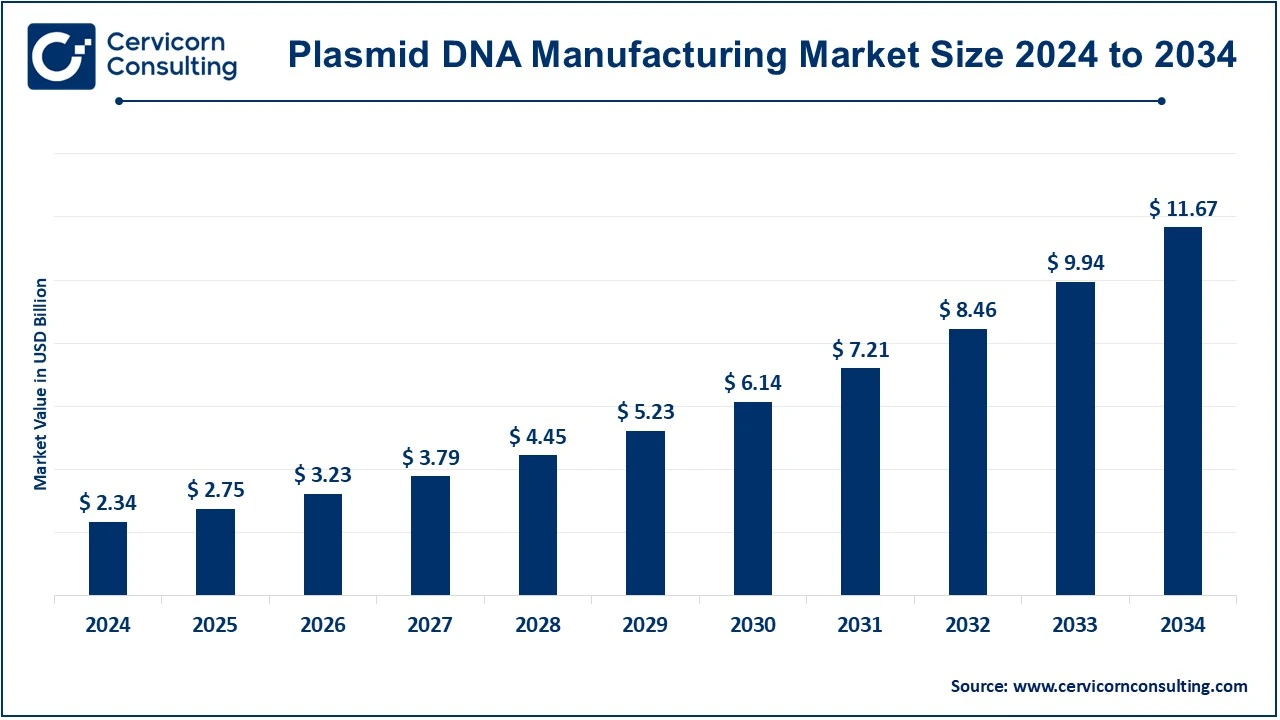

The global plasmid DNA manufacturing market size was valued at USD 2.34 billion in 2024 and is expected to be worth around USD 11.67 billion by 2034, growing at a compound annual growth rate (CAGR) of 17.43% over the forecast period 2025 to 2034.

Increased customized medicine, improved DNA vaccines, and demand in the gene therapy sector are further growing the market for plasmid DNA synthesis. It is the most crucial aspect for industry participants since high-quality, scalable plasmid DNA synthesis has emerged as one of the most important aspects in biopharmaceuticals aiming to produce revolutionary treatments for infectious diseases, cancer, and genetic disorders. All of these processes are accelerated by increased expenditure in research and development, regulatory assistance, and new advances in synthesis technologies of plasmids. The applications of biotechnology in therapy and other therapeutic areas should continue fuelling this process.

