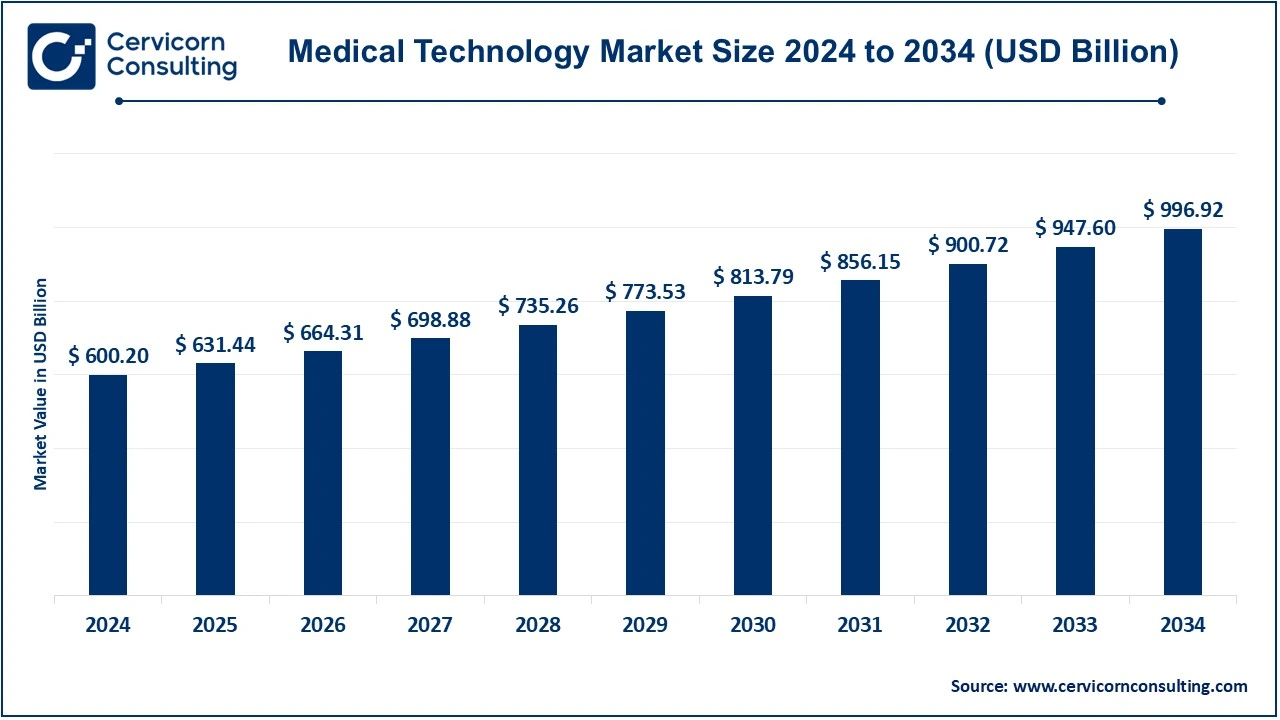

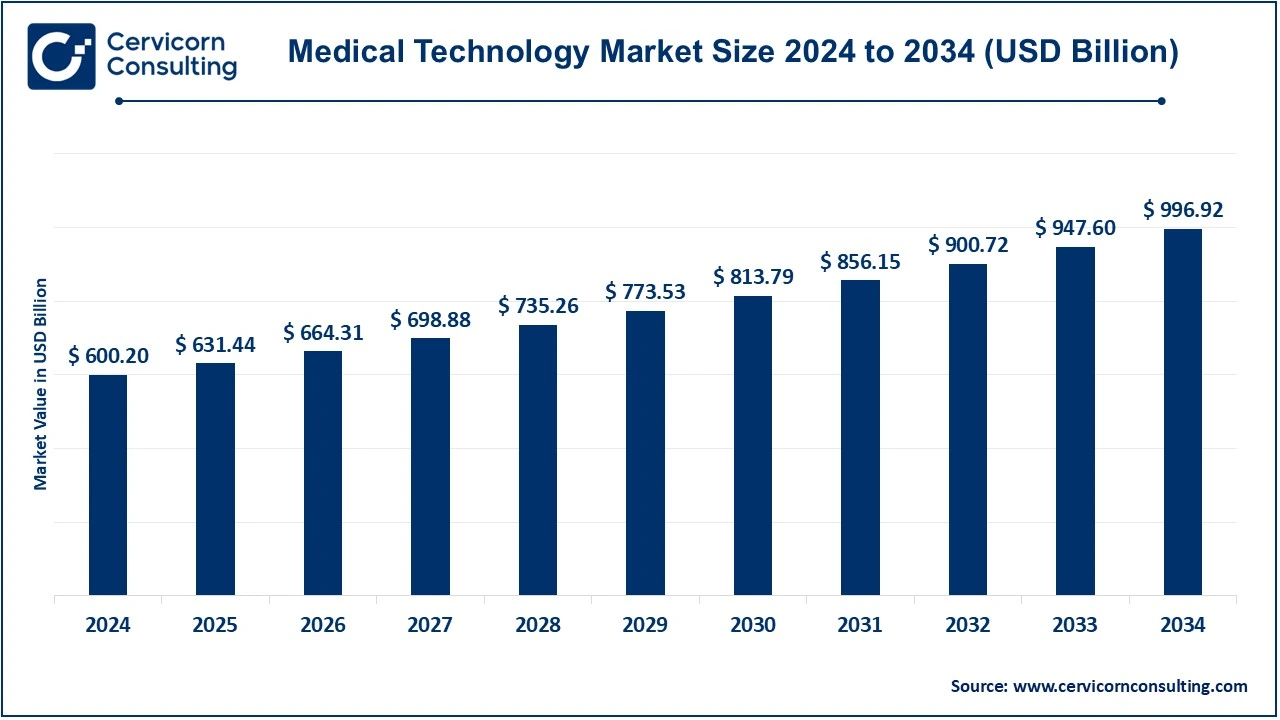

Medical Technology Market Size and Growth 2025 to 2034

The global medical technology market size was valued at USD 600.20 billion in 2024 and is expected to be worth around USD 996.92 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.20% over the forecast period 2025 to 2034.

The medical technology market is experiencing rapid growth due to rising healthcare demands, an aging population, and advancements in artificial intelligence, IoT, and robotics. The adoption of digital health solutions like telemedicine, wearable devices, and AI-powered diagnostics has increased significantly, improving patient outcomes and reducing hospital visits. Emerging trends such as personalized medicine, 3D printing for implants, and minimally invasive surgeries are further fueling market expansion. Government initiatives and increased funding for healthcare innovations are also driving market growth. The demand for medical technology is rising in developing nations due to improved healthcare infrastructure and increased awareness. Companies are investing heavily in research and development to create smarter and more cost-effective medical solutions, making healthcare more accessible worldwide.

What is Medical Technology?

Medical technology refers to the tools, devices, and innovations used to diagnose, monitor, and treat diseases, improving healthcare outcomes. It includes medical devices like MRI machines, pacemakers, surgical robots, and wearable health monitors, as well as software-driven solutions like AI-based diagnostics and telemedicine platforms. These advancements enhance accuracy, speed, and accessibility in healthcare, benefiting both patients and medical professionals. The field of medical technology is constantly evolving, with breakthroughs in biotechnology, nanotechnology, and artificial intelligence revolutionizing patient care. Digital health records, remote patient monitoring, and robotic surgeries are making healthcare more efficient and reducing errors. With increasing demand for better healthcare services, investments in medical technology continue to rise, leading to faster disease detection, personalized treatments, and improved recovery rates.

Key Insights

- AI in healthcare is expected to enhance diagnostics by 40% faster than traditional methods.

- Telemedicine adoption surged by 400% post-pandemic, improving accessibility.

- Wearable health devices market is growing at a CAGR of over 20%, aiding real-time monitoring.

- Robotic-assisted surgery has increased by 15% annually, enhancing precision and reducing recovery time.

- Investment in digital health startups has increased by 30% year over year, indicating strong growth potential.

