Energy Retrofit Systems Market Size and Growth 2025 to 2034

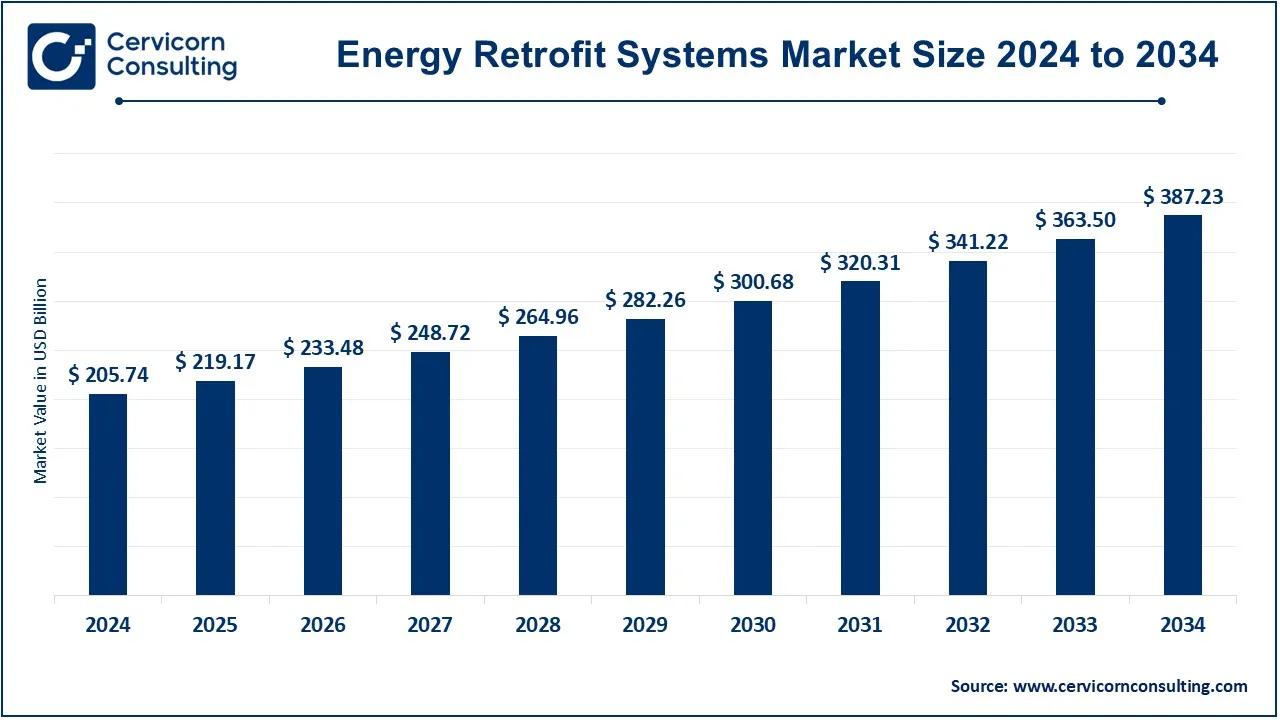

The global energy retrofit systems market size was valued at USD 205.74 billion in 2024 and is expected to be worth around USD 387.23 billion by 2034, growing at a CAGR of 7.6% over the forecast period 2025 to 2034. The global demand for energy retrofit systems is rapidly increasing due to rising energy costs and growing awareness of sustainability. Government regulations and initiatives promoting energy efficiency in residential and commercial sectors have further fueled market growth. Additionally, businesses are investing in energy retrofits to meet carbon reduction targets, improve operational efficiency, and comply with green building standards. The integration of IoT and AI in energy management has also contributed to the market’s expansion.

According to recent studies, energy retrofits can reduce energy consumption in buildings by 30-50%, leading to significant cost savings. Data suggests that countries implementing strict energy efficiency policies have witnessed an annual 10-15% increase in retrofit projects. Additionally, financial incentives have resulted in a 20-30% growth in adoption rates among commercial buildings. As climate change concerns and energy efficiency targets become more prominent, the energy retrofit market is expected to grow at a steady pace over the next decade.

What is an Energy Retrofit Systems?

Energy retrofit systems involve upgrading existing buildings with modern energy-efficient technologies to reduce energy consumption, enhance performance, and lower carbon footprints. These retrofits can include improvements such as better insulation, advanced HVAC systems, LED lighting, solar panels, smart energy management systems, and high-performance windows. By optimizing energy usage, these systems help reduce operational costs while making buildings more environmentally friendly.

