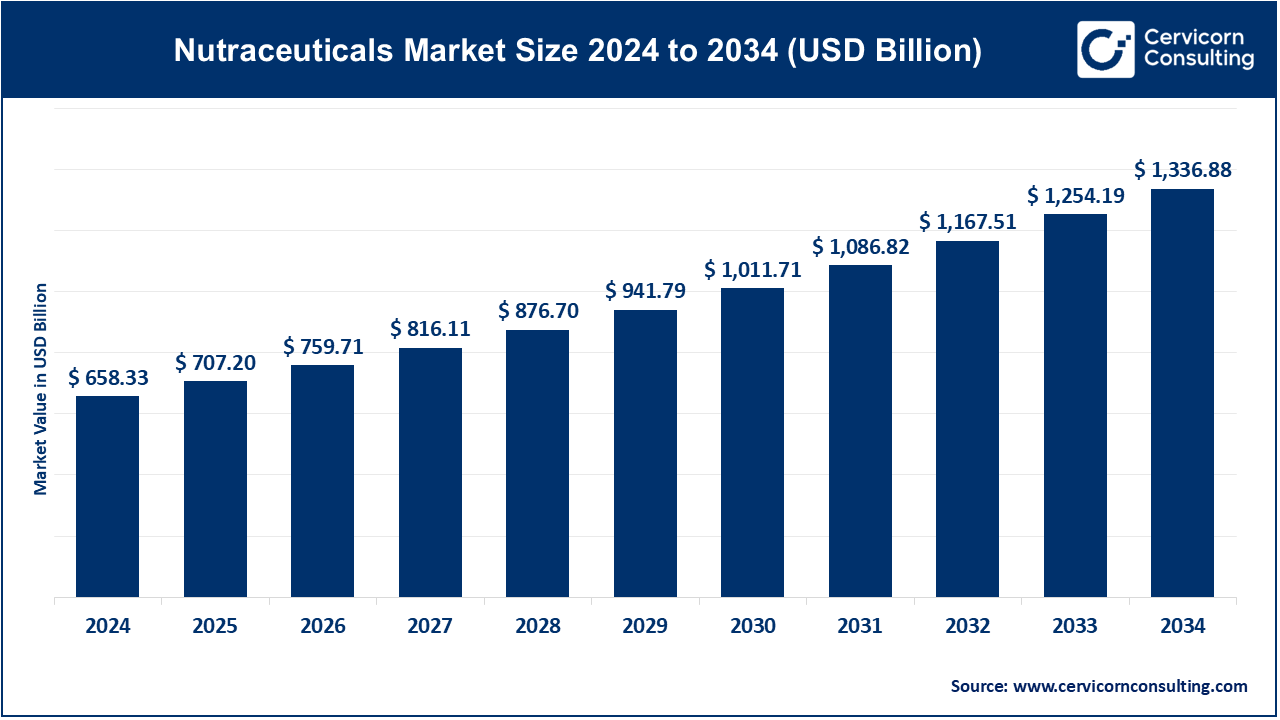

The global nutraceuticals market size was accounted for USD 658.33 billion in 2024 and is projected to surpass around USD 1,336.88 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.42% over the forecast period 2025 to 2034.

The global nutraceutical market is experiencing robust growth, driven by increasing consumer awareness about health and wellness. Rising concerns over lifestyle-related diseases, such as obesity, diabetes, and heart disease, are fueling the demand for nutraceuticals as preventive health solutions. The shift towards natural, plant-based, and organic products is also influencing consumer preferences, encouraging the expansion of the nutraceutical sector. In addition, the aging population, particularly in developed countries, is further boosting the demand for these products as older individuals seek ways to maintain their health and vitality. This market is projected to continue expanding at a significant rate in the coming years. The increasing popularity of personalized nutrition and the rise of e-commerce platforms that offer easier access to nutraceuticals are also contributing factors. Worldwide, there were 2,658 nutraceutical export shipments from March 2023 to February 2024, with India, the United States, and China being the top exporters.

