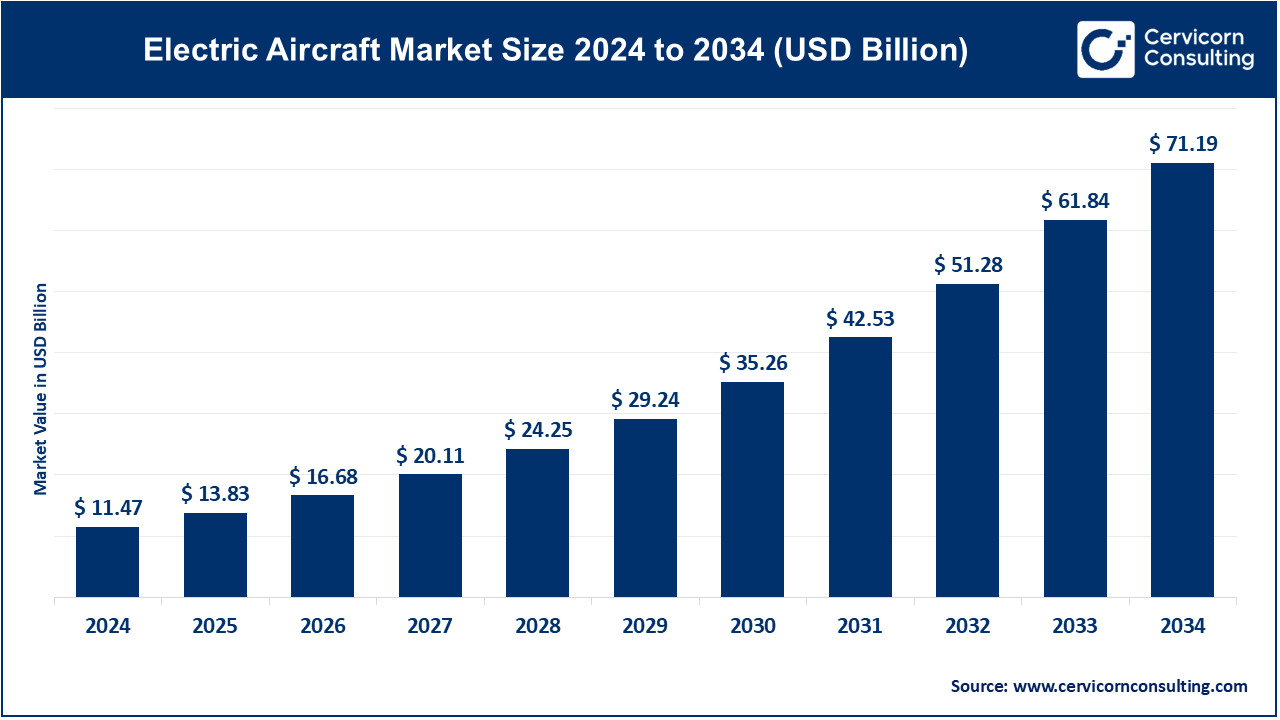

The global electric aircraft market size was accounted for USD 11.47 billion in 2024 and is expected to reach around USD 71.19 billion by 2034, growing at a compound annual growth rate (CAGR) of 20.02% over the forecast period 2025 to 2034.

The electric aircraft market is growing significantly due to the increasing demand for sustainable and eco-friendly aviation solutions. As concerns over climate change and environmental impact rise, the aviation industry is exploring electric propulsion to reduce carbon emissions. Innovations in battery technology and advancements in electric motor design are accelerating the development of electric aircraft. Startups and established aerospace companies are investing heavily in electric aviation, with various prototypes and test flights already underway. Market growth of electric aircraft is also driven by regulatory support, with governments setting targets for reducing aviation's environmental footprint. Our analyst predict that electric aircraft could transform regional air travel, offering quieter, cheaper, and cleaner alternatives to conventional aircraft. The market is expected to expand rapidly in the coming years, with a growing focus on urban air mobility and short-haul flights.