Production of plasmid DNA, which generates plasmid DNA as smaller, circular DNA segments that can be removed from chromosomal DNA, is generally located within bacteria. Its production involves amplifying plasmids in a bacterial host and extracting and purifying the plasmid DNA. Plasmid DNA is significantly used in genetic research, gene therapy, as well as vaccine development because it carries foreign genes and delivers them into cells for their application in a therapeutical degree. Therefore, its manufacturing process with strict quality control is vital to ensure that it is highly pure and quality, free from any contaminant, and according to the regulatory standards for clinical or research purposes.

Report Highlights

CEO Statements

Christopher Murphy, CEO of Akron Biotech

"At Akron Biotech, we are committed to advancing the future of gene therapy and vaccine development through the production of high-quality plasmid DNA. Our state-of-the-art manufacturing processes, combined with rigorous quality controls, ensure that we deliver reliable and scalable solutions to our partners in the biopharmaceutical industry. As the demand for plasmid DNA continues to grow, we remain dedicated to driving innovation and enhancing the efficiency of our production systems to meet the evolving needs of our clients and ultimately contribute to better patient outcomes."

Peter Coleman, CEO of Cobra Biologics & Pharmaceutical Services

"At Cobra Biologics, we are committed to advancing the development and manufacturing of high-quality plasmid DNA, which is essential for gene therapies, vaccines, and other biopharmaceuticals. Our state-of-the-art facilities and robust processes ensure the scalability, purity, and compliance needed to meet the evolving demands of the industry. With a strong focus on innovation and collaboration, we continue to be a trusted partner in the global biomanufacturing landscape."

Kevin Ballinger, CEO of Aldevron

"As a leader in plasmid DNA manufacturing, Aldevron is committed to delivering high-quality, scalable solutions for the development of gene therapies and vaccines. Our cutting-edge facilities and deep technical expertise ensure that we can meet the rigorous demands of our clients, from early-phase research through to commercial-scale production, while maintaining the highest standards of safety and regulatory compliance."

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 2.34 Billion |

| Estimated Market Size in 2034 | USD 11.67 Billion |

| Projected CAGR 2025 to 2034 | 17.43% |

| Dominant Region | North America |

| Growing Region | Asia-Pacific |

| Key Segments | Disease Type, Grade, Development Phase, Application, Region |

| Key Companies | Akron Biotech, Cobra Biologics & Pharmaceutical Services, Aldevron, Plasmidfactory GmbH, Vigene Biosciences, Charles River Laboratories, VGXI, Inc., Danaher (Aldevron), Kaneka Corp., Nature Technology, Cell and Gene Therapy Catapult, Eurofins Genomics, Lonza, Luminous BioSciences, LLC |

The plasmid DNA manufacturing market is segmented into disease type, grade, development phase, application and region. Based on disease type, the market is classified into infectious disease, cancer, genetic disorder, and others. Based on grade, the market is classified into R&D grade and GMP grade. Based on development phase, the market is classified into pre-clinical therapeutics, clinical therapeutics, and marketed therapeutics. Based on application, the market is classified into DNA vaccines, cell & gene therapy, immunotherapy, and others.

