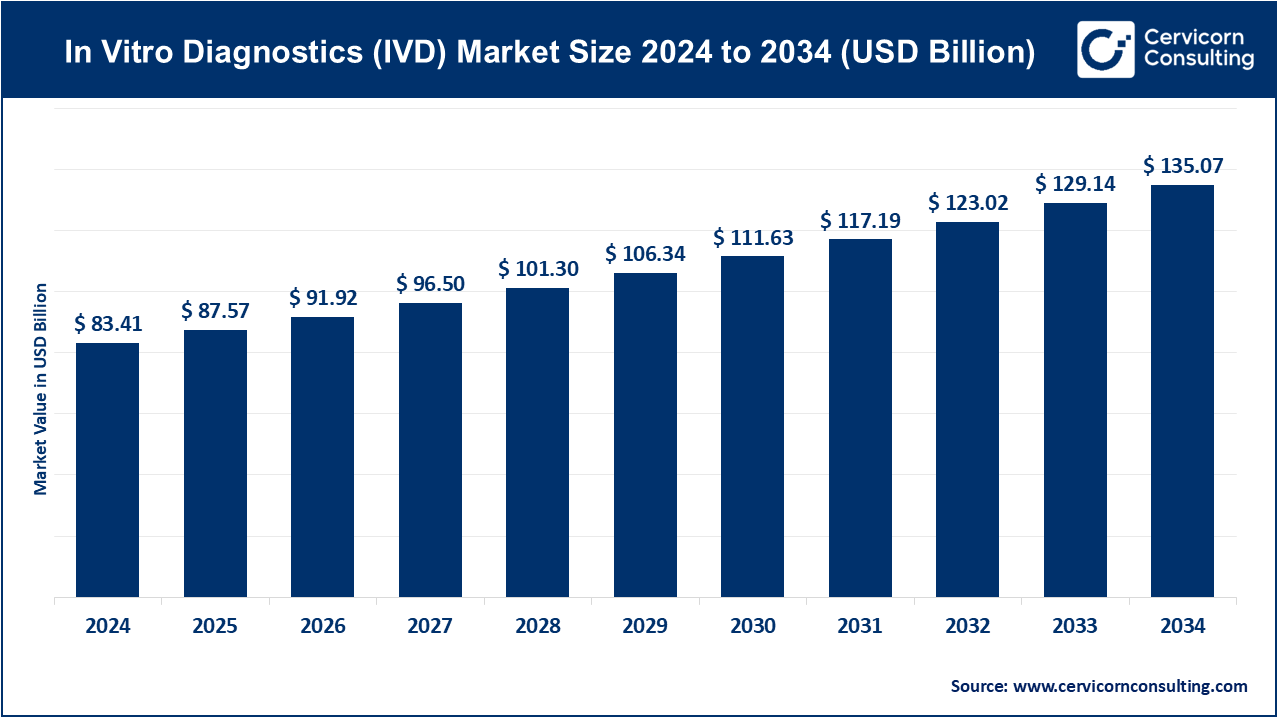

The global in vitro diagnostics (IVD) market size was accounted at USD 83.41 billion in 2024 and is forecasted to reach around USD 135.07 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.97% from 2025 to 2034.

The global in vitro diagnostics (IVD) market has experienced significant growth in recent years, driven by advancements in healthcare technology, increasing awareness of early disease detection, and rising demand for personalized medicine. Factors such as aging populations, the prevalence of chronic diseases, and the growing need for point-of-care testing have further propelled market growth. The demand for IVD tests has increased across various segments, including molecular diagnostics, immunoassays, and clinical chemistry. As healthcare systems continue to prioritize early diagnosis and prevention, the adoption of IVD solutions has surged worldwide. In the coming years, the IVD market is expected to continue its upward trajectory due to technological innovations like the integration of artificial intelligence and automation in diagnostic processes. Additionally, the growing trend of home-based diagnostics and the ongoing focus on precision medicine are anticipated to contribute significantly to market expansion.

