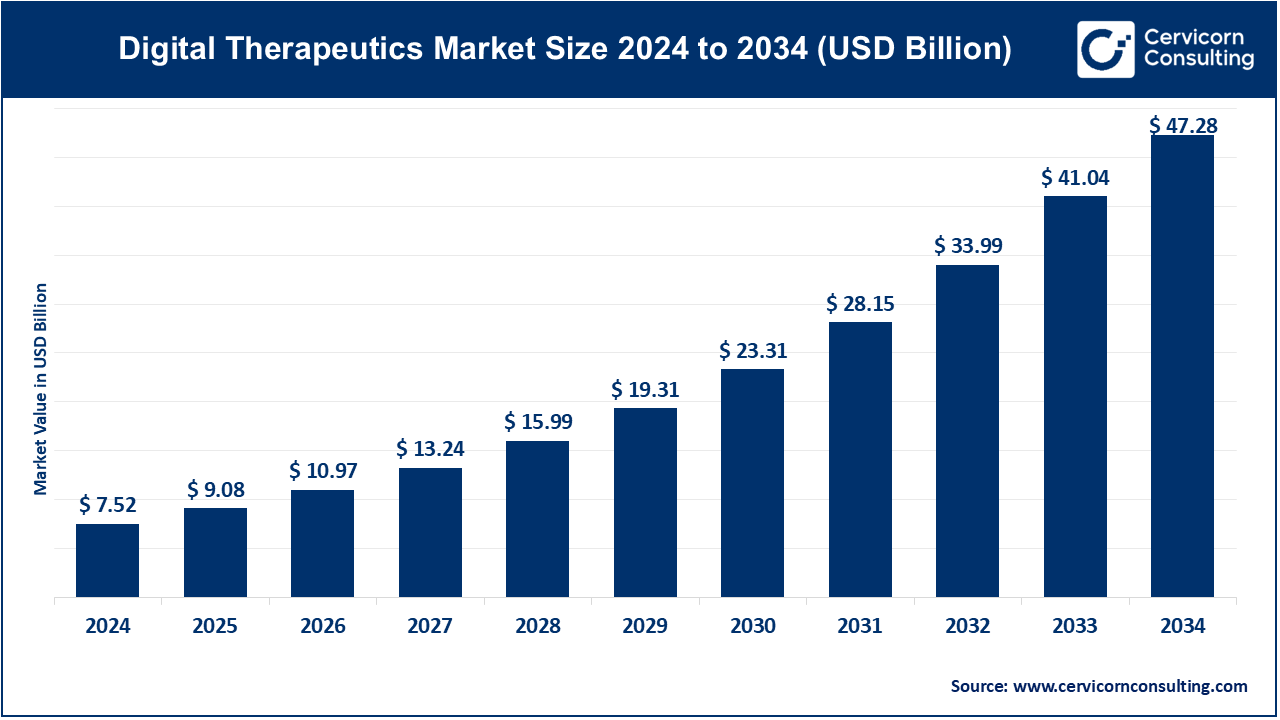

The global digital therapeutics market size was valued at USD 7.52 billion in 2024 and is expected to be worth around USD 47.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 20.18% from 2025 to 2034.

The digital therapeutics (DTx) market is experiencing robust growth, driven by a combination of factors such as technological advancements, increased healthcare demand, and the growing recognition of the need for personalized care solutions. The market is seeing heightened investment in research and development, leading to innovations in software-driven treatments that can manage various chronic conditions, including diabetes, cardiovascular diseases, and mental health disorders. These digital solutions are gaining traction due to their ability to provide real-time monitoring, personalized interventions, and remote care, making them particularly attractive to both healthcare providers and patients. As healthcare systems globally face mounting pressure to improve patient outcomes and reduce costs, digital therapeutics present a cost-effective alternative to traditional treatments. In 2022, corporate investment in digital therapeutics reached USD 329 million, indicating a robust interest in this sector.

