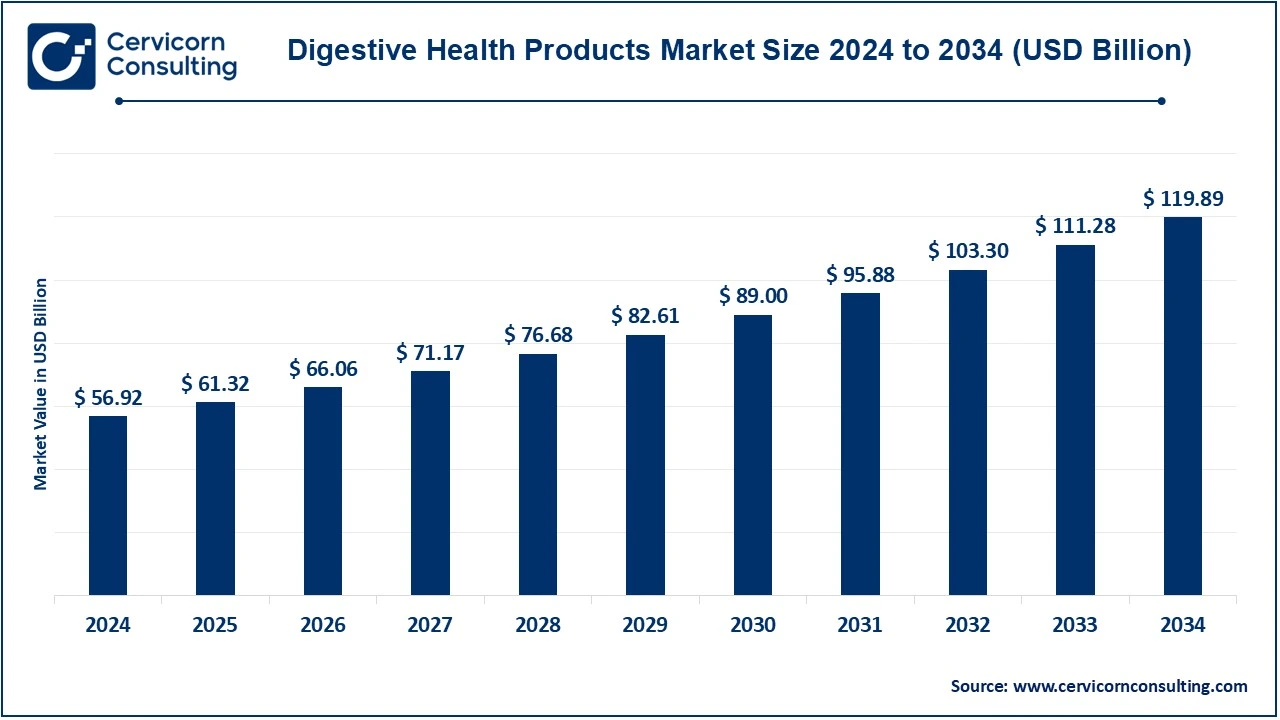

The global digestive health products market size was valued at USD 56.92 billion in 2024 and is expected to be worth around USD 119.89 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.73% over the forecast period 2025 to 2034. The U.S. digestive health products market size was estimated at USD 13.26 billion in 2024 and is projected to surpass around USD 27.94 billion by 2034.

In the past, digestive health products were generally simple ways to treat certain stomach problems. Examples of such medications include antacids and laxatives. As the complex relationship between gut health and overall well-being becomes increasingly clear, the perspective on a holistic approach to digestive health has changed. Due to this progression, a vast array of goods, including as fibre, digestive enzymes, probiotics, and prebiotics, have been developed and made widely available. Each of these items has a unique mechanism of action and is said to provide health advantages. The market expanded due to the rise of dietary supplements and drinks that contain ingredients that enhance digestion, offering consumers easy and delicious choices to assist them in reaching their digestive health objectives.

Many digestive health supplements contain digestive enzymes including lactase, lipase, and amylases, which help with digesting and keeping stomach acid levels under control. The increasing demand for nutritional and dietary supplements is one of the key factors driving the market. Digestive health products are projected to see significant demand from the dairy sector for usage in milk, cheese, yogurt, and drinks. Given the increasing use of probiotics and food enzymes in newborn formulae, as well as increased health concerns among adults, these products are expected to drive market expansion in the future years.

