Off-the-Road (OTR) Tires Market Size and Growth 2025 to 2034

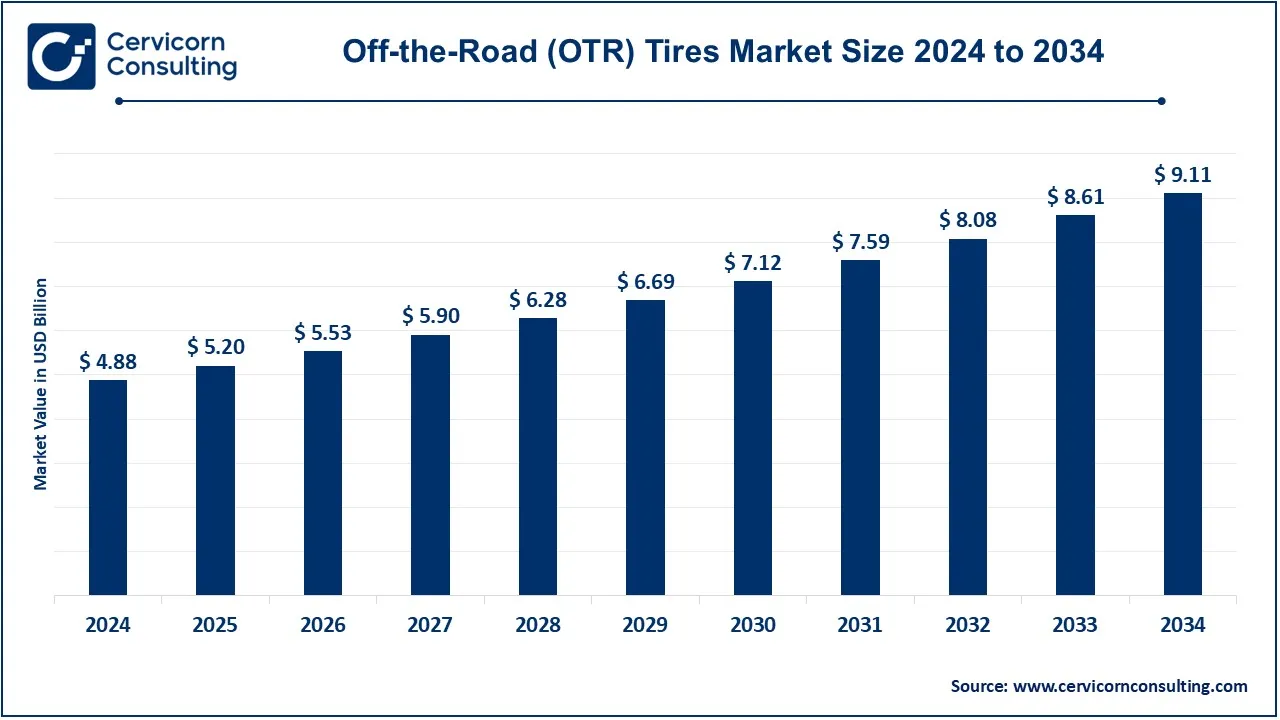

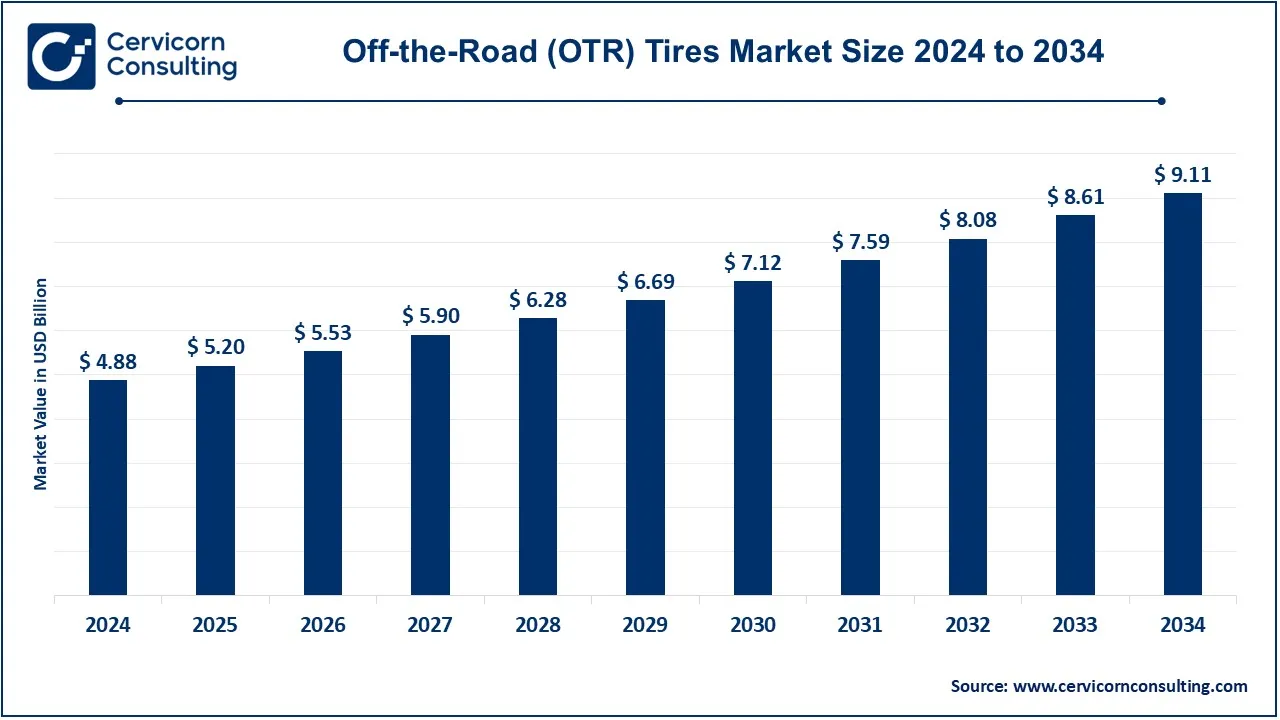

The global off-the-road (OTR) tires market size was reached at USD 4.88 billion in 2024 and is expected to be worth around USD 9.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.51% from 2025 to 2034.

The OTR tire market has experienced steady growth due to expanding construction, mining, and industrial activities worldwide. Government investments in infrastructure projects, including roads, highways, and commercial buildings, have fueled the demand for heavy-duty vehicles, thereby boosting OTR tire sales. Additionally, the increasing use of advanced rubber compounds and sustainable materials in tire manufacturing has improved performance and longevity, further driving market expansion. The rise in mechanized farming and the growing need for efficient agricultural vehicles have also contributed to market growth. Developing economies, particularly in Asia-Pacific and Latin America, are witnessing rapid urbanization and industrialization, leading to a higher demand for OTR tires. Moreover, technological advancements such as intelligent tires with real-time monitoring capabilities are enhancing operational efficiency and reducing downtime, making them more attractive to industries.

Off-the-road (OTR) tires are specially designed for heavy-duty vehicles used in challenging terrains such as construction sites, mining areas, and agricultural fields. These tires provide enhanced durability, deep treads for superior traction, and resistance to punctures, cuts, and extreme conditions. OTR tires are commonly used in machinery like loaders, dump trucks, graders, and bulldozers, ensuring reliable performance in harsh environments. Manufacturers design OTR tires using advanced rubber compounds and reinforced sidewalls to withstand heavy loads and rough surfaces. The three main types of OTR tires include radial, bias, and solid tires. Radial tires offer better heat resistance and fuel efficiency, while bias tires provide superior load-bearing capacity.

