The EV battery market is crucial for the global decarbonization effort, driving growth in electric cars, trucks, buses, and stationary storage systems. As EV adoption grows, the demand for batteries is skyrocketing, transforming automotive supply chains and industrial strategies across nations.

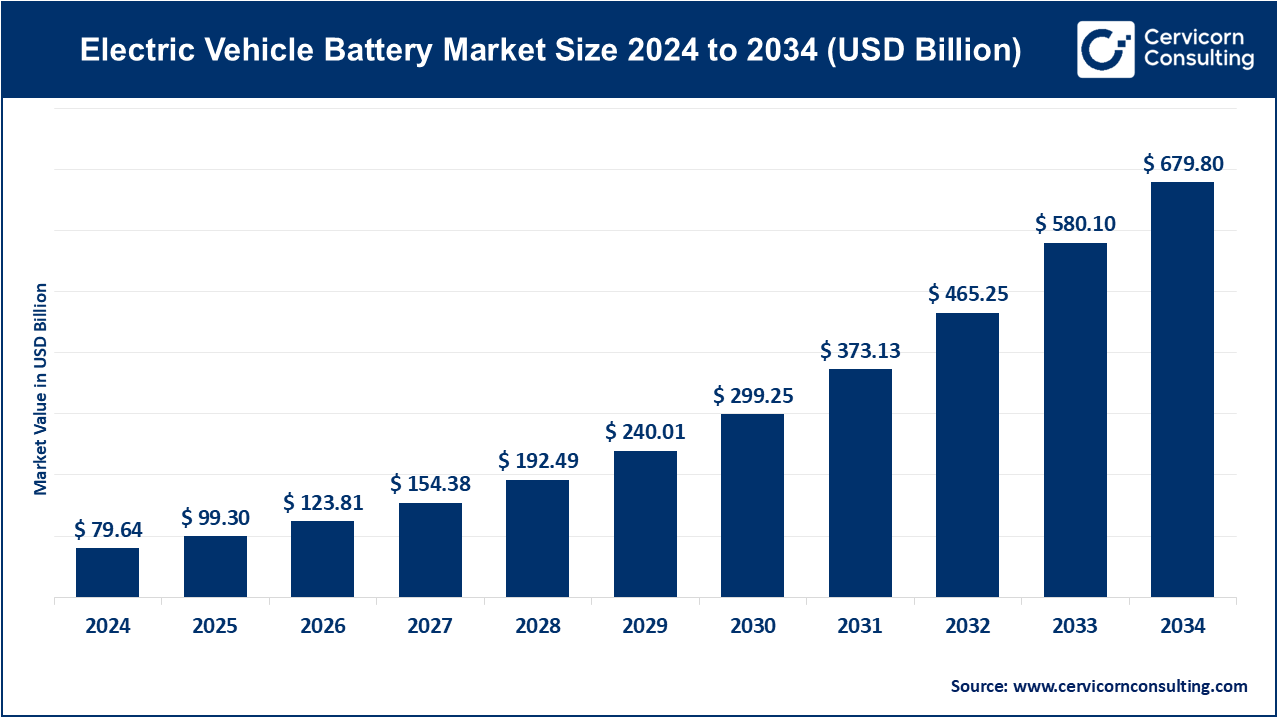

The global electric vehicle battery market size was recorded at USD 79.64 billion in 2024 and is expected to be worth around USD 679.80 billion by 2034, growing at a compound annual growth rate (CAGR) of 23.91% from 2025 to 2034.

The electric vehicle (EV) batteries market is driven by increased awareness of climate change, government incentives, and the growing adoption of electric vehicles worldwide. With more people opting for EVs, manufacturers are investing heavily in developing batteries that offer longer range and shorter charging times. This surge in demand has attracted new companies into the EV battery manufacturing sector, fueling competition and innovation. Additionally, the push for cleaner energy sources and stringent emission regulations have accelerated the shift towards EVs, further boosting the battery market�s growth. As the market expands, we also see a focus on improving battery recycling and sustainability, addressing environmental concerns tied to battery production and disposal. China is the world's largest exporter of EV batteries, accounting for approximately 12% of its EV battery production. In 2023, China exported over 4 million cars, including 1.2 million EVs, marking an 80% increase in electric car exports compared to the previous year.

