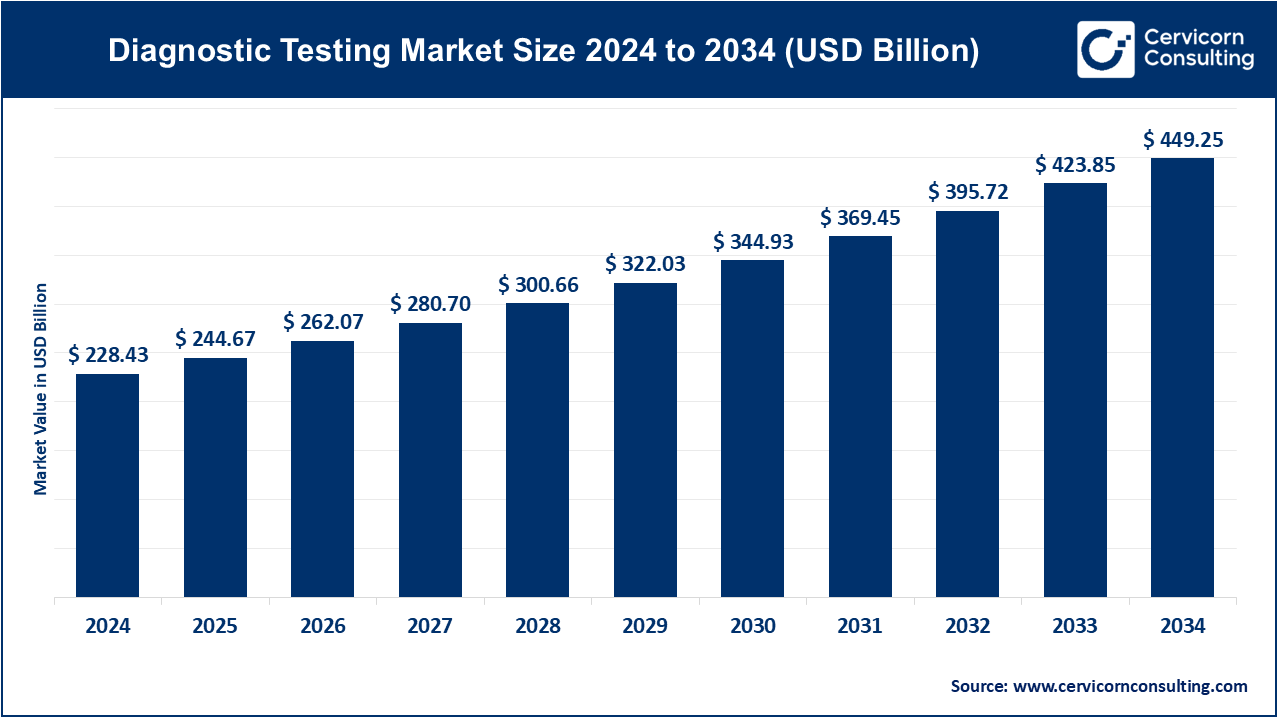

The global diagnostic testing market size was valued at USD 228.43 billion in 2024 and is expected to hit around USD 449.25 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.99% from 2025 to 2034. The diagnostic testing industry plays a pivotal role in global healthcare by enabling early disease detection, guiding treatment plans, and supporting epidemic surveillance. Its reach spans infectious diseases, chronic conditions, oncology, genetics, and point-of-care testing. The market evolution is influenced by regulation, innovation, and global health dynamics, making diagnostics a strategic growth lever for healthcare systems and policymakers.

The global diagnostic testing market has experienced significant growth due to advancements in technology, increasing healthcare awareness, and the rising demand for early detection of diseases. The adoption of innovative tools such as molecular diagnostics, point-of-care testing, and next-generation sequencing has enhanced diagnostic accuracy, resulting in better patient outcomes. Additionally, the growing prevalence of chronic diseases, infectious diseases, and genetic disorders has further fueled the demand for diagnostic testing. Healthcare systems are increasingly investing in automation and digital solutions to streamline the diagnostic process, further driving market growth. In recent years, the market for diagnostic testing is expanding at a rapid pace, especially in emerging economies where healthcare infrastructure is improving. The demand for home-based diagnostic kits and telemedicine services has surged, driven by the COVID-19 pandemic, which prompted a shift towards remote healthcare solutions.

