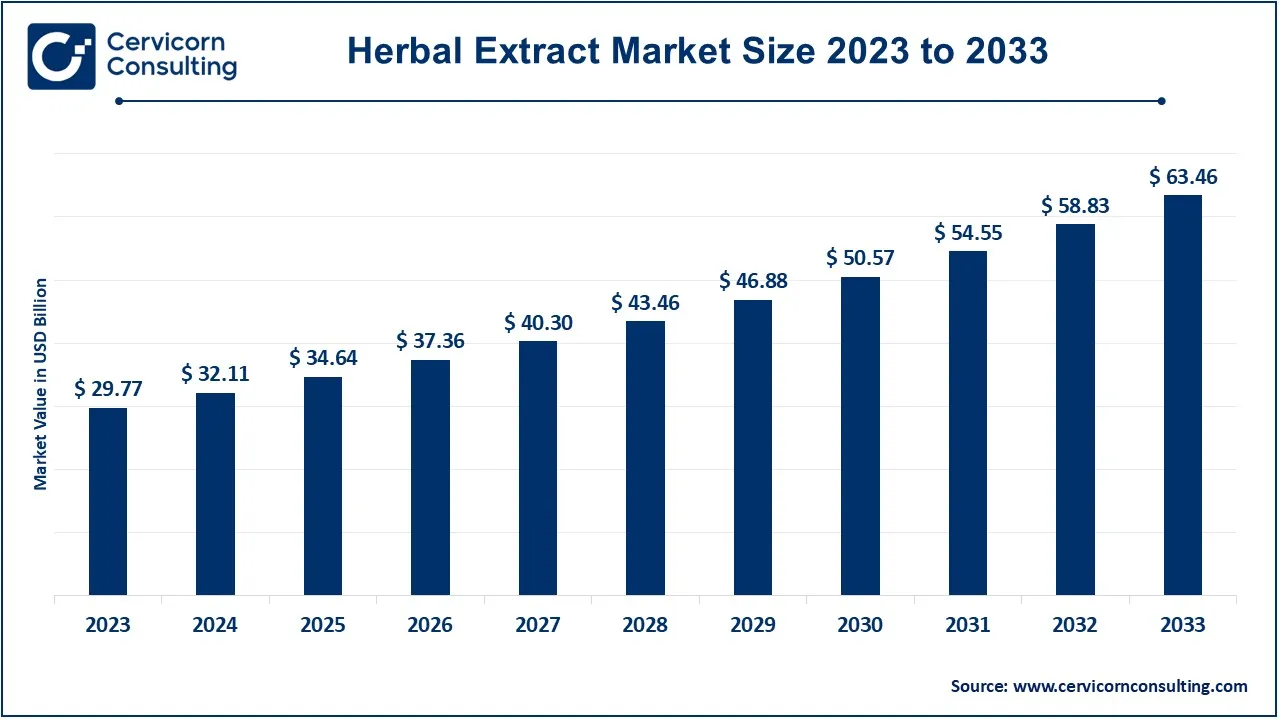

The global herbal extract market size was valued at USD 32.11 billion in 2024 and is expected to be worth around USD 63.46 billion by 2033, growing at a compound annual growth rate (CAGR) of 7.86% from 2024 to 2033.

The herbal extract market is growing rapidly, driven by the increasing demand for natural and plant-based products across various industries. Consumers are increasingly leaning toward herbal supplements, skincare, and food products, as they are perceived as safer and more sustainable alternatives to synthetic chemicals. The health and wellness trend, especially post-pandemic, has amplified interest in herbal extracts for boosting immunity, reducing stress, and supporting overall health. Popular extracts like ashwagandha, turmeric, and ginseng are seeing heightened demand globally. Asia-Pacific dominates the herbal extract market due to its deep-rooted traditions in herbal medicine and Ayurveda, while North America and Europe are witnessing growth fueled by the organic and natural products movement. In 2023, Thailand's herbal extract imports from China were valued at approximately 1.4 billion Thai baht, making China the leading supplier to Thailand. The food and beverage industry is also adopting herbal extracts to enhance flavors and nutritional value, further boosting the market.

Herbal extract is a concentrated substance made by extracting the active components of plants, such as leaves, roots, flowers, or seeds. The process involves soaking the plant material in solvents like water, alcohol, or oil to isolate beneficial compounds such as antioxidants, vitamins, or essential oils. These extracts are commonly used in industries like medicine, cosmetics, food, and wellness due to their natural health benefits. For example, green tea extract is valued for its antioxidants, while turmeric extract is popular for its anti-inflammatory properties. Herbal extracts are often available in liquid, powder, or capsule form and are widely used in dietary supplements, skincare products, and beverages. Their appeal lies in their perceived natural origin and effectiveness in supporting overall health.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 34.64 Billion |

| Projected Market Size (2033) | USD 63.46 Billion |

| Growth Rate (2024 to 2033) | 7.86% |

| High-impact Region | Asia Pacific |

| Fstest Growing Region | North America |

| Key Segments | Product, Source, Form, Application, End User, Region |

| Key Companies | Naturex,  Martin Bauer Group, Indena S.p.A., Döhler GmbH,  Synthite Industries,  Arjuna Natural Ltd., Bioprex Labs, Kalsec Inc., Nexira,  Sabinsa Corporation, Givaudan,  Himalaya Wellness,  Symrise AG |