Digital therapeutics (DTx) refers to evidence-based software-driven interventions designed to prevent, manage, or treat medical conditions. These interventions typically take the form of apps, wearable devices, or online platforms that deliver therapeutic content, monitor patient progress, and offer tailored treatment plans. DTx can be used to treat conditions like diabetes, mental health disorders, obesity, and chronic diseases by offering real-time data and feedback to both patients and healthcare providers. Unlike general wellness apps, digital therapeutics undergo rigorous clinical testing and have proven efficacy, often being prescribed by healthcare professionals or used alongside traditional therapies.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 9.08 Billion |

| Projected Market Size (2034) | USD 47.28 Billion |

| Growth Rate (2025 to 2034) | 20.18% |

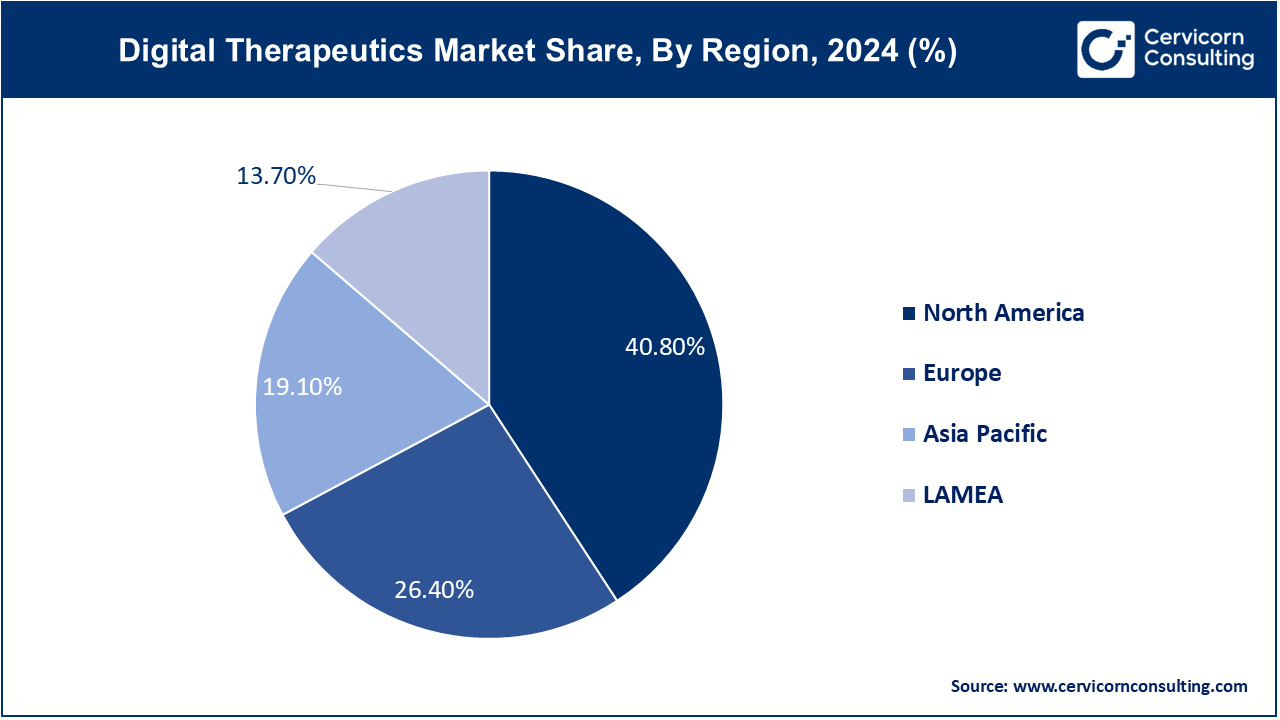

| Dominating Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Type, Application, Sales Channel, End User, Region |

| Key Companies | Fitbit Health Solutions, 2MORROW, Inc., Medtronic Plc., Livongo Health, Inc.(Teladoc Health, Inc.), Pear Therapeutics, Inc., Omada Health, Inc., Resmed, Inc. (Propeller Health), Limbix Health, Inc., Proteus Digital Health, Inc., CureApp Inc., Welldoc, Inc., Voluntis, Inc., DarioHealth Corp., Canary Health Inc., Noom, Inc., Brain+ A/S, Mango Health Inc., Dthera Sciences, JogoHealth, GAIA AG, HYGIEIA, BigHealth |

Rising Frequency of Preventable Chronic Disorders

Increased Accessibility of Care

Strict Regulatory Requirements

Concerns Regarding Data Security and Privacy

Growing Technological Advancements

Rising Government Initiatives

Lack of Awareness

Accessibility and Scalability

The digital therapeutics market is segmented into type, application, sales channel, revenue modal, end use and region. Based on type, the market is classified into devices, software & services. Based on application, the market is classified into obesity, diabetes, respiratory care, mental health, cardiovascular, smoking cessation, chronic respiratory disorders, musculoskeletal disorders, medication adherence, gastrointestinal disorders, substance use & addiction management, rehabilitation & patient care, others. Based on sales channel, the market is classified into business-to-business (B2B), and business-to-consumer (B2C). Based on revenue modal, the market is classified into subscription, one time purchase/licensing, and outcome/value based. Based on end use, the market is classified into patients, providers, payers, employers, and others.

