Generative Al in Automotive Market Size and Growth 2025 to 2034

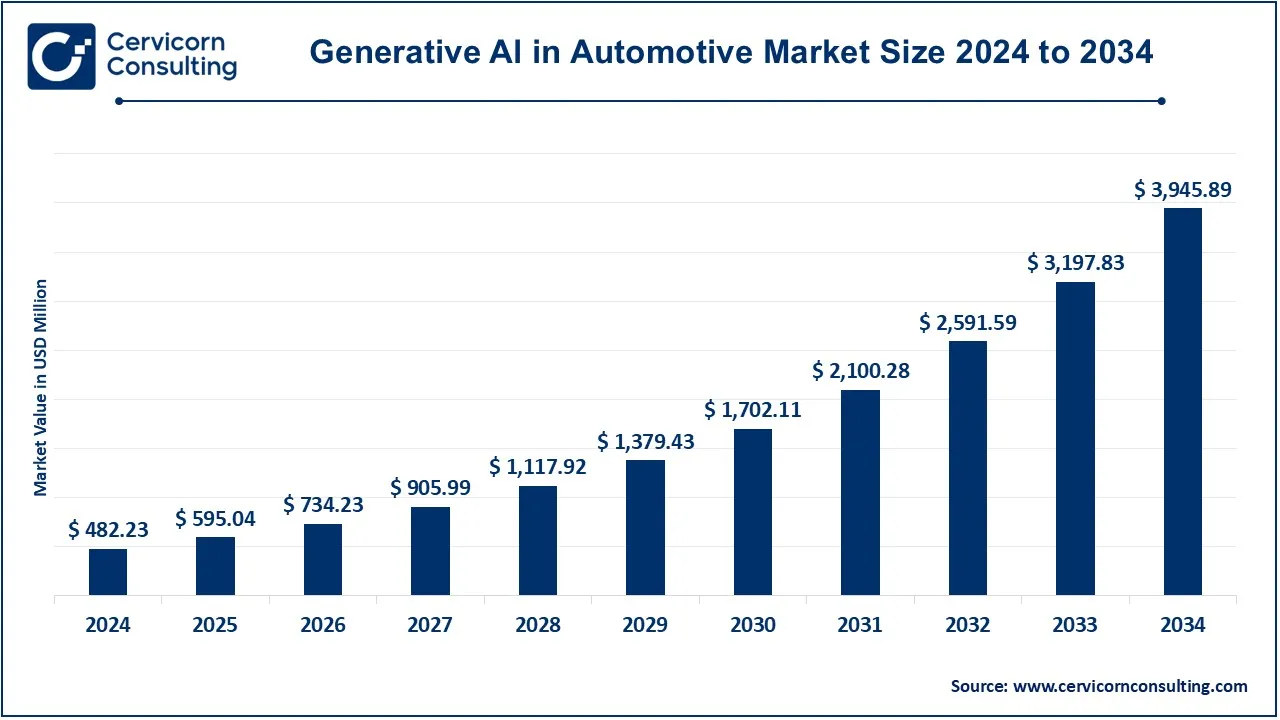

The global generative Al in automotive market size was valued at USD 482.23 million in 2024 and is expected to reach around USD 3,945.89 million by 2034, growing at a compound annual growth rate (CAGR) of 25.65% over the forecast period 2025 to 2034.

The market for generative AI in automotive is expanding rapidly due to the industry's increasing reliance on AI to enhance efficiency, reduce costs, and foster innovation. As the automotive sector embraces electric vehicles (EVs), autonomous driving, and smart manufacturing, generative AI plays a crucial role in optimizing designs and processes. Automakers are leveraging generative AI to accelerate prototyping, test various configurations, and create advanced driver assistance systems. The growing demand for energy-efficient designs, coupled with increasing investments in AI-driven technologies, positions the automotive industry for a transformative future. In addition, generative AI's potential to improve vehicle safety and reduce time-to-market for new models further boosts its adoption.

Generative AI in the automotive industry refers to the use of artificial intelligence technologies to autonomously generate design, solutions, and components, enabling innovation and optimization. Unlike traditional AI, which often focuses on predefined patterns, generative AI creates new possibilities by analyzing vast amounts of data and generating original outputs. This technology is employed in various automotive applications, such as designing vehicle parts, optimizing manufacturing processes, enhancing autonomous driving capabilities, and improving overall vehicle performance. For instance, generative AI can design parts with specific requirements, such as strength or weight reduction, by using algorithms that generate multiple solutions and test them in a simulated environment. Additionally, it is utilized in driver assistance systems, improving safety features, and streamlining supply chain logistics.