An electric vehicle (EV) battery is a rechargeable battery that powers an electric vehicle. It stores electrical energy and delivers it to the motor to drive the vehicle. These batteries are typically lithium-ion (Li-ion) or lithium iron phosphate (LiFePO4), known for their efficiency, high energy density, and long lifespan. The battery�s performance is crucial in determining the range, charging time, and overall efficiency of the EV. A good EV battery should provide enough energy to run the vehicle for long distances, charge quickly, and endure many cycles of use. The growing demand for EVs has led to advances in battery technology, improving energy storage and making EVs more affordable and practical.

Key Global Trends in the Electric Vehicle Battery Market

Global EV Battery Trade & Regional Dynamics

| Region/Country | Key Highlights |

| China | Dominates global battery production with approximately 60% market share and accounts for 75% of global lithium-ion cell manufacturing capacity. It also leads in refining and processing key materials such as lithium, cobalt, and graphite. |

| United States | Imports account for 84% of all lithium-ion storage batteries in 2024, with 69% originating from China. Strategic efforts are underway to localize battery production and reduce dependency through the Inflation Reduction Act. |

| European Union | Through the European Battery Alliance (EBA), the EU is investing in the development of regional gigafactories (Germany, Hungary, Spain) to enhance energy security and decrease import reliance. |

| Global Trade | Electric vehicle exports reached USD 150 billion in 2023, reflecting a 60% year-over-year increase. China and Germany lead the market, together accounting for over 70% of global EV shipments. |

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 99.30 Billion |

| Market Size by 2034 | USD 679.80 Billion |

| Market Growth Rate | CAGR of 23.91% from 2025 to 2034 |

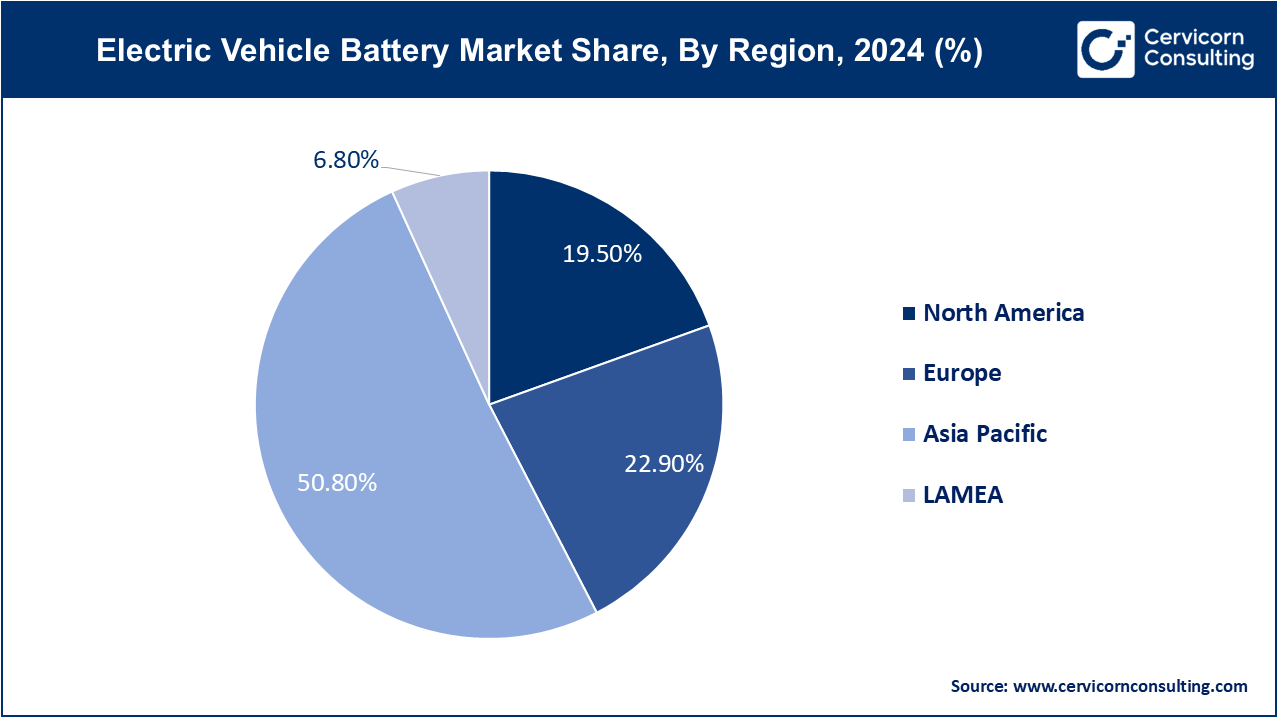

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Segment Coverage | By Battery Type, Propulsion, Battery Form, Vehicle Type, Material Type, Battery Capacity, Battery Component and Regions |

