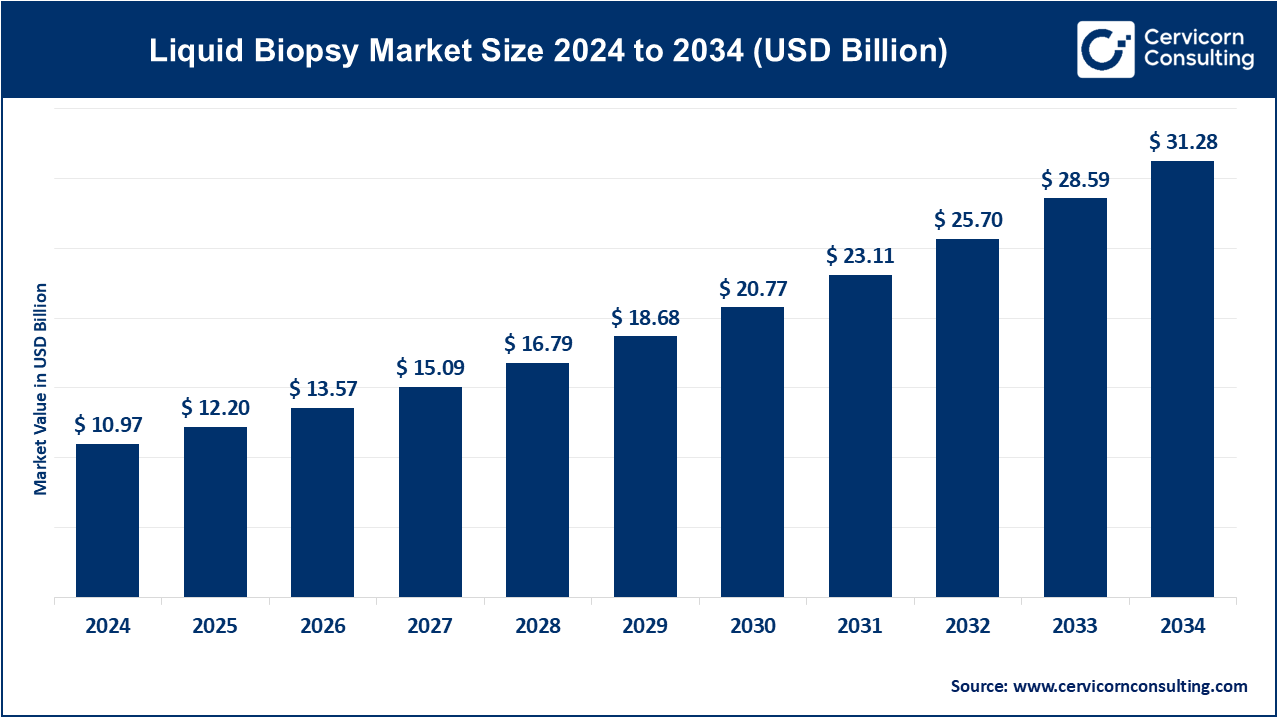

The global liquid biopsy market size was valued at USD 10.97 billion in 2024 and is expected to be worth around USD 31.28 billion by 2034. It is growing at a compound annual growth rate (CAGR) of 11.05% over the forecast period 2025 to 2034. The liquid biopsy market is experiencing rapid growth due to increasing cancer prevalence, demand for non-invasive diagnostics, and advancements in precision medicine. The adoption of liquid biopsy is driven by its ability to detect cancers early, reducing reliance on traditional biopsy methods. Governments and healthcare organizations are funding research to improve the technology, further boosting market expansion. The growing preference for personalized medicine and the rising awareness of liquid biopsy’s benefits among healthcare professionals are fueling demand. Pharmaceutical companies and biotech firms are investing heavily in developing innovative liquid biopsy solutions. Companies are focusing on improving sensitivity, accuracy, and cost-effectiveness, making liquid biopsy more accessible. The integration of artificial intelligence (AI) and machine learning (ML) in data analysis is enhancing diagnostic capabilities.

What is Liquid Biopsy?