Off-the-Road (OTR) Tires Market Report Highlights

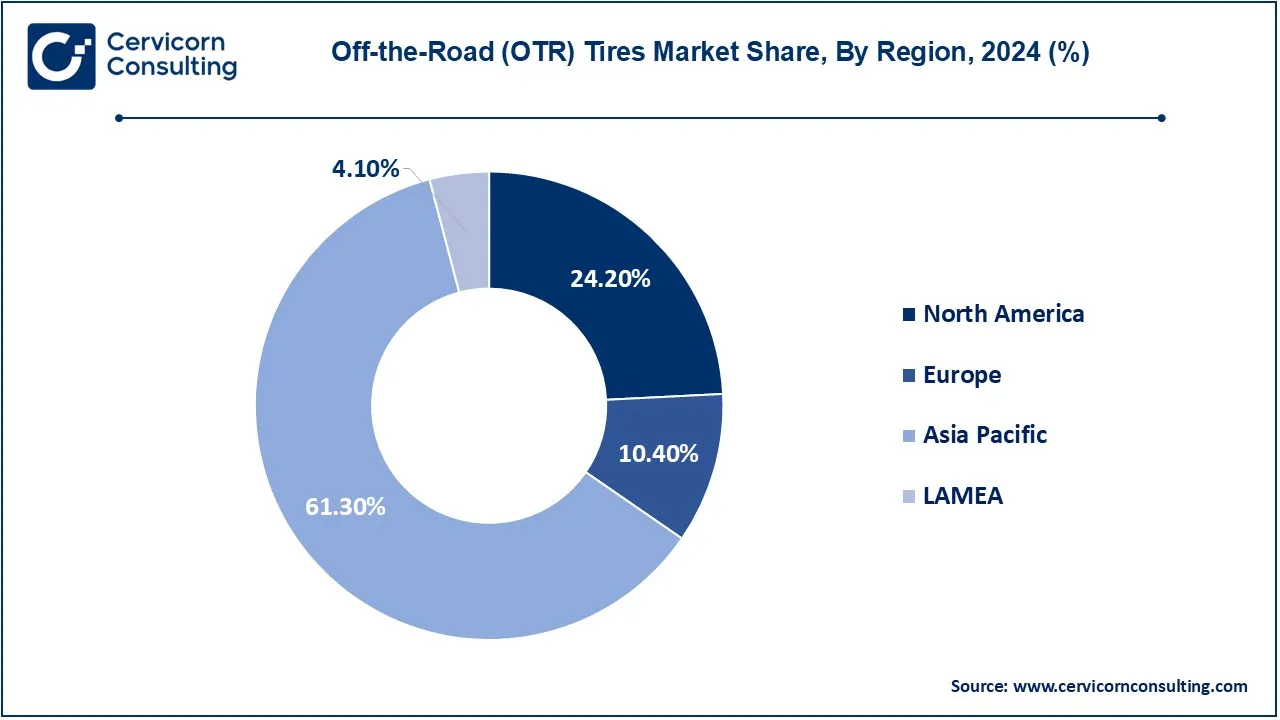

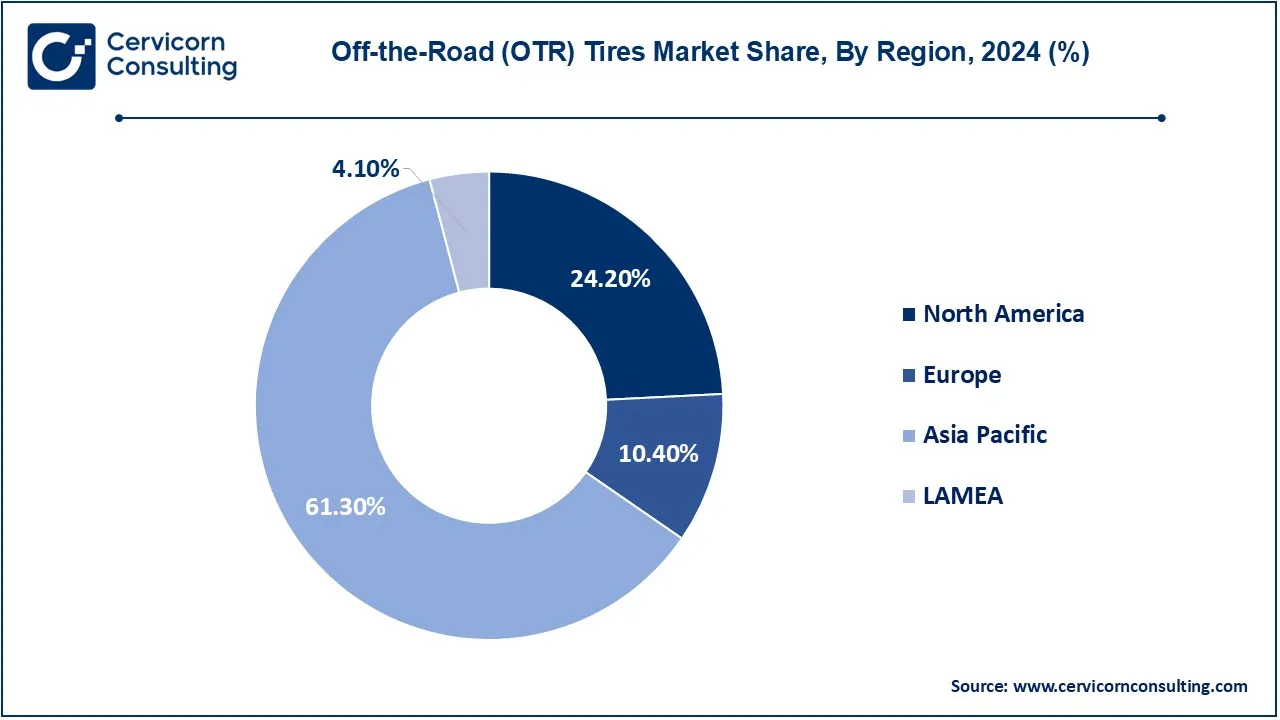

- Asia-Pacific region has dominated the market in 2024 and accounted 61.30% of the total revenue share.

- North America has generated revenue share of 24.20% in 2024.

- By vehicle type, the earthmovers segment has captured revenue share of 24.10% in 2024.

- By tire size, the below 31-inch segment has accounted highest revenue share in 2024.

- By material, the reinforcing material segment is expected to hit highest CAGR during the forecast period.

- By material, the rubber compound segment will hit significant market share during the forecast period.

- By tire weight, the up to 2000 lbs segment has lead the market in 2024.

- By industry, the construction & industrial equipment has held revenue share of 39% in 2024.

- By distribution channel, the aftermarket sector hold revenue share of 70% in 2024.

Off-the-Road (OTR) Tires Market Growth Factors

- Infrastructure Development: Major drivers for the OTR tires market are infrastructure developments around the world. There are investments in massive road construction, bridges, and other infrastructure by governments as well as private sectors. The increased construction activities need heavy machinery, which calls for strong and reliable OTR tires. With more projects starting, the demand for specialized tires to be used on rugged terrains becomes a must, thereby giving the market a strong growth trajectory.

