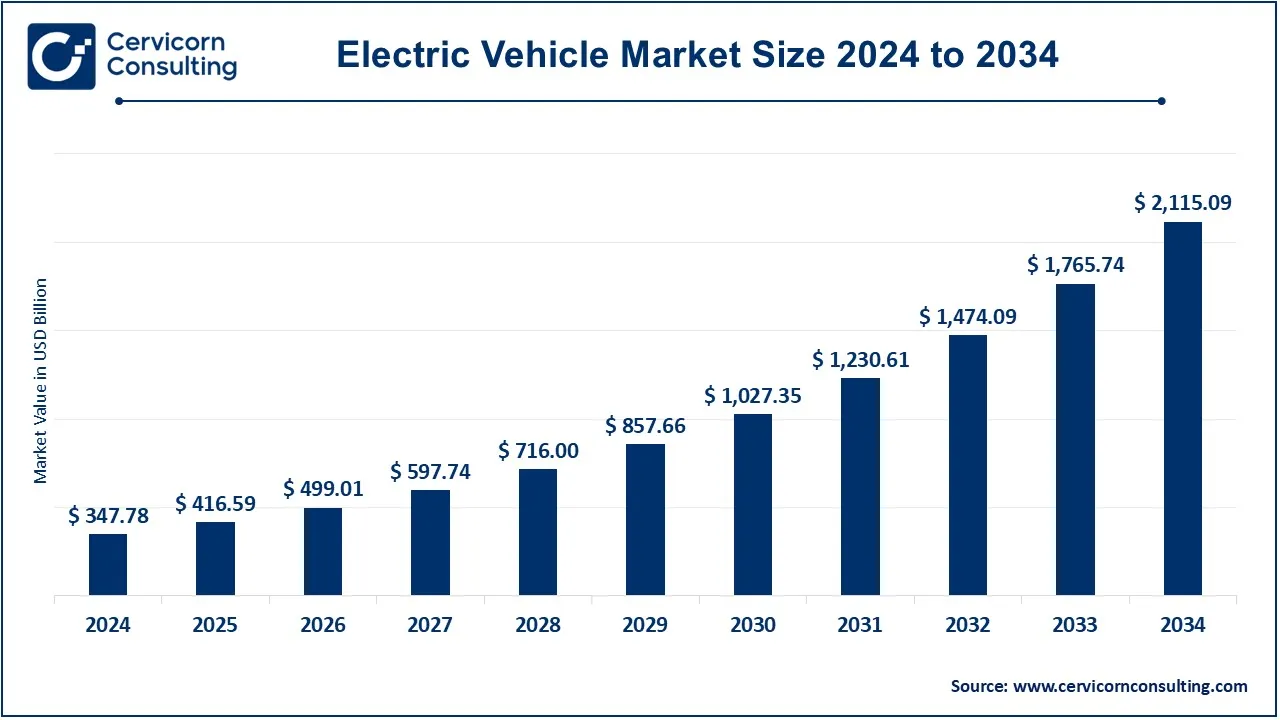

The global electric vehicle market size was valued at USD 347.78 billion in 2024 and is expected to be worth around USD 2,115.09 billion by 2034, growing at a compound annual growth rate (CAGR) of 19.78% from 2025 to 2034.

The electric vehicle market is growing rapidly due to rising environmental awareness, government incentives, and technological advancements. Many countries are setting ambitious targets to phase out petrol and diesel cars, leading to increased investments in EV infrastructure and battery development. Companies like Tesla, BYD, and traditional automakers such as Ford and Volkswagen are expanding their EV lineups, contributing to higher adoption rates. With declining battery costs and improvements in charging networks, global EV sales have increased exponentially. For example, EV sales in 2023 grew by 35% compared to 2022, driven by strong demand in China, Europe, and North America. Governments are offering tax benefits, subsidies, and stricter emission regulations, pushing automakers to accelerate their transition to electric mobility. The industry is expected to see continued growth, with EVs projected to make up over 50% of global car sales by 2035.

The electric vehicle market involves infrastructure for recharging electric vehicle, including residential, public, and workplace charging solutions. Key trends include the rapid expansion of charging networks driven by increased EV adoption and government incentives. Technological advancements such as ultra-fast chargers and smart grid integration are enhancing efficiency and user experience. The market is also seeing a rise in wireless charging technologies and partnerships between automakers and charging providers. Additionally, the shift towards renewable energy sources to power charging stations reflects a broader commitment to sustainability and reducing the carbon footprint of electric transportation.

