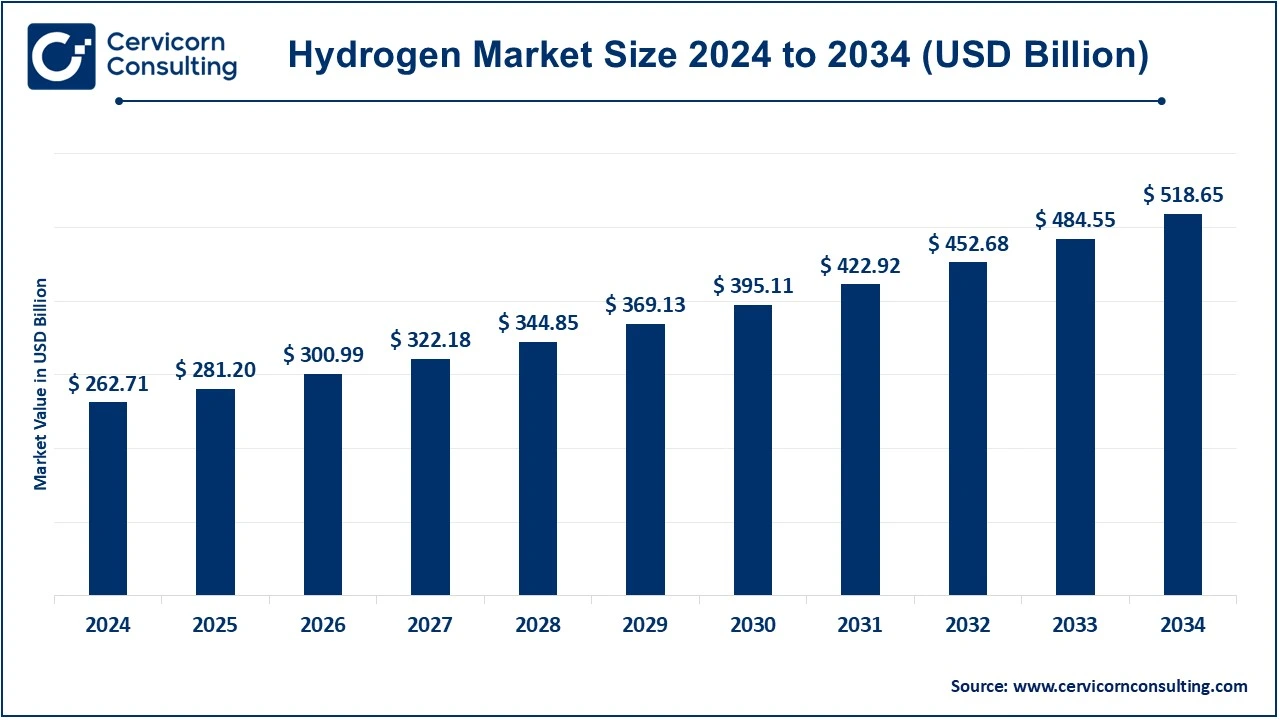

The global hydrogen market size was valued at USD 262.71 billion in 2024 and is expected to surpass around USD 518.65 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.03% over the forecast period 2025 to 2034.

Hydrogen market is growing very robustly driven by a combination of the global push for cleaner energy, government policies and incentives that are supporting decarbonization, and improvements in hydrogen production technologies. To reduce carbon emissions, both industries and governments are seeing hydrogen as a key solution for sectors that are tough to electrify, including heavy industry, transportation, and long-duration energy storage. Investment in infrastructure, that is hydrogen fueling stations and pipelines, as well as the breakthroughs concerning green hydrogen production, especially about power from renewable sources for the electrolysis, is thus furthering the growth in the market. Hence, there is a critical role in the shift to a low-carbon economy played by hydrogen.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 262.71 Billion |

| Expected Market Size in 2034 | USD 518.65 Billion |

| Projected CAGR 2025 to 2034 | 7.03% |

| Leading Region | Asia Pacific |

| Key Segment | Technology, Source, Generation and Delivery Type, Storage, Application, Region |

| Key Companies | BASF SE, Air Liquide, Air Products and Chemicals, Inc., Linde Plc, Messer SE & Co. KGaA, Bhuruka Gases Limited, Thai Special Gas Company Limited, Taiyo Nippon Sanso Corporation, Yueyang Kaimeite Electronic Specialty Rare Gases Co., Ltd., Coregas, The Wengfu Group |

The hydrogen market is segmented into technology, source, generation and delivery type, storage, application, region. Based on technology, the market is classified into steam methane reforming (SMR), partial oxidation (POX), coal gasification, electrolysis. Based on source, the market is classified into blue hydrogen, grey hydrogen, and green hydrogen. Based on generation and delivery type, the market is classified into captive, by-product, and merchant. Based on storage, the market is classified into on-board storage, underground storage, and power-to-gas storage. Based on application, the market is classified into petroleum refinery, ammonia production, methanol production, transportation, and power generation.