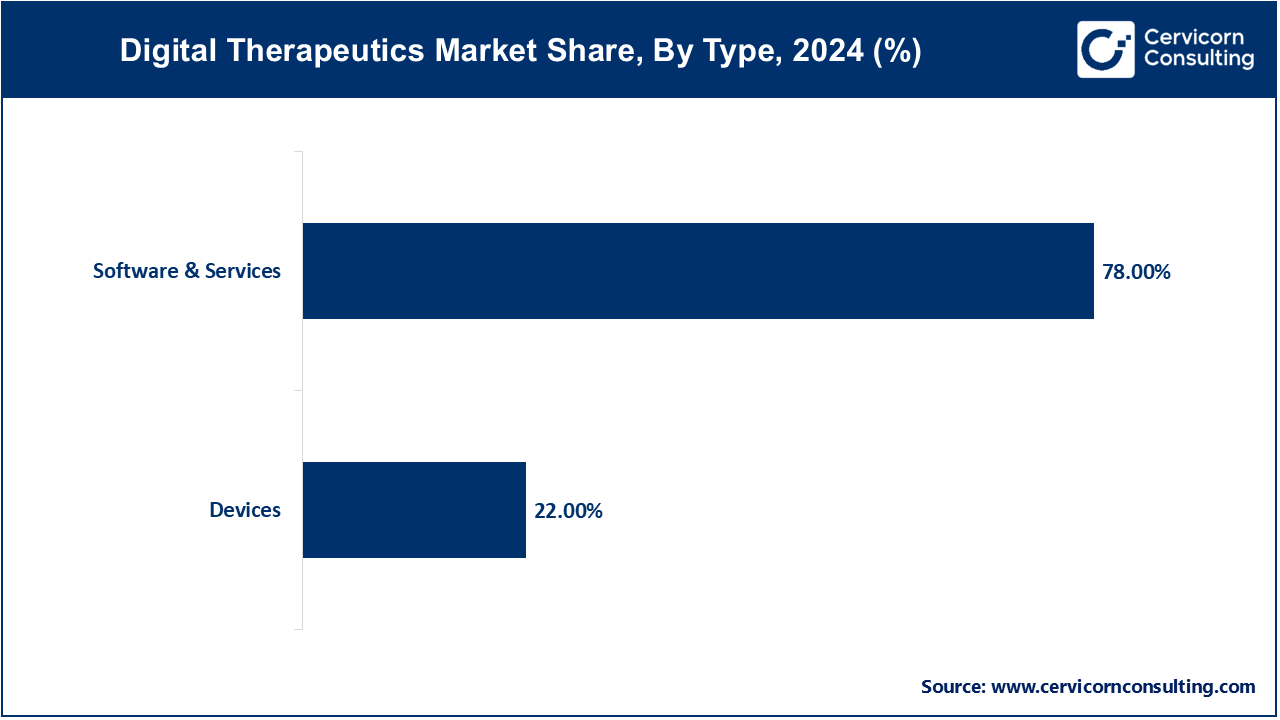

Device

The device segment has captured revenue share of around 22% in 2024. Digital health devices enable remote care through the increasing use of wearable technologies and monitoring tools by patients and physicians. In addition, the use of digital health devices has increased as more people suffer from chronic diseases such as diabetes, cardiovascular disease, and respiratory diseases. This is because these illnesses require ongoing monitoring to be treated.

Software & Services

The software & services segment captured approximately 78% of the revenue share in 2024. The software offers convenient usability, easy access, and personal medications to patients. Their real-time monitoring, AI integration, and easy accessibility improve patient engagement and treatment adherence, strengthening their dominance in the market. For example, Omada Health offers a software-based platform for managing chronic diseases such as diabetes and hypertension that combines behavioral analytics, real-time data monitoring, and personalized coaching. Moreover, the growing importance of market players in developing software for patients with chronic diseases such as diabetes, cardiovascular disease, and mental health issues will support the expansion of the segment.

