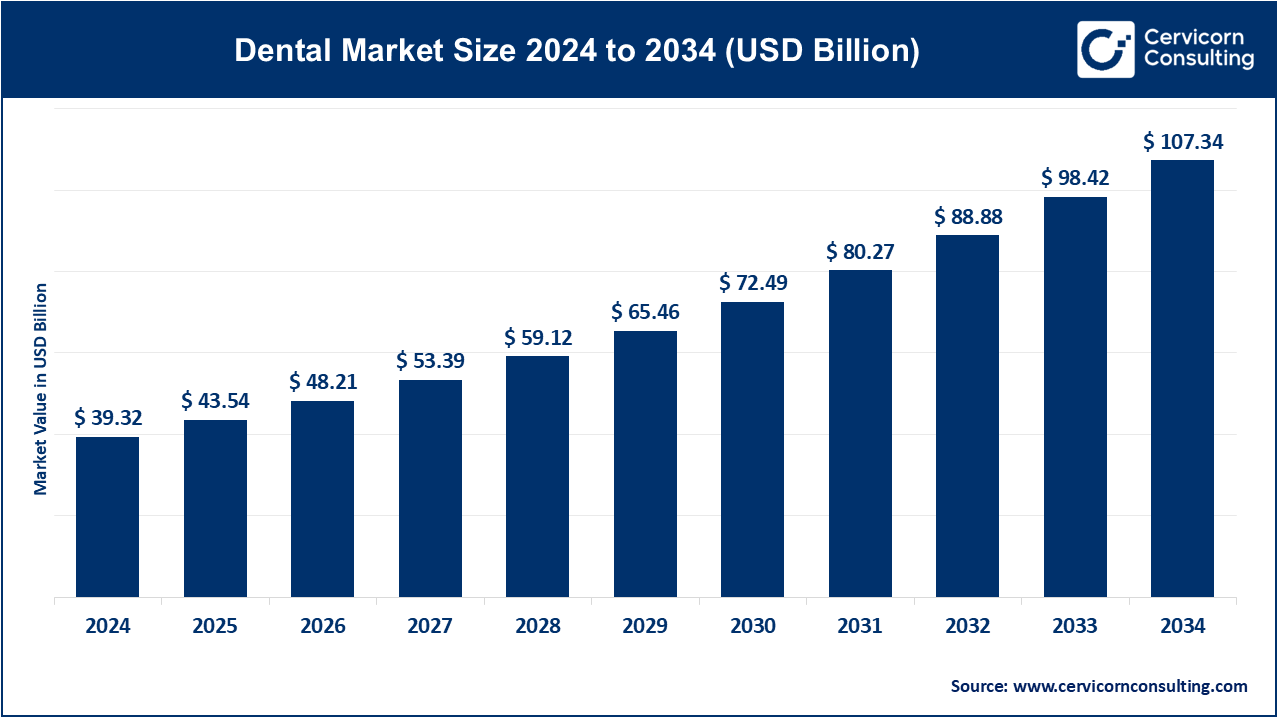

The global dental market size accounted at USD 39.32 billion in 2024 and is expected to be worth around USD 107.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.73% from 2025 to 2034.

The dental market has witnessed significant growth in recent years, driven by rising awareness about oral health and increasing demand for cosmetic dental procedures. The global dental industry is expanding rapidly due to advancements in technology, such as digital dentistry, which has improved diagnosis, treatment, and patient care. Additionally, an aging population and growing focus on aesthetics have contributed to the demand for dental services, including orthodontics and cosmetic surgeries. The market is also fueled by an increase in dental insurance coverage and government initiatives promoting oral health education. The dental market is expected to continue its growth trajectory, with key trends including the rise of teledentistry and at-home dental care products. Technological innovations like 3D printing, AI in diagnostics, and laser treatments are expected to enhance the patient experience and reduce treatment time. Between March 2023 and February 2024, the world imported 40,038 shipments of surgical dental products, supplied by 8,644 exporters to 5,697 global buyers, marking an 84% growth compared to the preceding twelve months.