A liquid biopsy is a non-invasive diagnostic test that detects cancer and other diseases by analyzing biomarkers found in bodily fluids like blood, urine, or saliva. Unlike traditional tissue biopsies, which require surgical extraction, liquid biopsies use a simple blood draw to identify circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), and other genetic materials shed by cancer cells. This test helps in early cancer detection, monitoring disease progression, assessing treatment response, and identifying genetic mutations for personalized therapies. Liquid biopsy is particularly beneficial for patients where tissue biopsy is challenging or risky. It allows real-time monitoring of tumors, offering faster results with minimal discomfort. This technique is widely applied in oncology for lung, breast, colorectal, and prostate cancers.

Some of the major trends in the market include the increasing demand for non-invasive diagnosis methods, the integration of next-generation sequencing technologies, and the

+. This can be viewed against a background of growing demands to minimize time and cost from traditional tissue biopsies, coupled with efforts at improving diagnostic accuracy and providing real-time insights into tumor dynamics. Government initiatives and regulatory support for early cancer detection and precision medicine have also helped a lot to boost the growth of the liquid biopsy market.

Key Insights Beneficial to the Liquid Biopsy Market:

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 12.20 Billion |

| Projected Market Size 2034 | USD 31.28 Billion |

| Growth Rate (2025 to 2034) | 11.05% |

| Leading Region | North America |

| Growing region | Asia-Pacific |

| Report Segmentation | Type, Sample Type, Product & Service, Technology, Clinical Application, Application, End-Users, Region |

| Key Companies | Guardant Health, Illumina, Inc., Biocept, Inc., Qiagen N.V., Roche Diagnostics, Thermo Fisher Scientific, Inc., Foundation Medicine, Inc., Freenome, Inc., Exact Sciences Corporation, Grail, Inc., Natera, Inc., Menarini Silicon Biosystems, Agena Bioscience, Inc., Epic Sciences, Inc., Personal Genome Diagnostics, Inc. |

