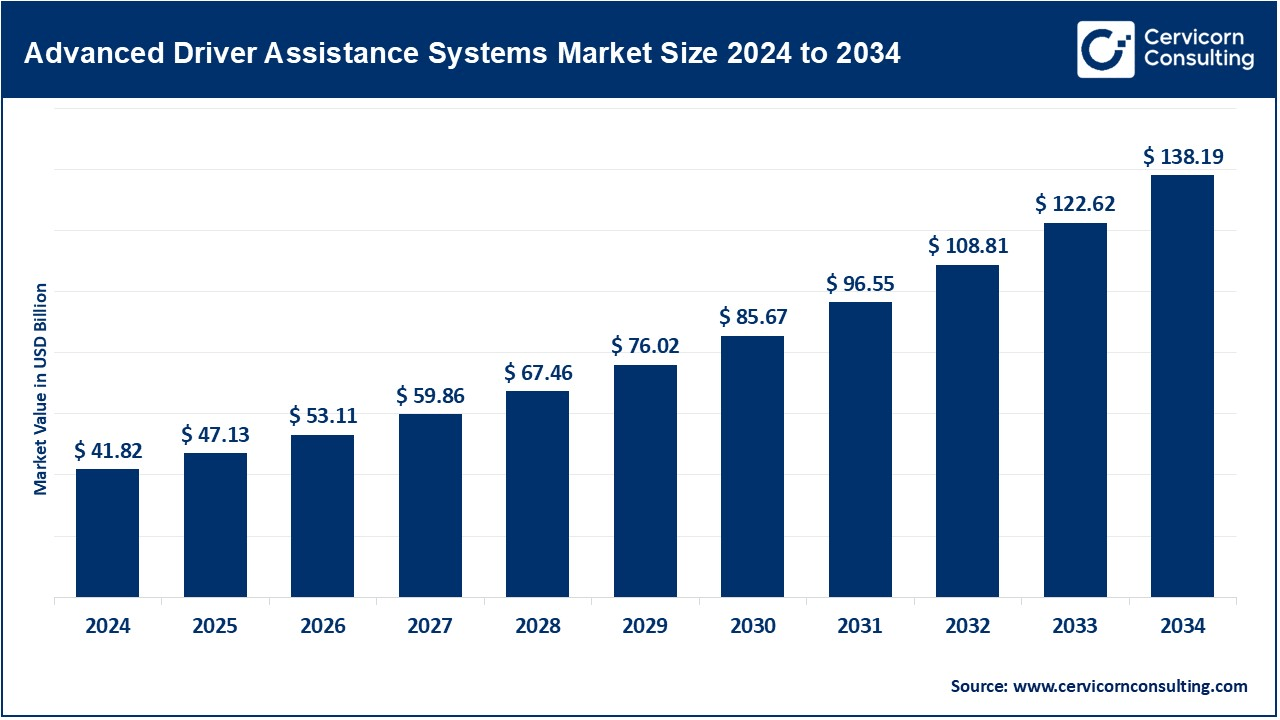

The global advanced driver assistance systems (ADAS) market size was reached USD 41.82 billion in 2024 and is expected to surpass around USD 138.19 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 12.69% during the forecast period 2025 to 2034. The ADAS market is expected to grow owing to the increasing demand for the ADAS in the compact passenger cars. It is expected that escalating governmental regulations requiring the mandatory adoption of ADAS in vehicles will also boost demand.

The advanced driver assistance systems (ADAS) market is experiencing rapid growth, driven by increasing demand for vehicle safety, regulatory mandates, and advancements in sensor technology. ADAS includes features such as adaptive cruise control, lane departure warning, automatic emergency braking, and blind-spot detection, enhancing driver safety and reducing road accidents. The market is fueled by rising consumer awareness, government regulations promoting road safety, and the integration of AI and machine learning for real-time decision-making. Major automotive manufacturers and tech companies are investing heavily in ADAS development, leading to innovations in LiDAR, radar, and camera-based systems.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 47.13 Billion |