Increased Consumer Shift Toward Natural Ingredients

Rising Health Consciousness

High Cost of Quality Extraction Methods

Regulatory Challenges

Expansion into Emerging Markets

Increased Usage in Pharmaceuticals and Nutraceuticals

Standardization of Quality and Safety

Supply Chain Constraints

Cosmetics & Personal Care: The cosmetics and personal care segment has dominated the market in 2023. Herbal extracts are now an important component of cosmeceutical and personal care products due to their natural, skin friendly characteristics. Some extracts include aloe vera, chamomile, lavender, etc as they work miraculous for skin as they contain skin conditioning properties, they also act as skin healers, skin softeners, skin protectants and skin tonics. Consumers are shifting towards clean beauty and organic skin care products so the usage of herbal products in lotions, creams, and serums is escalating quickly.

Pharmaceuticals: Dermal extracts obtained from herbs are used in pharmaceuticals because they are natural therapeutic agents or supplements to synthetic drugs. Product like those ginsengs, echinacea and turmeric are famous due to its anti-inflammatory, antioxidant and immune system booster. The use of herbs in medications is becoming popular as the positive effects of chemical drugs are being felt around the world with many people now seeking natural products such as plant extracts.

Dietary Supplements: There is now a great emphasis on herbal extracts and they make up a very large part of the dietary supplements. Herbs such as green tea, garlic, and ginkgo biloba are extracted and used in products that advertises brain function, weight loss, and heart health respectively. Burgeoning consciousness for disease prevention, together with the shift towards healthier and more clean label products has greatly boost the herbal supplement market.

Food & Beverages: As the people get more conscious with their health, the food and beverage industry today adapts the use of herbal extract in functional food and beverages. Some of these include; Ginger extracts for enhancement of flavours, preservation, and nutritional value addition; rosemary, mint amongst others. This sector is experiencing enhanced sales due to an increased consumption of organic, plant base and functional products such as herbal teas and energy drinks.

Phytomedicines: Phytomedicines segment has lead the market in 2023. Phytomedicines are medicinal preparations derived from plant products meant for curing diseases in the body. Some of the active extracts in this category include; St. John’s Wort for mental ailments, and valerian root for sleeplessness. The trend towards natural remedies and the chronic use of plant materials in medicine are the components of the high demand for phytomedicines.

Spice Extracts: These extracts as spices like Turmeric, Black Pepper, Cinnamon and many more are found to possess amazing medical values and are used in the food and medicinal industry as seasoning agents. It is also to note that they contain antioxidants, anti-inflammatory, antimicrobial effects, so useful in drugs and nutraceuticals.

Essential Oils: Derived from plants and flowers, lavender, eucalyptus, tea tree and citrus, oil is a primary ingredient of aromatherapy, cosmetics and natural healers. These due to their therapeutic uses such as in stress relaxation, skin treatment, and in support of respiration to be used in wellness and cosmetic products. The increase in the use of holistic and other interrelated natural healings has additionally contributed to the growth of the global essential oils market.

Polyphenols: Due to their antioxidant effect, polyphenols derived from plant foods such as grapes, green tea, and berries are popular in supplemental and functional products. A lot of value is placed on these extracts due to the possible health benefits, such as for the heart, anti-aging, and cancer fighting, which makes the extracts relevant to nutraceutical and supplement markets.

Nutraceutical Manufacturers: There is an extensive utilization of herbal extracts as active pharmaceutical ingredients by nutraceutical firms to produce nutritional supplements and functional foods. These extracts assist in managing some ailments such as arthritis, heart disease, and over and above, dementia. With consumers getting conscious of their diets, the nutrient supplement producers are using more plant-based foods for their products.

Food & Beverage Companies: Herbal extracts are commonly applied by the firms in the food and beverage industry as flavouring agents, nutritive values and preservatives. Essential oils, antioxidants, and other functional compounds like ginger and turmeric are often incorporated in the drink products, snacks and processed foods. Trends to clean-label products and the use of organic ingredients have forced the adoption of herbal extracts in this sector.

Cosmetics Manufacturers: Natural extracts are again a popular segment for cosmetics and personal care that focuses on herbal care for the skin and hair. Substances such as aloe, neem and chamomile are preferred for their anti-inflammatory, moisturising and rejuvenator effects. With cosmetic addicts going organic and natural, manufacturers are now incorporating herbal extracts in creams, serums, shampoos, and soaps.