Nutraceuticals are food products that offer both nutritional and health benefits. They are typically derived from natural ingredients like plants, herbs, or other food sources and contain bioactive compounds that contribute to the prevention or treatment of diseases. These products go beyond basic nutrition by providing additional health benefits, such as improving immunity, supporting joint health, or managing chronic conditions. Common forms of nutraceuticals include dietary supplements, functional foods, and fortified products. Examples of nutraceuticals include omega-3 fatty acids, probiotics, antioxidants, vitamins, and minerals. They are often used to enhance overall well-being and prevent deficiencies or health issues, making them an appealing option for individuals seeking to improve their health without relying solely on medication.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 707.2 Billion |

| Market Size by 2034 | USD 1,336.88 Billion |

| Market Growth Rate | CAGR of 7.42% from 2025 to 2034 |

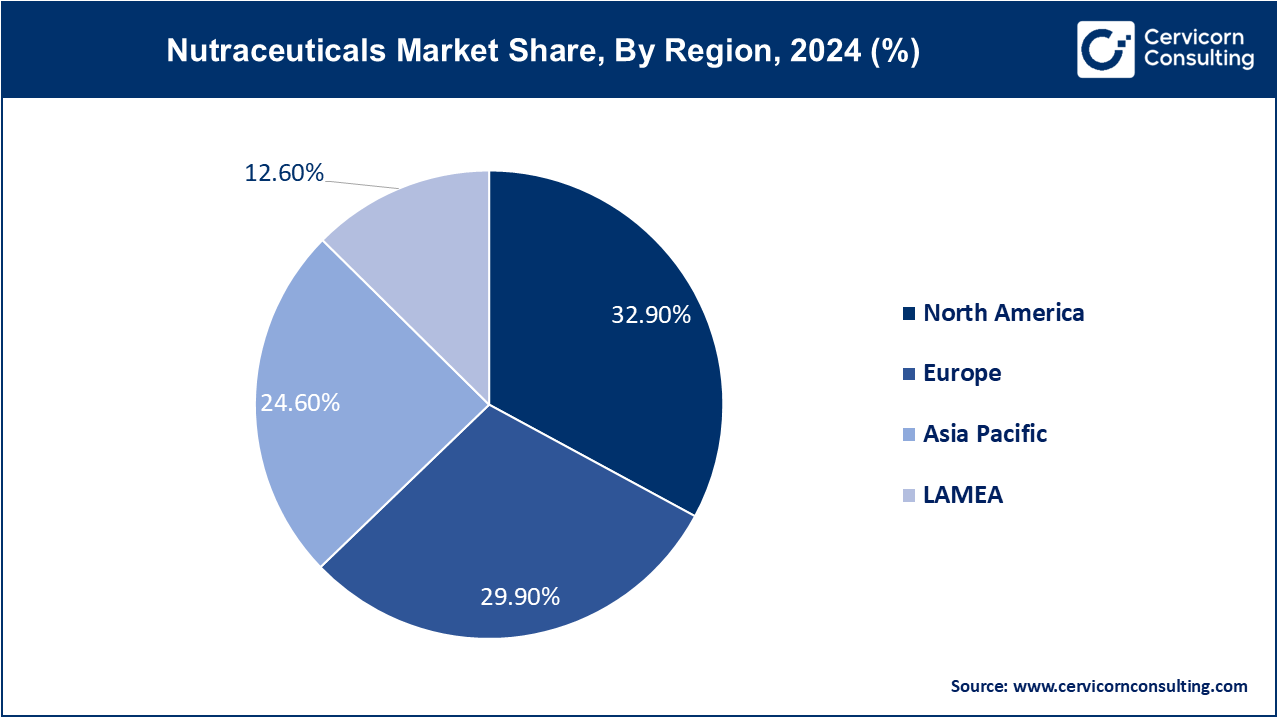

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | By Product Type, Form, Distribution Channel, Application and Regions |