Technological Advancements in Battery Chemistry

Government Incentives and Policies

Limited Raw Material Availability

Recycling and Disposal Challenges

Advancements in Battery Technology

Expansion of Recycling and Second-Life Applications

Technological Complexity and Integration

Global Supply Chain Dependencies

Lead-Acid: The lead-acid battery segment has measured market share of 14.28% in 2024. Lead-acid batteries are one of the oldest types used in vehicles, primarily known for their cost-effectiveness and reliability. However, they are gradually being phased out in the EV market due to their lower energy density and shorter lifespan compared to newer battery technologies. Their use is mostly limited to auxiliary functions rather than propulsion.�

Lithium-Ion: The lithium-ion batteries segment has captured highest market share of� 64.93% in 2024. Lithium-ion batteries dominate the EV market due to their high energy density, lightweight nature, and long cycle life. They are the preferred choice for most electric vehicles, driven by ongoing advancements in energy storage capacity and cost reductions, making them increasingly accessible for mass-market vehicles.�

Solid-State: Solid-state batteries are an emerging technology expected to revolutionize the EV market by offering higher energy density, improved safety, and faster charging times. These batteries use solid electrolytes instead of liquid ones, which reduces the risk of leaks and fires, making them a highly anticipated innovation in the near future.�

Nickel-Metal Hydride: The nickel-metal hydride batteries segment has garnered market share of 6.15% in 2024. Nickel-metal hydride batteries are primarily used in hybrid electric vehicles (HEVs) due to their robustness and longer lifespan compared to lithium-ion batteries. However, they are heavier and have lower energy density, limiting their adoption in fully electric vehicles, where efficiency and weight are critical factors.�

Sodium-Ion: Sodium-ion batteries are being explored as a lower-cost alternative to lithium-ion batteries. They offer similar energy density but with abundant and cheaper raw materials. Although still in the early stages of development, sodium-ion technology is gaining attention for its potential to reduce dependency on lithium and cobalt.�

Others: The other segment has achieved market share of 5.23% in 2024. This segment includes various experimental and emerging battery technologies such as aluminum-air, magnesium-ion, and lithium-sulfur. These alternatives are under research and development, with the goal of achieving higher energy densities, faster charging times, and lower costs, potentially offering breakthroughs in the future of EV batteries.