Key Insights on Generative Al in Automotive:

- Automakers’ AI investment: Over 40% increase in AI adoption for design, manufacturing, and autonomous driving technologies.

- Generative AI applications: 35% of vehicle prototypes are now optimized through AI-driven solutions, reducing development time by up to 25%.

- Safety enhancements: AI-powered systems contributing to a 20% improvement in vehicle safety and accident prevention features.

- Supply chain improvements: Generative AI helps reduce operational costs by up to 15% through smarter logistics and inventory management.

Generative Al in Automotive Market Report Highlights

- The U.S generative Al in automotive market size was estimated at USD 148.29 million in 2024 and is expected to reach around USD 1,213.36 million by 2034.

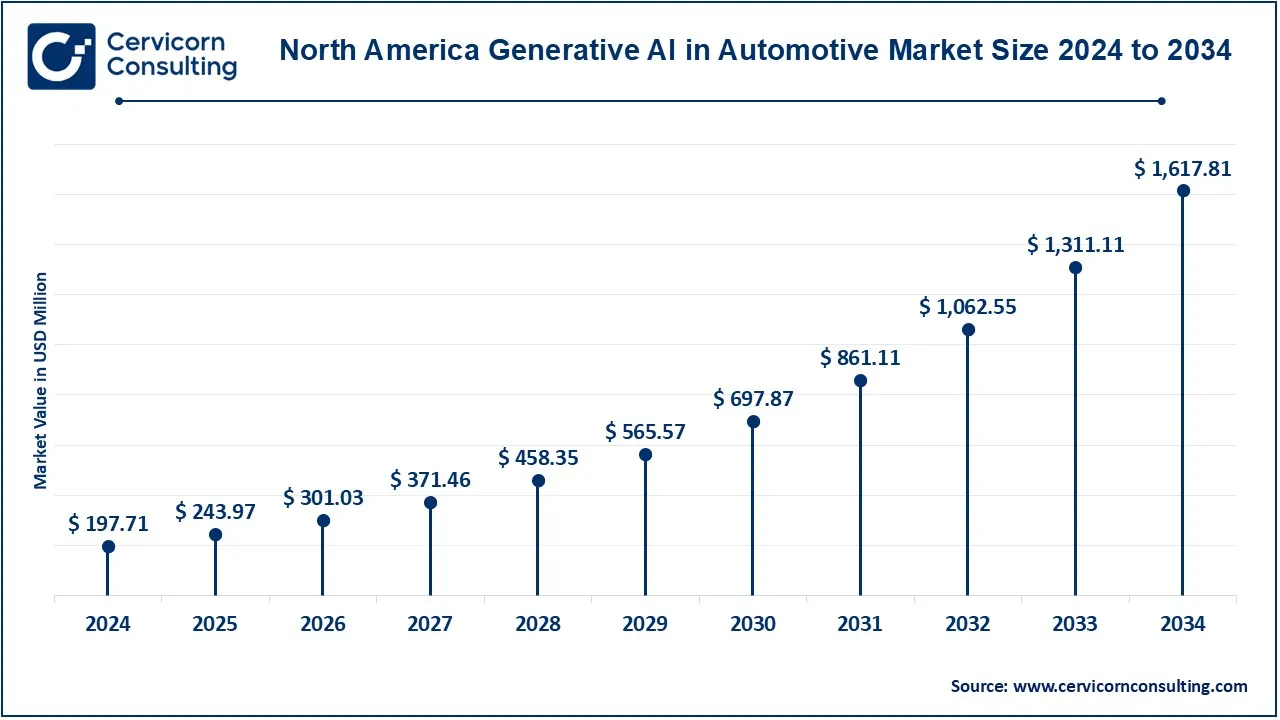

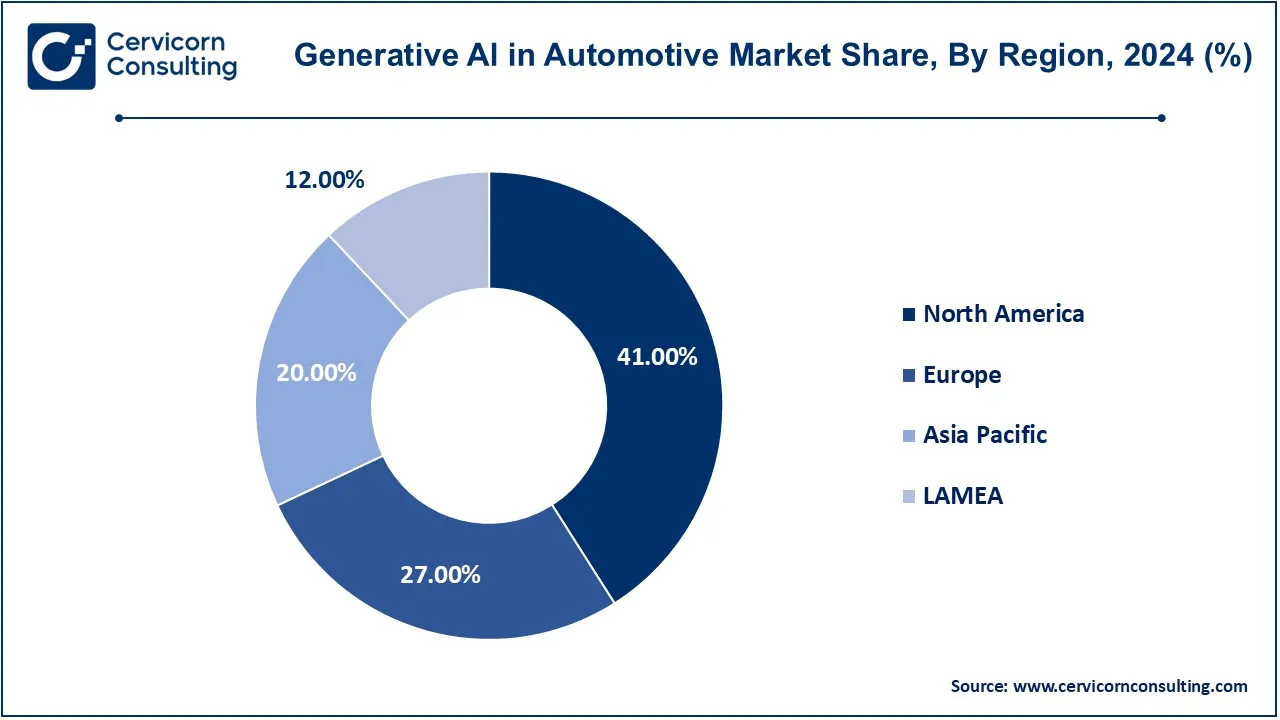

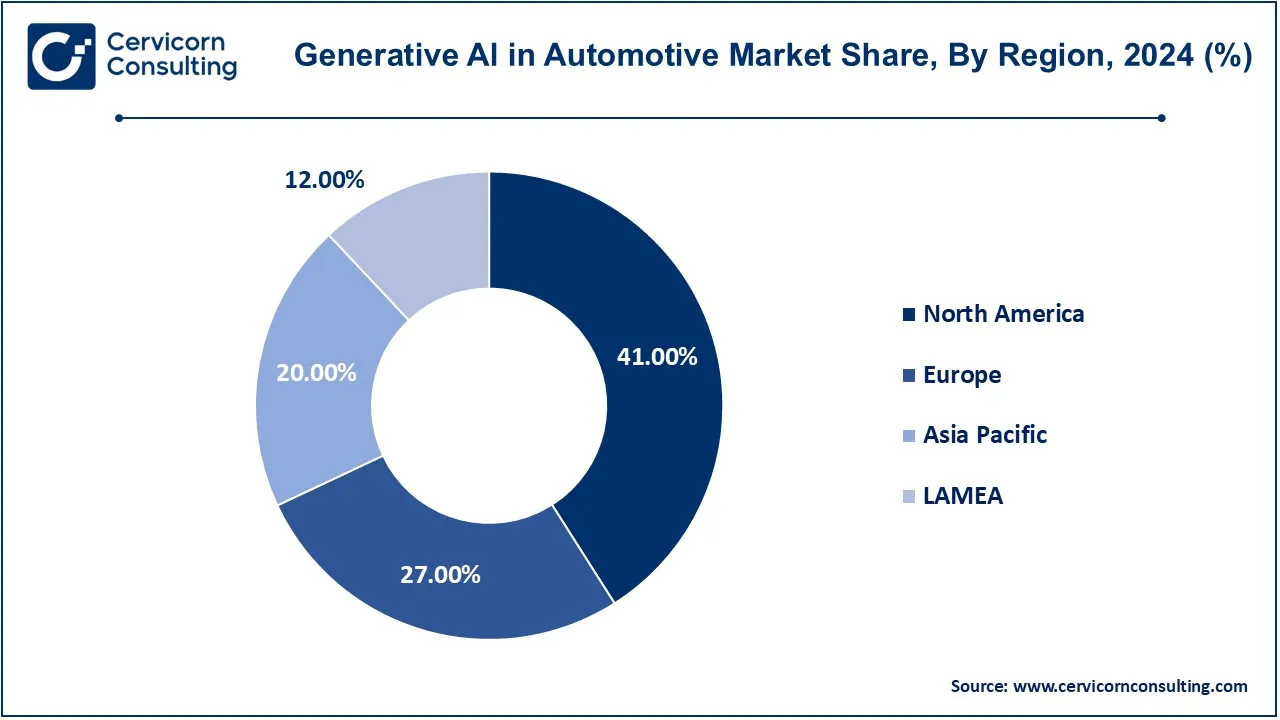

- The North America has accounted highest revenue share of 41% in 2024.

- The Europe has captured revenue share of 27% in 2024.

- By vehicle type, the passenger vehicles segment has led the market in 2024.

- By vehicle type, the commercial vehicles segment is expected to witness strong growth over the forecast period.

- By technology, the machine learning segment is expected to experience significant growth in the forecast period.

- By application, the vehicle design segment has dominated the market in 2024.

Generative Al in Automotive Market Growth Factors

