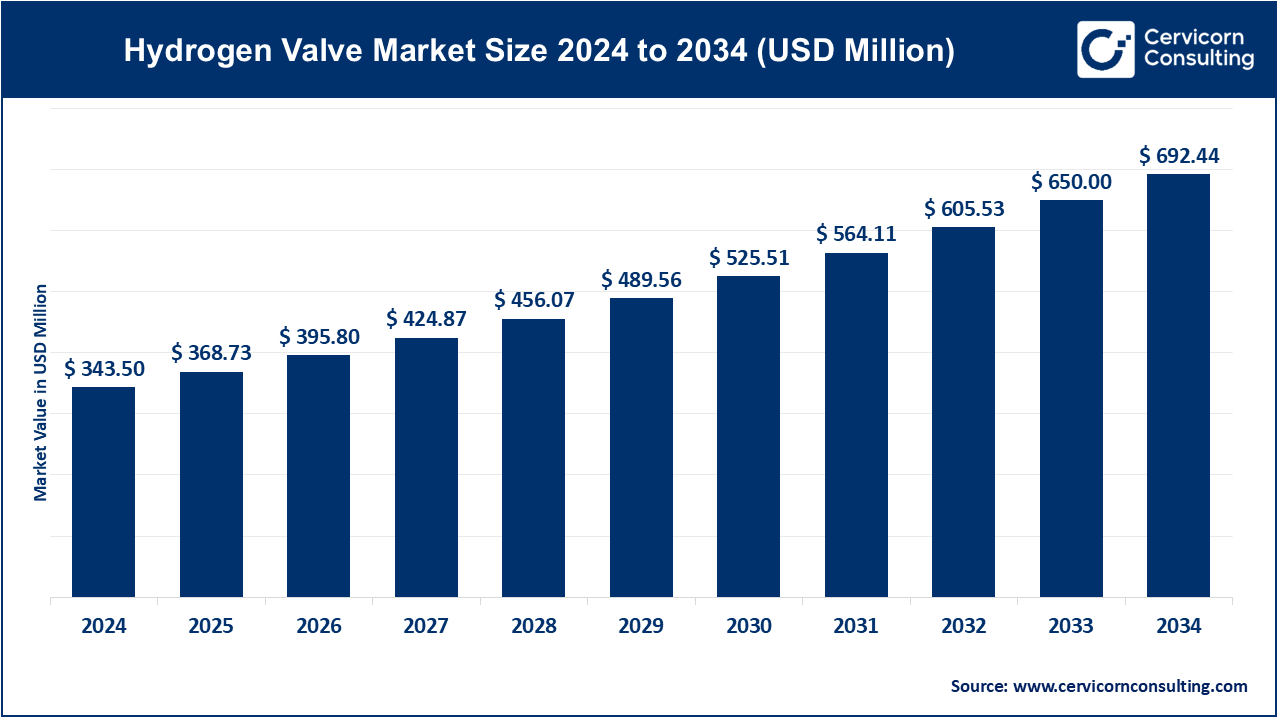

The global hydrogen valve market size was valued at USD 343.50 million in 2024 and is expected to be worth around USD 692.44 million by 2034, growing at a compound annual growth rate (CAGR) of 7.34% from 2025 to 2034.

The global hydrogen valve market is growing rapidly due to the increasing demand for clean energy and hydrogen fuel. As governments worldwide focus on reducing carbon emissions and supporting sustainable energy solutions, hydrogen energy, seen as a green alternative, is receiving significant attention. Hydrogen fuel cells, which are used in vehicles, power plants, and other industries, are driving the need for efficient and reliable hydrogen valves to regulate gas flow under high pressures and demanding conditions. In addition, technological advancements in hydrogen storage and transport are pushing the demand for specialized valves. The hydrogen infrastructure required for energy transition plans, including refueling stations and pipelines, is expanding, which further supports market growth. As more industries adopt hydrogen as a clean fuel source, the hydrogen valve market is expected to experience continued growth, with manufacturers investing in developing highly reliable and advanced valve technologies to meet industry standards.