Steam Methane Reforming (SMR): It is the most prevalent process for hydrogen production. Methane reacts with steam in the presence of a catalyst to produce hydrogen and carbon dioxide. It is used extensively because it is very efficient, but it's carbon-intensive, which leads to environmental issues. SMR usually needs natural gas as feedstock; hence, it is economical in regions that have vast reserves of natural gas. It produces a large quantity of hydrogen but is one of the major sources of carbon emissions in the world.

Partial Oxidation (POX): This is the alternative method for the production of hydrogen. In this procedure, hydrocarbons such as natural gas or oil are combusted partially in the presence of oxygen to produce the syngas. These syngases are further purified to extract hydrogen. Smaller molecules are preferred through this method, which works faster than SMR but can handle a larger and heavier range of feedstock. However, it creates carbon dioxide as well as similar to SMR is high energy consuming and less favorable to the environment, less friendly than electrolysis's cleaner alternatives.

Coal Gasification: It converts coal into syngas—a mixture of hydrogen, carbon monoxide, and carbon dioxide—using high-temperature steam and oxygen. The syngas can then be processed further to separate hydrogen. Coal gasification is used in areas with high reserves of coal and can produce huge volumes of hydrogen. However, it is very carbon-intensive, which adds a large volume of greenhouse gases. Steps are being taken to capture the CO2 emissions but this process hurts the environment.

Electrolysis: It breaks water into hydrogen and oxygen using electricity. When used with renewable energy sources like solar or wind, it is considered one of the cleanest ways of producing hydrogen. The key advantage of electrolysis is that it produces no direct emissions, making it a critical technology for the decarbonization of industries. However, electrolysis is still a costlier process than SMR or POX because electricity and infrastructure are expensive. Economically, it is getting better with the declining cost of renewable energy.

Captive: Hydrogen production is on-site hydrogen, which is manufactured, mostly in industrial installations, like refineries and chemical plants, for supply to consumers within the manufacturing plant. Captive production provides assured supply without needing to transport hydrogen or to acquire it from the outside market. Such a production scheme makes economic sense when there are significant consumption requirements of a particular quantity for a particular product, like ammonia or methanol production. However, it may not give the flexibility or scale benefits of merchant production, and infrastructure costs are big.

By-product: Hydrogen is produced as a by-product from industrial-related processes like the manufacturing of chlorine or the refinement of crude oil. They are normally collected and purified in order to be reused in either refining, ammonia, or manufacturing chemicals. This process can be cheaper than on-site hydrogen production because it uses readily available industrial-related processes. By-product hydrogen is usually also limited in quantity and often in purity, and therefore its availability depends on scale and nature of the primary producing processes involved.

Merchant: Merchant hydrogen refers to hydrogen that is generated in central plants solely for distribution to external customers. It usually finds its way to consumers like refineries, chemical plants, and transportation sectors by pipelines, trucks, or tankers. Merchant hydrogen is usually produced in a bigger quantity than captive hydrogen, and it is sold commercially. Merchant hydrogen is versatile and can be applied in a wide range of industries, but transport and storage costs are factored into the end price. Merchant hydrogen forms an increasingly important share of global energy markets as demand rises.

On-board Storage: It simply means that storing hydrogen in a vehicle or movable unit, usually in combination with high-pressure tanks or cryogenic storage systems. This would become highly crucial to applications like hydrogen-fuelled vehicles, because of the portability and efficiency the requirement would be. With on-board storage, fueling times can thus approach those of conventional gasoline- or diesel-fuelled vehicles, thus making hydrogen accessible to the transportation sector. It does, however, have large infrastructure investment and poses technical challenges in terms of safety, storage density, and overall energy efficiency, particularly for long-distance applications.

Subsurface Storage: This is the natural storage of salt caverns, depleted oil fields, and aquifers. It would give large-scale, long-duration storage, which can sometimes balance intermittent renewable power generation. Hydrogen could then be injected into those caverns when demand is at low levels or when supplies are in excess and then returned up when needed. It is an economical method to control surplus energy and help in grid stability but needs to be well maintained so that no leakages occur and the storage site is not compromised.

