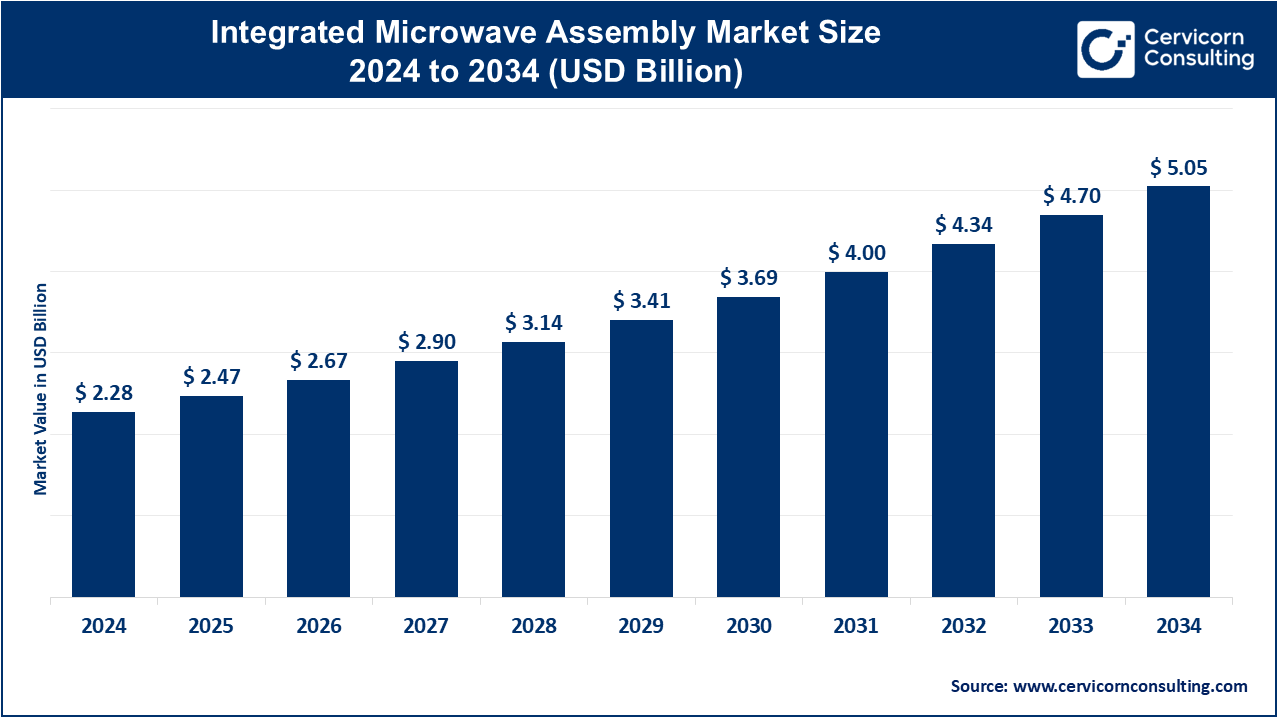

The global integrated microwave assembly market size was valued at USD 2.28 billion in 2024 and is expected to be worth around USD 5.05 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.28% from 2025 to 2034. The U.S. integrated microwave assembly market size was valued at USD 0.81 billion in 2024.

The integrated microwave assembly (IMA) market is experiencing significant growth due to the increasing demand for advanced communication technologies and the rise in defense and aerospace applications. The proliferation of 5G networks, advancements in satellite communication systems, and the expanding use of radar systems for autonomous vehicles are key drivers of this growth. As more industries require high-frequency communication solutions, the need for IMAs that offer efficient integration of microwave functions will continue to rise. The aerospace and defense sector remains the largest end-user, as IMAs are crucial in military and satellite communication systems. The ongoing technological advancements and the growing trend toward miniaturization further boost the market's prospects. In addition, the market growth is fueled by the increasing adoption of automation in manufacturing and improvements in the design and packaging of microwave components. In 2023, Skyview Capital LLC acquired Integrated Microwave Technologies (IMT) from The Vitec Group plc. This acquisition aimed to strengthen Skyview's position in the IMA market by integrating IMT's advanced microwave solutions into its portfolio.