Advancements in Biotechnology

Rising Healthcare Costs

Regulatory Challenges

High R&D Costs

Expansion in Emerging Markets

Integration with Digital Health

Consumer Skepticism

Supply Chain Issues

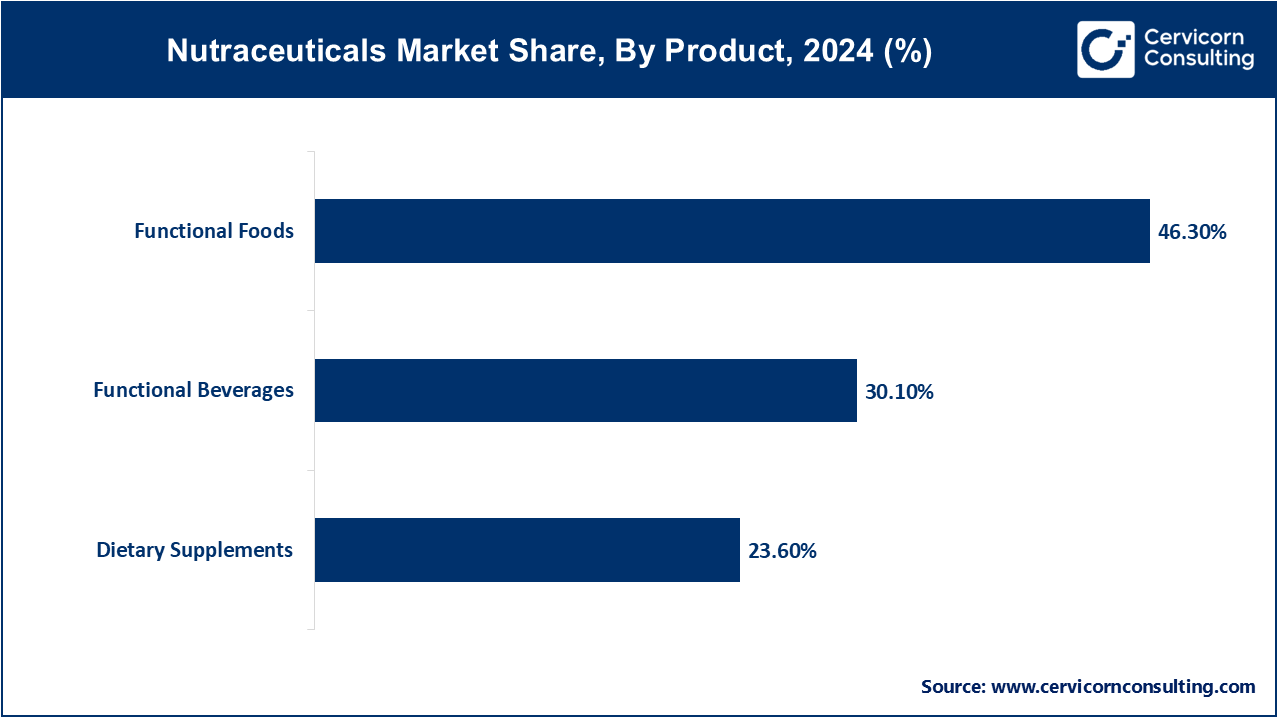

Dietary Supplements: The dietary supplements segment has registered market share of 23.6% in 2024. Dietary supplements are experiencing growth due to increasing consumer awareness about preventive healthcare and wellness. Trends such as personalized nutrition, plant-based ingredients, and innovative delivery formats like gummies and powders drive this segment. The rising prevalence of chronic diseases and the aging population also boost demand, as consumers seek products that support overall health and specific health concerns.

Functional Foods: The functional foods segment has covered 46.3% of market share in 2024. Functional foods are gaining popularity as they offer additional health benefits beyond basic nutrition. Trends include the incorporation of probiotics, prebiotics, omega-3 fatty acids, and antioxidants to support gut health, immunity, and heart health. The demand for clean label products, plant-based alternatives, and fortified foods is driving innovation and market growth in this segment.