- The Need and Demand for Self-Driving Cars Motors on: Large investments into the generative AI solutions are due to the upsurge in the interest towards self-driving vehicles, as such systems are core in enabling vehicle, perception, decision-making and interaction. Generative AI solutions help refine this complex procedure making it more efficient and reliable. However, it is clear that AI technologies will never stop improving until the market embraces these self-driving machines.

- Technological Advances in Artificial Intelligence and Deep Learning: These advancements could lead to significant generative AI enhancement and precision within these applications. They would also interact and present things incising automotive systems and hence improving safety, performance and user experience of the system.

- The Demographics of Retail Personalization: Generative AI applications have to be introduced in automotive as they are driven by the in-car consumer experience demand. Therefore, such OEM’s focus can enable them offer personalized features, infotainment and entertainment powered by AI. orientation of such strained engendered marketing techniques enhances consumer satisfaction which is actively engaged in the mobile phones market and which might, therefore, occasion the expansion of the growth in this market.

- Technologies Vehicle to Vehicle: The market for connected car technology has been recently boosted by the use of generative AI technologies, such as those that update information in real time, enable cloud-based connection of cars as well as enable cars to interact with each other. To that end, exemplary advanced generative AI applications would be predictive maintenance and intelligent navigation, aimed at improving user experience and performance on board the vehicle.

Generative Al in Automotive Market Trends

- Integration with In-Vehicle Assistants: Automakers are continually embedding generative AI into voice and visual recognition systems that can operate intuitively and hands-free during activities like navigation and communication. This trend increases user safety and convenience, appealing to the tech-savvy consumer looking for seamless experiences in cars.

- Smart City Initiatives: Generative AI is fundamental to smart city initiatives, where vehicles become connected with the infrastructure in real time for updates and optimization. These developments enable vehicles to navigate more efficiently and to respond to traffic, weather, and urban congestion so as to provide autonomous and connected transportation support.

- Subscription-Based Models: Automakers use the subscription-based model to provide AI features as add-on options, thereby creating another source of revenue. This model responds to the consumer's interest in customizable experiences, providing access to premium generative AI features, like enhanced navigation, anticipatory diagnostics, and personalized in-car entertainment.

- AI in Vehicle Design & Prototyping: AI-driven generative design is fast becoming a common vehicle manufacturing route, permitting businesses to streamline design processes to create optimized structures. In so doing, operating costs go down, material waste is eliminated, and market timing is accelerated, thereby improving operating efficiencies and product innovations.