Increased Funding and Investment

Growing Demand for Non-Invasive Diagnostics

High Costs and Reimbursement Challenges

Regulatory and Validation Challenges

Emerging Technologies

Expansion into New Cancer Types

Supply Chain Disruptions

Ethical and Privacy Concerns

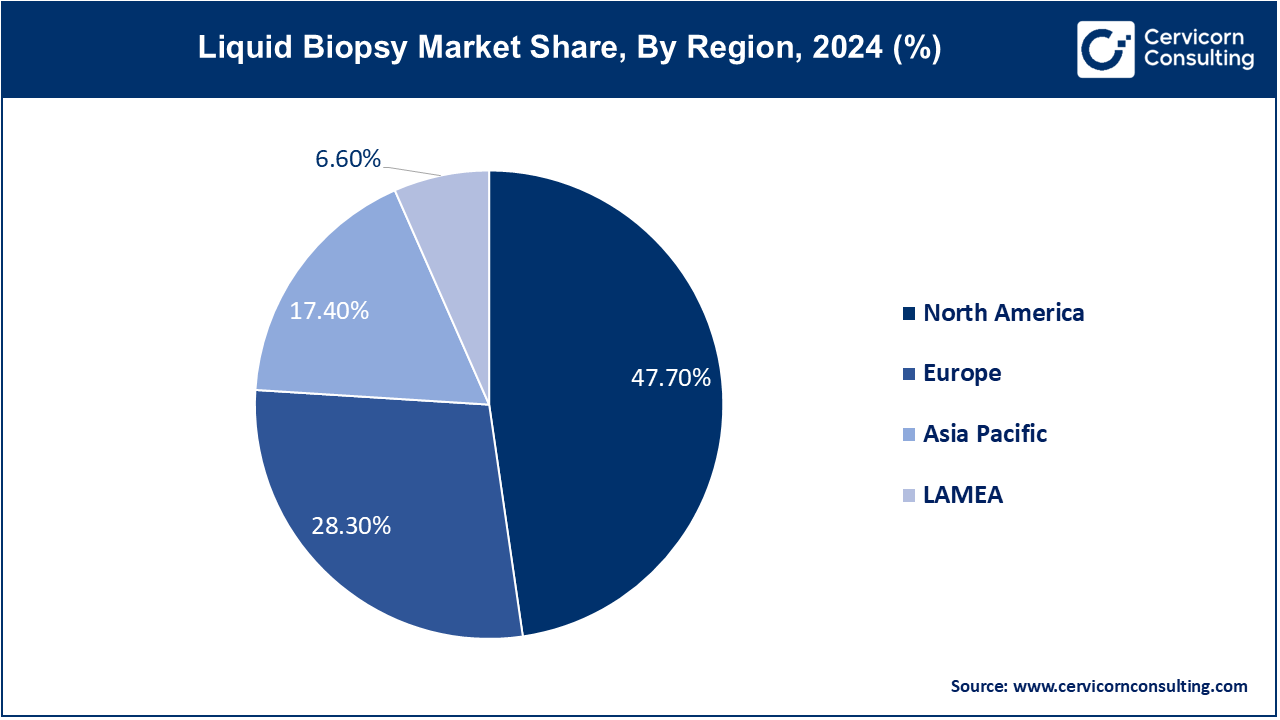

The liquid biopsy market is segmented into various regions, including Asia-Pacific, North America, Europe, and LAMEA. Here is a brief overview of each region:

