a waste. Ascribe or towns are becoming more many in their circular economy and this is increasing the importance of WTE in the management of waste sustainably. There is also a growing trend with respect to demand for WTE systems as a consequence of efforts aimed at promoting sustainable machinery and reducing landfilling activities.

- Reducing Greenhouse Gas Emissions: WtE contributes to reducing greenhouse gas emissions by diverting waste from landfills, where waste decomposition produces methane, a potent greenhouse gas. WtE plants convert waste into energy with lower emissions compared to fossil fuels, making them a more climate-friendly alternative. Countries looking to meet carbon reduction goals are turning to WtE projects as part of their renewable energy strategies, particularly in Europe and Asia, where emission reduction commitments are strict.

Waste to Energy Market Trends

- The Progression Towards Enhanced Technology: Newer Waste-to-Energy facilities for instance are making use of innovative techniques such as gasification, pyrolysis and gasification using plasma. Such methods are more energy efficient and have lower emissions than the regular incineration systems that raise environmental concerns. The use of robots and AI in the management of the plant and waste segregation systems is on the rise as well, which helps in increasing efficiency and accuracy of operations. The progression towards enhanced technology.

- The Rising Adoption of Circular Economy: The heightening circular economy that prioritizes resource use efficient and reducing waste encourages the WtE integration within waste management schemes. The safe to incinerate waste energy recovery, which is WTE complemented the circular economy’s principles of minimizing waste tom eco friendly levels.

- Increasing Demand for Sustainable energy: With the encouragement of governments and businesses towards cleaner sources of energy, waste to energy or WTE is on the verge of establish itself as one of the renewable energy sources. It has the added advantage of being a steady energy source, unlike wind or solar power which is dependant on weather. Corresponding to targets on carbons emissions cut many countries began integrating WTGE units with combined resquestions and renewables systems.

- Increased Waste Generation in Under Developed Economies: The fast pace urbanization and industrialization in the developing economies especially India developing and southeastern regions are increasing a lot the volumes of municipal solid waste (MSW). Waste to Energy WTE is also in demand in those areas as a solution to the waste management problems and energy deficit in the regions.

Report Scope

| Area of Focus |

Details |

| Market Size in 2024 |

USD 43.65 Billion |

| Expected Market Size in 2034 |

USD 81.72 Billion |

| CAGR (2025 to 2034) |

6.47% |

| Leading Region |

Europe |

| Fastest Growing Region |

Asia-Pacific |

| Key Segments |

Waste Type, Technology, Application, Region |

| Key Companies |

Mitsubishi Heavy Industries Ltd, Waste Management Inc., A2A SpA, Veolia Environment SA, Hitachi Zosen Corp., MVV Energie AG, Martin GmbH, Babcock & Wilcox Enterprises Inc., Zheng Jinjiang Environment Holding Co. Limited, Suez Group, Xcel Energy Inc., Wheelabrator Technologies Inc., Covanta Holding Corp., China Everbright International Limited. |

Waste to Energy Market Dynamics

Drivers

- Improvement in Biomass Use: It is becoming standard practice to apply WtE processes to biomass wastes associated with agriculture, forestry and industrial activities. Such development promotes organic waste-to-energy conversion and opens up the market for bio-based WtE technologies.

- Effective Cost Waste Management Awareness: There is increasing public sensitization about the dangers posed by wastes and their careless management, hence both municipalities and corporates have been forced to normalize effective cost waste management. Waste-to-Energy (WtE) is becoming more popular now as a method which enhances energy production whilst ensuring that waste is properly dealt with.

- Evolution of Smart City Initiative: Development of smart cities will enhance sustainable infrastructure such as effective waste disposal and use of renewable sources of energy. As the WTE deals with waste disposal challenges while creating energy locally, it is therefore one of the prime elements of the smart city projects being implemented across the globe.

Restraints

- Investment in Construction of Waste to Energy Facilities is High: Construction of WtE plants entails a large amount of money mobilised for the construction, embedding of technology and equipping of the plants with emission control devices. These prohibitive costs of installing new plants may prevent municipalities and corporations from WtE facilities, more so in developing countries and regions where budget or financial assistance is insufficient.

