Radial Tyre Market Size and Growth 2025 to 2034

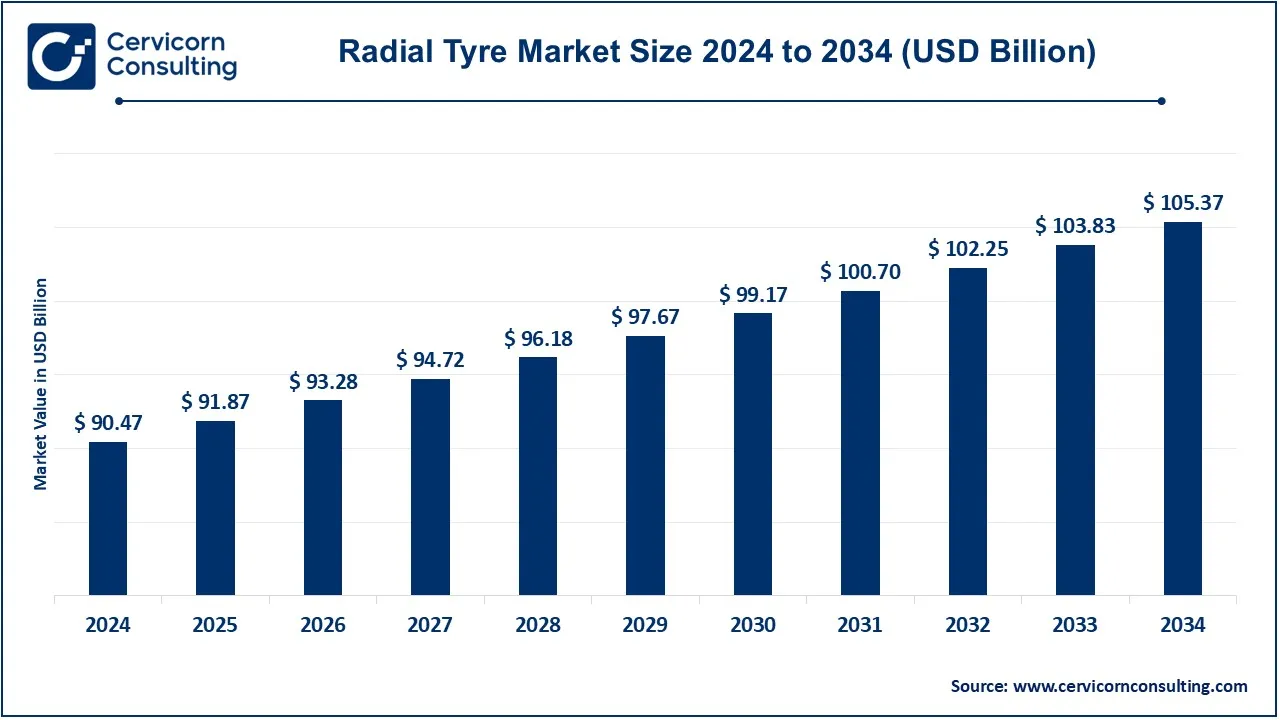

The global radial tyre market size was valued at USD 90.47 billion in 2024 and is expected to be worth around USD 105.37 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.1% from 2025 to 2034.

The global radial tyre market is experiencing steady growth due to increased vehicle production, demand for fuel efficiency, and improved road infrastructure. The automobile industry’s expansion, particularly in emerging economies like India and China, is fueling this growth. Additionally, stricter environmental regulations and consumer preference for durable, high-performance tyres contribute to the rising adoption of radial tyres. The replacement tyre segment is also a key driver, as customers seek better mileage and durability. Technological advancements like self-sealing tyres and airless radial tyres further enhance the market potential. The commercial vehicle segment holds a significant share due to the need for heavy-duty, long-lasting tyres in logistics and transportation.

Statistical Data Supporting Market Growth

- Fuel Efficiency Demand: Radial tyres reduce fuel consumption by 5-10%, promoting adoption.

- Increase in Commercial Vehicles: Over 60% of heavy-duty vehicles use radial tyres globally.

- Replacement Market Growth: The replacement tyre industry is growing at a CAGR of 5-7%.

- Rising Car Ownership: Emerging economies witness a 15-20% rise in vehicle ownership yearly.