Functional Beverages: Functional beverages are becoming increasingly popular due to their convenience and ability to provide health benefits on-the-go. In 2024, This segment has recorded market share of 30.1%. Trends such as enhanced hydration solutions, energy-boosting drinks, and beverages fortified with vitamins and minerals drive this segment. The rising interest in fitness, wellness, and natural ingredients contributes to the demand for functional beverages that support physical and mental well-being.

Probiotics: Probiotics are increasingly sought after for their gut health benefits and immune support. Trends include the development of multi-strain formulations and targeted probiotic blends for specific health issues. Drivers such as rising digestive health awareness and the demand for natural and preventative healthcare solutions are boosting the probiotic segment.

Proteins & Amino Acids: The growing focus on fitness, muscle health, and weight management drives the demand for proteins and amino acids. Trends include plant-based protein sources and innovative delivery formats like protein bars and powders. The increasing popularity of high-protein diets and sports nutrition further fuels this segment's growth.

Phytochemicals & Plant Extracts: Phytochemicals and plant extracts are gaining traction due to their natural origin and health benefits, such as antioxidant and anti-inflammatory properties. Trends include the use of superfoods and botanical extracts in nutraceutical formulations. Drivers include consumer preference for natural ingredients and the increasing awareness of plant-based nutrition.

Fibers & Specialty Carbohydrates: Fibers and specialty carbohydrates are essential for digestive health and metabolic support. Trends focus on prebiotic fibers that enhance gut microbiota and overall wellness. Drivers include the rising prevalence of digestive disorders and the growing interest in dietary fiber for weight management and chronic disease prevention.

Omega-3 Fatty Acids: Omega-3 fatty acids are popular for their cardiovascular, cognitive, and anti-inflammatory benefits. Trends include the development of sustainable, plant-based omega-3 sources and high-purity formulations. Drivers such as increasing awareness of heart health and the benefits of omega-3 supplements for overall wellness drive this segment.

Vitamins: Vitamins remain a staple in the nutraceutical market, driven by their essential role in maintaining health. Trends include personalized vitamin formulations and the integration of vitamins into functional foods and beverages. The rising health consciousness and the need to address vitamin deficiencies fuel the demand for vitamin supplements.

Prebiotics: Prebiotics are in demand for their role in supporting gut health and enhancing the efficacy of probiotics. Trends include combining prebiotics with probiotics (synbiotics) and incorporating them into various food products. Drivers include the growing focus on digestive health and the increasing consumer interest in holistic health solutions.

Carotenoids: Carotenoids, known for their antioxidant properties and eye health benefits, are gaining popularity. Trends include their use in functional foods and supplements targeting skin and eye health. Drivers such as the rising awareness of the benefits of antioxidants and the demand for natural colorants in food products propel this segment.

Minerals: Minerals are essential for numerous bodily functions, and their demand is driven by the need to address dietary deficiencies. Trends include bioavailable mineral formulations and fortification of foods with essential minerals. Drivers include the growing health consciousness and the need to prevent mineral deficiencies for overall well-being.

Others: The others segment includes various bioactive compounds and specialty ingredients that offer unique health benefits. Trends in this segment involve the exploration of new, innovative ingredients and their integration into multi-functional nutraceutical products. Drivers include ongoing research and development and consumer demand for novel, effective health solutions.

Supermarkets/Hypermarkets: The supermarkets and hypermarkets segment has calculated market share of 32% in the year of 2024. Supermarkets and hypermarkets are key distribution channels due to their wide reach and convenience for consumers. Trends include the increasing availability of private label nutraceutical products and dedicated health and wellness sections. Drivers such as the growing consumer preference for one-stop shopping and the trust in established retail brands boost this channel's importance.

Convenience Stores: Convenience stores segment has measured 29% of market share in 2024. Convenience stores benefit from the demand for quick and easy access to nutraceutical products. Trends include the stocking of popular, fast-moving nutraceutical items and health-focused snacks. Drivers such as the increasing pace of urban lifestyles and the need for on-the-go health solutions support the growth of nutraceutical sales in convenience stores.

