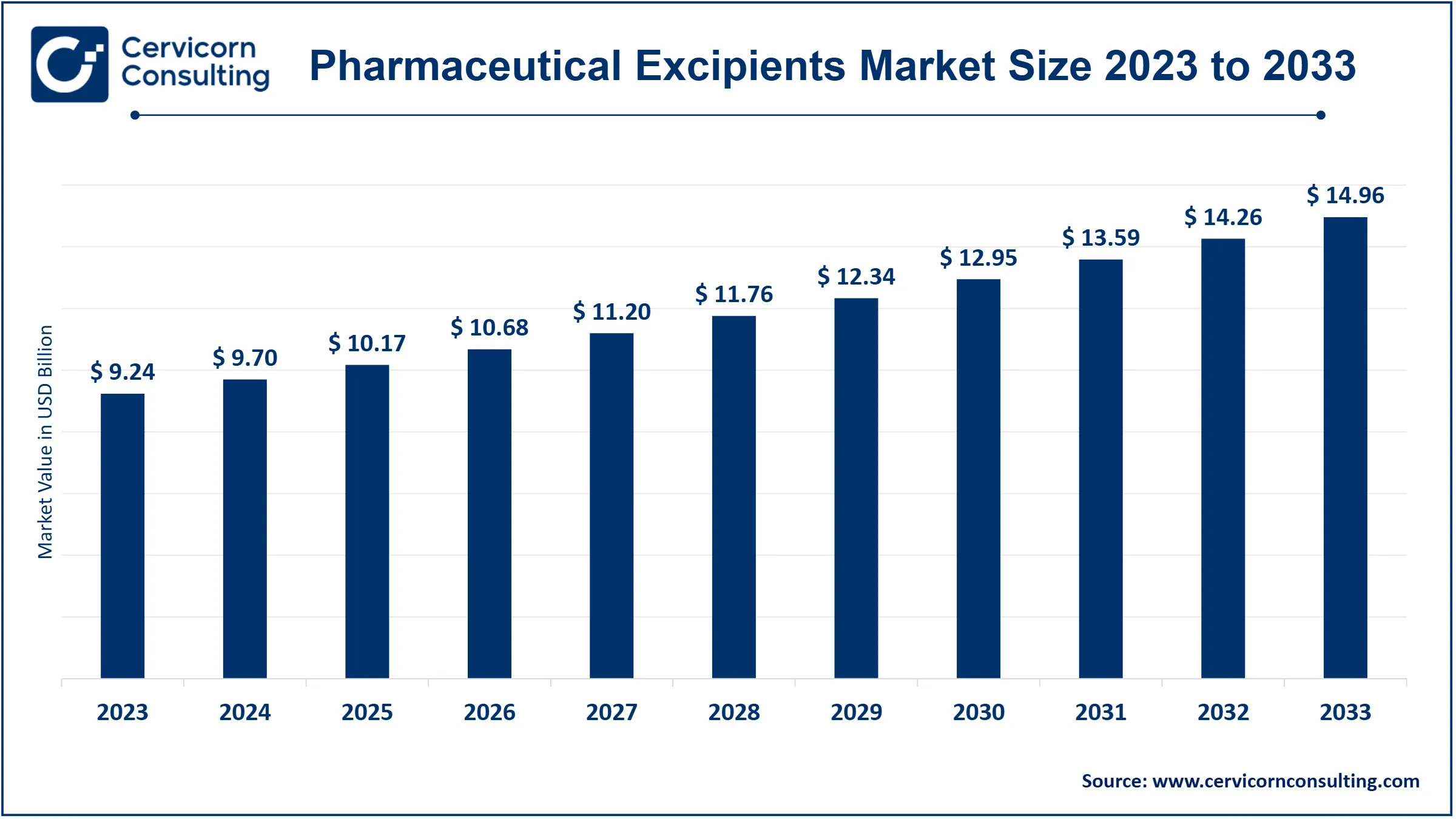

The global pharmaceutical excipients market size was valued at USD 9.70 billion in 2024 and is expected to be worth around USD 14.96 billion by 2033, growing at a compound annual growth rate (CAGR) of 4.93% from 2024 to 2033.