Diagnostic testing refers to the process of analyzing a sample (such as blood, urine, or saliva) or using medical equipment (like imaging tools) to identify a disease, condition, or infection in an individual. These tests help healthcare professionals determine the cause of symptoms, monitor the progression of illnesses, and guide treatment decisions. Common diagnostic tests include blood tests, X-rays, MRI scans, and genetic tests. They are vital in detecting conditions early, allowing for timely interventions, and improving patient outcomes. Diagnostic tests can be categorized into molecular diagnostics, in vitro diagnostics (IVD), point-of-care diagnostics, immunoassays, clinical chemistry, hematology testing, and microbiology testing.

According to Aspire Circle, the whole industry of medical diagnostics accounts for only 4-5% of all healthcare expenditure but influences the remaining 95% of the cost. Also, almost 70% of the medical decisions related to early diagnosis of a disease, prognosis of patients, and selection of treatment are based on laboratory diagnostic results.

The National Library of Medicine, citing a study on cervical cancer screening in sub-Saharan Africa, observes that it ranges between 2 and 20.2 percent in urban areas, while it stands at between 0.4 and 14 percent in rural areas. It is reported that barriers to screening, as identified in countries like Malawi, include cultural influences, religion, lack of knowledge about cervical cancer, low levels of awareness about prevention procedures, confusion between screening and diagnostic tests, fear of stigma, and embarrassment about the screening procedure.

Key Global Trends in Diagnostics

Global Diagnostic Deployment Strategies by Leading Health Organizations

| Organization | Key Activity or Initiative (2024–25) |

| WHO | Launched Emergency Use Listing for mpox diagnostics; distributing 30,000 tests to Africa |

| FIND | Partnering with 150+ entities to develop diagnostics for TB, HIV, malaria, mpox, etc. |

| Cepheid / Roche / Labcorp | Scaling mpox diagnostic rollout in collaboration with UN and WHO teams |

| U.S. laboratories | Bracing for potentially eased LDT regulations under new administration |

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 244.67 Billion |

| Projected Market Size (2034) | USD 449.25 Billion |

| Growth Rate (2025 to 2034) | 6.99% |

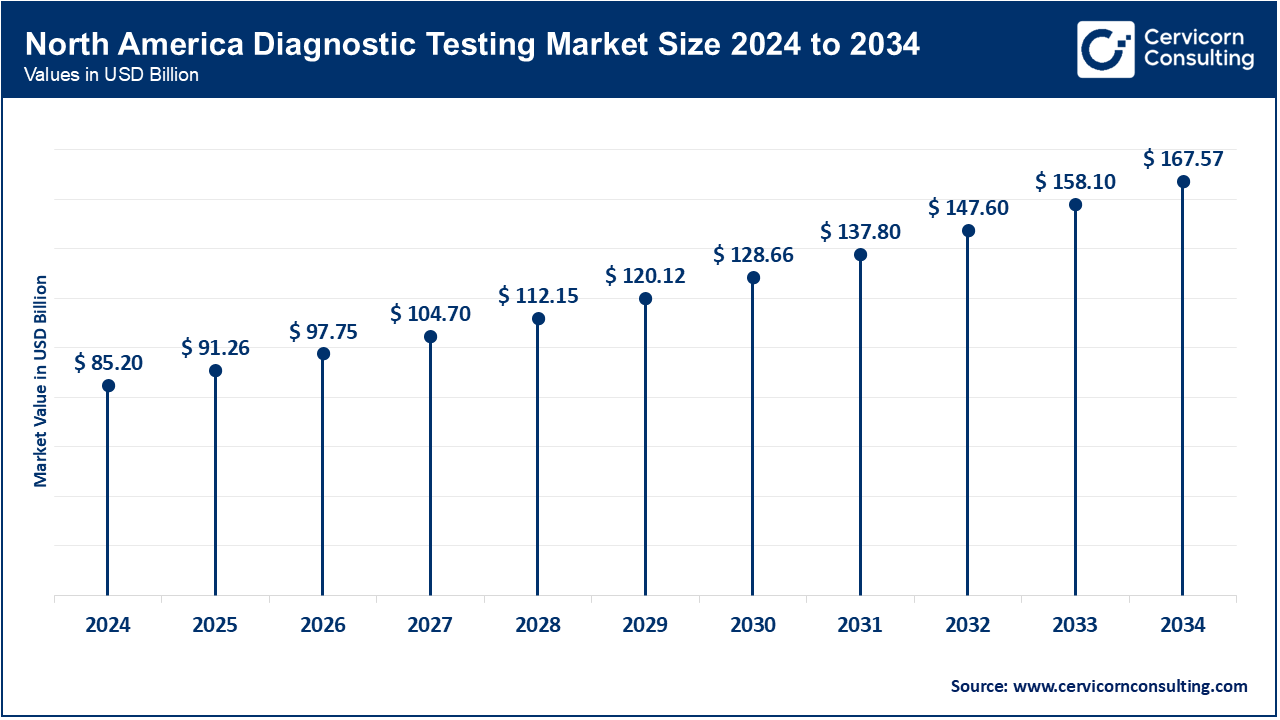

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Report Segments | Types, Applications, End Users |