An integrated microwave assembly (IMA) is a compact and highly specialized electronic component that integrates various microwave components such as amplifiers, filters, oscillators, and antennas into a single unit. These assemblies are used in high-frequency applications such as communication systems, radar systems, satellite systems, and military electronics. The primary purpose of IMAs is to optimize space, improve performance, and reduce the overall cost of electronic systems. By combining multiple microwave functions into one assembly, IMAs can offer better signal quality, enhanced functionality, and more reliable performance in smaller packages. They are often used in applications where size, weight, and performance are critical, such as aerospace, defense, and telecommunications.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 2.47 Billion |

| Projected Market Size in 2034 | USD 5.05 Billion |

| Growth Rate 2025 to 2034 | 8.28% |

| Leading Region | North America |

| Growing Region | Asia-Pacific |

| Key Segments | Product, Frequency, Packaging, Power Output, Technology, End User, Region |

| Key Companies | Integrated Microwave Corporation, Analog Devices, Qorvo, CAES, APITech, Narda-MITEQ, Teledyne Technologies, MACOM, CPI International, National Instruments, NXP Semiconductors, Thales Group, Rohde & Schwarz, Teledyne Microwave Solutions, Hitachi Metals, Skyworks Solutions, Cdiweb, Erzia, Anritsu, Micros |

The integrated microwave assembly market is segmented into product, frequency, technology, power output, packaging, end user and region. Based on product, the market is classified into amplifiers, oscillators, frequency converters, frequency synthesizers, filters, mixers, switches, and others. Based on frequency, the market is classified into Ku-Band, X-Band, Ka-Band, S-Band, and C-Band. Based on technology, the market is classified into Silicon Germanium (SiGe), Gallium Arsenide (GaAs), Indium Phosphide (InP), and Nitride Gallium Arsenide (GaNAs). Based on power output, the market is classified into low power (1 Watt), medium power (1-10 Watts), high power (10-100 Watts), and very high power (>100 Watts). Based on packaging, the market is classified into surface mount technology (SMT), ball grid array (BGA), ceramic quad flat pack (CQFP), and plastic quad flat pack (PQFP). Based on end user, the market is classified into military & defence, communication, avionics, automotive, medical, and others.

Based on product, the integrated microwave assembly market is segmented into amplifiers, filter, mixers, oscillators and switches. The amplifiers segment has dominated the market in 2024.

Amplifiers: Amplifiers operating within integrated microwave assemblies offer change in signal strength. They retain great importance for communication, military, satellite systems, and radar technologies. Signal amplification is critical in all aforementioned cited fields. Commercial demand for amplifiers is on the rise, especially among varying industries that require their signal to travel longer distances and where enhancement in the quality of that transmission is regarded as a key aspect. Therefore, amplifiers represent an important segment for products in the IMA market.

Filters: Filtering via IMAs happens regularly where frequency termination becomes part of signal integrity. These devices are deployed widely in telecommunications, defense systems, aerospace, etc., wherein frequency selectivity takes place with greatest precision. Sophisticated filtering processes for communication systems are becoming a constant subject in today constantly thereby resolving architecture for enhancing the communication systems' performance and reliability across applications.

Mixers: The mixers serve as important components in Integrated Microwave Assemblies. They are designed to convert signals from one frequency to another. Mixers are essential in radar applications, communication systems, and signal processing. Increased demand for efficient and compact mixers drives advancements in the design and technology of such systems for improving overall performance and effectiveness in modern microwave systems.

Oscillators: Oscillators are highly significant in generating pure microwave signals to IMAs. They play a prima facie role in communication and radar applications. For all the advantages alluded to them, they affect the accuracy and stability of the system. It is with this increased need for frequency stability and low phase noise from select industries that oscillator technology becomes an increasing beneficiary, which adds in creating innovation and development throughout the IMA region.

Switches: Switches are integral to IMAs because they enable routing and channel management of signals in complex systems. The significance is in communication networks, radar, and satellite systems, where multiple signals are buffered. Today's reality is that the more complex modern communications become, the higher the demand there is for smart, efficient, reliable switching technologies to produce high-performance switches in the IMA market.

Based on frequency, the integrated microwave assembly market is segmented into Ku-band, X-band, S-band, Ka-band, and C-band. the X-band segment has dominated the market in 2024.

Ku-Band: Ku-Band frequencies are used chiefly in satellite communications as they involve both broadcast and broadband services for direct broadcasting services. The supply of Ku-Band is anticipated to rise as the technology can be implemented to provide high data rates with large coverage. This particular band is fundamentally imperative in telecommunications and broadcasting; it creates opportunities for innovation in Integrated Microwave Assemblies to increase the ultimate performance and efficiency when providing satellite services.

