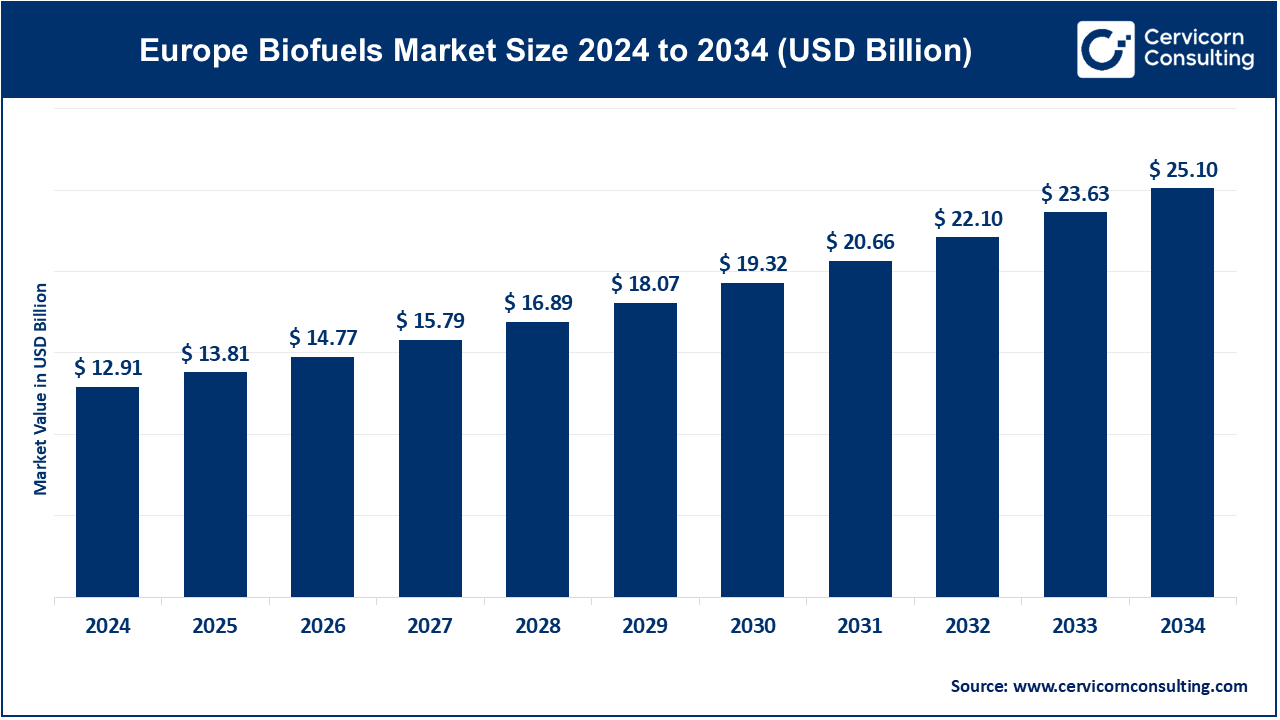

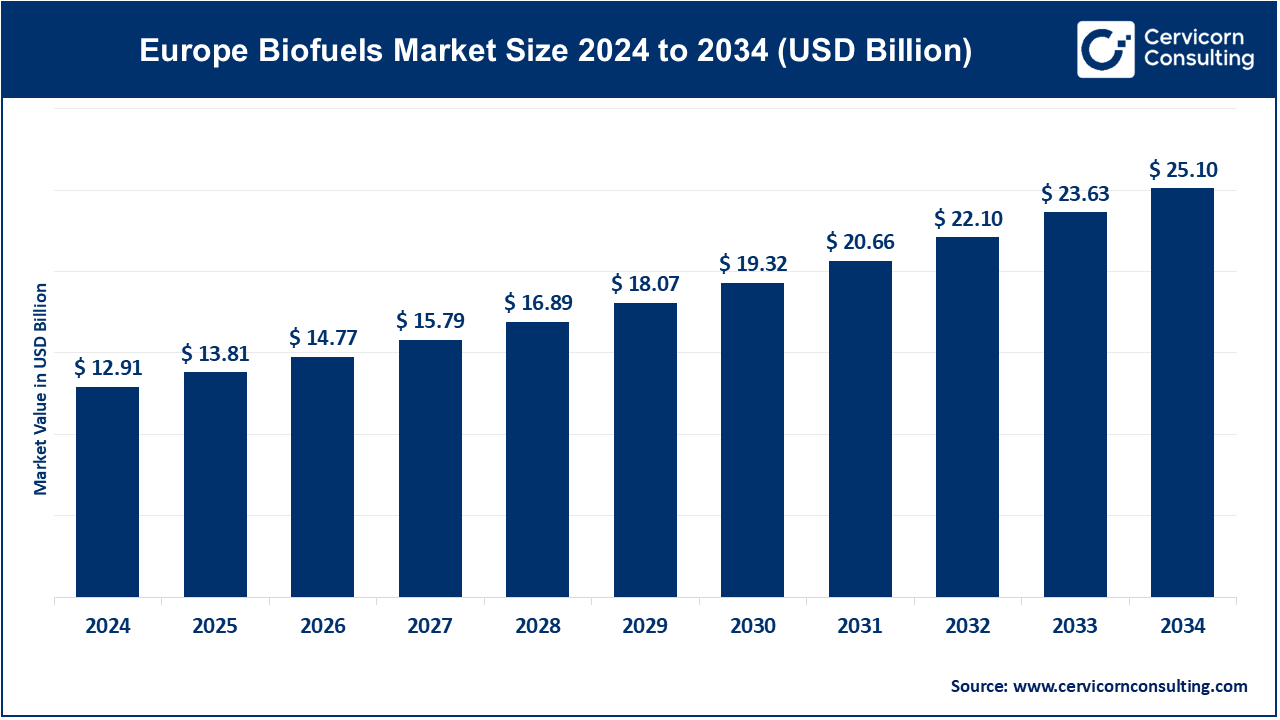

Europe Biofuels Market Size and Growth 2025 to 2034

The Europe biofuels market size was valued at USD 12.91 billion in 2024 and is expected to be worth around USD 25.10 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.9% from 2025 to 2034. The biofuels market in Europe is expanding rapidly due to stringent environmental regulations and ambitious carbon reduction targets. The European Union’s Renewable Energy Directive (RED II) has played a key role in promoting biofuels by setting mandatory renewable energy targets in transport. Countries like Germany, France, and the Netherlands are leading in biofuel production and consumption, with significant investments in second-generation biofuels made from non-food biomass. Additionally, the rise in electric vehicles has not slowed biofuel demand, as aviation and shipping sectors increasingly rely on biofuels to meet sustainability goals. Government incentives, carbon pricing mechanisms, and increasing consumer awareness about climate change are driving biofuel adoption across Europe.