| Top Companies | Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific Inc., Siemens Healthineers, Danaher Corporation, Becton, Dickinson and Company (BD), Quest Diagnostics, Bio-Rad Laboratories, Hologic, Inc., Cepheid (a Danaher company), PerkinElmer, Inc., Agilent Technologies, Qiagen N.V., Sysmex Corporation, Ortho Clinical Diagnostics |

Increased Funding and Investment

Advancements in Telemedicine

Economic Volatility

Regulatory Challenges

Emerging Markets

Integration of AI and Machine Learning

Supply Chain Disruptions

Skilled Labor Shortages

The diagnostic testing market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

North America is leading the market due to its robust healthcare infrastructure and high demand for advanced diagnostic technologies. The U.S. and Canada are at the forefront of adopting cutting-edge diagnostic methods, including molecular diagnostics and next-generation sequencing. Significant investments in healthcare innovation, supportive regulatory frameworks, and a strong focus on early disease detection drive market growth. Additionally, the region’s emphasis on personalized medicine and precision diagnostics fosters the development of advanced diagnostic solutions.

The Asia-Pacific region is expanding rapidly, fueled by increasing urbanization, rising disposable incomes, and expanding healthcare access. Countries such as China, Japan, and India are seeing significant advancements in healthcare infrastructure and the adoption of innovative diagnostic technologies. The growing prevalence of chronic diseases, government initiatives to improve healthcare accessibility, and investments in healthcare technology are driving the demand for diagnostic testing. The region’s focus on developing affordable diagnostic solutions to cater to its large population further boosts market expansion.

Europe's diagnostic testing industry is driven by its well-established healthcare systems and increasing demand for early and accurate disease detection. The region experiences growth due to supportive government regulations, expanded healthcare funding, and rising public awareness of preventive healthcare measures. Countries like Germany, the UK, and France are leaders in adopting new diagnostic technologies, including digital pathology and advanced imaging techniques. The focus on reducing healthcare costs through early diagnosis and the integration of innovative diagnostic tools into existing healthcare frameworks supports overall market growth.

LAMEA is expanding due to growing healthcare awareness and improving healthcare infrastructure. In Latin America, there is an increasing focus on modernizing healthcare systems and enhancing access to diagnostic services. The Middle East benefits from substantial investments in healthcare infrastructure and the adoption of advanced diagnostic technologies. Although Africa faces challenges such as limited resources and access to healthcare, progress is being made through international partnerships and funding initiatives aimed at improving diagnostic capabilities and access to essential healthcare services across diverse regions.

The diagnostic testing market is segmented into type, application, end-users, and region. Based on type, the market is classified into molecular diagnostics, in vitro diagnostics (IVD), point-of-care (POC) diagnostics, immunoassays, clinical chemistry, hematology testing, and microbiology testing. Based on application, the market is classified into infectious disease testing, oncology testing, cardiovascular disease testing, prenatal and newborn testing, metabolic disorder testing. Based on end-users, the market is classified into hospitals and clinics, diagnostic laboratories, research and academic institutes, biopharmaceutical and biotechnology companies.

Molecular Diagnostics: This segment involves tests that detect specific sequences in DNA or RNA that may or may not be associated with disease. Molecular diagnostics is crucial in areas such as infectious disease detection, oncology, and genetic testing. With advancements in PCR and next-generation sequencing, molecular diagnostics continues to grow rapidly, offering precise and early detection of diseases.

Immunoassays: Immunoassays are diagnostic tests that rely on the reaction between an antigen and an antibody to detect diseases. Commonly used for hormone, infectious disease, and cancer marker testing, this type of diagnostic test is highly valued for its accuracy and specificity. The market for immunoassays is driven by their broad application and ongoing innovations that improve sensitivity and reduce processing times.

Clinical Chemistry: This segment covers tests that analyze bodily fluids (like blood or urine) to detect the presence of specific substances. Clinical chemistry tests are vital in routine health checks and chronic disease management, such as monitoring glucose levels in diabetes patients or cholesterol levels in cardiovascular disease management. The market for these tests is supported by the growing prevalence of chronic diseases and the need for regular monitoring.