Obesity

Changing eating habits, largely influenced by the Western pattern that includes packaged foods with high-fat content, are the main cause of the increase in obesity cases. Moreover, hectic lifestyles and daily routines reduce the frequency of exercises and daily warm-up exercises, which in turn is considered to be the major factor in the accumulation of fat in the body. To control this, the general public is highly influenced by fitness apps as well as online help from concerned doctors, which helps in tracking daily physical activity and health data.

Diabetes:

Despite the advancements in conventional diabetes mellitus therapy, hurdles are still to be overcome such as improving medication adherence and patient prognosis. According to a 2023 report by the Institute for Health Metrics and Evaluation, over half a billion people are living with diabetes worldwide, impacting men, women, and children of all ages in every country. DTx has improved patient compliance, treatment success, and economic outcomes in diabetes mellitus management by enabling active patient engagement, lifestyle modification, comprehensive medical care, and regular monitoring of glycemic status.

Respiratory Care

Globally, respiratory disorders are a major contributor to morbidity and mortality. However, the appointment-based treatment plans currently in place are not well suited to the rapidly changing and unpredictable needs of patients with acute and chronic respiratory illnesses. Technologies related to digital health could help ease this load. For example, a quick, affordable, and easily accessible treatment option EASYBREATH is used for chronic respiratory diseases (CRDs), which has been known to significantly reduce dyspnea, increase exercise capacity, and enhance the overall quality of life.

Mental Health

About 20% of all Americans experience a mental illness at any given time, and researchers expect the global burden of mental illness to continue to grow. Treatment for mental illness often includes medication, psychotherapy, or a combination of both; however, major barriers remain. Nationwide provider shortages, logistical challenges patients face in attending appointments, and concerns about the stigma of mental illness limit patients' access to treatment.

Prescription digital therapeutics (PDTs) mark a promising era in mental health, offering physicians new ways to treat the increasing number of people struggling with mental illness. Digital therapeutics use apps and software to provide people with evidence-based therapeutic interventions. DTx products provide accessible and convenient mental health care that allows patients to track their progress, receive support, and develop healthy coping strategies.

Cardiovascular: Heart failure (HF) is the end stage of various cardiovascular diseases. Despite advanced interventions such as pharmacological treatment, cardiac synchrony, and heart transplantation, HF patients still have poor quality of life (QoL) and low survival rates. Digital therapeutics (DTx) is a novel intervention proposed in recent years and refers to the use of evidence-based therapeutic interventions guided by high-quality software programs to treat, manage, or prevent a medical condition.

Others

The “Others” segment includes central nervous system (CNS) disorders, gastrointestinal disorders, and smoking cessation. Central nervous system disorders are very heterogeneous and include manifestations ranging from headaches, dizziness, memory impairment, vision problems, depression, dysphoria, anxiety, and obsessive-compulsive disorders to seizures, strokes, and accelerated atherosclerotic disease.

Digital therapeutics for CNS disorders have come alongside the increasing popularity of wellness apps. As providers and patients become more comfortable with online and digital care, such tools have become increasingly popular in psychiatry, neurology, and behavioral health. In particular, the growth of digital therapeutics (DTx) has great potential to impact the central nervous system (CNS) field.

Behavioral digital therapies in gastroenterology include evidence-based interventions that use technology to identify and treat mental health disorders in individuals with gastrointestinal disorders. Digital therapies have significantly increased the prevalence of abstinence among smokers. Digital therapies to support smoking cessation have been more effective in COPD patients. Digital interventions such as text messaging, smartphone applications, web-based programs, and social media-based interventions promote smoking cessation rates and reduce relapse rates.

Business-to-Business (B2B)

The B2B segment has held revenue share of 70% in 2024. Digital therapies are effective for chronic conditions such as diabetes, high blood pressure, and mental health disorders. For instance, owing to the costs associated with the treatment of such conditions, employers and healthcare providers who are B2B customers have a strong incentive to use digital therapeutics to efficiently treat certain diseases. The strong data analytics capabilities and practical insights into employee or patient health trends that digital therapeutics provide can be beneficial to both employers and healthcare providers. This data can be used for improving patient outcomes, personalizing treatments, and highlighting the benefits of these solutions. These solutions are further integrated with the healthcare IT systems that are currently in use, such as electronic health records (EHRs) and health information exchange systems (HIEs), for streamlining data flow and improving the overall patient experience.