Report Scope

| Area of Focus |

Details |

| Market Size in 2024 |

USD 482.23 Million |

| Projected Market Size in 2034 |

USD 3,945.89 Million

|

| CAGR (2025 to 2034) |

25.65% |

| Dominant Region |

North America |

| Fastest Expanding Region |

Asia-Pacific |

| Key Segments |

Vehicle, Technology, Application, Region |

| Key Companies |

Microsoft, AUDI AG, Intel Corporation, Tesla Inc, Uber Technologies, Volvo Car Corporation, Honda Motors, Ford Motor Company, NVIDIA Corporation, Tencent, BMW AG |

Generative Al in Automotive Market Dynamics

Drivers

- Increased Safety Demand: Generative AI apps provide predictive diagnostics, collision detection, and driver assistance systems that help elevate the safety bar. Growing safety emphasis means more consumer interest in generative AI, as it tends to reduce accident risks and enhance driver and passenger security, which is a serious consideration for consumers and regulators.

- Consumer Demand for AI-Driven Experiences: There is a growing demand for more personalized systems in vehicles that will add pressure on Ford and other motor vehicle manufacturers to integrate generative AI capabilities; this incudes among others, intelligent voice access, personalized media provision, and dynamic navigation systems all among concern for enhancing customer experience and satisfaction.

- Anticipated Maintenance is on Mobile Rise: The generative AI could recognize the maintenance types, making a novel kind of optimal attraction for fleet managers and individual vehicle owners in minimizing downtimes and operational costs. Predictive maintenance increases the reliability of vehicles, predicting potential problems ahead of time and thereby extending the life of the vehicle.

- Increase in regulatory push towards reduced emissions: Governments around the world are pushing for the adoption of AI-enabled systems that reduce emissions, aligning carbon objectives with environmental goals. This regulatory push gives manufacturers more motivation to apply generative AI solutions that can fulfill efficiency and sustainability targets.

Opportunity

- Energy Efficiency Optimization: Generative AI for Energy Efficiency Optimization is indeed a big market opportunity to develop lightweight and efficient automotive parts and reduce fuel consumption and greenhouse gas emissions against the backdrop of global sustainability targets. It is the other area where AI could be helpful for manufacturers; it would enable simulation and creation of novel materials and structures beside performance enhancement without incurring extra costs. While the demand for cleaner vehicles is escalating amidst consumers and regulators, a company using generative AI to optimize energy may stand a chance of being competitive, drawing eco-conscious customers and also meeting limitations set on emissions: worthwhile market growth.

- Advancements in Autonomous Driving: Generative AI sweeps along the arduous process of autonomous driving by assuring safety and reliability in self-driving systems. Through the simulation of counterintuitive driving scenarios or rare events, AI ramps up the training of autonomous algorithms and thereby cuts costs and development times, resulting in more speeds of deployment of autonomous vehicles, which create the need for transportation services to be safer and more effective. As legislation grows friendly with consumer trust towards autonomous technology, the injection of generative AI to augment capability in autonomous driving opens the market scope for swallowing more of the share with companies leading into innovation in the automotive space.

- Intelligent Fleet Management: Generative AI-supported Intelligent Fleet Management presents immense market opportunities, lessened costs of operations, and improved vehicle utilization, by proposing visual logistics. AI systems glean huge amounts of data for optimum routing, maintenance needs, and efficient monitoring of fuel consumption. This results in improved productivity and lower operating costs for fleet operators; their services become even more competitive; better fleet management also leads to sustainable practices by heeding reduced fuel consumption and hence reduced emissions. There arises increasing demand for such solutions with logistics and delivery businesses growing, and thus market growth.

Restraints

- Expensive Up-front Investment: Molding generative AI claims into automotive systems may be costly due to specialized software and hardware. For a lot of manufacturers, those fixed investments represent a huge barrier to diffusion, especially in price-sensitive markets whereby affordability tops the priorities.

- Privacy Challenge: Generative AI must use a lot of information from data collection to work optimally, a situation that drags with it privacy concerns since cars store sensitive data of users. The regulations of privacy and concerns of data security pose a dilemma of implementing generative AI, in that the automaker has to deploy measures to protect consumer information strictly.

- Training Regularization: To train generative AI models that operate well in various automotive scenarios requires a lot of time, effort, and money. This complexity may considerably slow down deployment and reduce the applicability of AI systems in a slightly different environment-like autonomous driving.