In Vitro Diagnostics (IVD) refers to medical tests conducted on samples such as blood, urine, tissue, or other bodily fluids collected from a patient. These tests are performed outside the human body, typically in a laboratory setting, to detect diseases, conditions, or infections, and to monitor a patient’s health status. IVD devices include a wide range of products such as reagents, test kits, instruments, and software, designed for use in medical labs, hospitals, and even at home for self-testing. IVD tests can help in diagnosing chronic diseases, infectious diseases, genetic disorders, and more, providing crucial information that assists in patient care. Common examples of IVD tests include blood glucose monitoring, pregnancy tests, genetic screenings, and cancer diagnostics.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 87.57 Billion |

| Market Growth Rate | CAGR of 4.97% from 2025 to 2034 |

| Market Size by 2034 | USD 135.07 Billion |

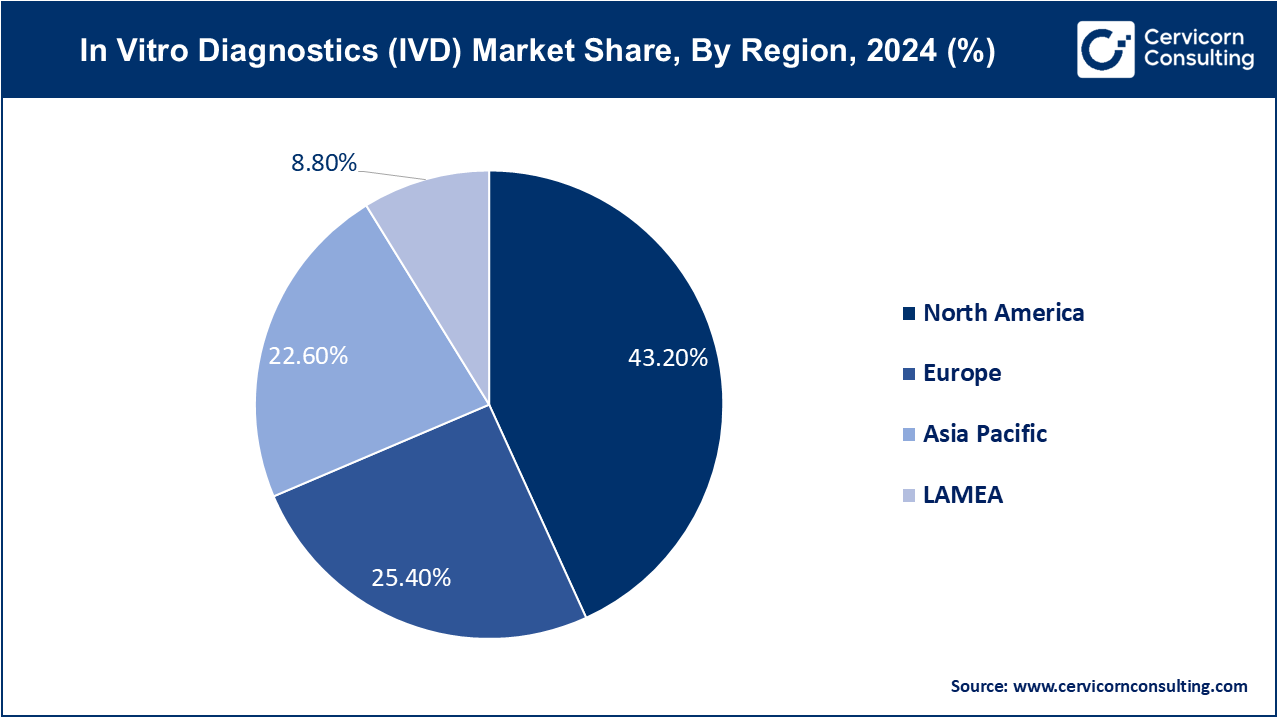

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | By Product, Technology, Application, Test Location, End-use and Regions |

Increasing government Initiatives and Funding

Rising Health Awareness and Preventive Healthcare

High Costs and Reimbursement Issues

Regulatory Challenges

Emerging Markets

Telemedicine and Remote Diagnostics

Data Privacy and Security:

Regulatory Hurdles

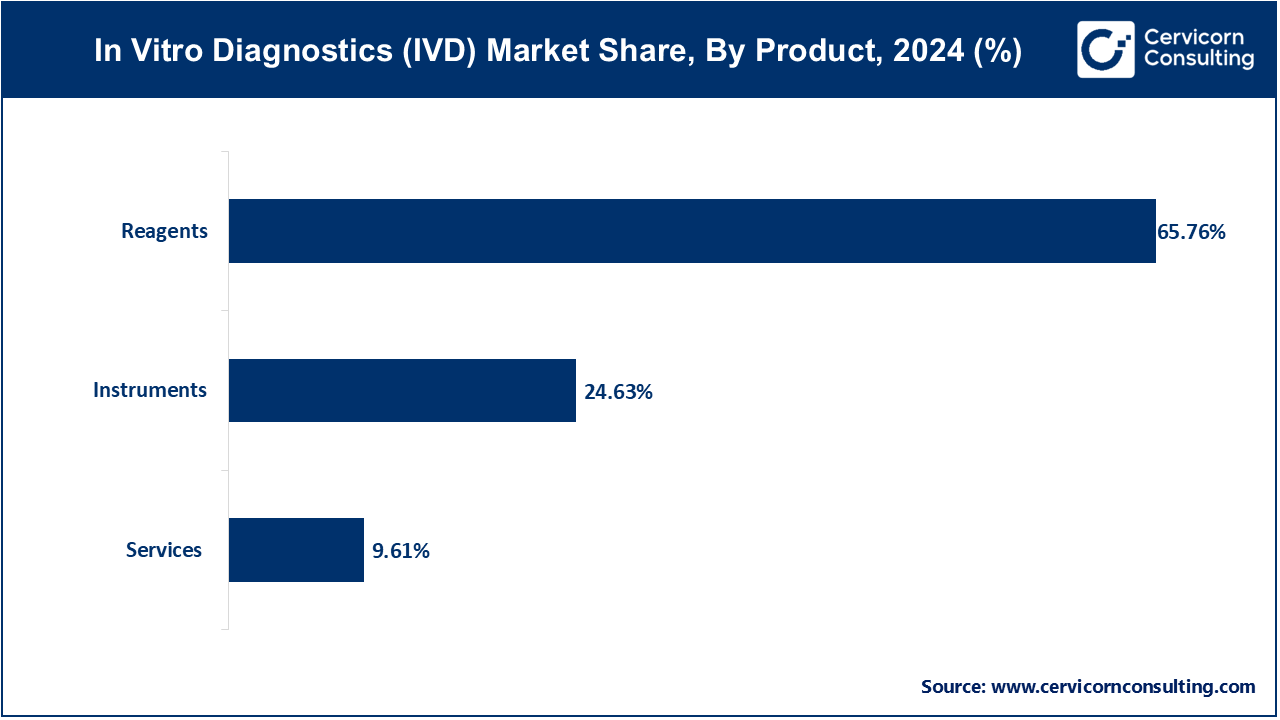

Instruments: The Instruments segment has calculated market share of 24.63% in 2024. In the in vitro diagnostic (IVD) market, instruments encompass a wide range of devices used for diagnostic testing, such as analyzers, readers, and testing platforms. The trend in this segment includes advancements in automation, miniaturization, and integration with digital technologies for enhanced efficiency and accuracy in diagnostic processes. Key drivers include demand for faster turnaround times, scalability, and the need for integrated diagnostic solutions across various healthcare settings.

Reagents: Reagents are essential chemicals, antibodies, or biomolecules used in diagnostic tests to detect specific targets like proteins or nucleic acids. Market trends involve the development of high-sensitivity and multiplex assays, which allow simultaneous detection of multiple analytes. This segment has registered highest market share of 65.76% in 2024. Drivers include the expanding applications of molecular diagnostics, personalized medicine, and the increasing prevalence of chronic diseases necessitating precise and reliable diagnostic tools.

