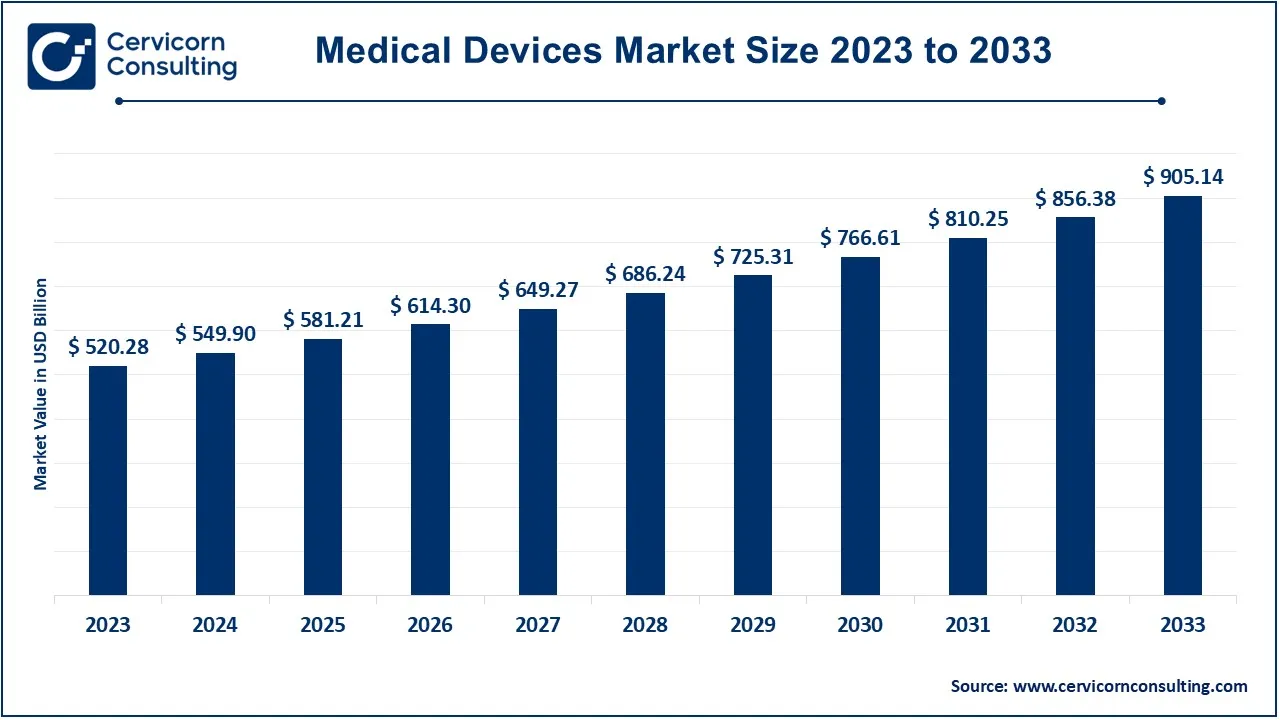

The global medical devices market size was valued at USD 549.90 billion in 2024 and is expected to be worth around USD 905.14 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.69% over the forecast period 2024 to 2033.

The global medical device industry is experiencing steady growth, driven by technological advancements, rising healthcare needs, and an aging population. Increased investments in research, demand for digital healthcare, and higher chronic disease cases fuel this expansion. Governments and private firms are investing in healthcare infrastructure, boosting medical device adoption. The rise of telemedicine, AI-driven diagnostics, and personalized medicine further contribute to industry growth. Additionally, emerging markets like India and China are witnessing rapid adoption due to better healthcare accessibility and government initiatives. The demand for home healthcare devices, such as remote monitoring tools and wearables, is rising. These trends suggest a strong future for the medical device market.