- Eco-Friendly Innovation: Over 30% of R&D investments in tyre manufacturing focus on sustainability.

What is a Radial Tyre?

A radial tyre is a type of tyre where the internal plies (cord layers) are arranged at a 90-degree angle to the direction of travel (radial direction). This design improves flexibility, durability, and fuel efficiency. The key feature of a radial tyre is the steel belt reinforcement, which provides strength and better grip on roads. These tyres are commonly used in passenger cars, trucks, and buses due to their ability to handle higher speeds, reduce rolling resistance, and improve mileage.

Key Benefits of Radial Tyres:

- Better Fuel Efficiency: Lower rolling resistance leads to less fuel consumption.

- Longer Lifespan: Enhanced durability due to steel belt reinforcement.

- Improved Comfort & Grip: Better shock absorption and road traction.

- Heat Resistance: Reduces overheating, especially during long drives.

- Cost-Effective in the Long Run: Though initially expensive, they last longer than bias-ply tyres.

Radial Tyre Market Report Highlights

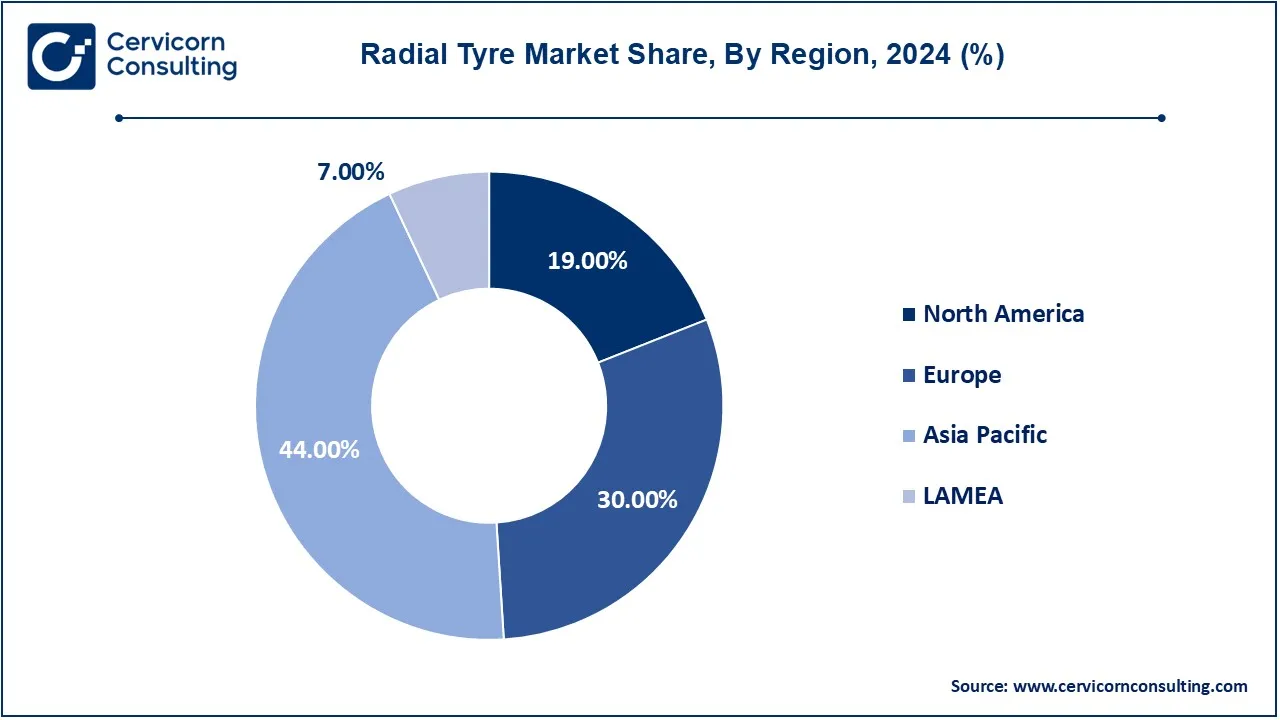

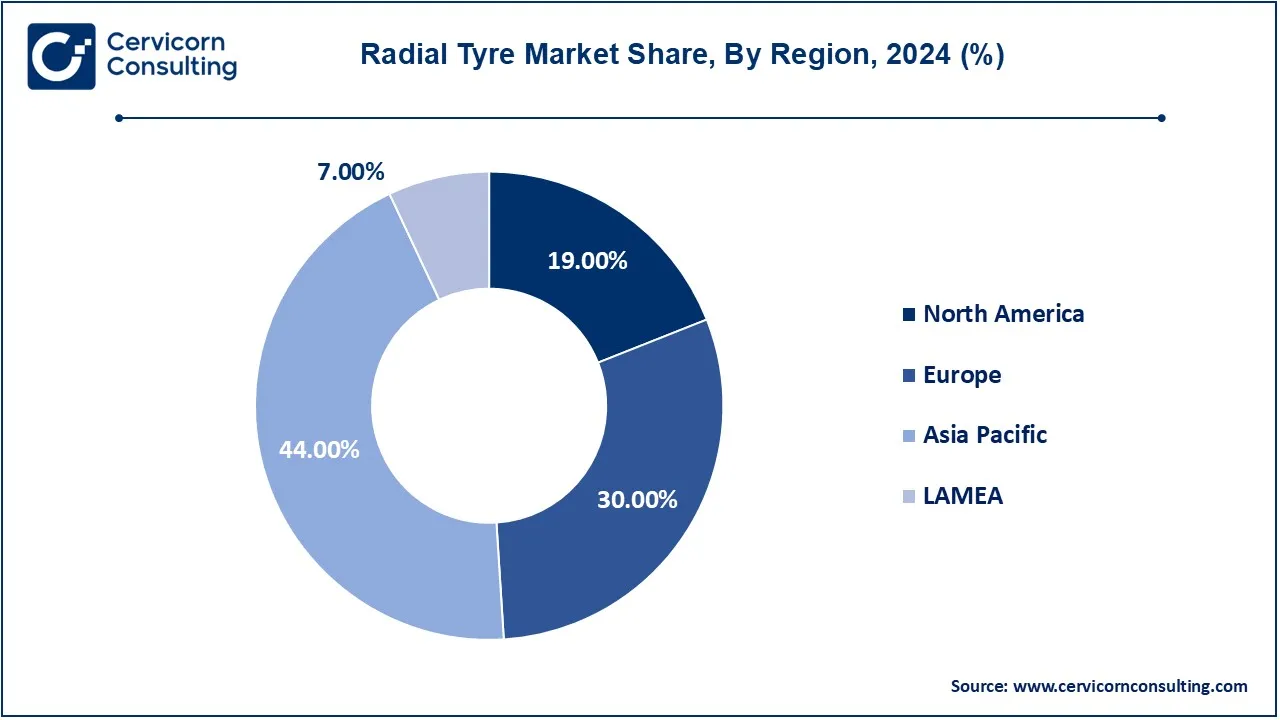

- The Asia-Pacific region led the market in 2024, accounting for a 44% revenue share.

- The Europe region has generated revenue share of 30% in 2024.

- By application, the vehicle segment has accounted revenue share of 69% in 2024.

- By distribution channel, the offline stores segment has recorded highet revenue share in 2024.

Radial Tyre Market Growth Factors