Dental refers to anything related to the teeth and oral health. It includes the study, diagnosis, prevention, and treatment of oral diseases. The primary focus is on maintaining healthy teeth, gums, and other mouth structures. Dental care involves routine visits to a dentist for check-ups, cleanings, fillings, and addressing issues like cavities, gum diseases, and oral infections. Dentists also provide cosmetic treatments like teeth whitening and veneers. Oral hygiene practices, such as brushing, flossing, and using mouthwash, are essential for preventing dental problems. Poor oral hygiene can lead to more severe health issues, including heart disease and diabetes. Regular dental visits are important for detecting problems early and ensuring overall well-being.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 43.54 Billion |

| Projected Market Size (2034) | USD 107.34 Billion |

| Growth Rate (2025 to 2034) | 10.56% |

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Segments Covered | Type, Application, End User, Region |

| Companies Covered | Dentsply Sirona, Align Technology, Danaher Corporation, 3M Oral Care, Henry Schein, Inc., Straumann Group, Zimmer Biomet, IvoclarVivadent, Patterson Companies, Inc., Planmeca Oy, Nobel Biocare (Part of Envista Holdings), Carestream Dental, GC Corporation, Coltene Holding AG, Kulzer GmbH |

Increased Funding in Dental Technology

Rising Demand for Dental Implants

High Costs of Advanced Dental Procedures

Limited Access to Dental Care in Rural Areas

Emerging Markets

Expansion of Preventive Dental Care Services

Regulatory Compliance and Market Entry Barriers

Shortage of Skilled Dental Professionals

The dental market is segmented into type, application, end-users, and region. Based on type, the market is classified into dental consumables, and dental equipment. Based on application, the market is classified into preventive care, restorative dentistry, cosmetic dentistry, periodontal care, and endodontics. Based on end-users, the market is classified into dental clinics, hospitals, dental laboratories, academic and research institutes, home care.

Dental Equipment: The dental equipment segment has accounted revenue share of 24% in 2024. This segment includes tools and devices used in dental procedures, such as dental chairs, handpieces, imaging systems (X-rays, intraoral cameras), lasers, CAD/CAM systems, and sterilization equipment. The demand for advanced dental equipment is driven by the increasing adoption of digital dentistry, which enhances diagnostic accuracy and treatment outcomes. Continuous technological advancements are propelling growth in this segment.

Dental Consumables: The dental consumable segment has accounted revenue share of 76% in 2024. This segment encompasses products that are used regularly and need to be replenished, such as dental implants, crowns, bridges, dental composites, bonding agents, and impression materials. The rise in cosmetic dentistry and the growing elderly population are key drivers of demand for dental consumables.

Dental Implants: Dental implants are a significant part of the market, used as a permanent solution for tooth loss. This segment includes endosteal and subperiosteal implants, which are gaining popularity due to advancements in materials and techniques, leading to higher success rates and patient satisfaction.

Dental Prosthetics: This includes products like dentures, crowns, bridges, and veneers used to replace or cover damaged teeth. The prosthetics market is growing due to the increasing number of elderly patients requiring tooth replacement, as well as the rising demand for cosmetic dental procedures.

Orthodontic Devices: This segment includes braces, aligners, and other devices used to correct misaligned teeth and jaws. The demand for orthodontic devices is driven by the growing popularity of cosmetic dentistry and the introduction of invisible aligners that offer a more aesthetic solution compared to traditional braces.

Preventive Care: This application segment focuses on products and services aimed at preventing dental issues before they arise. It includes routine check-ups, cleanings, fluoride treatments, sealants, and patient education on oral hygiene. The emphasis on preventive care is increasing as awareness grows about the long-term benefits of maintaining oral health, thereby reducing the need for more invasive treatments later.