- Mining Operations: The mining industry coincidentally accounts for the highest growth in OTR tires markets. As demand for minerals and other natural resources increases, more mining activities take place because of the growing need to expand mining needs to utilize heavy machinery from haul trucks to excavators, all of which are specialized equipment that will be required to endure such tremendous forces, operate over various types of conditions and environments. With increased mining activities worldwide, a growing demand in the form of high-performance tires arises.

- Agrarian Expansion: Increased agricultural extension is in rhythm with world population growth due to the high need for producing more foods. Modern agricultural productions have also adopted the use of heavy-duty farming machines including harvesters and tractors that perform exceptionally well irrespective of terrain conditions. This further extends with the increment in high-speed operation wherein OTR will be quite ideal for as it works in all terrain condition.

Off-the-Road (OTR) Tires Market Trends

- Sustainable Tires: This OTR tires market, with an increasing interest in sustainability, is being made environmentally friendly. Environmentally responsible customers are being drawn toward greener tires produced on more sustainable materials and process streams. The trend thus implies a commitment to environmental impact reduction and green practice within the industry; apart from catching the eye of a buyer, it also coalesces with global aspirations towards sustainability.

- Retreading Practices: Nowadays, retreading OTR tires gain ground due to the various advantages associated with it. Amongst its many benefits, its affordability and friendliness to the environment help much in attracting interest on the part of the companies, which are keenly interested in having a long time using the tires as well as avoiding producing so much waste procedure reduces waste for the businesses by appropriately disposing of the waste items.