What is an Electric Vehicle?

An electric vehicle (EV) is a type of automobile that runs on electricity instead of gasoline or diesel. Unlike traditional vehicles that rely on internal combustion engines (ICE), EVs use an electric motor powered by a rechargeable battery. These batteries can be charged at home using a standard outlet or at public charging stations. EVs are classified into three main types: Battery Electric Vehicles (BEVs), which run solely on electricity; Plug-in Hybrid Electric Vehicles (PHEVs), which use both electricity and fuel; and Hybrid Electric Vehicles (HEVs), which mainly run on fuel but use electricity to improve efficiency. One of the biggest advantages of EVs is their environmental benefit, as they produce zero tailpipe emissions, reducing air pollution and greenhouse gas emissions. Additionally, they offer lower operating costs since electricity is cheaper than fuel, and maintenance is minimal due to fewer moving parts. With advancements in battery technology, modern EVs now offer longer driving ranges and faster charging, making them a viable alternative to conventional vehicles.

Key insights related to the Electric Vehicles:

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 416.59 Billion |

| Expected Market Size in 2034 | USD 2,115.09 Billion |

| CAGR from 2025 to 2034 | 19.78% |

| Leading Region | Asia-Pacific |

| Key Segments | Type, Vehicle Type, Propulsion Type, Range, Drive Type, Vehicle Class, Component, Charging Point Type, Vehicle Connectivity, Region |

| Key Companies | Tesla, Inc., BYD Company Ltd., Nissan Motor Co., Ltd., General Motors Company, BMW Group, Volkswagen AG, Hyundai Motor Company, Ford Motor Company, Rivian Automotive, Inc., Mercedes-Benz Group AG, Honda Motor Co., Ltd., Stellantis N.V., NIO Inc., Lucid Group, Inc., Xpeng Motors |

Urbanization

Rising Fuel Efficiency Standards

High Initial Costs

Limited Charging Infrastructure

Expansion into Emerging Markets

Development of Energy Storage Solutions

Battery Supply Chain Constraints

Consumer Awareness and Acceptance

Based on vehicle type, the market is segmented into passenger car and commercial vehicle. The passenger car segment has dominates the market in 2024.

Passenger Car: The passenger car segment dominates the EV market due to growing consumer demand for sustainable and cost-effective transportation. Increasing urbanization, government incentives, and advancements in battery technology are key drivers. The variety of EV models available, ranging from compact cars to luxury sedans, further accelerates market growth as consumers have more options to choose from.

Electric Vehicle Market Revenue Share, By Vehicle Type, 2024 (%)

| Vehicle Type | Revenue Share, 2024 (%) |

| Passenger Car | 63.10% |

| Commercial Vehicle | 39.90% |

Commercial Vehicle: The commercial vehicle segment is experiencing growth driven by the electrification of fleets in logistics, public transportation, and delivery services. Companies are increasingly adopting electric vans, buses, and trucks to reduce operational costs and meet regulatory emissions standards, while also benefiting from lower maintenance expenses and government incentives for clean energy adoption.

Based on propulsion type, the market is segmented into battery electric vehicle, hybrid electric vehicle, and fuel cell electric vehicle. The battery electric vehicle has dominated the market iun 2024.

Battery Electric Vehicle (BEV): BEVs are fully electric vehicles that rely solely on battery power. They are gaining popularity due to zero emissions, lower running costs, and advancements in battery technology that are extending range and reducing charging times. The global shift towards decarbonization and stringent emission regulations are primary drivers for the growth of the BEV segment.

Electric Vehicle Market Revenue Share, By Propulsion Type, 2024 (%)

| Propulsion Type | Revenue Share, 2024 (%) |

| Hybrid Vehicles | 11.60% |

| Battery Electric Vehicles | 66.90% |

| Fuel Cell Electric Vehicles | 21.50% |

Hybrid Electric Vehicle (HEV): HEVs combine an internal combustion engine with an electric motor, offering a balance between fuel efficiency and reduced emissions. The HEV segment is driven by consumers seeking a transition to electric vehicles without fully committing to battery dependence. HEVs are especially popular in regions with limited charging infrastructure, as they do not require plug-in charging.

