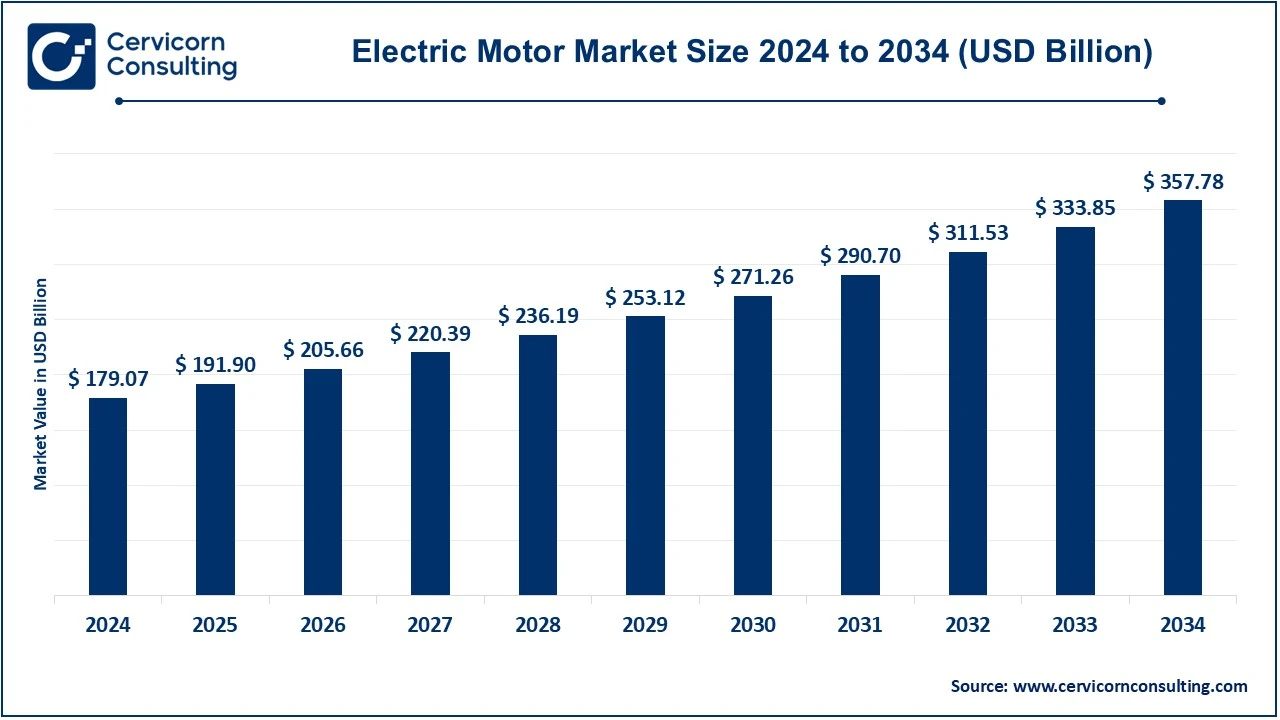

The global electric motor market size was estimated at USD 179.07 billion in 2024 and is expected to be worth around USD 357.78 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 7.16% over the forecast period 2025 to 2034.

The electric motors market is strong with the growing adoption of energy-efficient systems in furtherance of renewable energy. Electric motors play crucial roles in different applications like industries, automobiles, HVAC systems, and household appliances. The adoption of electric vehicles has significantly raised the demand for higher-performance motors, especially in those economies that are developed and inclined toward sustainability goals. Furthermore, emerging technologies like smart motors which are capable of IoT communications improve operational efficiency and energy conservation. The demand for motors is growing because emerging economies in the Asia-Pacific region rapidly industrializing and urbanizing. Nonetheless, high initial costs and reliance on rare earths to manufacture motors are some of the challenges faced. Government incentives favoring green energy use and strict regulations against energy consumption are bringing healthy growth to the market. Some inventiveness in materials and design development will go a long way in acting as a catalyst for steadily increasing the market.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 190.91 Billion |

| Projected Market Size in 2034 | USD 357.78 Billion |

| Expected CAGR 2025 to 2034 | 7.16% |

| Top-performing Region | Asia-Pacific |

| Key Segments | Motor Type, Power Rating, Voltage, Rotor Type, Output Power, Application, Region |

| Key Companies | ABB, Arc Systems Inc., Brose Fahrzeugteile SE & Co. KG, Coburg, DENSO CORPORATION, Emerson Electric Co., Johnson Electric Holdings Limited, Maxon, NIDEC CORPORATION, Regal Rexnord Corporation, Rockwell Automation Inc., Siemens AG, TAIGENE Inc. |