Services: The services segment in the IVD market includes laboratory testing services, contract research services, and maintenance and support for diagnostic equipment. The services segment has covered market share of 9.61% in 2024. Market trends focus on the growth of outsourcing diagnostic services, particularly in emerging markets, to reduce operational costs and improve accessibility to advanced diagnostic technologies. Drivers include the rising demand for specialized testing capabilities, regulatory compliance requirements, and the need for efficient healthcare delivery models that support integrated diagnostics and patient care pathways.

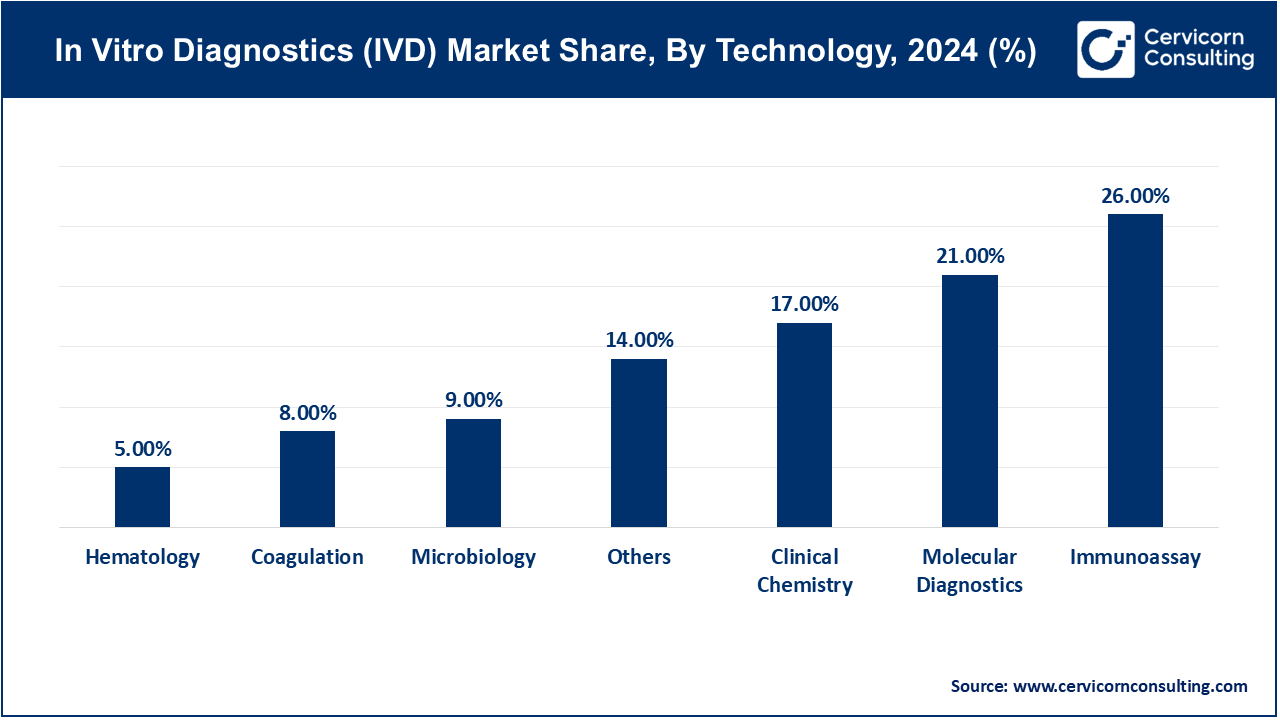

Immunoassay: Immunoassay technology in the IVD market is witnessing growth due to its sensitivity and specificity in detecting biomolecules like proteins and antibodies. This segment has Reported market share of 26% in 2024. Trends include the development of multiplex assays for simultaneous detection of multiple analytes, expanding applications in infectious disease diagnostics and oncology. Drivers include demand for rapid, accurate diagnostic tests and increasing prevalence of chronic diseases requiring frequent monitoring.

