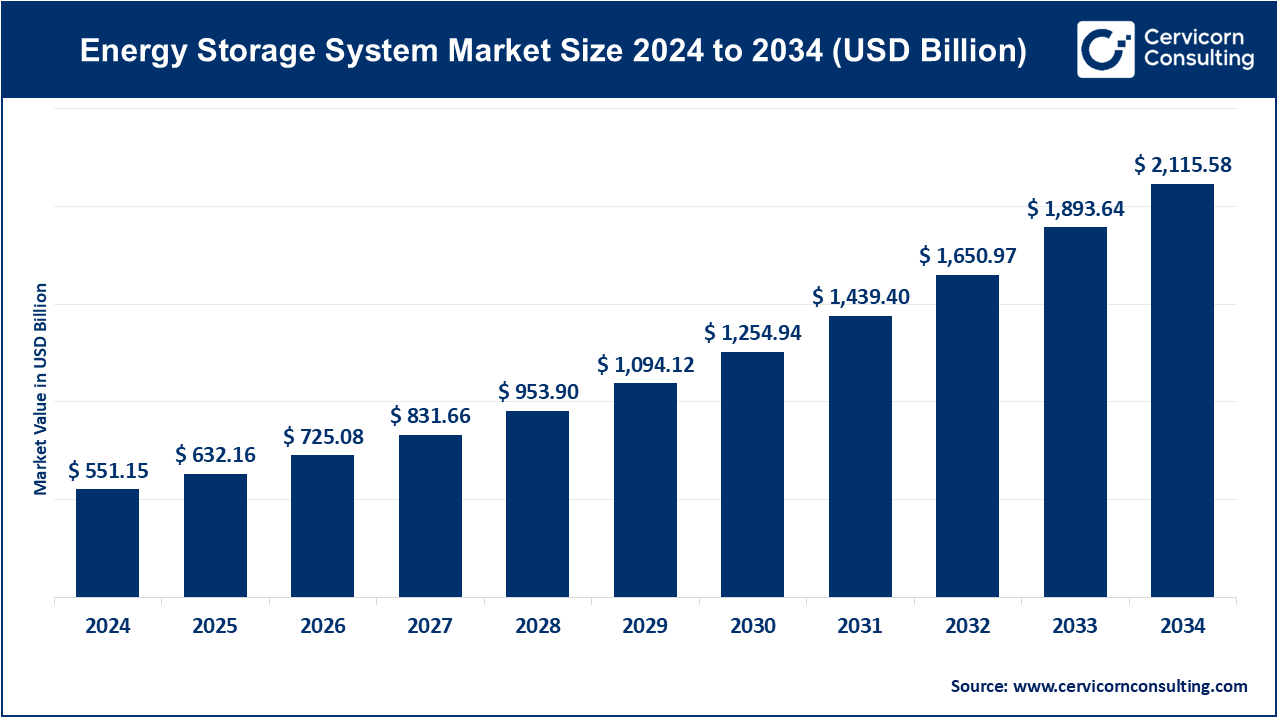

The global energy storage system Market size was accounted at USD 551.15 billion in 2024 and is expected to reach around USD 2,115.58 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.39% from 2025 to 2034.

The global energy storage system (ESS) market has seen significant growth, driven by the rising demand for renewable energy sources and the need for grid stability. As governments and industries push for cleaner, greener energy, ESS technologies are becoming essential for ensuring that renewable power can be stored and distributed efficiently. Additionally, the growing adoption of electric vehicles (EVs) is boosting the demand for advanced battery storage solutions. According to market reports, the global ESS market is expected to grow significantly, reaching billions of dollars in the next decade, with major investments in infrastructure and technology development. The market growth is not only fueled by renewable energy integration but also by the rising interest in decentralized energy systems. More consumers and businesses are turning to ESS to gain independence from the grid, reduce electricity costs, and ensure backup power. China's energy storage battery exports have seen substantial growth. From January to May 2024, the cumulative export volume reached 8.4 GWh, marking a year-on-year increase of 50.1%. Notably, in May alone, exports surged by 664% compared to the same month in the previous year.