Biofuels are renewable energy sources made from organic materials like plants, algae, and animal waste. Unlike fossil fuels, biofuels are considered more sustainable because they come from renewable sources and produce lower greenhouse gas emissions. The two most common types are biodiesel, made from vegetable oils or animal fats, and bioethanol, produced from sugarcane or corn. These fuels can be blended with conventional gasoline or diesel to reduce carbon footprints.

One of the biggest advantages of biofuels is their role in reducing reliance on fossil fuels, making energy production more sustainable. Additionally, biofuels help rural economies by creating jobs in agriculture and biofuel production. However, there are concerns about land use, as growing biofuel crops may compete with food production. Despite these challenges, advancements in biofuel technology are improving efficiency and sustainability, making them a promising alternative for the future.

Key Highlights on Biofuels

- Renewable Energy Targets: The EU aims to achieve at least 14% renewable energy in transport by 2030, boosting biofuel demand.

- Biodiesel & Bioethanol Usage: In 2024, biodiesel accounted for over 70% of biofuel consumption in the EU, while bioethanol grew by 6.8% from the previous year.

- Aviation Biofuels: Sustainable Aviation Fuel (SAF) demand is projected to increase by 300% by 2030, driven by EU regulations.

- Investment Growth: Investments in advanced biofuels have grown by 25% annually over the past five years.