Energy retrofitting is crucial for older buildings, as they often lack modern energy-efficient designs. The process can range from minor upgrades, such as installing energy-efficient appliances, to major renovations like integrating renewable energy sources. Governments and organizations worldwide promote energy retrofit initiatives through incentives, tax benefits, and policies aimed at reducing carbon emissions. Retrofitting not only helps businesses and homeowners save money but also contributes to global sustainability efforts.

Energy Retrofit Systems Market Report Highlights

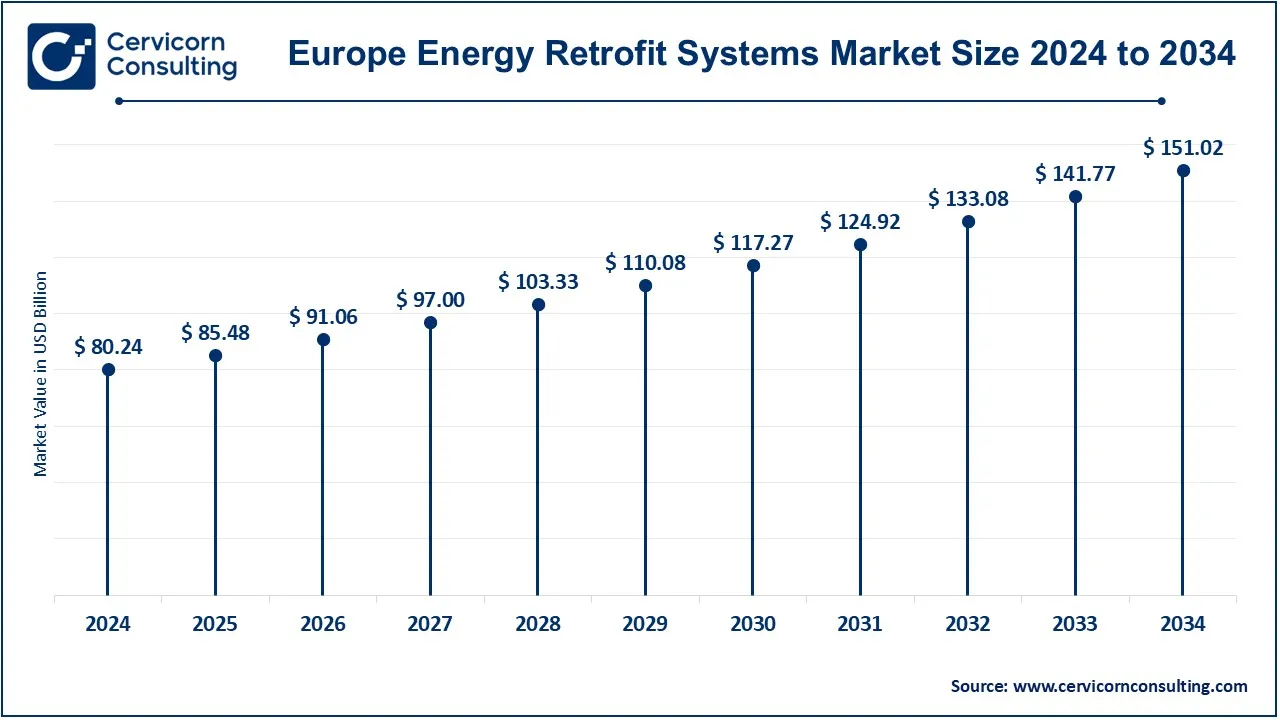

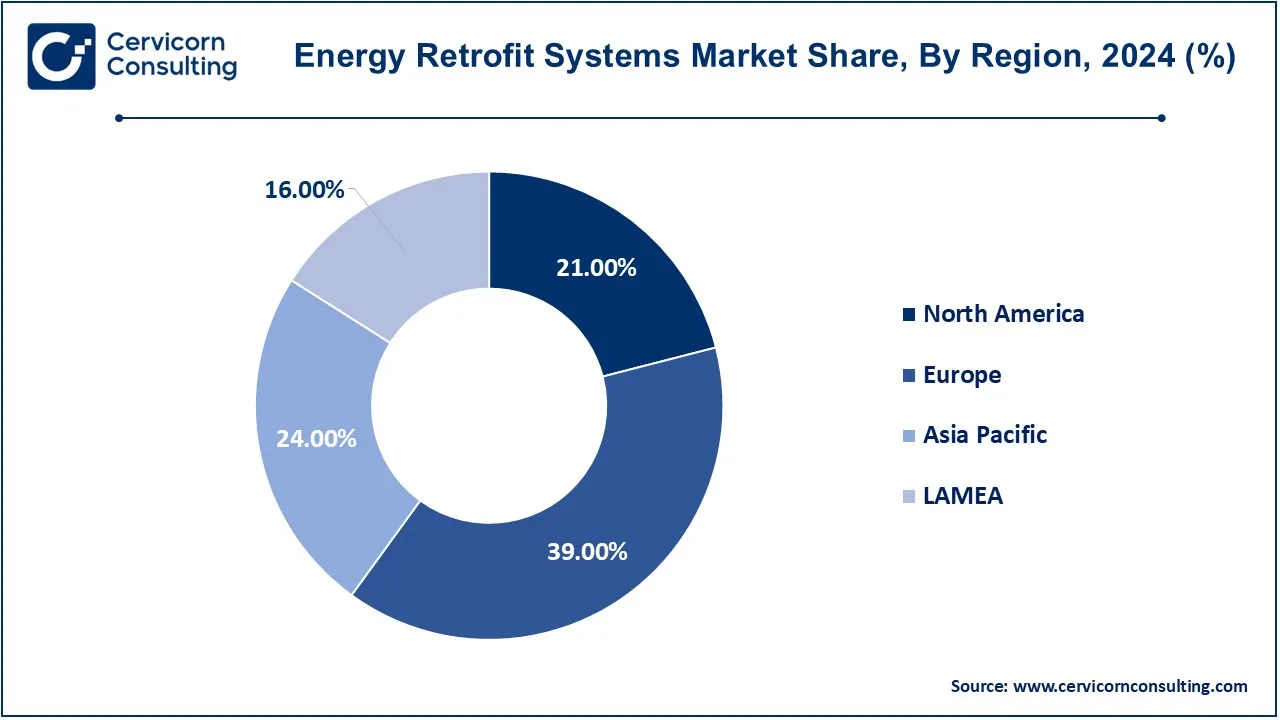

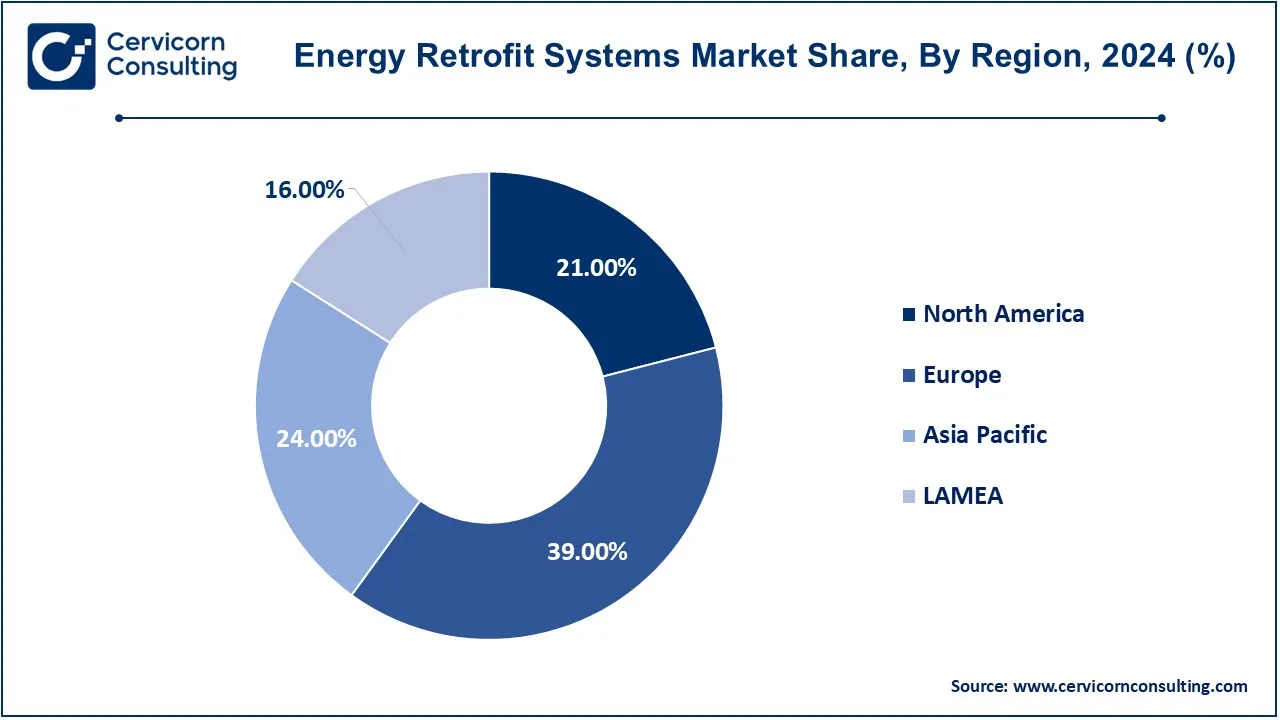

- The Europe region is leading the market with a 39% revenue share in 2024.

- The Asia-Pacific region has achieved a revenue share of 24% in 2024.