Electric aircraft are aircraft powered by electric motors that use energy stored in batteries or supplied by other electric propulsion systems. These aircraft offer a sustainable alternative to conventional aviation, which typically relies on fossil fuels. Electric aircraft are being developed for various applications, including regional passenger flights, cargo transportation, and urban air mobility. They promise to reduce carbon emissions, decrease noise pollution, and lower operating costs, making them an attractive solution for the future of air travel. These aircraft can range from small drones to larger commercial airplanes, with ongoing advancements in battery technology and electric propulsion systems to enhance performance and efficiency.

Report Scope

| Area of Focus | Details |

| Market size in 2025 | USD 13.83 Billion |

| Market size in 2034 | USD 71.19 Billion |

| Market Growth Rate | CAGR of 20.02% from 2025 to 2034 |

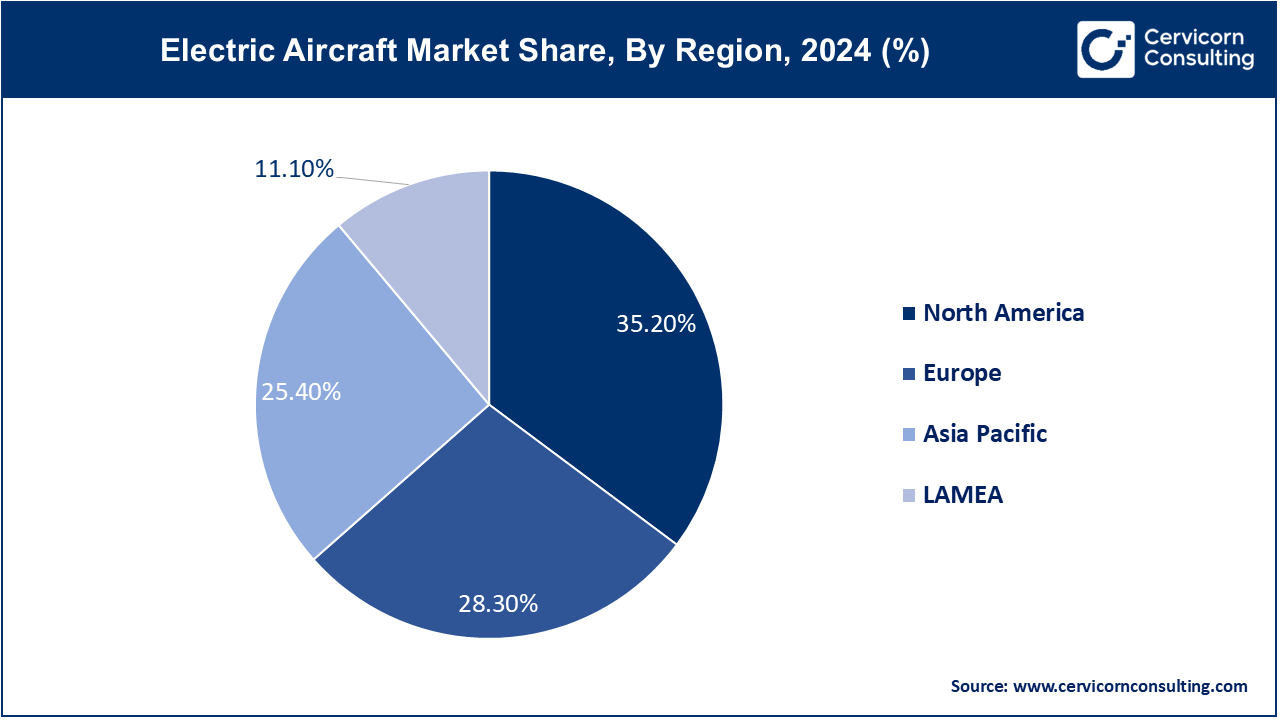

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Segment Covered | By Type, System, Technology, End Users, Regions |

Advancements in Electric Propulsion Systems:

Regulatory Support and Certification:

Limited Battery Energy Density:

Infrastructure Limitations:

Development of Hybrid Electric Aircraft:

Expansion of Cargo and Drone Applications:

High Initial Investment Costs:

Safety and Certification Complexity:

Fixed Wing: Fixed-wing electric aircraft include conventional airplanes powered solely by electric propulsion systems. Trends in this segment focus on improving battery efficiency and energy density to extend flight ranges and enhance operational capabilities, making them viable for regional and short-haul commercial flights.