- Raising Vehicle Output: The rising vehicle manufacturing all over the world, especially in developing countries, provides constant spatial demand for radial tires. This rapid growth within the automobile industry is one of the major reasons radial tire market is propelled as such types of tires have become the norm fitment for those vehicles owing to their performance, efficiency in cost as well as productivity.

- Growth of the Logistics Sector: The growing logistics and transportation sector, attributed to e-commerce and global trade, enjoys a great demand for effective and durable tyres for commercial fleets. These radial tyres suit the needs of supply operations, with their fuel efficiency and durability features. This has led to wider adoption of the same, as fleet operators favor tyres that offer low operating costs over time.

- Development of Road Infrastructure: Emerging economies such as those of the Asia Pacific region witness better development of the road infrastructure which in turn results to a more connected road networks- hence the consequent increased demand for radial tyres.These tyres are compatible with newly paved and maintained road surfaces, on which drivers favor the use of tyres providing better stability, security, and comfort. While nations continue to modernize their road networks, the demand for radial tyres will keep growing in urban and rural settings.

- Replacement Tyres: Replacement tyres have grown in consideration with time; their day-to-day wear and tear result in their periodic change out. Radial tyre terrific set in the replacement market known for its endurance and performance; they dispose of high-road quality, and most importantly, safety features essential for any customer eying optimum fuel economy and comfort.