- COâ‚‚ Emission Reduction: Biofuels have helped reduce carbon emissions by approximately 50-80% compared to fossil fuels.

Europe Biofuels Market Growth Factors

- Increasing Demand for Renewable Energy: Climate concerns coupled with global efforts to reduce greenhouse gases ushered in a shift from fossil fuels to renewable energy sources, such as biofuels. Therefore, governments and corporations are investing more in biofuels in an effort to lower their carbon footprints. This is further buttressed by global pacts aimed at achieving carbon neutrality.

- Expansion of the Transportation Sector: Transition to sustainable fuel alternatives develops a huge demand for biofuels. In particular, aviation and maritime biofuels provide a low-emission alternative meeting these stringent emission targets determined by aviation and maritime regulatory authorities.

- Biofuel Blending Mandates: Biofuel blending mandates seek to reduce emissions-and several governments have made it compulsory to blend biofuels with traditional fuels. The Renewable Fuel Standard in the United States, along with the EU Renewable Energy Directive, create a demand for ethanol and biodiesel while providing price support for biofuel producers.

- Investment in Infrastructure: Bio-refineries and distribution systems and associated investment into biofuels supply, especially in developing countries. A better infrastructure provides low-cost and easy access, together with assurances for the use of biofuels in various sectors.

- Carbon Trading Mechanisms: Due to the production of lower emissions from biofuels, carbon prices and trading mechanisms provide economic viability today, as these models offer credits for mitigated emissions-creating a usable credit for the firm, thus motivating it to utilize biofuels for compliance with emissions mandates while shielding it from financial detriment.

Europe Biofuels Market Trends

- Shift to Advanced Biofuels: Advanced biofuels that are developed from non-food and waste sources, such as algae and agricultural residues, offer a better chance for biofuels to co-exist with food; this shift also aids in circular economy actions as waste becomes feedstock, thus reducing an environmental burden.

- Growth in Biofuels for Aviation: Aviation is very rapidly adopting sustainable aviation fuels (SAFs) from biofuels, assisting airlines in moving toward stringent emissions regulations and responding to consumer demands for sustainable travel; hence positioning biofuels as preferable fuel sources.

- Growth in Third-Generation Biofuels: These algae-based biofuels, with far greater yield and hence lower land needs, started to gain acceptance. Third-generation biofuels produce better efficiency and viability, addressing concerns of environment and scalability.

- Hybrid Systems and Co-firing Technology: The use of biofuels in mixture with fossil fuels in hybrid energy systems generates effective operation with reduced emissions. Co-firing in power plants with biofuels can be an interim to some extent in reducing a coal or natural gas dependence.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 13.81 Billion |

| Expected Market Size in 2034 |

USD 25.10 Billion |

| CAGR (2025 to 2034) |

6.9% |

| Key Segments |

Type, Feedstock, Application |

| Key Companies |

ADM, BTG International Ltd, Borregaard AS, CropEnergies AG, Chevron Corporation, Cargill VERBIO AG, COFCO, CLARIANT, FutureFuel Corporation, Green Joules, My Eco Energy, MünzerBioindustrie GmbH, Neste, Praj Industries, POET, LLC, TotalEnergies, The Andersons, Inc., UPM, Wilmar International Ltd |

Europe Biofuels Market Dynamics

Drivers

- Environmental Sustainability Targets: Environmental sustainability targets constitute, at both governmental and corporate levels, a priority motive in reducing fossil fuel dependence; thus biofuels significantly reduce this dependence. The biofuels represent renewable alternatives toward achieving decarbonization targets globally in the especially hard-to-electrify sector.

- Decarbonizing heavy industries: Shipping, aviation, and freight are on the way to turn to biofuels for emission reduction targets, where electrification is impractical. These biofuels will allow the sectors to achieve deep decarbonization towards mainstream long-term environmental goals.

- Use of Biofuels in Agriculture and Rural Development: The development of biofuels increases the demand for crops like corn and sugarcane, providing rural economies with the opportunity for such demands. It thus allows small-scale farmers and rural communities to generate income and thus promote local development, combined with strengthening agricultural supply chains.