A hydrogen valve is a device designed to regulate the flow of hydrogen gas within pipelines, storage tanks, or hydrogen-powered systems. It controls the release, pressure, and direction of hydrogen gas to ensure safety and optimal functioning. These valves are typically built from high-strength materials, such as stainless steel or composite materials, to withstand the high pressure and corrosive nature of hydrogen. They are commonly used in industries like energy production, fuel cells, and hydrogen transportation. Hydrogen valves play a critical role in controlling hydrogen's pressure, ensuring it is safely transported or stored without leakage, which is a crucial consideration due to hydrogen's flammability and low molecular weight.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 368.73 Million |

| Projected Market Size (2034) | USD 692.44 Million |

| Growth Rate (2025 to 2034) | 7.34% |

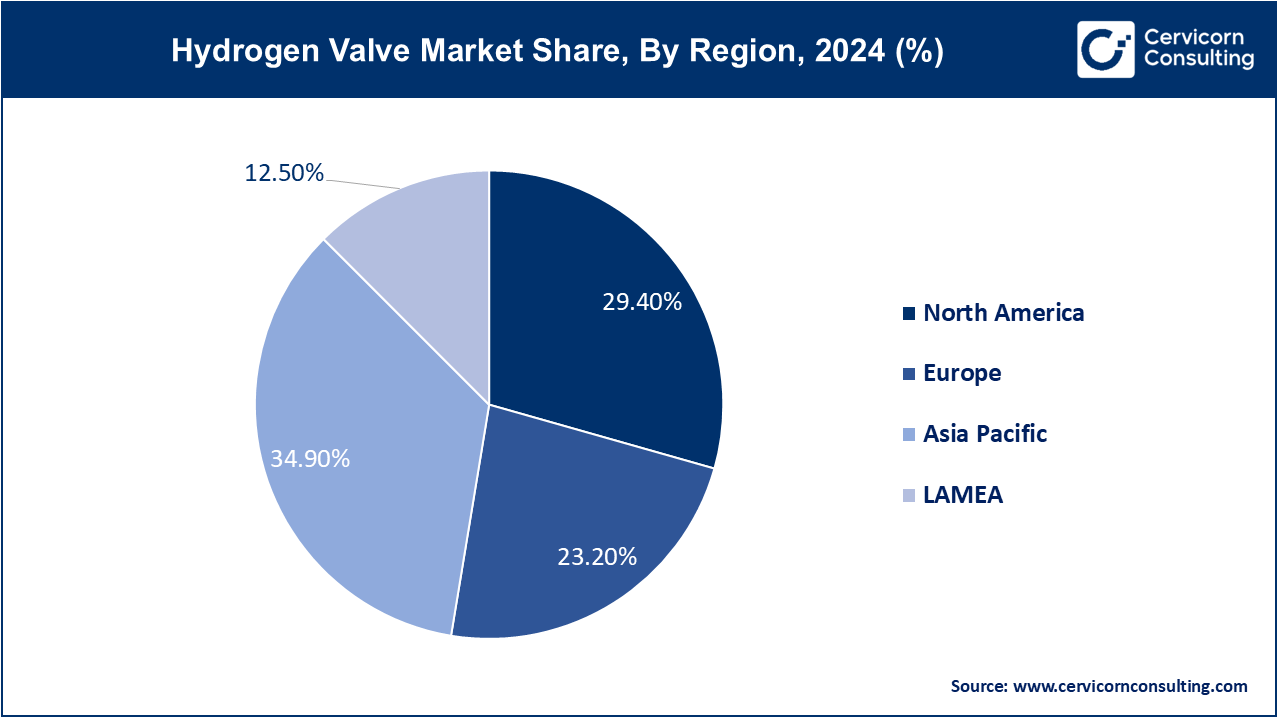

| Leading Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Segments Covered | Product, Material, Pressure Range, Size, Application, End User, Region |

| Key Players | Crane Company, Emerson Electric Co., GSR Ventiltechnik GmbH & Co. KG, Hartmann Valves GmbH, Jaksa d.o.o., Kevin Steel, KITZ Corporation, Oliver Valves Ltd., PARKER HANNIFIN CORP, SLB, Swagelok Company, Trillium Flow Technologies, Valmet, Velan Inc., Westport Fuel System Inc. |