Online Retail: The online retail segment has captured market share of 13% in 2024. Online retail is rapidly growing due to the convenience of shopping from home and access to a wide range of products. Trends include personalized recommendations, subscription services, and direct-to-consumer brands. Drivers such as the increasing use of e-commerce platforms and the preference for contactless shopping drive the expansion of nutraceutical sales online.

Others: The others segment includes specialty health stores, pharmacies, and direct sales channels. Trends in this segment involve professional recommendations, targeted marketing, and exclusive product lines. This segment has generated market share of 26% in 2024. Drivers include the need for expert advice on health products, the rise of wellness clinics, and the popularity of multi-level marketing for nutraceuticals.

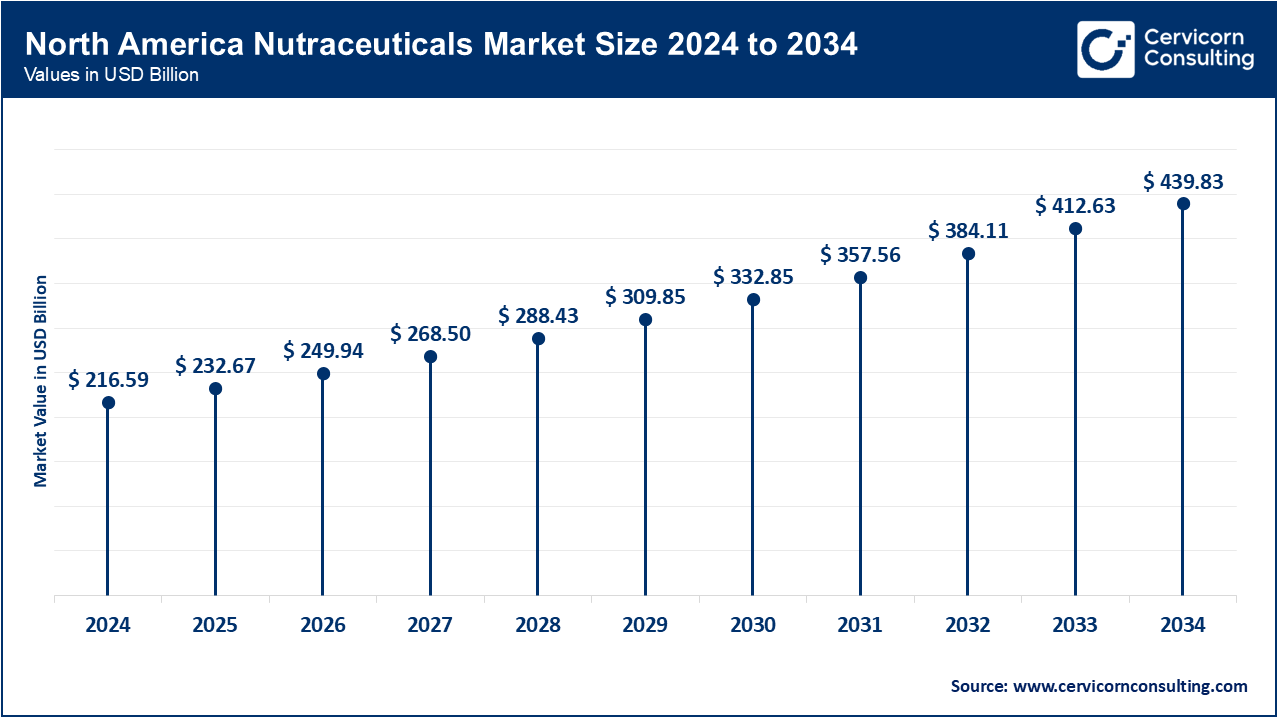

North America is a leading market for nutraceuticals, driven by high consumer awareness and demand for preventive healthcare. The North America market size is expected to reach around USD 439.83 billion by 2034 increasing from USD 216.59 billion in 2024 with a CAGR of 7.43%. The region benefits from advanced research and development, strong regulatory frameworks, and a robust distribution network. Key trends include the growing popularity of functional foods and dietary supplements, driven by rising health consciousness and the prevalence of chronic diseases. The presence of major market players and a well-established retail infrastructure further support market growth.