- By product, the envelope segment has accounted for a revenue share of 51.34% in 2024.

- By end user, the commercial segment has captured a revenue share of 56.12% in 2024.

Energy Retrofit Systems Market Growth Factors

- Rising Energy Costs: The rising rates of energy have been an important factor stimulating energy retrofitting. Depending on high energy bills, building owners become motivated to invest in retrofits. As the cost of energy continues to escalate, retrofitting may promise to be a viable pathway toward energy efficiency and cost reductions in the long term. The trend is expected to flow, further driving various stakeholders to sustainable pathways with great long-term savings.

- Government Incentives: Financial incentives, including tax credits, grants, and rebates from governments, play a major role in delivering energy retrofits. Lowering the costs of the process for building owners, they make energy-efficient upgrades into more attractive alternatives. More and more governments around the world fund projects whose goals reflect and align with sustainability, which continues to inspire the influx of retrofits aimed at improved energy performance, funded by government programs.

- Technological Advances: The constant innovations in energy-efficient technologies have been augmenting the effectiveness of retrofits and their pricing. Smart building systems, HVAC technologies, and energy management software development allow much more accurate control and optimization of energy use. These changes upgrade retrofitting not only to be more effective but also appealing to building owners who want to stay ahead in the competitive market over energy management.

- Integration with Renewable Energy: The growing integration of renewable energy sources in buildings provides another vital growth factor for energy retrofit systems. Owners of buildings that retrofit to accommodate renewable technologies can achieve greater energy efficiency brought about by a smaller carbon footprint. This trend is not only an important factor supporting sustainability but also an important contributor to global energy transition goals, potentially leading to increased investment potential for these types of projects as a whole.

- Improved Return on Investment (ROI): Energy retrofits are becoming an increasingly recognized means of providing a great return-on-investment by way of reducing the operational costs of running buildings and increasing their values. Building owners have learned to realize that investments in energy efficiency not only lead them to divert less to utility bills but also, at the same time, add to the overall value of the property. Financially driven reasons are compelling for many to pursue energy-retrofitting solutions.

- Consumer Awareness: Growing awareness regarding energy conservation and sustainability is leading to a greater demand for energy retrofits. Consumers are becoming much more knowledgeable about the benefits of energy-efficient upgrades, the savings they can provide, and what they can do for the environment. This appetite for knowledge is encouraging building owners to adopt the actual retrofitting solutions members of the public expect in line with their corporate sustainability goals, thus nurturing a more energy-conscious society.

Energy Retrofit Systems Market Trends

- Smart Technology Adoption: Apparently, smart technologies are moving into the limelight in the energy retrofitting project. IoT devices, smart metering system and energy management systems allow building owners to monitor and optimize energy consumption effectively. This further development of technology improves energy efficiency and also enhances comfort, rendering smart retrofits attractive.

- Healthy Focus: Special emphasis is being laid on making energy retrofits to create healthful indoor environments. Upgrades that improve indoor air quality, regulate temperature, and enhance natural lighting have good traction nowadays. This trend aligns with growing consumer awareness regarding the impact of environmental quality on health, thus pushing for retrofits that prioritize occupant well-being.

- Renewable Energy Integration: Efforts to incorporate renewable energy sources, such as solar panels and wind turbines, into energy retrofitting are now promoting. Building systems, more and more requiring energy independence and sustainability, make the retrofitting necessary in integrating such systems. It is well understood that renewable energy in the mix will invariably reduce the dependence on books and go to great lengths toward energy-efficient buildings.

- Data-Driven Solutions: Data analytics are being increasingly leveraged in energy retrofits that support more detailed assessments and optimizations of building performance. Stakeholders can assess energy use profiles and performance metrics to evaluate retrofit opportunities that are customized to suit their needs. This trend supports more effective energy management strategies and promotes informed decision-making in retrofit projects.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 219.17 Billion |

| Projected Market Size in 2034 |

USD 387.23 Billion |

| CAGR from 2025 to 2034 |

7.60% |

| Most Prominent Region |

Europe |

| Highest Growth Region |

Asia-Pacific |

| Key Segments |

Product, Type, End User, Region |

| Key Companies |

Ballard Power Systems, Plug Power Inc, ITM Power PLC, Intelligent Energy Limited, PowerCell Sweden AB, Cummins Inc., AVL, Nedstack Fuel Cell Technology BV, Horizon Fuel Cell Technologies, Altergy, NUVERA FUEL CELLS, LLC, ElringKlinger AG, Infinity Fuel Cell and Hydrogen, Inc., Doosan Fuel Cell Co., Ltd., Toshiba Corporation, Loop energy, Pragma Industries, SFC Energy AG, Shanghai Shenli Technology Co., Ltd., W. L. Gore & Associates |

Energy Retrofit Systems Market Dynamics

Drivers

- Energy Efficiency Standards: Energy efficiency standards have increasingly been made stricter through law since they represent an additional demand in the field of energy retrofitting. With changing times requiring sustainability to take precedent, building owners should upgrade existing systems into compliance. This would not only encourage technology adoption but also encourage retrofitting towards compliance with energy performance standards to the benefit of the market.