- Introduction and Towards Electrification: Electric machinery is the trend being shunted in this direction since electric equipment is adopted and utilized in construction, mining, and agriculture. For that reason, the need for specialized tires on electric equipment go up, and the development of products fit for this machinery will be within a tire manufacturer's capabilities through innovation and following the market.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 5.20 Billion |

| Projected Market Size in 2034 |

USD 9.11 Billion |

| CAGR (2025 to 2034) |

6.51% |

| High-impact Region |

Asia Pacific |

| Key Segments |

Tire Type, Industry, Vehicle Type, Material, Sales Channel, Tire Size, Tire Weight, Region |

| Key Companies |

Bridgestone Corporation, The Goodyear Tire & Rubber Company, Balkrishna Tyres Ltd. (BKT), Guizhou Tire Co. Ltd., Linglong Tire, Pirelli, PrinxChengshan (Shandong) Tire Co. Ltd. (Chengshan Group), Double Coin Holdings, Zhongce Rubber Group Co. Ltd., Shandong Taishan Tyre, Shandong Yinbao, Aeolus Tyre Co. Ltd. |

Off-the-Road (OTR) Tires Market Dynamics

Drivers

- More Project on Construction-Line: The construction industry is facing a renaissance, with multiple projects in each residential, commercial, and infrastructural development. Thereby, an increase raises the demand for heavy-duty machinery and consequently OTR tires. When construction organizations invest in new equipment to fulfill the orders of various projects, demand for OTR tires builds up drastically. This would reflect that construction activities influence the sale of tires highly.

- Economic Growth: Typically, economic growth implies more investments in most sectors, for example, mining, agriculture, and construction. In the course of economic growth, companies are bound to increase their activities and invest in new equipment. The expansions, therefore, give rise to a demand for OTR tires since the companies look for tires that will withstand harsh environments. Therefore, a sound economic environment is a significant driver of the OTR tire market.

- Usage of heavy machinery: Given the large sectors and industries such as mining, and construction, the need to have specialized tyres is mainly required for achieving the utmost level of performance as well as safety. Such special tires require immense endurance when exposed to severe environmental situations. Therefore, an imperative factor for this industry for the growth in the OTR tires market is thus in demand.

Restraints

- High Costs: Premium pricing of OTR tires is a significant restraint, especially for companies with tight budgets. Many companies will choose cheaper alternatives, which will hit sales in the OTR tires market in general. Such price sensitivity is more visible in developing markets, where the cost factor is the most important, creating difficulties for manufacturers to maintain competitive pricing without affecting the quality product.

- Limited Awareness: In this regard, limited awareness has been recorded in terms of the potential that investment in high-class OTR tires can bring. Very few entrepreneurs understand how higher-quality products can help better equipment functioning and durability. This could limit market expansion because several businesses are instead focusing more on short-term cost cuts than in long-term investments in quality products.

- Supply Chain Disruptions: Global supply chain challenges will impact the availability and the proper distribution of the OTR tire. Material shortages, delays in transportation, geopolitical tension, and other issues result in disruptions in the required quantities and supply in the market. Longer lead times in delivering tires mean that tires can directly impact the ability of the business to have the tires it wants when it needs them.

Opportunities

- Electrification of Off-Highway Vehicles: With the trend of electrifying off-highway vehicles, like mining trucks and construction equipment, specialized OTR tires are needed. EVs have a much higher torque level, which increases the power, and so they require stronger tires with longer life. It provides an opportunity to capture the growing segment in the OTR tire market through innovative design, catering to the specific demands of electric machines.

- Telematics and Tire Monitoring Systems: Telematics and tire monitoring systems can be integrated to track in real-time conditions such as pressure, temperature, and wear on the tires. This technology is employed to optimize performance of the tires, save fuels, and lower downtime. These smart OTR tire solutions ensure that the operation efficiency is at its best; the life expectancy of the tires is increased, and the tire can be utilised to its complete potential. Both the tire manufacturers and service providers in the market can seize the opportunity from it.

- Huge Increase in Demand for Agricultural Equipment: In emerging economies worldwide, an expanded agricultural sector will likely generate rising demand for OTR tyres used for the farm machinery fitted into equipment such as tractors and harvesters. Specialty tires providing for extra grip, comfort, and long run-time capabilities on loose and rough terrains will also find immense applications. Such is easy ground on which to take the ride from demand by tapping to fill manufacturers with creating their tires, in their varied versions.