Power-to-Gas Storage: This is a process of converting excess renewable electricity into hydrogen by electrolysis. It is stored and can be drawn on later to generate electricity or other industrial purposes. The energy storage solution helps to balance the supply and demand for power grids. Power-to-gas can store large amounts of energy for long durations, thereby bypassing the intermittency challenge posed by renewable energy sources. However, it is still in its early stages, and high costs for a large-scale implementation make it not widely adopted.

Petroleum Refinery: Hydrogen is primarily used in hydrocracking and desulfurization. Hydrogen is one of the primary necessities to upgrade crude oil into premium fuels such as gasoline, diesel, and jet fuel. It helps in removing sulfur impurities existing in fuels that upgrade them and reduce harmful emissions. The quantity of hydrogen required in the refinery is quite large; hence, refineries are significant users of industrial hydrogen. However, refiners are increasingly looking for low-carbon hydrogen sources to reduce their environmental impact, especially as governments introduce stricter emissions regulations and move towards cleaner fuels.

Ammonia Production: It relies heavily on hydrogen to produce ammonia, which is a key ingredient in fertilizers. The Haber-Bosch process, which synthesizes ammonia, uses hydrogen derived mainly from natural gas. Hydrogen is indispensable to world food production, thus the role of hydrogen is significant in the agricultural sector. The carbon footprint of producing hydrogen is a significant problem associated with hydrogen production especially from natural gas. Steps are underway to implement green hydrogen into ammonia plants to minimize the carbon footprint associated with the crucial industrial process.

Methanol Production: It uses hydrogen to manufacture methanol, a versatile chemical that is used in plastics production, adhesives, paints, and as a fuel. Hydrogen is mixed with carbon monoxide in a catalytic process to produce methanol. Methanol has broad applications in different industries, and it is a significant consumer of hydrogen in areas where the petrochemical industry is very strong. Like ammonia, there is increased interest in shifting to green hydrogen for methanol production as a way of increasing sustainability and reducing dependence on fossil fuels.

Transportation: It uses hydrogen as a clean fuel alternative in vehicles, especially in hydrogen fuel cell electric vehicles (FCEVs). Hydrogen-powered cars, trucks, buses, and even trains are a promising solution to reduce emissions from the transport sector. Fuel cells convert hydrogen into electricity, which powers electric motors. The only byproduct of this application is water vapor. This application is on the rise in regions that are keen to reduce carbon footprint in the transport sector. Challenges remain, however, such as infrastructure, cost of vehicles, and hydrogen production before this application can be more widespread.

Power Generation: It uses hydrogen as a fuel in conventional turbines and fuel cells, respectively. Hydrogen can replace natural gas in turbines, which means clean energy for grid stability and base-load power. On the other hand, hydrogen fuel cells can produce electricity more efficiently than traditional fuel cells in distributed power generation systems. Hydrogen has a good potential to solve the problem of decarbonization of the power sector when used in combination with renewable sources such as wind and solar. However, the cost of its production is so high that it cannot be widely applied for generating power.