Challenges

- Increased regulatory burden: All Automotive AI must operate under diverse regulation in various regions, in particular those related to safety and data privacy. Compliance and development of functionality and innovation, while stringently dealing with multiple environments, may be hugely impeded with cost and strength demands.

- Vulnerabilities in cybersecurity: With increasing connectivity, vehicles have come under the actual or perceived threat of becoming a potential target for cyberattacks. Apart from assuring cyber safety for consumers, the level of effort and active investment into security remains a challenge for automobile manufacturers to restore consumer faith.

- Data privacy concerns: As generative AI for automotive field is plagued by several challenges, data management and the actual management of large sets of data while adhering to privacy regulations are ongoing challenges. With increased concerns for data security, companies must have open, compliant data use practices so they can market themselves and support consumer trust and their regulatory expectations.

Generative Al in Automotive Market Segmental Analysis

The generative AI in automotive market is segmented into vehicle type, technology, application and region. Based on vehicle type, the market is segmented into passenger vehicles and commercial vehicles. Based on technology, the market is segmented into machine learning, natural language processing, context-aware computing, computer vision and others, Based on application, the market is segmented into vehicle design, manufacturing optimization, transportation & logistics, autonomous driving and ADAS.

By Vehicle Type

Passenger vehicles: Generative AI builds upon the in-car experience by enhancing the driver and happy passengers with advanced AI virtual assistants, personalized infotainment systems, and real-time insights into driving. This involves sophisticated AI systems that digest internal data and signal when maintenance will be needed and offer voice assistance and adaptive navigation. It provides the ability to create interactive environments inside the car that will adapt to the preferences of the driver and other conditions to provide a journey that's high on engagement and safety and very efficient. AI-based modifications are mixed with features like speech pattern recognition and visual data analytics to offer an enhanced and individualized experience for all passengers.

Commercial Vehicles: The highest demands for generative AI in managing a fleet, maintenance planning, and fuel efficiency come from the commercial sector. The AI tools analyze a vast amount of data in scenarios such as route planning, vehicle health, and operational cost minimization. In transition and distribution industries, AI serves to alert the driver on the prevailing traffic conditions in order to assist the driver in making the best possible and quickest delivery. This advances driver assistance since it allows for the use of automated the dispatch system and also enhances the management of resources within a commercial vehicle fleet.

By Technology

Machine Learning (ML): ML contributes to building vehicles from the way drivers drive, knowledge-sharing on maintenance, and route selection through data-driven insights. In automotive applications, ML algorithms apply processing on large datasets for improving autonomous driving features, optimization in fuel consumption, and enhancing user experiences. Based on learning vehicle and driver data, ML applications customize settings for vehicles based on performance features that make driving more intuitive and efficient for users.

Natural Language Processing (NLP): In automotive applications, NLP allows people to communicate with car systems smoothly. Thanks to NLP-enabled virtual assistants, drivers can give freedom-control of navigation, entertainment, and settings, making driving more convenient and safer. Generative AI in NLP gives conversational, context-aware responses, allowing the driver and passengers to communicate with on-board systems performing actions more efficiently.

Computer Vision: Computer vision endows vehicles with advanced image processing abilities-examples being object detection, lane-keeping, and control of autonomous navigation. Generative AI applications in computer vision further aid in helping the vehicle analyze real-time pictures through good navigation with an ability to avoid obstacles. Computer vision further aids the intelligent creation of a situational observation of self-driving and advanced driver-assistance systems by interpreting the surroundings of the vehicle for increasing safety during navigation.

Context-Aware Computing: This technology enables vehicles to accommodate situational contexts (location, climate change, and way of driving) into various settings. Simple examples of generative AI involve adjusting the climate control system or lighting system according to passenger comfort. Meaningful commercial applications of context-aware computing provide route optimization and resource allocation. Understandably therefore, the system assures users, within any given driving circumstance and user needs, continuity and adaptability in experience.

Others: This segment includes new technologies such as the edge technology or sensor fusion, which are incorporating other AI components for the best results possible. These technologies facilitate the functioning of advanced self-driving vehicles, inter-vehicle communication, and forecasting, which helps future changes in the automobile industry. The “Others” category is often focused on specialized technologies that are not the main ones but serve to improve the AI systems implemented within vehicles.

Generative Al in Automotive Market Regional Analysis

The generative Al in automotive market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The North America has dominated the market in 2024.

What factors contribute to North America's leadership in the generative Al in automotive market?