Restorative Dentistry: Restorative dentistry involves repairing or replacing damaged or missing teeth. This segment includes procedures such as fillings, crowns, bridges, implants, and root canals. The rising demand for restorative dentistry is driven by the aging population and the growing prevalence of dental caries and periodontal diseases.

Cosmetic Dentistry: Cosmetic dentistry focuses on enhancing the appearance of the teeth and smile. It includes procedures like teeth whitening, veneers, bonding, and gum contouring. The growing desire for aesthetic improvements, fueled by social media and increasing disposable income, is driving the growth of this segment.

Periodontal Care: This segment addresses the prevention, diagnosis, and treatment of gum diseases such as gingivitis and periodontitis. Products and treatments include scaling and root planing, periodontal surgeries, and the use of specialized antimicrobial agents. The increasing awareness of the importance of gum health and its connection to overall health is boosting this segment.

Endodontics: Endodontics involves the treatment of dental pulp and root tissues. This segment includes procedures like root canal therapy and endodontic surgery. The demand for endodontic treatments is growing as patients seek to preserve their natural teeth rather than opting for extractions.

Dental Clinics: Dental clinics represent the largest end user segment, providing a wide range of dental services, from preventive care to complex surgical procedures. The growth of this segment is driven by the increasing number of dental clinics worldwide and the rising demand for personalized dental care.

Hospitals: Hospitals with dental departments or specialized dental hospitals cater to patients requiring advanced dental procedures, such as oral surgeries or treatment for severe dental trauma. This segment is expected to grow due to the increasing integration of dental services within general healthcare facilities.

Dental Laboratories: Dental laboratories play a crucial role in the production of dental prosthetics, orthodontic devices, and other customized dental products. The demand for dental laboratories is growing in line with the rising need for high-quality, customized dental solutions, driven by advancements in digital dentistry and materials science.

Academic and Research Institutes: This segment includes universities, dental schools, and research institutions involved in dental education and research. The growth in this segment is fueled by the continuous need for skilled dental professionals and ongoing research into new dental technologies and treatments.

Home Care: Home care products include over-the-counter items such as toothbrushes, toothpaste, mouthwashes, and dental floss. The emphasis on preventive care and oral hygiene is driving growth in this segment, with consumers increasingly investing in high-quality home care products to maintain their dental health.