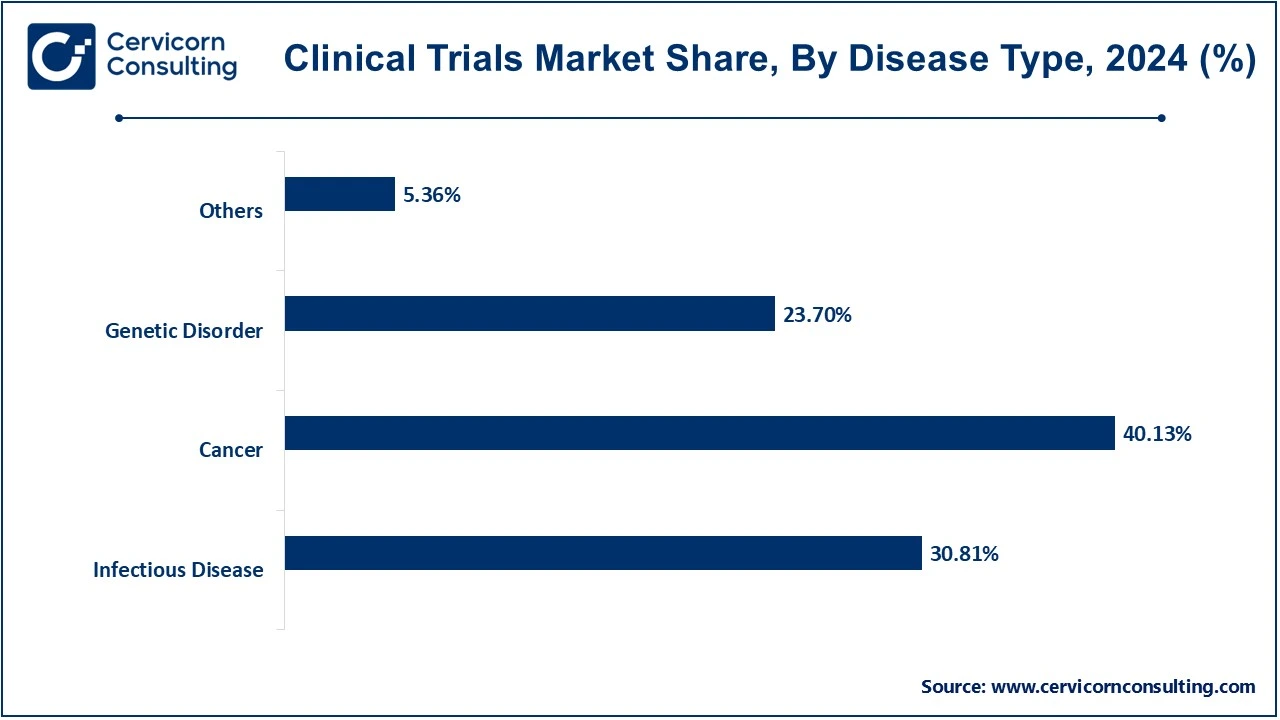

Cancer: The cancer segment has dominated the market in 2024. The increasingly used treatment in cancer is immunotherapy, which relies on the body's immune system for the identification and eradication of the body's cancer. This is achieved through plasmid DNA with vaccines that encode those tumor antigens specifically involved in identifying cancer cells. In addition to this, plasmid DNA can be used in the delivery of genes that induce immunity or inhibit tumor growth. For therapy use in the treatment of cancer, the production of plasmid DNA must involve the preparation of highly purified and stable plasmids.

Infectious Disease: The most important application of plasmid DNA manufacturing in the development of vaccines and treatments for bacterial, viral, and other infectious diseases induced by pathogenic agents is the area of DNA vaccines. DNA vaccine seems to function through conferring immunity against several infectious agents, including influenza, HIV, and COVID-19. Plasmid DNA can be constructed to carry open reading frames encoding proteins from the pathogenic agent and, thus, elicit a protective immune response in the host. With rapid production and flexibility in tailoring to specific pathogens, plasmid DNA assumes a special position in the fight against infectious diseases.

Genetic Disorder: Plasmid DNA as a source for gene therapy in genetic disorders replaces or corrects defective genes responsible for cystic fibrosis, muscular dystrophy, or hemophilia. The healthy gene is supposed to be introduced by the plasmid DNA within the cells of the patient to replace the missing or faulty gene or to introduce a beneficial gene that might help counteract the effects of the disease. This application depends on the highly reliable manufacturing of plasmid DNA for delivered genes to ensure high-quality delivery because these therapies have long-term implications for patient health.

Others: This category covers diseases and conditions that may not fall under the broad heading of infectious diseases, cancer, or genetic disorders. Apart from those mentioned earlier, applications of plasmid DNA therapeutics encompass autoimmune diseases, cardiovascular diseases, and metabolic disorders. Plasmid DNA will be used in such applications in the early stages, but its promises lie in discovering new treatments meant to address a wide array of health conditions hard to treat with traditional therapies.