Radial Tyre Market Trends

- Increase in High Performance Vehicle Sales: The increasing sales of high-performance vehicles which provided radial tyres improved durability, traction and stability for the more serious upmarket versions of cars has also fueled the demand. Of late, however, with skirts and other performance-oriented aspects of cars gaining popularity, the radial tyre market witnessed an upsurge in growth as they provided better handling and fuel efficiency.

- Expansion of Electric Vehicles (EVs): Soaring growth in the electric vehicle market has incited greater demand for radial tyres designed to satisfy low rolling resistance requirements. The tend towards radial tyres, aimed to minimize energy losses, is critical for EV manufacturers, which consider efficiency to be their competitive edge toward extending battery life. The enabling tendencies toward electric vehicles are indeed molding the radial tyre market wherein companies are brought to innovate and design EV-specific tyre solutions focused on maximizing range while providing durability and reduced noise.

- Advances in Smart Tyre Technology: The incorporation of smart tyre technology into radial tyres is enshrined as the chief trend particularly for fleet management and commercial sectors. Tyres, equipped with sensors for monitoring in real-time, provide better safety in vehicles, improve operational efficiency, and increase tyre life by making sure conditions are on optimum levels. This trend bolsters data-driven maintenance, which is receiving growing appreciation across logistics and other high-use sectors.

- Switch to Low-Emission Tyres: Tighter emission standards usher in a migration towards radial tyres that have lower rolling resistance, thus helping to reduce fuel consumption and emissions. Such a tendency is all too pointedly felt, especially in Europe and North America, where regulatory frameworks stand guard against green technologies. Tyre manufacturers are doing what they can in formulating environment-friendly radial tyres that align with regulatory and consumer demand for sustainability.

- Increased Utilization in the Heavy Duty Segment: The heavy-duty vehicle segment, particularly in long-haul trucking, shows a higher rate of acceptance for radial tyres – which have a better load capacity and fuel efficiency as well as less wear. Fleet owners enjoy improved operational convenience since they have strong durability and long-term savings in spite of the fact that the transport and logistics industry is growing in leaps and bounds across the globe.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 91.87 Billion |

| Expected Market Size in 2034 |

USD 105.37 Billion |

| Projected CAGR 2025 to 2034 |

4.10% |

| Prime Region |

Asia Pacific |

| Key Segments |

Type, Material, Application, Region |

| Key Companies |

GT Radial, Finixx Global Industry, Goodyear, Bridgestone, Michelin, BFGoodrich, Otani Tyre, JK Tyre, Balkrishna Industries, Tianli |

Radial Tyre Market Dynamics

Drivers

- Longer Tyre Life: The radial tyre offers customers superior durability, thus drawing preference. The radial tyre distributes the tread pressure more uniformly than the bias-ply tyre and thus tends to wear less and provides a longer life span. If a tyre lasts longer, it means less cost in the long run, which is big for individual cars and commercial fleets. Additionally, the reduced rate of replacement offers both economic and ecological advantages to the radial tires, making them favorable on a wide variety of vehicles as cars, trucks and farm equipment.

- Better Stability and Comfort: Radial tyres afford improved stability, high handling, and comfort especially on highways and well-paved roads. The nature of their construction allows radial tyres to be more flexible on the sidewalls while keeping the tread in a more rigid shape, making for a smoother and more controlled ride. This mixture of comfort and performance is appreciated by customers especially in places where quality tyres are the driving condition most essential feature. This quality remains also a very sensitive buying consideration in the premium vehicle segments.

- Increased Automotive Production: With increased automobile production mainly in emerging markets, radial tyres' demand for durability is gaining momentum. These markets accept radial tyres to meet consumer expectations regarding performances and dependability. Also, with a thrust on disposable incomes, consumers have become comfortable investing more in quality tyres, which is ensuring a steady flow of trade. This trend also goes hand in hand with the manufacturers concerned with including radial tyre models at cheaper rates in fresh vehicle appetites to bolster their hold in the market.

Restraints

- Initial High Cost: Most radial tyres are generally more expensive than traditional bias tyres because of their complex manufacturing processes and superior materials. Such efforts are compounded by the fact that high initial costs deflect price-sensitive customers, especially in regions still dominated by bias tyre markets. Owing to the long-run economy of radial tyres, nevertheless, a high first cost acts as an impediment to a broader acceptance for certain marketplaces, especially low-income families or small business ventures with large fleets.