Based on drive type, the market is segmented into all-wheel drive (AWD), front-wheel drive (FWD), and rear-wheel drive (RWD). The all-wheel drive (AWD) segment has dominated the market iun 2024.

All-Wheel Drive (AWD): AWD electric vehicles offer superior traction and stability, making them ideal for varying road conditions and terrains. The demand for AWD EVs is driven by consumers in regions with harsh weather conditions, as well as by those seeking high-performance vehicles. Luxury and performance EV models commonly feature AWD to enhance driving dynamics.

Front-Wheel Drive (FWD): FWD EVs are popular due to their efficient power delivery and lower manufacturing costs. This drive type is commonly found in smaller, more affordable EVs, making it appealing to budget-conscious consumers. The simplicity and efficiency of FWD systems contribute to their widespread use in urban and compact electric vehicles.

Rear-Wheel Drive (RWD): RWD EVs are favored for their balanced weight distribution and enhanced handling, particularly in sports and luxury vehicles. The RWD segment is driven by performance-oriented consumers and automakers seeking to deliver superior driving experiences. As EV technology advances, RWD systems are becoming more common in high-performance models.

Based on range, the market is segmented into up to 150 miles, 151-300 miles, and above 300 miles.

Up to 150 Miles: EVs with a range of up to 150 miles cater to urban commuters and short-distance drivers. These vehicles are typically more affordable and appeal to consumers in densely populated cities with access to frequent charging. The segment is driven by cost-conscious buyers and those with predictable daily driving patterns.

151-300 Miles: This range segment represents a balance between affordability and practicality, appealing to a broad audience of EV buyers. Vehicles in this category are suitable for both daily commutes and occasional longer trips. The segment's growth is driven by advancements in battery technology, which extend range while maintaining cost efficiency.

Above 300 Miles: EVs with a range exceeding 300 miles cater to long-distance travelers and consumers seeking flexibility without frequent recharging. The segment is driven by advancements in high-capacity batteries and fast-charging infrastructure. These vehicles are popular among luxury buyers and those who prioritize convenience and extended range capabilities.

Based on component, the market is segmented into up to battery cells & packs, on-board charge, motor, reducer, fuel stack, power control unit, battery management system, fuel processor, power conditioner, air compressor, and humidifier.

Battery Pack & High Voltage Component: This segment is critical to EV performance, as battery packs determine range, charging time, and overall efficiency. The market is driven by continuous improvements in battery technology, such as increased energy density and reduced costs, which are essential for the widespread adoption of EVs.

Motor: Electric motors are central to vehicle performance, directly influencing acceleration, efficiency, and power delivery. The growth of this segment is driven by advancements in motor technology, including higher efficiency and compact designs, which enhance the driving experience and make electric vehicles more competitive with traditional combustion engines.

Brake, Wheel & Suspension: This segment focuses on components that ensure safety, handling, and comfort in EVs. Regenerative braking systems, lightweight materials, and advanced suspension technologies are driving the segment's growth, as automakers strive to improve vehicle performance and driving dynamics in electric vehicles.

Body & Chassis: The body and chassis segment is crucial for vehicle durability, safety, and aerodynamics. The use of lightweight materials and innovative design solutions is driving the segment, as manufacturers aim to reduce vehicle weight to improve range and efficiency, while also meeting safety standards.

Low Voltage Electric Component: This segment includes electrical systems that power auxiliary functions such as lighting, infotainment, and climate control. The segment's growth is driven by the increasing complexity and integration of electronic systems in EVs, requiring more sophisticated low-voltage components to manage energy efficiently and enhance the user experience.