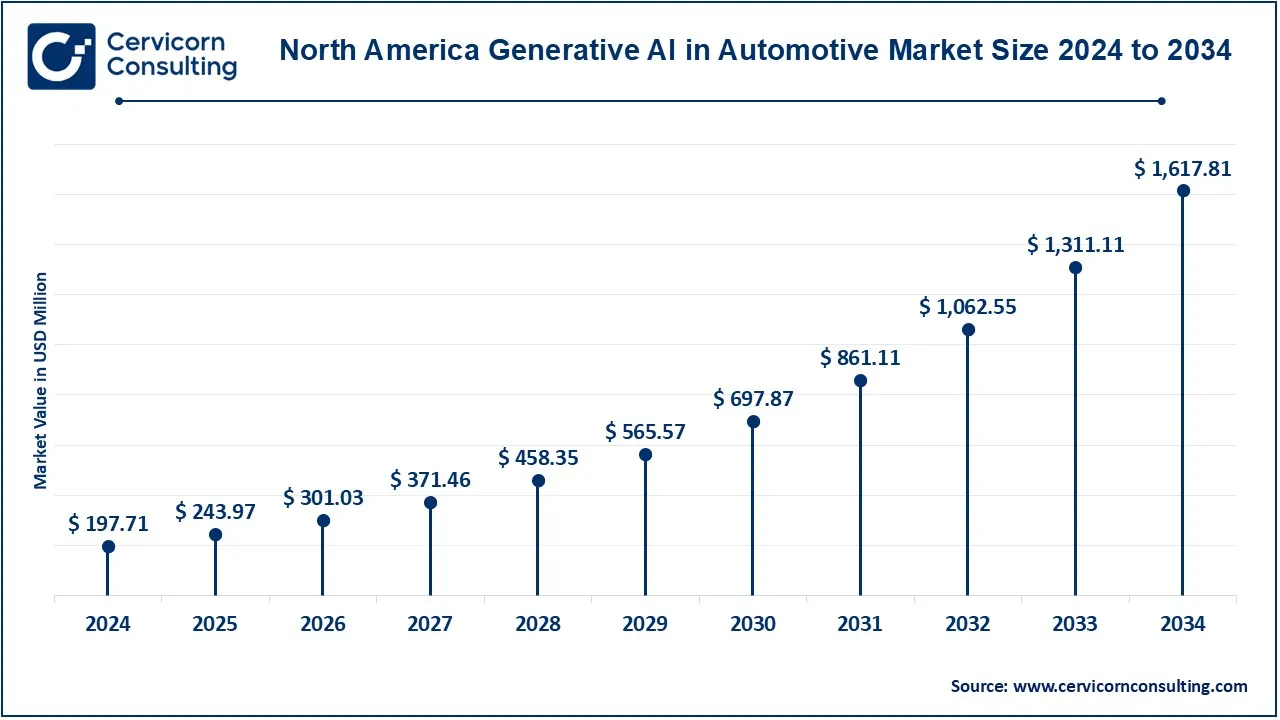

The North America generative Al in automotive market size was valued at USD 197.71 million in 2024 and is expected to be worth around USD 1,617.81 million by 2034. North America, owing to the very strong presence in R&D domains, substantial automotive manufacturing base, and readiness for the adoption of state-of-the-art technology, has always been on the forefront. This acceleration is especially seen in the U.S., which is home to some of the major players such as Tesla and General Motors as they deploy generative AI in making their vehicles safer, more autonomous, and more personalized for the user. In turn, Canada too provides a strong base on this front as the government promotes several campaigns that would spur further AI innovations. The region is a key player thanks to the strategic investments to develop start-up companies on AI and joint collaborations that much strengthen this technology around natural language processing and machine learning.

Europe Generative Al in Automotive Market Growth

The Europe generative Al in automotive market size was estimated at USD 130.20 million in 2024 and is projected to surpass around USD 1,065.39 million by 2034. Europe market is driven by robust policies for autonomous vehicle development and sustainability goals. Countries like Germany, France, and the UK are front-runners, with companies like BMW and Volkswagen integrating AI-driven safety and predictive analytics into their vehicles. The EU’s strong regulatory environment supports safe AI adoption, and various programs fund AI research to foster competitive automotive innovation. Growing consumer demand for smarter in-car experiences and the region’s high adoption rate of electric vehicles further boost AI integration in vehicles.