X-Band: The X-Band frequencies are mostly used in radar and military applications because they boast high resolution and long-range features. Focus on defense and surveillance technologies should drive market demand for X-Band systems. Integrated Microwave Assemblies in this frequency range are really important in providing situational awareness and operational effectiveness in military operations and civilian radar applications.

Ka-Band: Ka-Band frequencies serve as the backbone of high-capacity satellite communications and advanced radar systems in use. The growth of broadband satellite services and their requirement for high-speed data transmission are increasingly demanding Ka-Band technology. Integrated Microwave Assemblies in this frequency domain allow the enabling of communication links that are reliable and efficient in applications in telecommunications, broadcasting, and military domains; thus, they greatly affect market growth.

S-Band: The S-Band frequencies are now becoming an area of great interest, as there is a growing demand for radar systems, weather monitoring, and satellites. Their versatility constitutes a desirable property for both military and civil applications. The increasing requirements for reliable communication and tracking systems are consequently driving demand for Integrated Microwave Assemblies that operate within the S-Band; these assemblies will, therefore, help in improving performance and reliability in various applications.

C-Band: C-Band frequencies are critical in relation to satellite communications, wireless networks, and broadcast services. C-band technology has very much been in demand, given its efficiency in providing reliable communication services. Integrated microwave assemblies within this frequency band have become essential in this respect and are the driving force behind innovation and improvement emanating from it.

Based on end use, the integrated microwave assembly market is segmented into military and defense, communication and avionics. The military & defense segment is projected to dominate the market in 2024.

Military & Defense: The military and defense segment, being the main consumers of integrated microwave assemblies (IMAs), applies such devices by combining state-of-the-art microwave technologies for different specialization like radar, communication, and surveillance. Increasing worldwide defense budgets raise demand for advanced IMAs. Such assemblies are critical for ensuring reliable, satisfactory, and efficient means of communication in military developments and thus would provide an excellent platform for stimulating both innovation and development in the market for IMAs.

Communication: The communication sector is a prime consumer of integrated microwave assemblies for telecommunications, broadcasting, and data transmissions. Shockingly, ever-expanding mobile networks as a result of the implementation of 5G are creating a growing market for high-performance IMAs, as improved connectivity and faster data transmission are further required for industry use. IMAs are a critical enabler of the communication infrastructure.

Avionics: Integrated microwave assemblies are hugely consumed within avionics. Applications range from navigation, communications, and radar on board aircraft. The emphasis on safety and efficiency form the basis for developing further IMAs. Such assemblies contribute chiefly, in part, to the realization of next-generation avionics systems that improve operational capability and reliability for modern aircraft and an enhancement in their market before highly commercial aircraft systems.