Challenges

- Maintaining Quality Standards: The ever-rising demand for OTR tires in the market would further aggravate problems and challenge quality standards by producers. When it needs to step up its production levels at the same time, ensuring it meets performance and safety norms would become somewhat of a herculean task. Where there is some sort of compromise, this might trigger safety issues along with losing the reputation of the firm, which in turn creates a necessity to ensure extremely stringent quality control measures in the maintenance of products.

- Technological Adaptation: For OTR tire makers, the rates of technological progress typically provide difficulty. All these would require investment as well as the necessary skill and know-how in matters of innovation in materials, designs, and production processes. It therefore calls for constant adaptation to various forms of change without any signals of slowdowns, something that could be resource-demanding and complicated.

- Logistics Issues: Large and heavy OTR tires pose logistics problems. The manufacturers have to make sure that they transport such big tires effectively and efficiently in a cost-effective manner. Inefficiencies in logistics may cause delays affecting the satisfaction of customers and the profitability of the tire companies. Logistics management continues to be an ongoing problem for the industry.

Off-the-Road (OTR) Tires Market Segmental Analysis

The OTR tires market is segmented into tire type, industry, vehicle type, material, sales channel, tire size, tire weight and region. Based on tire, the market is classified into radial, bias and solid. Based on industry, the market is classified into construction, agriculture, mining, industrial and port. Based on vehicle type, the market is classified into earthmovers, loaders & dozers, tractors, forklift and others. Based on material, the market is classified into rubber compound, reinforcing material and others. Based on sales channel, the market is classified into OEM and aftermarket. Based on tire size, the market is classified into below 31 Inches, 31-40 Inches, 41-45 Inches and Above 45 Inches. Based on tire weight, the market is classified into upto 2000 lbs, 2001 to 4000 lbs, and above 4000 lbs.

Tire Type Analysis

Radial Tires: The fabric cord in layers on a radially outward run running through the center point of a radial tire makes that far more flexible for their distribution of heat out instead of building it around hot in the middle. Improving also upon designs can produce better fuel efficiencies for improving traction and treading all the while along increases on lives of the tire due to tread wear in long processes. Heavy loads such usage in construction along with use in agricultural type for terrains.

Bias Tires: Layers of cloth cords are crisscrossed and laid at angles to one another on bias tires. The sidewall will be stiffer as a result, making it more resistant to punctures and, sometimes, stability; however, bias tires often run hotter and wear faster than radial tires. In industrial and agricultural machines, for example, bias tires are used frequently because durability is more important than fuel economy.

Rigid Tyres: Solid rubber or any other material can be made into one and more unbreakable pieces such that the tires cannot possibly blow out or puncture. Its durability and stability are quite good. As applied, it will be very nice for heavy machinery working inside very tough environments such as building construction and warehouses. With these, there is good grip but is less to undergo maintenance as compared to a pneumatic tire although they give a rugged ride, as opposed to pneumatic tires.

Industry Analysis

Construction: The construction & industrial equipment has a held revenue share of 39% in 2024. Construction industries heavily employ specialized tires for large machinery like excavators, bulldozers, and cranes. Construction tire designs need to be able to tolerate various demanding conditions, such as rough terrain and heavy loads. They have to be equipped with excellent traction and stability features to ensure safety and effectiveness on job sites.

Agriculture: Tires play a very important role in agriculture, as tractors, combines, and most other farm implements run on them. Such tires allow the vehicle to navigate soft ground with minimal soil compaction. Large, deep treads improve traction in muddy conditions-essential features to plant, grow, and harvest crops.

Mining: This requires tires that are tough for handling extreme conditions such as sharp rocks and abrasive surfaces. Tires for mining purposes are designed with high load capacities and higher durability. Specialized tread patterns for off-road performance provide grip, which is necessary for trucks and equipment used in mines.

Industrial: Applications for this industry sector are divided between warehouses and factories. This industry needs durability as well as stability in forklift and pallet jack tires. By navigating confined places, an industrial tire can provide more traction for applications on smooth surfaces.