Cell & Gene Therapy: The cell & gene therapy segment has dominated the market in 2024. Plasmid DNA is being used to deliver therapeutic genes into the cells of a patient for the treatment of genetic disease or other disease conditions in cell and gene therapy. The plasmids can be introduced to cells ex vivo (outside the body) or in vivo (directly into the body) for correcting defective genes, replacing absent genes, or for stimulating therapeutic proteins. High purity and quality of DNA are critical factors in this field of plasmid DNA production to support the safety and effectiveness of these therapies.

DNA Vaccines: The DNA vaccines segment is projected to hit the fastest CAGR over the forecast period. DNA vaccines are another type of new-generation immunization. In this application, plasmid DNA, which carries the genetic material of a pathogen-like a virus or bacteria, is introduced into the body. This way, it makes the cells of the host produce proteins from that pathogen. Through this, the system can be awakened to recognize and fight it off when it might eventually be encountered. Vaccines produced using plasmid DNA are expanding dramatically, particularly for infectious diseases, as this is a rapid, scalable method of vaccine production that is safe.

Immunotherapy: Immunotherapy is the use of the body's immune system to combat diseases, including cancer. Cancer vaccines are often generated using plasmid DNA to enhance the immune response against cancer cells. Plasmids can be engineered to express antigens to stimulate an immune response or to provide proteins that modulate immunity. Manufacturing plasmid DNA is a central component of immunotherapy; these genes will be available when needed for therapeutic purposes.

Others: This category includes diverse applications of plasmid DNA toward the development of diagnostic tools, the production of proteins, and the establishment of research experimental models. Plasmid DNA is used in both biotechnological and pharmaceutical industries for the production of therapeutic proteins and enzymes. The scope of applications of plasmid DNA in many of the most advanced areas of biotechnology makes it versatile.