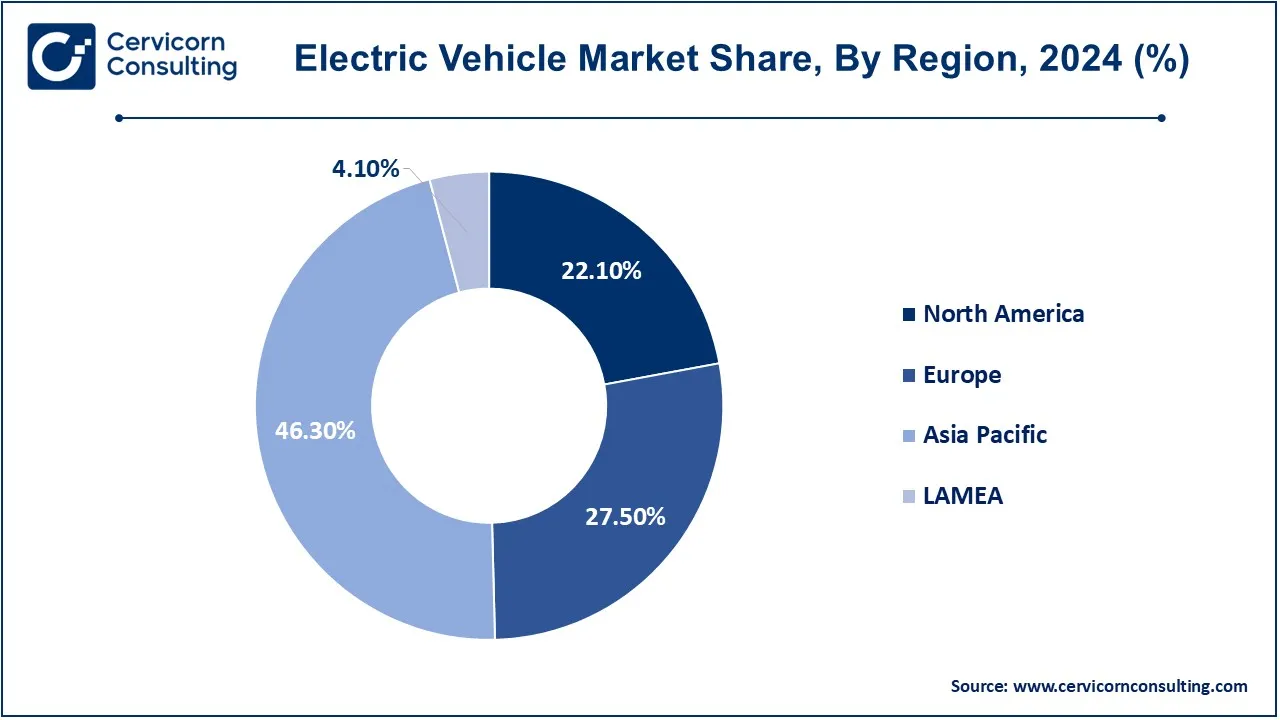

The electric vehicle market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific segment has dominated the market in 2024.