- Corporate Sustainability Goals: Many corporations are committing to ambitious sustainability goals that will entail considerable cuts in energy consumption at great cost. The commitment drives the companies to invest more in energy retrofits within their overall environmental strategies. By implementing the sweetest energy-efficient measures, organizations would meet their sustainability pursuing operational efficiency and a boost in brand reputation.

- Market Demand: One such factor that stands at the forefront in driving energy retrofits is that of the currently increasing demand for green-built energy-efficient infrastructure. As consumers and businesses prioritize sustainability and environmentally friendly policies, there arises a higher demand to be raising the bar on already existing structures via retrofitting. The change in market demand is bringing competition in the energy retrofitting market and promoting investment therein.

- Utility Incentives: Incentives and rebates for energy-efficient upgrading from utilities offer cutting-edge impetus for retrofitting works. Utilities support property owners with financial aids in increasing demand for energy-saving measures, thereby lowering load on the grid. Overall, utilities make retrofitting missions more financially attractive and increase the energy-efficient system rate of dissemination in residential and commercial industries.

Opportunity

- Increased Demand for Green Buildings and Sustainable Construction: There is an increased demand for green buildings and eco-friendly construction practices. As global awareness towards sustainability has increased, the demand for green buildings and eco-friendly construction practices has also increased. Energy retrofitting systems are cost-effective ways of changing existing structures to meet the parameters of green buildings, such as LEED certification. This creates a targeting opportunity for retrofit companies serving the residential, commercial, and industrial markets to enable buildings to lower their carbon footprint while meeting the fluctuating sustainability goals.

- Emerging Energy Cost and Economic Pressure: This increasing pressure on energy and economic stresses is driving business and consumer needs for effective cost solutions. The utility-conserving systems, which reduce energy usage, also help in reducing cost for consumers. As the cost of energy increases, economic savings offered by Energy Efficiency Measures will become an ever-stronger market driver for the adoption of retrofit systems after building renovation. Energy efficiency measures enable overall economic savings by avoiding energy wastage and getting the building operated at peak efficiency.

- Technological advancement in retrofit solutions: The emergence of advanced technologies, including smart meters, sensors, and other IoT-based systems, is opening up new windows in energy retrofitting. These new technologies allow for better monitoring and optimizing energy consumption. Smart retrofitting systems leverage sophisticated technology for monitoring to provide real-time insights into building performance, hence enabling owners to make informed decisions on energy efficiency improvements. The anticipated rapid growth of the market for energy retrofit systems will, however, take into account the increasing affordability and accessibility of these technologies.

Restraints

- Cost Implications: One of the major inputs for energy retrofitting at the outset is expensive. This is especially true for a small building owner who of course is not ready to part with this large sum. Very often potential investors might be discouraged and refuse to go for energy efficient measures because of the high upfront costs of modern technologies and materials. In principle, the long run savings can as well compensate for these expenses. However, appropriate financing for such ventures may be difficult for the stakeholders to arrange.

- Market Fragmentation: The entire energy retrofit market is graceful; however, it is full of fragmentation due to a myriad of players that straightforwardly provide different solutions and technologies. The resulting lack of standardization can play tricks on the unpracticed consumer and complicate their purchasing decisions. While moving through a fragmented market, the various stakeholders might complicate the adoption of effective retrofit strategies and thus delay the implementation of the projects.

- Technological Changeovers: There are integration complexities for energy retrofitting to merge new technologies into old systems. Building owners encounter compatibility differences with existing components of their systems, and this damages the affordability and extends the project schedule. Fundamental steps must be taken to handle these technical barriers, reorganizing them themselves may cause will through rethinking of other complex projects and hence lose innovative proposals due to investments in retrofitting efforts.

Challenges

- Resistance to Change: Owners and occupants might oppose changes to existing structures, making it even more difficult to fit them for modern usage. The resistance could be in the form of distractions, cost, or simply a poor understanding of the benefits of changing energy use. Such objections should be handled through comprehensive communication and putting together a proper plan to demonstrate to various stakeholders the advantages of energy-efficient upgrades to foster wide acceptance and investment.