- Lack of Awareness in Emerging Markets: In a number of developing markets, consumers and fleet owners may appreciably be unaware of the advantages offered by radial truck tyres in such a transition. These markets are typically dominated by their use of conventional bias-ply tyres, and there has been a very slow transition to radial strategies, partly owing to this ignorance. In the absence of adequate education on the long-term cost savings associated with radial tyres and their performance benefits over bias-ply tyres, the potential market remains reluctant to embrace a more costly solution.

- Complex Manufacturing Requirements: The most complex stages of production are required while producing radial tyres. The use of highly complicated technology makes them more difficult to produce at a very high cost. Radio tyres require sophisticated machines, specialized raw materials, and trained workers; these conditions frequently develop constraints of their own within the supply chain. This complexity inhibits the ability of smaller manufacturers to enter the market. Besides, delays in production can be a blockade on supply in some areas.

Opportunity

- Rising Demand for Electric Vehicles (EVs): A surge in electric vehicle (EV) adoption is providing radial tyre manufacturers with a huge opportunity. To augment energy efficiency and battery life, EVs require tyres that support low rolling resistance, enhanced durability, and greater performance. Radial tyres meet these requirements considerably well and thus provide an opportunity for manufacturers to devise and supply tyres tailored specifically for EVs. The surging sales of EVs will thus, on the other hand, inflate the demand for these high-performance tyres and consequently, drive the growth in the market.

- Growth in the Automotive and Transportation Sectors: As the automotive and transportation sectors grow, they are generating increasing demand for radial tyres in developing economies. With a growing number of vehicles on the other end of the spectrum in the Asia-Pacific region, demand for durable and efficient tyres is matched by demand. Consumers and manufacturers are interested in radial tyres for their supposed fuel efficiency and durability. Such opportunities keep on arising for the tyre manufacturers as the development of the automobile industry advances.

- Increasing Focus on Sustainability and Eco-Friendly Tyres: The radial tyres provide an opportunity for manufacturers to embrace the growing move towards sustainability and environmentally-friendly tyres. In view of growing environmental consciousness and prohibitive guidelines, both consumers and manufacturers are looking for tyres giving better fuel economy and a reduction in carbon emissions. . Low rolling resistance and longer-lived radial tyres are contributing to sustainability goals. Manufacturers that specialize in creating eco-friendly radial tyres with renewable materials will find this opportunity quite rewarding, serving both the regulatory concerns and changing consumer preferences in regard to green products.

Challenges

- Sustainability Demands: The demand for sustainability practices put pressure on the tyre manufacturing industry, including radial tyre products. Producing sustainable tyres from material sourcing, through manufacturing, and all the way to disposal presents serious challenges. The costs of ongoing investments in research dated in sustainability demands, eco-friendly materials, and production processes often mean the costs will go high. Shifts towards the circular economy focused on recyclability are further propelling manufacturers toward sustainable production innovations.

- Volatility in the supply chain: Since natural rubber, steel, and synthetic compounds are also the main raw materials for radial tyre manufacture, tire manufacturing is constantly exposed to supply chain issues. Supply chain challenges running high from natural disasters and conditions of political unrest to the global COVID-19 pandemic have become challenges in recent times. Often disturbances in the supply chain lead to the suspension of production, delaying delivery of raw materials, and raising costs of raw materials, hence affecting the profitability and security of radial tyre manufacturing companies. It is vital to ensure an agile supply chain to reduce or mitigate these issues; unfortunately, this remains a very challenging job.

- Climate-induced wear and tear: The performance and lifespan of radial tyres depend on climatic considerations, where extreme weather hastens wear and tear. Tyres on the other hand always wear faster in extreme, hot weather; this normally compromises the life span and also impacts safe driving. Manufacturers have been confronted with the challenge of coming up with radial tyres that withstand distances through diverse climates and road conditions, while still maintaining the maximum durability and performance necessary. This problem remains valid, especially in areas with huge temperature variations whereby the consumers expect the tyres to be circular.