Hematology: Hematology technology focuses on analyzing blood samples to diagnose conditions like anemia, infections, and blood cancers. In 2024, hematology segment has covered market share of 5%, Market trends include automation of hematology analyzers for high-throughput testing, advancements in cell counting accuracy, and integration with digital solutions for remote monitoring. Drivers include the aging population, rising incidence of blood disorders, and the need for rapid turnaround in diagnostic results.

Clinical Chemistry: Clinical chemistry involves analyzing biochemical components in bodily fluids such as blood and urine. Trends include miniaturization of analyzers, development of point-of-care testing solutions, and expansion in therapeutic drug monitoring applications. Drivers include the demand for real-time diagnostics in critical care settings, growth in personalized medicine, and advancements in bioinformatics enhancing data interpretation. This segment has recorded market share of 17% in 2024.

Molecular Diagnostics: Molecular diagnostics use nucleic acid testing to detect genetic variations and infectious agents. Trends include adoption of next-generation sequencing for precision medicine, development of rapid PCR-based tests for infectious diseases, and growth in companion diagnostics for targeted therapies. Drivers include advancements in genomics, increasing prevalence of genetic disorders, and demand for personalized treatment strategies. The molecular diagnostics segment has generated market share of 21% in 2024.

Coagulation: Coagulation technology analyzes blood clotting mechanisms to diagnose bleeding disorders and monitor anticoagulant therapies. The coagulation segment has Exceeded market share of 8% in 2024. Trends include automation of coagulation analyzers, development of point-of-care devices for home use, and integration with digital platforms for real-time data analysis. Drivers include aging populations, rising incidence of cardiovascular diseases, and the need for accurate monitoring of coagulation disorders.

Microbiology: Microbiology technology involves identifying pathogens causing infectious diseases using culture-based or molecular methods. Trends include automation of microbial identification systems, growth in rapid diagnostic tests for sepsis and antibiotic resistance, and advancements in bioinformatics for microbial genotyping. Drivers include global outbreaks like COVID-19, increasing antibiotic resistance, and demand for quick pathogen identification in healthcare settings. Microbiology segment was valued market share of 9% in 2024.

Others: The others segment has acquired market share of 14% in 2024. This segment includes emerging technologies like flow cytometry, cytogenetics, and mass spectrometry in the IVD market. Trends include integration of multiparameter analysis capabilities, development of high-throughput screening solutions, and expansion in research and clinical applications. Drivers include advancements in analytical techniques, increasing research funding, and demand for specialized diagnostic assays across diverse medical disciplines.

Infectious Diseases: The IVD market for infectious diseases is expanding with trends towards rapid diagnostic tests (RDTs), multiplex assays for detecting multiple pathogens, and point-of-care testing devices. Drivers include global health concerns like pandemics, increasing antibiotic resistance, and the need for early detection to prevent outbreaks.

Diabetes: Diabetes diagnostics focus on glucose monitoring and HbA1c testing, with trends towards continuous glucose monitoring systems (CGMs), integrated insulin pumps, and digital health solutions. Drivers include the rising prevalence of diabetes worldwide, demand for personalized diabetes management, and technological advancements in wearable devices.

Oncology: Oncology diagnostics involve tumor markers, liquid biopsy tests, and companion diagnostics for targeted therapies. Trends include genomic profiling, circulating tumor DNA (ctDNA) analysis, and AI-driven pathology solutions. Drivers include increasing cancer incidence, demand for precision medicine, and advancements in cancer research leading to tailored treatment approaches.

Cardiology: Cardiology diagnostics encompass biomarkers like troponin and NT-proBNP, electrocardiography (ECG), and lipid profiles. Trends include portable cardiac monitors, remote cardiac telemetry systems, and point-of-care testing for cardiovascular risk assessment. Drivers include aging populations, rising cardiovascular disease prevalence, and demand for early detection to prevent heart-related complications.

Nephrology: Nephrology diagnostics focus on kidney function tests (e.g., creatinine, electrolytes) and biomarkers for renal diseases. Trends include kidney injury biomarkers, home-based monitoring devices, and integrated digital health platforms for renal care management. Drivers include increasing incidence of chronic kidney disease, demand for personalized nephrology care, and advancements in renal biomarker research.