A medical device is a piece of work for diagnosis, prevention, or therapy of a disease which does not change the biological processes by means of a chemical agent. These instruments are of numerous varieties: from the simplest, for example thermometers, to the most sophisticated, for instance MRI machines and robot-assisted systems. It is worth noting that the increase in medical devices market is caused by the demographic shift in developed regions, the growing incidence and prevalence of chronic diseases, and emerging technologies including artificial intelligence, internet of things, and minimal invasive therapy as well as growth of private and public health coverage in developing countries. Moreover, the opportunity for further advancement of the industry is enhanced by such factors as regulatory facilitation, increasing spending on research and development and homecare services, as well as orthopaedic belts and other portable devices.

What are Medical Devices?

Medical devices are instruments, machines, implants, or software used for diagnosing, monitoring, and treating medical conditions. These devices range from simple tools like thermometers and blood pressure monitors to advanced technologies like MRI scanners, pacemakers, and robotic surgical systems. They help doctors improve patient care, enhance treatment precision, and enable early disease detection. Medical devices play a crucial role in hospitals, clinics, and home healthcare, ensuring better health outcomes. Regulatory bodies like the FDA (U.S.) and CE (Europe) oversee their safety and effectiveness. The industry is rapidly evolving with innovations in artificial intelligence (AI), wearable technology, and minimally invasive procedures, making healthcare more efficient and accessible.

Key Insights Beneficial to the Medical Devices Market:

Report Highlights

Government Policies and Regulations

Technological Advancements

Home Care and Telemonitoring

Health Expenditure

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 581.21 Billion |

| Projected Market Size in 2033 | USD 905.14 Billion |

| Growth Rate (2024 to 2033) | 5.69% |

| Leading Region | North America |

| Growing Region | Asia-Pacific |

| Key Segments | Device Type, Application, Technology, End User, Region |

| Key Companies | Medtronic, Johnson & Johnson, Abbott Laboratories, Siemens Healthineers, GE Healthcare, Philips Healthcare, Becton Dickinson (BD), Stryker Corporation, Boston Scientific, Zimmer Biomet, 3M Healthcare, Thermo Fisher Scientific, Fresenius Medical Care, Smith & Nephew, Edwards Lifesciences |

Diagnostic Equipment: Diagnostic equipment is one very essential tool used in diagnosing medical conditions. Advanced imaging diagnostic equipment includes MRI (Magnetic Resonance Imaging) and CT (Computed Tomography) scanners, which give healthcare providers views of the internal body structures at high precision. In vitro diagnostic devices include objects such as blood glucose monitors and analysers used in laboratories to help make earlier diagnoses and monitor diseases. Therapeutic devices are crucial in effective patient management, especially concerning timely interventions derived from proper diagnostics.

Therapeutic Devices: This category of therapeutic devices encompasses many tools oriented towards the treatment of a variety of medical conditions. This covers infusion pumps administering drugs and nutrients to patients, dialysis machines for kidney failure patients, and surgical instrumentation in different medical treatments. The performance of the devices is essential to the enhancement of patient results because it enables medical practitioners to administer focused treatments effectively. The medical device technology evolves and develops by incorporating new technologies to make the treatments more precise and safer.

Monitoring Devices: A monitoring device is that device which monitors the real-time health parameters of the patient continuously or periodically. It includes in its constituent heart rate monitors that provide immediate data on cardiac function, blood pressure monitors used in both clinical and home setups, and wearable health trackers that enable individuals to monitor their fitness and wellness metrics. These devices not only empower patients to take an active role in the management of their health but also assist healthcare providers in decision-making based on the continuous data available, especially for chronic disease patients.

Surgical Devices: Surgical devices are those instrumental items used during the operation for the facilitation of surgical proceedings. It consists of robotic surgical systems that provide precision and control in complicated surgeries. An endoscope helps avoid dissection at the site of operation by providing the inside visualization of the body. Sutures and other tools used for closing wounds or incisions are part of this segment. The developments observed in surgical devices are giving better results to patients in terms of reduced recovery time, better surgical outcomes, and improved safety.