Business-to-Consumer (B2C)

The B2C segment accounted for around 30% of the revenue share in 2024. The growing awareness regarding the advantages and usability of digital healthcare products for patients and caregivers is expanding market growth. Rising consumer demand for convenient and easily accessible healthcare solutions, increasing penetration of smartphones and internet connectivity enabling direct-to-consumer delivery models, rising health awareness, and the trend towards self-management among people are expected to increase the demand for these therapeutic applications. In addition, marketing strategies by players emphasizing user-centric features and benefits play a crucial role in driving product adoption through this distribution channel.

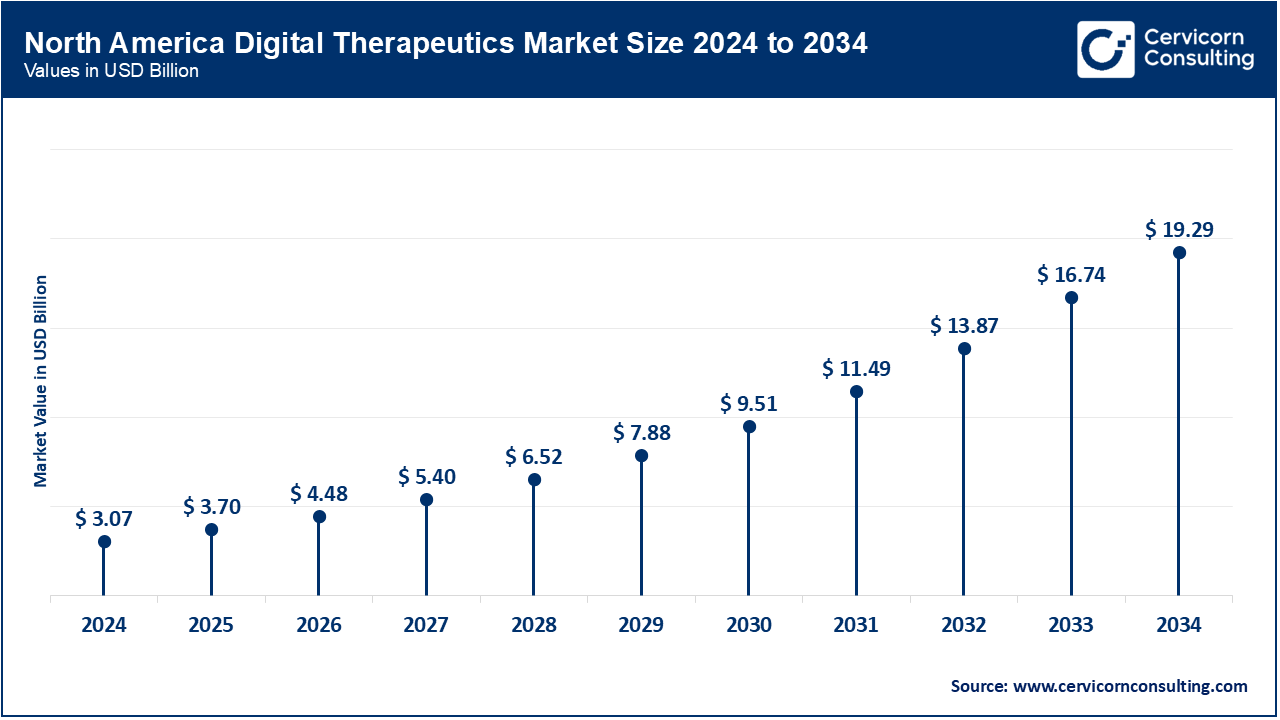

The North America digital therapeutics market size was estimated at USD 3.07 billion in 2024 and is expected to hit around USD 19.29 billion by 2034. The number of individuals in North America who are expected to experience chronic illnesses and mental health problems, including substance use disorders, is expected to rise, which will hasten market expansion.

According to a report issued by the U.S. Centers for Disease Control and Prevention (CDC) in November 2021, the number of drug-related deaths in the United States during the 12 months ending in April 2021 was estimated to be approximately 100,000. Compared to the 78,056 deaths that took place during the same period in 2020, this indicates a 28.5% increase.

In addition, the adoption of these devices in North America is anticipated to increase as a result of the rising number of agreements and collaborations between important players to concentrate on the research and development of these products.

