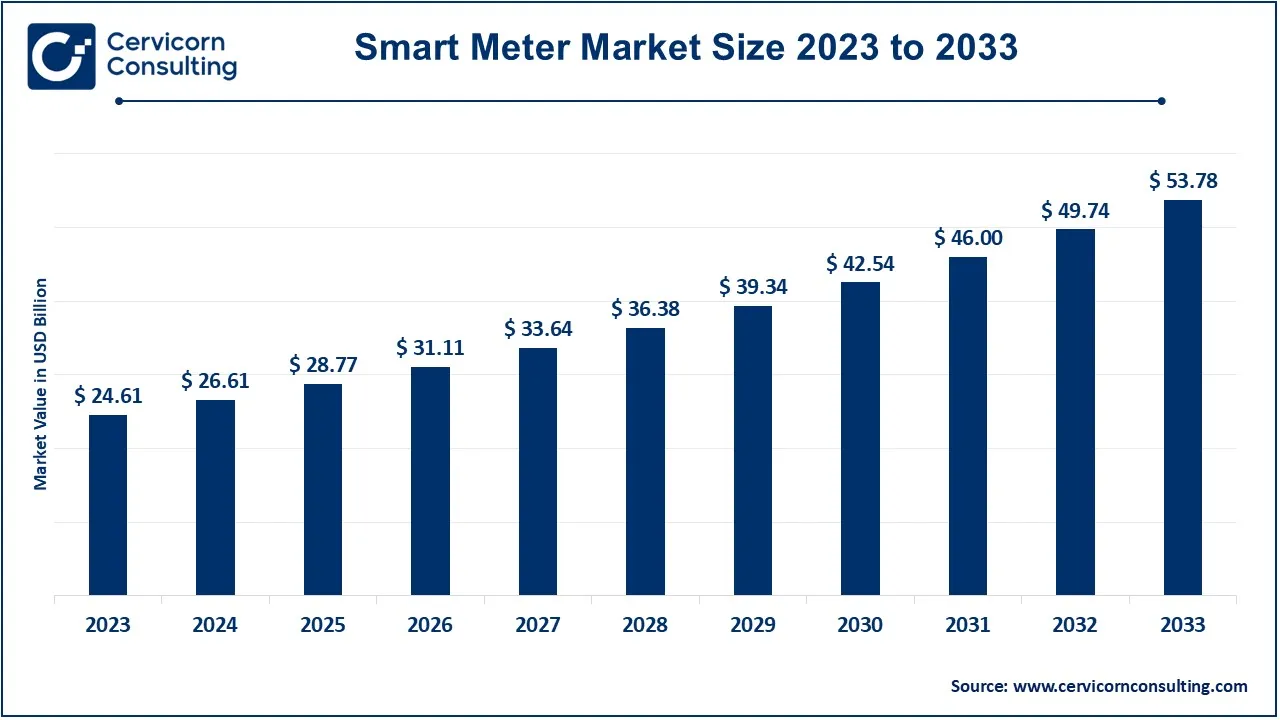

The global smart meter market size was valued at USD 26.61 billion in 2024 and is expected to be worth around USD 53.78 billion by 2033, growing at a compound annual growth rate (CAGR) of 8.13% from 2024 to 2033.

The smart meters market has been growing rapidly due to the global shift towards smart grid technologies, which aim to enhance the efficiency and reliability of energy distribution. Governments and utility companies are increasingly investing in smart meter infrastructure to reduce operational costs, improve customer service, and integrate renewable energy sources more effectively. In addition, smart meters contribute to energy conservation and are a vital component in the internet of things (IoT), facilitating advanced data analytics and smart home integrations. This growth is being driven by increasing energy demands, a push for sustainability, and evolving consumer expectations for better service. In December 2024, EQT and Singapore's sovereign wealth fund GIC acquired a majority stake in UK-based smart meter provider Calisen for £4 billion. Calisen manages approximately 12 million smart meters in the UK and is involved in electric vehicle charging units, solar, and battery technology.

A smart meter is an advanced digital device used to measure and record energy consumption (electricity, gas, or water) in real-time. Unlike traditional meters that only record usage periodically and require manual readings, smart meters provide continuous, automated updates to both consumers and utilities. They send data wirelessly to the utility company, allowing for accurate and timely billing, better energy management, and immediate identification of faults. Smart meters also help in monitoring energy usage patterns, providing insights that help consumers optimize their energy consumption and reduce costs. With the added benefit of real-time data, they contribute to more sustainable energy management by detecting inefficiencies and encouraging conservation efforts.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 28.77 Billion |

| Estimated Market Size (2033) | USD 53.78 Billion |

| Growth Rate | 8.13% from 2024 to 2033 |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Segments | Type, Communication Technology, Component, Technology, Application, Region |

| Key Companies | Itron Inc., Landis+Gyr, Honeywell International Inc., Schneider Electric, Siemens AG, General Electric, Aclara Technologies LLC, Sensus (Xylem Inc.), Elster Group (Honeywell), Kamstrup A/S, EDMI Limited, Iskraemeco, Zenner, Jiangsu Linyang Energy Co., Ltd., Wasion Group Holdings |

The smart meter market is segmented into type, communication technology, technology, component, application and region. Based on type, the market is classified into electricity meters, water meters, and gas meters. Based on communication technology, the market is classified into radio frequency (RF), power line communication (PLC), cellular, and Wi-Fi. Based on technology, the market is classified into automatic meter reading, and advanced meter infrastructure. Based on component, the market is classified into hardware, software, and services. Based on application, the market is classified into residential, commercial, and industrial.