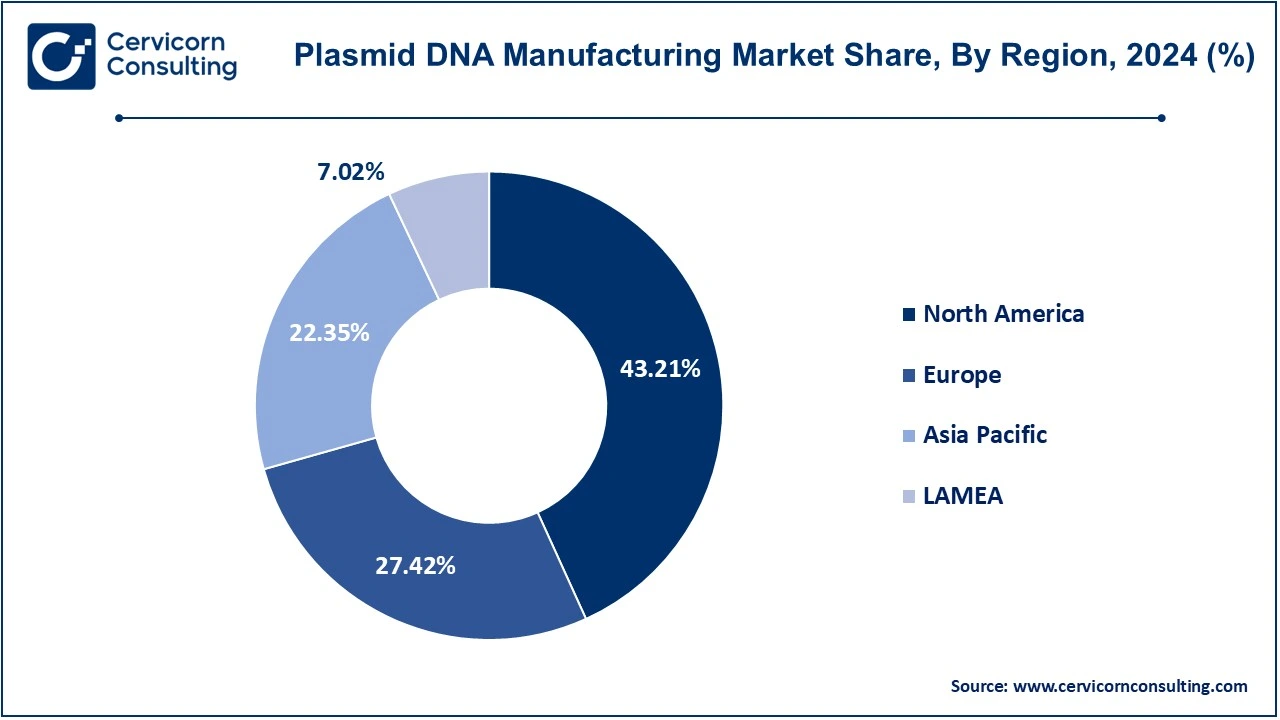

The plasmid DNA manufacturing market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