Orthopaedic Devices: These are orthopaedic devices developed to support as well as treat conditions associated with the musculoskeletal system. This division houses an array of products that are currently made available in the market, including prosthetics, which replace missing limbs, orthopaedic implants, such as artificial joints, and braces that offer physical support and stabilisation to ailing or weakened bones and joints. Advances in materials and technology in this field are revolutionizing orthopaedic care by bringing greater functionality, comfort, and quality of life to patients following surgery or injury.

Other: This category includes a broad variety of miscellaneous medical devices that cannot be classified within one of the categories above. This category includes wheelchairs and crutches as well as other such ambulances to help the patient move around, products for patient care, which remove discomfort and enhance the comfort of providing quality care. They are a substantial entity in patient care, particularly in those with low mobility or chronic illness, whereby their daily activities are encouraged to enjoy independence and general well-being.

AI: Artificial Intelligence is transforming the arena of medical devices through high-powered algorithms that result in higher diagnostic capabilities, predictive analytics, and customized care. How smart can that be? AI's ability to scan big datasets, find patterns, and predict is attractive to healthcare professionals because AI-powered devices could possibly increase the ability to speed up and improve the diagnosis of conditions. For instance, AI is used in radiology to interpret image results and in pathology to analyse tissue samples, therefore, eliminating human error and promoting a better outcome for the patient. Continuous evolution in AI technologies holds more promises in health care delivery and patient care.

Wearable Technology: Wearable technology is gaining recognition among consumers in real-time tracking of various health metrics. Tools such as the use of fitness trackers or smartwatches, equipped with health-monitoring facilities like heart rates, sleep patterns, and other activity levels, help people manage their health. This segment is more beneficial in the arena of preventive healthcare because it allows users to keep track of any potential health problems and helps them live healthy lifestyles. Involving wearables in the health care system helps patients communicate with care providers in filling the gap in personalized care.

Telemedicine: This encompasses various technologies that may be utilized during remote consultations, diagnostics, and monitoring. It shall comprise videoconferencing tools and equipment for distant diagnostic apparatus that can aid health professionals in examining patients to enhance access, more so for persons who have limited accessibility and reside in rural or underdeveloped settings. The covid pandemic displays the rapid growth of telemedicine and displays real benefits it could bring into the health care delivery system with enhanced patient engagement and quality care. Its applications are likely to keep growing with advancements in telehealth technologies in healthcare settings.

Robotics: Health robotics is defined as the application of robots used in numerous medical treatments, such as surgical interventions, rehabilitation, as well as helping and supporting patients. Surgical robots augment accuracy and dexterity in operations, hence facilitating minimally invasive surgery and more favourable patient results. The robotic systems in rehabilitation are also utilized to assist patients in building mobility and strength that has been affected by injuries. In addition, increased reliance on robotics has transformed the healthcare arena with new answers toward efficiency and care of patients.

Internet of Things (IoT): Internet of Things (IoT) implies connecting medical devices to the internet with better data exchange and surveillance capabilities. IoT-enabled gear, such as connected wearables and smart home health devices, allows for constant surveillance of health parameters of the patients and automatic data transmission to healthcare providers. The preparedness of interventions and personalized care plans raises patient outcome and operational efficiencies within a system of healthcare. IoT in healthcare is opening avenues for the healthcare sector to get more intelligent and integrative.

Cardiology: This is an incredibly wide range of devices for diagnosing, recording, and treating heart diseases under the cardiology segment. Some of the best products are stents, working by opening up constricted blood arteries; pacemakers, meant to control heart rhythms; and ECG monitors to record electrical activity of the heart. Cardiology devices: The sector is always carrying out innovations that are continuously done to positively address the prevalence of cardiovascular diseases, and healthcare professionals will be in a position to address patients at risk on time with proper care.