The Europe digital therapeutics market size was reached at USD 1.99 billion in 2024 and is projected to reach around USD 12.48 billion by 2034. The growing use of apps by patients and healthcare providers is anticipated to propel the European market during the forecast period. Throughout the projection period, the existence of developed economies like Germany, the United Kingdom, France, Spain, and Italy is anticipated to strengthen the market in Europe.

The Europe market strategy can provide consumers and businesses with access to online services and goods across Europe, thereby creating the necessary conditions for the growth of the digital network and related services, which is expected to help maximize the growth potential of the European economy. Moreover, a growing emphasis on collaborations and geographical growth among major industry participants in conjunction with the introduction of new products is anticipated to stimulate market expansion throughout the projected period.

The Asia-Pacific digital therapeutics market size was estimated at USD 1.44 billion in 2024 and is expected surpass around USD 9.03 billion by 2034. The Asia Pacific is anticipated to grow significantly due to rising government spending on healthcare and a strong demand for IT services. Hospitals are now better equipped to manage their clinical, financial, and administrative operations, which has led to a greater demand for healthcare IT systems.

Technological developments and the increasing uptake of digital healthcare solutions by consumers are some other factors propelling the market growth. For example, NERVTEX, a Chinese company specializing in digital therapy solutions for neurological disorders, received approval from the National Medical Products Administration of China in February 2023 to use its artificial intelligence-based software for the analysis of movement disorders.

Other factors driving the rapid expansion of the digital therapeutics industry in Asia Pacific include the growing demand for high-quality healthcare, more widespread internet access, and rising smartphone penetration.

The LAMEA digital therapeutics market size was accounted for USD 1.03 billion in 2024 and is anticipated to hit around USD 6.48 billion by 2034. It is projected that Latin America's rapidly advancing technology and increasing digitization will lead to an increase in the market for digital therapeutics. This may be the result of various factors, such as increased public awareness of healthcare issues and the availability of state-of-the-art medical procedures for the detection and management of life-threatening diseases. The region's use of e-prescription systems has increased as a result of the growing internet penetration. In addition, regional governments are making larger investments, and both domestic and international private businesses are making sizable investments to strengthen their positions. Even though the South African market is still in its infancy, it is anticipated to grow as more cutting-edge technologies are used in healthcare. For instance, the 2019–2024 National Digital Health Strategy for South Africa seeks to fortify the sector's governance, create robustly integrated platforms to encourage the advancement of information systems and construct the required infrastructure in partnership with multiple government agencies.

Industry leader Pear Therapeutics, Inc., holds a dominant position with a strong software portfolio. The increasing sales of reSET & reSET-O in the US contribute to its strong market share. Also, the company's increasing R&D expenditure on developing these products is another factor contributing to the company's higher market share. To boost their sales in the market, various other market participants like AppliedVR, Inc., Welldoc, Inc., CureApp, Inc., and Brain+ A/S are also concentrating on incorporating new strategic initiatives into practice like partnerships, distribution agreements, market penetration, and mergers and acquisitions. For instance, to promote innovation in the life sciences sector, AstraZeneca launched Evinova, a new health technology division, in November 2023. This division will focus on improving clinical trial conduct and improving health outcomes. In 2021, AppliedVR, Inc. received U.S. FDA approval for RelieVRx through the De Novo process to provide a complementary pain relief treatment based on cognitive behavioral therapy skills for patients diagnosed with chronic low back pain.

CEO Statements

Eddie Martucci, Co-Founder and CEO, Akili Interactive:

"Digital therapeutics have the potential to be a brand-new kind of medicine, but they must go through the same rigorous regulation and approval process as any other drug."

Peter Hames, CEO, Big Health:

"We are in what I would consider the ‘quack medicine’ era of digital medicine and digital therapeutics, where there’s a huge morass of solutions with incredible variance in quality—and there isn’t yet an established set of criteria."

Key players in the digital therapeutics industry are pivotal in delivering a variety of innovative construction solutions, such as prefabrication techniques, sustainable materials, and advanced digital technologies. Some notable developments in the market include:

These advancements mark a notable expansion in the digital therapeutics market, driven by strategic acquisitions and innovative projects. The focus is on boosting sustainability, enhancing construction efficiency, and broadening product offerings to meet diverse building needs.

Market Segmentation

By Type

By Application

By Sales Channel

By Revenue Modal

By End Use

By Region