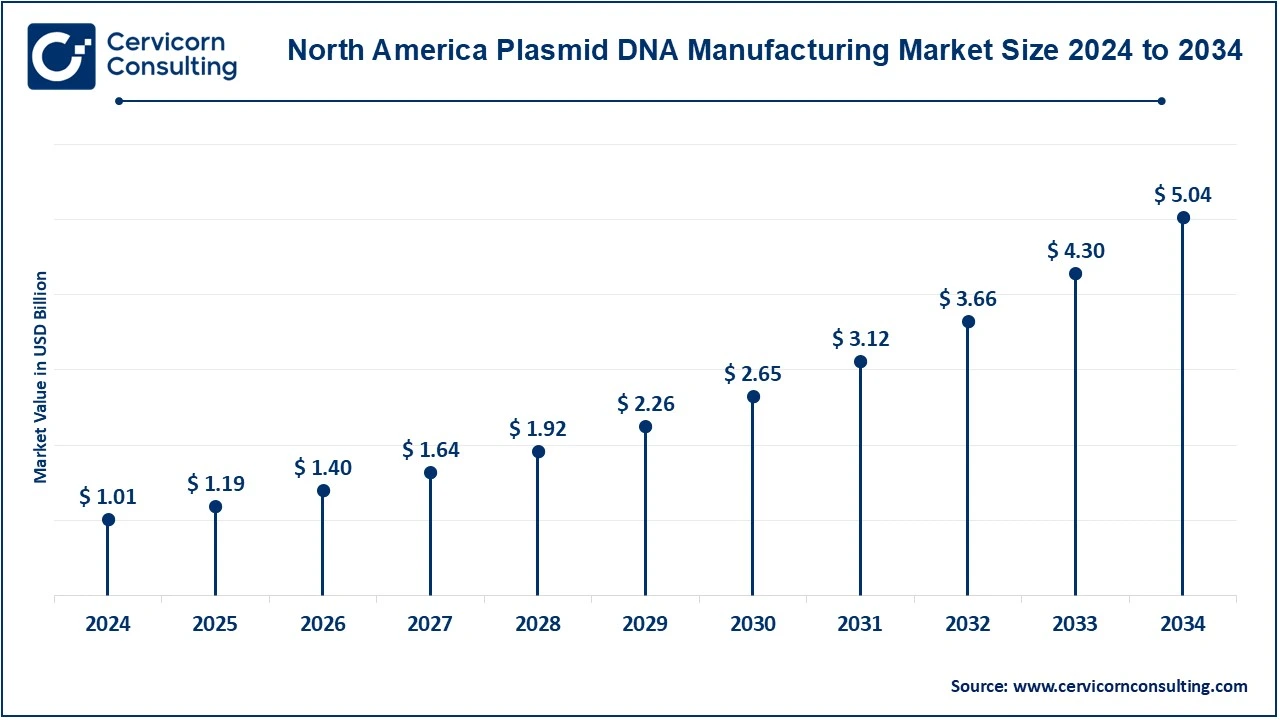

The North America plasmid DNA manufacturing market size was valued at USD 1.01 billion in 2024 and is expected to reach around USD 5.04 billion by 2034. North America takes the top spot for plasmid DNA production globally as its healthcare system is better established, and its biopharmaceutical industry is strong, while good investment has been put into gene therapy and vaccine development. Demand soared because plasmid DNA continues to be in demand for gene therapy, vaccine production, and especially mRNA vaccines. As recently as June 2024, it pledged to spend USD 100 million building a production facility for plasmid DNA. It had little idea where that placed it in the new biotechnology industry that was coming together around gene engineering and molecular pharmaceuticals, in the same way as the US did.

The Europe plasmid DNA manufacturing market size was estimated at USD 0.64 billion in 2024 and is predicted to surpass around USD 3.20 billion by 2034. Established biotech companies and significant R&D in gene therapy across the region of Germany, the UK, and France have driven growth. Vaccine research and manufacture lead the world through 22% of total vaccine clinical trials conducted over the last two decades, with big facilities hosting strong vaccine companies. This is further amplified by COVID-19, where the EU has been exporting nearly 40% of the world's vaccine exports. Even with such challenges as funding limitations, high clinical standards, and prolonged timelines for development, gene therapies have gained EMA approval, which triggered an upswing in demand for plasmid DNA. A benign regulatory climate explains the growth curve of the plasmid DNA market in the European region.

The Asia-Pacific plasmid DNA manufacturing market size was accounted for USD 0.52 billion in 2024 and is projected to hit around USD 2.61 billion by 2034. The Asia-Pacific region is rapidly growing in the market, considering increased investment in biotechnology and pharmaceuticals and higher healthcare requirements across the region. China, Japan, and India are the major countries for the said growth. China has made tremendous strides in biotechnology, especially in manufacturing of plasmid DNA, and has been identified as the world's largest producer because of high-volume production with relatively low costs of manufacture and increasing interest in gene therapy. It is for instance reported that in February 2023, according to Biopharma APAC, cell and gene therapy research investments were also made in the Asia Pacific region. For example, South Korea has recently allocated a 1.3-billion-dollar fund to develop these therapies. Primarily, Japan is highly investing in regenerative medicine and gene therapies, and it's the most support from both the government and private sectors for innovative biotech solutions. India, growing pharmaceutical industry, and interest in biologics and biosimilars, is a relatively emerging market player as well.

The LAMEA plasmid DNA manufacturing market was valued at USD 0.16 billion in 2024 and is anticipated to reach around USD 0.82 billion by 2034. The LAMEA region has been a mixed bag in countries but the area is emerging as a market. Latin America is one of the key areas with Brazil and Mexico looking to expand their pharmaceutical and biotech sectors with a focus on gene therapies and vaccines even as challenges exist, particularly on the infrastructure and regulation side. The countries of the Middle East are therefore investing in biotechnology and healthcare to diversify their economies and build high research facilities. In Africa, where the market for plasmid DNA is still in its infancy, South Africa seems to be leading from the front though there are some hurdles the region faces in terms of limited infrastructure and healthcare spending. International interest and investment are growing with the gene therapies for diseases such as malaria and sickle cell.

These firms are competing with innovation by structuring strategic linkages and technological advancements through the development of their capabilities to respond to the increasing need for quality plasmids in gene therapies and vaccine development. Akron Biotech, Cobra Biologics, Aldevron, among others are capitalizing on their power in plasmid production toward better scalability and higher quality control, and speedier turnaround. In its quest to speed up the development of plasmids for recently emerging applications such as DNA vaccines, gene editing, and cell therapies, these companies would collaborate with academic, biopharmaceutical companies and contract manufacturers. It combines their efforts and creates a competitive landscape for this to drive growth and increase the overall efficiency in production processes of plasmid DNA are critical to advancement in genetic medicine.

Some notable examples of key developments in the plasmid DNA manufacturing arket include:

Market Segmentation

By Disease Type

By Grade

By Development Phase

By Application

By Region