- Performance Measurement: Accurately measuring the performance and savings attributable to retrofitted systems is quite complicated at times. A delay in making the investments required to support energy upgrade may arise simply because the stakeholders are put in a position of determining the energy savings or effectiveness of the upgrade undertaken. If reliable metrics are not set up to evaluate the success of the retrofit, doubt will set in and slow investment in energy efficiency.

- Adoption of New Technologies: Resistance on the part of the Richmond stakeholders toward adopting a new technology still hinders and will continue to hinder the ever-accelerating growth of the market. Stakeholders could be averse to investing in new unknown solutions or simply lack training and resources for their application. Meeting with this challenge involves creating an awareness and education campaign directed toward various stakeholders about the benefits of adopting modern technologies to maximize the energy retrofit.

Energy Retrofit Systems Market Segmental Analysis

Product Analysis

Envelope: Performance-directed envelope retrofitting generally focuses on the exterior portion of the building, including the walls, roofs, windows, etc. The primary function performed in the retrofitting is to improve thermal performance to reduce energy loss. The retrofitting process can include achieving an insulated and air-sealed building envelope in the ground-floor zone. Reductions in cost through less energy required to beat the indoor heat transfer lend to tremendous savings in heating and cooling while improving occupant comfort. The embrace and application of energy efficiency codes and standards have initiated increasing investments into envelope retrofitting by all sorts of industries.

LED Retrofit Lighting: LED retrofit lighting transforms standard lighting into energy-efficient LED technology. Besides that, the effects of transforming the energy of light into effective other lights make LEDs operate longer. With greater emphasis on sustainability, LED retrofitting has become an integral part of retrofit strategies being put in place by a multitude of companies that have made the switch. Lower placement of electricity bills and minimal maintenance costs is what makes LED retread quite appealing in residential and commercial spaces.

Energy Retrofit Systems Market Revenue Share, By Product, 2024 (%)

| Product |

Revenue Share, 2024 (%) |

| Envelope |

51.34% |

| LED Retrofit Lighting |

12.43% |

| HVAC Retrofit |

24.78% |

| Appliances |

11.45% |

HVAC Retrofit: Retrofitting heating, ventilation, and air-conditioning (HVAC) systems with upgraded, more efficient units or optimized existing systems to give customers the most bang for their buck might easily include the addition of smart thermostats or high-efficiency boilers and advanced filtration systems into the retrofitting equation. It will greatly reduce energy use and improve indoor air quality through improved comfort and health. HVAC retrofitting is becoming an increasingly vital step in the whole energy efficiency management plan that companies are putting in place as regulatory pressure for energy efficiency starts rising in an average between the last 3 to 5 years.

Appliances: Energy-efficient appliances utilize much less energy than regular refrigerators, washers, and dryers. Replacing such appliances with more modern Energy-Star rated devices will drastically cut back energy usage and utility bills for the consumer or business itself and others. Both consumer and business appliance retrofits are becoming important aspects in reaching their sustainability and operational efficiencies. Accordingly, the rise of awareness to save energy and available rebates and incentives is inducing energy-efficient appliances to be embraced in several organizations, thus promoting the energy retrofitting process.

End User Analysis

Residential Sector: Weak competition for the house does prevail in the energy retrofit market. The owners prefer energy-efficient options to the maximum in order to get more utility savings and comfort. Energy retrofit in this sector typically refers to improvement in insulations of the primary HVAC systems and appliances. The increasing awareness among residents regarding sustainability enables the prospect of investing in energy retrofits continuously recommended by various government incentives and in the form of financing launched to support energy retargeting initiatives to bring down energy consumption and reduce the carbon footprint.

Commercial Sector: Companies making use of energy retrofits as methods of improving efficiency and lowering operating expenses. Modifications generally include the upgrade of lighting and HVAC systems as well as the renovation of building envelopes in accordance with energy standard codes. The pressure on the corporate world owing to increasing competition to implement sustainable practices has contributed to the growth in demand for energy retrofitting solutions. With an enhancement in energy performance, cost saving, and improvement of the working environment, it has now become imperative for businesses with an edge over others in the cut-throat competitive market.

Energy Retrofit Systems Market Revenue Share, By End User, 2024 (%)

| End User |

Revenue Share, 2024 (%) |

| Residential |

29.64% |

| Commercial |

56.12% |

| Institutional |

14.24% |

Institutional Sector: The institutional sector generally concerns schools, hospitals, and government buildings. The sector is the same for the energy retrofit market. All institutions face pressure on improving energy efficiency and sustainability. The sector retrofits mostly deploy advanced technologies including smart building systems and renewable energy sources. Through energy retrofits, the institutions can effectively reduce energy consumption, lower operational costs, along with enhancing the comfort and wellbeing of occupants.

Energy Retrofit Systems Market Regional Analysis

The energy retrofit systems market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The Europe region has dominated the market in 2024.