Opportunities

- Increasing Demand for Sustainable Transportation Fuels: International pressure toward reducing carbon footprint in the transport sector means new green alternatives could replace the fossil fuels that the world relies so heavily on for transportation. European countries like Sweden and Germany mandate the use of biofuel blends in their networks, breaking boundaries for producers to enter this biofuel industry. This would create additional impetus in the biofuels market in line with the European Union's ambitions for the sustainable decarbonization of transport.

- Environmental Awareness of Escalation and Sustainability Goals of Corporates: In order to educate the people, the European industries and consumer sectors become increasingly sensitized towards environmental impact, and the resultant greater demand for sustainable fuel sources becomes inevitable. Major efforts toward sustainability goals and biofuels are adopted to reduce carbon emissions across various corporate settings, with the trend being most prominent in logistics, aviation, and shipping. In these sectors, biofuels can step in and play an important part in decarbonization efforts. Growing demand for a green solution comes with huge opportunities for biofuel producers to tie their operations with corporate social responsibility.

- Growing Investment in Renewable Energy Infrastructure: The transition toward sustainable energy in Europe accelerates, with biofuels being a major part of this shift. Concurrent investments such as biorefineries, blending stations, and logistics networks are rising in acceptance across the region. The expansion of this infrastructure assures better distribution of biofuels combined with the resilience of the supply chain, nurturing the operation of such markets. The growth and sustainment of renewable energy infrastructure development in various countries will coincide with government-based initiatives being triggered by private-sector investments, which in turn will open opportunities for biofuel companies to enhance their operations.

Restraints

- Competition for Food Production: Food Production Conflict: Food equities such as corn and soy may compete with biofuels. Such food commodity competition may well increase food prices. The "food vs. fuel" debate raises ethical and economic issues, particularly in a food-insecure zone of the globe.

- High Prices: Biofuel production, especially advanced biofuels, is mostly costlier than those derived from fossil fuels. It may, therefore, increase the cost of production, limiting the extent to which biofuels can be used. There is a need to invest in new technologies to bring down the costs of production and improve their price competitiveness in the energy market.

- Too Few Refining and Distribution Facilities: The biofuels market faces considerable inadequacies in refining and distribution infrastructure, especially in a developing economy. Limited infrastructure prevents large-scale adoption of biofuels and inhibits growing biofuel markets in the case of advanced biofuels.

Challenges

- Supply Integration Volatility: Changes in climate, pests, and harvest cycles can impact the availability of biofuels feedstock. This supply volatility of biofuels thereby disrupts their production, providing headaches for companies depending on a particular feedstock source for sustainability.

- Energy Limitations: Biofuels usually have lower energy density relative to fossil fuels. This limits their efficiency when used in high-energy-demand applications. This gap in energy density makes biofuels less attractive for certain applications, such as heavy-duty transport.

- Limitations of Technology for Biofuel Conversion: Many biofuels need further technological improvements if efficient production and conversion processes are to be put in place-a limitation of current biofuel technology that affects the scalability of production and the efficient capability of responding to rising demand.

Europe Biofuels Market Segmental Analysis

Types Analysis

Biodiesel: Headway is mostly made by vegetable oils or animal fats or recycled greases which are usually later used for heating and in diesel engines. Biodiesel burns cleaner than fossil fuel-based diesel, which accounts for part of its growing ingestion in Europe and North America. Biodiesel helps support rural development by providing an outlet for local feedstock. Biodiesel is used as a straight-run fuel for existing types of diesel engines, which is additional validation of its viability as an alternative sustainable fuel.

Ethanol: Ethanol is an alcohol-based biofuel derived from sugar and starch sources such as corn and sugar cane. The twin pillars on which the ethanol markets run today are the United States in conjunction with Brazil and driven by mandates for renewable fuels and flex-fuel vehicles. For it is perhaps the most popular transport fuel in the chemical biofuel arena.

Other: This is a conglomerative category, being akin to biogas, bio-butanol, and green diesel. Biofuels produced from a number of feedstocks including organic waste and algae give versatility and serve to avail less dependence on fossil fuels including in heating and aviation. Very recently, new biofuel technologies within this category are emerging to meet the market demand for sustainable high-energy fuels.