Orthopaedics: Orthopaedic devices facilitate treatments for musculoskeletal conditions, which would aid surgeries and rehabilitation in cases involving bone and joint problems. This category includes knee and hip implants, commonly used arthritic patients, as well as surgical tools such as drills and fixation devices, which are orthopaedic assistive devices. The advancement of materials and technological improvements related to orthopaedic devices play a very important role in the surgery outcome and improve patients' quality of life who have recovered from orthopaedic surgeries.

Ophthalmology: This is the area of ophthalmologic instruments and devices used in eye care and vision correction. It ranges from devices for cataract surgery that eliminates the cloudy lenses up to corrective lenses that can be prescribed for refractive errors, diagnostic tools like optical coherence tomography to assess retinal health. In this regard, because eyesight is turning out to be one of the valued possessions, the innovation about ophthalmic devices will be needed for advancing visions correction and treatment for many of the eye problems.

Neurology: Neurological devices are created to diagnose and treat neoromantic diseases. There include deep brain stimulators for the treatment of Parkinson's disease, EEG monitor for the diagnosis of epilepsy and other neurological conditions, neurostimulation devices emitting therapeutic effects. It is fast development of neurological devices that has to be crucial to improve the treatment and the quality of life for many patients suffering from complex neurological disorders.

Chronic Condition Management: These are appliances that are used specifically to manage chronic diseases such as diabetes and hypertension. Examples include insulin pumps, which facilitate continuous supply of insulin to patients suffering from this disease, and blood pressure monitors, whereby one measures blood pressure periodically and regularly from the comfort of their home. It is critical in the current health environment due to the rising trends of chronic conditions that are rife and the need for effective self-management tools that educate patients to take charge of their health care for better results.