Autoimmune Diseases: Autoimmune disease diagnostics involve autoantibody testing and inflammation markers. Trends include multiplex immunoassays, point-of-care testing for autoimmune panels, and digital platforms for autoimmune disease management. Drivers include rising autoimmune disease prevalence, advancements in autoimmune diagnostics, and demand for early detection to prevent disease progression.

Drug Testing: Drug testing diagnostics include screening for illicit drugs, therapeutic drug monitoring, and pharmacogenomics testing. Trends include rapid urine drug testing kits, oral fluid testing devices, and portable mass spectrometry for on-site drug analysis. Drivers include regulatory requirements, workplace safety concerns, and advancements in forensic toxicology and pharmacogenomics.

Others: This segment encompasses emerging applications like allergy testing, reproductive health, and neurology in the IVD market. Trends include personalized allergy panels, fertility testing kits, and biomarkers for neurodegenerative diseases. Drivers include increasing awareness and diagnosis rates, advancements in neuroimaging and neurogenetics, and demand for specialized diagnostic solutions in niche medical fields.

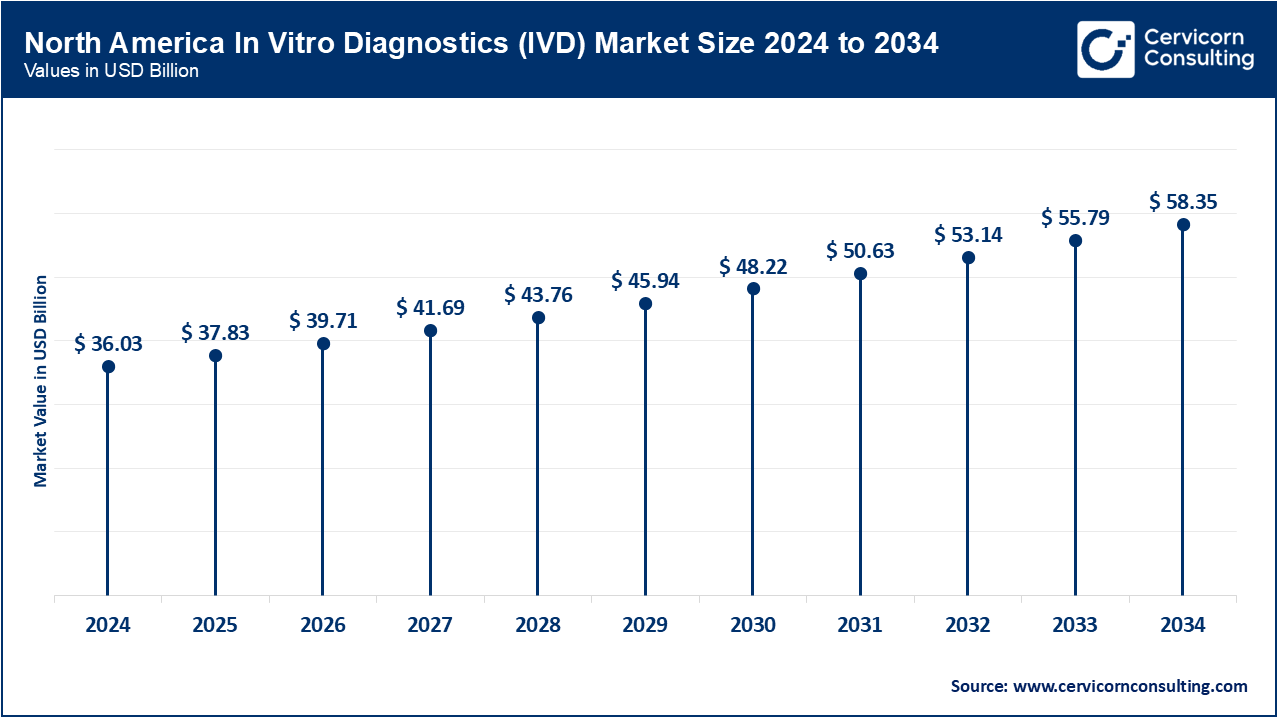

North America market size is expected to reach around USD 58.35 billion by 2034 increasing from USD 36.03 billion in 2024. North America leads the IVD market with a robust healthcare infrastructure, high healthcare expenditure, and technological advancements. The region benefits from a strong regulatory framework favoring innovation. Key trends include the adoption of personalized medicine, increasing prevalence of chronic diseases, and demand for point-of-care testing solutions. Drivers include growing healthcare awareness, favorable reimbursement policies, and a strong presence of major IVD companies.