- Operational and Maintenance Costs are High: Moreover, it takes a lot of money to operate and maintain Wte plant since there is need to keep employee skilled, maintain the technology employed and abide by the laid down rules. These prohibitive operational expenses may affect returns especially when the level of energy output is less or there’s no government assistance within the regions.

- Environmental Protection Laws are Too Strict: There is a rise in the costs associated with the operation and maintenance of Wte plants due to the need to meet the environmental regulations on emissions, predominantly, on Co2, Dioxins, and particulate matters. These very strict thresholds may restrict the growth of Waste to Energy, more so in the areas which have a very high regard for Environmental conservation.

Opportunity

- Advancements in Technology: Technological advances have opened into practice the incineration, gasification, and pyrolysis techniques, leading to improvements in waste-to-energy systems that would translate to more efficient conversion of waste to energy. This in turn would lead to lesser costs of processing for such companies, as they will produce far more energy per ton of waste and enhanced environmental sustainabilityManufacturers and service providers in the waste-to-energy arena could capitalize on these technologies as competitive advantages to either increase market share or get closer to that goal.

- Increasing demand for renewable energy: With the global urge to cut their dependence on fossil fuels drastically, demand for renewable energy is on the up. Waste-to-energy projects have a double advantage-it resolves the waste problem and produces renewable energy. With increasing urbanization and industrialization, the demand for cleaner and renewable energy has surged, thus providing the waste-to-energy market sustained growth as a key element within the realm of renewable energy.

- Growing generation of Municipal Solid Waste: Waste generation arises in strong relation to urbanization. However, there is also a recommendation that with the rising municipal solid waste (MSW) production, the disposal of such waste provides an excellent and sustainable feedstock source for waste-to-energy plants. With the disposal and management of MSW still a major challenge in various cities and regions, converting waste substrates into energy brings new, eco-friendly, and cost-effective solutions to the forefront. Henceforth, there is an opportunity for growing waste disposal solutions in waste-to-energy market companies to expand their operations into new territories.

Challenges

- Implementation of Various Waste-to-Energy Technologies: WTE methods, for instance, incineration or gasification, and pyrolysis are complex systems that require advanced technology to install and operate. These systems can not be effectively used in most instances because personnel able to work with such systems does not exist in the region.

- Challenges of Waste Operations: It is true that the proper management of all waste-to-energy incineration facilities depends significantly on how well the existing Residue to be Energy Utilized (RTEU) is prepared as well as segregated before entry into the facility. In other words, when the waste is not effectively separated at source, recovery of energy from the waste becomes less efficient, which leads to problems in operation. Having to deal with such waste streams tends to make the process more expensive and also results in a decrease in the performance of the plant.

- Threat of Competing Forms of Renewable Energy: WTE confronts severe competition from other forms of renewable energy such as solar, wind and hydro sources of energy. Such technologies are less damaging to the environment and available subsidies are more attractive thereby making it difficult for WTE to draw in investments in areas where cleaner technologies are given priority.

Waste to Energy Market Segmental Analysis

The waste to energy market is segmented into waste type, technology, application and region. Based on waste type, the market classified into municipal solid waste (MSW), agricultural waste, process waste and others. Based on technology, the market classified into thermochemical, incineration, pyrolysis & gasification and biochemical. Based on application, the market classified into electricity, heat and others.

Waste Type Analysis

Municipal Solid Waste (MSW): The Municipal Solid Waste (MSW) segment has dominated the market in 2024. Consists of general waste generated through various household and business activities and is collected by a municipality. This waste includes things like scraps of food, papers, plastics, metals as well as other non-hazardous materials. WtE plants use MSW as their main feedstock by burning or melting this type of waste in order to create energy. WtE development optimizes MSW handling by escalading means of energy generation while reducing the amount of waste directed to landfills.

Agricultural Waste: This consists of organic waste associated with agriculture and includes residues of crops, animal dung and processing wastes. Bioenergy can be derived from agricultural waste such as through anaerobic infection or bio burn incineration. WtE solves the issues of reducing agricultural waste by giving value to agricultural waste for energy needs within rural areas.