Radial Tyre Market Segmental Analysis

The radial tyre market is segmented into type, material, application, distribution chennel and region. Based on type, the market is classified into whole steel wire, half-steel wire, and whole fiber. Based on material, the market is classified into natural rubber, fabrics, steel, and synthetic rubber. Based on application, the market is segmented into vehicle and others. Based on distribution channel, the market is segmented into online stores and offline stores.

Type Analysis

Whole-steel Wire: Whole steel wire radial tyres use steel reinforcement throughout the carcass and belt, conferring remarkable durability and an ability to carry a load. Such tyres generally find favour in heavy-duty and high-performance applications like commercial trucks and construction vehicles where stability and long-lasting strength are key. The whole steel wire construction equips such tyres to take up extreme conditions, hence increasing their lifespan and making them fit for rugged environments and high mileage applications.

Half-steel wire: Half-steel wire radial tyres use steel reinforcement on the belt area while using other materials like fiber in the carcass. This sort of design provides an equilibrium of durability and flexibility, which results in optimum performance in various terrains. Half-steel tyres are commonly used in light commercial vehicles and passenger cars, as they give a comfortable ride with adequate strength. Their structure offers versatility and adaptability that allows them to be used without difficulty in urban and semi-rough conditions without sacrificing durability.

Whole Fiber: Whole fiber radial tires have the whole body made of fiber; thus they are quite weightless and far superior in flexibility when compared with fully steel-reinforced types. This kind of tire is mostly used for cars that prioritize effortlessly of ride view and fuel efficiency-for instance, passenger cars in urban areas. Whole fiber tires will cut down rolling resistance tremendously, which helps with fuel economy. Well, they can also be rather big; hence their ability to carry weight and lifespan might really not be equivalent to steel-reinforced radial tires in terms of their delivery-suited particularly for heavy-duty applications.

Application Analysis

Vehicle: The application segment includes all road vehicles inclusive of passenger cars, light commercial vehicles, and heavy-duty trucks. The vehicle segment forms the primary driver of demand in the radial tyre market, as radial tyres become the standard for modern vehicles. High stability of construction, owing to the specific knobbly patterns introduced for off-road tires, guaranteed better traction on gradients, less fuel consumption, and higher longevity. The emerging economies are beginning to see a lot of growth in the automotive sector and, hence, the demand for radial tires.

Radial Tyre Market Revenue Share, By Application, 2024 (%)

| Application |

Revenue Share, 2024 (%) |

| Vehicle |

69% |

| Others |

31% |

Other: It covers off-road and specialist vehicles involved in farming, mining, and construction: applications that are inexorable and divergently situated concerning standard road vehicles. These tyres are often engineered and designed to maximize features like durability, traction, and abusive environment resistance. Radial tyres for this kind of application are designed for rugged environments while promoting stability and comfort of operation, characterized by their widespread need in industries where the equipment operates in difficult terrain. This segment demonstrates high flexibility of the application of radials in nonautomotive use.

Radial Tyre Market Regional Analysis

The radial tyre market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The Asia-Pacific region has dominated the market in 2024.

Why is Asia-Pacific leading the radial tire market?