Rapid Adoption of Hydrogen as Clean Energy Fuel

Growth in Hydrogen-Powered Infrastructure

Higher Initial Cost

There are also low-cost options as well

Hydrogen for Use in IC Engine Vehicles

Public-Private Partnerships and Government Incentives

Extreme Flammability and Embrittlement Due To Hydrogen

Possibility of Leaks in Packaging and Joints

The hydrogen valve market is segmented into product type, material, pressure range, size, application, end-user industry and region. Based on product type, the market is classified into hydrogen ball valve, hydrogen check valves, hydrogen needle valves, hydrogen pressure relief valves, hydrogen pressure solenoid valves, pressure regulating valves, flow control valve, and others. Based on material, the market is classified into stainless steel, aluminum, and others. Based on pressure range, the market is classified into <50 BAR, >50-350 BAR, >350-700 BAR, >700-1,000 BAR, and >1,000 BAR. Based on size, the market is classified into <1", >1"-6", >6"-12", >12"-20", and >20". Based on application, the market is classified into hydrogen production, hydrogen fueling station, hydrogen storage, hydrogen transportation, and others. Based on end-user industry, the market is classified into oil & gas, energy & power, pharmaceutical, chemical, metals & mining, automotive, and others.

Hydrogen Check Valves: Hydrogen check valves are one-way flow components that are inserted in the hydrogen systems to avoid backflow and ensure hydrogen flows in the right direction. They are very important in hydrogen fuel stations, pipelines, and storage facilities as backflow can cause equipment or contamination.

Hydrogen Needle Valves: Hydrogen needle valves are specific types used in precision flow control that allow for proper flow regulation of hydrogen in gas or liquid state in the entire system or any appliance. It has a thin plunger that helps to make slight variations when regulating the hydrogen flow.

Hydrogen Pressure Relief Valves: Hydrogen pressure relief valves are installed wherever the risks stem from the hydrogen circuit, high pressure hydrogen tanks, compressor, pressure tanks, CNG-applications, as well as the pressure cylinder pack. They avoid equipment failure or damage due to rise in pressure since these devices vent off excess pressure whenever the system operative pressure exceeds a pre-set level, and then shut when system pressure drops below a set level.

Hydrogen Pressure Solenoid Valves: Hydrogen pressure solenoid valves are small energy-efficient electromechanical valves used in a wide range of industrial and automotive applications. The product is compact, with low energy consumption, and it's very reliable.

Pressure Regulating Valves: Hydrogen pressure regulating valve reduces hydrogen gas pressure from a high-pressure storage tank to the level of a fuel cell stack. It is a critical component in the development of CO2-free fuel cell vehicles, these valves provide reliable and constant hydrogen pressure under all conditions and protect hydrogen circuits, pipes, and tanks.

Stainless Steel

The stainless steel segment has dominating the market, captured revenue share of 46.80% in 2024. Hydrogen valves commonly use stainless steel offering resistance from corrosion acting as a strong and sturdy. It is very durable both to internal pressure higher than normal, and also to operational temperature lower than expected. Stainless steel valves are used in high-pressure hydrogen systems, such as refuelling stations, storage tanks, pipelines, and industrial applications.

Aluminum

The aluminum segment has generated revenue share of 34.70% in 2024. In contrast to its weight, aluminum possesses good corrosion and heat transfer characteristics which makes it suitable for hydrogen valve applications. It is used in low to medium pressure hydrogen systems, including transportation and mobile storage systems, and also in more lightweight applications as portable hydrogen storage vessels, hydrogen-powered transport, and drones.

Others

Others segment has reported revenue share of 18.50% in 2024. Other metals utilized during the production of hydrogen valves include nickel alloys, titanium, polymers, and composites, among others. Nickel alloys such as Inconel and Hastelloy find applications in hydrogen processing plants, fuel cells, and aerospace to maintain resistance to hydrogen embrittlement, high temperatures, and corrosion.

Hydrogen Production

The hydrogen production segment has accounted revenue share of 22.60% in 2024. Hydrogen Valves are used in the three primary processes: electrolysis, steam methane reforming (SMR), and biomass gasification. They are used to control the gas flows in the production process but are also useful in safety applications besides providing the necessary pressure levels in reactors, electrolysers, etc.

Hydrogen Fueling Station

The hydrogen fueling station segment has garnered revenue share of 11.30% in 2024. Hydrogen valves are the core of hydrogen fuelling stations as they are believed to regulate the safe transfer of hydrogen from the storage tanks to the vehicles' fuel cells. They decide on pressure regarding the existence of suitable pressure and volume pertaining to the safety procedure.