The energy storage system (ESS) market encompasses technologies and solutions that store energy for later use, ensuring a reliable and efficient power supply. These systems include batteries, flywheels, compressed air, and thermal storage. ESS is crucial for balancing supply and demand, integrating renewable energy sources, and enhancing grid stability. Growth in the market is driven by increasing renewable energy adoption, advancements in battery technology, and supportive government policies. ESS applications range from residential and commercial use to large-scale grid support, contributing to energy efficiency, peak load management, and resilience against power outages.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 632.16 Billion |

| Market Size by 2034 | USD 2,115.58 Billion |

| Market Growth Rate | CAGR of 14.39% from 2025 to 2034 |

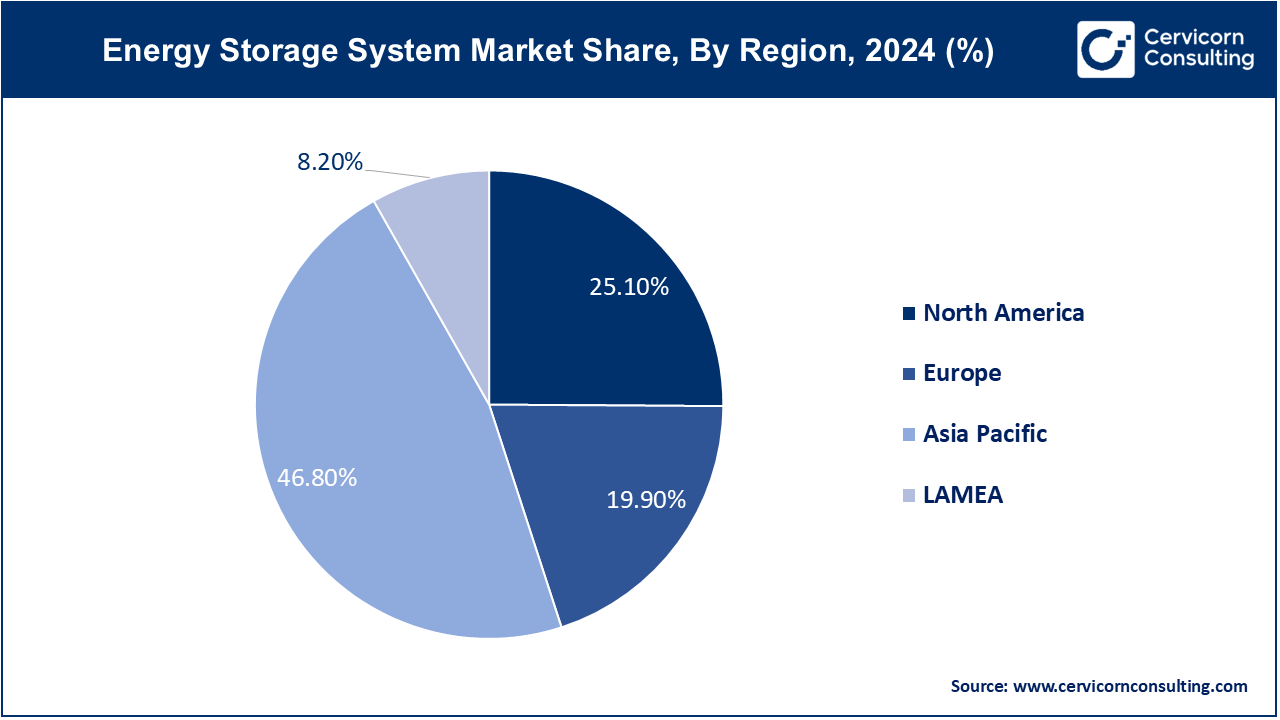

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Segment Coverage | By Technology, Application, End Use and Regions |

Decreasing Costs of Energy Storage Technologies:

Regulatory Mandates and Energy Security Concerns:

Limited Lifespan and Degradation Issues:

Complexity and High Initial Investment:

Advancements in Alternative Storage Technologies:

Integration with Renewable Energy Projects:

Regulatory and Standardization Issues:

Grid Integration and Infrastructure Limitations:

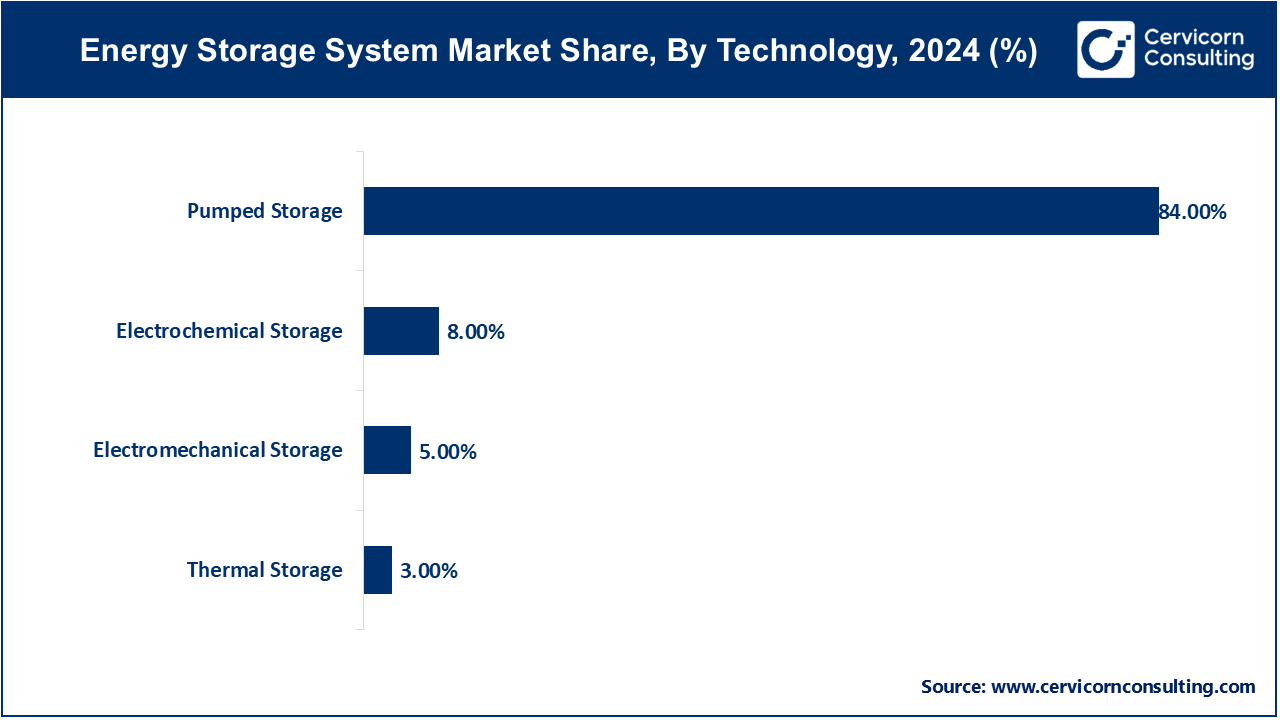

Pumped Storage: Pumped storage segment has registered highest market share of 84% in the year of 2024. Pumped storage is a type of hydroelectric power generation that stores energy by pumping water from a lower elevation reservoir to a higher elevation during low demand periods. It releases the stored water during high demand, generating electricity. Increased renewable energy integration drives the growth of pumped storage. Advancements in technology aim to enhance efficiency and reduce environmental impact, while regulatory support promotes large-scale projects to stabilize grids.

Electrochemical Storage: The electrochemical storage segment has covered market share of 8% in 2024. Electrochemical storage, primarily involving batteries like lithium-ion, stores and releases electrical energy through chemical reactions. It is widely used in applications ranging from consumer electronics to grid storage. Advancements in battery technology focus on increasing energy density, reducing costs, and improving safety. The rise of electric vehicles and renewable energy sources fuels demand, with significant investments in recycling and second-life applications for used batteries.