Electricity Meters: The electricity meters segment has accounted revenue share of 51% in 2023. The most commonly used AMI is the smart electricity meter applied by utilities to control and measure the electricity consumption. They give actual information concerning energy use, facilitating DSM at the demand side and accurate tariffs. These are essential in deploying renewable energy and regulating the stability of the grid.

Water Meters: The water meters segment has generated revenue share of 30% in 2023. Smart water meters assist utilities and consumers to view water consumption data in real-time and identify leakage and wastage. These meters are emerging useful as people start adopting water saving in practice, and more so where water is scarce.

Gas Meters: The gas meters segment has held 19% of the total revenue share in 2023. Facilities that use smart gas meters include information on gas consumption, identify gas leakage and offer remote management. They become safer and more efficient especially in the cities that employ a lot of gas for heating and cooking.

Radio Frequency (RF): RF based smart meters are those which operates wirelessly that is it sends data through radio frequencies. This technology also permits subsequent transitions of the meter to utility companies through transmission of data for long distances without physical wired links. This one is employed vastly in the areas that have no possibility to use wired networks, for instance, in the districts.

Power Line Communication (PLC): PLC sends data wirelessly through power lines from smart meters to utility systems from where it is sent for analysis. This method is applied mostly at large cities where the base is created and the population has a high level of adaptation. PLC provides a dependable means of communication with minor costs of maintenance.

Cellular: Cellular-based smart meters use mobile networks to transmit usage data. These are particularly useful in regions without a dedicated smart grid infrastructure, allowing for flexibility and scalability.

Wi-Fi: Some smart meters use Wi-Fi networks for communication, particularly in homes or businesses where internet connectivity is already established. This option provides seamless integration with smart home systems and offers real-time monitoring via mobile apps.

Hardware: This includes the physical smart meter devices installed in homes, businesses, or industrial settings. It also covers any additional equipment needed for meter functioning, such as communication modules, sensors, and control units.

Software: Smart meter software is used to analyse and manage the data collected by the meters. Software solutions include meter data management systems (MDMS), which process and store the data, and analytics platforms, which help utilities and consumers understand and act on energy consumption patterns.

Services: Service providers offer installation, maintenance, and consulting services related to smart meters. These services are crucial for the deployment and ongoing support of smart meter systems, ensuring they operate efficiently and reliably.

The smart meter market is segmented into various regions, including North America, Europe, Asia-Pacific, andLAMEA. Here is a brief overview of each region:

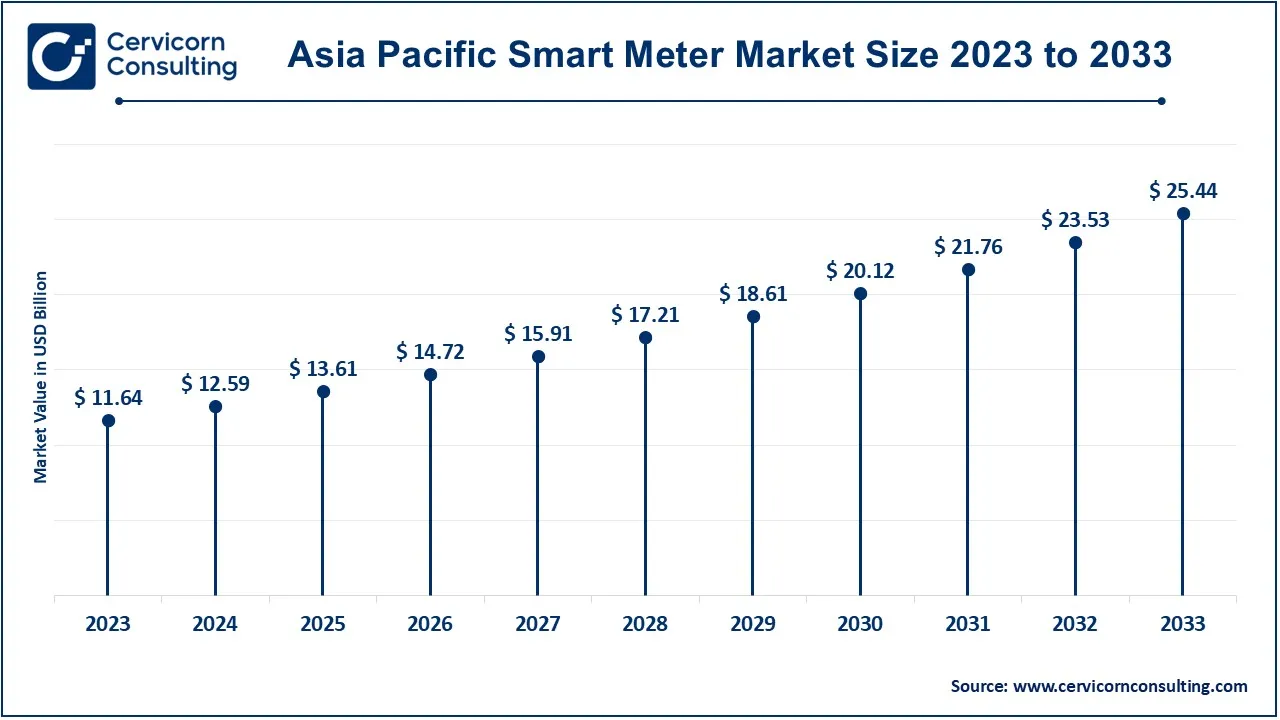

The Asia-Pacific smart meter market size was valued at USD 11.64 billion in 2023 and is expected to reach around USD 25.44 billion by 2033. The Asia-Pacific market is driven by large-scale investments from countries such as Japan, China, and South Korea. These nations are focusing on hydrogen as a key component of their energy transition strategies. Trends include significant development in hydrogen production, storage technologies, and fuel cell applications. The region is also investing heavily in hydrogen infrastructure to support its growing energy needs and reduce carbon emissions.

The North America smart meter market size was accounted for USD 5.59 billion in 2023 and is projected to surpass around USD 12.21 billion by 2033. Currently, the North America market is opening rapidly due to growing investment in smart grid and energy management systems. North America is leading with the United States and Canada where most adoption strategies are aided by government incentives. They are The AMI installation is rapidly progressing currently, and another trend is the recognition of the need for smart grid integration. Utilities are presently concentrating on cutting down expenses and handling energy distribution with close to real-time information and having the alternatives for distant control.

Europe

The Europe smart meter market size was estimated at USD 6.03 billion in 2023 and is predicted to hit around USD 13.18 billion by 2033. The European market is expanding, which has received significant government support and has a clear approach in attaining various sustainability objectives. Growing adoption of smart metering is due to the Europeans Union efforts toward energy efficiency and reduction of carbon. Some of the leading global smart meter markets such as the UK, Germany and France have set aggressive deployment targets accompanied by relatively sound polices. The use of advanced meters is, therefore, a key element of the strategy for security of supply and utilization of renewable energy sources in Europe as well as for advancing consumers’ control over their energy consumption.

The LAMEA smart meter market was valued at USD 1.35 billion in 2023 and is anticipated to reach around USD 2.96 billion by 2033. The LAMEA region is emerging, with a growing focus on energy diversification and sustainability. Countries are beginning to explore hydrogen solutions to address energy access and environmental concerns. Trends include initial investments in hydrogen infrastructure and pilot projects. The region's vast renewable energy resources offer potential for hydrogen production, although growth is tempered by economic and infrastructural challenges.

Emerging companies in the smart meter sector, such as Aclara and EDMI, are making progress with cutting-edge technology, focussing on advanced data analytics and IoT integration to improve energy management efficiency. Meanwhile, industry heavyweights such as Itron and Landis+Gyr have a strong presence thanks to their extensive global reach and profound knowledge in smart grid systems.

Itron stands out for its broad smart meter networks and sophisticated energy management platforms, whilst Landis+Gyr pushes the boundaries through strategic collaborations and continual research and development. Both emerging and established businesses are critical to pushing the advancement of smart meter technology and seamlessly integrating it into the current energy landscape.

CEO Statements

Philip Mezey, CEO of Itron Inc.

"At Itron, we are committed to driving innovation in energy and water management. Our smart meter technology empowers utilities and consumers alike to manage resources more effectively, contributing to a more sustainable future."

Werner Lieberherr, CEO of Landis+Gyr

"As a global leader in smart metering solutions, we are focused on enabling utilities to build a smarter, more sustainable grid. Our technology is essential in the transition to renewable energy sources and efficient energy management."

Darius Adamczyk, Chairman and CEO of Honeywell International

"Honeywell is at the forefront of creating innovative energy solutions, and our smart meter technology is playing a crucial role in driving energy efficiency and sustainability for both utilities and consumers."

Strategic launches and expansions highlight the rapid advancements and collaborative efforts in the smart meter industry. Industry players are involved in various aspects of smart meter, including technology, component, and material, and play a significant role in advancing the market.Some notable examples of key developments in the market include:

Market Segmentation

By Type

By Communication Technology

By Technology

By Component

By Application

By Regions