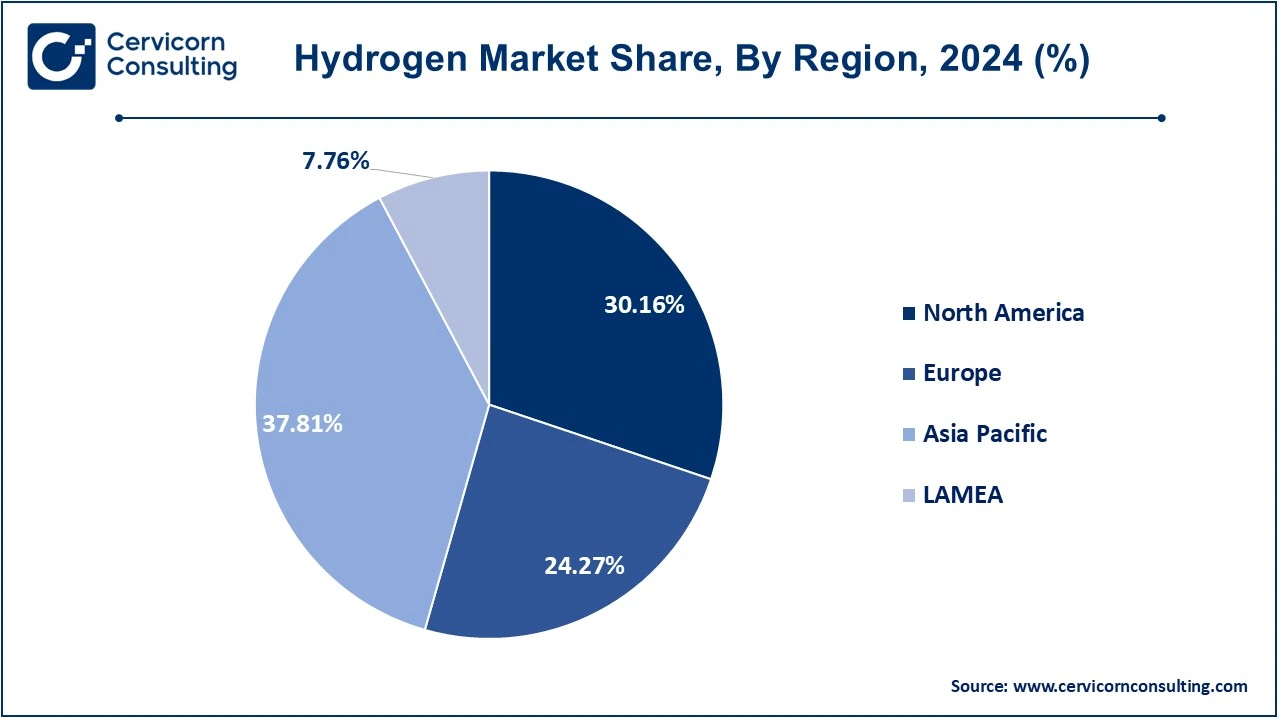

The hydrogen market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

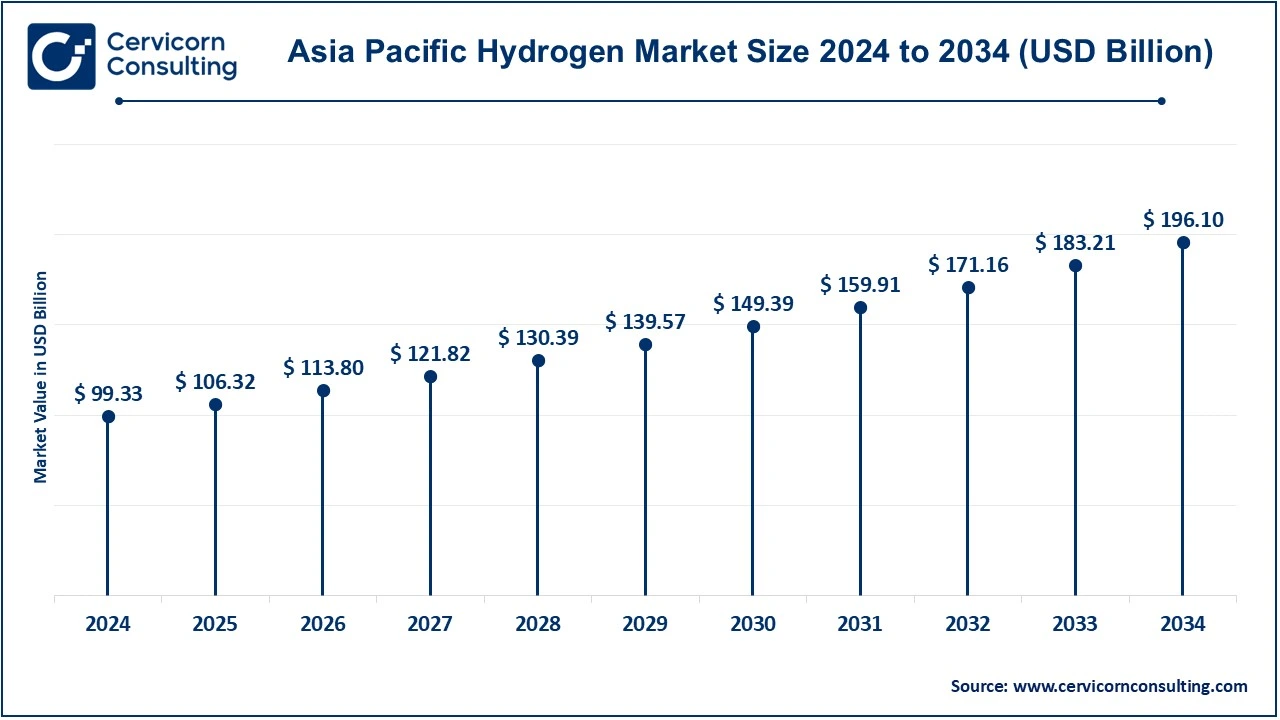

The Asia-Pacific hydrogen market size was valued at USD 99.33 billion in 2024 and is predicted to surpass around USD 196.10 billion by 2034. The Asia-Pacific region is moving ahead with a very high speed in the hydrogen sector. It is the most important player for Japan, South Korea, and China. Japan was always the pioneer country in the development of hydrogen-based fuel cells and vehicles, mainly transportation-based. South Korea has been more focused on FCEVs and hydrogen infrastructure development. With huge industrial capacity, China is expanding its production capabilities, particularly for green hydrogen. The site would be a perfect place for innovation and commercialization in hydrogen with much emphasis on clean energy solutions in the region.

The North America hydrogen market size was accounted for USD 79.23 billion in 2024 and is expected to reach around USD 156.42 billion by 2034. The North American hydrogen market is made up of two countries, the United States and Canada, which highly invest in hydrogen production as well as technology. The U.S. leads globally in the applications of hydrogen, in particular fuel cells, industrial use and transportation. Hydrogen infrastructure is centered in California. For example, in November 2024, Mitsubishi Heavy Industries successfully tested its cryogenic hydrogen pump for more than 1,200 hours at the US Livermore Hydrogen Hub operated by FirstElement Fuel. The pump had 1,500 refueling cycles without a single stop. The 900 bar Class Ultra-High-Pressure Liquid Hydrogen Booster Pump demonstrated the highest durability and efficiency by pumping about 140 tonnes of liquid hydrogen at a rate of 160 kg per hour. MHI will install next year at a large hydrogen station to be built in Japan, marking a start to the spread of a hydrogen economy. Canada focuses on developing green hydrogen, especially in Alberta, which is full of renewable energy resources like wind and solar. Both countries are also working on policy changes that will help with the adoption of hydrogen in their transition to clean energy.