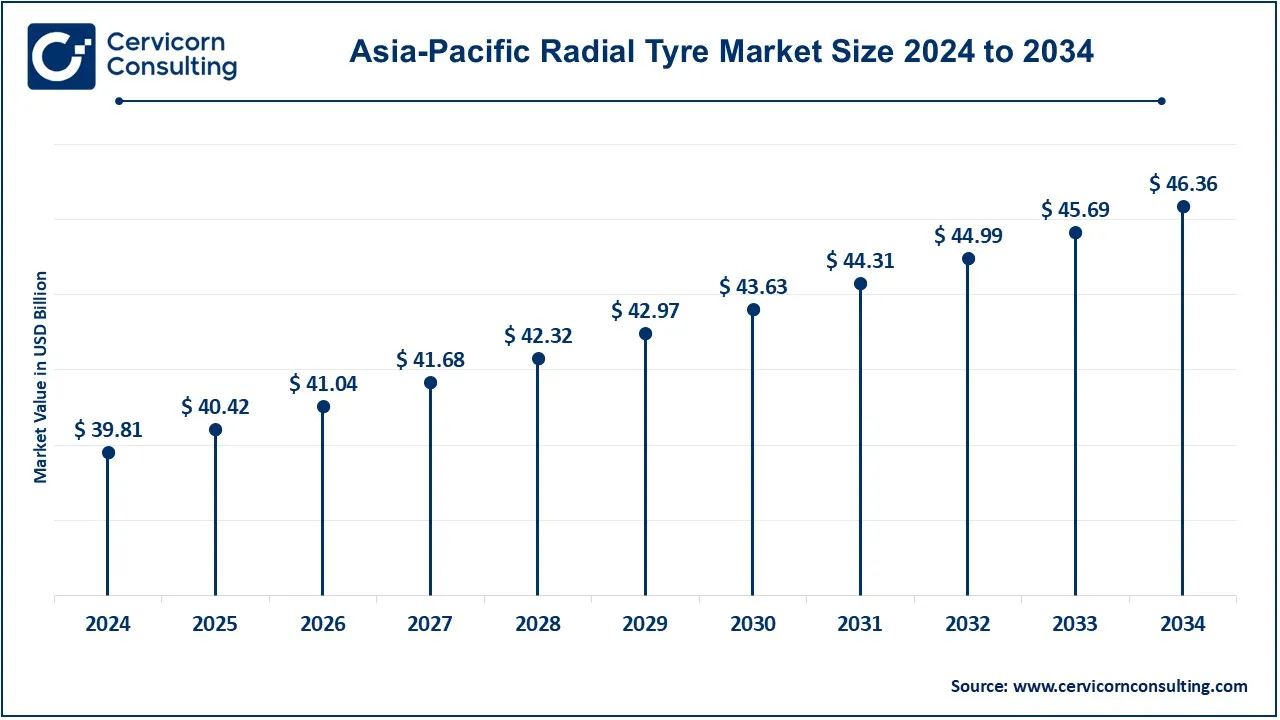

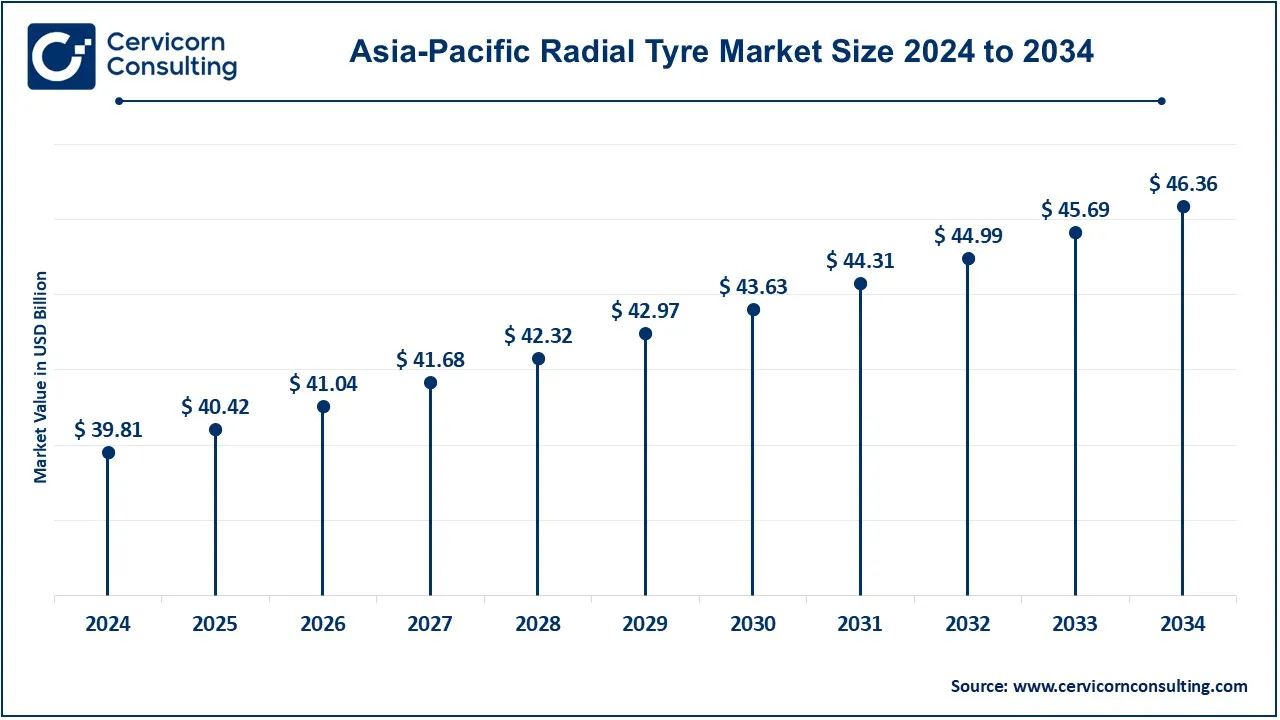

The Asia-Pacific radial tyre market size was accounted for USD 39.81 billion in 2024 and is predicted to surpass around USD 46.36 billion by 2034. Asia-Pacific has emerged as the largest segment and is projected to grow with high growth rates owing to rapid industrialization and urbanization. China, India, and Japan significantly grow. China is the highest producer and consumer of tyres, supported by an ever-booming automotive industry. With vehicle ownership and infrastructure development on the upswing, the radial tyres are seeing increased demand in India. Further contributing to the region's economic growth and a burgeoning middle-class population, which is steeply contributing to the demand for passenger and commercial vehicles.

What are the driving factor of North America region in radial tyre market?

The North America radial tyre market size was valued at USD 17.19 billion in 2024 and is expected to reach around USD 20.02 billion by 2034. North America finds impetus in radial tyre business with its major contributor being the US and Canada. Substantial demand for passenger and commercial vehicles drives the production vigour to the investment support. Other forces driving the vigorous automobile are steep consumer preferences for fuel-efficient tyres. Further, the United States benefits from massive investments in tyre manufacturing and innovation. Demand for radial tyres in the commercial segment is also spurred on by the growth of e-commerce and logistics services.

Why is the Europe radial tyre market experiencing sustainable growth?

The Europe radial tyre market size was estimated at USD 27.14 billion in 2024 and is projected to hit around USD 31.61 billion by 2034. Europe is influenced by stringent regulations on vehicle emissions and safety that hasten the uptake of advanced tyre technologies. Major players like Michelin, Continental, and Pirelli are headquartered in this region, especially countries such as Germany, France, and Italy. The European market has laid particular emphasis on sustainability and burgeoning demand for eco-tyre options. In addition, with the growing inclination for electric-vehicle (EV) market development, the radial tyre segment will be presented with another promising opportunity in providing new solutions.