| Projected Market Size in 2034 | USD 138.19 Billion |

| Expected CAGR 2025 to 2034 | 12.69% |

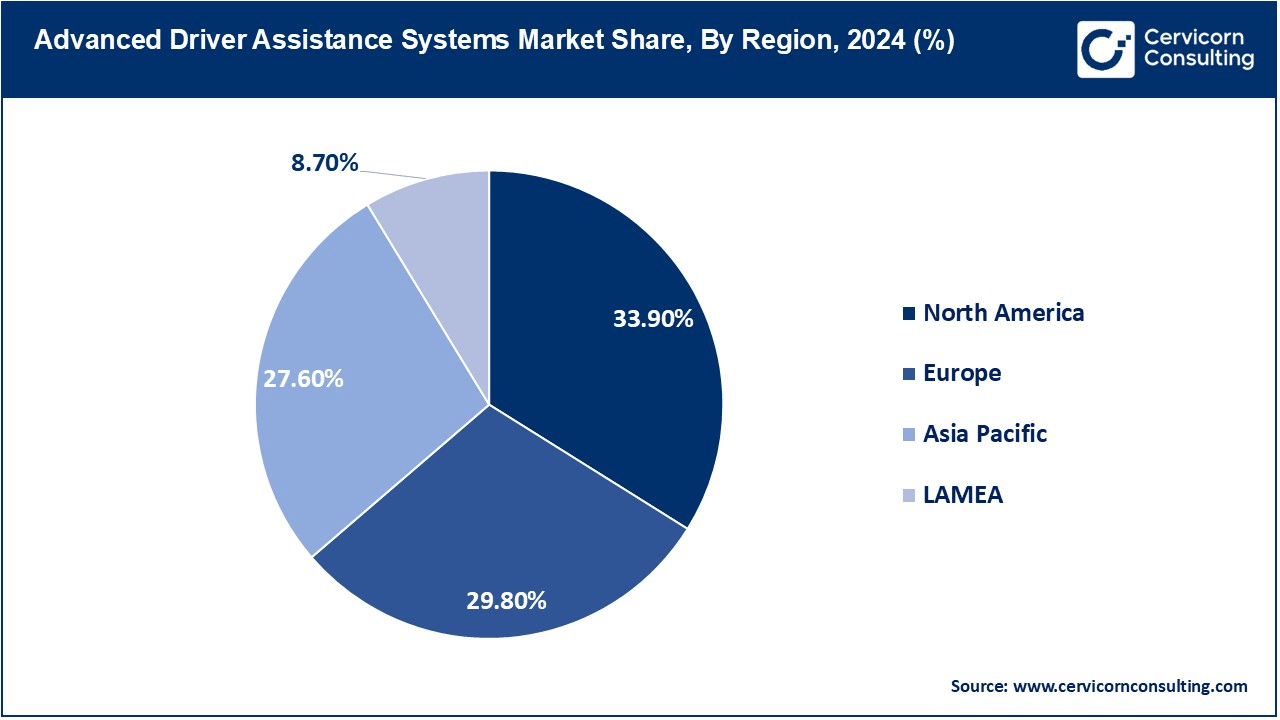

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Solution Type, Component, Vehicle Type, Sales Channel, Electric Vehicle Type, Level of Autonomy, Region |

| Key Companies | Wabco Holdings Inc, Valeo SA, Robert Bosch GmbH, Mobileye, Magna International Inc., Infineon Technologies AG, Garmin Ltd., DENSO CORPORATION., Continental AG, Autoliv Inc., Altera Corporation (Intel Corporation) |

Technological Innovations in the Automotive Industry

Insurance Benefits for ADAS-equipped Vehicles

High Cost of ADAS Components

Cybersecurity Risks

Expansion in Emerging Markets

Advancements in AI-based Driver Monitoring Systems

Lack of Standardization

Infrastructure Limitations

Adaptive Cruise Control (ACC): The adaptive cruise control segment has dominated the market in 2024. Adaptive Cruise Control (ACC) is an advanced safety feature that automatically adjusts a vehicle’s speed to maintain a safe following distance from the vehicle ahead. ACC detects traffic environment using radar, cameras and sensors, and adjusts itself accordingly to minimize the need to brake and accelerate manually. It improves driving comfort, particularly on high-ways, by avoiding large increases and decreases in speed, as well as by reducing risk of rear-end collisions. ACC is catching up with AI and machine learning being integrated in it, allowing adaptive predictions for road properties.

Blind Spot Detection System (BSD): The blind spot detection system segment is estimated to grow at a fastest CAGR over the forecast period. The blind spot detection system adds to automotive safety by providing warnings to drivers of vehicles or objects in their blind areas which reduces the likelihood of lane-change-related collisions. In BSD, ultrasonic sensors, cameras, or radar are used to detect traffic around the vehicle and visual, audible, or haptic alerts are generated whenever there is an intrusion into the driver's blind spot by another road vehicle. By virtue of this system, especially in urban environments and high speed lane merging situations, it becomes much more beneficial.