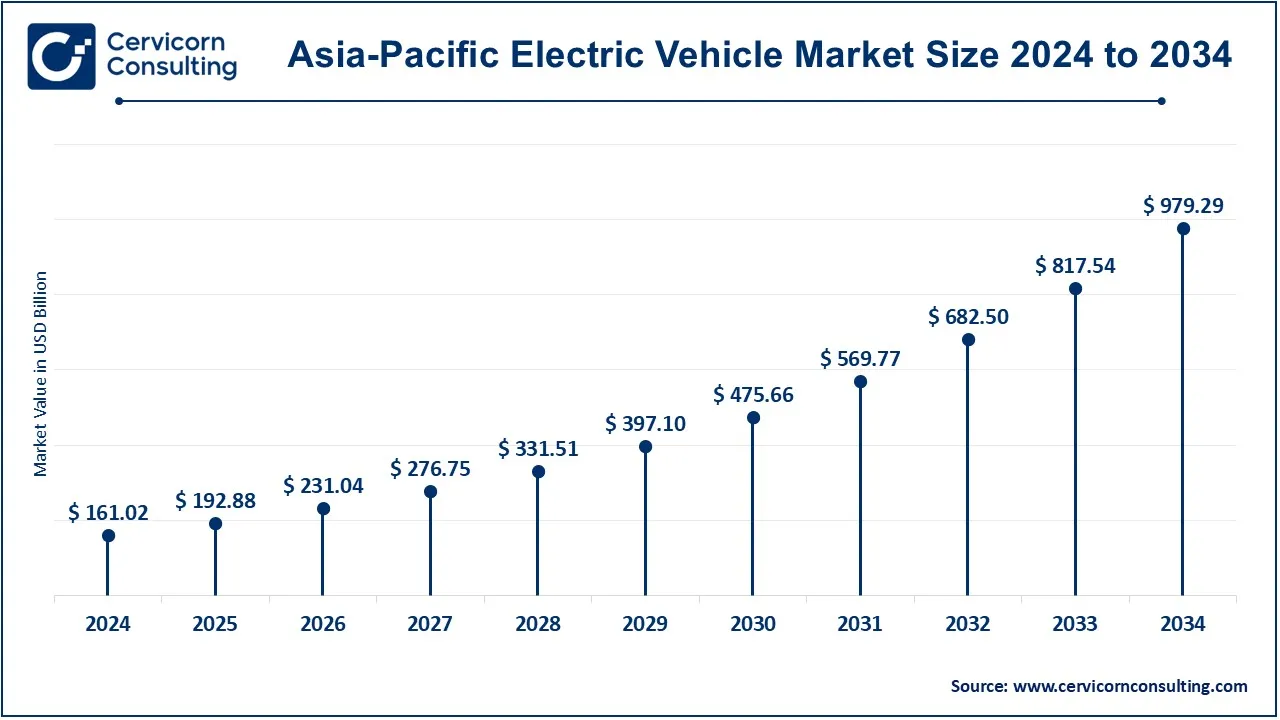

The Asia-Pacific electric vehicle market size was valued at USD 161.02.78 billion in 2024 and is expected to reach around USD 979.29 billion by 2034. Asia-Pacific is the largest and fastest-growing EV market, with China dominating the region due to strong government support, massive investments in EV manufacturing, and a rapidly expanding charging infrastructure. Japan and South Korea are also key players, focusing on innovation in battery technology and electric mobility solutions. The region's growth is driven by increasing urbanization, rising environmental concerns, and the push for energy security, making it a critical area for future EV development.

The North America electric vehicle market size was estimated at USD 76.86 billion in 2024 and is projected to hit around USD 467.43 billion by 2034. The North American ev market is driven by strong government incentives, stringent emissions regulations, and significant investments in EV infrastructure. The United States, in particular, is leading the region's growth with increased adoption of electric cars, supported by federal and state tax credits, as well as the expansion of charging networks. Additionally, the presence of key EV manufacturers and tech companies in the region, coupled with rising consumer awareness about environmental issues, continues to fuel market expansion.

The Europe electric vehicle market size was reached at USD 95.64 billion in 2024 and is predicted to surpass around USD 581.65 billion by 2034. Europe is at the forefront of the global ev market, driven by aggressive environmental policies, high fuel prices, and government initiatives promoting zero-emission vehicles. Countries like Norway, Germany, and the Netherlands are leading in EV adoption, with substantial investments in charging infrastructure and incentives for consumers. The region's commitment to reducing carbon emissions, along with the European Union's stringent automotive emissions standards, is accelerating the transition to electric mobility.

The LAMEA electric vehicle market was valued at USD 14.26 billion in 2024 and is anticipated to garner USD 81.72 billion by 2034. The EV market in LAMEA is still in its nascent stages but shows significant potential for growth. Latin America is seeing increased adoption due to rising fuel prices and government initiatives to reduce emissions. In the Middle East, wealthy nations like the UAE are investing in EV infrastructure as part of broader sustainability goals. Africa, although slower in adoption, is beginning to see interest in electric vehicles, driven by urbanization and the potential for renewable energy integration in EV charging.

New players like Rivian and Lucid are leveraging advanced technology and a focus on luxury and performance to carve out a niche in the competitive EV market. Rivian, with its emphasis on rugged, adventure-ready electric trucks and SUVs, has attracted significant investment and partnerships, including a high-profile collaboration with Amazon.

On the other hand, dominating players like Tesla and BYD are driving market growth through continuous innovation, extensive charging infrastructure, and global expansion. Tesla’s focus on autonomous driving technology and energy storage solutions, along with BYD’s vertical integration and battery technology leadership, continue to set them apart in the industry.

CEO Statements

Elon Musk, CEO of Tesla, Inc.

Wang Chuanfu, CEO of BYD Company Ltd.

Mary Barra, CEO of General Motors Company

Herbert Diess, CEO of Volkswagen AG

Hyun-Soon Lee, CEO of Hyundai Motor Company

Lucid Motors, CEO Peter Rawlinson

Market Segmentation

By Type

By Vehicle Type

By Propulsion Type

By Drive Type

By Range

By Vehicle Class

By Component

By E/E Architecture

By Charging Point Type

By Vehicle Connectivity

By Region