Michael Peter, CEO of Siemens Mobility: "We believe that battery hybrid drives and dual-power trains will play an important role in reducing emissions and protecting the environment."

Tracy Robinson became president and CEO of the Canadian National Railway Company (CN Rail): "You can reduce emissions by about 75% if you shift from truck to rail, but doing that requires us to think about our business very differently."

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 61.32 Billion |

| Expected Market Size in 2034 | USD 119.89 Billion |

| Estimated CAGR 2025 to 2034 | 7.73% |

| Most Prominent Region | North America |

| High-growth Region | Asia-Pacific |

| Key Segments | Product, Ingredient, Delivery Format, Application, Distribution Channel, Region |

| Key Companies | Abbott, Cargill, Arla Foods, Amway Corp., BASF SE, EZZ Life Science Holdings, Anagenix, Associated British Foods plc, Bayer AG, Pantheryx, Deerland Probiotics & Enzymes, Ingredion Incorporated, NP Nutra |

Increasing Demand for Nutritional Supplements

Growing Awareness of the Gut-Brain Connection

Strict Regulatory Requirements

Expensive R&D

Growing Technological Advancements

Increasing R&D

Limited Reimbursement Coverage

Challenges in Satisfying Client Expectations

The digestive health products market is segmented into product, ingredient, delivery format, application, distribution channel, and regions. Based on product type, the market is classified into dairy products, bakery & cereals, non-alcoholic beverages, supplements, and others. Based on ingredient, the market is classified into prebiotics, probiotics, and food enzymes. Based on delivery format, the market is classified into capsules, tablets, chewable, drops, caplets, and sticks. Based on application, the market is classified into functional foods, functional beverages, breakfast cereals, and pharmaceuticals. Based on distribution channel, the market is classified into supermarkets & hypermarkets, e-commerce, pharmacy, and specialty stores.

Dairy: The dairy product segment has dominated the market in 2024. The market is driven by the growing consumer inclination towards preventive healthcare, coupled with the development of efficient probiotic strains for dairy products to reduce gut inflammation and improve gut health and immunity. The popularity of functional beverages, including relaxation drinks, sports drinks, and kombucha, has increased significantly due to their unique taste and health benefits. Therefore, the inclusion of functional ingredients, including prebiotics and probiotics, in non-alcoholic beverages is expected to increase, which in turn is expected to benefit the market growth.

Bakeries and Grains: Breads, baked goods, and baking mixes are great for using more gut-friendly ingredients. There are several ingredients to make baked goods more gut-friendly, including fiber, prebiotics, and probiotics, and processing techniques such as sprouting and fermenting. The products available in the baking category contain ingredients that have a positive impact on the microbiome, providing consumers with the opportunity to include gut-friendly, healthy ingredients in their diet. Cereals have the greatest potential as an alternative to non-dairy probiotic foods. Their recognized health-promoting effects can be exploited, leading to the development of cereal-based probiotic products. Cereal products can improve nutritional quality and stimulate the immune system. Over the generations, cereal grains have been transformed into value-added products with the help of microorganisms and their enzymes. Fermented cereals can also improve digestion and reduce blood lipid levels. Therefore, the added nutritional value of fermentation improves the properties of the product, making it a better food ingredient than the original cereal.

Soft drinks: Soft drinks account for a significant share of the global market and are expected to increase significantly during the forecast period due to factors such as the increasing popularity of soft drinks as they do not have the harmful effects of alcohol. They serve as a healthy substitute to their alcoholic counterparts. The positive effects of non-alcoholic beer during breastfeeding are well known. It also helps to relieve anxiety and leads to better sleep. It works well against stress and has shown signs of fighting cancer, also having a positive impact on heart health.

Dietary Supplements: Positive attitudes towards diet and health, driven by increasing awareness about the benefits of an active lifestyle and dietary supplements, are expected to significantly boost digestive health products. Aging population and growing concern about gut health are also major drivers of increased product demand. With increasing age, the digestive system may become less efficient, leading to various health problems. Digestive health products can support gut health and promote overall well-being. Increasing consumer spending on products that improve gut health is expected to further boost product demand during the forecast period.