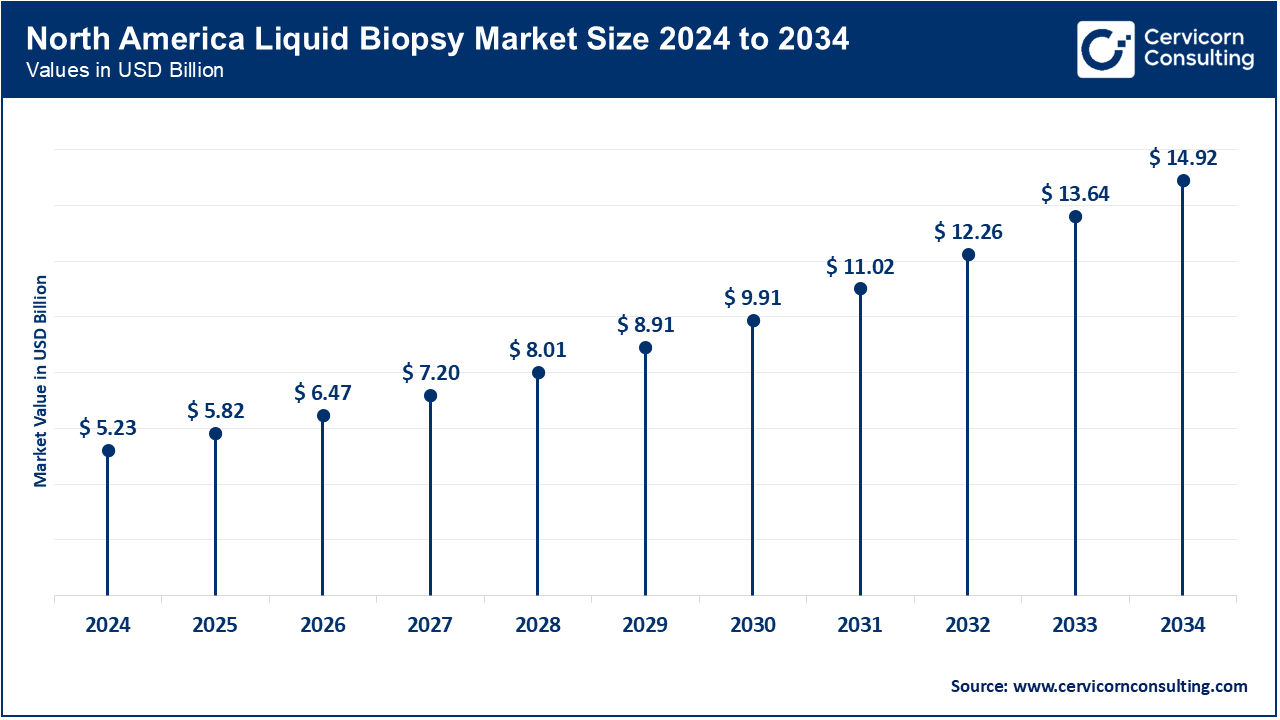

The north america liquid biopsy market size is growing from USD 5.23 billion in 2024 to USD 14.92 billion by 2034 and growing at a CAGR of 11.30% from 2025 to 2034. North America dominates the market due to its advanced healthcare infrastructure and high prevalence of cancer, particularly in the U.S. and Canada. The region leads in the adoption of cutting-edge diagnostic technologies, including liquid biopsies, driven by significant investments in research and development, and favorable regulatory environments. The presence of major market players and the increasing demand for personalized medicine are also key factors fueling growth in this region. Additionally, government initiatives to promote early cancer detection and the growing awareness among healthcare providers and patients further accelerate market expansion.

The Europe liquid biopsy market size was valued at USD 3.10 billion in 2024 and is expected to reach around USD 8.85 billion by 2034. Europe market is growing rapidly, propelled by a strong focus on innovation and the widespread adoption of personalized medicine. Countries like Germany, the UK, and France are at the forefront of integrating liquid biopsy technologies into clinical practice, supported by robust healthcare systems and government initiatives aimed at improving cancer diagnosis and treatment. The region's emphasis on reducing healthcare costs and improving patient outcomes through early detection and minimally invasive diagnostic methods also contributes to the market's expansion.

The Asia-Pacific liquid biopsy market size was estimated at USD 1.91 billion in 2024 and is projected to hit around USD 5.44 billion by 2034. The Asia-Pacific region is experiencing significant growth, driven by increasing cancer incidence, rising healthcare expenditures, and improving access to advanced medical technologies. Countries such as China, Japan, and India are key contributors to market growth, with substantial investments in healthcare infrastructure and growing adoption of liquid biopsy technologies for early cancer detection. Government initiatives focused on expanding healthcare access and the rise of medical tourism in the region further support the market's development. The region's large and aging population also creates a substantial demand for innovative cancer diagnostics.

The LAMEA liquid biopsy market size was estimated at USD 0.72 billion in 2024 and is projected to hit around USD 2.06 billion by 2034. The LAMEA is expanding, albeit at a slower pace, due to varying levels of healthcare infrastructure and economic development across the region. In Latin America, countries like Brazil and Mexico are increasingly adopting liquid biopsy technologies, driven by rising cancer rates and improving healthcare access. The Middle East, with its substantial investments in healthcare infrastructure and advanced medical technologies, also shows promising growth. In Africa, while the market is still in its nascent stages, international partnerships and funding initiatives are gradually improving access to innovative diagnostic tools, including liquid biopsies, across the region.

Circulating Tumor DNA (ctDNA): ctDNA is widely used in liquid biopsies to detect and analyze DNA fragments released by tumors into the bloodstream. It is primarily employed for early cancer detection, monitoring treatment responses, and detecting minimal residual disease. The non-invasive nature of ctDNA testing allows for frequent monitoring, providing critical insights into cancer progression and treatment efficacy.

Circulating Tumor Cells (CTCs): CTC analysis in liquid biopsies offers valuable information on cancer metastasis and progression. By isolating and characterizing these cells, clinicians can gain a deeper understanding of the biology of the cancer, which aids in making informed treatment decisions and predicting patient outcomes.

Exosomes and Extracellular Vesicles: These small particles, released by cells into bodily fluids, carry proteins, RNA, and DNA, making them an important component of liquid biopsies. They provide an additional avenue for cancer detection and monitoring, offering insights into the molecular changes occurring within tumors.

RNA Biomarkers: RNA-based liquid biopsies target molecules like microRNAs or messenger RNAs, which can indicate the presence of cancer and provide insights into gene expression changes. This type of analysis is particularly useful for understanding the underlying mechanisms of cancer and tailoring personalized treatment strategies

Blood: The blood segment has accounted highest revenue share in 2024. Blood is the most common sample type used in liquid biopsies due to its minimally invasive nature and ease of repeat testing. Blood-based liquid biopsies are particularly effective for detecting ctDNA and CTCs, making them ideal for monitoring cancer over time and adjusting treatment strategies as needed.