Electromechanical Storage: In 2024 electromechanical storage segment has recorded market share of 5%. Electromechanical storage includes technologies like flywheels and compressed air energy storage (CAES), which store energy in mechanical forms and convert it back to electricity when needed. Innovations aim to enhance the efficiency and durability of electromechanical systems. Flywheels are gaining traction for short-duration, high-power applications, while CAES is explored for large-scale storage, benefiting from improved materials and integration with renewable energy sources.

Thermal Storage: The thermal storage segment has calculated market share of 3% in 2024. Thermal storage involves storing energy in the form of heat, which can be used for heating or converted back to electricity. Common methods include molten salt and phase change materials. Growing adoption in concentrated solar power (CSP) plants and district heating systems drives thermal storage market. Research focuses on increasing storage capacity, reducing costs, and improving thermal efficiency. Hybrid systems combining thermal and other storage methods are also emerging to enhance grid reliability.

Stationary Energy Storage Systems: The stationary segment has captured dominating market share of 79% in 2024. Stationary energy storage systems are fixed installations designed to store energy for later use, often for grid support, renewable energy integration, or emergency backup. Key trends include increasing deployment of lithium-ion batteries, growing adoption of renewable energy sources, and government incentives promoting energy storage for grid stability. Innovations in battery technology and decreasing costs are driving market growth, along with rising demand for decentralized power solutions.

Transport: The transport segment has generated market share of 21% in the year of 2024. Transport energy storage systems refer to energy storage solutions used in electric and hybrid vehicles, including cars, buses, and trains. The transport segment is experiencing rapid growth due to the global shift towards electric mobility, advancements in battery technology, and stringent emission regulations. Major trends include the development of high-energy-density batteries, fast-charging solutions, and investments in electric vehicle infrastructure, driving the expansion of the electric vehicle market.

Residential: Residential segment has reported market share of 11% in 2024. Residential energy storage systems (ESS) store energy for homes, often used with solar panels to manage energy use and reduce electricity costs. Increased adoption of solar-plus-storage systems, driven by declining battery costs and rising energy independence. Smart home integration and demand for backup power during outages are also boosting the market.

Non-Residential: The non-residential segment has confirmed market share of 23% in 2024. Non-residential ESS include systems for commercial and industrial applications, providing energy management, demand charge reduction, and backup power. Growing emphasis on sustainability and energy efficiency, enhanced by corporate ESG goals. Microgrids and distributed energy resources are gaining traction, supported by advancements in battery technology and decreasing costs.

Utilities: The utilities segment has accounted market share of 66% in 2024. Utility-scale ESS are large systems used by electric utilities to store and distribute energy, improving grid stability and integrating renewable energy sources. Expansion driven by the need for grid modernization and renewable energy integration. Policies supporting clean energy and advances in battery technology are pivotal. Increased focus on long-duration storage solutions and frequency regulation capabilities.