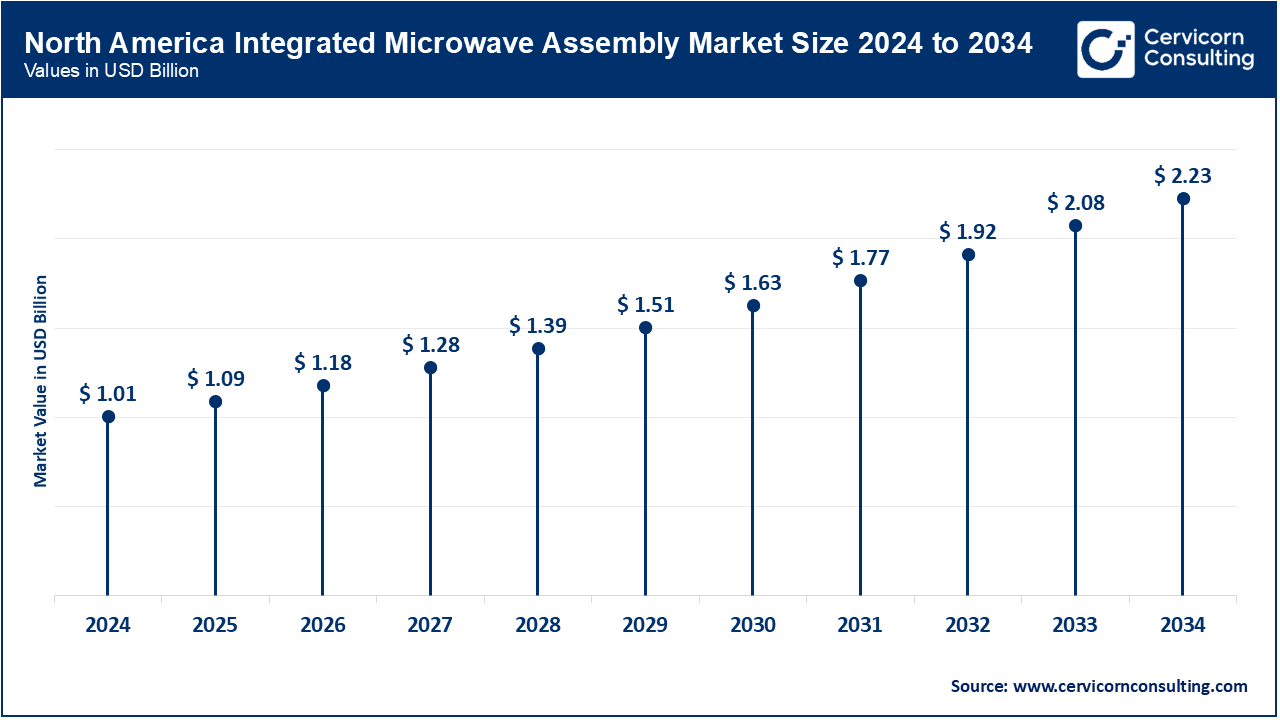

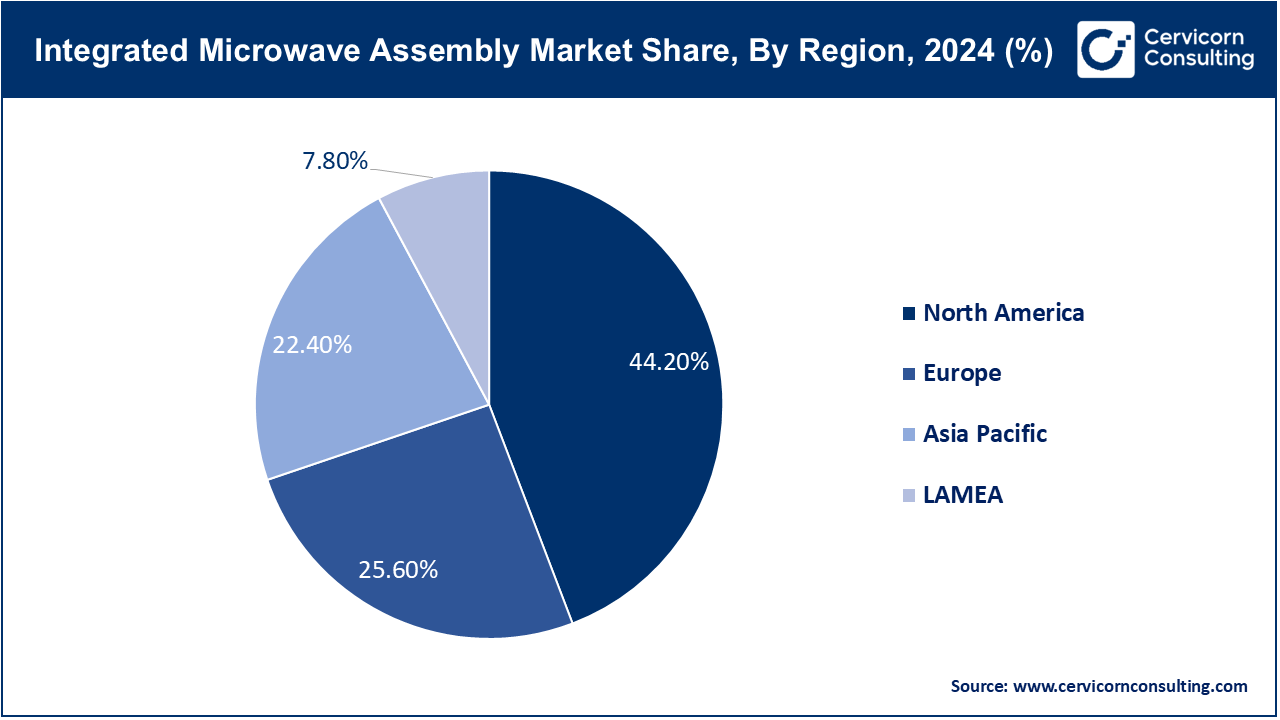

The integrated microwave assembly market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The North America has dominated the market in 2024. Here’s an in-depth look at each region:

The North America integrated microwave assembly market size was valued at USD 1.01 billion in 2024 and is expected to be worth around US 2.23 billion by 2034. The United States accounts for a relatively large share of the Integrated Microwave Assemblies (IMAs) in North America, buoyed by extensive investments in the defense, aerospace, and telecommunication industries. The development of advanced radar and communication systems within the U.S. armed forces fuels demand for high-performance IMAs. The Canadian market also emerges, enabled by increased investments in satellite communications and defense technologies. Driven largely by the growth of these countries in the microwave domain, the region has the richest microwave business, with higher degrees of innovation and technology enhancement, thus further increasing its presence in the global market.