What makes Europe the leader in the energy retrofit systems market?

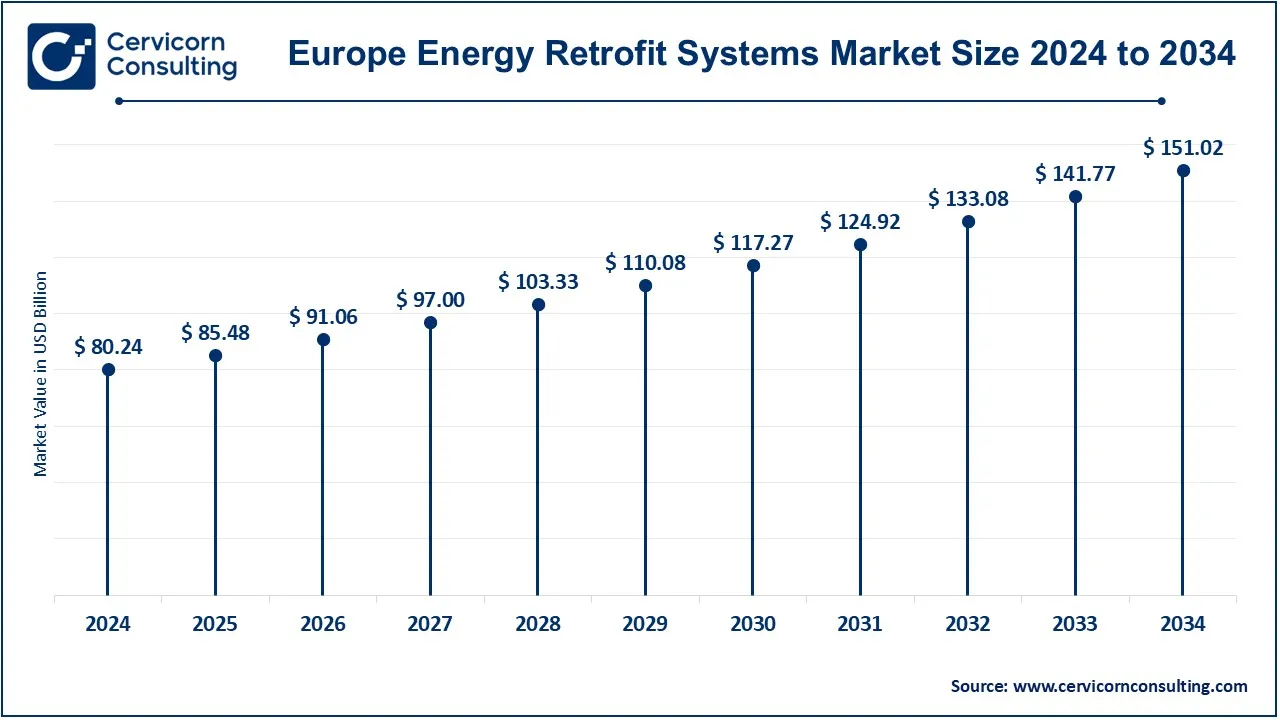

The Europe energy retrofit systems market size was estimated at USD 80.24 billion in 2024 and is projected to hit around USD 151.02 billion by 2034. The europe hit tremendous growth, characterized by theEuropean Union's daunting climate targets and strict energy efficiency directives. Germany, France, and the UK are the major countries where energy-efficient retrofits have been introduced, especially in the residential buildings sector. The EU Green Deal plays a fundamental role in vigorous encouragement to a plethora of programs that aim at rigorous investments in retrofitting with a view of becoming carbon neutral by 2050. Moreover, financial incentives and grants are available to support energy efficiency upgrades, so Europe remains at the helm of energy retrofit innovations.

North America Energy Retrofit Systems Market Growth

The North America energy retrofit systems market size was valued at USD 43.21 billion in 2024 and is expected to reach around USD 81.32 billion by 2034. North America, led by strong energy efficiency rules and an emphasis on sustainability, stands at the forefront of the energy retrofit systems marketplace. With tremendous investments in retrofitting operations intended to reduce energy use and greenhouse gas emissions, the United States, particularly California and New York, is in a prime position for retrofitting and energy efficiency efforts. In addition to this, Canada is dealing with issues related to energy-efficiency, again promoting both residential and commercial retrofits. Government incentives and financing programs have further reinforced this movement, which makes North America as the dominant position in energy retrofit developments.

What are driving the rapid growth of the Asia-Pacific region in energy retrofit systems market?