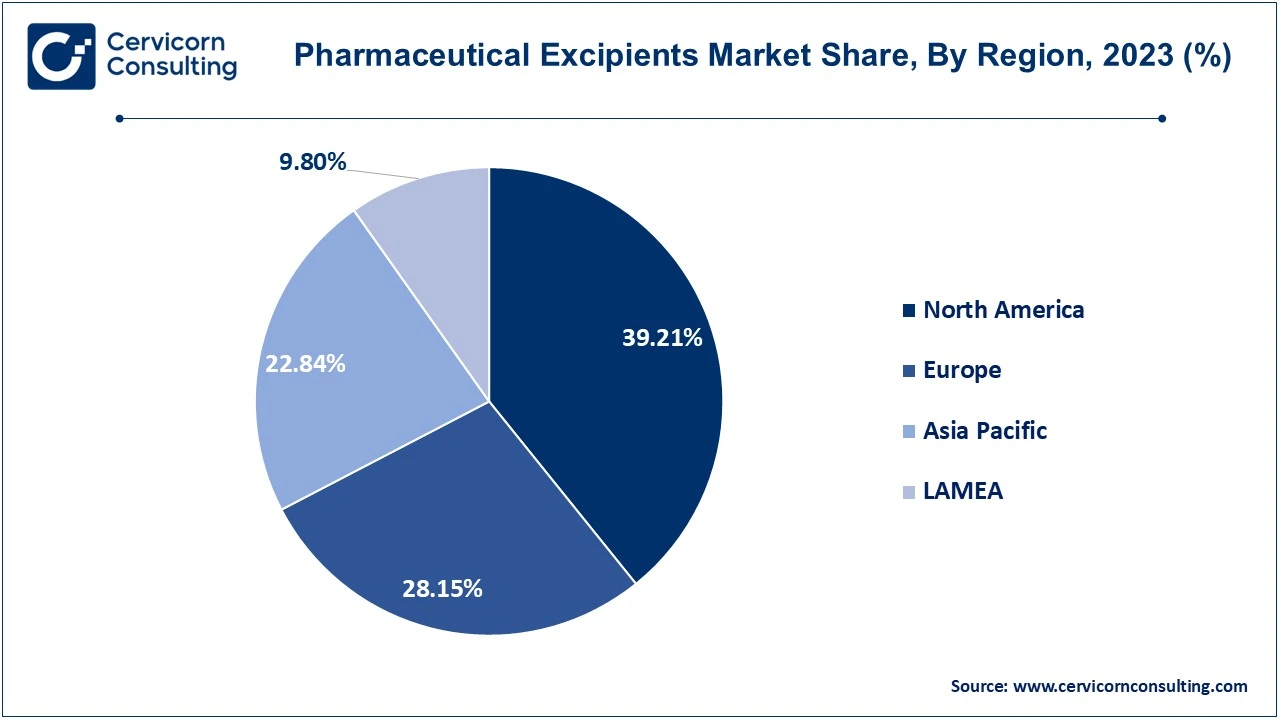

The pharmaceutical excipients market is growing significantly due to the rising demand for better drug formulations and innovations in drug delivery systems. Factors such as an increase in chronic diseases like cancer, diabetes, and cardiovascular conditions have amplified the need for more advanced and patient-specific medicines, thereby boosting the demand for excipients. Additionally, the development of biologics and complex drug formulations has led to the increased use of specialized excipients that ensure the stability and efficacy of these medications. Regionally, North America holds the largest market share due to its strong pharmaceutical industry, advanced research capabilities, and higher healthcare spending. Europe follows closely, driven by stringent regulations that prioritize excipient safety and quality. The Asia-Pacific region, particularly countries like India and China, is emerging as a major player due to its cost-effective manufacturing capabilities and rapidly expanding healthcare infrastructure. In November 2024, Roquette completed a €1.2 billion bond offering to support its acquisition of IFF Pharma Solutions. This strategic move is expected to bolster Roquette's position in the pharmaceutical excipients market.

Pharmaceutical excipients are inactive ingredients used in the formulation of medicines. These substances do not have any therapeutic effect but are crucial for the proper manufacturing, delivery, and storage of drugs. Excipients serve various roles, such as improving drug stability, enhancing the taste, aiding in drug absorption, and making the medication easier to swallow or apply. Common types of excipients include binders, fillers, lubricants, preservatives, and flavoring agents. For instance, lactose is used as a filler, while magnesium stearate serves as a lubricant. Without excipients, many drugs would be ineffective, unsafe, or impractical to produce.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 10.17 Billion |

| Expected Market Size in 2033 | USD 14.96 Billion |

| Growth Rate 2024 to 2033 | 4.93% |

| Dominant Region | North America |

| Rapidly Expanding Region | Asia-Pacific |

| Key Segments | Dosage Form, Type, Functionality, Formulation, Application, ENd User, Distribution Channel, Region |

| Key Companies | Roquette, Colorcon, Inc, Ashland Global Holdings, Associated British Foods, Roquette Feres, Avantor Performance Materials, Inc., Croda International, Archer Daniels Midland Company, DuPont, FMC Corporation, Evonik Industries, Lubrizol Corporation, BASF SE, Lubrizol Corporation, Evonik Industries AG |