Others: Includes include industrial waste, medical waste, and waste that is hazardous, as well as waste which cannot be recycled. These waste types are typically dealt with by advanced WtE processes, such as its gasification or pyrolysis, for safe energy recovery with controlled release of poisonous materials.

Application Analysis

Electricity: Waste-to-energy (WtE) processes convert or combust waste to generate energy in the form of electricity which can be fed in the grid or utilized for consumption at the end-use site. In most of the cases, electricity generation is the use of WtE as a common need. These facilities prevent the burning of more fuel which fossil fuels and generates renewable power from waste.

Waste to Energy Market Revenue Share, By Application, 2024 (%)

| Application |

Revenue Share, 2024 (%) |

| Electricity |

56% |

| Heat |

32% |

| Others |

12% |

Heat: Heat resulting from waste combustion is used for district heating systems of industrial activities. In some countries, WtE facilities are associated with district systems and provide heat energy to households for heating or production activities as required. This dual production of heat and electricity enhances the effectiveness of WtE activities.

Waste to Energy Market Regional Analysis

The waste to energy market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The Europe region has dominated the market in 2024.

What factors contribute to Europe leadership in the waste to energy market?

The Europe waste to energy market size was estimated at USD 18.16 billion in 2024 and is projected to hit around USD 34 billion by 2034. Europe - At the very fewest, WtE sector is in the hands of Europe, where countries such as Germany, Sweden and the Netherlands are making huge investments in WTE generation systems. The European region has capitalized on aggressive promotion, as well as put policies in place that require waste to be disposed of in certain ways, which make municipalities mostly wastewater treatment facility. This opportunity is even more enhanced by the fact that WTE is regarded as one of the energy options in Europe, considering the European Commission’s Strategy on Waste. Waste to energy (WtE) incineration in Europe has a number of advantages over landfills more advanced technologies as well as lack of public awareness and acceptance. Disposal as well as commercial losses attends to note due to conventional and effective recycling methods that already exist and operate in the countries of her development. In some regions, waste to energy plant expansion efforts may also be compromised by anti-incineration sentiment and environmental regulations that limit emissions.

What are the driving factors of North America waste to energy market?

The North America waste to energy market size was valued at USD 8.82 billion in 2024 and is expected to be worth around USD 16.51 billion by 2034. North America especially the US and Canada is one of the regions with advanced waste-to-energy technology and waste management policies. This trend in the region is attributed to growing concern in the public about how to manage wastes through measures taken by environmental policies which are so tough that stresses on how wastes are disposed off. Moreover, the provision of a number of federal and state level incentives along with policies encouraging the undertaking of projects of renewable energy sources creates a conducive environment for the investment in waste to energy technologies. Nevertheless, there are some drawbacks such as the fact that construction of WTE plants necessitates huge investment which deters most investors and the fact that the public has a negative perception on waste incineration owing to existing health hazards from such operations. Furthermore, high recycling rates tend to limit or reduce the need for WTE systems, which can also affect the market growth.

Why is Asia-Pacific experiencing rapid growth in waste to energy market?

The Asia-Pacific waste to energy market size was accounted for USD 12.53 billion in 2024 and is predicted to surpass around USD 23.45 billion by 2034. The Asia-Pacific region is experiencing rapid growth, driven by increasing urbanization, industrialization, and a corresponding rise in waste generation. Countries like China, India, and Japan are leading the charge, implementing government initiatives aimed at improving waste management systems to address the escalating energy demands of their growing populations. The focus on sustainability and environmental conservation is further propelling investments in WtE technologies. However, this region faces several challenges, including limited public awareness of WtE benefits and a lack of technical expertise necessary for advanced waste conversion technologies. Additionally, varying regulatory frameworks across countries can create complexities for market players. Moreover, the continued reliance on cheaper landfill options in many developing countries poses a significant challenge to the widespread adoption of WtE solutions.