Park Assistance: Park Assistance technology assists the driver during parallel, perpendicular and low parking by sensors, cameras and ultrasonic technology to detect driving lanes and proximity to objects. High-tech systems provide semi-autonomous or fully autonomous parking features, in which the car steers into a parking place by itself with the driver controlling the acceleration and braking. There are such systems, e.g., remote parking or self-parking using which vehicles can be parked with a very low amount of driver interventions.

Lane Departure Warning System (LDWS): Lane Departure Warning System (LDWS) is an adjunctive technology that keeps drivers from unintentionally drifting out of the lane by identifying road lane markings and driver drowsiness. LDWS tracks the position of the vehicle in lanes with cameras and sensors and provides audible, visual, or haptic warning to the driver if unintended lane departure is sensed. This function is especially applicable in the context of preventing fatigue-related traffic accidents on the highway. Powerful LDWS extensions combine Lane Keeping Assist (LKA), which softly guides the vehicle back to its lane.

Tire Pressure Monitoring System (TPMS): The Tire Pressure Monitoring System (TPMS) increases the safety of vehicles by continuously checking tire pressure values and also telling the drivers if they are under-inflated or over-inflated. Thanks to direct sensors (attached to wheels) or indirect sensors (mounted inside wheel speed and ABS sensors), TPMS can minimize the risk of tire blowouts, increase fuel efficiency and enhance tire durability. As a consequence, the use of TPMS has been made mandatory by governments, such as those in North America and Europe, as a result of car manufacturers forcing its installation into their vehicles.

Autonomous Emergency Braking (AEB): Autonomous Emergency Braking (AEB) is a crash prevention system that automatically activates the brakes when a potential crash is detected. AMEB detects barriers, pedestrians and vehicles on the road path and initiates the emergency braking if the driver does not respond. More sophisticated systems provide intersection collision avoidance and cyclist detection too. AEB alleviates accident severity to a high degree of effectiveness and is now mandatory in several countries where its uses are expanding thanks to the acceptance in the passenger and commercial vehicle systems.

Adaptive Front Lights (AFL): Adaptive Front Lights (AFL) enhance night driving (and low-visibility driving) through the automatic adjustment of direction and brightness of the headlights to the steering angle, vehicle speed and road conditions. In the reminders to look of car operators and drivers when encountering curves, crossings, and uneven ground, as well as in raising the visibility around curves, crossings and uneven ground, which reduces the accident rate. AFL systems use LEDs, xenon, and matrix beam technologies to provide precise illumination. As the need for vehicle safety and luxury features grows, AFL implementation is increasing, especially in premium and high-end cars.

Others: In the ADAS "Others" category, there are solutions like Traffic Sign Recognition (TSR), Driver Monitoring Systems (DMS), Night Vision, and Cross Traffic Alerts. TSR assists drivers with identification and visualization of road signs, and DMS surveils drivers for fatigue, distraction, and sleepiness by employing AI-based facial recognition. Night Vision systems improve view in dark conditions by identifying pedestrians, animals and road-related obstacles through use of infrared technology. These sophisticated functionalities are finding their way into the luxury, commercial and electric vehicles and are enhancing the overall road safety.

Processor: The Processor segment is expected to expand at a significant CAGR over the forecast period. Processors are important in ADAS as they drive the processing of large amounts of data from cameras, radar, LiDAR, and ultrasonic sensors in real time. These processors employ AI, deep learning, and edge computing to perform fast decision making for applications such as Autonomous Emergency Braking (AEB), Lane Departure Warning (LDWS), and Adaptive Cruise Control (ACC). High-performance System-on-Chip (SoC) (primarily GPUs and neural processing units) can be used to enhance the performance of the ADAS.

Sensor: The sensor segment has dominated the market in 2024. Sensor is the heart of ADAS, i.e., employed for sensing the vehicle environment and detecting obstacles, human and vehicular traffic conditions. Different sensor modalities—radar, LiDAR, cameras, ultrasonic, and infrared—are used in concert to deliver holistic awareness of the surroundings. LiDAR has enhanced 3D mapping and object detection, whereas the distance can be determined by radar under adverse conditions. Vision-based sensors like cameras enable lane recognition, traffic signs detection and night vision.