CEO Statements

Joaquin Duato, CEO of Johnson & Johnson: "At Johnson & Johnson, we are committed to advancing medical technology to improve patient outcomes and revolutionize the healthcare experience. Through innovation and collaboration, we are shaping the future of healthcare by developing transformative solutions that address the needs of patients and healthcare professionals around the world."

Dr. Bernd Montag, CEO of Siemens Healthineers: "Medical technology is transforming healthcare by making it more precise, personalized, and accessible. At Siemens Healthineers, we are committed to advancing this transformation through innovation, collaboration, and a relentless focus on improving patient outcomes globally."

Geoff Martha, CEO of Medtronic: "At Medtronic, we believe that medical technology can help solve the world’s most significant healthcare challenges. Our mission is to transform healthcare for the better by innovating with solutions that improve patient outcomes, reduce costs, and increase access to life-saving therapies around the world."

Growth Factors

- An aging population: The global population, increasingly in rapid numbers, is getting old. The sector is characterized by very few countries that have developed in population aging, the founders of the phenomenon. The main growth driver of this sector is increasingly needed medical services and technologies to treat ailments, including dementia, arthritis, and cardiovascular issues.

- Demographic Factors Driving Sector Growth: The most prominent demographic change driving the sector growth is the growing demand for equipment for aged care, diagnostics, and rehabilitation. In this regard, the high rate of prevalence of chronic diseases, such as diabetes, heart disease, and cancers, proliferation is also highly attributed to lifestyle and environmental effects as well as aging populations. Since these are ailments that require constant management and care, the greater usage of highly advanced diagnostic tools and medical monitoring and treatment equipment enhances the demand for advanced medical technologies for the proper management of these diseases.

- Advancements in Technology: It is now very much because of medical technology, particularly in the areas of AI, robotics, and biotechnology that the industry is growing. Improvements in diagnostic equipment, minimal access to surgical techniques, and imaging equipment only ensure that improvements in patient outcomes mean an impetus to invest even more in health technology. It becomes critical in the efficiency and accuracy of healthcare delivery because of the continued innovation wave.

Market Trends

- Artificial Intelligence and Machine Learning: AI will revolutionize healthcare technology to embrace a new frontier in diagnostics, predictions, and personalization of treatment plans. For example, they could parse gigantic datasets coming in from electronic medical records, imaging, and patient monitoring systems to reveal insights that even human providers would have great trouble finding. This is changing everything starting from radiology and oncology up to precision medicine.

- Telemedicine and Remote Monitoring: The boom of telehealth has changed the face of service provision with the COVID-19 pandemic catalyzing an extraordinary boost in momentum. More patients now experience virtual consultations, remote monitoring, and home-based diagnostics-mostly coming from the under-served and rural populations with products that will support telemedicine assuming the form of wearable health trackers and portable diagnostic devices that will enable monitoring outside traditional healthcare settings.

- Regenerative Medicine: A field with rapid development is regenerative medicine, employing stem cells, tissue engineering, and gene therapy for the regeneration or repair of damaged tissues and organs. With medical technologies focused on healing and regeneration, medical science is likely to overcome conditions that have long been considered incurable, such as spinal cord injuries, severe burns, and degenerative diseases.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 631.44 Billion |

| Estimated Market Size in 2034 |

USD 996.92 Billion |

| Projected CAGR 2025 to 2034 |

5.20% |

| Dominant Region |

North America |

| Region with the Quickest Growth |

Asia-Pacific |

| Key Segments |

Product, End User, Region |

| Key Companies |

Johnson & Johnson, Medtronic, Siemens Healthineers, GE Healthcare, Stryker, Abbott Laboratories, Boston Scientific, BD, Olympus Corporation, Zimmer Biomet |

Market Dynamics

Drivers

- Innovation in Medical Devices: It is the new medical devices and technology that contribute to the growth of this industry. Advancements in surgical instruments, medicines, and diagnostics lead to better clinical results and recovery with fewer health hazards. The advancement of complexity leads to the use of more of the product by the healthcare practitioners.

- Regulatory Support: In almost all regions, regulatory authorities are enhancing their frameworks to speed up the approval of new medical technologies. The reduced bureaucratic burden on the approval process for both devices and treatments, which assures a safe profile for patients, encourages innovation. Hence, this level of regulatory support sets up a more conducive environment for the growth of medical technologies.