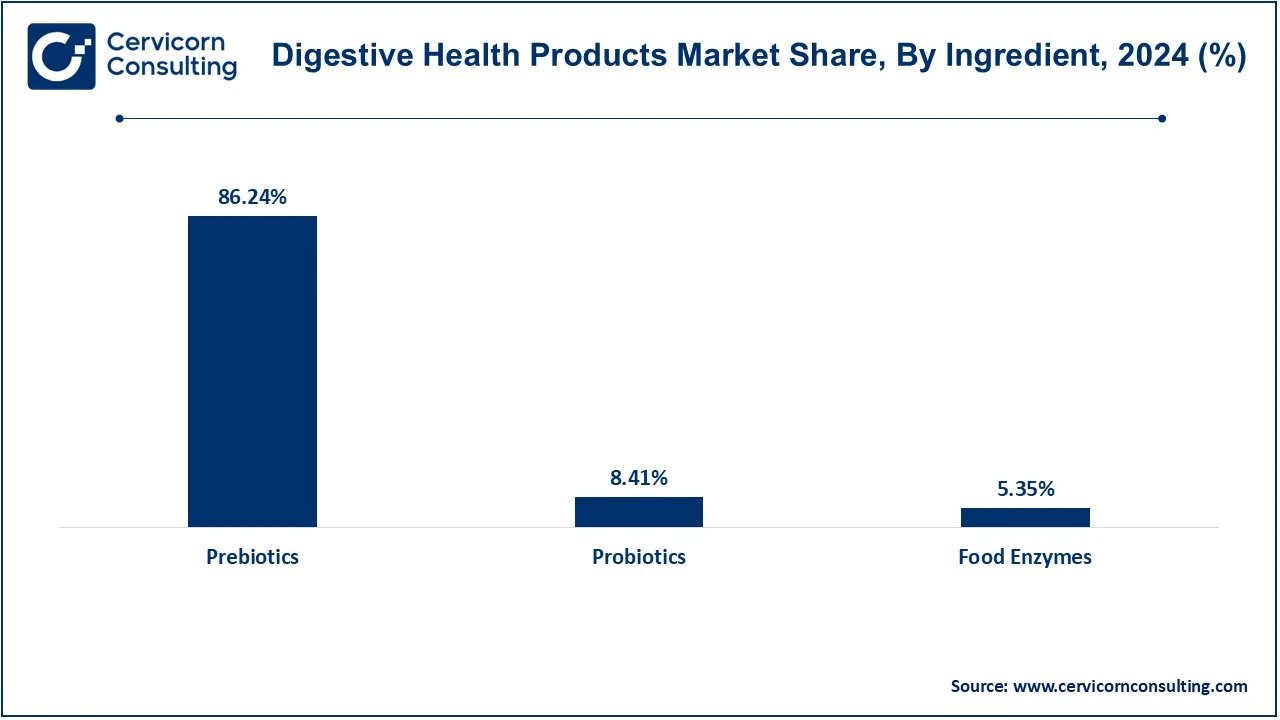

Prebiotics: The prebiotics segment has captured high market share in 2024. Prebiotics create the perfect environment for the healthy bacteria already present in the gut to thrive. Prebiotics also promote healthy weight management. PrebiotinTM is a complete prebiotic fiber that nourishes bacteria on both sides of the colon and prevents the growth of unwanted microbiota.

Probiotics: Probiotics are often found in fermented supplements and foods and are considered safe for most people. The popularity of probiotic ingredients in healthy foods and supplements is due to growing consumer awareness of their potential health benefits, such as supporting immune function, improving digestive health, reducing inflammation, and promoting mental health. This trend is driven in part by a growing concern for health and well-being, as well as an increasing desire for natural and healthy food options. In addition, probiotic ingredients are believed to have a positive impact on a number of health issues, including allergies, autoimmune diseases and mental health.

Food Enzymes: Multifunctionality of food enzymes and growing demand for enzyme cultures from the food and beverage industry are expected to drive the segment growth during the forecast period. Food enzymes are primarily used in the production and processing of dairy products. They are widely used across the food industry to improve the quality, texture and taste of various products. Applications in the food industry include traditional areas such as baking, brewing and cheese making, as well as newer areas such as fat modification and the development of new sweeteners.