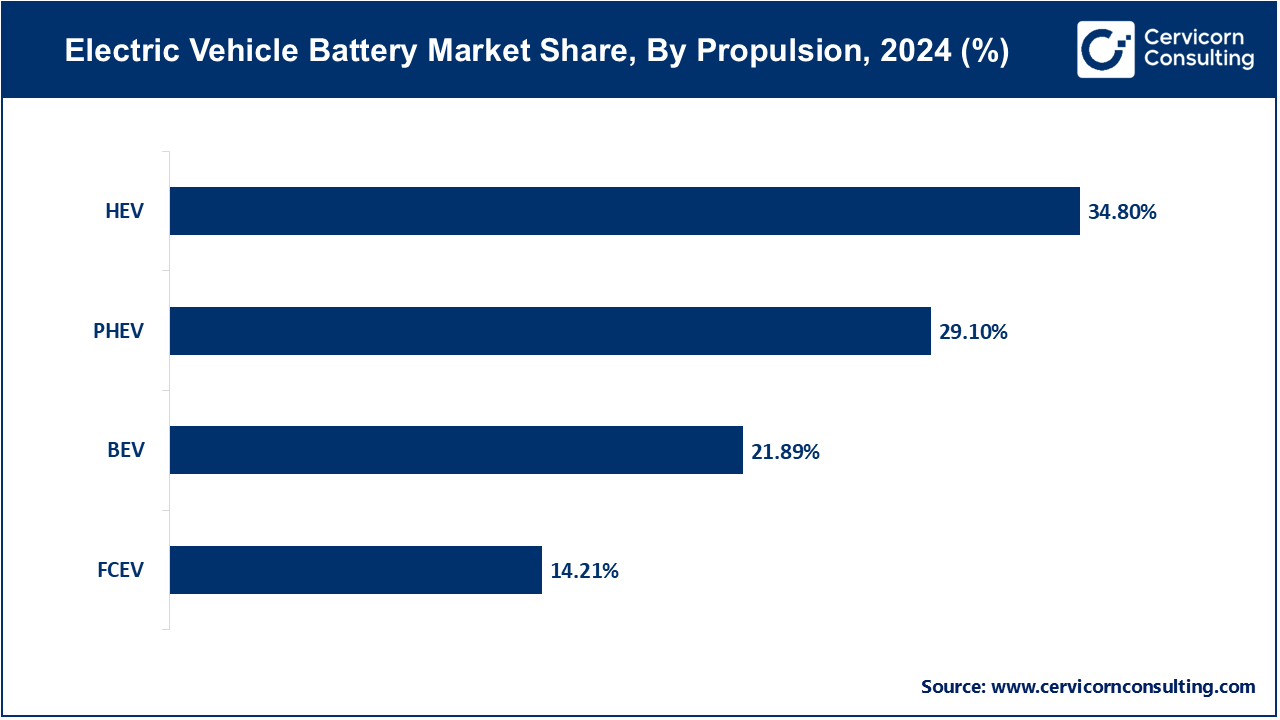

Battery Electric Vehicle (BEV): Battery Electric Vehicle (BEV) segment has registered 21.89% of market share in 2024. BEVs are fully electric vehicles powered solely by batteries. The increasing focus on reducing greenhouse gas emissions and advancements in battery technology are driving the demand for BEVs. Government incentives and growing charging infrastructure are further supporting their adoption, making BEVs a key segment in the EV battery market.�

Plug-in Hybrid Electric Vehicle (PHEV): The PHEV segment has covered market share of 29.1% in 2024. PHEVs combine a conventional internal combustion engine with a battery-powered electric motor, allowing for both electric and gasoline-powered driving. The flexibility of using either fuel source makes PHEVs appealing to consumers transitioning to electric vehicles, especially in regions with limited charging infrastructure.�

Fuel Cell Electric Vehicle (FCEV): The FCEV segment has recorded market share of 14.21% in 2024. FCEVs use hydrogen fuel cells to generate electricity for propulsion. While still a niche market, FCEVs are gaining traction due to their long-range capabilities and quick refueling times. However, the lack of hydrogen refueling infrastructure remains a significant barrier to widespread adoption.

Hybrid Electric Vehicle (HEV): In 2024�the HEV segment has calculated market share of 34.8%. HEVs use a combination of an internal combustion engine and an electric motor, with energy stored in batteries. They do not require external charging, as the battery is charged through regenerative braking and the engine. HEVs are popular for their improved fuel efficiency and reduced emissions compared to traditional vehicles.�

Prismatic: The prismatic segment has covered market share of 32.29% in the year of 2024. Prismatic batteries are known for their compact and rectangular shape, making them easy to stack and integrate into vehicle designs. They are widely used in electric vehicles due to their high energy density and efficient space utilization, contributing to the ongoing trend of optimizing battery packaging.�

Pouch: The pouch segment has registered market share of 43.09% in 2024. Pouch batteries offer flexibility in design, as they can be shaped to fit various spaces within a vehicle. They provide high energy density and are commonly used in electric vehicles where weight and space savings are crucial. The lightweight nature of pouch batteries supports the trend towards increasing vehicle efficiency.�

Cylindrical: The cylindrical segment has measured market share of 24.62% in 2024. Cylindrical batteries are known for their durability and high energy density. They are commonly used in electric vehicles, especially in performance-oriented models, due to their ability to handle high discharge rates. The uniform shape also aids in efficient cooling, aligning with the trend of enhancing battery performance.��

Passenger Cars: Passenger cars represent the largest segment in the EV battery market, driven by the increasing consumer demand for electric vehicles as a greener alternative to traditional vehicles. Government incentives, advancements in battery technology, and the expansion of charging infrastructure are key drivers in this segment.