Emerging Markets

Electrification of Railways

High Initial Investments

Dependency on Rare Earth Materials

Smart Grid Technologies

Industrial Automation & Robotics

Challenges in Thermal Management

Raw Material Price Volatility

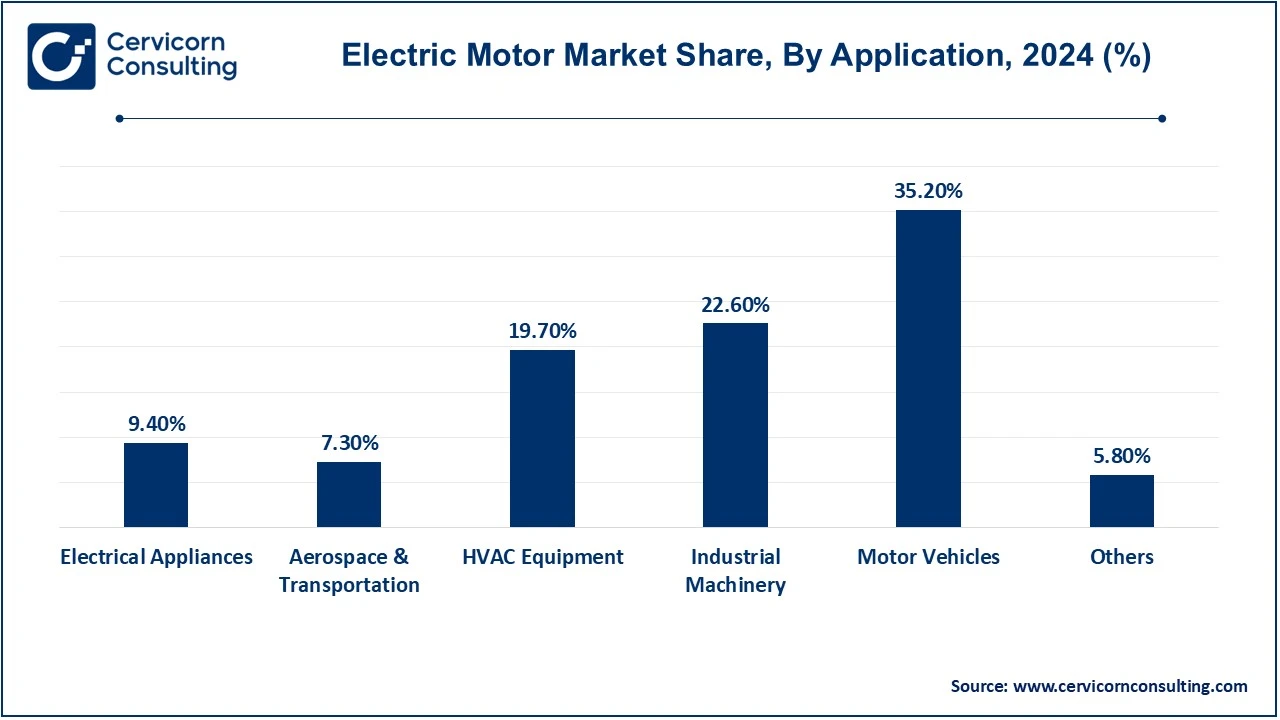

The electric motor market is segmented into motor type, power rating, voltage, rotor type, output power, application, and region. Based on motor type, the market is classified into AC motor, DC motor and hermetic motor. Based on power rating, the market is classified into above 75 kW, 10 kW to 75 kW, 5 kW to 10 kW, and Up to 5 kW. Based on voltage, the market is classified into low voltage, medium voltage and high voltage. Based on rotor type, the market is classified into inner and outer. Based on output power, the market is classified into <1 HP Motors and >1 HP Motors. Based on application, the market is classified into electrical appliances, aerospace & transportation, HVAC equipment, industrial machinery, motor vehicles and others.