- Technological Convergence: IT, Telecom, and healthcare are being merged in an innovative way to redefine what healthcare is or should be. In interesting ways, how technology is merging to end up in better health care, smarter medical devices, AI-based diagnostic tools, and telemedicine platforms are converging upon the front lines, creating better patient outcomes and new business opportunities for companies that will properly employ those technologies.

Restraints

- Higher Development Costs: The development and marketing of innovative new medical products require a significant amount of investment. Many costs are accumulated during research and development, clinical trials, and the regulatory clearances acquired to introduce new medical devices and treatments to patients. Such costs are a significant barrier to innovation because they threaten small companies in particular. More investment costs have reduced the rate and usage of new products.

- Security Risks: Cyber Security-With digital platforms linking medical devices and health systems even more intensively than in previous years, these platforms are targeted by stronger cyber threats. Such hacking risks, therefore, pose an immediate threat to patients' safety and their data being kept private. Medical technologies will thus remain a significant challenge where robust cybersecurity is required as some of the most targeted areas for cyberattacks have been healthcare systems.

- Fragmented Healthcare Systems: Fragmentation of health landscape: with much policy, system, and practice heterogeneity at the regional and, more subtly, at country levels, which makes the scenario of scaling medical technology solutions across regions more complicated. Standardization of health care systems also adds a big barrier to the implementation of universal solutions in countries due to their widespread diversity.

Challenges

- Adoption Resistance: New generations of medical devices and solutions are often resisted by health institutions during adoption. Providers don't want to deploy innovative technologies because they feel unsafe, or not as effective, or harder to learn and apply. Patients too have apprehensions about the reliability or privacy of a technology, especially with new ones like AI-based diagnostics or telemedicine.

- Increase in Preventive Healthcare: As diseases are being prevented, preventive care is gaining increasing attention, and the preventive space has also created new challenges for medical technology companies. Solutions persuading both patients and doctors by making early detection, disease prevention, and wellness monitoring have an effective impact. Preventive technologies- increasing wearables, at at-home diagnostic tests, which gain popularity but bear some barriers regarding users' compliance and accuracy, besides being sometimes cost-ineffective. Convincing patients and doctors about long-term value is another challenge.

- Health inequities: The challenge of deploying high technical medical advances to all populations, especially to those who live in less-income or medically underserved regions, is quite challenging. Some of the members of society cannot enjoy the fruits of new medical technology because its cost is high, or infrastructure and access to healthcare are lacking. These health inequities should be resolved to ensure that new medical technologies will be available to all people who may require them.

Opportunity

- Minimally Invasive Surgery: Robotic system and its like systems of laparoscopy and laser devices allow to get surgery with minimal incisions, less pain, quicker recovery and, in most cases, they require fewer complications, shorter period to recover, and less scarring. This is what usually ensures a better satisfaction of the patient. The market expands where less invasive options are preferred over more invasive ones, that directly helps healthcare providers by diminishing the operational costs and facilitates the patients' recovery outcomes in the shortest time possible.

- Point-of-Care Testing (POCT): POCT offers immediate, on-site diagnosis; therefore, decisions are made and treatment instituted sooner. POCT devices are particularly valuable in acute care situations, rural settings, or chronic disease management. POCT thereby reduces wait times for lab results and thereby improves patient outcomes through quicker diagnoses. POCT can now be extended to a larger range of conditions due to advances in technology. This would benefit both the healthcare provider and the patient with more convenience and cost-effective solutions while reducing the burden on centralized labs.

- Regenerative Medicine and Stem Cell Therapy: Instead, regenerative medicine, which includes stem cell therapies, is changing the way heart diseases, diabetes, and even spinal cord injuries are treated.It's expected to regenerate body parts by repairing or replacing damaged tissues with stem cells or tissue-engineered products. Research will continue in this field as regenerative therapies are applied to previously untreatable conditions, giving medical technology companies focused on innovative treatments and long-term patient care solutions an opportunity to capitalize on it.