The Asia-Pacific region is experiencing rapid growth in the nutraceuticals market due to increasing disposable incomes, urbanization, and growing health awareness. Key drivers include the rising prevalence of lifestyle-related diseases and a shift towards preventive healthcare. The Asia Pacific market size is calculated at USD 161.95 billion in 2024 and is projected to grow around USD 328.87 billion by 2034 with a CAGR of 8.30%. Trends favor traditional ingredients combined with modern science, such as herbal supplements and functional foods. Expanding e-commerce platforms and government initiatives supporting health and wellness further propel market growth in this diverse and populous region.

Europe nutraceuticals market is characterized by strong regulatory standards and a high level of consumer health awareness. The demand for natural and organic products is significant, with trends favoring plant-based ingredients and clean label products. Factors such as the aging population, rising healthcare costs, and the emphasis on preventive health measures drive market expansion. The Europe market size is measured at USD 196.84 billion in 2024 and is expected to grow around USD 399.73 billion by 2034 with a CAGR of 7.60%. Innovations in product formulations and the presence of leading nutraceutical companies enhance the region's market dynamics.

LAMEA presents significant growth opportunities for the nutraceuticals market, driven by increasing health awareness and rising disposable incomes. The demand for dietary supplements and functional foods is growing, supported by the region's focus on improving healthcare infrastructure. The LAMEA market size is forecasted to reach around USD 168.45 billion by 2034 from USD 82.95 billion in 2024 with a CAGR of 6.10%. Trends include the use of locally sourced ingredients and the adoption of international health and wellness standards. Challenges such as varying regulatory environments and economic instability are being addressed, enhancing market potential in this emerging region.

Among the key players, Herbalife Nutrition Ltd. and Nature’s Bounty Co. are new entrants leveraging direct-to-consumer sales and personalized nutrition. Nestlé S.A. and PepsiCo Inc. dominate the market, driven by extensive distribution networks and strong brand recognition. Nestlé collaborates with biotech firms for innovative health solutions, while PepsiCo integrates functional ingredients into popular products. DSM Nutritional Products focuses on sustainable practices and R&D, partnering with tech firms to enhance product efficacy. These collaborations and innovations enable both new and established players to meet evolving consumer demands for health and wellness.

Herbalife Nutrition Ltd. John Agwunobi, CEO

"Our mission is to improve nutrition and wellness around the world, and we are committed to delivering high-quality, science-backed products that support healthier lifestyles."

Nestlé S.A. Mark Schneider, CEO

"Nestlé is at the forefront of nutritional science, and we are dedicated to enhancing the quality of life and contributing to a healthier future with our innovative nutraceutical solutions."

PepsiCo Inc. Ramon Laguarta, CEO

"We are transforming our portfolio to offer more nutritious options, integrating functional ingredients to meet the growing consumer demand for health and wellness."

DSM Nutritional Products, Geraldine Matchett, Co-CEO

"Sustainability and innovation are at the core of our strategy, driving us to develop cutting-edge nutritional solutions that benefit both people and the planet."

Amway, Milind Pant, CEO

"Empowering people to live healthier lives through our extensive range of high-quality nutraceutical products remains our primary focus, underpinned by decades of scientific research and development."

GlaxoSmithKline PLC, Emma Walmsley, CEO

"We are committed to advancing the science of nutrition, combining our pharmaceutical expertise with innovative nutraceutical approaches to support global health and wellness."

These statements reflect the CEOs' commitment to innovation, quality, and consumer health, showcasing the strategic focus of leading nutraceutical companies on advancing nutrition science and meeting the evolving wellness needs of consumers.

Market Segmentation

By Product Type

By Form

By Distribution Channel

By Application

By Region