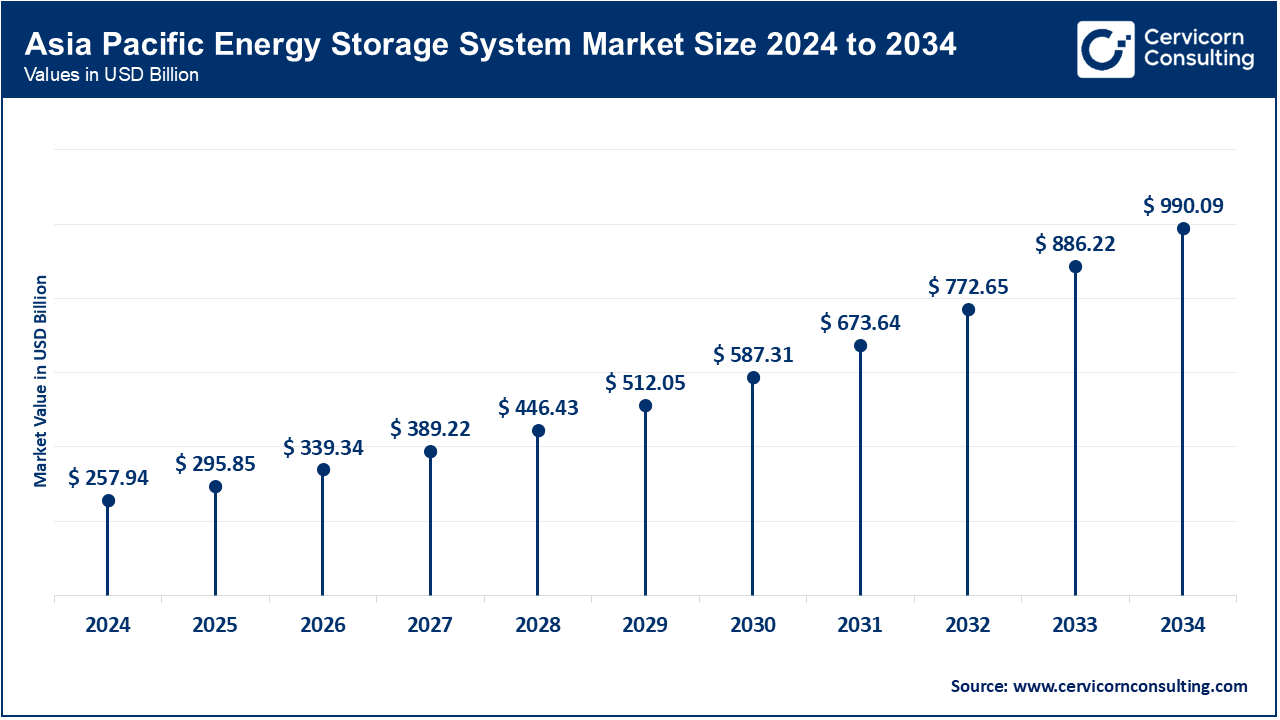

Rapid industrialization and urbanization in Asia-Pacific drive the demand for robust energy storage solutions. Countries like China, Japan, and South Korea are leading in energy storage deployments, supported by significant investments in renewable energy projects and technological advancements. Asia Pacific market size is calculated at USD 257.94 billion in 2024 and is projected to grow around USD 990.09 billion by 2034. Government initiatives promoting energy security and the transition to cleaner energy sources are also key trends.

North America's energy storage system market is driven by supportive government policies, incentives, and regulatory frameworks. U.S market size is estimated to reach around USD 424.81 billion by 2034 increasing from USD 110.67 billion in 2024. Increasing investments in grid modernization, coupled with the rise in renewable energy installations, especially in the U.S. and Canada, are significant growth factors. There's also a notable trend towards adopting advanced battery technologies for residential and commercial use.

In Europe, stringent environmental regulations and ambitious renewable energy targets propel the energy storage system market. The European Union's Green Deal and various national initiatives support large-scale energy storage projects. There's a strong focus on developing and integrating smart grid technologies and decentralized energy systems, enhancing grid flexibility and reliability. Europe market size is measured at USD 109.68 billion in 2024 and is expected to grow around USD 421.00 billion by 2034.

In LAMEA(Latin America, Middle East, and Africa), the energy storage market is growing due to the increasing need for reliable power supply and the integration of renewable energy sources. Solar power projects in the Middle East and Africa are particularly driving the demand for storage solutions. Additionally, economic development and rising energy access initiatives in Latin America are contributing to market expansion.

Companies like Energy Vault Holdings and Form Energy, Inc. are entering the market with innovative energy storage solutions, such as gravity-based systems and long-duration iron-air batteries, respectively. Tesla, Inc., LG Energy Solution Ltd., and Samsung SDI Co., Ltd. dominate the market due to their advanced lithium-ion battery technology, large-scale production capabilities, and extensive distribution networks. Their continuous investments in R&D and strategic partnerships further strengthen their market positions, enabling them to offer efficient, reliable, and scalable energy storage solutions.

Market Segmentation

By Technology

By Application

By End Use

By Regions