Vans/Light Trucks: The adoption of electric vans and light trucks is growing, particularly in the logistics and delivery sectors. The demand for cleaner urban transportation solutions, coupled with advancements in battery technology that offer longer range and higher payload capacity, is driving growth in this segment.

Medium & Heavy Trucks: Electric medium and heavy trucks are gaining traction as industries seek to reduce carbon emissions from freight and logistics operations. The development of high-capacity batteries capable of supporting long-haul routes and heavy loads is a key driver, alongside increasing regulations on emissions in the commercial vehicle sector.

Buses: Electric buses are becoming increasingly popular in public transportation as cities aim to reduce air pollution and carbon emissions. Government initiatives and subsidies, along with advancements in battery technology that provide longer ranges and faster charging, are significant drivers in this segment.

Off-Highway Vehicles: Electric off-highway vehicles, including construction and agricultural machinery, are seeing increasing adoption due to the demand for quieter, emission-free operations. Battery advancements that offer high power and energy density are crucial for supporting the heavy-duty requirements of these vehicles, driving market growth.

Cobalt: Cobalt segment has recorded 24.31% of market share in 2024. Cobalt is a critical component in many lithium-ion batteries, known for its stability and ability to improve battery energy density. However, supply chain challenges and ethical concerns regarding cobalt mining are driving research into reducing cobalt content or finding alternative materials in battery production.�

Lithium: The lithium segment has generated market share of 34.45% in the year of 2024. Lithium is the cornerstone material for lithium-ion batteries, widely used across all types of electric vehicles. The growing demand for EVs has led to a surge in lithium mining and production, making it a critical focus area for ensuring the sustainability and cost-effectiveness of battery production.�

Natural Graphite: Natural graphite segment has measured market share of 15.01% in the year of 2024. Natural graphite is used as an anode material in lithium-ion batteries, providing high conductivity and improving battery performance. As the demand for high-performance batteries increases, the market for natural graphite is expanding, with a focus on enhancing its properties for better energy storage capabilities.�

Manganese: The manganese segment has reported 26.23% of market share in 2024. Manganese is used in some battery chemistries to improve energy density and safety. Its role in stabilizing the battery structure and enhancing performance is driving its demand, particularly as manufacturers seek to optimize battery life and efficiency in electric vehicles.��

Iron: Iron is primarily used in lithium iron phosphate (LFP) batteries, known for their safety, long cycle life, and thermal stability. The affordability and abundance of iron make it an attractive material for mass-market EVs, particularly in regions where cost considerations are paramount.

Phosphate: Phosphate is a key component in LFP batteries, contributing to their safety and stability. The use of phosphate-based batteries is growing, particularly in applications where safety is a priority, such as in electric buses and commercial vehicles.

Nickel: Nickel is a crucial material in high-energy-density batteries, particularly in nickel-cobalt-manganese (NCM) and nickel-cobalt-aluminum (NCA) chemistries. The demand for nickel is increasing as manufacturers seek to enhance battery performance and extend the range of electric vehicles.

Others: This segment includes a variety of materials being explored for next-generation batteries, such as silicon, sulfur, and aluminum. These materials hold potential for improving energy density, reducing costs, and enhancing the overall performance of electric vehicle batteries, making them a key area of research and development.

<50 kWh: The <50kWh battery capacity segment has considered 16.65% market share in 2024. Batteries with a capacity of less than 50 kWh are typically used in smaller electric vehicles and hybrid models, where range is not the primary concern. The trend towards producing affordable, compact EVs for urban use is driving demand in this segment.�

111�200 kWh: The 111-200kWh battery capacity segment has held market share of 20.35% in 2024. Batteries in this capacity range are used in higher-end electric vehicles and larger vehicles like SUVs, vans, and light trucks. The increasing consumer demand for vehicles that offer long-range capabilities and enhanced performance is a key driver in this segment.��

201�300 kWh: The 201�300 kWh battery capacity segment has accounted market share of 16.51% in the year of 2024. High-capacity batteries in the 201�300 kWh range are used in electric buses, medium and heavy trucks, and performance-oriented electric vehicles. The need for extended range, higher power output, and the ability to support heavy loads are driving demand in this segment.�

>300 kWh: The >300kWh segment has confirmed market share of 14.18% in 2024. Batteries with a capacity of over 300 kWh are primarily used in commercial and industrial vehicles, such as heavy trucks, buses, and off-highway vehicles. The trend towards electrifying long-haul transportation and heavy-duty applications is fueling demand for these high-capacity batteries.�

Positive Electrode: The positive electrode, or cathode, is a critical component of lithium-ion batteries, determining the battery's energy density, cycle life, and safety. Advances in cathode materials, such as the development of high-nickel chemistries, are driving improvements in battery performance and efficiency.