Herbal Medicine Producers: Manufacturers of herbal products utilize extracts from Indian herbs to provide conventional as well as other therapies for diseases. Echinacea for instance is used to support the human immune system and ashwagandha for stress relief are examples of demand products within the herbal medicine industry. The increasing number of consumers who are searching for natural or holistic healthcare remedies is the primary reason for the growth of this market.

The Asia-Pacific herbal extract market size was estimated at USD 14.15 billion in 2023 and is expected to reach around USD 30.16 billion by 2033. The Asia-Pacific region is rapidly turning into the largest consumer region for herbal extracts as countries like China and India have strong historical correlates with herbal medicine. Rising consumer consciousness towards the nutrition value of plant products and the demand for herbal nutrition and care products is fueling the growth of the market. The growth of nutraceutical and functional foods market in the region is another factor, which also leads to increased use of herbal extracts.

The North America herbal extract market size was estimated at USD 4.80 billion in 2023 and is expected to be worth around USD 10.24 billion by 2033. The North America also shows a substantial growth due to growing consumer preferences towards natural food ingredients, in the food, cosmetics and the dietary supplements industries. America stands as the most advanced country in the research and development of the herbal products through heavy investment in the nutraceutical industry and the boosting wellness Segment. They are also expanding; while increasing consumer interest in plant-based treatments and wellness supplements, has boosted market growth in Canada as well.

The Europe herbal extract market size was valued at USD 7.39 billion in 2023 and is expected to be worth around USD 15.74 billion by 2033. Europe possesses remarkable growth in the market due to the increased demand for antioxidants from organic sources such as cosmetics and food products. Germany, France, and the UK remain dominant in this growth due to their sound regulations that make consumers to embrace safe and quality plant-bases proteins. Another factor that enhances the uptake of herbal extracts in the region includes; sustainability and clean-label products.

LAMEA

The LAMEA herbal extract market was valued at USD 3.44 billion in 2023 and is predicted to hit around USD 7.32 billion by 2033. The LAMEA herbal market is not yet fully expanded, yet holds great potentiality for strong future growth because of ever-increasing globally consciousness & consumption of natural health and beauty products. For instance, the Brazil market is experiencing growing demand for its herbal remedies products due to its diverse bio-chemical content. The Middle East is also embracing herbal extracts in wellness and skincare and even though Africa’s consciousness towards natural cure is slow the market is gradually expanding.

Some of the new entrants in herbal extract industry are going for herbal extract market as the consumers are looking for natural and plant-based products in today’s context; the companies such as Nature’s Way and Gaia Herbs observes high growth as they deal with the dietary supplementary and extracting herbal extracts. On the other hand, Pure Encapsulations is entering with the pure, premium-grade herbal extracts for bespoke health issues like immune support, and cognition problems, where consumer can get the right science-backed herbal supplements. Newer entrants on the scene are flexing their muscles through new formulation and enhancing accessibility of natural health products.

Already in place, NOW Foods and Herbalife are other examples of natural products retailing giants that have extended the range of herbal products they offer based on a long-term perspective in the field. They have very large distribution networks and customers trust them enough to get what they need in supplemental nutrition which includes the herbal supplements. Various sustainable sourcing farming industries, and increased research on extraction methods have seen competition in the Herbal Extract market emerging from new entrants and old incumbents, investors offering consumers an array of natural health solutions.

CEO Statements

Christophe Fargier, CEO of Naturex:

"At Naturex, we are committed to advancing the herbal extract industry by integrating sustainable sourcing and cutting-edge extraction technologies. Our goal is to deliver the highest quality natural ingredients that meet the growing demand for health and wellness products, ensuring transparency and safety at every stage of production."

Massimo Polzoni, CEO of Indena S.p.A.:

"Indena’s strength lies in our long-standing expertise in botanical research. We are focused on unlocking the full potential of herbal extracts for pharmaceutical and nutraceutical applications, where consumers are looking for natural alternatives to conventional medicine. Our science-driven approach allows us to provide safe, efficacious, and innovative products."

Key market participants in the herbal extract sector are increasingly looking at research being done on products providing a rich, natural compound for use across the food & beverages, cosmetics, and pharmaceuticals segments. It has always been corporations that are pushing the development of extraction processes that have minimal effects to the efficacy and integrity of the active constituents in the herbs, including supercritical CO2 and cold pressing. They provide a possibility of developing the higher and more natural solutions for the human health. Notable developments in the herbal extract industry include:

Some of these advances have stemmed herbal extract market growth from acquisitions, collaborations, and higher levels of funding towards the natural health field. By exploring new forms of herbal ingredients, companies are discovering new characteristics for their products, targeting new consumer needs by innovating their products and services, and engaging in close partnership with governmental and non-governmental agencies that oversee the safety and quality of their products. They are intended to address the growing customer needs of plant-derived health products, as well as increasing the accepted notion of solely natural food and cosmetic products.

Market Segmentation

By Product

By Source

By Form

By Application

By End-Users

Regional