The rising geriatric population drives the demand for pharmaceuticals

Expansion in the production of generics

Rising use of nanotechnology in drug formulations

High-cost parentage of novel and specialized excipients

Growing environmental concerns and sustainability hurdles

Challenges of Developing Excipients for Biologics

Lack of Standardisation in Excipient Regulations Across Regions

The pharmaceutical excipients market is segmented into dosage form, type, functionality, formulation, application, end user, distribution channel and region. Based on dosage form, the market is classified into solid, semi-solid, and liquid. Based on type, the market is classified into organic chemicals, inorganic chemicals, other chemicals. Based on functionality, the market is classified into fillers and diluents, coating agents, colorants, binders, suspending and viscosity agents, disintegrants, emulsifying agents, preservatives, Flavoring Agents and sweeteners, other functionalities. Based on functionality, the market is classified into oral formulations, topical formulations, parenteral formulations, and other. Based on formulation, the market is classified into taste masking, stabilizers, modified-release, solubility & bioavailability enhancement, and others. Based on end user, the market is classified into pharmaceutical and biopharmaceutical companies, contract formulators, research organization and academics, others. Based on distribution channel, the market is classified into direct tender, retail sales, and others.

Based on dosage form, the global market is segmented into solid, semi-solid, and liquid. The solid segment has dominated the market with highest revenue share in 2023.

Solid: Solid forms, i.e. they will encapsulate, tablets, and powders, are some of the most used amongst various pharmaceutical applications. Solid formulations are also common and are the popular choice among marketers owing to the capability to alter their stability, handling, and ability to deliver a fixed dosage. In the solid state, the physical properties of the product formulation are very much supported by the addition of solid excipients, for instance, fillers, binders, and disintegrants. The growth is driven by a high volume of solid dosage forms due to the convenience and efficacy in delivery provided by the dosages of medicines in the treatment of chronic diseases.

Semi-solid: Semi-solid dosage forms, for example, creams, ointments, and gels, that are targeted generally for topical and transdermal applications, form vital components of the pharmaceutical industry. These aforementioned dosage forms require special excipients in order to achieve the required consistency, stability, and drug release qualities. Emulsifiers, thickeners, and preservatives include most excipients in this section. Growth in this market segment would be driven by an increasing demand for dermatological products and of localized therapy too, as sought by patients for more effective and highly bioavailable semi-solid formulations as deliverable.

Liquid: Liquid dosage forms, including solutions, suspensions, and emulsions, are essential for delivering medications, especially for patients with swallowing difficulties, such as children and the elderly. Liquid excipients play a vital role in stabilizing active pharmaceutical ingredients (APIs), enhancing solubility, and ensuring uniform distribution. This segment is experiencing growth due to the rising demand for liquid formulations in various therapeutic areas, including pediatrics and injectables, as well as the increasing trend towards personalized medicine that emphasizes patient-centric solutions

Based on application, the global market is segmented into taste masking, stabilizers, modified-release, solubility & bioavailability enhancement, and others.

Taste Masking: Taste masking is a critical application of excipients, particularly for pediatric and geriatric formulations. Many APIs have unpleasant tastes, which can hinder patient compliance. Excipients such as sweeteners, flavoring agents, and coating materials are employed to mask these tastes, making medications more palatable. This application is vital for solid and liquid dosage forms, ensuring that patients, especially children, can ingest medications without resistance, ultimately improving adherence to treatment regimens.

Stabilizers: Stabilizers are essential excipients that enhance the physical and chemical stability of pharmaceutical formulations. They prevent degradation of APIs due to environmental factors like temperature, light, and humidity. Stabilizers, including antioxidants and preservatives, are crucial in both liquid and semi-solid forms. Their use ensures the shelf-life and efficacy of medications, thereby safeguarding patient safety. The demand for stabilizers is increasing as more complex formulations are developed, requiring advanced technologies to maintain product integrity over time.

Modified-Release: Modified-release formulations are designed to control the release rate of an API, improving therapeutic effectiveness while minimizing side effects. Excipients play a crucial role in achieving this goal through various mechanisms, such as coating and matrix formation. These formulations are particularly beneficial for chronic conditions requiring steady drug levels over extended periods. The rising prevalence of chronic diseases and the focus on patient compliance are driving demand for modified-release excipients, promoting innovations in formulation technologies.