Feedstock Analysis

Coarse Grain: Coarse grains, particularly corn, are the primary feedstocks for ethanol production, remarkably in the U.S. Biofuel production from coarse grains, hence, supports agricultural economies, but it raises the issues of “food versus fuel.” Advanced methods of processing are being designed to continue improving their efficiency and yield in the production of biofuels from grains.

Sugar Crop: Sugar crops notably include sugarcane and sugar beets, the most popular feedstocks for biofuels, for instance, in Brazil. Ethanol from sugarcane is one of the most productive in terms of energy yield whilst emitting lower levels of pollutants. That is one added reason, its cause of use in the transport sector.Biofuel from sugar crop residues is thought to be more sustainable than that from grain-based sources.

Vegetable Oil: Soy, palm, and canola oil are the most common feedstocks for biodiesel. These oils are sustainable sources of biofuels; however, sustainability issues do surface in regard to land-use change and deforestation associated with palm oil cultivation. New ways of sourcing feedstock aim to reduce the environmental footprint of oil-based biofuels.

Other: This means organic waste, algae, and lignocellulosic biomass. These alternative feedstocks respond to sustainability and food security by using unconsumable sources of biofuels. Algae-based biofuels and waste-to-fuel technologies represent promising answers for future biofuel supply, following a circular economy.

Europe Biofuels Market Top Companies

- ADM

- BTG International Ltd

- Borregaard AS

- CropEnergies AG

- Chevron Corporation

- Cargill VERBIO AG

- COFCO

- CLARIANT

- FutureFuel Corporation

- Green Joules

- My Eco Energy

- MünzerBioindustrie GmbH

- Neste

- Praj Industries

- POET, LLC

- TotalEnergies

- The Andersons, Inc.

- UPM

- Wilmar International Ltd

The Europe biofuels industry is significantly dominated by key players like ADM, BTG International Ltd, Borregaard AS, CropEnergies AG, Chevron Corporation, and others. These companies leverage expertise in feedstock processing and innovative biofuel technologies to enhance production efficiency and reduce environmental impact. They are investing heavily in research and collaborations to expand biofuel applications across transportation, heating, and industrial sectors, addressing rising energy demands and supporting Europe’s transition to sustainable, low-emission fuel sources.

CEO statements

Juan Luciano, CEO of ADM

- “ADM is advancing biofuels innovation as part of our commitment to renewable energy solutions. Our recent biodiesel and ethanol advancements are directly aligned with ADM's vision to significantly reduce greenhouse gas emissions through sustainable production."

Dr. Fritz Georg von Graevenitz, CEO of CropEnergies AG

- “Our focus on building Europe’s first plant for green ethyl acetate is a critical step in promoting renewable chemicals. CropEnergies is positioned as a leader in bio-based, sustainable chemicals for a cleaner future.”

Mike Wirth, CEO of Chevron Corporation

- “Chevron’s biofuels strategy emphasizes renewable diesel production to meet Europe’s demand for clean energy. Our partnerships in biofuel technology reflect Chevron’s commitment to energy efficiency and a lower carbon footprint in the transition to sustainable fuels.”

Recent Developments

- In February 2022, BDI-BioEnergy International GmbH announced a contract with Renewable Energy Group to enhance two biodiesel production facilities in Germany. This collaboration involves installing advanced feedstock pre-treatment technology to process diverse fats and oils, supporting increased biodiesel production efficiency and sustainability. The project is scheduled for completion by late 2023, marking a significant investment in biofuel infrastructure.

- In May 2021, the German government introduced new biofuel legislation, mandating that oil companies significantly increase the use of biodiesel, bioethanol, and biomethane in the transportation sector. This policy aims to curb carbon emissions and accelerate Germany's transition to greener energy solutions.

Market Segmentation

By Type

By Feedstock

- Coarse Grain

- Sugar Crop

- Vegetable Oil

- Other

By Application

- Transportation

- Aviation

- Others

By Geography

- Germany

- United Kingdom

- France

- Rest of Europe

...

...