AC Motor: AC motor is an electric motor associated with the electric motor market as it benefits from efficiency, long life span, and versatility. They are motors whose rotation is based on the alternating current and can be usually classified into two major categories, induction and synchronous. Unlike synchronous motors, induction motors are not that suited for purposes where very high efficiency in speed is important, like conveyor belts, pumps, or other general industrial processes. Use of alternating current motors will thus minimize maintenance costs and increase the lifetime of appliances. With the improvement in the technology of AC motors, such as the variable frequency drives (VFDs), AC motors can become even more efficient and adaptable. They are also used in manufacturing, HVAC, and transportation industries.

Electric Motor Market Share, By Motor Type, 2024 (%)

| Motor Type | Revenue Share, 2024 (%) |

| AC Motor | 71.40% |

| DC Motor | 18.50% |

| Hermetic Motor | 10.10% |

DC Motor: DC motors are tailored for very fine speed control and high torque at low speeds. Applications associated with these qualities are those that require actuating some exact motion, such as robotics, automotive, and small machinery. DC motors operate on a DC power source and are broadly categorized into brushed and brushless motors. Most of the time, brushed motors are cheaper but involve more maintenance over time. A brushless direct-current motor is said to involve increased life and high performance with maintenance reduction. Due to the significant increase in demand resulting from advancing technologies in electric vehicles and their associated automated systems, demand for DC motors-the BLDC version in particular-has escalated remarkably. Their suitability for portable applications, performance adaptability, and energy savings continue to make them popular among various sectors.

Up to 5 kW: The electric motors upto 5kW are the most advanced in the small applications such as household appliances, fans, pumps, and light machinery. These are preferred owing to the small size, energy efficiency, and reduced cost and are normally domestic or commercial in nature. This small power segment also features mostly in automotive applications as secondary systems, e.g., windshield wipers and cooling fans. New and innovative motor designs such as brushless DC motors have continued to improve their efficiency and life. The market for motors in this power range is still vibrant and continues to grow with the increased demand for consumer appliances and small-scale automation.

5 kW to 10kW: The motors with a range of power consumption from 5kW to 10 kW are being major used in the medium-scale industrial and commercial applications. They cover equipment like conveyors, compressors, and HVAC systems in industries and commercial buildings. The best possible mix of performance versus cost, reliability, and efficiency is confined to the load, which is moderate. They also find wide applications in electric vehicles (EVs), especially in hybrid models as well as smaller EVs. The market for this range of motors is anticipated to increase with advancements in motor efficiency and durability as industries and commercial establishments adopt energy-efficient technologies.

10kW to 75kW: Electric motors cover the power ratings from 10 kW to 75 kW mostly for heavy-duty applications like pumps, fans, and crushers. These motors are ubiquitous in manufacturing, mining, and oil & gas operations, where high power and continuity are crucial. This range also caters to the electric vehicle propulsion system, especially large and high-performance EVs. Motors in this context have now adopted energy-efficient and variable frequency technology as requirements for reduced operational costs and compliance with stringent energy regulations evolve. Besides, the increasing need for industries to be more productive and sustainable would greatly increase the demand for motors in this power range.

Above 75 kW: The motors above 75 kW are typically reserved for large-scale industrial and infrastructural applications such as power generation, heavy machinery applications, and marine propulsion systems. These motors are generally reserved for massive heavy-duty applications where durability and reliability are requirements - including turbines, crushers, and large compressors. These high-rated motors also support energy generation projects that employ renewable energy sources like wind and run-off hydropower systems. Due to the high consumption of energy for these large engines, improvement on their efficiency and smart motor technologies is emphasized in this sector. As more and more infrastructures and energy projects come into existence globally, the demand for high-capacity motors above 75 kW will remain high due to industrialization and energy needs.

Industrial Machinery: Industrial motors make all electric motors that supply power to actuate equipment such as conveyor belts, pumps, compressors, or robotics. They perform reliable and efficient automated operations, which, in particular, can enhance productivity in manufacturing, as well as in operations like mining and oil and gas extraction. In machines, induction motors are preferred for their economy as well as their robustness. Technological advancements that include smart and energy-efficient motors aim to support energy savings and predictive maintenance in growing requirements for sustainable solutions from this application segment.

Motor Vehicles: The electric motor plays a major role in the automotive industry from its contribution to internal combustion engine applications- starters or alternators- to fully electric vehicles. Hence, EV propulsion constitutes electric motors, which are now the best-in-class systems among all current technologies according to their performance. Their high efficiency, instant torque, and lower environmental impact make electric motors the primary propulsion systems in such vehicles. Brushless DC motors and permanent magnet synchronous motors are basically the present holders of the crown in the EV competition for obvious size and performance superiority.