Negative Electrode: The negative electrode, or anode, plays a key role in the battery's charge capacity and cycle life. Research into new anode materials, such as silicon and graphene, is focused on increasing energy density and improving the overall performance of lithium-ion batteries.

Electrolyte: The electrolyte facilitates the flow of ions between the battery's electrodes, affecting the battery's conductivity, safety, and performance. Innovations in solid and liquid electrolytes are crucial for enhancing battery efficiency, safety, and energy density in electric vehicles.

Separator: The separator is a thin membrane that prevents the electrodes from contacting each other while allowing ion flow. Advances in separator technology, such as the development of more robust and thermally stable materials, are essential for improving the safety and longevity of lithium-ion batteries.

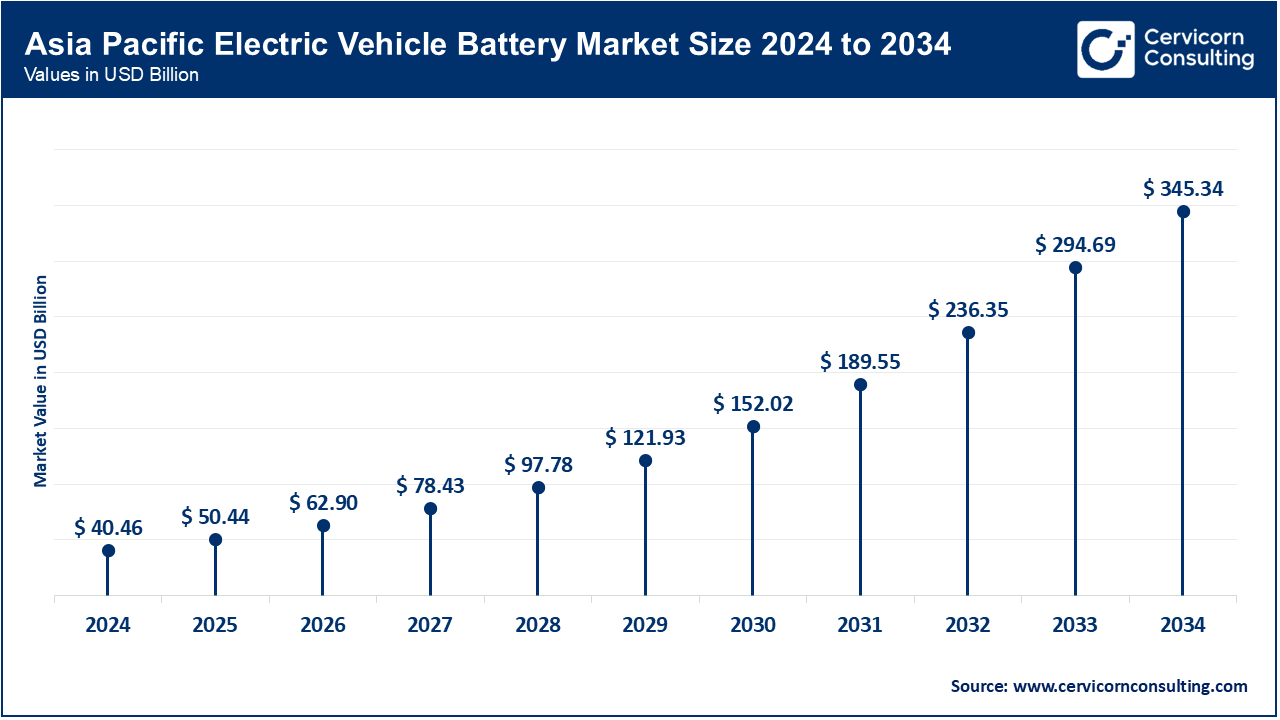

The Asia-Pacific region dominates the global EV battery market, with China leading as the largest producer and consumer of electric vehicle batteries. Asia Pacific market size is calculated at USD 40.46 billion in 2024 and is projected to grow around USD 345.34 billion by 2034�with a CAGR of 26.73%. The region�s growth is fueled by government policies promoting electric mobility, extensive battery manufacturing capacity, and significant investments in R&D. Japan and South Korea are also major players, with companies like Panasonic, LG Chem, and Samsung SDI driving innovation in battery technology. The region's strong manufacturing base and rapidly expanding EV market make it a critical hub for global battery production and supply.