Hydrogen Storage

The hydrogen storage segment has dominated the market, accounted revenue share of 39.70% in 2024. Hydrogen storage valves play a very prominent role in storage since they ensure safe confinement under extreme pressure. Filling, discharge, and venting of the processes in tanks and containers must be done within secure means in order to allow safe storage and release.

Hydrogen Transportation

The hydrogen transportation segment has held revenue share of 18.40% in 2024. Hydrogen valves are supposed to be crucial for transporting hydrogen in order to store it safely and control the changes in hydrogen pressure transport. They maintain hydrogen flow in pipes, regulate it in tanks, and even offer a leak prevention and emergency shut-off facility.

Others

The others segment has generated revenue share of 8% in 2024. Others applications of hydrogen valve use in fuel cells, industrial hydrogen use, and research and development facilities. Other uses involve safe and efficient operations in systems where hydrogen is a fuel or energy carrier.

Oil & Gas: The oil and gas industry utilize hydrogen valves in critical operation as they handle hydrogen gas flow with regulated pressure for safe running. As the usage of clean energy is increasing, the demand for application-specific valves featuring high pressure along with a corrosive environment is growing.

Energy & Power: Hydrogen is used as a fuel used in hydrogen fuel cells to generate power. It is also a storage system for powering renewable energy sources, and control valves are utilised both in the facilities generating power and in the store. Demand for high-performance valves fosters adoption of hydrogen fuel cell technology.

Pharmaceutical: Hydrogen valves in pharmaceutical industries are used to control the flow of hydrogen accurately enough with total safety and under legal compliance at synthesis processes. The demand for reliable and strongly built valves designed for high operation stresses is rapidly increasing.

Chemical: Hydrogen is an important feedstock in the chemical industry primarily for the production of ammonia and methanol. Valves regulate the hydrogen in the reactors and storage facilities. The pursuit of green ammonia production, which relies on renewable hydrogen, is thus driving demand for specialty valves.

Metals & Mining: Hydrogen is employed in metallurgical processes for the reduction of metal ores, and so high-performance valve solutions are needed in this area for safe and efficient operation, in particular because greener mining technologies in furnaces are gaining in importance and significantly increasing usage of hydrogen.

Automotive: The automobile industry places a lot of emphasis on zero-emission vehicles. This has increased investment in hydrogen fuel cell technology. With the growth of usage of FCVs, there is a growing need for strong hydrogen valves as the flow of hydrogen can only be manageable with efficient hydrogen valves.

Others: Hydrogen is used in industries, including food processing, electronics manufacturing, and aerospace, which require good control and safety measures. There is a growing need for versatile valve solutions that work under various conditions.