The Europe hydrogen market size was estimated at USD 63.76 billion in 2024 and is projected to hit around USD 125.88 billion by 2034. Europe is a prominent player in the hydrogen industry globally, with Germany, France, and the Netherlands being in leadership in hydrogen technology and policymaking. The European Union wants to decarbonize by 2050; indeed, hydrogen is an indispensable part of this plan. As such, Germany is currently invested in large-scale projects whereas the Netherlands focuses on industrial purposes through hydrogen. For example, Germany has spent some USD 21.1 billion until 2032 for building the hydrogen infrastructure and would implement an integrated core network by July 2024 to facilitate the production, consumption, storage, and import of hydrogen. The draft law passed by the federal cabinet should finance that plan covering some 9,700 kilometers of pipelines, including 60% of repurposed natural gas lines. France is further backing hydrogen-based transportation and will attempt to form a hydrogen economy to meet carbon-neutrality targets.

The LAMEA hydrogen market size was valued at USD 20.39 billion in 2024 and is anticipated to reach around USD 40.25 billion by 2034. The LAMEA region, which is Latin America, the Middle East, and Africa, is slowly surfacing as a significant area for hydrogen development. In Latin America, countries such as Brazil are developing hydrogen as a renewable source of energy. Green hydrogen from wind and solar power is the emphasis in the region. In the Middle East, due to large energy resources, it is investing in diversification through hydrogen, primarily in the UAE and Saudi Arabia. The new opportunities for South Africa are with hydrogen in the clean energy strategy being pursued by these nations, with a massive potential for renewable hydrogen.

Some of the major players dominating the market of hydrogen are BASF SE, Air Liquide, Air Products and Chemicals, Inc., Linde Plc, and Messer SE & Co. KGaA among others. These companies have been utilizing advanced technologies along with innovative processes such as electrolysis, steam methane reforming (SMR), and carbon capture and storage (CCS) to manufacture hydrogen on a large scale. In addition to that, they are investing in renewable sources of energy like wind and solar. Using this, they drive the sustainability of the company into hydrogen production. Strategic partners or acquisitions are also key contributors to their market supremacy. With the companies mentioned, firms are thus expanding their production hydrogen and distribution networks around the globe.

CEO Statements

Dr. Markus Kamieth, CEO of BASF SE

François Jackow, CEO of Air Liquide

Sanjiv Lamba, CEO of Linde Plc

Market Segmentation

By Technology

By Source

By Generation and Delivery Type

By Storage

By Application

By Region