LAMEA radial tyre market is gradually expanding

The LAMEA radial tyre market was valued at USD 6.33 billion in 2024 and is expected to reach around USD 7.38 billion by 2034. The LAMEA radial tyre market is gradually expanding, due to increasing vehicle production and sales in Brazil and South Africa. The factors driving the passenger vehicle demand in Latin America include urbanization and increasing disposable income. Coupled with developed logistics and transportation in the Middle East, that has bolstered the demand for commercial tyres, the African market continues to develop due to improved infrastructure and the increasing volume of vehicles being used. However, challenges arising from economic instability that threaten to hinder progress abound.

Radial Tyre Market Top Companies

CEO Statements

Michelin CEO of Florent Menegaux

- "Our commitment to sustainability and innovation drives our strategies as we aim to lead in the development of eco-friendly tyres that meet the evolving needs of our customers."

Bridgestone CEO of Shuichi Ishibashi

- "We are focused on enhancing our technological capabilities to provide safer and more efficient tyre solutions, particularly in response to the growing demand for electric vehicles."

Goodyear CEO of Rich Kramer

- "The integration of smart technology in our tyres is essential for improving performance and safety, and we are dedicated to leading this transformation in the industry."

Recent Developments

- In February 2024: Cabot Corporation's engineered elastomer composites (E2C) have seen significant adoption in the off-road tyre segment, celebrating four years since their market launch.

- In December 2023: Sailun Group announced an expanded investment plan for a tire manufacturing facility in León, in the central Mexican state of Guanajuato, through a joint venture with Mexico's TD International Holding.

Market Segmentation

By Type

- Whole Steel Wire

- Half-Steel Wire

- Whole Fiber

By Material

- Natural Rubber

- Fabrics

- Steel

- Synthetic Rubber

By Application

- Vehicles

- Passenger Cars

- Light Commercial Vehicles

- Heavy-duty Trucks

- Other

- Others

- Farming

- Mining

- Construction

- Other

By Distribution Channel

- Online Stores

- Offline Stores

By Region

- North America

- APAC

- Europe

- LAMEA

...

...