Solubility & Bioavailability Enhancement: Many APIs face challenges related to solubility and bioavailability, impacting their therapeutic effectiveness. Excipients that enhance solubility, such as surfactants and solubilizers, are crucial for improving drug absorption in the body. This application is especially important for poorly soluble compounds, which are increasingly prevalent in drug development. The growing focus on developing new formulations with improved bioavailability is driving demand for excipients that facilitate enhanced drug release and absorption, ultimately leading to better patient outcomes.

Others: The Others category encompasses a variety of applications for excipients that do not fit into the primary segments. This includes functionalities such as fillers, lubricants, and anti-caking agents that enhance the manufacturing process and improve product quality. These excipients contribute to the overall performance and stability of pharmaceutical formulations, supporting a wide range of dosage forms. The diverse applications in this category indicate the versatility of excipients and their crucial role in optimizing pharmaceutical products to meet specific therapeutic needs.

Based on region, the global market is segmented into North AMerica, Europe, Asia-Pacific, Latin America and Middle East and Africa. The North America has accounted dominance in the market in 2023.

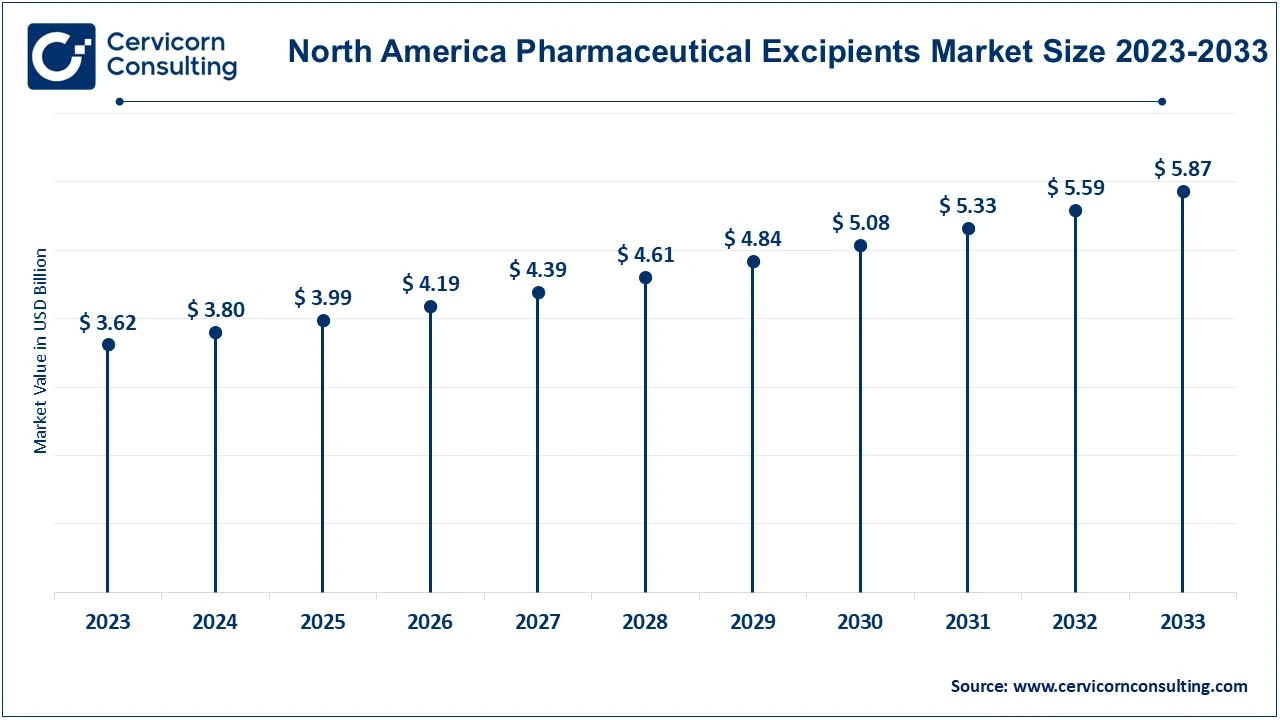

The North America pharmaceutical excipients market size was valued at USD 3.62 billion in 2023 and is expected to reach around USD 5.87 billion by 2033. North America is a leading market for pharmaceutical excipients, driven by the strong presence of pharmaceutical companies, advanced healthcare infrastructure, and significant R&D investments. The United States dominates the region, with Canada also contributing to the market’s growth. The region’s mature pharmaceutical industry, coupled with increasing demand for innovative drug formulations, supports the demand for advanced excipients. Additionally, the rising prevalence of chronic diseases, an aging population, and the expansion of generic drug production fuel market growth. Regulatory frameworks like those from the FDA ensure high standards for excipient production, further enhancing the region’s market potential.

