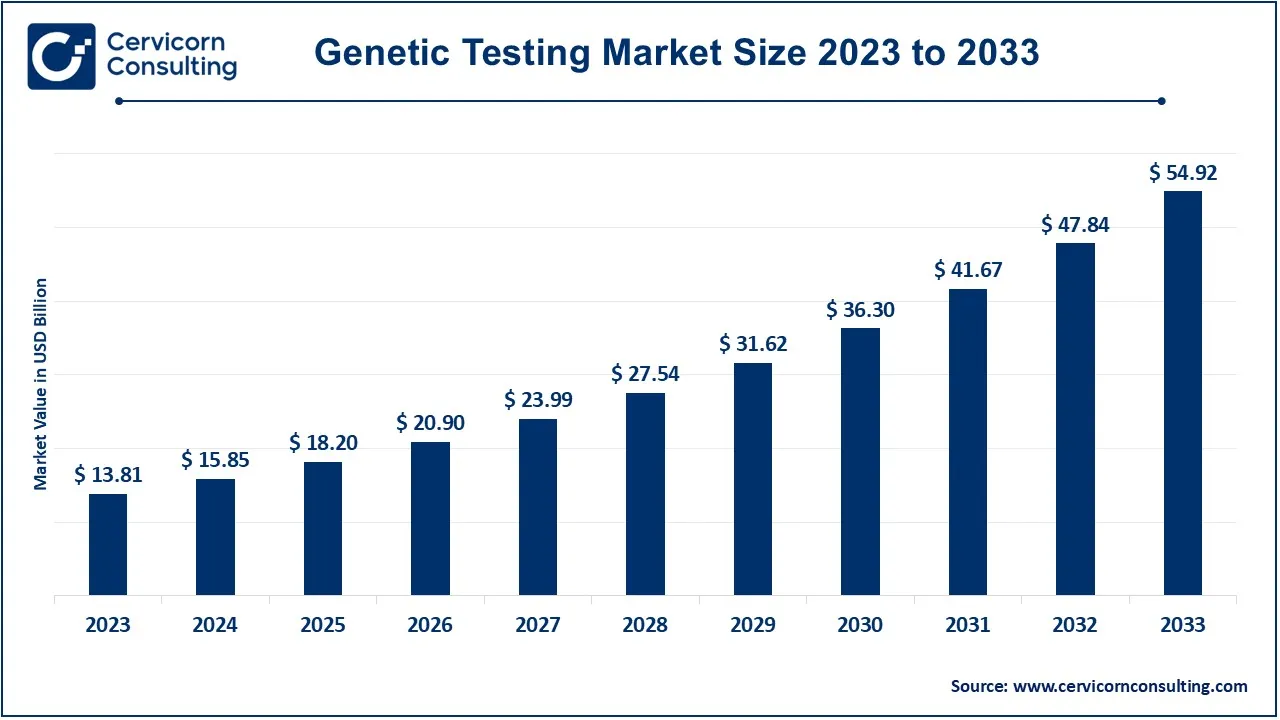

The global genetic testing market size was valued at USD 15.85 billion in 2024 and is expected to be worth around USD 54.92 billion by 2033, growing at a compound annual growth rate (CAGR) of 14.80% from 2024 to 2033.

The global genetic testing market has experienced significant growth in recent years, driven by advancements in genomics and the rising demand for personalized healthcare. The market is expected to continue expanding due to the increasing adoption of genetic tests for medical diagnostics, prenatal testing, and carrier screening. The widespread availability of affordable genetic testing, coupled with the growing awareness of genetic disorders, has contributed to a surge in the number of individuals opting for such tests. Furthermore, advancements in biotechnology and improved sequencing technologies have reduced the cost of genetic tests, making them more accessible to the public and driving demand. Additionally, the rise of direct-to-consumer genetic testing services, such as ancestry testing and health risk assessments, has further fueled market growth. Companies offering home-based genetic testing kits, which allow individuals to assess their genetic traits from the comfort of their homes, have become increasingly popular. In recent, specializing in genomics-related diagnostic testing, GeneDx has experienced substantial growth, with a nearly 2,700% increase in its stock in 2024, partly due to the FDA's new guidelines on artificial intelligence in medical devices.