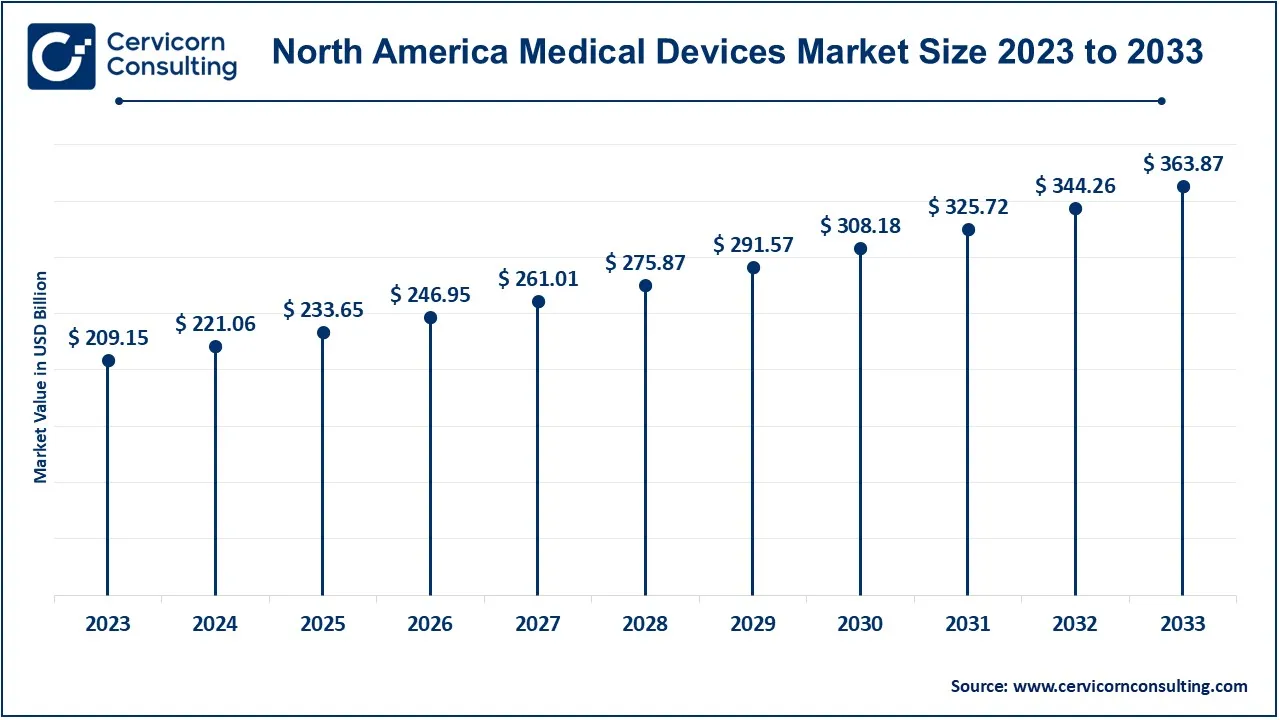

The North America medical devices market size was estimated at USD 209.15 billion in 2023 and is expected to reach around USD 363.87 billion by 2033. North America is one of the biggest markets in this medical device industry, dominated by its advanced health care infrastructure, high level of health care expenditure, and marked significance on research and development. In this region, the United States is an important market with remarkable trends in adopting state-of-the-art medical technologies.

The Europe medical devices market size was valued at USD 147.76 billion in 2023 and is projected to hit around USD 257.06 billion by 2033. Mature markets in Europe have strict rules and high patient safety emphasis, and Germany, France, and the UK still account for majority growth in the market due to government initiatives regarding digitization of health care.

The Asia-Pacific medical devices market size was accounted for USD 119.66 billion in 2023 and is predicted to surpass around USD 208.18 billion by 2033. The Asia-Pacific is witnessing tremendous growth by investing in healthcare, increased demand for high-tech medical equipment, and improved access to healthcare. Markets in this region would be China, Japan, and India.

The LAMEA medical devices market was valued at USD 43.70 billion in 2023 and is anticipated to reach around USD 76.03 billion by 2033. Latin America, Middle East, and Africa- steadily growing medical device market. As there's a strong emphasis on improving access to healthcare and healthcare infrastructure, its economic prospects are likely to shine. The regions continue facing economic challenges, but improve for potential growth as more healthcare requirements garner an increasing number of government initiatives.

The medical device industry is undergoing a rapid transformation with new and existing companies making progress in this area. Among these are Epic Systems Corporation and GE Healthcare which are leading the way in the application of high-end technologies, including Industry 4.0, advanced artificial intelligence (AI), data science, and internet-of-things (IoT). These innovations, among others, seek to improve the productivity and usefulness of such technologies as health care, which in turn will lead to enhancements in the treatment of patients and operations of the process.

AI can be infused in these organizations which enables them to process large volumes of health data with enhanced results in the diagnosis and treatment of the illness. Additionally, pioneering companies like Tempus and Owlet are establishing a presence in the medical device industry. To improve the quality of patient care, Tempus employs medical data analytics to interpret useful information from clinical and molecular information for the purposes of precision medicine. Owlet has smart monitors that aim to keep anxious new parents updated on the health status of their infants using relevant metrics. These trends represent a movement towards better and effective measures using data analytics and IoT applications which help improve patient care and administration of health care.

CEO Statements

Geoff Martha, CEO, Medtronic

"At Medtronic, we're focused on accelerating innovation and making healthcare technology more accessible. We believe in the power of technology to improve patient outcomes and transform the healthcare experience."

Alex Gorsky, Former CEO, Johnson & Johnson

"We remain committed to pioneering healthcare innovations that improve lives worldwide, advancing technologies that drive better patient care and sustainable solutions."

Robert B. Ford, CEO, Abbott Laboratories

"We are building a future where health is not just about treatment but about prevention, driven by technological advancements and personalized care."

Strategic Launches and Expansions highlight the rapid advancements and collaborative efforts in the medical devices industry. Industry players are involved in various aspects of medical device, including technology, component, and AI. It plays a significant role in advancing the market. Some notable examples of key developments in the market include:

These developments underscore significant strides in advancing digital infrastructure and technology, reflecting growing launches and strategic investments aimed at expanding the global healthcare economy.

Market Segmentation

By Type of Device

By Technology

By Application

By End-User

By Region