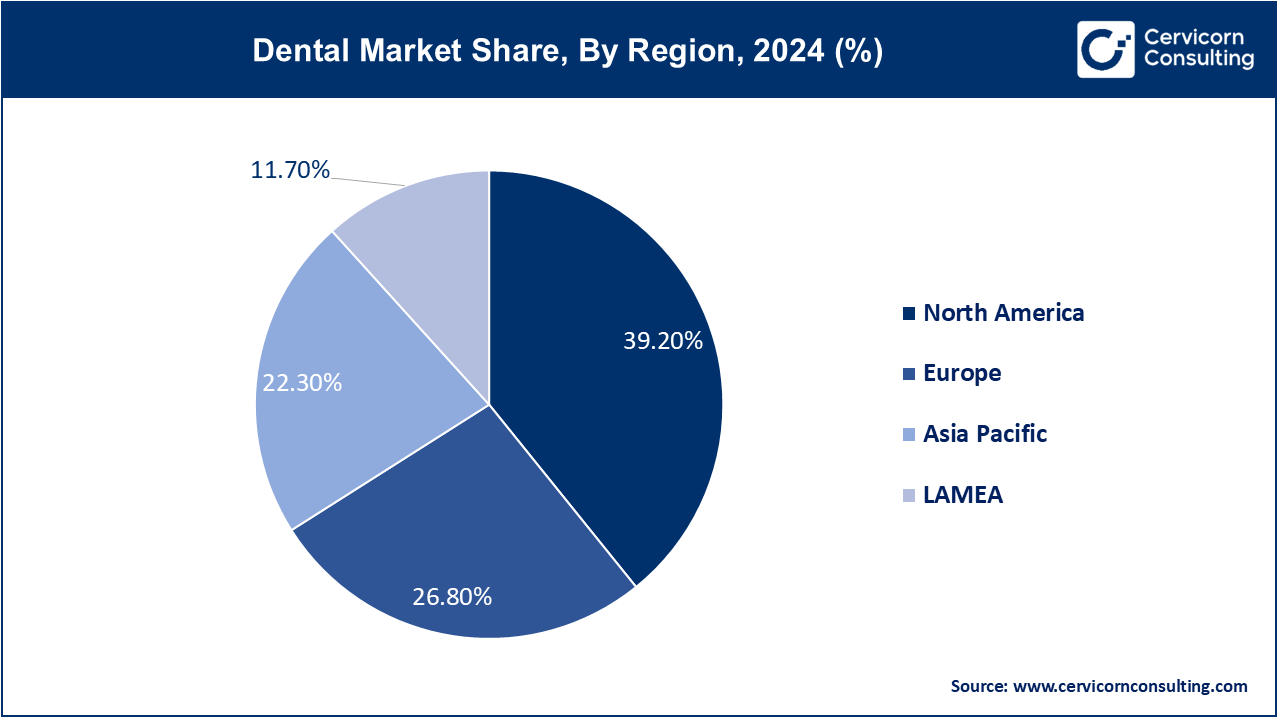

The dental market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

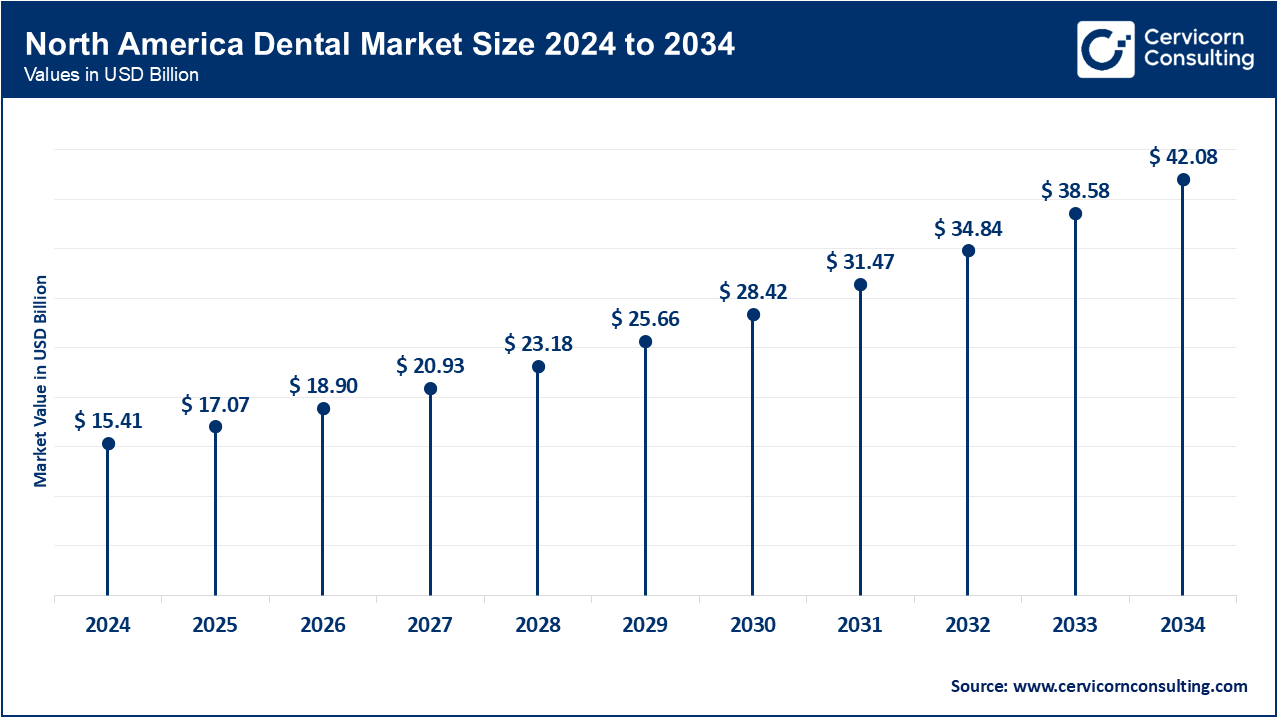

The North America dental market size was valued at USD 15.41 billion in 2024 and is expected to reach around USD 42.08 billion by 2034. North America leads the dental market due to its advanced healthcare infrastructure, high awareness of oral health, and strong demand for cosmetic dentistry. The U.S. and Canada are at the forefront of adopting innovative dental technologies, including digital imaging, CAD/CAM systems, and laser dentistry. Significant investments in dental research, a robust network of dental professionals, and comprehensive dental insurance coverage drive market growth. Additionally, the region's focus on preventive care and the rising popularity of aesthetic dental procedures further boosts the market's expansion.

The Europe dental market size was accounted for USD 10.54 billion in 2024 and is projected to surpass around USD 28.77 billion by 2034. Europe’s dental market is characterized by a well-established dental care system and growing demand for advanced dental treatments. Countries like Germany, the UK, and France are leaders in adopting new dental technologies, including 3D printing for dental prosthetics and minimally invasive surgical techniques. The market benefits from supportive government health policies, expanded access to dental care, and increasing public awareness of oral health's importance. The emphasis on integrating cutting-edge technologies and improving patient outcomes supports overall market growth.

The Asia-Pacific dental market size was estimated at USD 8.77 billion in 2024 and is expected to be worth around USD 23.94 billion by 2034. The Asia-Pacific region is experiencing rapid growth, driven by increasing urbanization, rising disposable incomes, and expanding access to dental care. Countries such as China, Japan, and India are witnessing significant investments in dental infrastructure and the adoption of advanced dental technologies. The growing demand for cosmetic dentistry, coupled with a focus on improving overall oral health, is notable. Government initiatives aimed at expanding healthcare access and increasing awareness of oral hygiene are key factors propelling market growth.