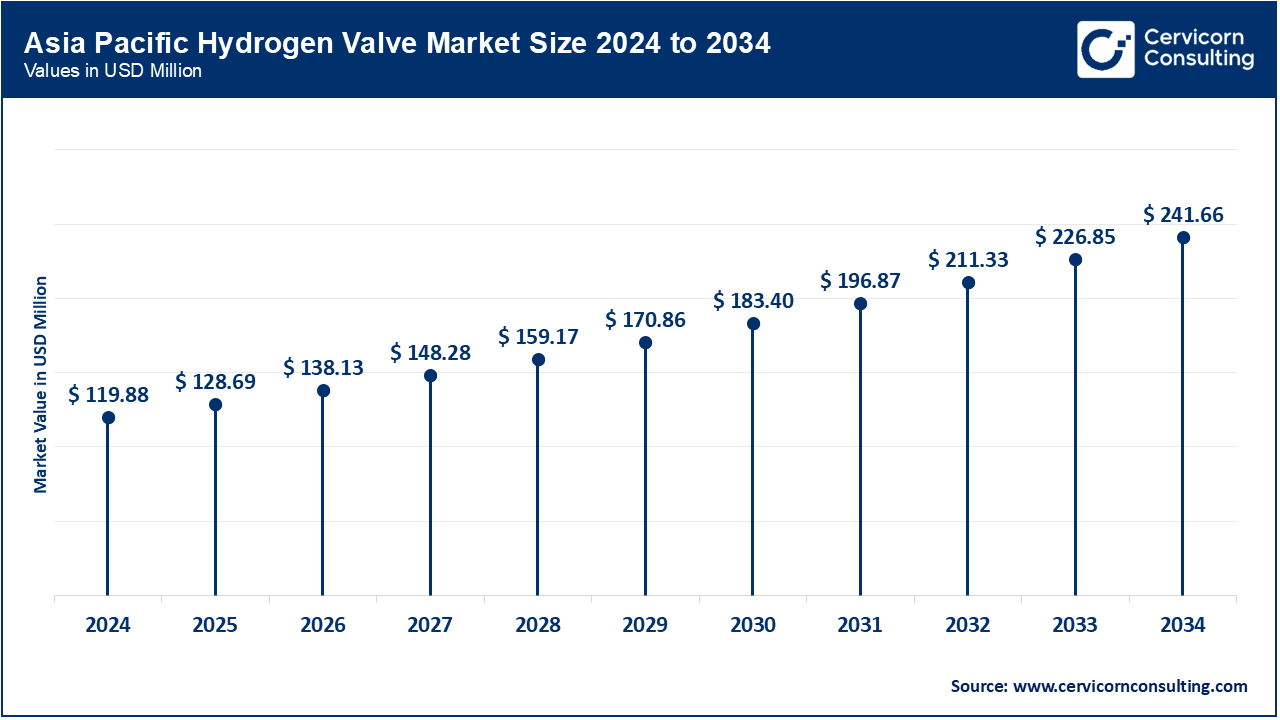

The Asia-Pacific hydrogen valve market size is predicted to surpass around USD 241.66 million by 2034 from valued at USD 119.88 million in 2024. Huge investments are currently being made in the hydrogen infrastructure by countries such as China, Japan, South Korea, and Australia, and the Asia Pacific region is therefore growing at a large size. Japan and South Korea are reformation energies, which will eventually increase the demand for hydrogen valves due to hydrogen fueling stations, fuel cell systems, and transportation systems.

The North America hydrogen valve market size was estimated at USD 100.99 million in 2024 and is expected to reach around USD 203.58 million by 2034. North America and, specifically, the US and Canada, constitutes an important area for hydrogen valves, since investments in infrastructure are gaining momentum and initiatives to promote clean energy attract attention to hydrogen. Rapid infrastructure development is underway at a rapid pace, with the US Department of Energy's Hydrogen Energy Earthshot Initiative supporting hydrogen fuel cell vehicles coming into the market and consequently requiring high-quality valves on their manufacturing lines.

The Europe hydrogen valve market size was accounted for USD 79.69 million in 2024 and is projected to hit around USD 160.65 million by 2034. Europe is driving the hydrogen economy and the Green Deal and Hydrogen Strategy for a Climate-Neutral Europe by the EU are providing improvements in infrastructure. Germany, France, and the Netherlands are all developing an expanding hydrogen refueling network for hydrogen fuel cell vehicles increasing demand for hydrogen valves.

The LAMEA hydrogen valve market was valued at USD 42.94 million in 2024 and is expected to reach around USD 86.55 million by 2034. LAMEA region is gaining significance in the global hydrogen economy, especially in the Middle East and Africa, where investment is expected for large projects. These projects have translated into increased demand for hydrogen valves in production facilities, storage systems, as well as transportation networks.

New players such as müller co-ax gmbh are focusing on the development of high-pressure valves ranging upto 1,000 bar and a very high Kv valve. These Valves provide a comprehensive solution for the production, transportation, and distribution of hydrogen throughout the entire value chain. While dominating players like Air Liquide and Linde plc stand out due to their extensive global hydrogen infrastructure and industry expertise. Air Liquide excels with its expansive hydrogen networks and advanced storage solutions, while Linde plc drives innovation through its strategic partnerships and R&D efforts. Both established and emerging players are crucial in advancing hydrogen storage technologies and integrating them into broader energy systems.

Strategic partnerships and acquisitions highlight the rapid advancements and collaborative efforts in the hydrogen valve market. Industry players are involved in various aspects of hydrogen energy storage, including production, storage technologies, and fuel cells, and play a significant role in advancing the market. Some notable examples of key developments in the hydrogen valve market include:

These developments underscore significant strides in advancing hydrogen infrastructure and technology, reflecting growing collaborations and strategic investments aimed at expanding the global hydrogen economy.

By Product Type

By Material

By Pressure Range

By Size

By Application

By End-user Industry

By Region