Rotary Wing: Rotary-wing electric aircraft, such as electric helicopters and eVTOLs, are vertical take-off and landing vehicles. Trends here emphasize developing quiet, efficient electric propulsion systems suitable for urban air mobility and cargo transport, addressing noise reduction and improving energy efficiency.

Hybrid Wing: Hybrid-wing electric aircraft combine features of both fixed-wing and rotary-wing designs. Trends include integrating hybrid-electric propulsion systems that offer extended range capabilities while maintaining operational flexibility for various mission profiles, such as regional transportation and aerial surveys.

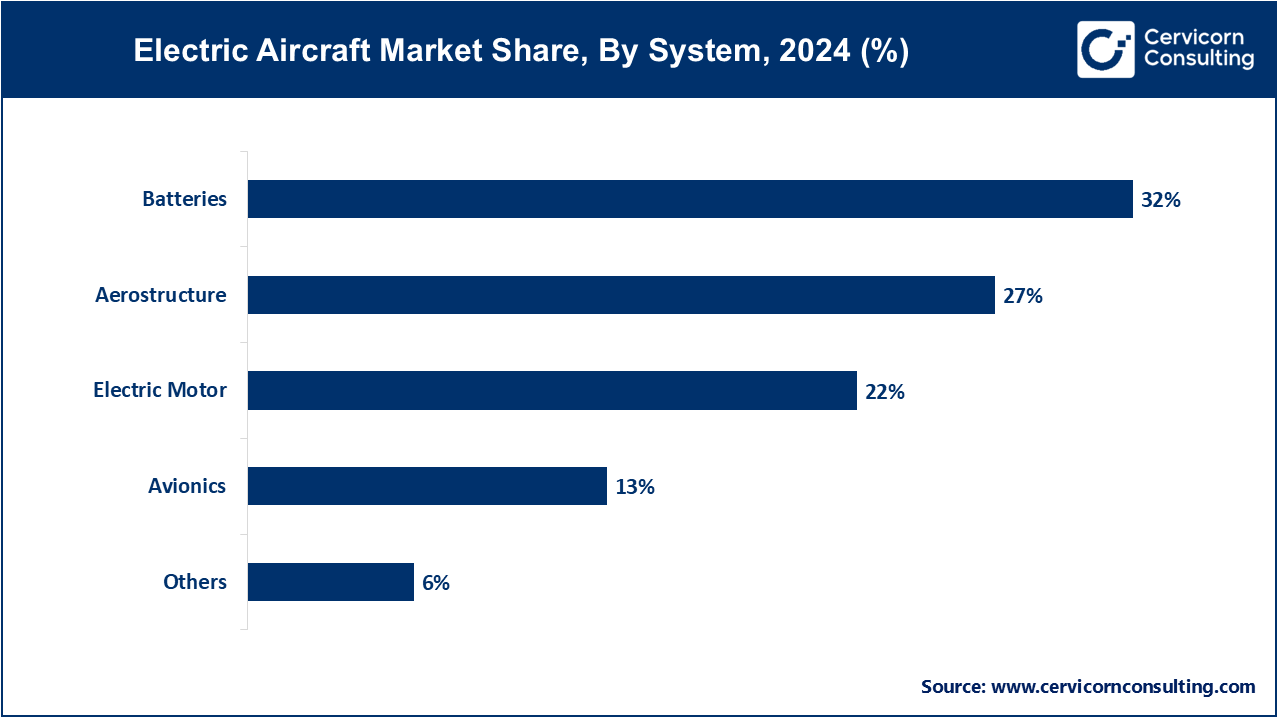

Batteries: The batteries segment has registered highest market share of 32% in 2024. Essential for electric aircraft, battery technologies are evolving towards higher energy density, faster charging capabilities, and improved safety features. Trends include advancements in solid-state batteries, which promise increased energy storage capacity and reduced weight, enhancing range and operational efficiency.

Electric Motor: The electric motor segment has covered market share of 22% in 2024. Innovations focus on enhancing motor efficiency, reducing weight, and improving power output. Trends include the development of more compact and lightweight electric motors with higher power densities, enabling greater aircraft performance and efficiency.