Port: The heavy containers and other equipment at the ports would stress out the tires because of pressure and movement. They are therefore designed to withstand all the heavy loads and resistance in wear ascribed to constant movement on other surfaces. Port tires would typically have particular tread designs for maximum traction and port loading and unloading activities.

Vehicle Type Analysis

Earthmovers: The earthmovers segment has accounted highest revenue share in 2024. These earthmovers consist of excavators and backhoes that are required to ride on very tough terrains without compromising their traction. Earthmover tires will have loads to carry heavy machinery and withstand extreme conditions, making these tires a mainstay in construction and mining.

Loaders & Dozers: Tires for loaders and dozers need to be heavy-duty, as they have heavy loads and are needed on uneven ground. Such tires are usually made to maximize traction and durability in tread patterns with the intent of performing effectively in construction and earthmoving operations.

Off-The-Road (OTR) Tires Market Revenue Share, By Vehicle Type, 2024 (%)

| Vehicle Type |

Revenue Share, 2024 (%) |

| Earthmovers |

24.10% |

| Loaders & Dozers |

14.20% |

| Tractors |

18.40% |

| Forklift |

12.50% |

| Others |

30.80% |

Tractors: It provides the farm tractor with balanced tread tires, which, comparatively speaking, disturb less soil compared to conventional agricultural tools since their larger dimensions facilitate a deep tread design of the machine that can handle diverse farming conditions by being applicable in various farm environments as well as terrains.

Forklift: For example, forklifts have tires meant to provide stability and movement through warehouse spaces. Tires may also differ from solid to pneumatic depending on the type of working environment and loads they encounter.

Others: This category encompasses different automobiles, which might not fit into the ones discussed earlier, and encompasses specialty equipment used in various industries. Tires for such automobiles are produced considering the specific needs of certain operations concerning load capacity, terrain, and durability.

Material Analysis

Rubber Compound: The rubber compound segment has captured highest revenue share in 2024. This greatly impacts the performance of the rubber compound in such attributes as traction, toughness, and heat resistance. Such compounds can be tweaked based on factors like hardness for longevity versus softness for grip.

Reinforcing Material: The tires contain reinforcing materials. For instance, the steel belts or nylon would stiffen and stabilize the tire. Such materials make the tire puncture resistant as well as support heavier loads; very important factors in construction, agricultural, and mining uses.

Others: Other raw materials in tire production are employed, although they are not classified as either rubber or reinforcement. Some examples would be alternatives or new agents that improve performance, durability, and environmental sustainability in tire manufacturing.

Off-the-Road (OTR) Tires Market Regional Analysis

The OTR tires market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The Asia-Pacific region has dominated the market in 2024.

What factors contribute to Asia Pacific leadership in the OTR tires market?

The Asia-Pacific OTR tires market size was accounted for USD 2.99 billion in 2024 and is predicted to surpass around USD 5.58 billion by 2034. The Asia-Pacific region has lead the OTR tire market. Demand for the regions is driven by China, India, and Australia. China is one of the huge industrial centers that has gigantic demands for OTR tires in the mining and construction industries. Infrastructures are growing fast in India, and agriculture is getting expanded, and this gives a boost to market growth. Advanced OTR tire solutions are in high demand within Australia's mining industry, especially in the coal and iron ore sectors. In terms of infrastructure investment and industrial activity trends, Asia-Pacific plays an important developing role within the OTR tire industry.

North America OTR Tires Market Trends

The North America OTR tires market size was valued at USD 1.18 billion in 2024 and is expected to reach around USD 2.20 billion by 2034. North America is the largest marketplace for OTR tires since this market is powered by one of the largest mining sectors, along with a prominent construction sector. The markets that drive this demand consist of the United States and Canada, whose demand surges due to the continuance of infrastructure and the advancement in mining and mineral industries. Specifically, among all the major markets worldwide, the United States contributes most to heavy-duty applications because of the large scope of construction activities and farms that require these heavy-duty tires.

Europe OTR Tires Market Trends

The Europe OTR tires market size was estimated at USD 0.51 billion in 2024 and is projected to hit around USD 0.95 billion by 2034. The European region is diversified with leaders in OTR tires from Germany, France, and the UK. Emphasis is placed on sustainability and innovation. Manufacturers have designed environmentally friendly solutions for the tires of this region. The growth factor is contributed to by booming construction and agricultural sectors through governmental initiatives in improving the efficiency of infrastructure and agriculture productivity. The European market carries features of high-end technologies and regulations that are rather inclined towards minimizing the degradation of the environment, thus enhancing the demand for premium OTR tires.