�

The North American electric vehicle (EV) battery market is experiencing significant growth, driven by increasing government incentives, stringent emissions regulations, and growing consumer demand for sustainable transportation. The U.S. leads the region, supported by substantial investments in battery manufacturing and R&D. The rise of domestic battery production, including the development of gigafactories, aims to reduce reliance on imports and strengthen the supply chain. The region also benefits from the growing adoption of electric vehicles, especially in states like California, which are at the forefront of the EV revolution. U.S market size is estimated to reach around USD 92.79 billion by 2034 increasing from USD 10.87 billion in 2024 with a CAGR of 25.4%.

Europe is a key player in the global EV battery market, propelled by strong regulatory support, aggressive carbon reduction targets, and a robust automotive industry. Countries like Germany, France, and the U.K. are leading the charge, with substantial investments in battery production facilities and innovation hubs. The European Union�s Green Deal and other policies are accelerating the shift towards electric mobility, while initiatives like the European Battery Alliance aim to establish a self-sufficient battery supply chain, reducing dependency on external sources and fostering technological advancements.

The LAMEA region is gradually emerging in the EV battery market, with growing interest in electric mobility driven by environmental concerns and the need for sustainable energy solutions. Latin America, particularly Brazil, is seeing increased investment in EV infrastructure and battery manufacturing. The Middle East is focusing on diversifying its energy resources, with countries like the UAE exploring EV adoption. Africa is in the early stages, with efforts centered on leveraging abundant mineral resources, like cobalt, essential for battery production, to develop a localized supply chain and support regional market growth.�

Among the newer players, Northvolt AB is leveraging its focus on sustainable battery production and strong partnerships with European automakers, positioning itself as a key supplier in the region's growing EV market. Gotion High-Tech Co., Ltd. is also emerging by emphasizing innovation in battery materials and securing strategic collaborations, such as its recent MoU with BASF. Dominating players like CATL and LG Energy Solution drive the market through large-scale production capabilities and extensive R&D investments. Their collaborations with global automotive giants, including partnerships like LG Energy's agreement with Toyota, highlight their dominance and commitment to advancing battery technology.

Robin Zeng, CEO of CATL

"Our focus remains on accelerating the transition to clean energy by continuously innovating in battery technology, ensuring that our products meet the highest standards of safety, efficiency, and sustainability."

Young Soo Kwon, CEO of LG Energy Solution

"We are committed to leading the global EV battery market by expanding our production capacity and forging strategic partnerships that drive the widespread adoption of electric vehicles worldwide."

Peter Carlsson, CEO of Northvolt AB

"Northvolt is on a mission to deliver the world's greenest batteries, and we are making significant strides through sustainable manufacturing processes and collaborations with key automotive partners."

Masaki Sugisawa, CEO of Panasonic Energy

"As a pioneer in battery technology, Panasonic is dedicated to advancing energy solutions that power the next generation of electric vehicles while contributing to a more sustainable future."

Robert Lee, CEO of SK On

"SK On is focused on pushing the boundaries of battery performance and safety, ensuring that our technology not only meets but exceeds the expectations of our partners and customers in the EV industry."

Bill Wessel, CEO of Gotion High-Tech

"Our collaboration with global leaders and our commitment to continuous innovation in battery materials are key drivers that will help us shape the future of electric mobility."

These CEO statements highlight the strategic focus of key players in the EV battery market on innovation, sustainability, and global partnerships. Their collective efforts are aimed at driving the widespread adoption of electric vehicles through advancements in battery technology and production capabilities.

Market Segmentation

By Battery Type

By Propulsion

By Battery Form

By Vehicle Type

By Material Type

By Battery Capacity

By Battery Component

By Regions