Aerostructure: The aerostructure segment has recorded second highest market share of 27% in 2024. Lightweight materials like carbon fiber composites and advanced aerodynamic designs are pivotal. Trends include the integration of additive manufacturing techniques to produce complex, lightweight structures that enhance aircraft performance, reduce drag, and maximize range.

Avionics: The avionics segment has calculated market share of 13% in 2024. Advances in avionics systems cater to the specific requirements of electric propulsion, including optimized power management and control algorithms. Trends include the development of smart avionics solutions that enhance flight safety, efficiency, and reliability in electric aircraft operations.

Others: Others segement has measured market share of 6%. This category encompasses critical components such as charging infrastructure development to support electric aircraft, as well as specialized systems like thermal management solutions to ensure optimal battery performance and safety in varying operating conditions.

CTOL (Conventional Takeoff and Landing): CTOL electric aircraft utilize traditional runways for takeoff and landing. Trends include advancements in battery and propulsion technology to increase range and payload capacity, making them viable for regional and short-haul flights. Regulatory focus is on adapting existing certification standards to accommodate electric propulsion systems and ensuring seamless integration into current aviation infrastructure.

STOL (Short Takeoff and Landing): STOL electric aircraft are designed to operate from shorter runways or even unpaved surfaces. Trends involve optimizing electric propulsion systems for efficient vertical and short takeoff capabilities, enhancing operational flexibility for remote regions and urban air mobility applications. Innovations focus on improving power-to-weight ratios and battery efficiency to support STOL operations while complying with stringent noise and emissions regulations.

VTOL (Vertical Takeoff and Landing): VTOL electric aircraft are capable of taking off and landing vertically, eliminating the need for traditional runways. Trends include the development of electric vertical takeoff and landing (eVTOL) aircraft for urban air mobility and on-demand transportation services. Advances in battery technology and electric propulsion systems are critical, enabling longer flight durations and improving safety features such as redundant propulsion systems and advanced flight control systems.

Commercial Aviation: Electric aircraft in commercial aviation aim to reduce operational costs and emissions, catering to short-haul routes with electric propulsion systems. Trends include partnerships between airlines and manufacturers to develop hybrid-electric aircraft, focusing on regional travel sustainability.

Urban Air Mobility (UAM): UAM involves electric vertical take-off and landing (eVTOL) aircraft for intra-city transport, addressing urban congestion and offering emission-free solutions. Trends include investments in infrastructure for charging stations and regulatory frameworks for air taxi operations.

Military and Defense: Electric aircraft in military applications focus on unmanned aerial vehicles (UAVs) and surveillance platforms, enhancing operational efficiency and reducing logistics. Trends include developments in long-endurance UAVs and hybrid-electric aircraft for tactical missions.

Others: This category encompasses niche applications like electric gliders, recreational aircraft, and specialized research platforms. Trends include advancements in lightweight materials and battery technology, enabling longer flight endurance and enhanced performance in diverse aviation sectors.