Supermarkets & Hypermarkets: The supermarkets & hypermarkets segment has held dominant position in 2024. Supermarkets provide customers with an easy and enjoyable shopping experience with a diverse selection of items, accessibility and availability. They also offer discounts, promotions, contests and cashback to make shopping more enjoyable. Hypermarkets provide a holistic shopping experience by offering various items, discounts and competitive prices. They provide customers with a quick and effective way to find everything they need and prioritize customers' convenience and comfort, making them popular among families and individuals.

E-Commerce: E-commerce offers low cost, flexibility, speed, comprehensive product descriptions, easy availability through search engines, reduced inventory costs, technology and 24/7 availability. It reduces middlemen, encourages customer reviews and automates tasks, making it an attractive option for businesses. Many e-commerce platforms offer subscription and automatic replenishment services for digestive health products, allowing consumers to schedule regular deliveries based on their frequency of use. This encourages enduring client loyalty and ensures product supply continuity.

Digestive Health Products Market Revenue Share, By Distribution Channel, 2024 (%)

| Distribution Channel | Revenue Share, 2024 (%) |

| Supermarkets & Hypermarkets | 46.31% |

| E-Commerce | 23.15% |

| Pharmacy Stores | 18.27% |

| Others | 12.27% |

Pharmacy: Consumers are increasingly looking for ways to self-treat minor digestive issues, driving demand for easily accessible products and supplements. These products are convenient and affordable and do not require a prescription, making them appealing to a wide range of consumers. OTC digestive health supplements, including probiotics, enzymes, and fiber products, are widely available in pharmacies as consumers continue to emphasize preventive healthcare and wellness.

Specialty Stores: The specialty stores are convenient and affordable and do not require a prescription, making them attractive to a wide range of consumers. Moreover, growing health awareness, rising disposable incomes, and the prevalence of digestive disorders are contributing to the growth of the segment.

The digestive health products market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