The LAMEA dental market is expanding due to growing awareness of oral health and improving healthcare infrastructure. In Latin America, countries like Brazil and Mexico are seeing heightened demand for both basic and advanced dental care services. The Middle East benefits from substantial investments in healthcare infrastructure and the adoption of innovative dental technologies. While Africa faces challenges such as limited resources and access to dental care, progress is being made through international partnerships and funding initiatives aimed at improving dental services and access to modern dental technologies across the region.

Among the emerging players in the dental market, Carbon, Inc. leverages advanced 3D printing technology to provide innovative dental solutions, enhancing precision and reducing treatment times. Envista Holdings Corporation focuses on developing cutting-edge dental implants and orthodontic products, combining clinical efficacy with patient comfort for various dental applications.

Dominant players like Dentsply Sirona drive growth through their extensive product lines and recent introductions, including digital dentistry solutions that streamline workflows and improve patient outcomes. Align Technology integrates advanced clear aligner technology with its wide range of orthodontic products, facilitating comprehensive dental solutions. Innovations and collaborations, such as Carbon’s new material developments and Align Technology’s strategic partnerships, underscore their leadership in the evolving dental market.

CEO Statements

Dr Chris Ciriello, CEO and founder of Perceptive:

Sarah Chavarria, CEO of Delta Dental:

Key players in the dental industry are influential in providing a range of innovative dental solutions, including digital dentistry, advanced materials, and minimally invasive technologies. Some notable examples of key developments in the market include:

These developments highlight a significant expansion in the dental industry through acquisitions and innovative projects, aimed at improving patient outcomes, enhancing treatment efficiency, and broadening product offerings for various dental applications. By integrating cutting-edge technologies and advancing minimally invasive techniques, key players are driving the growth of the dental industry, ensuring that patients have access to more effective, comfortable, and sustainable dental care solutions.

Market Segmentation

By Type

By Application

By End-Users

By Regions