The Europe pharmaceutical excipients market size was estimated at USD 2.60 billion in 2023 and is projected to hit around USD 4.21 billion by 2033. Europe is another key market for pharmaceutical excipients, with countries such as Germany, France, the United Kingdom, and Switzerland playing pivotal roles. The region benefits from its highly regulated pharmaceutical industry and a robust focus on quality and safety. Europe's pharmaceutical excipient market is supported by strong R&D initiatives, particularly in biologics and personalized medicine. The region's aging population and increasing demand for over-the-counter medications drive the use of innovative excipients. Additionally, environmental and sustainability concerns in countries like Germany and the Netherlands are pushing manufacturers to focus on eco-friendly excipients, further influencing market dynamics in Europe.

The Asia-Pacific pharmaceutical excipients market size was accounted for USD 2.11 billion in 2023 and is predicted to surpass around USD 3.42 billion by 2033. The Asia-Pacific is one of the fastest-growing regions for pharmaceutical excipients, with countries like China, India, Japan, and South Korea leading market expansion. The region’s growth is fuelled by increasing pharmaceutical production, rising healthcare spending, and growing demand for generic drugs. China and India, in particular, have become global manufacturing hubs for excipients, driven by cost-effective production and favourable government initiatives. Japan and South Korea focus on advanced drug formulations and R&D, further enhancing the demand for specialized excipients. The region’s expanding middle-class population and increasing prevalence of chronic diseases also boost the pharmaceutical excipients market.

The LAMEA pharmaceutical excipients market was valued at USD 0.91 billion in 2023 and is anticipated to reach around USD 1.47 billion by 2033. The LAMEA region represents a growing pharmaceutical excipients market, with Brazil, Mexico, and South Africa emerging as key contributors. In Latin America, rising healthcare access and government initiatives to improve pharmaceutical production are boosting the demand for excipients. Brazil and Mexico are leading in the production of generic drugs, increasing the demand for cost-effective excipients. In the Middle East, countries such as Saudi Arabia and the UAE are investing heavily in healthcare infrastructure, supporting market growth. In Africa, improving healthcare systems and rising pharmaceutical production in countries like South Africa are creating opportunities for the excipient market’s expansion.

The pharmaceutical excipients industry is dominated by a few central players, including Kerry Group plc., DFE Pharma, Cargill, Incorporated, Pfanstiehl, Colorcon, MEGGLE GmbH & Co. KG, Omya AG, Peter Greven GmbH & Co. KG, among others. These organizations are recognized for their innovative solutions and commitment to advancing Pharmaceutical Excipients through technology.

Continuous advancements in technology, sustainability initiatives, and the growing trend of personalized medicine are shaping the future of this market. As companies focus on developing high-quality excipients to meet regulatory standards and consumer demands, strategic partnerships and R&D investments will be crucial for competitive advantage.

CEO Statements

Harald Schwager – Deputy CEO of Evonik

“Darmstadt has been at the center of oral drug delivery innovation for five generations. That’s why it is with great pride that we begin a new chapter in EUDRAGIT history here. Our new facility enables our customers to develop oral drugs more efficiently and innovatively, improving the lives of more patients worldwide.”

Mark Schiller – CEO of IFF (International Flavors & Fragrances)

"We are excited to showcase our new innovations in excipients at CPHI 2024, especially our solutions aimed at nitrosamine mitigation. This reflects our commitment to supporting the pharmaceutical and biotech industries through advanced product development."

Giorgio O. Garofalo – CEO of Dow

"Our strategic initiatives in the excipients sector are designed to ensure that we are at the forefront of sustainability and innovation. We are committed to providing materials that enhance drug delivery and safety."

Strategic acquisition highlights the dynamic advancements and collaborative efforts within the pharmaceutical excipients industry. Industry players are actively involved in various initiatives aimed at enhancing technological capabilities and manufacturing expertise. For instance, in February 2022, Kerry Group Plc., a global leader in taste and nutrition, made significant strides by acquiring c-LEcta, a biotechnology innovator focused on precision fermentation and optimized bioprocessing, along with Enmex, an established enzyme manufacturer in Mexico. These acquisitions not only expanded Kerry Group’s biotechnology portfolio but also contributed to revenue growth. Some notable examples of key developments in the market include:

Market Segmentation

By Dosage Form

By Type

By Functionality

By Formulation

By Application

By End User

By Distribution Channel

By Region