HVAC Equipment: Electric motors are important to the HVAC systems which drives compressors, fans, and pumps for heating, ventilation, and air conditioning. Efficiency is expected in energy consumptions within this aspect in maintaining indoor air quality and thermal comfort in homes, buildings, and industries. Besides technologies such as variable speed drives, installation of energy-efficient motors would lead to overall energy consumption reduction in their use while promoting better sustainability. Technological advancements also have brought other innovations, like IoT-smart-enabled motors, which would make predictive maintenance and operational control, further improving the systems' dependability.

Electrical Appliances: Electric motors are important for the household as well as commercial electrical appliances like refrigerators, washing machines, fans and vacuum cleaners. Along with ensuring the smooth functioning, performance characteristics and energy efficiency it is being used owing to the rising demand for convenience and sustainability among the consumers. The innovation such as inverter technology are making appliances quieter and energy efficient. As the penetration of smart home appliances increases, market demand for advanced electric motors with IoT capabilities is also stimulated.

Others: This category "Others" for applications of electric motors covers a variety of sectors, from agriculture to health care, and renewable energy. It applies to motors for irrigation, grain elevators, and machinery used in modern farms. Motors mainly use them for medical equipment like ventilators, pumps, and imaging devices. In renewable energy, wind turbines and solar tracking systems use motors to optimize energy generation. Some other applications include elevators and escalators and marine propulsion systems. The versatility of the new motors is highlighted as their various applications continue to increase within these sectors that have much more improved energy-efficient and sustainable solutions.