Genetic testing involves analyzing a person's DNA to identify changes or mutations in genes that might cause disease or affect how their body responds to certain treatments. It can be used to assess the risk of developing genetic disorders, to diagnose conditions, or to guide personalized treatment plans. The tests are typically done by collecting a sample of saliva, blood, or tissue, which is then analyzed in a laboratory. Genetic testing can also be used to trace ancestry, identify inherited traits, and determine carrier status for various conditions. By understanding genetic makeup, individuals can make informed decisions about their health and lifestyle.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 18.20 Billion |

| Projected Market Size (2033) | USD 54.92 Billion |

| Growth Rate (2024 to 2033) | 14.80% |

| Dominating Region | North America |

| Fastest Expanding Region | Asia-Pacific |

| Key Segments | Technology, Test, Channel, Product, Application, End User, Region |

| Key Companies | 24 genetics, Circle DNA, Tellmegen, 23andme, AncestryDNA, MyDNA, Everly Well, Igenomix, VitaGen, Myriad Genetics, Inc., Mapmygenome, Helix OpCo LLC, MyHeritage Ltd., Illumina, Inc., Color Genomics, Inc., Amgen, Inc. |

Growing Incidence of Genetic Disorders

Strong Demand for Personalized Medicine

Availability of Direct-to-Consumer Testing

Acceptance in Developing Markets

High Costs of Advanced Testing

Lack of Regulatory Standardization

Limited Infrastructure in Developing Countries

Integration with Healthcare Systems

Educating Healthcare Professionals

Handling Inconclusive or Uncertain Results

The genetic testing market is segmented into technology, test type, product, channel, application, end-user and region. Based on technology, the market is classified into polymerase chain reaction, DNA sequencing, array technology, PCR-based testing, and cytogenetic testing. Based on test type, the market is classified into predictive testing, carrier testing, prenatal and newborn testing, diagnostic testing, pharmacogenomic testing, nutrigenomics, and other. Based on product, the market is classified into consumables, equipment, software & services. Based on channel, the market is classified into online, and offline. Based on application, the market is classified into cancer treatment, tissue typing for transplantation, ancestry testing, forensic identity testing, paternity testing, and other. Based on end-user, the market is classified into hospitals & clinics, diagnostic laboratories, and others.

Next Generation Sequencing (NGS): Next Generation Sequencing is a rapidly evolving technology that allows for high-throughput sequencing of DNA, providing fast and accurate genetic information. It is widely used for diagnosing genetic disorders, personalized medicine, and detecting mutations associated with cancer. The ability to sequence multiple genes simultaneously makes NGS highly cost-effective and efficient, contributing to its dominance in the genetic testing market.

Array Technology: Array technology is used for analyzing multiple genetic variations in a single test, including SNPs (Single Nucleotide Polymorphisms) and chromosomal abnormalities. It is particularly useful in cancer genomics, identifying genetic predispositions, and pharmacogenomics. This technology offers high throughput and is relatively affordable, making it a popular choice in clinical diagnostics and research applications, especially for large-scale genetic screening.

PCR-based Testing: Polymerase Chain Reaction (PCR) is one of the most widely used techniques in genetic testing for amplifying small DNA segments. Its high specificity and sensitivity make it ideal for detecting infectious diseases, genetic mutations, and hereditary conditions. PCR-based testing remains a cornerstone technology in genetic diagnostics due to its cost-effectiveness and reliability in providing rapid and precise results.

FISH (Fluorescence in Situ Hybridization): FISH is a cytogenetic technique used to detect and localize the presence or absence of specific DNA sequences on chromosomes. It is frequently employed for identifying chromosomal abnormalities, cancer diagnostics, and prenatal testing. FISH provides detailed insight into genetic rearrangements, making it highly valuable for diagnosing conditions like leukemia, lymphoma, and other genetic disorders.

Others: This category includes other technologies such as Sanger sequencing, southern blotting, and comparative genomic hybridization (CGH). These methods play specific roles in niche applications, including rare disease diagnostics, detecting genetic translocations, and analyzing gene expression patterns. While not as widely adopted as NGS or PCR, these technologies offer critical solutions for specialized genetic testing requirements.

Predictive Testing: Predictive genetic testing is performed to assess the risk of developing certain genetic conditions before symptoms appear. It is used primarily for hereditary diseases like breast cancer and Huntington’s disease. Predictive tests allow for early intervention and risk management, helping individuals make informed decisions about preventive healthcare strategies.

Carrier Testing: Carrier testing identifies individuals who carry a single copy of a gene mutation that, when present in two copies, causes genetic disorders. It is commonly offered to individuals planning to have children, especially when there's a family history of certain genetic conditions. This test helps assess the risk of passing on genetic disorders like cystic fibrosis or sickle cell anemia to offspring.

Prenatal and Newborn Testing: The prenatal and newborn testing segment has captured 39.40% in 2023. Prenatal and newborn testing is used to detect genetic disorders in fetuses and newborns. Non-invasive prenatal testing (NIPT) and newborn screening are widely employed for early diagnosis of conditions like Down syndrome, cystic fibrosis, and congenital heart defects. These tests help in timely medical interventions, improving long-term health outcomes for affected children.