The Asia-Pacific energy retrofit systems market size was accounted for USD 49.38 billion in 2024 and is predicted to surpass around USD 92.94 billion by 2034. The Asia-Pacific region hit rapid growth, mainly due to urbanization and growing energy demand. Investment in energy efficiency retrofitting is rising in major markets such as China and India to enhance energy efficiency in the building to mitigate environmental impact. Carbon neutrality by 2060 dictates China's strong interest in investing in energy-efficient technologies. Moreover, Australia focuses its effort on retrofitting of the commercial building sector to infrastructural sustainability objectives. A mixture of government support and heightened awareness of energy conservation are thereby causing the fast expansion of the market in this region.

LAMEA Energy Retrofit Systems Market Growth

The LAMEA energy retrofit systems market was valued at USD 32.92 billion in 2024 and is anticipated to reach around USD 61.96 billion by 2034. In LAMEA region, slow and gradual acceptance of energy retrofit systems is seen in the LAMEA region, where countries in Latin America, the Middle East, and Africa are aware of energy efficiency. Brazil and Mexico lead the Latin American countries in various programs for improving energy performance in buildings. The UAE is investing in sustainable retrenching in the commercial sectors. Africa faces unique challenges, though initiatives backed by international partnerships and funding are already in place to promote energy efficiency and sustainability.

Energy Retrofit Systems Market Top Companies

- Ballard Power Systems

- Plug Power Inc

- ITM Power PLC

- Intelligent Energy Limited

- PowerCell Sweden AB

- Cummins Inc.

- AVL

- Nedstack Fuel Cell Technology BV

- Horizon Fuel Cell Technologies

- Altergy

- NUVERA FUEL CELLS, LLC

- ElringKlinger AG

- Infinity Fuel Cell and Hydrogen, Inc.

- Doosan Fuel Cell Co., Ltd.

- Toshiba Corporation

- Loop energy

- Pragma Industries

- SFC Energy AG

- Shanghai Shenli Technology Co., Ltd.

- W. L. Gore & Associates

The energy retrofit systems market is significantly dominated by key players such as Ballard Power Systems, Plug Power Inc., ITM Power PLC, Intelligent Energy Limited, PowerCell Sweden AB, and Cummins Inc. These companies use their developed technologies and their huge Research and Development departments in order to come up with new energy-time systems that help enhance efficiency while minimising carbon emissions. They try to improve their market positions through joint ventures, acquisitions and slanting towards sustainable development. For example, Plug Power has integrated hydrogen fuel cell systems, while Ballard Power is enhancing its clean energy technologies to meet the increasing demand for energy efficient systems worldwide. Collaboration with various governments and other interested parties is also another strategy that increases their power in the retrofit systems market.

CEO Statements

Kevin Knobloch, CEO of Plug Power Inc.

- "As we navigate the changing landscape of energy efficiency and decarbonization, our commitment is to advance sustainable retrofit technologies. Our focus remains on developing solutions that not only meet current energy demands but also align with global climate goals. By collaborating with key stakeholders, we aim to drive adoption and implementation of retrofitting practices that can drastically reduce emissions across various sectors."

Amory Lovins, CEO of RMI

- "Decarbonizing our built environment is not merely an option but a necessity for achieving our climate targets. Our recent projects demonstrate the potential of equitable building retrofits to deliver not just energy savings, but also improve health and comfort for residents. We believe that by streamlining retrofitting processes and creating robust markets, we can enable more communities to participate in the clean energy transition."

Eric Doub, CEO of a low-energy home building firm

- "The approach to energy retrofitting must prioritize envelope improvements before considering renewable energy installations. By enhancing the building envelope, we can significantly lower energy loads, making renewable investments more financially viable. Our ongoing zero-net-energy retrofitting projects reflect this philosophy and aim to set benchmarks for efficiency and sustainability in home renovations."

Recent Developments

- In January 2024, Danfoss entered a partnership with Google to enhance energy efficiency in data centers. This collaboration will enable Google to utilize Danfoss' heat reuse modules, allowing the company to capture and repurpose the heat generated by its data centers. This innovative approach will provide renewable energy for on-site heating as well as for nearby commercial and residential buildings, helping to meet community and industrial heating needs.

- In January 2024, Honeywell announced a collaboration with NXP to incorporate NXP's neural network-enabled, industrial-grade application processors into Honeywell’s building management systems (BMS). This integration aims to enhance the functionality and efficiency of BMS, facilitating smarter building operations.

Market Segmentation

By Product

- Envelope

- LED Retrofit Lighting

- HVAC Retrofit

- Appliances

By Type

- Quick Wins Retrofit

- Deep Retrofit

By End User

- Residential

- Single-family

- Apartments/Condominiums

- Commercial

- Food sales & service

- Office Buildings

- Mercantile

- Warehouse

- Others

- Institutional

- Education

- Healthcare

- Worship Buildings

By Region

- North America

- APAC

- Europe

- LAMEA

...

...