LAMEA OTR Tires Market Trends

The LAMEA OTR tires market was valued at USD 0.20 billion in 2024 and is expected to reach around USD 0.37 billion by 2034. The LAMEA countries are different for every economy in Brazil, South Africa, and the United Arab Emirates. Brazil has the biggest market in agriculture in OTR tires; there is a huge mining industry in South Africa, heavily influencing the dynamics of the market. In the case of the UAE, huge investments in construction and infrastructure are driving demand. LAMEA is a growing market, and mining, construction, and agricultural industries are expected to grow in this region, thus offering potential to OTR tire manufacturers.

Off-the-Road (OTR) Tires Market Top Companies

CEO Statements

Shuichi ISHIBASHI, CEO of Bridgestone Corporation

- "As the global leader in tire manufacturing, Bridgestone is committed to advancing the Off-the-Road (OTR) tire market by delivering innovative solutions that enhance safety, efficiency, and sustainability. Our latest OTR tire technologies are designed to meet the rigorous demands of industries such as construction, mining, and agriculture. We believe that by investing in research and development, we can provide our customers with products that not only perform exceptionally but also contribute to reducing environmental impact. Together, we are paving the way for a more sustainable future in heavy-duty transportation."

Mark Stewart, CEO ofThe Goodyear Tire & Rubber Company

- "As we continue to meet the evolving needs of our customers, our commitment to delivering high-performance OTR tires that enhance productivity and safety remains paramount. We're also focused on sustainable practices, ensuring our tires not only perform well in the toughest environments but also contribute to a healthier planet."

Arvind Poddar, CEO of Balkrishna Tyres Ltd. (BKT):

- "At BKT, we are dedicated to providing high-performance OTR tires that enhance efficiency and safety for our customers. Our focus on research and development ensures that we meet the evolving needs of industries such as agriculture, construction, and mining, delivering durable solutions that withstand the toughest conditions."

Recent Developments

- In January 2024, Goodyear Tire & Rubber Company unveiled the GP-3E, a new Off-the-Road or OTR tire series, with tread compounds designed to offer longer wear and better abrasion resistance in a variety of underfoot circumstances, matched with other features and sizes.

- In March 2022, Bridgestone Americas, a world leader in sustainable mobility solutions and tires, attended the AGG1 Aggregates Academy & Expo in Nashville, Tennessee, in March 2022. To demonstrate the benefits of intelligent goods backed by integrated technological solutions, Bridgestone showcased its comprehensive portfolio of Off-the-Road (OTR) products, technologies, and services. The company showcased the merits of its real-time tire monitoring system, IntelliTire, to construction and quarry customers during the event besides presenting its 3-star 24.00R35 rigid dump truck tire.

- In August 2024, Shandong Linglong Tire Co., Ltd. plans to invest US$645 million in its Serbian plant's capacity for the manufacture of more high-performance radial tires. Core components include civil works and equipment purchases, along with a 24MW photovoltaic power generation system, all completed by the end of December 2030. The facility is to generate 1.1 million sets a year; all-steel, engineering, agricultural, and retreads, as well as liquid reclaimed rubber at the end of its implementation. So far, part of this factory production of the semi-steel and the off-road tires- is completed; set to continue with a production target of achieving 12 million sets a year mid the year of 2025.

Market Segmentation

By Tire Type

By Industry

- Construction

- Agriculture

- Mining

- Industrial

- Port

By Vehicle Type

- Earthmovers

- Loaders & Dozers

- Tractors

- Forklift

- Others

By Material

- Rubber Compound

- Reinforcing Material

- Others

By Sales Channel

By Tire Size

- Below 31 Inches

- 31-40 Inches

- 41-45 Inches

- Above 45 Inches

By Tire Weight

- Upto 2000 lbs

- 2001 to 4000 lbs

- Above 4000 lbs

By Region

- North America

- APAC

- Europe

- LAMEA

...

...