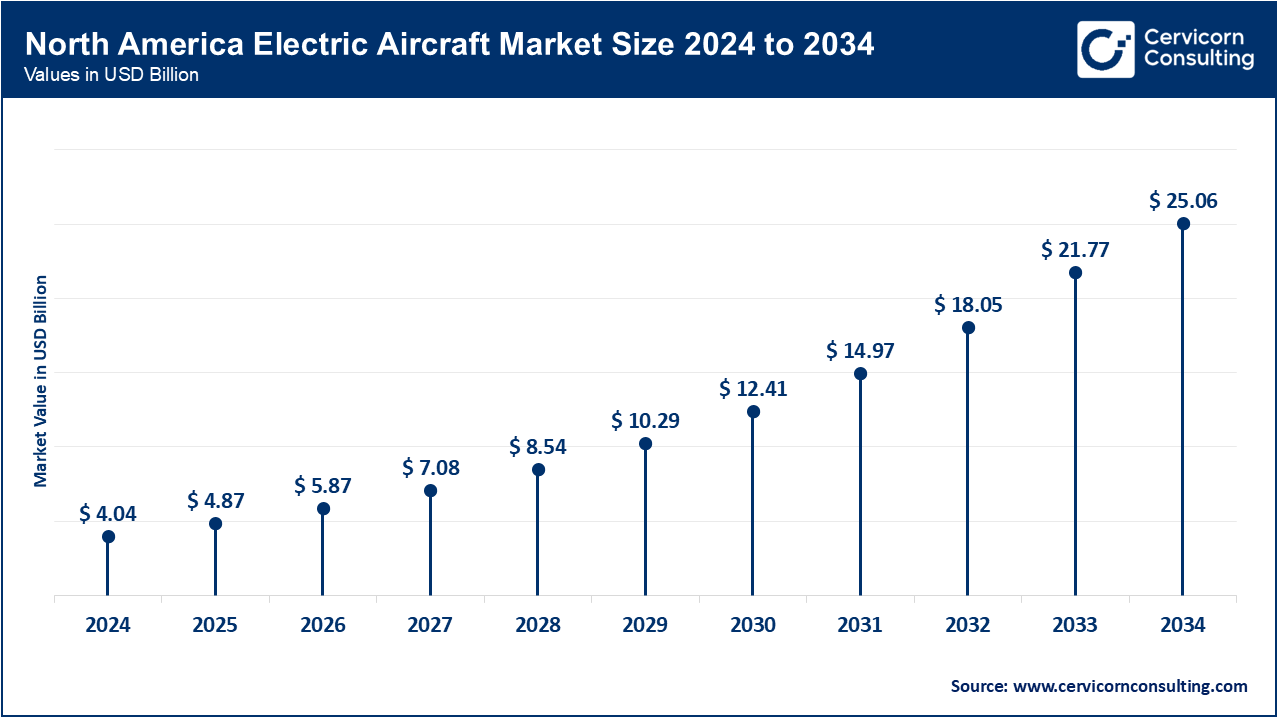

The North America electric aircraft market size is captured USD 4.04 billion in 2024 and is forecasted to hit around 25.06 billion by 2034. North America leads in electric aircraft innovation, driven by strong R&D investments and regulatory support. Trends include partnerships between aerospace giants and startups, focusing on developing electric propulsion systems and urban air mobility solutions. The region also emphasizes infrastructure development for electric aircraft, such as charging networks and testing facilities.

The Europe electric aircraft market size is registered USD 3.25 billion in 2024 and is estimated to reach around 20.15 billion by 2034. Europe is focused on sustainable aviation solutions, with robust government initiatives and funding for electric aircraft development. Trends include collaborations between aerospace companies and academic institutions to advance battery technology and hybrid-electric propulsion systems. The region leads in electric vertical take-off and landing (eVTOL) aircraft development for urban air mobility applications, supported by stringent environmental regulations.

The Asia-Pacific electric aircraft market size is garnered USD 2.91 billion in 2024 and is projected to surpass around USD 18.08 billion by 2034. Asia-Pacific: Asia-Pacific is witnessing rapid growth in electric aircraft adoption, driven by increasing urbanization and air travel demand. Trends include investments in electric propulsion technology by leading aviation companies and startups. The region focuses on developing cost-effective electric aircraft solutions for short-haul regional flights and urban air mobility, supported by government incentives for sustainable aviation initiatives.

LAMEA is exploring opportunities in electric aircraft, primarily focusing on urban air mobility and cargo transport applications. Trends include partnerships between local governments and international aerospace firms to pilot electric aircraft projects. The region faces challenges such as infrastructure development and regulatory frameworks but is leveraging its geographical advantages for electric aviation trials and deployments.

New players such as Joby Aviation, Lilium GmbH, and Wright Electric are leading with innovative electric aircraft designs, focusing on vertical take-off and landing (eVTOL) and regional electric planes. They leverage advanced battery technologies and sustainable aviation solutions to gain market entry. Established leaders like Airbus SE and Boeing dominate through extensive R&D investments, global manufacturing capabilities, and partnerships with technology firms and airlines. They maintain dominance by scaling production, securing regulatory approvals, and integrating electric propulsion into existing aircraft models, setting high barriers for new entrants in the evolving electric aircraft market.

Market Segmentation

By Type

By System

By Technology

By End Users

By Region