Segmental Analysis

The medical technology market is segmented into product, end user, and region. Based on product, the market is classified into medical devices, medical equipment, in-vitro diagnostics (IVD), telemedicine platforms, and others. Based on end use, the market is classified into hospitals and clinics, ambulatory surgical centers, home healthcare, and diagnostic laboratories.

Product Analysis

Medical Devices: Medical devices are instruments used for diagnosis, treatment, or monitoring of a patient. They range from rather simple instruments, such as stethoscopes, to complicated devices, like pacemakers and ventilators. These are important because they will enhance patient care, especially in chronic disease management and during surgery.

Medical Equipment: Medical equipment is the large machinery used in hospitals and clinics. MRI scanners, CT machines, and ventilators are all examples. They can bring precision in diagnostics, inpatient monitoring, and treatment. Improvements in this class enhance the capability of healthcare delivery and patient outcomes.

In-vitro Diagnostics (IVD): IVD tests are those that are conducted outside the human body, for example in the lab, to check or monitor a disease. They include blood tests and genetic screenings. In-vitro Diagnostics (IVD) assumes much significance in disease diagnosis as well as management since new technologies have taken the lead in faster yet more precise results.

Telemedicine Platforms: Video calls and online messaging service enables a patient to get his or her remote consultation. There has been increased access for patients, both in rural areas and routine follow-up of their mental health, by following up with telemedicine platforms.

End Use Analysis

Hospitals and Clinics: Medical technologies will vary greatly in various hospitals and clinics to ensure proper treatment for all patients. From diagnostic devices to equipment that can sustain lives, these setups enable emergency and scheduled healthcare services to be provided to patients. Some of the benefits of new technologies include better outcomes and efficiency in healthcare delivery procedures.

ASCs: ASCs provide immediate outpatient surgical care and increasingly embrace the use of new medical technologies to ensure more effective, less expensive interventions. These types of institutions employ techniques that involve the use of minimally invasive surgical instruments and imaging systems to ensure faster restoration and improved patient results.

Home Healthcare: Home health care provides medical care for patients in their homes, care that they get through portable medical devices, such as blood pressure monitors and telemedicine platforms. The demand for this market is growing because patients, especially the elderly and/or chronically ill, prefer to be cared for at home, thus reducing hospital visits and improving comfort.

Diagnostic Laboratories: Through tests like blood work and imaging, uses of diagnostic laboratories in the case of disease diagnosis take place. However, for all this to be possible, advanced diagnostic tools utilized in the laboratory, such as IVD products and automated analyzers, are used to deliver quick but correct results for a timely treatment decision and better care of patients.

Regional Analysis

The medical technology market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

North America dominated the medical technology market

North America is one of the largest and most developed markets for medical technology. It's dominated by the United States and Canada. It is due to a very high spending level on health care, an efficient infrastructure regarding health care, and thorough adoption of new medical technologies. For instance, in 2022, it invested USD 110 billion into healthcare technology. The rise in the activities of capital markets in the health sector of the USA is about 45% from the effect of the COVID-19 pandemic. Health tech innovators played a very important role during the response stage and in healing and rebuilding post the pandemic. Though much smaller, Canada remains one of the markets whose higher demand for more advanced medical devices and technologies is being driven by an aging population as well as improved healthcare outcomes.

Europe hit notable growth in the medical technology market

Europe hit significant growth in the market. Germany represents 27% of the market. Sales by this country alone amount to almost USD 45 billion. The European MedTech market, which includes IVDs, was USD 170 billion in 2022; Germany accounted for approximately USD 40 billion of this total. The most important markets are the United Kingdom, France, Italy, and Spain. UK demand is very strong due to the comprehensive healthcare needs of the NHS. Orthopedic products and medical imaging are also regionally strong, but home healthcare equipment can be a challenging category in these countries. Strict regulations are good for quality but difficult for new market entrants.