Waste to Energy Market Revenue Share, By Region, 2024 (%)

| Region |

Revenue Share, 2024 (%) |

| North America |

20.20% |

| Europe |

41.60% |

| Asia-Pacific |

28.70% |

| LAMEA |

9.50% |

LAMEA waste to energy market is in emerging stages

The LAMEA waste to energy market was valued at USD 4.15 billion in 2024 and is anticipated to reach around USD 7.76 billion by 2034. The LAMEA region is still in its emerging stages, with countries actively exploring WtE technologies as a means to manage growing waste and energy demands. Urbanization and increasing energy costs are significant factors driving this interest, prompting governments in regions such as Brazil, South Africa, and the UAE to consider WtE as a sustainable waste management strategy. Additionally, international partnerships and funding from development banks are helping to facilitate the development of WtE projects, bolstering market growth. However, the region faces several challenges, including economic instability, a lack of adequate waste management infrastructure, and limited public acceptance of WtE technologies. The reliance on traditional waste disposal methods, coupled with insufficient investment in advanced waste treatment technologies, can hinder the market’s expansion in LAMEA. Thus, overcoming these challenges will be essential for unlocking the full potential of the Waste-to-Energy market in these regions.

Waste to Energy Market Top Companies

- Mitsubishi Heavy Industries Ltd

- Waste Management Inc.

- A2A SpA

- Veolia Environment SA

- Hitachi Zosen Corp.

- MVV Energie AG

- Martin GmbH

- Babcock & Wilcox Enterprises Inc.

- Zheng Jinjiang Environment Holding Co. Limited

- Suez Group

- Xcel Energy Inc.

- Wheelabrator Technologies Inc.

- Covanta Holding Corp.

- China Everbright International Limited.

CEO statements

Eric M. Stein – CEO of Fortistar

- "Fortistar is committed to creating sustainable energy solutions that transform waste into valuable resources. Our latest projects highlight our dedication to advancing WtE technologies that can significantly reduce landfill waste and generate clean energy."

Aidan O’Brien, CEO of Covanta

- "We are continuously enhancing our operational efficiencies and exploring partnerships to maximize the impact of our waste-to-energy facilities. By converting waste into energy, we not only reduce landfill use but also contribute to a cleaner environment."

Antoine Frérot, CEO of Veolia

- "The transition to a circular economy is crucial, and our waste-to-energy initiatives are at the forefront of this change. By investing in state-of-the-art technologies, we aim to enhance waste valorization and provide sustainable energy solutions that benefit both society and the planet."

Recent Developments

The recent awards and investment indicate the rapid growth and cooperation in the market. Top organizations, such as Mitsubishi Heavy Industries Ltd, Waste Management Inc., A2A SpA, Veolia Environment SA, these companies are actively engaged in developing advanced WtE solutions that effectively manage waste, convert it into valuable energy, and contribute to sustainable practices. Their efforts focus on improving operational efficiency, reducing greenhouse gas emissions, and addressing the increasing demand for renewable energy sources. This cooperative spirit is pivotal in driving the growth of a circular economy, ultimately fostering environmental sustainability and energy security. Some notable examples of key developments in the waste to energy industry include:

- In April 2023: Egypt signed a USD 120 million contract to design, develop, own, and manage the country's first solid waste-to-electricity facility. The contract was signed by the Giza governorate and a partnership consisting of Renergy Egypt and the National Authority for Military Production. As part of Egypt Vision 2030, the Abou Rawash, Giza plant would convert 1,200 metric tons of household solid waste per day to power.

- In January 2023: Lostock Sustainable Energy Plant awarded Babcock & Wilcox a contract to support the delivery of the power train for a waste-to-energy plant near Manchester in the United Kingdom. The plant will create more than 60 MW of energy for people and companies and process around 600,000 metric tons of garbage every year. The contract is valued at USD 65 million.

Market Segmentation

By Waste Type

- Municipal Solid Waste (MSW)

- Agricultural Waste

- Process Waste

- Others

By Technology

- Thermochemical

- Incineration

- Pyrolysis & Gasification

- Biochemical

By Application

By Region

- North America

- APAC

- Europe

- LAMEA

...

...