The electric motor market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

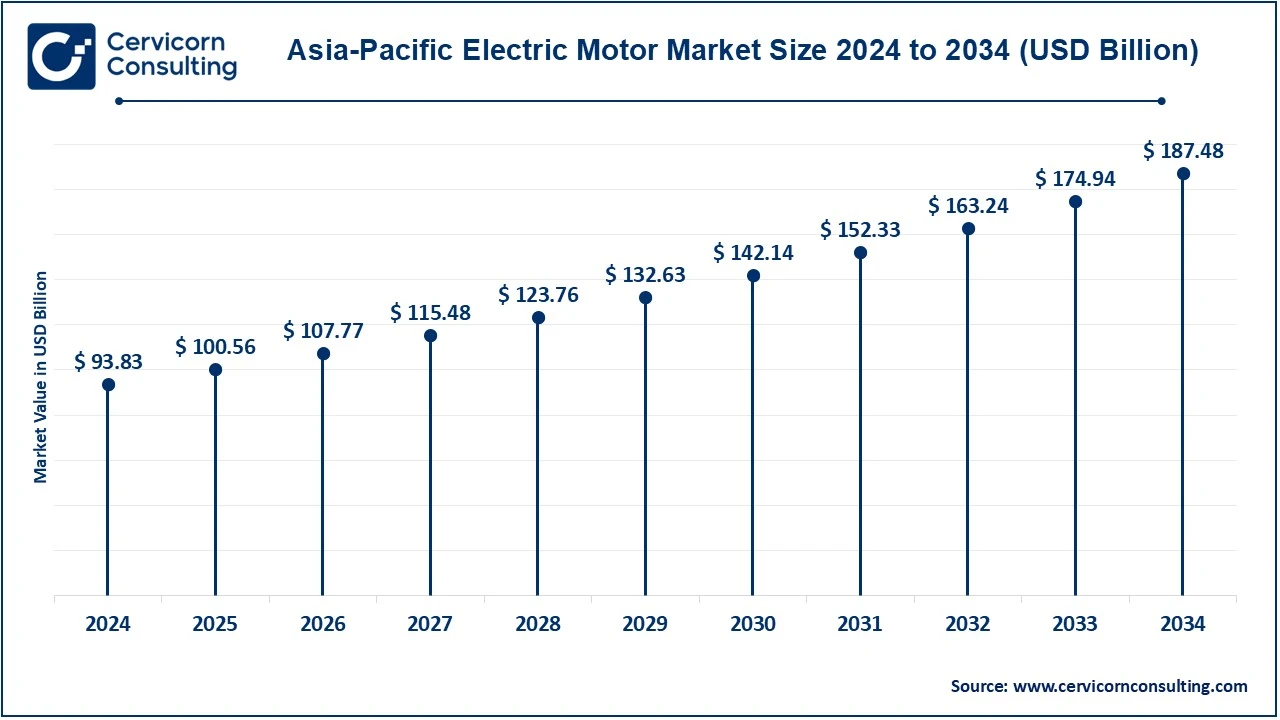

The Asia-Pacific electric motor market size was accounted for USD 93.83 billion in 2024 and is projected to hit around USD 187.48 billion by 2034. It is the largest region, and it is fast growing due to rapid industrialization, urbanization, and development in the automotive sector. The countries like China, Japan, and India have quite consumed a lot of market shares owing to dominating manufacturing industries and electric vehicle usages. It also creates demand for electric motors all over this region, given that many infrastructure projects are going-on besides renewable energy investments. More and more, consumer culture is revolutionizing due to the increase in household equipment requirement and HVAC systems, which is another attribute to the growth of this market. The government promotes energy efficiency by providing subsidies for using sustainable technologies, which hastens the widespread use. It will then further increase with the advancement of technology and economic growth.

The North America electric motor market size was estimated at USD 35.28 billion in 2024 and is expected to reach around USD 70.48 billion by 2034. Advanced industrialisation, a strong automobile sector and energy efficient trends characterise the North America market. The electric vehicle (EV) market and renewable energy penetration have driven innovations in both motor design as well as efficiency. Uncompromising energy regulations and government incentives provide strong reasons for industries to invest into high-efficiency motors. Manufacturing, HVAC, and healthcare are three of the most vibrant contributing industries to demand for electric motor. This regional market is represented pretty much overwhelmingly in the U.S. but with great contributions from Canada and Mexico as a result of increasing activities in their industrial and automotive sectors. This smart technologies and automation techniques will prove to be the major boost for this phenomenal market over the next few years.

The Europe electric motor market size was valued at USD 43.33 billion in 2024 and is expected to be worth around USD 86.58 billion by 2034. The europe market is being driven by the stringent energy efficiency standards along with rising focus on sustainability and advancements in the EV technology. Countries such as Germany, France, and the UK are leading the market owing to the industrial bases and rising renewable energy projects. The ambitious climate goals that cut across the different countries, for example, carbon neutrality, require different sectors such as manufacturing, transport and construction in the region to adopt energy efficient motors. This, together with a thriving EV market, is greatly propelling demand for electric motors in Europe. A weighty competitive edge in the global electric motor market also puts Europe because, apart from an active end-user segment in the form of an EV market, it also boasts many innovations under development related to smart motor technologies and the extension of automation in industries.

Electric Motor Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 19.70% |

| Europe | 24.20% |

| Asia Pacific | 52.40% |

| LAMEA | 3.70% |

The LAMEA electric motor market size was valued at USD 6.63 billion in 2024 and is anticipated to reach around USD 13.24 billion by 2034. It is recording steady growth because it is being backed up by industrialization, urban development, and renewable energy projects. Brazil is among the states in Latin America that fuel demand due to its automotive and manufacturing activities while Mexico is also quite a player in this area. On the contrary, Middle Eastern nations are shedding light on the diversifying economies via infrastructure and energy investments, where electric motors have assumed great importance in the construction and oil & gas sectors. Increasing electrification projects with the extent of industrialization are bringing about high demand creation for big markets in Africa. There exist challenges like unstable economies and infrastructural limitations. However, foreign investments into the region and the political will of the government to drive sustainable energy solutions have opened markets for potentiality in the LAMEA region.

The new entrants into the electric motor industry clearly focus their innovations and niche specialization on sustainability to get foothold. The company takes advantage of the high-end technologies including 3D printing, IoT, and AI motor management to innovate energy-efficient and intelligent motors. New engineers are also struck deep where high-growth areas such as electric vehicles, renewable energy, and robotics require too many space-saving, high-performance motors in the nearby future. Developing a green production process and raw materials, new entrants would also be inline with global sustainability agendas. They base their efforts on customized solutions and competitive pricing to entice industries transitioning to energy-efficient technologies and new markets looking for low-cost motor systems to enhance their reach. Collaborations with tech corporations and investments in R&D would see these players rolling out products in record time to earn their chunk of the competitive consumer market compared to established companies.

Market Segmentation

By Motor Type

By Power Rating

By Voltage

By Rotor Type

By Output Power

By Application

By Region