Asia-Pacific hit high-growth in the medical technology market

The Asia-Pacific represents one of the high-growth areas in medical technology, being driven forward by economic development, large populations, and growing healthcare needs. China and India are identified as critical markets, with China being the largest, thanks to a rising middle class, urbanization, and the increase in health expenditure. In 2021, the healthcare market of China reached almost USD 1500 Billion and is supposed to reach about USD 2400 Billion by 2030 under the "Healthy China 2030" initiative. Demand for medical devices such as diagnostic equipment, prosthetics, and monitoring systems is increasing. Opportunities also are present in India, especially in affordable medical technologies. Meanwhile, Japan, South Korea, and Australia are developed countries in health care systems. In medical robotics and imaging technologies, Japan is number one, and in the healthcare system, South Korea is behind.

LAMEA medical technology market growth

The LAMEA region is found to be a widely diversified healthcare market, also including Latin America, the Middle East, and Africa. It covers various levels of infrastructure as well as different adoptions of technologies. Tends for the countries in these regions to increase demands for medical devices in the diagnostics and treatment areas mainly due to a growing middle class and modernization of healthcare in Latin America. Middle East: Healthcare infrastructure in the region enjoys huge investment as demand remains high for highly sophisticated technologies such as diagnostics imaging and surgical robotics. But Africa is mixed. South Africa and Nigeria have increased healthcare investing, while challenges persist due to lessened infrastructure and low spending for growth. There remains a strong demand for affordable medical devices, diagnostics, and telemedicine - mainly in underserved rural areas.

Medical Technology Market Top Companies

Recent Developments

The latest product launches and strategic partnerships undertaken by the companies operating in the medical technology industry bring about remarkable innovations in industry leaders such as Johnson & Johnson, Medtronic, Siemens Healthineers, GE Healthcare, Stryker, and Abbott Laboratories. This approach has further driven medical progress through such leading-edge technologies as artificial intelligence, robotics, minimally invasive procedures, and personalized healthcare solutions. They improve their capabilities in surgical robotics, diagnostic imaging, and patient monitoring by partnerships and acquisitions and enhance global presence while improving health care delivery. This is a wave of innovation changing not only clinical outcomes but also how patients are treated around the world as well as how healthcare systems work more efficiently.

Some notable examples of key developments in the medical technology industry include:

- In October 2024, Johnson & Johnson's MedTech company released the first commercial launch of its VOLT Variable Angle Optimized Locking Technology Plating System, which was intended to better fracture management through the introduction of stability, performance, and efficiency. Orthopedic trauma indeed forms the biggest headache for every country; the VOLT system meets the emergency need for better solutions, including various shapes, lengths, and sizes of screws for the multilingual use of different fracture needs. The design was innovative to minimize irritation of soft tissues, and a flexible tray system paired with color-coded instruments will help ease the surgical workflows. That new launch further cements their leadership in trauma care and further shows off their commitment to innovation from Johnson & Johnson.

- In September 2024, Medtronic plc unveiled several new software, hardware, and imaging innovations at the North American Spine Society 39th Annual Meeting in Chicago quick update for advancing AiBLE, Medtronic's smart ecosystem for spine and cranial procedures. Underpinned by navigation, robotics, AI, imaging, software, and implants, updates elevate the predictability and clinical outcomes of surgeries. Related, Medtronic announced the company has partnered with Siemens Healthineers to potentially advance access to high-end, pre-and post-operative imaging technologies, thereby further enriching care quality to patients suffering from spinal conditions and broadening the evolution of innovation in spine care.

- In October 2024, GE HealthCare launched a new cloud application known as CareIntellect for Oncology, and this now can consolidate all the multiblock patient data into one convenient easy place: medical images, records, and notes. This is the very first generative AI application that encapsulates clinical reports in compact statements of essential points of information for clinicians so that they can get an idea of how the diseases are progressing, deviation from intended treatment plans, and proper intervention decisions.CareIntellect, focusing initially on prostate and breast cancer, will help respond to assessments at the point of treatment, eligibility for clinical trials, and adherence and present an approach to keep cancer care more efficient. It forms part of GE HealthCare's broader initiative-CareIntellect- to make the adoption of applications that healthcare providers use on both the clinical and operational sides less complex.

Market Segmentation

By Product Type

- Medical Devices

- Medical Equipment

- In-vitro Diagnostics (IVD)

- Telemedicine Platforms

- Others

By End Use

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Home Healthcare

- Diagnostic Laboratories

By Region

- North America

- APAC

- Europe

- LAMEA