Europe is a significant market for IVD, characterized by stringent regulatory standards and high healthcare spending. Europe market size is measured at USD 21.19 billion in 2024 and is expected to grow around USD 34.31 billion by 2034. The region emphasizes personalized healthcare solutions and early disease detection. Trends include the integration of digital health technologies, expansion in molecular diagnostics, and increasing demand for non-invasive diagnostic techniques. Drivers include aging population, rising incidence of infectious diseases, and government initiatives supporting healthcare innovation.

Asia-Pacific is experiencing rapid growth in the IVD market due to expanding healthcare infrastructure, rising healthcare expenditure, and increasing awareness about preventive healthcare. Key trends include the adoption of point-of-care testing devices, growth in chronic disease burden, and advancements in healthcare technology. Asia Pacific market size is calculated at USD 18.85 billion in 2024 and is projected to grow around USD 30.15 billion by 2034. Drivers include large population demographics, urbanization, and increasing healthcare access in emerging economies like China, India, and Southeast Asian countries.

LAMEA represents a growing market for IVD, driven by improving healthcare infrastructure, rising healthcare spending, and government initiatives to enhance healthcare access. The region shows increasing demand for diagnostic solutions in infectious diseases, oncology, and diabetes management. LAMEA market size is forecasted to reach around USD 11.89 billion by 2034 from USD 7.34 billion in 2024. Key trends include the expansion of telemedicine, adoption of mobile health technologies, and partnerships for technology transfer. Drivers include demographic changes, healthcare reforms, and efforts to address public health challenges.

New players like Hologic, Inc., PerkinElmer, Agilent Technologies, and DiaSorin are leverage innovation, strategic acquisitions, and expanding their diagnostic capabilities across specialized areas to carve out a niche in the competitive IVD market. Key players dominating the market include Roche Diagnostics, Siemens Healthineers, and Abbott, leveraging their extensive portfolio, broad range of diagnostic imaging and laboratory diagnostics solutions, and strategic partnerships enable these companies to expand their product offerings, enhance diagnostic accuracy, and cater to evolving healthcare needs globally. Collaborations like Roche with Foundation Medicine in cancer genomics, Siemens with IBM Watson Health in AI diagnostics, Abbott with Bigfoot Biomedical in diabetes management, and Danaher with Mayo Clinic in clinical assays drive innovation and global market leadership in the IVD market.

Roche Diagnostics (Severin Schwan, CEO)

"Roche is committed to driving innovation in diagnostics to improve patient outcomes. Our focus remains on advancing personalized healthcare through breakthrough technologies in molecular diagnostics and digital solutions."

Siemens Healthineers (Bernd Montag, CEO)

"Siemens Healthineers continues to lead in transforming healthcare delivery with our broad portfolio of imaging and diagnostics solutions. We are accelerating digitalization and AI integration to enhance clinical decision-making and patient care globally."

Abbott Laboratories (Robert B. Ford, CEO)

"Abbott remains dedicated to advancing healthcare through innovation. We are expanding our leadership in diabetes care with continuous glucose monitoring and advancing molecular diagnostics to address emerging health challenges worldwide."

Danaher Corporation (Rasmus Hogh, CEO of Danaher's Life Sciences Segment)

"Danaher's Life Sciences segment is focused on accelerating innovation in diagnostics and life sciences. We are leveraging our strong portfolio to drive growth in precision medicine, point-of-care testing, and molecular diagnostics globally."

Market Segmentation

By Product

By Technology

By Application

By Test Location

By End-use

By Regions