Hematology Testing: Hematology testing involves the analysis of blood components and is essential for diagnosing conditions such as anemia, leukemia, and clotting disorders. As technology advances, automated hematology analyzers are becoming more sophisticated, allowing for more detailed and accurate analysis. This segment is seeing growth due to the rising incidence of blood disorders and the demand for comprehensive blood tests.

Microbiology Testing: This segment focuses on detecting and identifying pathogens responsible for diseases like bacterial, viral, and fungal infections. Microbiology testing is crucial in hospitals for infection control and is increasingly important due to the rise of antibiotic-resistant strains. Innovations in this area include rapid culture methods and the use of molecular techniques for faster and more accurate diagnosis.

Oncology Testing: Cancer diagnostics, including screening and monitoring, represent a significant application of diagnostic testing. Tests for biomarkers, genetic mutations, and tumor-specific antigens are key in early cancer detection, monitoring treatment efficacy, and guiding therapy decisions. The growing emphasis on personalized medicine is propelling advancements in oncology diagnostics.

Cardiovascular Disease Testing: Diagnostic tests in this segment focus on detecting heart-related conditions such as coronary artery disease, heart failure, and arrhythmias. Tests include lipid panels, troponin levels, and ECGs, which help in assessing the risk, diagnosing, and monitoring the treatment of cardiovascular diseases. The high prevalence of heart diseases globally fuels the demand for advanced diagnostic tools in this area.

Prenatal and Newborn Testing: This segment includes tests performed during pregnancy and after birth to detect genetic disorders, congenital anomalies, and other health conditions in the fetus and newborns. Non-invasive prenatal testing (NIPT) and newborn screening are growing in popularity due to their ability to provide early and accurate detection, thereby improving health outcomes.

Metabolic Disorder Testing: Diagnostic tests for metabolic disorders, such as diabetes and thyroid conditions, are crucial for early detection and management. These tests often involve blood glucose monitoring, lipid profiling, and thyroid function tests. The rise in lifestyle-related diseases and the need for regular monitoring drive this segment's growth.

Hospitals and Clinics: The primary users of diagnostic testing services, employing a wide range of tests for disease detection, treatment monitoring, and health assessments. The growing demand for accurate and timely diagnostics drives this segment.

Diagnostic Laboratories: These facilities process large volumes of diagnostic tests, providing services to hospitals, clinics, and other healthcare providers. The segment is expanding due to the increasing need for specialized testing and advanced diagnostic capabilities.

Research and Academic Institutes: Utilize diagnostic testing in research settings, focusing on understanding disease mechanisms, developing new treatments, and identifying biomarkers. This segment is crucial for the advancement of medical science and personalized medicine.

Biopharmaceutical and Biotechnology Companies: Use diagnostic testing in drug development, especially for identifying therapeutic targets and monitoring clinical trial outcomes. The segment is growing as these companies invest in developing new diagnostics and companion therapies.

Among the new players in the diagnostic testing market, companies like Guardant Health leverage advanced liquid biopsy technology to offer innovative solutions for cancer detection, enhancing early diagnosis and personalized treatment. Foundation Medicine focuses on developing comprehensive genomic profiling services, combining cutting-edge sequencing technologies with data-driven insights to support precision medicine.

Dominant players like Roche Diagnostics drive growth through their extensive product lines and recent introductions, including high-sensitivity tests for infectious diseases. Abbott Laboratories integrates advanced digital health technologies with its wide range of diagnostic tools, facilitating comprehensive solutions for various healthcare applications. Innovations and collaborations, such as Roche's new test launches and Abbott's strategic partnerships, underscore their leadership in the evolving Diagnostic Testing Market.

CEO Statements

Robert Ford, CEO of Abbott:

Anand K, CEO of SRL Diagnostics:

Han-Oh Park, Founder & CEO of Bioneer:

Key players in the diagnostic testing market are influential in providing a range of innovative healthcare solutions, including advanced diagnostic technologies, precision medicine tools, and digital health platforms. Some notable examples of key developments in the Diagnostic Testing Market include strategic acquisitions, partnerships to enhance diagnostic capabilities, and the introduction of high-sensitivity tests for early disease detection:

These companies are expanding the market through acquisitions and innovation, aiming to advance accuracy, enhance accessibility, and introduce next-generation diagnostic tools. This includes high-sensitivity tests and AI-driven platforms, fostering collaboration between industry leaders and healthcare providers to improve patient outcomes.

Market Segmentation

By Type

By Application

By End-Users

By Regions