Diagnostic Testing: Diagnostic testing is performed to identify a specific genetic disorder in individuals showing symptoms. It confirms the presence of genetic mutations responsible for conditions such as cancer, muscular dystrophy, or cystic fibrosis. Diagnostic testing enables healthcare providers to prescribe tailored treatments based on genetic findings, significantly enhancing patient care.

Pharmacogenomic Testing: Pharmacogenomic testing examines how an individual's genetic makeup influences their response to medications. It helps in optimizing drug selection and dosages for patients, particularly in areas like oncology, psychiatry, and cardiovascular diseases. This test is essential for personalized medicine, reducing adverse drug reactions and improving treatment outcomes.

Nutrigenomics: Nutrigenomics explores the interaction between an individual’s genes and their diet, influencing how their body responds to certain foods. This emerging field helps create personalized nutrition plans aimed at preventing chronic diseases like diabetes or obesity. Nutrigenomic testing is gaining popularity among health-conscious consumers looking for tailored dietary recommendations based on their genetic profile.

Others: This segment includes various other tests such as preimplantation genetic testing, which is used during IVF to identify genetic abnormalities in embryos, and mitochondrial testing for rare genetic diseases. These specialized tests cater to niche markets but are growing in importance as advancements in genetic testing continue to expand their applications

Cancer Treatment: Genetic testing plays a crucial role in cancer treatment by identifying mutations in genes like BRCA1/BRCA2, which are associated with a higher risk of developing cancer. Tests guide treatment options, such as targeted therapies or immunotherapies, and help in prognosis. This personalized approach enhances treatment outcomes and minimizes side effects, making it a rapidly growing segment in the market.

Tissue Typing for Transplantation: Tissue typing involves genetic testing to match organ donors and recipients, reducing the risk of transplant rejection. It ensures compatibility by comparing HLA (Human Leukocyte Antigen) markers, which are critical for immune system function. Tissue typing is essential in transplant procedures, improving success rates and reducing complications, especially in kidney, bone marrow, and stem cell transplants.

Forensic Identity Testing: Forensic genetic testing is widely used in criminal investigations, paternity disputes, and disaster victim identification. Techniques such as DNA profiling and short tandem repeat (STR) analysis help establish biological relationships or identify individuals with high accuracy. This application is key to law enforcement and legal proceedings, making genetic testing indispensable in forensic science.

Ancestry Testing: Ancestry testing analyzes genetic markers to trace familial and ancestral origins. By comparing DNA to reference populations, individuals can discover their ethnic background and genetic heritage. Companies like 23andMe and AncestryDNA offer these tests to consumers, contributing to the growing trend of using genetic testing for personal and genealogical purposes.

Paternity Testing: Paternity testing determines biological relationships between a father and child. It is widely used in legal cases, custody disputes, and immigration applications. The test compares DNA sequences from both individuals to confirm a biological link with high accuracy. Paternity testing is a well-established market segment, driven by its legal, social, and medical applications.

Other: This category includes lesser-known applications like pharmacogenetic testing for drug efficacy, genetic counseling for inherited conditions, and population genetics studies. These tests serve specialized needs across various fields, including public health research, sports genetics, and rare disease diagnostics, contributing to the expanding scope of the genetic testing market.