Urine: Urine-based liquid biopsies are emerging as a non-invasive method for detecting and monitoring cancers, especially in the bladder and prostate. Analyzing DNA, RNA, and proteins in urine samples provides a convenient alternative to more invasive procedures, while still offering valuable diagnostic information.

Saliva: Saliva samples are increasingly being used in liquid biopsies for detecting oral and throat cancers. They can also be used to monitor certain biomarkers associated with other cancers, providing a non-invasive, easily accessible sample type for ongoing cancer monitoring.

Other Bodily Fluids: Liquid biopsies can also analyze cerebrospinal fluid (for brain and spinal cancers) and pleural effusion (for lung cancer), offering targeted insights into cancers in specific parts of the body. These samples provide crucial information for diagnosing and managing cancers that affect the central nervous system and respiratory system.

Early Cancer Detection: Liquid biopsies are increasingly used for the early detection of various cancers, offering the potential to diagnose cancer at a more treatable stage. This application is particularly crucial for detecting cancers that are difficult to identify through traditional methods, improving survival rates by catching the disease early.

Monitoring Treatment Response: Liquid biopsies allow for real-time monitoring of how well a patient is responding to treatment by tracking changes in tumor DNA or RNA. This application helps clinicians adjust treatment plans promptly, improving patient outcomes by ensuring therapies remain effective.

Minimal Residual Disease (MRD) Detection: After treatment, liquid biopsies are used to detect minimal residual disease, which refers to small numbers of cancer cells that may remain and could lead to relapse. Detecting MRD helps in assessing the risk of cancer recurrence and deciding on further treatment, ensuring comprehensive care.

Prognosis and Disease Progression: Liquid biopsies provide valuable information about the likely course of the disease, helping clinicians predict outcomes and plan appropriate interventions. By monitoring the molecular changes in a patient's cancer, liquid biopsies aid in tailoring long-term management strategies.

Hospitals and Clinics: The hospitals and clinics segment has captured 44.70% revenue share in 2024. Hospitals and clinics are the primary users of liquid biopsy technologies, employing these tests for early cancer detection, monitoring treatment response, and guiding therapeutic decisions. The increasing adoption of liquid biopsies in clinical settings is driven by their non-invasive nature and the detailed molecular insights they provide.

Research and Academic Institutes: The research and academic institutes segment has generated 32.60% revenue share in 2024. These institutions use liquid biopsies for cancer research, particularly in studying the molecular mechanisms of cancer, identifying new biomarkers, and developing new therapeutic approaches. Research applications of liquid biopsies are crucial for advancing personalized medicine.

Diagnostic Laboratories: Independent diagnostic laboratories play a significant role in processing liquid biopsy samples, and providing testing services for hospitals, clinics, and research institutes. The growth of this segment is supported by the increasing demand for specialized testing and advanced diagnostic capabilities.

Biopharmaceutical and Biotechnology Companies: These companies use liquid biopsy technologies in drug development, particularly for identifying potential therapeutic targets, monitoring treatment efficacy during clinical trials, and developing companion diagnostics.

Among the emerging players in the liquid biopsy market, Freenome, Inc. is leveraging advanced multi-omics technology to develop early cancer detection tests that integrate genomic, proteomic, and epigenomic data, pushing the boundaries of non-invasive diagnostics. Epic Sciences, Inc. focuses on novel liquid biopsy technologies that analyze circulating tumor cells (CTCs) to provide real-time insights into cancer metastasis and treatment response.

Leading companies like Guardant Health drive market growth through their comprehensive liquid biopsy platforms, which are widely used for early detection and monitoring of various cancers. Illumina, Inc. continues to integrate cutting-edge sequencing technologies into its liquid biopsy solutions, facilitating the development of precision oncology treatments. Innovations and strategic collaborations, such as those seen with Grail, Inc.'s multi-cancer early detection tests and Foundation Medicine, Inc.'s partnership with biopharmaceutical companies, underscore their leadership in the rapidly evolving market.

CEO Statements

Helmy Eltoukhy, Chairman and Co-CEO of Guardant Health:

Michael Nall, President and CEO of Biocept:

Market Segmentation

By Type

By Sample Type

By Product & Service

By Technology

By Clinical Application

By Application

By End-Users

By Region