Software: Software is particularly important for ADAS, such as sensor fusion, AI, computer vision, and real-time decision-making. Sophisticated algorithms analyse data from various sensors to provide faithful object detection, trajectory prediction, and fully automated vehicle actions. With machine learning and deep neural networks, the abilities such as driver monitoring, predictive braking, and adaptive headlight control are further enhanced. Software-as-a-service (SaaS) updates via over-the-air (OTA) capabilities offer step-based improvements to safety features.

Others: The others category encompasses the key components of ADAS functional, namely connectivity modules and power management system, actuators, as well as human-machine interfaces (HMI). The communication module (5G and V2X communication module) can enable vehicles to establish communication with traffic infrastructure in real time and, consequently, the traffic flow can be improved and the occurrence of accidents can be avoided. Power management systems guarantee proper functioning of ADAS components, especially in electric and hybrid (hybrid electric) vehicles.

Passenger Car: Passenger cars are the dominant part of the ADAS market thanks to the demand for, safety, convenience and autonomous driving features amongst consumers. Of the ADAS systems such as lane keeping assist, adaptive cruise control, auto emergency braking, and blind spot detection, they are increasingly integrated into entry-level and high-end vehicles. As tighter safety regulations and increased focus on road safety have brought about, more and more passenger cars are fitted with ADAs by automotive manufacturers.

Advanced Driver Assistance Systems Market Revenue Share, By Vehicle Type, 2024 (%)

| Vehicle Type | Revenue Share, 2024 (%) |

| Commercial Vehicle | 27.10% |

| Passenger Car | 72.90% |

Commercial Vehicle: Commercial vehicles (trucks, buses and delivery vans) are becoming increasingly reliant on ADAS to improve safety, operational expense and driver performance. Adaptive cruise control, collision avoidance, lane departure warning and automatic parking are just some of the features which have the most impact on reduction of human error, accident occurrence, and fleet operation. Growing use of ADAS in commercial vehicles will be expected as safety regulation becomes more stringent and fleeter demand for operational efficiency also increases.

The ADAS market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America advanced driver assistance systems (ADAS) market size was valued USD 14.18 billion in 2024 and is expected to hit around USD 46.85 billion by 2034. The North America is fueled by high vehicle production, a robust auto industry, and stringent safety standards. The U.S. and Canada adopted strict vehicle safety requirements that require active safety features (lane departure warning, adaptive cruise control, and automatic emergency braking) to be included. In addition, the increased requirement for autonomous vehicles and the fast penetration of electric vehicles (EVs) are driving market expansion.

The Europe advanced driver assistance systems (ADAS) market size was estimated USD 12.46 billion in 2024 and is projected to reach around USD 41.18 billion by 2034. Europe is driven by high safety standards, the rapid adoption of autonomous driving technologies, and significant advancements in sensor technology. The European regulation of the Union for new vehicles, which has many of safety features, has led to widespread acceptance of systems such as blind spot detection, automatic emergency braking and lane keeping assist. However, the high market demand is further fueled by the innovation of ADAS carried out by automotive manufacturing giants Volkswagen, BMW, Mercedes-Benz, and Audi, etc.

The Asia-Pacific advanced driver assistance systems (ADAS) market size was accounted for USD 11.54 billion in 2024 and is expected to surpass around USD 38.14 billion by 2034. Asia-Pacific is growing rapidly due to rising vehicle production, urbanization and enhanced safety consciousness. Countries like China, Japan, South Korea, and India are seeing significant adoption of ADAS, particularly in premium and mid-range vehicles. In China, government mandates for autonomous vehicle testing and advancements in smart cities infrastructure are driving ADAS development. At the same time, automobile manufacturers in Japan and South Korea are pushing the boundaries of ADAS technology integration along with features such as collision avoidance, lane assisting and driver monitoring.

The LAMEA advanced driver assistance systems (ADAS) market size was surpassed at USD 3.46 billion in 2024 and is anticipated to reach around USD 12.06 billion by 2034. The LAMEA area is experiencing the gradual expansion of ADAS through a rising adoption of vehicles, particularly in Brazil, Mexico, UAE and South Africa. While ADAS takes longer in developing markets than in those already conceptualized, the market demand for more and more safety features in passenger and commercial vehicles is continuously increasing because of the increased awareness on road safety and improved road infrastructure.

Market Segmentation

By Solution Type

By Component Type

By Vehicle Type

By Sales Channel

By Electric Vehicle Type

By Level of Autonomy

By Region