The Europe integrated microwave assembly market size was estimated at USD 0.58 billion in 2024 and is expected to be worth around USD 1.29 billion by 2034. European countries make pioneering contributions to the integrated microwave assembly market: Germany, the United Kingdom, and France. Demands from the German aerospace and defense sectors spur the market to enhance the IMAs, especially in the areas of radar and communication systems. The UK does not like to miss the opportunity in the development of the new generation of communication technologies (5G). Satellite communications are in the line for France and stimulate its market presence. In this region, collaborative research initiatives and robust regulatory support facilitate innovation and growth for industries dependent on microwave technology.

The Asia-Pacific integrated microwave assembly market size was accounted for USD 0.51 billion in 2024 and is projected to hit around USD 1.13 billion by 2034. In the Asia-Pacific region is growing fast, with young countries like China, Japan, and India spearheading this growth. The booming telecommunications sector in China and its military modernization efforts boost IMA demand significantly. The advanced technology-based landscape of Japan, particularly regarding electronics and defense, is favorable for growth in the IMAs market. Major investments in satellite communications and defense technologies further allow India to enhance its market presence. Urbanization and other developments in pursuing the infrastructure across the region are on the uprise for high-performance microwave solutions.

The LAMEA integrated microwave assembly market was valued at USD 0.18 billion in 2024 and is anticipated to reach around USD 0.39 billion by 2034. South Africa, the UAE, and Brazil in the LAMEA region emerge as key markets for Integrated Microwave Assemblies. In Brazil, growth in telecommunications, increasing mobile connectivity, is drivers for IMAs. UAE investment is set to host superior communication technologies and defense systems, providing better market support. The infrastructure development for telecommunications and improvements in defense capabilities boost microwave technology adoption in South Africa. Diverse industrial environments create definite opportunities for growth in the integrated microwave assembly market in the region.

The market for integrated microwave assembly is dominated by major players such as Integrated Microwave Corporation, Analog Devices, Qorvo, CAES, APITech, Narda-MITEQ, and Teledyne Technologies. These companies leverage their extensive research and development capabilities to innovate and produce high-performance microwave solutions that meet the growing demands of industries like telecommunications, aerospace, and defense. By investing in advanced manufacturing processes and forming strategic partnerships, these market leaders enhance their competitive advantage and expand their product offerings, thus driving significant growth in the integrated microwave assembly sector. Their focus on reliability and efficiency positions them as trusted suppliers in a rapidly evolving market landscape.

CEO Statements

Robert Mehrabian, CEO of Teledyne Technologies

Chuck Swoboda, CEO of Qorvo

Vincent Roche, CEO of Analog Devices

Recent investments and product launches underscore significant growth and collaboration within the integrated microwave assembly industry. Leading companies such as Integrated Microwave Corporation, Analog Devices, Qorvo, CAES, APITech, Narda-MITEQ, and Teledyne Technologies are focused on enhancing their technologies to address the increasing demand for high-performance and efficient microwave solutions. This demand is driven by advancements in telecommunications, aerospace, and defense sectors, where reliable and compact microwave assemblies are critical. The integration of innovative materials and manufacturing techniques is expected to further bolster market growth, ensuring these companies remain competitive in a rapidly evolving landscape. Some notable examples of key developments in the Integrated microwave assembly Market include:

These developments underscore significant advancements in the integrated microwave assembly industry, highlighting innovative technologies that improve efficiency, reliability, and performance across various applications. Companies are integrating cutting-edge materials and designs, enabling the production of compact and lightweight microwave solutions. Furthermore, the focus on advanced manufacturing techniques is enhancing scalability and reducing production costs. The growing demand from sectors such as telecommunications, aerospace, and defense is driving these innovations, positioning the market for robust growth in the coming years. This evolution reflects the industry's commitment to meeting the complex needs of modern applications.

Market Segmentation

By Product

By Frequency

By Technology

By Power Output

By Packaging

By End User

By Region