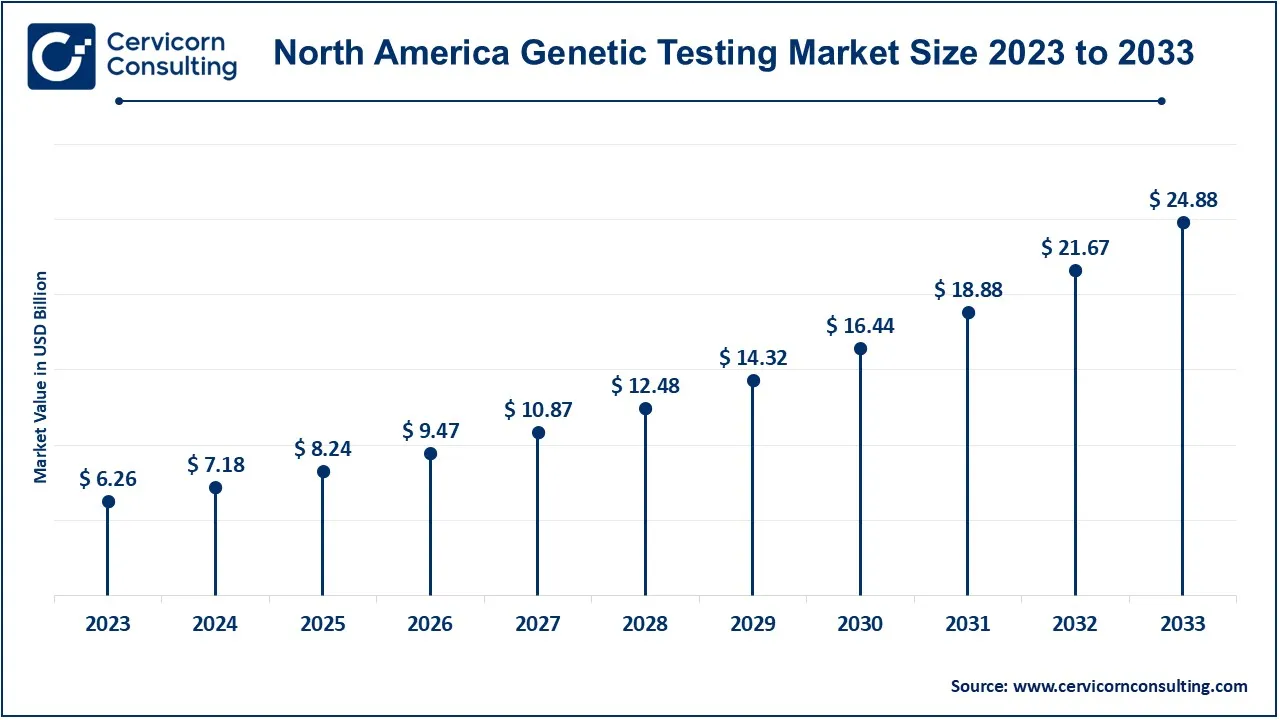

The North America genetic testing market size was estimated at USD 6.26 billion in 2023 and is expected to reach around USD 24.88 billion by 2033. North America dominates the market due to advanced healthcare infrastructure, high awareness, and widespread adoption of personalized medicine. The U.S. leads this region, driven by rising cancer cases and increased direct-to-consumer (DTC) genetic testing services. The presence of major market players and extensive research in genomics further strengthens its position. Canada follows with a growing focus on preventive healthcare and public funding for genetic screening programs. Favourable government policies and growing demand for pharmacogenomics are also key growth factors in this region.

The Europe genetic testing market size was reached at USD 3.33 billion in 2023 and is projected to hit around USD 13.24 billion by 2033. Europe holds a significant share, supported by a strong regulatory framework, high healthcare expenditure, and growing public awareness of genetic conditions. Countries like the UK, Germany, and France are leading in adopting genetic testing for personalized medicine and prenatal screening. The UK has invested in initiatives like the 100,000 Genomes Project, driving demand for genetic research. Germany’s advanced healthcare system and growing focus on rare diseases contribute to the region’s market expansion, while France is investing in national genomics strategies.

The Asia-Pacific genetic testing market size was valued at USD 2.72 billion in 2023 and is predicted to surpass around USD 10.82 billion by 2033. Asia-Pacific is witnessing rapid growth, propelled by increasing healthcare investments, expanding middle-class populations, and rising awareness of genetic disorders. China and Japan lead the market, with China’s growing biotechnology sector and Japan’s advancements in precision medicine driving demand. India is also emerging as a key player, with a focus on prenatal and cancer screening. Government support and improved healthcare access across developing countries are expected to boost market growth further, making this region highly lucrative for future investments.

The LAMEA genetic testing market was valued at USD 1.51 billion in 2023 and is anticipated to reach around USD 5.99 billion by 2033. The LAMEA region shows gradual growth in the market, driven by increasing awareness and improving healthcare infrastructure. Brazil and Mexico are key markets in Latin America, with rising investments in genetic research and diagnostics. In the Middle East, countries like Saudi Arabia and the UAE are embracing genetic testing for inherited conditions, driven by higher incidences of genetic disorders in consanguineous populations. However, limited healthcare access and affordability issues pose challenges in many African nations, though emerging public health initiatives are expected to stimulate growth in the coming years.

The genetic testing industry is dominated by a few central players, including 4 genetics; Circle DNA; Illumina Inc.; tellmegene; 23andme; AncestryDNA; MyDNA; Everly Well; Igenomix; VitaGen; and Myriad Genetics, Inc, among others. These organizations are recognized for their commitment to innovation and advancement in genetic testing. They leverage cutting-edge technologies and develop innovative solutions that enhance the capabilities of genetic testing, making significant contributions to the field and expanding accessibility for consumers. Through their efforts, these companies are shaping the future of personalized medicine and genetic analysis.

Market Segmentation

By Technology

By Test Type

By Product

By Channel

By Application

By End-user

By Region