Why is the Asia-Pacific region considered the potential fastest-growing market?

The Asia-Pacific generative Al in automotive market size was accounted for USD 96.45 million in 2024 and is predicted to hit around USD 789.18 million by 2034. The Asia-Pacific, potentially the fastest growing market, expanding under the lead of China, Japan, and South Korea. The growth in automotive generative AI is fuelled by the high demand for vehicles, new technologies, and a strong consumer base eager for innovative in-car experience. China has become the world hub of companies investing heavily in AI technology for autonomous and connected vehicles, with local giants such as Baidu and Alibaba commanding the area. It is such that Japan and South Korea are quite influential, lending their ranks into the improvements of generative AI to work on achieving vehicle autonomy and energy efficiency to serve technology-obsessed end-users.

LAMEA Generative Al in Automotive Market Growth

The LAMEA generative Al in automotive market size was recorded at USD 57.87 million in 2024 and is anticipated to reach USD 473.51 million by 2034. LAMEA’s adoption of generative AI in automotive is in the early stages, though certain nations show promising growth potential. The Middle East, particularly the UAE and Saudi Arabia, is investing in AI to enhance smart transportation systems, with a focus on building smart cities. Latin American countries like Brazil show increasing interest in connected automotive solutions, with generative AI promising to boost road safety and efficiency. Despite infrastructure challenges, the region’s market is projected to grow as economic stability and urbanization fuel demand for advanced automotive technology.

Generative Al in Automotive Market Top Companies

- Microsoft

- AUDI AG

- Intel Corporation

- Tesla Inc

- Uber Technologies

- Volvo Car Corporation

- Honda Motors

- Ford Motor Company

- NVIDIA Corporation

- Tencent

- BMW AG

CEO Statements

Satya Nadella, CEO of Microsoft

- "We’re advancing our collaboration with partners to integrate generative AI deeply within the automotive industry. By leveraging Microsoft’s Azure OpenAI Service, we're enabling conversational AI that transforms in-vehicle experiences, making it intuitive for users to interact with their cars as companions on the road"

Mike Schoofs, Chief Revenue Officer at TomTom

- "Together with Microsoft, our vision is to innovate generative AI for automotive solutions. We’re integrating our navigation and location expertise with AI to reshape in-car interactions, allowing users to trust their vehicle’s AI for navigation and in-car adjustments seamlessly"

Elon Musk, CEO of Tesla Inc.

- " We are committed to leveraging generative AI not just for better user experiences but also for optimizing our production lines. This technology allows us to streamline operations and innovate more rapidly, setting new benchmarks in automotive technology"

Recent Developments

- In July 2023, Microsoft and ABB announced a partnership to integrate generative AI into industrial applications. The collaboration focuses on deploying Copilot features in ABB’s industrial analytics platforms, such as AI Suite and ABB Ability Genix, to enhance user interaction and streamline complex processes with more intuitive AI capabilities.

- In April 2023, SoundHound AI, Inc. introduced SoundHound Chat AI, an advanced voice assistant developed for automakers. This cutting-edge technology, powered by generative AI similar to ChatGPT, enhances in-car voice experiences for both manufacturers and drivers.

- In May 2023, Faraday Future Intelligent Electric Inc. launched its Generative AI Product Stack, a pioneering feature in the flagship FF 91 model. This launch marks the company as the first automaker to embed generative AI capabilities in a vehicle, positioning Faraday Future as an innovator in automotive AI integration.

These developments underscore significant advancements in the generative AI in automotive industry, with companies like Microsoft, AUDI AG, Intel Corporation, and Tesla Inc. enhancing their product offerings to incorporate cutting-edge AI technologies. These enhancements focus on improving vehicle functionalities, including advanced driver assistance systems, personalized user experiences, and more intuitive interfaces. By integrating generative AI capabilities, these companies are striving to revolutionize how consumers interact with their vehicles, leading to safer and more efficient driving experiences. As the competition heats up, the push for innovative solutions continues to drive the automotive sector forward.

Market Segmentation

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Technology

- Machine Learning

- Natural Language Processing

- Context-aware Computing

- Computer Vision

- Others

By Application

- Vehicle Design

- Manufacturing Optimization

- Transportation & Logistics

- Autonomous Driving

- ADAS

By Region

- North America

- APAC

- Europe

- LAMEA

...

...