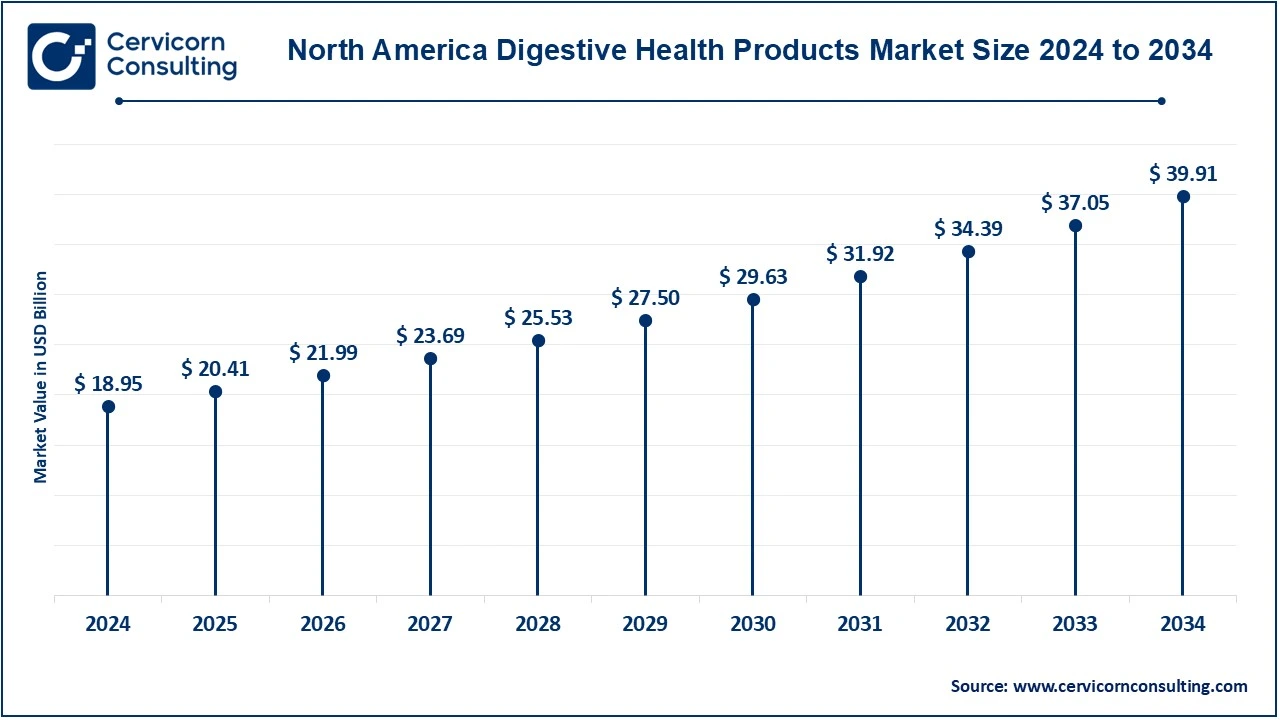

The North America digestive health products market size was valued at USD 18.95 billion in 2024 and is expected to reach around USD 39.91 billion by 2034. The high market share in this region is the result of the strong presence of leading players in this region, government support for new product development and technological advancements in the probiotics and prebiotics sector. In addition, factors such as rising healthcare costs, changes in food laws affecting labelling and product claims, rapid advancements in science and processing technology, increasing aging population and growing interest in achieving wellness through diet are increasing consumer interest in digestive health products in North America.

The Europe digestive health products market size was estimated at USD 16.34 billion in 2024 and is projected to hit around USD 34.42 billion by 2034. The European market is expanding as consumers become more aware of digestive health issues, lifestyle-related diseases, and a desire for natural and functional meals. As customers prioritize their health, there is a rising need for natural and creative digestive health solutions, creating opportunities for both new and established firms. Key nations such as the United Kingdom and Germany are propelling a rise in demand for digestive health products. The growing significance of probiotics is additionally supporting the market, although as the industry progresses, growth may decelerate.

The Asia-Pacific digestive health products market size was accounted for USD 13.63 billion in 2024 and is predicted to surpass around USD 28.70 billion by 2034. There is increasing health awareness among consumers in Asia Pacific, focusing on healthy digestion and its impact on overall well-being. This has heightened the need for digestive health items like probiotics, prebiotics, supplements, and functional foods. Digestive issues like IBS, constipation, and acid reflux are increasing in the area, attributed to factors like evolving diets, stress, and a lack of physical activity. Consumers are looking for effective solutions for digestive issues, which is driving the demand for digestive health products. With a rising population, greater disposable income, and improved living conditions, especially in China and India, the market is expected to grow further in the region.

Digestive Health Products Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 33.29% |

| Europe | 28.71% |

| Asia-Pacific | 23.94% |

| LAMEA | 14.06% |

The LAMEA digestive health products market size was valued at USD 8 billion in 2024 and is anticipated to reach around USD 16.86 billion by 2034. The LAMEA market is a growing sector characterized by increasing consumer awareness of health and well-being, increasing incidence of digestive disorders, and increasing preference for functional foods and dietary supplements. The market for digestive health products is growing due to increased awareness and demand for functional foods. The need for quick-acting probiotic treatments, such as yoghurt drinks and fortified meals, is growing in sub-Saharan Africa as urbanisation increases. The increasing middle class, which has more disposable income, is willing to spend on digestive health goods, driving market growth in this sector.

Major players are focusing on the Southeast Asia market as there is a target audience in the region. Manufacturers are expanding their production capacities, tracking the changing demand of the food and beverage industry, investing in R&D, and launching new products to meet the growing product demand from various application verticals. In March 2024, Ombre, a leading innovation company in the microbiome testing and probiotics sector, is excited to declare its involvement in the forthcoming Natural Products Expo West, occurring March 13-16 in Anaheim, California. Ombre will be presenting its newest digestive health offerings: the 3-in-1 Probiotic + Prebiotic and Postbiotic, and Prebiotic with SuperGreens. Ombre will be showcasing its latest digestive health products: the 3-in-1 Probiotic + Prebiotic & Postbiotic, and Prebiotic with SuperGreens. Ombre's commitment to scientifically improving gut health is taking major steps forward with these new product launches.

In August 2023, Herbalife launched Herbalife V, a new line of plant-based nutritional supplements, to meet growing consumer demand for plant-based products, including dietary supplements. Various products carry prestigious certifications such as USDA Organic, Verified Non-GMO and Certified Kosher. BASF and Cargill (Provimi) have expanded their partnership to develop and supply feed enzymes in South Korea. The partnership aims to create innovations for South Korean animal protein producers by combining BASF’s enzyme research and development capabilities with Cargill’s market access and application expertise.

Market Segmentation

By Product

By Ingredient

By Delivery Format

By Application

By Distribution Channel

By Region